China

13 Chapter Transfer Price Taxation

-

-

1 Chapter Introduction

1.1 The history of Japanese companies entering the world

1.2 New business model in China

1.3 Advance scheme through Hong Kong

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.2 Province and region of China

3.5 Investment incentives and regulations

4 Chapter Economic Environment

5 Chapter Establishment

5.3 Establishment of business base

5.4 Procedure after incorporation

6 Chapter Withdraw

7 Chapter Foreign exchange

7.1 Foreign exchange management system in China

7.2 Foreign currency management system of ordinary items

7.3 Foreign exchange control system of capital items

7.4 Foreign exchange control system in bonded area · Hong Kong

7.5 Individual foreign currency control system

8 Chapter M&A

8.2 Laws and regulations concerning M & A

8.5 Challenges after corporate acquisition

9 Chapter Corporate Laws

10 Chapter Accounting

11 Chapter Tax law

11.2 Representative Office Taxation

11.4 Individual Issues in China Domestic Tax Law

12 Chapter International taxation strategy

12.1 International tax relating to entering China

12.2 International taxation strategy

12.3 Individual Issues in International Taxation

12.4 Tax issues related to withdrawal

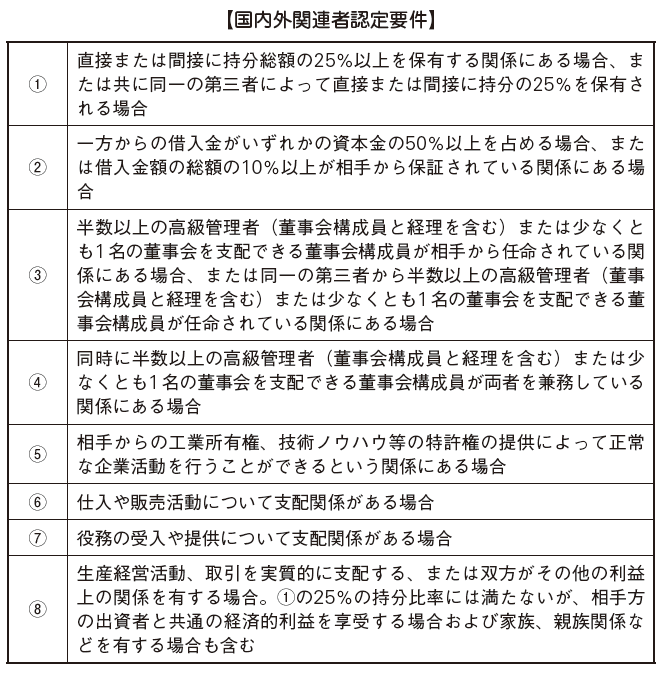

13 Chapter Transfer Price Taxation

13.2 Individual provision pertaining to transfer pricing taxation

13.3 Transfer price taxation and documentation

13.4 Transfer price survey in China

14 Chapter Labor

14.4 Points to remember when bringing Japanese

15 Chapter International Human Resources Management

15.1 Human Resources Labor Management

15.3 Personnel evaluation system

-

-

-

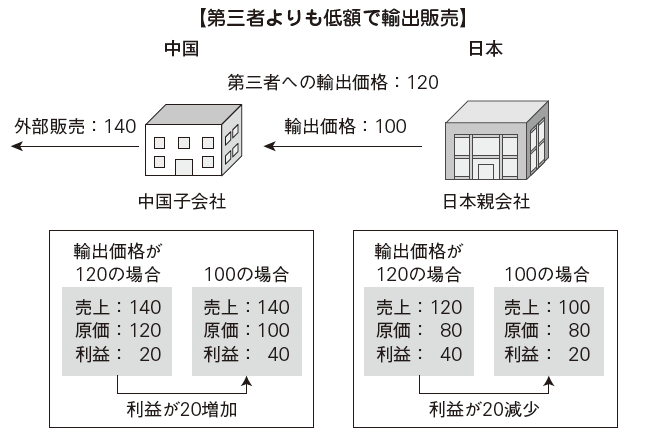

Understanding transfer pricing taxation

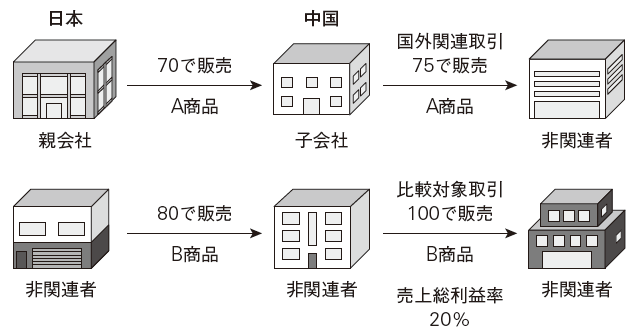

The transfer pricing taxation (Transfer Pricing Taxation) is a transaction price with a foreign affiliated company of a company (a parent company, a capital relationship like a brother company, a foreign company in a personal relationship such as dispatching officers) By calculating again with the transaction price (inter-company price: armslengthprice) conducted with the three parties, it is possible to prevent income obtained through transactions with foreign related parties from transferring to other countries, It is a tax system aimed at realizing international taxation.In major countries including Japan and China, the relevant transaction price is set at the same level as the price that would have been established in similar non-affiliate transactions based on the principles established by the Organization for Economic Cooperation and Development (OECD) (Independent Intercompany Principles) In principle it is set up. The point that we must pay attention to in the transfer pricing tax system is that taxpayers are taxed regardless of whether they intend to avoid taxes or not. Since recent transfer pricing taxation covers all related party transactions (tangible asset transactions, intangible asset transactions, service offering transactions, financial transactions, etc.), companies are required to consider transfer pricing risk at all times.

For example, as shown in the figure, when a Japanese parent company exports to a subsidiary in China at a price lower than the stand-alone company price by 20, the company's profit will be reduced by 20. Since overseas related persons usually have a constant external sales price, the profit will be increased by 20 compared to the case of importing and selling the product from a third party. In this way, merely by changing the transfer price, the income that the country should originally taxes is reduced. Therefore, transfer pricing taxation system is institutionalized in each country in order to prevent income from transferring to other countries and realize appropriate international taxation.

If the tax authorities in each country recognize transactions that can be a problem in terms of transfer pricing taxation, transfer pricing survey will be conducted for that company. The company will cost a lot of time and cost to deal with it. In the event that it will eventually be subject to a disposition, there will be a double taxation risk in addition to the additional taxes and delinquent taxes, which could result in a significant loss in operating results. With regard to unexpected tremendous transfer pricing risk, we will analyze potential risks and devise their response / solution.

-

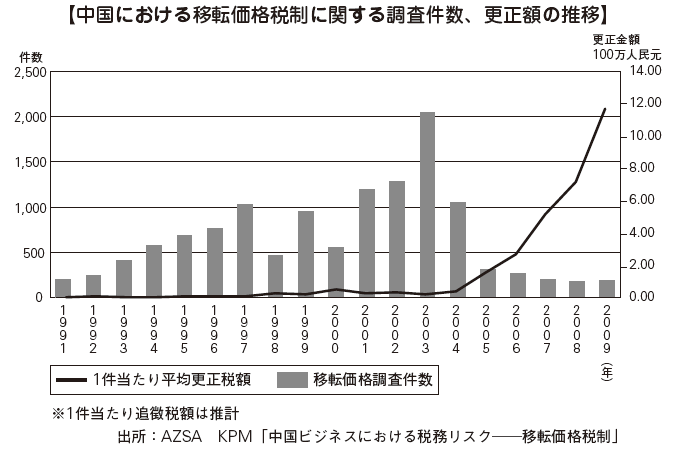

Transition of China transfer pricing taxation

In China, the transfer pricing taxation was introduced for the first time in China in 1991 by the People's Republic of China Foreign Investment Company and Article 13 of the Foreign Corporate Income Tax Law adopted the Independent Inter-Enterprise Principles on Related Transaction Prices. Around this time, Deng Xiaoping's reform and open-mind policy matures, reform in the domestic market, opening up overseas (deregulation, establishment of development zones, preferential taxation, etc.) was promoted. The transfer pricing taxation system was also introduced as part of system improvement aimed at attracting foreign companies.Draft Tax Management Regulations on Business Relationships between Related Operators (Trial) In 1998, according to the National Tax Initiative [1998] No. 59, the holding requirements of related companies, application to transactions with domestic and foreign affiliated companies, Guidelines stipulating responsibilities, estimate taxation, retroactive adjustment, objections, etc. were promulgated, and transfer pricing management was strengthened. In this background, foreign companies entering China at that time mainly focused on labor-intensive manufacturing with motivation for low manufacturing costs, mostly due to overseas relocation of profits using transfer pricing, Chinese enterprises It is said that it became a deficit. For that reason, it is said that concerns about giving impressions that Chinese companies are not making profits to overseas investors, and transfer pricing management was strengthened for the purpose of preventing image deterioration against investment in China.According to Article 36 of the Tax Collection Collection Management Act of the People's Republic of China in 2001, the independent corporate principle was applied to intercompany transactions for all companies and all tax matters. In accordance with China's socialist market economy system China's accession to the WTO (2001), the scope of the transfer pricing taxation was expanded.In 2004, the APA (Advance Pricing Agreement) guideline will be promulgated by the Implementation Regulation Regarding Reservation Price of Business Relationship between Related Operators (National Tax Release [2004] No. 118). In order to avoid the risk of transfer pricing taxation in advance in advance, the APA is a system to obtain confirmation that a transaction price with foreign affiliated persons is an independent company price with the taxation authority prior to the transaction. In this way, China has joined the international economy as both name and reality as a result of accession to the WTO, but at the same time China has emphasized various problems such as regional disparity, income disparity and environmental pollution brought about by the market economy, and President Hu Jintao It is a time when we tried to correct the disparity with the slogan of Wakayama society. Forced to reconsider the relationship between economic development and social structure, the stance of attracting foreign enterprises changed from quantity to quality in response to that.Circular consultation proceedings were issued in 2005 by the Chinese Inland Tax Mutual Interpretation Procedure Application Provisional Enforcement Valuation Act (National Tax Release [2005] No. 115). In the case of taxation based on the transfer pricing taxation, double taxation will occur temporarily between international countries. Therefore, the tax authorities of each country where foreign affiliated persons are located will decide to negotiate with each other for the purpose of eliminating this international double taxation.In 2008, the new corporate income tax law was enacted, and due to the regulation of tax evasion measures, tax and air pollution prevention tax system, undercapital tax system, cost sharing, overdue tax, transfer pricing adjustment, advance confirmation system, etc., transfer pricing Management has been further strengthened. In response, foreign companies are forced to respond.

Transfer price simultaneous documentation provision was introduced by the 2009 Special Tax Adjustment Act (Valid Law) (Trial) (National Tax Release [2009] No. 2, Transfer Price Guidelines). As a result, all Chinese enterprises are required to submit corporate annual intercompany transaction reports from the annual corporate income tax declaration in FY2008, and to submit concurrent documents as transfer pricing analysis documents.

Today, the law relating to China transfer pricing taxation is the trinity of the People's Republic of China enterprise income tax law, the enterprise income tax law implementing ordinance of the People's Republic of China, and the special tax adjustment adjustment valuation law are three, and the Gross Domestic Product (GDP) It is comprehensive content suitable for the country which is second place.

-

-

-

Scope of target company (target corporation)

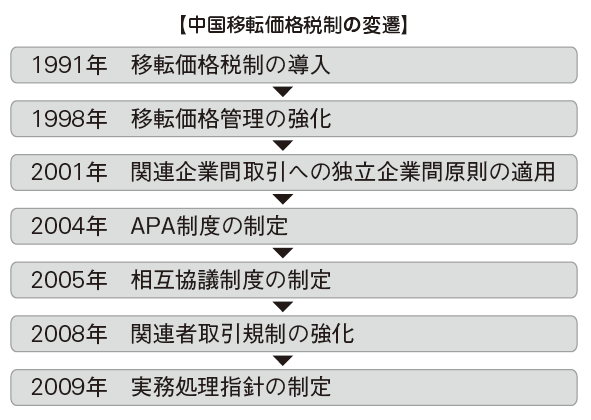

Transactions subject to the transfer pricing taxation are transactions between companies and foreign related persons (hereinafter referred to as related persons). Related persons are defined as follows.

Affiliates are companies, other organizations or individuals that fall under either of the following relationships (affiliated relationships) with the company (Article 109 of the People 's Republic of China' s corporate income tax law).

· In cases where there is a direct or indirect control relationship concerning funds, management, trading, etc.· You are under direct or indirect control by the same third party· Other relationships with profit related

In the Special Tax Adjustment Invalidation Act (hereinafter referred to as the Act on Investment Act), the related persons to be applied are more concretely stipulated from the form of income tax law in addition to the enterprise income tax law. On the formal side, the 25% ownership ratio of ① is applicable, and in real terms, real control by other companies related to funds, management, trading, etc. other than ① falls under Article 9 of the Implementation Valve Law. In other words, even if there is no capital relationship, attention should be paid as it becomes a related person if the real aspect applies. Real control over trading etc. is judged to have real control by another company if transactions with other companies account for 50% or more of total transactions.

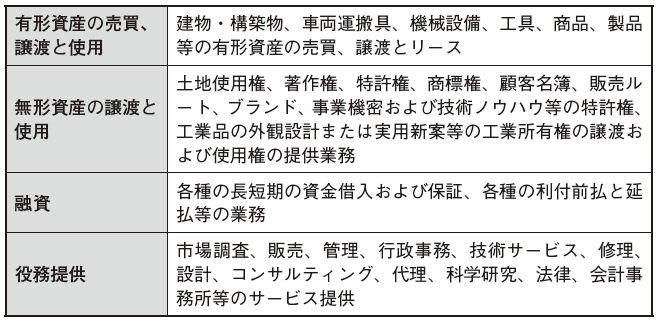

According to the definition of overseas affiliates (Article 9 of the Implementation Valve Law), the Chinese tax authorities have extensively placed related persons and can read the strong will to apply transfer pricing taxation. Transactions between related persons and companies subject to the application are subject to transfer pricing taxation and in principle transfer pricing taxation is also applied to domestic transactions. Regarding related party transactions, they are categorized into the following four categories (Article 10 of the same law).

-

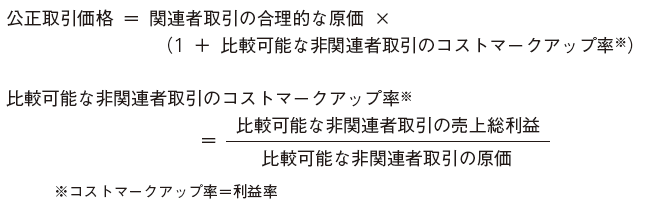

Price calculation method in China tax law

The enterprise income tax regulation implementation ordinance sets forth the following five methods as a reasonable transfer price calculation method (Article 111 of the enterprise income tax law). On the other hand, the Investment Validation Law stipulates applicable methods and points to be noted about each transfer pricing method. Regarding the five methods, there are no specific provisions for priority application, and it is necessary to select the optimal method after understanding their respective characteristics.

Independent Price Comparable Substitution Law ... ❶The Comparable Uncontrolled Price Method (CUP) is a method of deeming a price collected for business activities that are equivalent or similar to related business transactions performed between non-related parties as a fair transaction price (Act on Investment Act 23). This is useful when there are unrelated transactions that are equivalent or similar to affiliate transactions, or when the difference between related transactions and non-related transactions can be reliably adjusted. However, since it is extremely difficult to obtain unrelated party transaction data that can be compared in practice, it is rare to compare by independent pricing method.

In this case, the selling price per kg between related persons is as follows.

900 ÷ (150 kg * 0.5) = 12

In contrast, the selling price per kg of unrelated persons is as follows.

1200 / (100 kg * 0.8) = 15

In other words, in this case, the original selling price is 15, rare metal 1 kg3 income has been transferred outside the country.

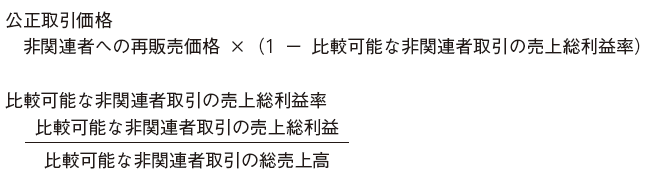

■ Resale Price Standard Law ... ❷The Resale Price Method (RP method) is a method in which the gross profit margin in a comparable non-related party transaction is subtracted from the price when reselling the products purchased from related persons to non-related persons It is a method to make the amount afterward as the fair transaction price for the purchase of the related party's goods (Act on Investment Act 24).

Discuss the functions and risks of related party transactions and non-related party transactions, the differences related to contract provisions and other factors that affect the gross profit margin, and if there is a large difference, the effect of the difference on the gross margin It must be reasonably adjusted. This adjustment is carried out when it is possible to objectively confirm the difference in profit margin due to differences in terms and conditions such as delivery conditions and settlement conditions with non-relevant persons to be compared. This method can not be adopted if reasonable adjustment is not possible.The resale price standard law is generally applied to simple processing or simple trading in which reseller does not perform substantial value added processing such as change of external type, performance, structural change or replacement of trademark for goods I will.

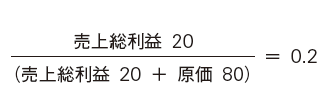

In this case, the gross margin of comparable non-affiliated transactions is as follows.

In addition, the fair deal price according to the resale price standard law is as follows.

Resale price of related party transaction 75 × (1 - 0.2) = 60

In this case, the income of 15, which is the difference between the fair transaction price of 60 and the foreign transaction price 75, has been transferred outside the country by the establishment of the subsidiary.

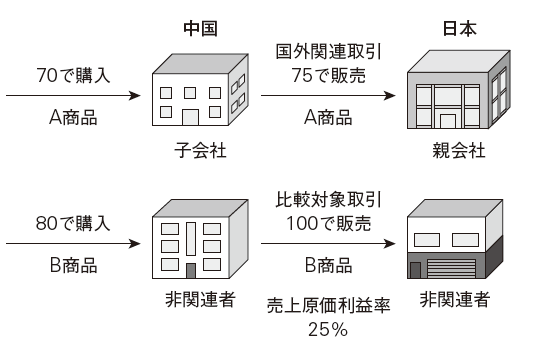

Cost basis method ... ❸Cost Plus Method (CP method) is the sum of gross profit on non-affiliated parties that can be compared with reasonable cost (cost) generated from affiliate transactions to fair trade It is a method to make it price (implementation method law 25).

Consider the functions and risks of related party transactions and non-related party transactions, the differences in terms of contract provisions and other factors that affect the cost markup rate, and if there is a large difference, the difference is converted to the cost markup rate It is necessary to rationally adjust the influence you give. This method can not be adopted if reasonable adjustment is not possible. Cost basis method is normally applied to trading, transfer and use of tangible assets, inter-party transaction of provision of services or fund transfers.

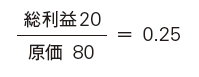

In this case, the cost of sales profit ratio of comparable non-affiliate transactions is as follows.

In this case, the cost of sales profit ratio of comparable non-affiliate transactions is as follows.

In addition, the fair transaction price by the cost basis method is as follows.

Cost purchased by a subsidiary 70 × (1 + 0.25) = 87.5

In this case as well, the income of 12.5, which is the difference between the fair transaction price of 87.5 and the related transaction price of 75, has been transferred outside the country.

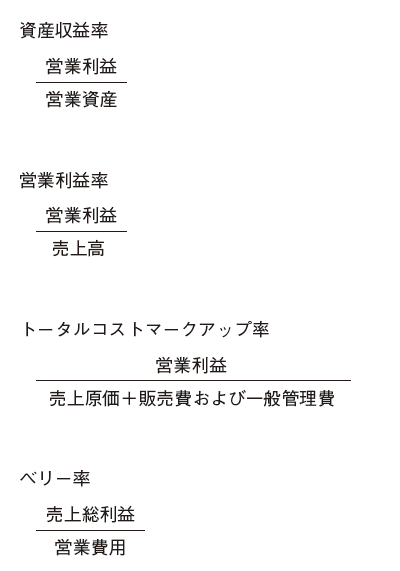

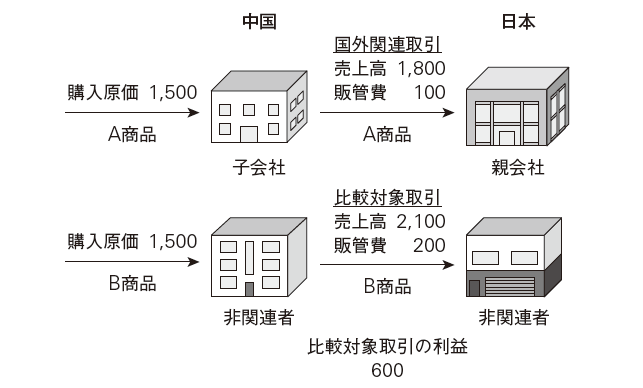

■ Trading unit operating income method ... ❹Transactional Net Margin Method (Transactional Net Margin Method) is a method of determining the transfer price of related party transactions by comparing non-affiliate transaction margin indicators. Profitability index includes asset return rate, operating profit ratio, total cost markup rate, berry rate, etc. (Act on Investment Act 26).

Discuss the functions and risks of inter-related transactions and non-related person transactions, the differences related to the economic environment and other factors that affect operating profit, and if there is a large difference, rationalize the impact of such differences on operating income It is necessary to adjust it in a way. This method can not be adopted if reasonable adjustment is not possible.Transaction unit operating profit law is generally applied to related party transactions such as purchase and sale of tangible assets, transfer and use, transfer and use of intangible assets, and provision of services. Since this method is a method of comparing the level of operating profit, it is generally less susceptible to differences in function and risk, etc. compared with the resale price standard method or cost basis method which compares the level of gross profit It is widely adopted in practice.

In this case, the price between independent companies is as follows.

In this case, the income of 440, which is the difference between 2,240 independent company prices and 1,800 sales of overseas related transactions, has been transferred outside the country.

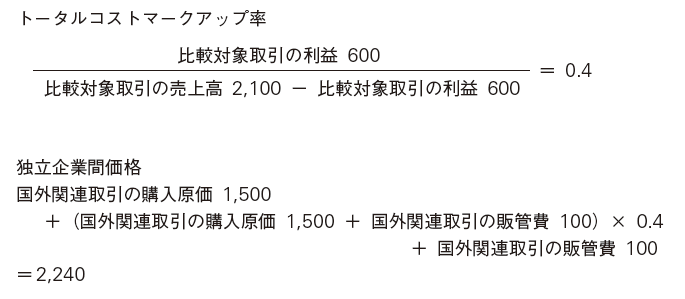

■ Profit division method ... ❺Profit Sprit Method (PS Law) is a method of calculating the amount of profits to be allocated to each affiliate based on the degree of contribution to the consolidated profit of the company and its related parties. There is a general profit division method and a residual profit division method (Article 27 of Implementation Valve Law).The General Profit Splitting Law is a method of determining the profit to be obtained by each party based on the functions of each party of the related party transactions, the risks they owe and the assets used. On the other hand, the residual profit split method is based on the contribution of each party to the residual profit, with the remainder after deducting the ordinary profit allocated to each party from the combined profit of each party of the related party transactions It is a method to allocate. The profit split method is generally applied when the integration of the related party transactions between parties is high and it is difficult to evaluate the transaction results of each party independently.

In this case, the profit between independent companies is as follows.

In this case, 50 income, which is the difference between 100, which is the profit between the independent companies and the profit 150 of foreign affiliate transactions, has been transferred outside the country.

■ Other methods that conform to the principle of independence between independent companies ... ❻The implementation regulations of the Implementation Validity Law are also approved by methods other than ❶ ~ ❺ that conform to the principle of independent trading. -

Cost sharing contract

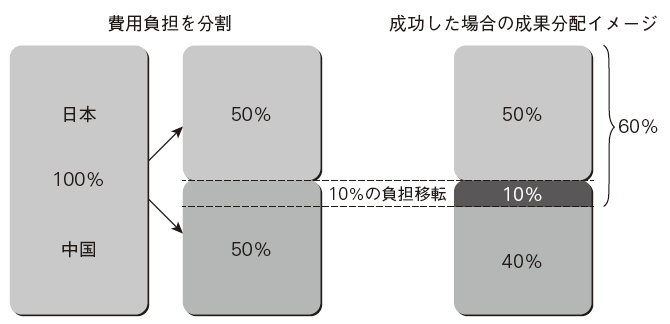

While the importance of intangible assets has been pointed out as the source of international competitiveness, in recent years, multinational corporations conducting joint research and development between affiliated companies crossing national borders through a cost sharing contract (Cost Contribution Arrangement) Has been increasing.Cost sharing is based on the OECD transfer pricing guidelines "to allocate costs and risks related to the development, production or acquisition of assets, services or rights, and to determine the nature and extent of interests in those assets, services or rights (OECD Transfer Price Guidelines VIII, Bi) 8.3.).The cost sharing contract negotiates the allocation of expenses in the joint development of intangible assets and is characterized by cost burden corresponding to the expected benefit. In addition to the business management benefits of financing a large amount of R & D expenditure and diversification of risk at the time of failure, participating companies will develop intangible assets jointly, so the collection of royalties to use the deliverables There is also a merit that payment of withholding income tax is not required.If a cost sharing agreement is made between affiliated companies, income transfer may be deemed to have taken place. For example, assuming that a parent company in Japan and a subsidiary in China jointly conduct research and development and acquire a patent in China, the actual cost burden is assumed to be 50% of the Japanese parent company and 50% of the Chinese subsidiary. On the other hand, the ratio of the total expected benefit when the development succeeds is 60% of the Japanese parent company and 40% of the Chinese subsidiary. However, if this expense burden is held between independent companies, it is judged that it is reasonable to bear the burden according to the ratio of the total expected benefit, so the cost burden ratio will be 60% Japan, China It will be done at 40%. Therefore, 10% (60% - 50%) of the cost burden amount will be arbitrarily transferred from Japan to China.

■ China's cost sharingThe cost sharing provision in China is similar to the related provisions of the OECD and the Internal Revenue Code of the United States, but it is distinguished by the fact that the scope of cost sharing for services is clearly stated.

[Scope of application]China allows cost sharing contracts in the following two situations (Implementation Valve Act 64).

· Develop intangible assets jointly or receive assignment· Provide services jointly or receive services

However, the cost sharing contract for services is limited only to group purchasing and group marketing plans (Implementation Valve Act 67).

[notification]Companies are required to submit a notification to the State Taxation Bureau via the tax authorities within 30 days from the date of entering the cost sharing agreement (Implementation Valve Act Article 69).

[Storage of Simultaneous Documents, etc.]During the period of cost sharing contract, companies need to prepare and keep simultaneous documents of the following cost sharing agreement (Implementation Valve Act 74). Also, these documents must be submitted to the tax authorities by June 20 of the following year of the implementation year (Article 74, paragraph 8 of the same law).

· Copy of cost sharing contract· Other contracts concluded between each participant in the cost sharing agreement to implement the contract· Usage status of the outcome of the contract by non-participants in the contract, amount of payment, method data· The situation of Buy-in ※ 1 or Buy-out ※ 2 of participants in the current cost sharing contract (Name of the participant who purchased in or purchased out, the country or district where the purchase was made, relation, Buy-in Payment or Buy-out compensation amount, including form)· Materials concerning the status of change and termination of the cost sharing contract (including causes of change or termination, processing or allocation to the results of already formed contracts)· Materials relating to the total cost of goods and construction status that occurred in accordance with the cost sharing agreement for the current fiscal year· Information on the status of cost sharing of each participant during the current fiscal year (including the amount of money payment, form, object, amount of compensation paid or accepted payment, format, subject)· Comparison of the projected benefit of the contract of the current fiscal year with the actual result and the data on adjustment* 1 New participation in the cost sharing contract※ 2 Withdraw from the cost sharing contract

[Change / Cancellation of Participants in Existing Contract]For existing cost sharing agreements, if there is a new participant or withdrawal from the contract or when you cancel the contract, the company needs to make the following adjustments based on the principle of interindependent business transactions Valve method Article 70).

· Subscription paymentCompensation for Withdrawal· Adjustment of the participants' benefits and cost burden situation by changing participants· When canceling the contract, reasonable allocation of the outcome of the contract to each participant

■ Tax treatmentIf a company has a cost sharing contract in accordance with the principle of inter-company transactions, the company can do the following tax treatment (Article 72 of the Implementation Valve Law).

· Tax deductible for each cost prescribed by the contract of the cost shared by the company based on the contract· If there is compensation adjustment, it should be included in the taxable income in compensation adjustment year· Cost sharing agreement on intangible assets, as stated above, when distributing outcomes of contracts at the time of compensation or termination of contract, to process according to the provisions related to purchase or disposal of assets

However, when a company enters into a cost sharing agreement with an affiliated person, if it falls under any of the following circumstances, it is not possible to include the cost allocated to deductible (Article 75 of the same law).

· Reasonable business purpose, no economic substance· Does not comply with the principle of transaction between independent companies· We do not comply with the principle of correspondence between cost and profit· Based on the relevant regulations, we have not notified or prepared, stored, or provided simultaneous documents of cost sharing agreement· Retroactive from the date of signing of the cost sharing agreement and the company's management period is less than 20 years -

Advance confirmation system

Advance Pricing Agreement (APA) is an agreement between a company and a tax authority in advance about the transfer pricing method to be applied to transactions between related parties for a specified period, and a tax issue related to related party transactions in a specified period In China, details are stipulated in Chapter 6 of the Immigration Control Act.A company that satisfies all of the following requirements can usually apply for APA (Article 48 of the Implementation Valve Law).

· Companies with an annual related party transaction amount of 40 million RMB or more· Companies that perform related declaration obligations under the law· Companies that create, prepare, store, provide simultaneous documents based on regulations

The validity period of APA is a consecutive year of 3 to 5 years from the year following the year the company has officially applied for permission, and APA will be applied to related transactions conducted during that period (Article 49 of the same law).

APA negotiations and conclusion do not affect the transfer pricing survey for the fiscal year that formally submitted the written application or prior years (Article 49 of the same law). However, if the relevant transactions in those years are the same as or similar to the relevant transactions in the APA application year, companies that meet that requirement apply and, once approved by the tax authorities, APA can be applied (Article 49 of the same law). -

Procedure of advance confirmation system

When applying the advance confirmation system, it usually goes through six stages: preliminary meeting, official application, review and evaluation, consultation, concluding and implementation. Since it takes about a year to complete all the processes, it is necessary to implement related work systematically. Each stage will be explained below.

■ Preliminary meeting ... ❶Before submitting APA's formal application, we will hold a preliminary meeting to discuss the possibility of APA implementation between the taxpayer and the competent tax bureaus. Before the company officially applies for concluding from APA negotiations, I will submit written intention to negotiate / conclude with the tax authorities. Since it is not formal consultation with the tax authorities at this point, preliminary talks can be done anonymously (Implementation Valve Act Article 50).

Documents to be submitted to the tax authorities when conducting preliminary talks are as follows (Article 1 paragraph).

· Documents showing the year of application of the check target· Documents related to related persons and related transaction information· Description of the company's previous year's production management situation· Functions and risks description of each related person· Instructions concerning the transfer pricing problem in previous years· Instructions concerning circumstances requiring explanation

Formal application ... ❷After reaching an initial agreement with the competent tax bureau in the preliminary talks, the taxpayer will submit an official application form for prior confirmation. The submission deadline is stipulated within 3 months from the date of receipt of notice concerning official negotiation. (Implementation Valve Act 51) The application form should include the following items (Article 1 paragraph).

· Related group organization, company internal organization, relationship of related companies, status of related transactions· Financial statements in the last three years, characteristics of products and data on retained property· Type of related intercompany transactions and tax year· Functions and risk sharing situation among related companies· Analysis of transfer pricing method, functional analysis and industry benchmarking, prerequisites etc· Market, industrial analysis, competitive environment etc· Project profit and loss forecast for the target fiscal year, company size, plan etc.· Financial information related to related transactions· On the issue of double taxation· About domestic and overseas related laws and tax treaties

■ Review and evaluation ... ❸The competent tax bureaus focus on the six requirements (taxpayer's past management situation, function and risk, comparison target price information, preconditions, pricing principle and calculation method, predicted price or profit range) to hold. The company will review and evaluate within five months from the date the company submitted an official application form in advance. However, if the tax authorities have special circumstances, the period of review and evaluation may be extended by up to three months (Act on Investment Act 52).

■ Consultation ... ❹After conducting the assessment and evaluation, the competent tax bureaus consult on the six requirements listed in ❸ and prepare a draft confirmation draft through agreement by the taxpayer. Talks will be held within thirty days from the date the tax authorities have concluded the review and evaluation of prior confirmation. In the event that an agreement is reached at consultation, the National Taxation Bureau reviews the draft of the prior confirmation and the examination evaluation report (Article 53 of the Implementation Act).

Conclusion ■ ❺Within thirty days from the day the jurisdiction tax office and the taxpayer agree on the content of the draft the representative who was authorized by the statutory representative of the National Taxation Bureau and the company or a legal representative will conclude an official pre-confirmation consultation document Article 54).

■ Implementation ❻Companies need to carry out the following procedures during the APA period.

· Complete storage of APA related documents and materials (including books and related records etc.) (Implementation Valve Act Article 56 1)· An annual report to the tax authorities on the implementation status of APA within five months after the taxable year end (same paragraph of the same Article)· In the event of a substantial change affecting APA, written report to the taxing authority (including submission of related materials) (paragraph 4 of the same Article)

APA negotiations can be suspended or suspended from the start of official negotiations until the conclusion of the negotiations. In this case, you must return all the materials you acquired during the negotiations (Article 55 of the same law). -

Application for Continuation Continuation Confirmation

APA expires automatically after expiration. Therefore, if the enterprise continues to conclude consultations, it is necessary to apply for the continuation of the conclusion to the tax authorities by 90 days before the expiration date of APA and submit application for continuation of prior confirmation.In addition, companies must submit reliable certification materials to the tax authorities, there is no substantial change in the facts mentioned in the current preliminary confirmation and the relevant environment, and consistent with each provision and agreement of the prior confirmation We must explain that we are in compliance (Act on Investment Act Article 57).

-

-

-

Fiscal year related intercompany transaction report

Companies engaged in transactions with related persons from the corporate income tax annual reporting deadline (May 31st) in fiscal year 2008 are included in the annual corporate income tax filing declaration form, which is the corporate income tax return, attached to the enterprise intercompany transaction report I needed it(Article 43 of the Corporate Income Tax Law, Article 11 of the Implementation Valve Act). Detailed information disclosure on transactions between companies and related parties to the tax authorities is required. This is equivalent to disclosure of the transaction price calculation method with overseas related persons in Appended Table 17 (3) "Detailed Statement of Foreign Affiliated Persons" in Japanese Income Tax Return Form.The items and necessary information are as follows.

■ Relationship table (Table 1)· Related party name· Taxpayer identification number· Country of origin (region)· Street address· Legal representative· Types of relationships (capital relationship, etc.)

■ Related Transaction Summary Table (Table 2)· Total transaction amount (aggregated by nature of transaction)· Amount and percentage of related party transactions· Amount and percentage of transactions among overseas related persons· Amount and ratio of transactions among domestic related parties· Presence or absence of a cost sharing contract· Whether preparation of simultaneous documents of transfer pricing is required (whether the document is prepared or not, if required)

■ Purchasing and sales table (Table 3)· Purchase and sale from affiliates in Japan and overseas or third parties· Amount of related persons and non-related person transactions by trade method· Name of counterparty with overseas related persons and non-related persons when occupying 10% or more of total import / export total· The country of its location (region)· Transaction amount· Rationale for pricing

■ Service Table (Table 4)· Amount of service provided by affiliates in Japan and overseas or from third parties and expenditure· Revenues related to service provision and names of counterparties of overseas related persons and non-related persons, which account for 10% or more of expenditure amount· The country of its location (region)· Transaction amount· Rationale for pricing

■ Intangible asset table (Table 5)· Amount of transfer and amount transferred for intangible asset transactions (by type) with relevant parties and third parties in Japan and overseas

■ Fixed asset table (Table 6)· Transfer amount and transfer amount etc. of fixed asset transactions (by type) with relevant parties and third parties in Japan and overseas

■ Loan Funding Table (Table 7)· Ratio of credit investment (borrowing) and interest-earning investment (capital) acquired from finance-related persons with related persons in Japan and overseas· Name of affiliated people in Japan and overseas and their country of origin (region)· Currency· Interest rate· Loan term· Interest income expenditure· Name of guarantor· Guarantee fee and guarantee rate

The ratio of credit investment and equity investment acquired from this related person will be questioned from the viewpoint of under capital taxation. The tiny capital tax system is a tax system that prevents tax evasion by intentionally increasing the borrowing of related parties by generating interest payment.

■ Foreign investment situation table (Table 8)· Basic information of foreign company to be invested· Shareholding information· Income tax burden status of investee's foreign company· Status of dividends· Financial data· Whether the investee's foreign company is located in a non-low-tax country (region) enumerated by the State Taxation Bureau· Whether the annual profit of the investee's foreign company is less than 5 million Yuan

The information on the external investment situation table will be used to judge whether the investee's foreign company falls under the controlled foreign company.

■ External payment situation table (Table 9)· Payment amount to overseas related persons· Withholding collected income tax amount and tax concession benefit or not

Many of the above report tables are data that can be extracted from the day-to-day accounting practices, such as the counterparties and amounts of affiliate transactions.The purchase / sales table (Table 3) and the service table (Table 4) require filling in price policy to be applied for each important affiliate transaction, so the administrative burden for handling transfer pricing taxation is simply It will increase. It is necessary to ensure that there is no discrepancy between the Chinese side report and the Japanese side tax return for the same affiliate transaction. The check column for asking whether or not a simultaneous document relating to transfer pricing was created in the related transaction summary table in Table 2 is because it is necessary to prepare a tax return form and a simultaneous document (transfer pricing analysis material) according to the provisions It means. Contents of concurrent documents are widespread, and considerable administrative burden will increase as Table 3 and Table 4 of the report table.

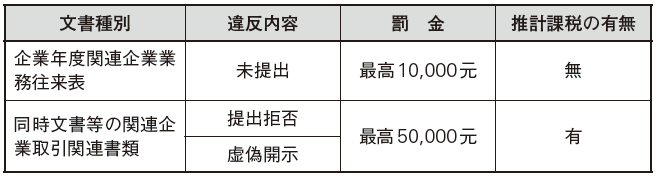

If you do not submit company-related intercompany transaction reports and concurrent documents to the tax authorities, direct penalties will only be a fine of not more than 10,000 RMB (Tax Collection Administration Act 60, 62). However, the risk above the penalty is the latent risk that companies not submitting related party transactions according to the provisions or companies not submitting concurrent documents will likely be selected for the transfer pricing survey. From another point of view, it can be said that problems in terms of internal control are revealed. -

Simultaneous document (transfer pricing analysis material)

■ Defining concurrent documents"Simultaneous" meaning simultaneous documents means to create a tax return form and transfer pricing document at the same time. However, although the company creates concurrent documents at the same time as the tax return, it is not required to submit both to the tax authorities at the same time. The transfer pricing document is to be submitted within 20 days after receiving the submission request from the tax authorities (Act on Investment Act 16).

The responsibility to prove the adequacy of pricing related to inter-related transactions in the transfer pricing survey is not on the relevant person but on the company side. Those that taxpayers (companies) create to fulfill their burden of responsibility will be concurrent documents.

However, companies falling under any of the following are exempted from the preparation of simultaneous documents (Article 15 of the same law).

· Annual purchase of related persons · Sales amount (calculated on the basis of import and export customs clearance price for material processing in terms of material processing) is less than 200 million RMB and other inter-related transaction amount (inter-related loan transaction is received and Calculated based on the amount of interest payment) is less than 40 million RMB (40 million RMB does not include the amount of related party transactions related to cost sharing or prior confirmation by companies within the year)· When related party transactions are subject to prior confirmation· When foreign ownership interest is less than 50% and only related persons in China are involved in transactions between related parties

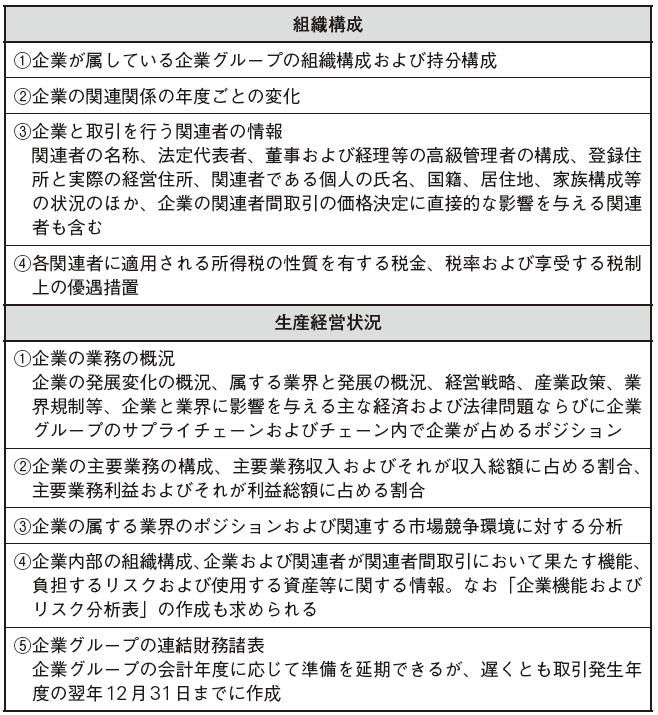

■ Contents of concurrent documentsCompanies must prepare concurrent documents relating to inter-related transactions for each tax year and submit it as requested by the tax authorities (Implementation Valve Act 13). Contents of simultaneous documents consist of 5 major items and 26 small items (Article 14 of the same law). In order not to point out deficiencies, in principle it is desirable to list all the following items.

If companies are to undergo a transfer pricing survey, they will develop discussions with tax authorities on the basis of concurrent documents (transfer pricing analysis data). Therefore, simultaneous documents share the contents of related business transactions described in the simultaneous document between the company and the tax authorities, which has the effect of greatly reducing the time and cost required to recognize the facts prior to the discussion development. Companies should therefore create concurrent documents with recognition of the first step of the transfer pricing survey. However, it is not practical from the viewpoint of cost and quality to prepare concurrent documents within a company because the content of the concurrent documents required by the Investment Law Act is broad and the special analysis is required . From the present situation like this, in practice, there are many cases where external experts specializing in transfer pricing analysis, such as searching for comparative companies / transactions and benchmarking analysis, are asked.

■ Other points to keep in mindPoints to keep in mind about the creation, storage and submission of concurrent documents prescribed by the Implementation Valve Act are as follows (Article 17 to 20 of the Implementation Valve Act).

· A simultaneous document to be submitted pursuant to the request of the taxing authority shall be affixed with a seal and a signatory or seal must be signed by a legal representative or a representative authorized by a legal representative· When quoting information in the creation of simultaneous documents, the source must be specified· When a company changes or deletes a tax registration due to merger, division, etc., companies after merger / division must preserve simultaneous documents· Chinese are used for simultaneous documents, and Chinese copies must be attached when the source material is a foreign language· Simultaneous documents must be kept for 10 years from June 1st the following year of the year when the enterprise related party transaction occurred

-

-

-

Survey regulations

Detailed provisions are set up in Chapter 5 of the Special Tax Adjustment Validation Act (hereinafter referred to as "Investment Act") for investigation and correction of transfer pricing taxation. This provision is mainly based on the survey on the transfer pricing taxation, which companies are covered, what kind of materials are required to be submitted, what kind of procedures will be used for the investigation and reform, after the revision We have decided what kind of procedures are there. Companies subject to survey also need to pay attention to the following points.

· When companies do not take risks of management decisions, research and development, sales, etc., but simply process products according to ordering related companies, it is necessary to secure a certain profit level (Article 39 of the Implementation Valve Law)· If there is an offsetting transaction between receipts and payments between related parties, the tax authorities will return to the total amount traded and conduct comparability analysis and tax adjustment (Article 40 of the same law)· The tax authorities can use both published and undisclosed data on publicly available independent prices when evaluating whether related transactions of a company are in compliance with the principle of independent transactions (see Article 37 )· Analyzing the profit level of the company by using the quartile method (a method of dividing the population from the top by 25% into four and obtaining the average value with the remaining 50% excluding the top and bottom 25%) · When evaluating, if the profit margin of the company falls below the mid-range of the profit ratio range of the comparable company, the tax authorities adjust the transfer price adjustment as a rule at a level not lower than the intermediate value (Article 41 of the same law). -

Survey process

■ Selection of survey targetsThe target of the survey will be selected from companies with the following characteristics (Article 29 of the Implementation Act).

· Companies with comparatively large amount of related party transactions or types of related party transactions· Companies lacking in the long term or companies with small profits or companies with profitable changes· Companies whose profit is lower than the average profit level of the industry· Companies in which the function of the profit level and the risk borne by the profit level are significantly different· Companies with transactions with affiliates located at tax · haven· Companies that have not filed related party transactions according to regulations or companies that do not prepare simultaneous documents· Other companies that are clearly against the principle of independence

■ Investigation[on-site inspection]The tax authorities will conduct on-site survey for the selected surveyed companies. Participants in this survey must be at least two people, present a tax inspection certificate and issue a tax inspection notice (Implementation Valve Act Article 32 (1), paragraph 2). In-situ survey methods include hearing, books and related materials orders, field inspections. Also, in order to collect evidence, the tax authorities can record, record, record, shoot, copy, etc. (Implementation Validity Act Article 32 (7)).

[Documents to be submitted]The following items are clearly indicated as materials to be submitted by field survey (Article 114 of the enterprise income tax law).

· Concurrent documents including price, cost determination criteria, calculation method and explanation, etc. for related party transactions· Resale (transfer) price of assets, asset use rights, services etc. relating to inter-related transactions, or data on final sale (transfer) price· Product prices, pricing methods and methods that can be compared with the surveyed company, which must be submitted by other companies related to the survey of inter-related transactions (companies whose business contents and manufacturing methods are similar to surveyed companies) Materials such as profit level· Other materials related to related party transactions

[Settlement of investigation]If the inter-related transactions of the company are based on inter-company price, the tax authorities will issue a special tax payment conclusion notice and the transfer pricing survey will be terminated (Article 42 of the Implementation Law). On the other hand, if taxpayer does not comply with independent company price and taxable income is small, taxation authority will adjust transfer pricing tax (Article 43 of the same law).

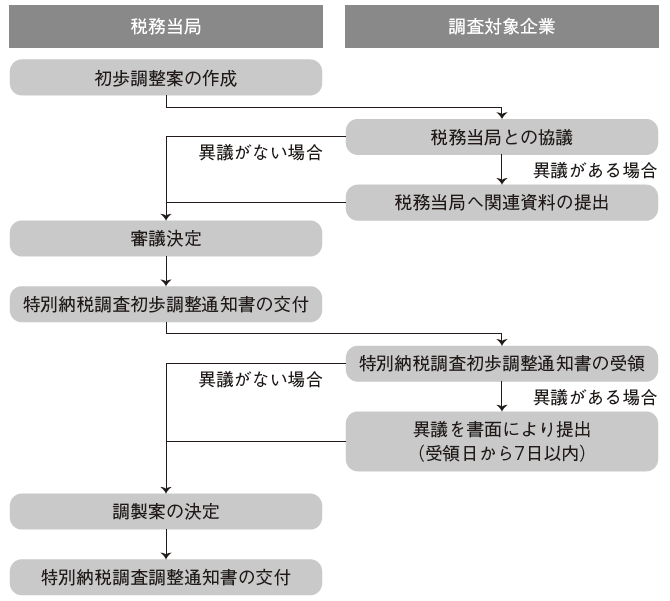

[Transfer Pricing Tax Adjustment]The tax authorities will carry out transfer pricing tax adjustment by the process of the following figure to the surveyed company judged to have violated the independent transaction principle and collect tax and interest (Act on Investment Act 43).

There are two opportunities to file objections to the tax authorities, but it is necessary to pay attention to the fact that the period for submitting objections to the special tax payment preliminary adjustment notice is as short as 7 days from the receipt of the notice Valve method Article 43 (4)).

[Tracking Management]The tax authorities will carry out tracking management for five years from the year following the final year in which transfer pricing has been carried out to companies. In the tracking management period, the company receiving the correction order must submit a simultaneous document on the tracking year to the tax authorities by June 20 of the following year. If the tax authorities find fluctuations in the transfer price of the company during the pursuit management period, it is necessary to revise again under a simple tax investigation by the tax agency (Article 45 of the Implementation Valve Law). -

Penal Provisions

If the taxpayer neglects to submit a report sheet, transfer pricing texts, or other related intercompany transactions, or if the enterprise refuses to submit materials relating to intercompany transactions, or if the taxpayer refuses to furnish documents that are false, incomplete , The following penalty provisions apply, respectively.

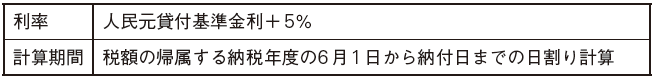

The Chinese tax authorities can conduct estimate taxation in cases where a company refuses to submit documents related to transactions between related companies such as simultaneous documents or makes false disclosures. Since companies do not issue related documents above, income will be adjusted by the transfer pricing tax set by the Chinese tax authorities. In addition, the Chinese tax authorities can retroact this income adjustment for up to 10 years. For this reason, enterprises will incur significant losses unless filing transfer pricing-related information including relevant documents as appropriate to the Chinese tax authorities. In the event that additional interest taxation takes place, the company must add interest to the payment amount. The method of calculating the interest amount is as follows.

If the company submits related party transactions, such as simultaneous documents, related document transaction related documents through tax return declaration, the interest rate is only RMB loan reference interest rate. -

Remedy

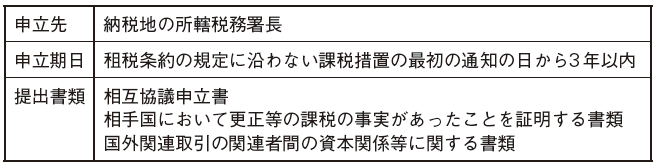

Relief measures relating to transfer pricing tax have mutual consultation as a procedure and reduction and corresponding adjustment of the amount of correction as a result. Mutual consultation is a procedure aimed at eliminating international double taxation and is done between authoritative tax authorities. Between Japan and China it is stipulated in Article 25, para. 1 and 2 of the Japan - China DTA. Mutual consultation is done between the National Tax Agency and the National Taxation Bureau, and the petitioner can not participate in direct consultation.The contents of mutual consultation are as follows. Corresponding adjustment is to eliminate international double taxation by reducing the amount equivalent to the amount of correction by the transfer pricing tax system from one taxable income in one country. In order to apply this, it is necessary for both parties to agree in the mutual consultation mentioned above.

Corresponding adjustment is to eliminate international double taxation by reducing the amount equivalent to the amount of correction by the transfer pricing tax system from one taxable income in one country. In order to apply this, it is necessary for both parties to agree in the mutual consultation mentioned above.

-

-

-

Transfer price example

In this section, we will explain about transfer pricing taxation by giving examples.

■ Case 1 Discretion of affiliates concerning purchasingManufacturers of the Japan-China joint venture, which are engaged in maintenance work of personal computers and television in Dalian, were certified as high-technology companies. It is characterized by the high gross margin of high-tech enterprises being generally high. However, the maker's gross margin from 2000 to 2002 was as low as around 9%, which was a deviation from the gross margin of general high-tech enterprises. When tax authorities gathered data from the company and investigated it, we found that most of the raw materials were purchased from overseas affiliates, and it was found that overseas related persons decided who purchased the raw materials and purchase price . As a result, income tax of 2.95 million yuan was collected.

Issue: relevant person's decision-making function From the point that most of the raw materials are purchased from related persons, and related parties have decision-making functions regarding the supplier and purchase price, the manufacturer is an independent company It is not considered.

VerificationThe point of this case is the gap between the general gross margin of other companies in the same industry and the gross margin of the manufacturer. Tax authorities subject companies that have management indicators that deviate from general industry management indexes in the initial stage of tax investigation. From this, it can be said that Chinese tax authorities indirectly determine the profit level of the industry. If you are setting the price which deviates from the industry average value and competitors, it is more likely that you will be pointed out by the tax bureau and be picked up. It is necessary to clarify the relationship between the company and the affiliated company and decide the intercompany price while considering the situation of the market.

■ Case 2 Principles of Independent Intercompany PriceElectronic equipment assembly manufacturers with Hong Kong companies as their parent company saw sales increase from 20% to 100% between 1998 and 2001. Nonetheless, the gross profit margin was as low as just under 1%. According to the investigation by the tax authorities, it turned out that the gross profit margin was around 2% and it was pointed out that tax payment of about 50 million RMB was owed.

Issue: Rationality of transfer pricingDespite the strong growth in sales, gross profit is a low trend, so there is a risk that it may be deemed to be lacking in rationality in setting transfer pricing.

VerificationThe point of this case is whether or not the gross profit margin of less than 1% conforms to the principle of independent company price. It is a time when it is stipulated that the inter-independent principle applies to all foreign affiliated transactions in China, and it will conform to the principle.Because of this, it is considered that China is implementing a transfer pricing taxation with clearly the intra-company price in mind, so it is always necessary to be conscious of the price between independent companies. If a new notification etc. is issued from the tax bureau, it is necessary to review the intercompany price.

■ Case 3 A company that has a simple functionShoe manufacturers with Hong Kong companies as their parent company had been receiving raw material from the parent company, but they accumulated deficit on a recurring basis. As a result of investigation by the tax authorities, it was decided that "cost + cost + reasonable profit" is an intercompany price, and then taxable income is calculated again and it is decided to pay corporate income tax .

Issue: Generation of current account deficitSince companies are generally aimed at earning profits, the distortion of selling price setting against cost, which is one of the causes of the accumulation of ordinary deficits, is regarded as a lack of rationality as an independent company . In other words, setting transfer pricing is not based only on the selling price between independent companies, but also on the premise that companies should make appropriate profits.

VerificationThe point of this case is that shoe makers have accumulated deficits on a regular basis. The Chinese tax authorities are standing on the idea that "a company that has a simple function (such as a factory that manufactures only for affiliated companies) constantly obtains a certain profit".Therefore, it is considered that this manufacturer who had accumulated deficits on a regular basis was the subject of the transfer price survey. If many companies in the same industry are in surplus but only their company is in the red, it is more likely that tax authorities will be pointed out. While looking at the performance of other companies in the same industry, we have to decide the intercompany price, but competition among companies is intense and we may have to lose money. In that case, we will verify the reason for turning to the deficit and reset it to the transaction price between the relevant parties convinced by the tax bureau.

■ Case 4 Transfer of income within the Chinese enterprise groupCertain manufacturers in Changde City purchased raw materials from companies in Changsha City, which is a related person, and sell them cheaply to the same company after processing. Tax rates etc in China may vary depending on the region. This corporate group reduced tax burden on corporate income tax and value added tax by using the tax rate difference.As a matter, there is a possibility that the tax authorities may be pointed out as tax notes declared.

Issue: Scope of related party transactions in ChinaIn Japan, transactions between domestic corporations and overseas corporations are dealt with as related parties, but transactions between related parties in China are also subject to survey on inter-related transactions, as there are preferential regional tax rates in China.

VerificationThe point of this case is that the Chinese tax authorities are judging the transfer pricing taxation system not by the enterprise alone but by the entire corporate group. When conducting transactions between related companies, it is necessary to tackle the transfer pricing taxation for the entire group of companies.

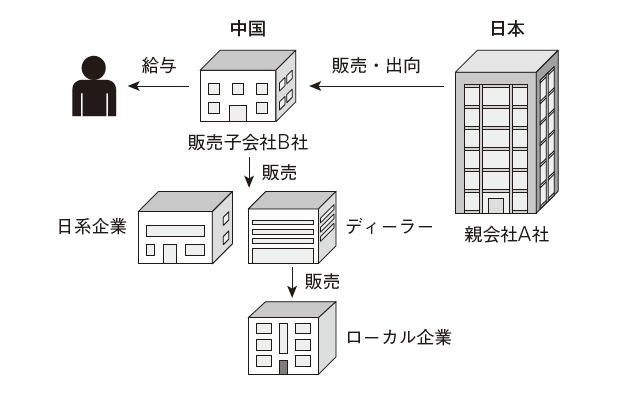

■ Case 5 Japanese royaltyThe manufacturer A of the electronic parts wholesale the parts manufactured in Japan to the sales subsidiary B of China and sells it to Japanese companies and Chinese local companies. Sales to Chinese local companies are through local dealers. The selling price from Company A to Company B is set equal to the selling price to the dealer. Company A is dispatching employees who have been engaged in business in China in Japan to Company B for the purpose of maintaining relations with Japanese companies. B is responsible for the salary of the person in question, but no further consideration has been paid to Company A.In this case, there is a possibility that the tax authorities may be pointed out as incomplete payment tax payment.

Issue: Substantial position of seconded employeesSince the Chinese sales subsidiary company B does not conduct substantive marketing activities, the sales know-how and connection of employees dispatched from Japanese parent companies are considered to be marketing intangible assets.

VerificationThe Chinese tax authorities seem to be looking at the flow of people within the corporate group in addition to the profit level of the transaction as an independent business transaction. In this case, there is a possibility that the difference from the operating profit margin of local dealers in China may be taxed as omission of loyalty collection. It is necessary to decide intercompany price taking into consideration the whole related transaction including intangible asset.

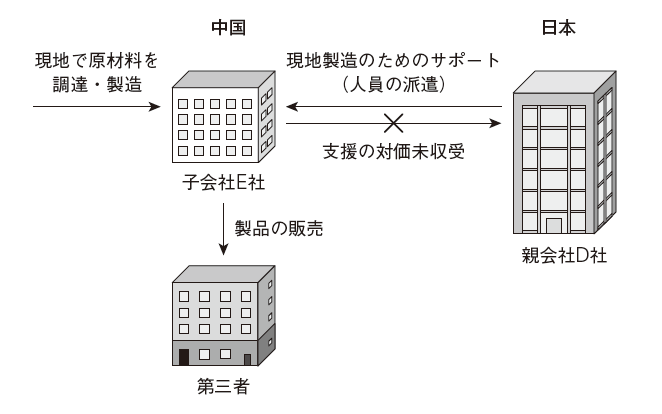

■ Case 6 Transfer price and donationThe parent company D, a Japanese manufacturer, launches E subsidiary of a local subsidiary in China, purchases raw materials at the site, manufactures it, and sells it. After the improvement of the local production line, we decided to dispatch local education staff and manufacturing technology support employees from D company to E company in China. We have entered into a contract to support engineers between Company D and Company E, but due to the uncertain future results of Company E, we have not received the consideration for support. In this case, there is a possibility that the tax authorities may be pointed out as incomplete payment tax payment.

Issue: Judgment of not yet received considerationIssues are whether the receipt of the consideration is recognized as a donation or subject to transfer pricing taxation. If you have not received the consideration for providing services, the Japanese side will be deemed to be free of economic benefits and this part will be certified as a donation.As an exception, if the subsidiary falls into a poor performance such as going bankrupt, the parent company is allowed to lend funds free of charge without paying interest in order to minimize the loss, but this This case does not apply because case examples are uncertain in the future performance and not realistically crisis situation.

VerificationThe point of this example is that the minimum necessary support for the subsidiary by the parent company is carried out on a regular basis, and it is difficult to immediately not have chargeability, and when conducting similar transactions Is that it is necessary to accept the consideration in some form and display intention that there is compensation.If it is considered to be paid, it will not be a donation, so it will be subject to transfer pricing taxation. In this case, we will discuss whether the amount of consideration under consideration is reasonable as the consideration for the service actually provided, ie whether it is an independent company price or not.In addition to clarifying the content of support within the company, it is necessary to consider countermeasures such as consulting experts separately for details of the support that may cause tax risks.

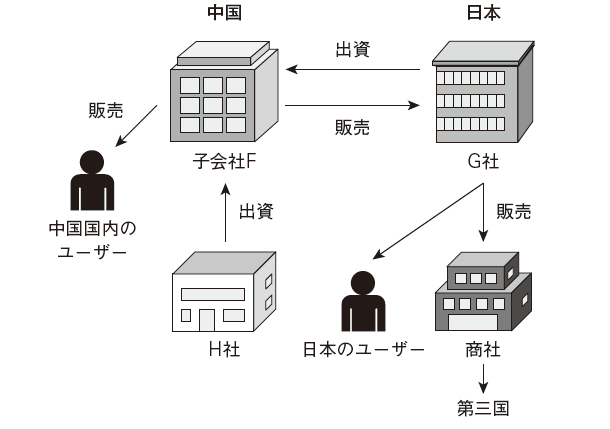

■ Case 7 Application example of profit ratio comparison methodF company in China merged company was established jointly by G company in Japan and H company in China co-financed. F China Company F is an electrical product manufacturer that sells its products both domestically and internationally. In China, we sell products directly to the end user in export sales, F company sells the products to G company, G company resells to the end user in Japan or resells to third countries through Japanese trading company I sell it. The company's dependence on sales to company G at F company is about 70%.Tax authorities have pointed out that the operating profit margin of export sales is negative.

Issue 1: Operating margin of export salesThe reason for the negative operating margin of export sales may be that the method of apportionment of manufacturing overhead costs and the method of apportioning selling expenses and general administrative expenses are not in line with the actual situation.

Issue 2: Margin Rate of Non-Related Party Transactions to be Targeted for Comparison with Transfer Price Calculation The tax authorities are considering revising the income amount of company F through a comparative analysis of operating profit levels by the profit ratio comparison method, Operating profit of export sales The profit ratio of non-related party transactions that should be compared with the method of calculating transfer prices is a secret-and-conflict case (the tax office side can not disclose companies and transactions that are referrals for independent taxpayer price calculation to taxpayers Despite the request, the tax office side unilaterally calculates interindependent enterprise price when taxpayers did not disclose it), I thought that 6 to 8% calculated properly.On the other hand, Company F insisted on the cost basis method used by the general manufacturing industry and submitted an analysis report using the markup rate (profit margin) of the comparable company selected from the listed companies in China.

VerificationFor the point that the operating profit margin of export sales is negative, it is necessary to review the manufacturing process and allocation criteria so that the relationship of cost versus revenue can be established.In the case where the transaction type is different between the related person and the non-related person, since examination of only gross profit is insufficient in the determination of the price between independent firms, depending on the proportional distribution method of manufacturing overhead cost and the distribution method of selling expenses and general administrative expenses It is also necessary to consider fluctuating operating profit levels. If the allocation method does not reflect the actual situation, distribution of profits within the company will be distorted, so the tax authorities will be doubtful about the rationality of the transfer pricing decision.

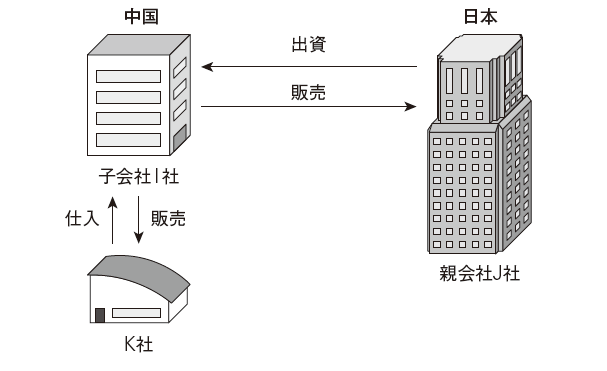

■ Case 8 When special factors occurManufacturing subsidiary I is a wholly owned subsidiary of Japanese parent company J. I company is a professional equipment maker, mainly engaged in advance processing with the Japanese parent company, J (processing material for importing materials of consigned processed goods for outsourcing, exporting processed goods) I will. In addition to this processing industry, some of the products are sold directly in China's domestic market. Company I purchased about 90% of the raw materials from Company C and sold approximately 70% of the product to Company K. Products sold to J will eventually be sold to end users in Japan and third countries.As the tax authorities have a significant difference in profit margin between related party transactions (exports) and unrelated party transactions (domestic), it is assumed that there is a possibility of a transfer price and an independent price with domestic sales as internal comparative transaction Applying the comparative method.

Issue 1: Difference between domestic selling price and export priceThe company I stated that "Domestic sales are not only manufacturing but also sales and marketing functions and risk of collecting receivables, but only production concerning export sales," that the function and risk are different between domestic sales and export sales I insisted. In addition, I company insisted that it should also consider paying the brand fee to J since "I gained the trust from the market as a Japanese product and is trading at a relatively high price".

Issue 2: divergence from the time of establishmentThe tax authorities focused on the fact that there is a big difference between the actual price of export sales and the price setting in the business plan submitted to the authorities at the time of establishment by this company.Meanwhile, Company I has created this business plan to explain that it is a profitable business to obtain approval for establishment and whether it is a business that contributes to the future development of China , It argued that it would not be the argument for setting the selling price.

Issue 3: Handling special factorsIn view of the above two points, the tax authorities judged that the applicability of the independent price comparison method, which was the initial argument, was low, and informed us to adopt the cost basis method. However, as I pointed out in point 2, I company insisted that it should be normal cost with the cost deducting special factors. As a result, the authorities approved some of the I's assertions and submitted a revised proposal and reached an agreement.

VerificationIn this discussion, it is thought that it is possible to deduct the influence from the cost as the basis of the cost basis method on the cost due to abnormal special factors. Upon transfer pricing survey, the rationality of the transaction price or profit ratio is judged. However, if there are special factors that will cause some change in the business environment, such as changes in the market situation or production system, the situation will be reported to the taxing authorities There is room for requesting appropriate consideration if we can explain. It is important that taxpayers prepare supplementary materials to support their claims and submit them to the tax office without delay.As a result of the transfer pricing survey, companies that received the revision instructions receive administrative oversight by the tax authorities for five years from the year following the survey target year, based on Article 47 of the transfer pricing control provision. In that case, however, similar treatment It can be said that it is possible.

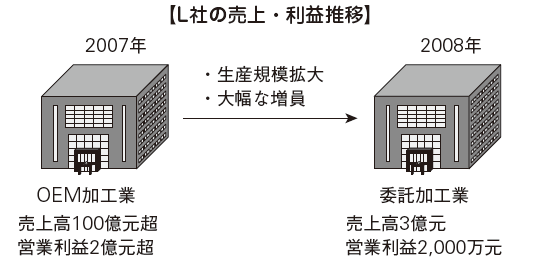

■ Case 9 Changes in business conditionsL company was founded in Shenzhen in 2005, sales in the second year of establishment exceeded 10 billion RMB, operating profit exceeded 200 million RMB. Immediately after the three-year tax exemption period, Company L shifted the business contents from raw material purchase processing industry (OEM processing industry) to consignment processing industry, and as a result, sales in fiscal 2008 increased from more than RMB 10 billion in 2007 to 300 million Original and operating income also decreased to 20 million yuan. However, despite a significant decline in sales, Company L has expanded its production scale and has also made significant increases. As for other changes in business, it is only the point that the headquarters does not directly purchase raw materials by purchasing. There was no agreement on concrete pricing methods in the consignment processing contract of L company and foreign affiliated company and there was nothing to confirm price rationality.

Issue: Material cost ratio of similar industriesIn this case, the tax authorities insisted on the application of the cost basis method as there was no reasonable arrangement of the transaction price with the related party in the consignment processing contract. Specifically, we refer to similar companies and refer to appropriate manufacturing costs and instruct them to calculate appropriate consignment processing fees.

VerificationIn this case, as a result of calculating the profit by the cost basis method, 180 million yuan is additionally collected. A sharp decline in sales seems to have triggered the tax investigation. In view of the fact that the operating profit margin (about 6.7%) in 2008 exceeded the operating profit margin (about 2%) in 2007, it increased significantly by increasing production scale, It may be adjusted by allocating expenses to general administrative expenses (cost ratio of sales is 80 to 90%). As a corporate measure, it is possible to consult experts in advance, assuming tax risks when the business situation changes and changes in accounting processing accompanying them.

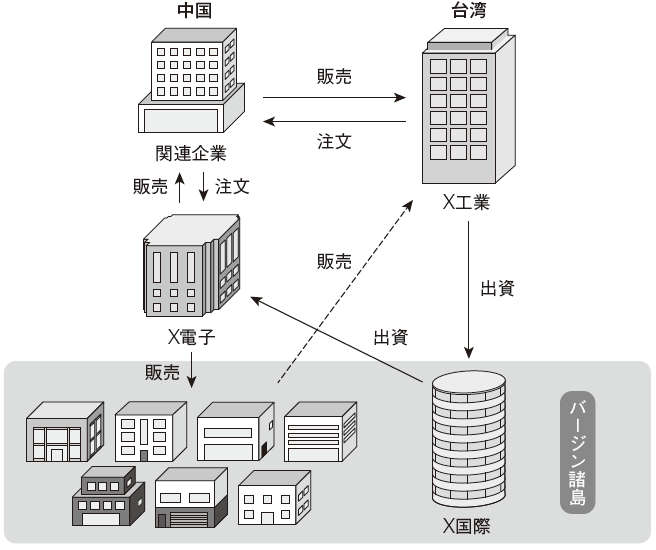

■ Example 10 Circular transactionX Electronic is a production type foreign investment enterprise established in China in 2000. We are assembling and selling laptop computers as our main business. The investor is X International Holding Limited Company located in British Virgin Islands, the final investor is Taiwanese X Industry.After establishing the company, X Electronics was almost unemployed for 4 years and profit margin for 4 years was around 0.5%, which was extremely low compared to the profit ratio of the parent company.X electrons ordered and sold through related companies in Taiwan X Industry in China, but eventually the X industry sold it to consumers. Furthermore, it was found out that the delivered products were extended to X Industry for all seven sales companies (companies located in the Virgin Islands) listed by X Electronics as subjects for non-related transactions during the transfer price survey .

Issue 1: Profit levelBecause the numerical value of the four-year profit margin of 0.5% is extremely low even compared with the financial statements of overseas parent company, X electrons set the selling price low and transferred income to X industry It is considered.

Issue 2: Actual conditions of seven companies in British Virgin IslandsIn this case, more than 10 million yuan was added for additional taxes in comparison with similar companies. Looking at the flow of transactions, since all products are crossed to X Industry, it can be thought of as being a transaction within the group. Also, regarding the determination of the price, since X Industry is doing, X electrons manufacture only the product, it is considered to be only the processing division of X industry.

VerificationIn X electronics, it is thought that independent price price method is adopted. In general, we will adopt the same law for goods with a large volume of distribution, but in China it is necessary to compare the level of profits with similar companies, not just the selling price .

-

-

-

References

・ 有限責任監査法人トーマツ編『中国の投資・会計・税務Q&A〈第5版〉』中央経済社、2013年・ あずさ監査法人中国事業室・KPMG編『中国子会社の投資・会計・税務』中央経済社、2011年・ あずさ監査法人中国事業室・KPMG編『中国移転価格税制の実務』中央経済社、2009年・ 亀井廉幸『中国進出企業の移転価格税制対策』中央経済社、2009年

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya