China

14 Chapter Labor

-

-

1 Chapter Introduction

1.1 The history of Japanese companies entering the world

1.2 New business model in China

1.3 Advance scheme through Hong Kong

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.2 Province and region of China

3.5 Investment incentives and regulations

4 Chapter Economic Environment

5 Chapter Establishment

5.3 Establishment of business base

5.4 Procedure after incorporation

6 Chapter Withdraw

7 Chapter Foreign exchange

7.1 Foreign exchange management system in China

7.2 Foreign currency management system of ordinary items

7.3 Foreign exchange control system of capital items

7.4 Foreign exchange control system in bonded area · Hong Kong

7.5 Individual foreign currency control system

8 Chapter M&A

8.2 Laws and regulations concerning M & A

8.5 Challenges after corporate acquisition

9 Chapter Corporate Laws

10 Chapter Accounting

11 Chapter Tax law

11.2 Representative Office Taxation

11.4 Individual Issues in China Domestic Tax Law

12 Chapter International taxation strategy

12.1 International tax relating to entering China

12.2 International taxation strategy

12.3 Individual Issues in International Taxation

12.4 Tax issues related to withdrawal

13 Chapter Transfer Price Taxation

13.2 Individual provision pertaining to transfer pricing taxation

13.3 Transfer price taxation and documentation

13.4 Transfer price survey in China

14 Chapter Labor

14.4 Points to remember when bringing Japanese

15 Chapter International Human Resources Management

15.1 Human Resources Labor Management

15.3 Personnel evaluation system

-

-

-

Worker

■ Labor force populationAccording to the announcement by the National Bureau of Statistics in China, the population of China at the end of 2014 was 1,355.69 million people and the labor force population was 921.12 million people. The population ratio of the workforce to the total population is 67.9%, which is decreasing year by year. The reason that the labor force population ratio is declining is that the birthrate has been at a low level due to China's one-child policy.At present, China is the most populous country in the world, but in 2025 China and India are about 1.4 billion people, almost the same number, in 2050 China is about 1.4 billion versus about 1.6 billion India It is said that India will become the world's No. 1 population powerhouse.In future we need to pay attention to population trends in China and supply problems of labor force.

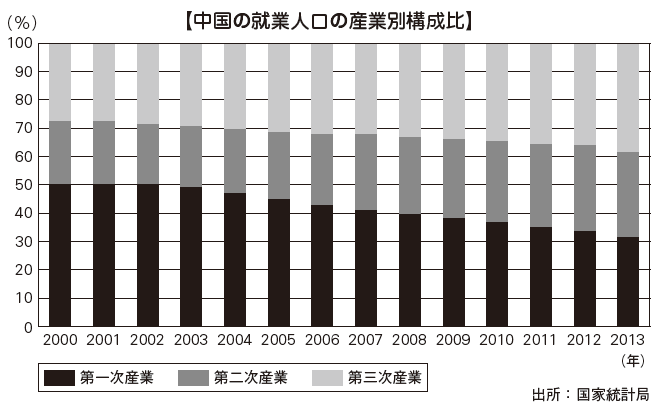

■ Working Population by IndustryThe employment rate of the primary industry which was 50% in 2000 is decreasing year by year from 31.4% in 2013. On the other hand, the employment rate of secondary industry and tertiary industry is increasing. Especially for the secondary industry, the employment rate has increased as the wage level is rising remarkably, and it can be said that there is still a big presence.In future China, the productivity age population ratio tends to decrease after 2010, so improvement of productivity will be more important for sustainable growth.Compared to the composition ratio of the working population of Japan and China in 2013, Japan accounts for 4% of the workers in the primary industry, 24.8% in the secondary industry and 70.2% in the tertiary industry ( Some jobs are impossible to classify). Meanwhile, China's primary industry share is 31.4%, secondary industry 30.1%, tertiary industry 38.5%. If China continues its economic growth in the future, it is expected that the tertiary industry's working population will increase as in Japan.

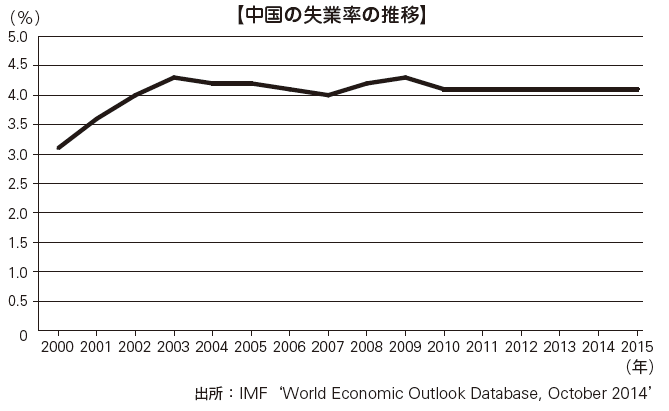

■ Unemployment rateAccording to official Chinese statistics the unemployment rate in 2014 is 4.1%. In Japan, as we calculate the unemployment rate only for those who are registered as job seekers in Hello Work, we also need to be careful as China is also a nominal figure calculated for registered unemployed only in China. In fact, many migrant workers with rural family register do not register, and the unemployment rate in China is said to be about twice the number officially announced.

■ Points to remember in ChinaBefore recruiting local staff in China, it is important to note that in the area such as Tianjin City, it is necessary to notify the administration when starting recruitment. Although there is no penalty provision for failing to report, it is better to have reported beforehand in order to establish a good relationship with local administration.When actually hiring local staff, check the city register or rural family register, hometown, academic background, employment history and so on. In the case of China, since respiratory fraudulence is so numerous, it is necessary to submit identification card and certificate of graduation of university. Also, because there are many counterfeits of identification cards, it is desirable to check with institutions that are looking for identities for a fee. You can check with the identity network (http://www.id5.cn/) etc of Beijing National Government Network Tangled Science Technology Co., Ltd.In order to adopt talented personnel in China, it is important not only to clarify the working conditions but also to clarify the vision of the company and the idea of how the activities in the company contribute to the Chinese society It is important to explain to. Specifically, it is required to appoint Chinese people to important posts, to establish clear career paths such as personnel system and wage system that emphasize impartiality. In China, it sometimes is said "There is a ceiling invisible to Japanese companies". It represents the distrust of Japanese people who have been transferred from Japan to become executives without failing to be promoted to executives no matter how hard the local Chinese worked. For excellent Chinese people, regardless of nationality, by appointing to executives as executives can make the future feel possible and make it a company that is attractive to Chinese. -

wage

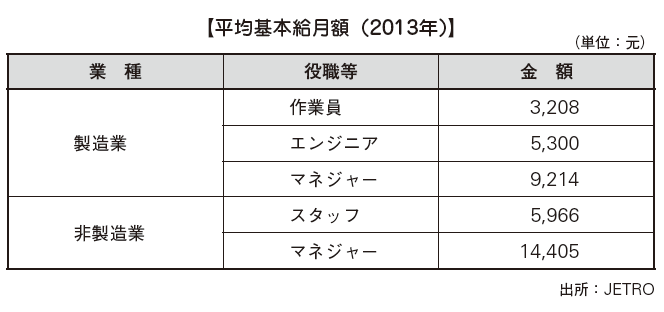

■ Wages by Industry, OccupationThe average monthly salary in China is as follows. The wage level of the workers in the manufacturing industry is 3,208 yuan per month, and the manager of the nonmanufacturing industry is 14,405 yuan per month, which shows that the disparity in wages according to the position is bigger than in Japan. Also wage increase is a problem, but the wage in China is low level. Each local government has been raising the minimum wage in 2015, and it is expected that wage increases in China will continue in the future.

■ Comparison of average wages in neighboring countriesWhen comparing Shanghai's average basic monthly salary with neighboring countries, it is higher than Thailand, Indonesia and Vietnam, but it is lower than Taiwan (Taipei), Korea etc. However, the wages of nonmanufacturers and managers are quite high even though they do not reach Taiwan and South Korea. Since wages are expected to rise further in the future, many foreign companies are paying attention to the China market with a population of 1.3 billion. If you are expanding as a production base, you may have the option of relocating the factory to other Asian regions in search of cheaper labor. China is attracting attention as a market linked with future wage increases.

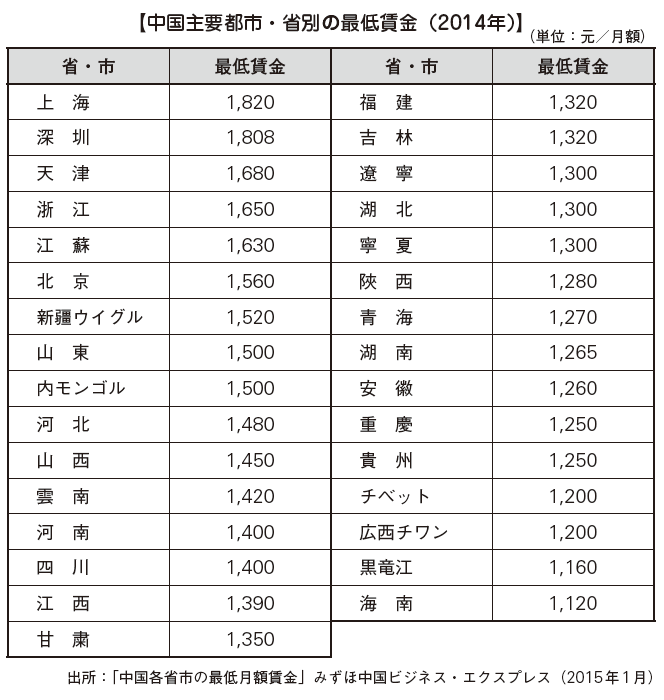

■ Transition of wage system in ChinaChina, a socialist state, held a uniform wage system from 1952 to 1978 until reform and opening up took place. Wages were determined by regional and occupational types by the grade wage system, and wages were determined according to the hierarchy in the job category by the job grade wage system. By building a unified wage system for state-owned enterprises, the government managed the wage total, aimed at managing reasonable labor and guaranteeing the lives of Chinese citizens.However, when wages were to be paid on average, workers' willingness to produce declined, which was a factor in hampering economic development. As China 's finances became a deficit in 1975, the unification of the wage system became wanted. From around 1978 the review of wage system began, and the payment system and incentive system were accepted. In 1985, a wage system was created in which corporate performance and wages were linked, and the wage system gradually changed.Currently in China, companies other than state-owned enterprises can freely set wages if they keep the minimum wage. It is important how to build a wage system among them. In China, it is common to show payroll details in the company, and furthermore, check the amount of salary of those engaged in the same industry in the neighborhood, and for reasons that "salary is cheap while doing the same work" It is not uncommon to be asked for a wage increase. In response to these demands, companies must have reasonable reasons for salary levels. If you can not answer clearly to workers, workers may be dissatisfied and change jobs. Furthermore, it may develop into a labor dispute, which may result in a large loss of the company.When entering China, it is required to build a system that makes everyone's satisfying personnel evaluation criteria and not to complain about the workers. As a specific countermeasure to payroll negotiations and labor disputes, it is important to first create clear rules on salaries and evaluations and make them known inside the company.Along with the remarkable rise in wages, it is necessary to constantly be aware of the wage level of workers currently employed and the wage levels of newly hired workers to build a wage system. In hiring a worker with a lower capability than a currently employed worker with a competent ability, it is possible that the employee can not hire unless he / she presents a higher level of wages than the currently employed workers That is why. If such reversal of salary occurs, there is a risk that a skilled worker is dissatisfied with the evaluation from the company and retires.Because China is a country with a vast country land, the economic situation and wage level will vary depending on the region. When enterprises enter China, it is necessary to pay attention to regional economic conditions and wage levels.

Specifically, the population of cities such as Beijing, Shanghai and Guangzhou, which are the core cities of the three coastal economic zones, accounts for 4% of the total population, and the population of inland small and medium cities (concentrated in central and western areas) It accounts for 68% of the total population. Comparing the per capita GDP of this coastal area and the inland area, workers in the coastal area will be more than five times that of inland workers.In 2020, the ultra wealthy people (annual disposable income is more than 300 thousand RMB, 4.8 million yen in Japanese yen, converted at 16 Yen in one yen) reaches 12 million households, of which 11.3 million households will concentrate on coastal areas It is expected. In this way the wage gap in China is clear. In China, 'prestigious theory' was being cast from 1978 to 1985. That is the policy of Deng Xiaoping at the time, "Enrich from those who can become affluent earlier", indeed China grew markedly due to the theory of wealth last. However, now the difference in rich and poor in China is a problem, and it is increasing that it is advocated that redistribution of wealth is necessary. -

Union

There is an organization called "Council" in China as a labor union organization. The Chinese labor union is an underlining executive organization of the Communist Party of China and it is influenced by the policy of the central party. Although the party does not participate directly in corporate decision making, etc., we do corporate governance through the assembly. The chairman is operated based on the China Council Law, characterized by a vertical division organization with the Chinese Communist Party as its lead, and the terminal organization is an internal association. There is no distinction between managerial side and labor side, and it is regarded as a profit community which mainly promotes welfare benefits and has the role of labor-management conflict prevention. In the event of labor disputes, the Council is supposed to play a role as a problem solving institution, but in reality it has become a moratorium and activities for welfare of employees are mostly.

Formation of labor unionIn China, all the people involved in labor are expected to belong to the workshop from the idea that all the people are workers, and corporate management teams are also required to be members of the workers. According to the Industrial Law enforced in 1992, "We can establish a labor union committee if there are more than 25 union members in companies, businesses and state organizations". However, even if it is less than 25 people, two or more enterprises can associate, or one organization member can be selected to organize members to develop the activities of the organization, so even theoretically one company employee can do the work It can be established.Companies must pay 2% of the total salary of the employees monthly to the church, and the subscribers of the industries pays 0.5% of their salaries monthly as an assembly expenses.

■ Number of labor unionsAccording to the statistics up to 2013, the number of foundation organizations that join the national assembly has reached 2.767 million, with 287 million members and an average of more than 10 million people each year in recent years. The union of trade unions of private small and medium enterprises has 69,041 associations, and the regional and industrial association has about 107,000 societies. -

Labor dispute

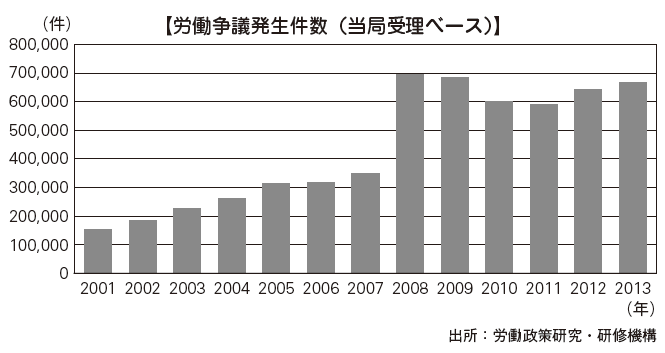

■IssueLabor Contract Law, arbitration fee free of charge, labor disputes sharply increased since 2008, due to reasons such as the absence of reflection on workers despite the fact that some industries have increased revenue due to economic stimulus measures did.In September 2010, it indicated that the scope of labor disputes accepted by the Supreme People's Court of China is to be expanded, and even if it is not a company directly hiring workers, companies that are in equity relationship may also be treated as parties It was. As a result, companies are more likely to become defendants.

■ Solving labor disputesThe resolution procedure of labor dispute is as follows.

① Settlement consultation② Mediation (Arrangement Organization of Council etc)③ Mediation (labor intermediary committee)④ Judgment by the Labor Arbitration Committee⑤ Charged to People's Court

The settlement consultation can be established in employment units (organizations in China, private economic organizations, private non-enterprise units, etc.) by adding parties, associations and third parties.If the settlement consultation is not successful, we will move on to mediation. Conciliation is done by mediation organizations such as in-house and regional societies, and the mediation decision will be effective with a signature by mutual agreement between the parties. In case of a failure, mediation will be done by applying for arbitration to the Labor Arbitration Committee.If the above arbitration also fails, the Labor Arbitration Committee will decide upon taking the facts into account. If you are dissatisfied with this ruling, you can file a suit against the People's Court.Although the procedure is as described above, the arbitration organization of labor dispute first recommends establishing a labor dispute mediation committee within the company. Normally, the chief of the company will be appointed chairman of the labor dispute mediation committee and mediate the opinions of the worker side and the company side. However, the actual situation does not work well, and there are many cases in which companies set new labor dispute resolution teams to solve problems.

In case of encountering labor dispute, we set up labor dispute resolution team within company. In that case, it is desirable to add local people who have experienced labor dispute resolution, such as lawyers and interpreters, to the team.

■ StrikeWhenever a strike is held, there should be a central figure who instigates workers to strike. Some masterminds led the strike by using people in the shade. In order to resolve labor dispute at an early stage, it is necessary to discuss directly with the mastermind's request. If it takes time to identify the mastermind, the resumption of the project will be delayed by that amount, so we will respond to requests for trustworthy Chinese workers to identify the mastermind.In addition, we will decide the solution of the strike with the management team and report to the government agencies, local labor unions and the solution to gain understanding. After that, we have a place to talk about mastery of strikes about working conditions and so on and converge the strike through agreement. At the same time, it is also important to build prevention measures so that similar problems will not occur in the future. -

Labor disputes frequently occurring areas

Looking at the situation of labor dispute occurrence by region, it occurs frequently in coastal areas, especially South China. By the enforcement of the 2008 Labor Contract Law, the number of cases of disputes sharply increased from 350 thousand in 2007 to 700 thousand in 2008.The main reasons for the increase in labor disputes are improvement of workers' rights awareness and protection of workersStrengthening of workers' self-interests, growing desire to pursue self-interests of workers, and increasing number of people with dissatisfaction with wage disparity.In recent years, due to the spread of the Internet, it became easier to exchange information with other workers, recognizing the difference in wage levels among the same type of business, and calling for demonstrations and strikes by using SNS also increasing.

-

-

-

Labor contract

■Type of labor contractGeneral labor contracts include the following.

· Fixed-term labor contract· Indebted labor contract (contract with regular employee)· Labor contracts with a contract period (completion of certain duties on business) (Article 12 of the Labor Contract Act)

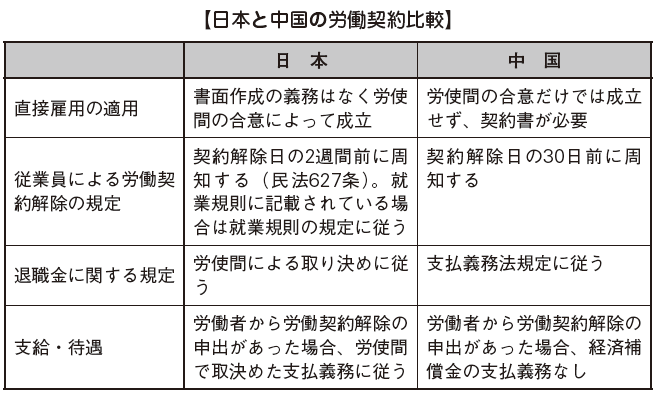

There is no clear upper limit on the number of renewal cases in Japan in the case of a fixed-term labor contract, but there is an upper limit on the number of renewal cases in the case of China, and if the temporary labor contract is renewed twice or more, that worker desires In that case, you must hire that worker with an indefinite labor contract. Also, if a worker with more than 10 years of service wishes, it is necessary to sign an indefinite labor contract as well. In the case of concluding a temporary labor contract in Japan, it is stipulated that the maximum period of the term of a fixed term that can be set in one contract is generally three years (in the case of professional work, five years, etc.) in principle, in the case of China There is no upper limit on the term of a fixed term labor contract.

Other than Japan, retirement age can be mentioned. In Japan, both males and females are prescribed to be 65 years old (or continued employment after 60 years old, etc.), while in China it is assumed that men are 60 years old and women are 50 years old.

Special labor contracts include the following.

· Group contract· Labor Dispatch Agreement· Part-time contract

[Group Contract]Group contract is an agreement that employers and employees select their respective representatives and conclude collective consultation on main labor conditions such as remuneration and working hours. If you make an individual contract separately, the condition must not fall below the conditions of the group contract.

[Labor Dispatch Agreement]A labor dispatch contract is a labor dispatch organization (a dispatching company) and a worker conclude. Dispatch workers to receiving organization (company to be dispatched) and work, labor dispatch organization pays compensation. It is equivalent to a Japanese worker dispatch contract.According to the Labor Contract Law amended on July 1, 2013, the requirement that labor dispatch is possible was specified as follows.

· If you do not exceed 6 months in office· When performing a supplementary task at a company to be dispatched· Temporary substitution such as sick leave, maternity leave, training etc. of workers at the company to be dispatched

Furthermore, provisional provisional labor dispatch provision was enforced on March 1, 2014, and it was stipulated that the labor dispatch ratio should not exceed 10% of the total number of employees. As a result, many companies that have complemented the labor force by labor dispatch are forced to respond. For companies whose current labor dispatch rate exceeds 10%, it is stipulated that the labor ratio must be within the standard within the two-year grace period.

[Part-time contract]Part-time contract refers to a labor contract of hourly wage with workers' average working hours per day not exceeding 4 hours and within 24 hours in a week.

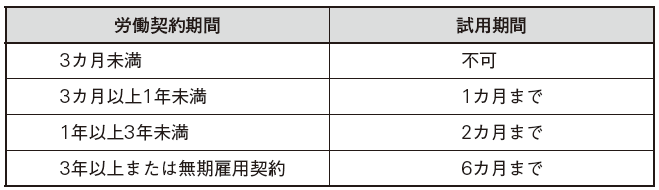

Trial periodAs in Japan, there is a trial period in China, but it is a complicated mechanism compared with Japan. With the establishment and enforcement of the labor contract law, it will be invalid unless there is reasonable grounds or grounds for dismissal within the trial period.The trial period of China is stipulated as follows according to the period of labor contract.

The trial period can only be set once and the salary during the trial period must be at least 80% of salary and equal to or more than the minimum wage when the labor contract is concluded.

■ Obligation to hire workersAccording to the Labor Employment Law Implementation Ordinance promulgated in September 2008, it was clearly stipulated that if a company employs workers, employment contracts must be made in writing within a month. In doing so, you have an obligation to create a list of employees describing the name, address, ID number of the worker, family register, date of starting work, form of employment, period of labor contract etc. The Labor Management Bureau may be asked to submit, and if you do not create a list of employees or refuse to submit it, you may be fined.If a worker refuses to conclude an employment contract, the company has an obligation to terminate the labor relations in writing and pay the wage for that worker's period of employment.

In the case of Japan, Article 6 of the Labor Contract Law stipulates that "Labor contracts are based on workers and employers agreeing that workers work by being used by users and paying wages to employers, It is stipulated that labor contracts will be established by agreement between labor and management. In other words, labor contracts are established without written and verbal (Notification of working conditions at the time of employment is obligatory). On the other hand, in China, the "formation by verbal agreement" is not permitted, and a written document is necessary.

■ Confidentiality obligation and obligation to avoid competitionIn the case of China, there are many workers who have less confidentiality and less concept of inevitable competition than Japan, so it is necessary for companies to make more stringent countermeasures for confidentiality obligations and non-compete work (see P. 602 " Competition avoidance obligation ").

Employment formThere are forms of employment in China, such as direct employment, indirect employment, temporary employment. It is necessary to pay attention because there are different points from Japan.

Direct employmentDirect employment refers to a form in which employment is made by establishing working hours, working conditions, labor compensation, social insurance, etc. in labor contracts regardless of the term of the term for a short period of time and concluding in writing. If you do not conclude a labor contract in writing even after one month from employment, you must pay twice the monthly wages for workers until you enter a written labor contract.If the labor contract period is less than 3 months, you can not have a trial period and you need to join social insurance. When employment contract labor contract ends due to the circumstances of the company side, you must pay economic compensation fee equivalent to one month salary per year of service. In Japan there is no provision to pay economic compensation at the end of labor contract.

Indirect employmentIndirect employment is a form in which a company indirectly employs workers through a labor dispatch organization. This form has no particular differences from Japan's worker dispatch contract.

In China, "The company to be dispatched must confirm the dispatch period with the dispatching company based on the actual necessity, and should not conclude by splitting several consecutive short-term labor dispatch consultations for a continuous employment period "(Labor Contract Act Law, Article 59, 22), we have set up a dispatch period deviating from the necessity of the actual situation and prohibit renewing the contract in the short term.

SecondedChina has no concept of legislation on law and there is no clear provision. Therefore, it is necessary to discuss and clarify in advance the wage of the employee to be dispatched by either the second-party company or the second-party company, the labor contract to be concluded, the social insurance premium payment by which is to be paid, etc. It is necessary to keep it.

Employment of foreignersIn order for foreigners to work in China in China, it is necessary to undergo procedures in the labor administration department, such as obtaining a work permit and employment certificate.

-

Obligation to prepare employment rules

Article 4 of the China Labor Contract Law stipulates that "the employer is concerned with the close interests of workers concerning labor compensation, working hours, break vacation, occupational safety and health, insurance benefits, employee training, labor discipline and labor quantification management etc When establishing, revising or determining directly related regulation systems or important matters, discussions by the employee representative tournament or all employees, submit drafts and opinions, decide after equal consultation with labor union or employee representative It must be set ". In other words, it is necessary for workers, labor unions and employers to decide what matters as "criteria directly related to the close interests of workers" standards.In addition to adopting, regulations concerning retirement must be stipulated.

Examples of entries in general employment rules are as follows.

Overview· Matters concerning working hours and breaks, vacation· Matters concerning determination of payment and payment method· Matters concerning the scope of applied workers· Matters concerning retirement· Occupational health and safety matters· Matters concerning welfare benefits· Matters concerning labor discipline of workers· Matters concerning training of workers

Article 89 of the Labor Standards Law stipulates that the obligation to prepare employment rules in Japan shall be notified to the chief of the Labor Standards Inspection Office when more than 10 workers are employed at all times. However, in China, if you hire even one worker you will be obliged to make it. In addition, in Japan it is stipulated that if there is a labor union representing the majority of business establishments, it is stipulated that the labor union, if not, the opinion of the representative of the majority of the workers must be heard. In contrast, in China, it is stipulated as follows.

① Users will discuss with workers' representative conventions or all workers② The employer submits the draft of the employment regulations and opinion based on ①③ The employee consults with the labor union or worker representative equally based on the original draft ② opinion④ The employer establishes employment rules based on ③⑤ The user shall disclose the employment rules established by the employer to the workers

When creating work rules, it is necessary to carefully prepare in China in comparison with Japan.

Payment of wages■ Rules on wage paymentThe wage payment provision in China is stipulated in the provisional wage payment provision, "wages must be paid at least once a month, weekly, daily, hourly wage system, weekly, daily, hourly It is stipulated that the wage must be paid on the day the user and the worker make a contract "(wage payment provisional provision 7 article). However, in-kind payment of wages is not allowed in China at all.

Extra wageExtra wages in China are divided into three types: overtime work, holiday work (only when no holidays are given), legal holiday work. These premium rates are as follows.

· When making overtime work, pay wage compensation not less than 150% of wage· If you are going to work on a holiday and you are not given a substitute holiday, pay wage compensation not less than 200% of the wage· If you want to work on statutory holidays pay wage compensation not less than 300% of wage

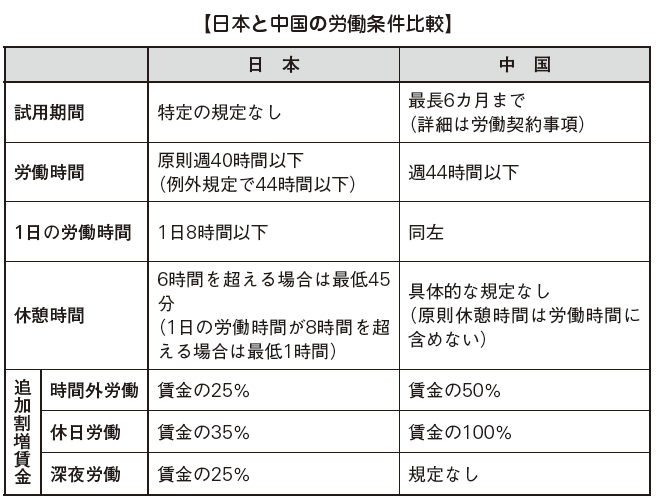

The big difference with the wage system in Japan is that there is no provision for premium wages on late-night labor in China. In Japan, there is an obligation to pay 125% of the average wage for work after 10 o'clock in the evening, but in China there is no obligation to pay extra wages against late-night work. Also in China, overtime is limited to 3 hours a day even in special cases such as emergency, and we are trying to protect workers by setting an upper limit on overtime hours. In Japan, the extra wage for holiday work is 135% of the average wage, but in China it is a large deviation of 200% of the average wage.Legally, restrictions on overtime work and extra wages are stipulated, but in reality, there are not a few companies that do not comply with labor laws in operation. However, due to the growing awareness of individual rights in China, criticism concerning overtime work due to no compensation and work in a poor work environment is increasing. When entering China, attention to compliance is necessary.

■ Regulations concerning overtime workThe deformed working hours system in China should not exceed 1 hour per day and when working hours are extended for special reasons, under the condition that the health of the workers' physical health is guaranteed, You can extend your working hours within 3 hours. However, it is stipulated that the total of one month extension time must not exceed 36 hours (China Labor Law Article 41).

■ BonusesBonuses in China are almost the same as in Japan. However, if you specify provisions for paying bonuses to your employment rules or labor contracts, you are obliged to pay and do not obligate you to legally pay bonuses to workers. The payment of bonuses in China is left to the provisions of employment rules and labor contracts.Although it is rarely seen in Chinese companies in China, local companies in China may also receive bonuses in kind. It is common for alcohol and other cards (such as prepaid cards and garlic cards) to be paid, including cars and households in some cases. -

A vacation

■ Annual paid vacationIn China as well as Japan there is a paid leave system stipulated by law. In China, "If the annual paid vacation days prescribed in labor contracts and employment rules exceeds the statutory standards, the employer shall give the number of days specified by that labor contract, work rules, etc." Corporate Employee Annual Paid Leave Practice Rule 13).

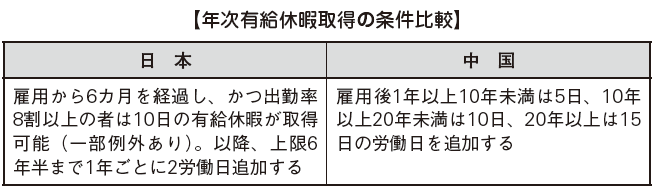

[Legal number of days]The requirements for obtaining annual paid leave are different in Japan and China.

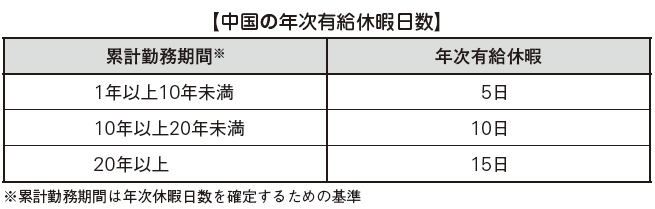

The definition of annual paid leave in China is defined as "when an employee of an organization such as an individual company with employment workers has worked continuously for more than 12 months, acquire the same wage income as the normal service period A vacation that can be done "and so on. Even for employees who do not work for less than one year, if they have worked continuously for more than 12 months, including the period of service in the former position, they have the right to acquire annual paid leave from the company currently working To do. In Japan, you can get paid leave by working more than 80% continuously for the same company and working for more than 6 months but in China you can get paid vacation if you work continuously for more than 12 months even if the company is different I will.The number of days of annual paid vacation stipulated in the Employee Annual Paid Leave Ordinance is as follows (Article 3).

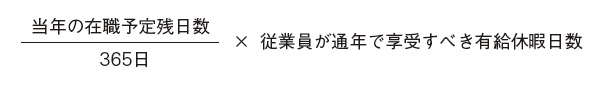

[Calculation method of paid vacation days in case of mid-career hiring]In the case of mid-career recruitment in China, we calculate the number of paid vacation days including the previous job history as mentioned above. This is to adjust to the previous service period. Specifically, if an employee is employed as a midway employee in a new company and is eligible for paid leave, the number of paid leave days for that year is fixed by converting it according to the number of remaining days in the calendar for the user concerned . Calculation method is as follows.

However, as a result of calculation, when the number of days is less than 1 day, there is no obligation to give paid.

[Undigested paid vacation]Handling of undigested paid holidays in China is different from Japan.

· Number of paid holidays when the number of days specified by employment rules etc. exceeds the statutory number of days· Number of paid leave days when paid leave granted per year remained without using paid leave· Paid vacation days when labor relations are resolved

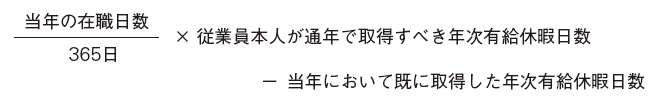

In the case of the above, during the year, we must pay unprecedented annual paid vacation wage fee for employee's undigested annual paid holiday on the basis of 300% of its daily wage income It is stipulated. This daily wage refers to the wage per day of an employee and can be obtained by dividing the monthly wage of an employee by the monthly wage calculation days. We calculate unpaid paid holidays as follows.

[Presence or absence of user's veto power]In China's labor law, we do not stipulate whether workers' refusal to obtain paid leave, in particular, does not specify, and even if the employer refuses to obtain paid vacation of workers, it will not be a violation of the labor law. However, it is considered desirable to consult with workers. On the other hand, in Japan, refusal to obtain employees' annual paid holidays is not allowed. However, if you are busy in a timely manner, the time designation right is granted.

■ sick leaveThere is a system called sick leave in the labor law in China. It is similar to the medical injury allowance of the Japanese health insurance law. This system is a system where employers pay wages to workers when workers get sick or injured out of work. In Japan, there is no provision under labor-related laws, there is similar provision by social insurance. However, injury and sickness allowance for Japanese health insurance can not work for 3 consecutive days due to injury / illness outside work, when absenteeism, from the 4th day wages will be paid from National Health Insurance Association or health insurance association Meanwhile, the sick leave in China is paid from day 1 which was absent due to injury or injury outside work, and the user is obliged to pay. It should be noted that the amount of payment for this sick leave should not be less than 80% of the minimum wage, and payment of 80% of the minimum wage set for each region, not wages for regular workers It is obligatory.The treatment period is limited within the limit period defined according to the total number of years of service of all companies who worked in the past and the number of years of service at the current company that worked when receiving injury or illness outside the office It is not allowed unless it is a thing.The treatment period and the restriction period according to the number of years of service etc are as follows.

■ childbirth leaveMaternity leave in China is "Female workers need at least 90It is possible to take a day off "(Article 62 of China Labor Law). Unlike Japan, there are supplementary provisions in China. The female employee labor protection special provision gives a minimum of 98 days for maternity leave and a further 15 days leave in case of dysfunction. -

retirement

■ Type of labor contract cancellationThere are three types of cancellation of labor contract:

· Cancellation of labor contract by agreementVoluntary retirement· Dismissal

Since it is unlikely that a major problem will occur on the part of companies concerning cancellation of labor contracts due to agreement and voluntary retirement, we will focus on dismissal below.

■ Points to remember when dismissingSince China is a socialist state, conventionally, all companies are state-owned enterprises and workers employed by state-owned enterprises are in the position of "doing work given from the country", so there is no concept of dismissal did. This is because all workers are national workers, because of the lifetime employment system. However, as the Chinese economy became a market, privatization of state-owned enterprises progressed, employment became liquid, and law on dismissal was decided.In Japan and industrialized countries, in order to protect the rights of workers, legislation has taken action to regulate dismissal. Meanwhile, in China, there is a tendency to relax dismissal regulations by labor law against workers being protected until now.In China, the Labor Law was enacted in 1995, and dismissal was accepted if certain requirements were met. However, payment for economic compensation may be obligatory, so you need to be careful about that point.

There are three kinds of dismissal which are accepted in China as follows.

[Immediate dismissal]Employers can terminate labor contracts if workers fall under the following requirements. In this case, there is no obligation to pay the economic compensation fee.

· When it becomes clear that it does not comply with hiring conditions during the trial period· Violation of labor discipline and employment rules greatly· In the event of severely neglecting duties or seriously damaging the interests of users by seeking interests· Criminal responsibility pursued based on law

[Preliminary notice dismissal]If the worker falls under the following requirements, it can be dismissed by notifying that he / she will be dismissed in writing by 30 days in advance. However, we have obligation to pay economic compensation.

· When workers are unable to return to their original jobs after the end of the treatment period due to illness or injury outside the workplace and also the employers can not take jobs assigned separately· If the worker is ineligible for the workplace and is not eligible for duties regardless of changes in training or duties· In the event of a significant change in objective facts which were regarded as the conditions of conclusion at the time of concluding a labor contract, in the event that the performance of the labor contract becomes impossible, even if the parties discuss, the change of labor contract When agreement is not reached

[Organized dismissal]In the case where a reduction in personnel is necessary due to the occurrence of a major problem in business continuity, after describing the situation to the labor union or the worker as a whole 30 days before the dismissal, hearing the opinion and reporting to the labor administration department , You can dismiss workers. However, we have obligation to pay economic compensation.

We can not dismiss a worker who falls under the dismissal restriction stated in the Labor Law even if it is a preliminary notice dismissal or arrangement dismissal. The dismissal restrictions stipulated by the Labor Law are as follows.

· Persons who are permitted to lose some or all of their labor abilities due to injury or illness in work· Persons who fall under the medical period stipulated by illness or injury· Female workers who are pregnant, childbirth, lactating period· When there are other circumstances prescribed by law, administrative law

When a company dismisses workers in China, it is necessary to pay attention to the provisions of these labor laws. If we do not proceed according to the law, it will invite not only the distrust of workers but also the burden of economic compensation money twice, and in the worst case the case may develop into litigation matters.

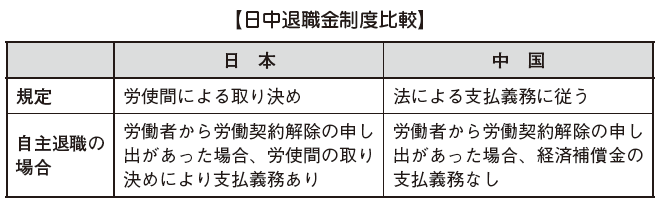

■ Compensation at retirementIn China, as compensation for retirement, there is a regulation concerning payment of money equivalent to Japanese retirement funds called economic compensation. If you retire from retirement due to retirement age pension will be paid from endowment insurance. In this way, we are compensated not to be troubled by workers' lives after retirement and until the next job search.

Retirement allowanceThe employer is obligated to pay economic compensation at the time of retirement. In Japan, retirement allowance can be arbitrarily determined by the company, so whether payment is made or not, both amounts are not legal, but in the case of China the payment of economic compensation is stipulated under the Labor Law.

The amount of economic compensation money is determined according to the number of years of service of the workers and is equal to the salary for one month per one year work. To cancel labor contracts due to illegal acts by business operators, it is obligatory to pay twice the economic compensation fee.

Depending on reasons for retirement, you may not need to pay economic compensation. Economic compensation money is generally provided when it is necessary to protect workers in principle and payment is unnecessary if one of the following applies.

· In case of cancellation of contract due to intention of workers (voluntary retirement)· In case of dismissal based on legitimate reason by the company

The point to keep in mind about voluntary retirement is that there is a possibility that employees may be asked to pay economic compensation even after their cancellation due to employee's retirement offer. If the company can not prove that the agreement has been canceled by an offer from the employee, he / she will not refuse the request for payment of economic compensation from the employeeThere are. However, even if it is a cancellation of a contract due to an offer from an employee,If it is due to a company's negligence, it is necessary to pay economic compensation money.

If you are required to pay statutory economic compensation from an employee after paying an amount less than the statutory economic compensation money and then canceling the contract, you can not refuse the payment due to the prior agreement. In cases where a company does not pay economic compensation with malicious intent, it may be possible to order additional payment of overseas economic compensation equivalent to 50% of economic compensation.Based on these, there are the following preventive measures to avoid troubles.

· Clarify in written document that employee has requested to cancel employment contract· When canceling an employment contract, clearly state on the above document that the employee agreed with the economic compensation amount

■ obligation to avoid competition after retirementRegulations for the prevention of competition inevitably established by local laws and regulations were clearly stipulated for the first time by the labor contract law enforced on January 1, 2008. The main contents of obligation to avoid competition prescribed in the same law are as follows.

· Workers who can impose a competitive retreat after retirement are limited to certain people such as senior management staff, high-level technicians and those who are obligated to keep confidentiality· The period during which retirement can not impose an obligation to avoid competition must not exceed two years· Users are obligated to pay economic compensation for the subjects during the inactive period of competition· Users can set a penalty when the target violates the obligation to avoid competition

During the period of inactivity, the employer must pay economic compensation to the subject every month. If the employer does not pay the economic compensation for the target person, the target shall not be subject to the competition avoidance application.As for the amount of economic compensation money, it is not stipulated by the Labor Contract Law, so it will be set according to each local regulation. According to judicial interpretation of the Supreme People's Court, 30% of the average monthly salary in the 12 months before termination of contract is reasonable (interpretation of the Supreme People's Court on the slight problem of application of law in labor dispute case hearing (4) Article 6).For example, in the case of Shanghai city, if the parties agree, pay the agreed amount, otherwise the subject will pay 50% from 50% of the monthly salary paid before retirement You have to pay as. Economy compensation amount will be decided by discussion between labor and management.

The user can also set the penalty fee, and if the target person violates the obligation to avoid competition, the penalty can be charged to the target person.

-

-

-

Latest News & Updates

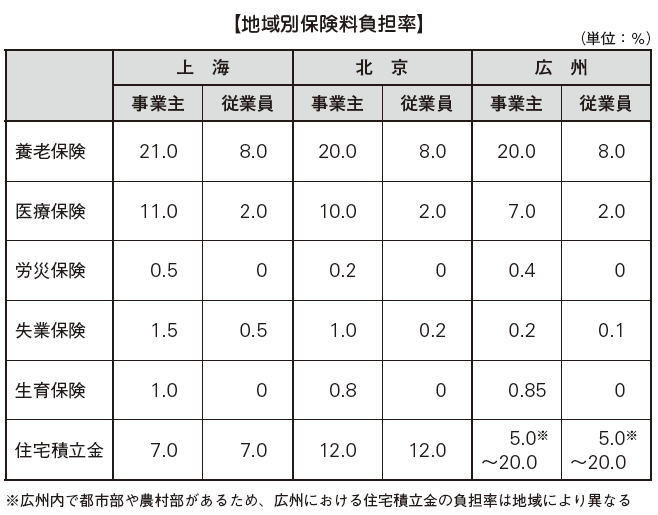

* Social Insurance Rate Reduction Presented in BeijingOn May 31, 2016 the Beijing Municipal Human Resource Social Security Bureau announced that it would lower the insurance premium rate of pension insurance and unemployment insurance covered by companies. It is planned to implement provisionally for two years from May 1, after receiving "Notice on lowering social insurance premium rate in stages" promulgated by Human Resources Social Security Department and Ministry of Finance on April 14, The ratio borne by is immutable.

We will reduce annuity insurance rate from 20.0% to 19.0% and unemployment insurance rate from 1.0% to 0.8%. We also announced a reduction in the worker 's accident insurance premium earlier this year, and from 1st July the standard rate for each type of industry is adjusted to 8 levels from 0.2% to 1.9% from 3 levels of about 0.5% to 2% did.

Beijing Municipal Human Resources Social Security Bureau will lower treatment standards and payment such as wages will not be a problem for lowering insurance premium rates such as whether it can affect treatment standards and payment of wages etc. I emphasized.

Details will be updated soon. -

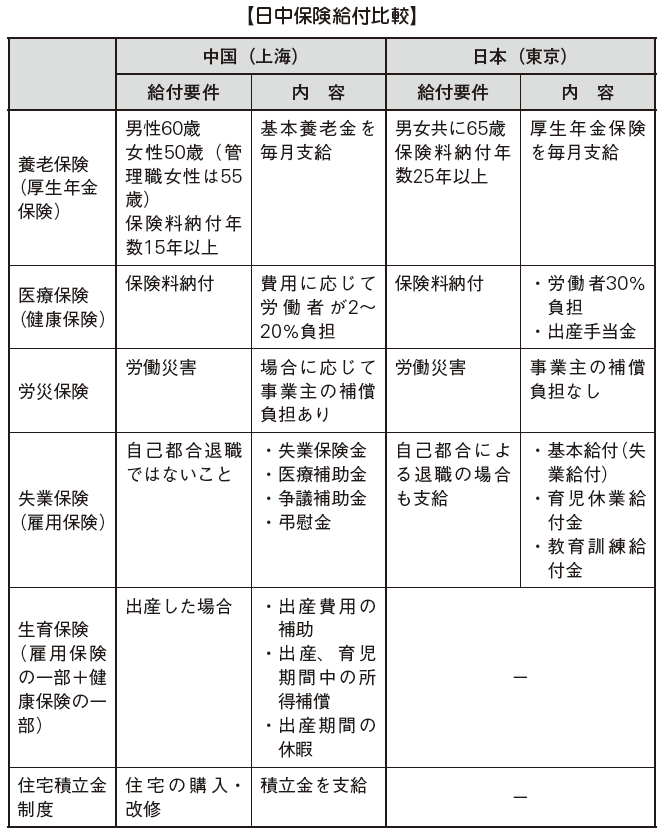

Social insurance

The Chinese social insurance system includes basic endowment insurance, basic medical insurance, occupational accident insurance, unemployment insurance, growth insurance. Although the scope of social security by region does not change so much, depending on family register (urban area, rural area) it varies widely.There is a housing reserve fund that is obligated by companies and employees as a welfare program.As a rule, these systems are forcibly applied to foreigners as well. However, since the way of operation and insurance premiums vary depending on the region at present, it is necessary to confirm with the local social insurance administration agency when actually transferring a representative to China. -

Social insurance application

■ Applicable business establishments, insured personsFor urban main workers, it is obliged to subscribe to basic endowment insurance (urban worker basic endowment insurance), basic medical insurance (urban worker basic medical insurance), occupational accident insurance, unemployment insurance, growth insurance However, in rural areas only old-age insurance (new rural social endowment insurance), medical insurance (new type rural cooperative medical care) is obligatory.

■ Insurance premium[Endowment Insurance]Insurance premiums for old-age insurance differ from region to region, but they are calculated based on employee's wage ratio. In the case of Shanghai city, the insurance premium burden of the employer is 22% of the total wage of the employee of the company and the burden of the employee is 8% of the total wage. An upper limit is set for the wage under which the insurance premium is calculated, and when the employee exceeds 300% of the regional average wage of the previous year, the wage of the employee is 300% of the average wage of the previous year Calculate insurance premium as.The requirement is that the payment period is 60 years for men, 50 years for women (55 years for managerial positions), and 15 years or more for payment of insurance premiums at the time the legal retirement age is reached. If the requirements are satisfied, basic pension is paid as a monthly pension each month.

[medical insurance]Insurance premiums for medical insurance differ from region to region, but it is calculated based on the wage ratio of employees. In the case of Shanghai city, the insurance premium burden of the employer is 12% of the total wage of the employee of the company and the burden of the employee is 2% of the total wage. The company and the individual jointly pay insurance premiums.Benefits will be paid at a fixed rate to expenses related to treatment, medicine, hospitalization etc.

[Occupational accident insurance]It is similar to the worker's accident insurance system in Japan (hereinafter referred to as workers' compensation), but China has a broader scope of employee's compensation responsibilities for disaster compensation. In Japan, wages of employees who are taking leave due to workers 'injuries are paid as insurance benefits, but in China it is necessary for operators to bear workers' accidents. It is necessary to pay attention to the safety management of employees in order to operate the company.Insurance premiums for workers' compensation insurance differ from region to region, but they are calculated based on the employee's wage ratio. In the case of Shanghai city, the employer 's insurance premium burden is 0.5% of the total wage of the employee of the company, there is no burden on the employee' s insurance premium.As with Japan, benefits will be made for injuries caused by business reasons. Benefit content includes treatment and compensation, and compensation depends on previous wages and disability weights of workers who received workers' compensation. There are cases where employers have to compensate for serious obstacles.

[Unemployment insurance]Unemployment insurance in China is similar to the employment insurance system in Japan, but in China there are insurance benefits in case of self-convened retirement and there is a medical subsidy and death compensation system in unemployment insurance system Be careful as there are points that differ from Japanese employment insurance system, such as points.Insurance premiums for unemployment insurance differ from region to region, but it is calculated based on employee's wage ratio. In the case of Shanghai city, the insurance premium burden of the employer is 1.5% of the total wage of the employee of the company, and the burden of the insurance premium of the employee is 0.5% of the total wage.The requirement to receive unemployment insurance is that there is hope for job seeking after completing registration of unemployment, that there is payment of insurance premium of one year or more by business owner and insured person, not retirement by self-circumstances . Benefits include unemployment benefits (1 to 24 months depending on the period of payment of insurance premiums), medical subsidies, funeral subsidies and condolence money in case of death.

[Growth insurance]Growth insurance is a combination of childbirth allowance in medical insurance in Japan and childcare leave benefit in employment insurance.Insurance premiums for growth insurance differ from region to region, but they are calculated based on the employee's wage ratio. In the case of Shanghai city, the employer's premium burden is 1% of the total wage of the company's employees, and there is no burden on the employee.Benefits include medical expenses and examination expenses for childbirth, childbirth allowance (childbirth, income compensation during child rearing period), childbirth vacation (childbirth period, can take a vacation).

[Residential reserve fund]Residential reserve funds are not social insurance, but in China, as a part of the welfare system there are more areas outside the rural areas where companies are obligating housing reserve fund systems (housing reserve fund management ordinance). Businesses and individuals will bear the reserve funds and are used when employees build houses or when renovating houses. The residential reserve amount varies according to the region, but it is calculated based on the employee's wage ratio. In the case of Shanghai city, employers' burden of insurance premium is 7% of the total wage of employees of the company and the burden of employees is 7%.

The following table summarizes the premium burden in China (Shanghai) and Japan (Tokyo). The total employer contribution ratio of social insurance in China is 44%, which is very high rate compared with 14% in Japan. When entering China, it is necessary to consider budget in consideration of social insurance costs etc.

-

Social insurance by region

In China, the labor insurance rate and social insurance rate vary depending on the region. Occupational accidents are the same as in Japan and there is no burden rate of employees. Also, in Japan, childbearing and childcare benefits etc. are included as health insurance, but in China there is a separate provision of growth insurance, there is no burden on employees. Details of each area are as follows.

In China, the Social Insurance Law came into effect in July 2011, aiming to build a nationwide unified social insurance system, but the actual operation is the situation that the social insurance management agencies in each region are responsible for. Since the operation method differs according to each region, it is important to check in advance with the social insurance management agency that has jurisdiction over the area if you actually want to transfer the representative to the site.

-

-

-

Various procedures

The following procedure is necessary when letting a representative to be transferred to China.

· Procedures at the time of departure (Year-end adjustment, Tax return, Transfer notification etc.)· Social insurance in Japan and China· Determination of salary (gross up calculation)· Acquire Visa and Work Permit

■ Year-end adjustment at departureThose overseas who stay in China for less than 183 days per year are required to declare and pay taxes in China regarding salary to be paid in China but pay tax paid in Japan on payment in Japan In order to do so, it will be tax exempted in China.However, those overseas who have stayed in China for more than 183 days per year, need to pay income tax in China regardless of payment in China and abroad regardless of their income.In China, senior management staff such as general manager etc is supposed to be a permanent resident occupation, so even if staying in China is less than 183 days per year it will be taxed on all domestic and foreign income (China Notice concerning the tax obligation problem of salary income acquired by individuals without domestic address).

In fact, there are many cases in which income is payable on a daily basis according to the length of stay in China, and no particular problem has arisen. Also, most high-level management staff who stay only less than 183 days in a year do not declare income overseas just like ordinary officials. Many cases are tolerated by tax authorities.

Currently it is operated with ambiguous criteria, but please be careful as criteria may become stricter as legal development goes forward.

■ Tax return at departureIn the case that there is income subject to comprehensive taxation, real estate lending income or the transfer of income in domestic assets, we appoint a tax administrator who fulfills the tax return obligation, etc., the date of departure from Japan Must notify the director of the tax office that has jurisdiction over the place of tax payment.

■ Notification of moving out at departureNotification of overseas transfer will only be signed with a passport at the resident registration desk of the local government registered in the country in Japan and sign the transfer statement, but the resident registration in that local government will be canceled and the resident card can not be acquired . The acceptance of the transfer notice is possible from two weeks before the planned departure date, and it is necessary to specify the country name and the city name even if the address of the transfer destination is not confirmed.

Procedure for overseas assignmentProcedures for the matters listed in the following table are also necessary when transferring overseas.

■ Health managementMedical checkupWhen employees are to be transferred overseas for more than six months, it is mandatory to undergo medical examinations in advance, such as medical history surveillance, anemia investigation, urinalysis, electrocardiogram examination (Article 45 paragraph 2 of the Occupational Safety and Health Regulation).

vaccinationIn South Asia including China, the risk of infection such as hepatitis A and tetanus, in particular, is high, so we should vaccinate with families who accompany them beforehand.

■ Japanese SchoolWhether or not to have a family member when there are families when staying abroad is an extremely serious problem.If you do not follow family members, family members remaining in Japan need to join social insurance, so we will compensate by providing an outpatient home allowance.Meanwhile, when you band a family member, you will receive an obligatory families allowance and supplement your living expenses in your place of work.In order to band a child in the field, it is necessary to investigate schools that you will go to school in advance. There are Japanese schools in China where Japanese companies concentrate. However, since the Japanese school in each area is an independent private school, the disparity in tuition fee by area is large. -

駐在員の給与体系

■Expatriate regulationsWhen bringing an employee from Japan to China, it is necessary to decide beforehand about treatment such as salary and allowance at parent company and Chinese subsidiary. The items described in the expatriate regulations are as follows.

· Purpose of regulations· Definition of terms (expatriates, travelers, etc.)· Affiliation under overseas work· Knowledge as an expatriate, other duties· Working hours, holidays (whether to obey the rules of the head office, follow local regulations, etc.)· Overseas assignment period (There are many cases to describe with a margin such as 3-5 years)· Salary and allowance during overseas assignment· Treatment of travel expenses and supplementary fees· Family stupidity (uniform prohibition, family bandage recommended, only applicants etc.)

■Salary / allowanceThe salary and allowance of expatriates will be decided by taking into consideration the price, the environment, the level of local social insurance premiums and income tax rates, family members, etc. for salary in Japan.The rough procedure is as follows.

① Determination of basic salary② Determination of each allowance③ Calculate takeover amount when receiving in Japan④ Gross amount so that the amount of takeover received in China is equal to ③Up calculation⑤ Determination of the ratio of pay burden among parent company and subsidiary in China

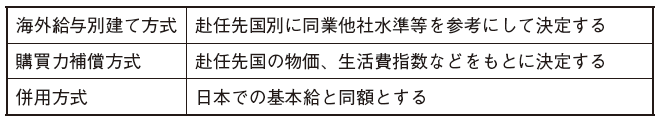

As for the basic salary, there are three decision methods when roughly divided.

When Japan is located in developed countries such as Europe and the United States, prices and living expenses levels are often higher than Japan, and in many cases, purchasing power compensation method is used. Meanwhile, in Asian countries such as China, prices of living expenses are often higher in Japan, so there are increasing cases where the following types of allowances are separately paid as basic salary of the same amount as Japan in combination method.

· Working overseas (incentive) allowance· Hardship allowance· Job allowance· Family allowance· Housing allowance· Missed home allowance· Child's education allowance

The hardship allowance is decided by reference to the Ministry of Foreign Affairs' Basic Data of the People's Republic of China (http://www.mofa.go.jp/mofaj/area/china/data.html) etc. and compared with the environment of other countries.In recent years, it is a tendency to reduce benefits paid as a plus alpha so far, because it is considered natural to take a job abroad and Japanese companies that are parent companies are not affordable.

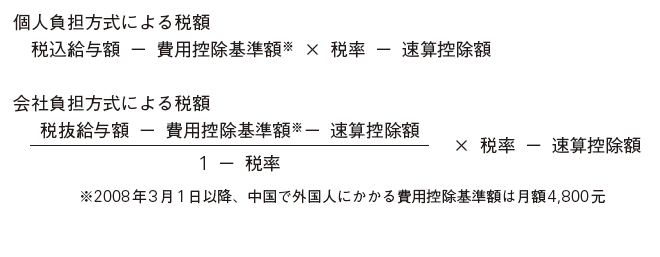

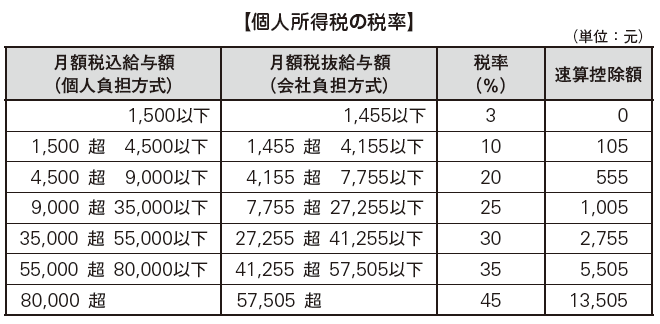

■ Calculation of income tax relating to persons who transferred to ChinaChina's income tax calculation has a personal burden method and a company burden method, and the calculation method differs depending on whether the income tax is borne by the individual or the company.

Tax calculation by each method is carried out at the following tax rate.

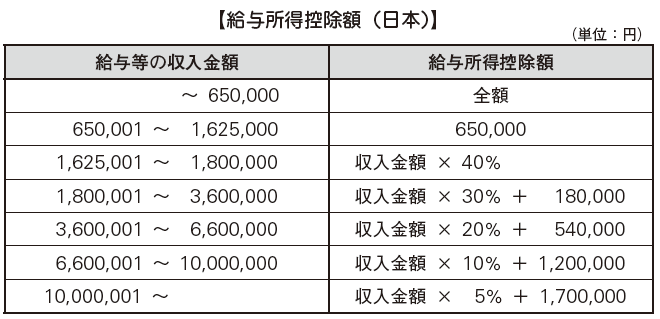

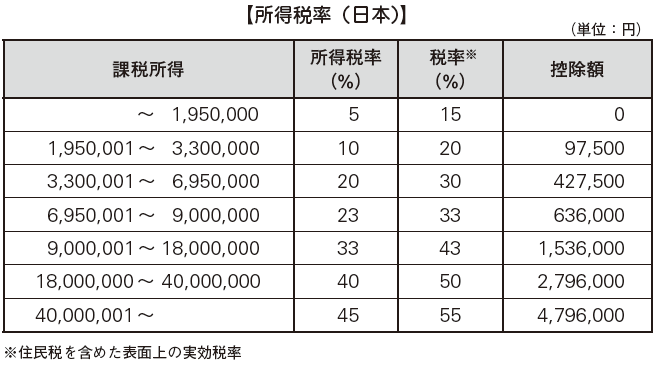

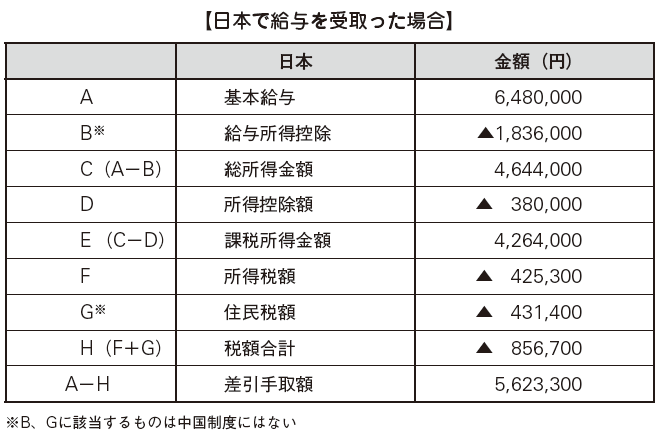

The salary income deduction and income tax rate in Japan are as follows. Because there is a difference in the applicable tax rate between Japan and China, paying the salary similar to that in Japan in China may result in a lower take-home wage salary.

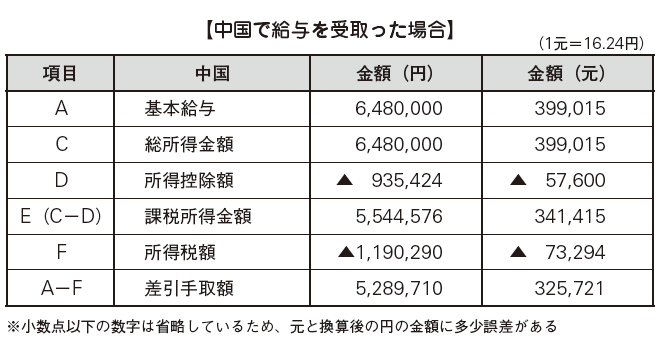

■ Example of income tax calculation in Japan and ChinaPrecondition *40-year-old man, annual income in Japan 6,480,000 yenNo dependents, planned to arrive for 3 years* Actually, other deductions need to be considered, but here we do not consider it because it is calculated simply

■ Example of income tax calculation in Japan and ChinaPrecondition *40-year-old man, annual income in Japan 6,480,000 yenNo dependents, planned to arrive for 3 years* Actually, other deductions need to be considered, but here we do not consider it because it is calculated simply

In this way, if the expatriate with annual income of 6.48 million yen receives salary in China, the takeover amount will be 5,289,710 yen, which will be 333,590 yen less than 5,623,300 yen in Japan takeover amount.

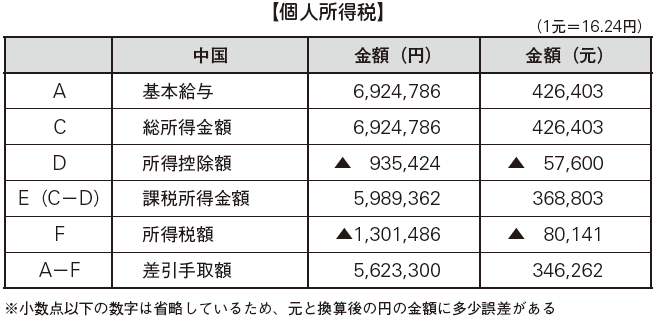

■ Gross Up Calculation Matching Committed AmountsIt is necessary to make a gross up calculation in order to match the takeovers in Japan and China. In order to set the take amount to the previous 5,623,300 yen, payment of 6,924,786 yen is required, so we add about 450,000 yen to the payment amount and adjust it. Because the amount to be added depends on the salary amount to be set up, it is necessary to prepare payment amount before assigning.

-

Handling of social insurance

In accordance with the People's Republic of China Social Insurance Law enforced in July 2011, foreign workers working in China were obliged to join the following five social insurance.

· Endowment insurance·medical insurance· Accident Insurance· Unemployment insurance· Growth insurance

Total of these five insurance premium rates is Shanghai, the employer's burden is 35%, and the burden on the person is 10.5%. In the case of Japanese expatriates, the salary which is the basis of calculation exceeds 16,353 yuan (about 327,000 yen) which is the upper limit of monthly salary which is the basis of social insurance in China, so it is 327,000 yen × 35.5% ≈ 116,085 yen, about 1,390,000 yen in the year. In the case of Japanese social insurance premiums, the worker's burden rate is 13.5%, the employer's burden rate is slightly higher than that, totaling less than 30%, the Chinese have a higher burden ratio for social insurance .

■ Treatment of social insurance in Japan[Social insurance]Salaries will be paid by Japanese companies when they are transferred to China with continued employment relations with companies in Japan. In this case all social insurance in Japan will continue. When salary is all paid by a local company in China, social insurance will not continue because it can not be accepted as being enrolled in a Japanese company. If you would like to voluntarily join the National Pension during your assignment, you will need a separate procedure.

Even if you take medical care abroad during your overseas assignment, you can apply for medical expenses to the health insurance association etc. to join (Conditions that you continue to join Japanese health insurance even while you are overseas) ). However, you need to pay attention to the following points when applying.

· In order to apply as a medical expenses, the principal once exchanged the medical expenses abroad, apply to the Japanese health insurance union etc· The medical expenses received overseas will be deducted from the amount calculated by converting it into the number of insurance medical examination cases when receiving medical insurance in Japan

Documents necessary for health insurance overseas medical expenses application are as follows.

· Medical treatment expenses application form· Certificate of medical treatment contents· Receipt statement· Receipt (Original)

If the documents to be submitted are written in languages other than Japanese, it is necessary to attach a Japanese translation with clearly the name and address of the translator. In addition, if a worker who wishes to go abroad seeks application of workers' compensation insurance in Japan, it is necessary to prepare a special application form and submit it to the prefectural labor bureau director in charge.

[Overseas travel accident insurance]When you move overseas, you need to consider subscribing to overseas travel accident insurance besides public insurance. If you are in overseas travel accident insurance, medical expenses will be complemented by insurance fees for medical treatment at hospitals insured by insurance companies. Also, unlike public insurance, actual expenses of medical expenses actually paid are limited to the contracted insurance amount.New registration procedures for overseas travel accident insurance must be completed by departure date. -

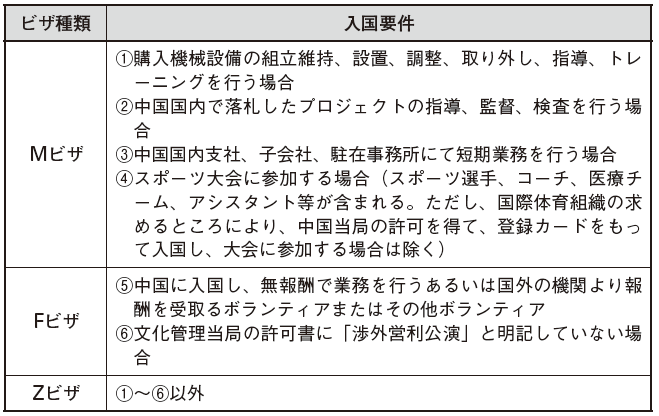

Acquisition of Chinese visa

In order to work in China it is necessary to obtain a visa. The type of visa required for entering China is stipulated in the "Regulations on Foreigners' Immigration Procedures for Executing Short-term Business (Trial)". In addition, there are D visa (for Chinese permanent residents) and C visa (for passengers such as airplanes and ships).

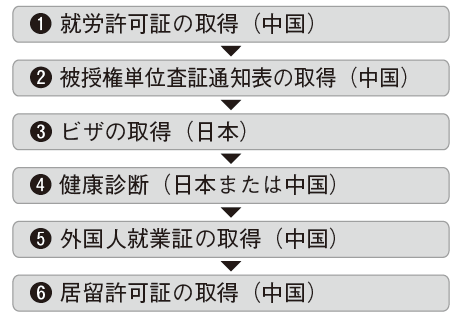

Usually, you will get a Z visa if you are going to China. The procedures for obtaining Z visa are as follows. Proceedings will be completed as soon as two months.

Usually, you will get a Z visa if you are going to China. The procedures for obtaining Z visa are as follows. Proceedings will be completed as soon as two months.

■ Acquisition of work permit (China) ... ❶Regarding the acquisition of a work permit (China), we will apply by submitting the following necessary documents to the foreign work center in each area. A work permit will be issued usually one week after application.

· Foreign work application form· Foreign companies of business license of work need also approval certificate (copy)· Organization of the work place Promotion certificate (copy)· Foreigner's history certificate· Education certificate· Passport (copy)· Credential certificate *※ Documents other than Chinese by qualification certificate etc. need to submit Chinese translation

■ Acquisition of authorized unit visa notice table (China) ... ❷Regarding the acquisition of the authorized unit visa notice table (China), the following necessary documents will be submitted to the external economic and trade committee of each region (organization name may vary depending on each region). An approved notice of unauthorized unit visa will be issued about one week after applying.

· Application form for authorized unit of visa· Foreign work permit· Applicant's passport (copy)· Business license of local company (copy)

■ Obtaining a visa (Japan) ... ❸For visa acquisition (Japan), submit the following required documents to the Chinese embassy in Japan and apply.

· People's Republic of China Visa Application Form· Applicant's passport (original) and certification photo page (copy)· Certificate picture 1 piece (4 cm × 3 cm, one that faces the front without a cap)· Unauthorized Unit Visa Notification Table (Original and Copy)· Work permit (original and copy)

■ Health check (Japan or China) ... ❹For medical checkups, you will be able to see a doctor if you obtain a work permit. In other words, it can be examined even before entering China even after entering the country. Reservate to the hospital designated on the phone or the Internet and consult a doctor. If you have visited in Japan and there are undiagnosed items, you need to take additional examination at the Chinese side. The following documents are necessary for consultation.

· Application form· Passport (original and copy)· Certificate photo 4 pieces ※ (4 cm × 3 cm)· Copy of business license of overseas affiliate※ 1 for visa application. After entering China we need three copies to obtain employment certificate

■ Acquisition of Foreign Employment Certificate (China) ... ❺For the acquisition of a foreign employment certificate (China), submit the following documents to the foreign work center in each area and apply. This procedure needs to be done within 30 days after entering China.

· Foreign work registration table (2 copies)· Business permit of the local corporation and organizational organization code (both copied)· Curriculum vitae· Passport (original and copy)· Work permit· Health certificate (copy)· 3 certification photos (4 cm × 3 cm each)· Labor contract (Chinese translation is required for Japanese version)

■ Acquisition of Residence Permit (China) ... ❻Regarding acquisition of a residence permit (China), submit the following documents to the entry and exit management office of each area and apply. This procedure needs to be done within 30 days after entering China.

· Foreign visa, application for residence permit (2 copies)· Passport (original)· Visa (Original)· Health certificate· Invitation letter issued by a local corporation· Business license of local company (original and copy)· Certificate of graduation (Foreign companies only)· Subsidiary organization organization organization certificate (original and copy)· Foreign worker's employment card· 1 certificate photo (4 cm × 3 cm)

-

-

-

References

・ 黒田法律事務所『新版Q&A中国進出企業の労務ハンドブック』清文社、2014年・ 渡辺基成編著『最新中国進出ビジネスQ&A──中小企業のための税務・労務』三協法規出版、2011年・ 高原彦二郎、陳軼凡編著『中国進出企業の労務リスクマネジメント』日本経済新聞出版社、2011年・ 射手矢好雄『そこが知りたい中国法務』時事通信出版局、2009年

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya