China

5 Chapter Establishment

-

-

1 Chapter Introduction

1.1 The history of Japanese companies entering the world

1.2 New business model in China

1.3 Advance scheme through Hong Kong

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.2 Province and region of China

3.5 Investment incentives and regulations

4 Chapter Economic Environment

5 Chapter Establishment

5.3 Establishment of business base

5.4 Procedure after incorporation

6 Chapter Withdraw

7 Chapter Foreign exchange

7.1 Foreign exchange management system in China

7.2 Foreign currency management system of ordinary items

7.3 Foreign exchange control system of capital items

7.4 Foreign exchange control system in bonded area · Hong Kong

7.5 Individual foreign currency control system

8 Chapter M&A

8.2 Laws and regulations concerning M & A

8.5 Challenges after corporate acquisition

9 Chapter Corporate Laws

10 Chapter Accounting

11 Chapter Tax law

11.2 Representative Office Taxation

11.4 Individual Issues in China Domestic Tax Law

12 Chapter International taxation strategy

12.1 International tax relating to entering China

12.2 International taxation strategy

12.3 Individual Issues in International Taxation

12.4 Tax issues related to withdrawal

13 Chapter Transfer Price Taxation

13.2 Individual provision pertaining to transfer pricing taxation

13.3 Transfer price taxation and documentation

13.4 Transfer price survey in China

14 Chapter Labor

14.4 Points to remember when bringing Japanese

15 Chapter International Human Resources Management

15.1 Human Resources Labor Management

15.3 Personnel evaluation system

-

-

-

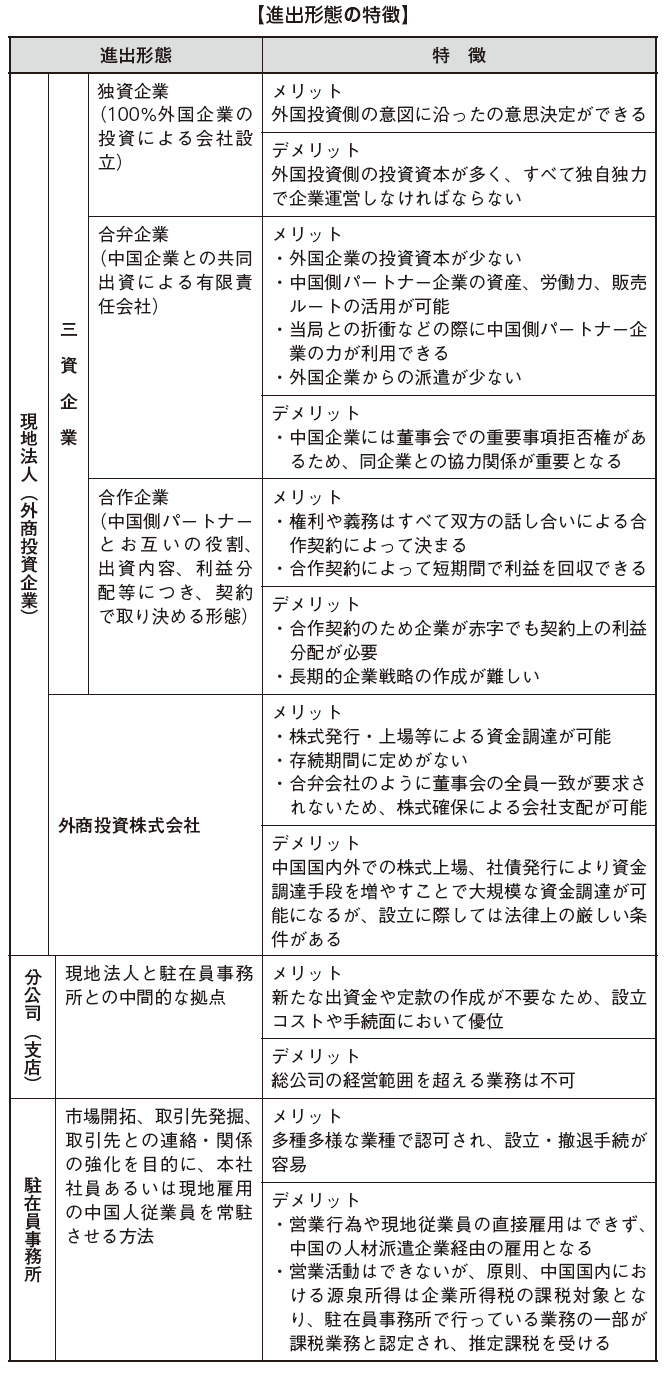

Advance form

In this chapter, we will explain the procedures necessary for establishing a base in China. The form of entering into China is divided into three: local corporation, branch office and representative office. In addition, the overseas affiliates can be divided into four types: monopolistic enterprises, joint ventures, cooperative companies and foreign investment enterprises. Among them, self-financed enterprises, joint ventures and cooperatives are collectively referred to as three-capital enterprises, and among the overseas affiliates recommended by the Chinese government, it is the most widely adopted form in recent years.Regarding the establishment of a branch office, if there is no head office in China, it is only accepted as a banking business. Regarding representative offices, establishment is permitted in all kinds of industries, and many companies are established for the purpose of market research and strengthening connection with the site. However, there is a disadvantage that sales activities such as sales activities can not be done.When establishing a base in China, the laws to be considered are the Company Law, the Three-Capital Corporate Law, the Private Enterprise Provision Ordinance, and the State-owned Enterprise Law. The Company Law was revised in 2013, and since 1 March 2014 conditions such as lowering the minimum capital and establishing a single company are relaxed. The Companies Act is a general law, under which there are special laws such as the Treasury Company Law, the Foreign Investment Corporation Regulations, foreign investors' domestic acquisitions provisions, antitrust laws and other laws. The application of laws to foreign invested enterprises is subject to special law. Therefore, the law acts of foreign-owned enterprises must comply with the basic matters stipulated in the Company Law and follow the provisions specified in special law.

-

-

-

Local corporation

■ Make-over companiesA monopolistic enterprise is a form in which the investment by the Chinese side is zero and 100% foreign company invests and establishes. Because the parent company has 100% management rights, it can make quick decisions, it is the most advanced way to minimize burdens such as cost, time and friction. Friction may occur with the headquarters (Japan), for example, in the case of making local people the general manager. Specific industries applicable to incentives, restrictions, etc. regarding the establishment of a monopolized enterprise are stipulated in the guidelines for foreign investment direction guidance and the guidance for foreign industry guidance.Establishment with a monopolistic enterprise has increased since 1990, and foreign investment by foreign investors in 2010 is the most used form of investment, 80% in number and 74% in value.

■ Joint venture companyA joint venture company (Chugai foreign-affiliated management company) means that a foreign-affiliated company and a Chinese-affiliated company approved by the Chinese government jointly establish a limited company with a Chinese company having a commercial right such as domestic sales and business permission It refers to the form. Of the registered capital, foreign owners' equity stake is generally 25% or more in principle. It is an effective method when entering in a business type that can not be established in a monopolistic enterprise, but if you do not compromise on price, it will be an obstacle to entering. Along with the difficulties of joint management with Chinese companies, cross-cultural friction is a form that is easy to surface.The joint venture was a relatively easy entry form and was adopted many times, but since 1998 the establishment of a monopolized enterprise has been reversed, foreign investment by foreign investors in 2010 is 18%, the amount is It is 21% and it is used the second time. In other words, foreign investment by foreign investors in 2010 will be 98% number of cases and 95% amount in two forms, monopolistic enterprises and joint venture companies.

■Collaborative companyThe cooperative company is the same as the joint venture in that it is established by both the investment by the Chinese side and the investment by the foreign side, but one that commits the share of responsibility and the distribution of profits among the investors regardless of the investment ratio is. This is the form normally used by overseas Chinese, it is what is called "goodwill division". It is an effective form in the case of substantial monopolistic management that makes land use as a simple investment case when engaging in a small business partner and service industry. Under the law, the investor becomes unlimited liability. Foreign parties of corporate type (with corporate status) cooperative companies are limited to a minimum investment ratio of 25%.

■ Foreign investment corporationForeign investment corporation (foreign capital corporation) is a form to be established jointly by foreign companies and Chinese companies in China (provisional provision concerning slight problem of establishment of foreign investment corporation, promulgated · enforced in January 1995 and listed A slight opinion of related issues related to the company's foreign investment, announced in October 2001). Under the provision, there are no specific provisions such as organizational organization, issue of shares, listing etc, so the general law such as corporate law, securities law etc will apply.Although it is possible to raise a large amount of funds by means of listing of shares in the country and abroad, issuing corporate bonds etc., there are severe conditions in the provisional provision, so at present the number of cases using these means is quite small.

■ Company establishment requirementUnder the Companies Act, the conditions for establishing a company in China were set as follows.

· The minimum capital is the amount of investment assumed by all shareholders for a limited liability company, the total shares assumed by all shareholders, Inc. is 30 million yuan for foreign investment shares limited company· In-kind investment can capitalize up to 70% of total investment capital· Limited liability company can capitalize from one person

As a result, if there is no provision in the special law concerning foreign-invested enterprises and there is no restriction on investment list by industry, it is possible to establish without limitation of the minimum capital of joint venture or cooperative company. In the case of establishing a one-person limited company by foreign capital independent investment, it will comply with the provision concerning one company limited company law of the Company Law.

However, it is rare that it can be established practically without being restricted by the minimum capital, and even if it can be established, it is about the size of a consulting company that can operate with a small capital. In recent years, since the capital amount that can be established is determined on the basis of permission and approval, it is necessary to inquire the commerce committee etc. every time the company is established.

■ Capital and total investmentAccording to the three capital corporate law, the ratio is clearly stipulated for the registered capital of a company and its investment amount. The difference between the registered capital and the investment amount can be used as a limit for foreign capital borrowing by a company.The investment amount refers to the total amount of company capital registered to the industrial and commercial administration agency in order to establish a company, which is the sum of the contributions each shareholder underwrote investment. Registered capital is the amount that shareholders should actually contribute, as there is no provision of authorized capital (for example, an upper limit frame making it easier for additional investment after establishment) in China. Registered capital is usually indicated by Renminbi, but it can also be displayed using foreign currency contracted by shareholders. Commonly used foreign currencies are US dollar, HK dollar and Japanese yen.The total investment is the total of basic construction funds and production and working capital that need to be introduced according to the production scale of the company. In other words, the total investment means the total amount of registered capital and borrowings. However, the borrowings here are actually limited to foreign bonds from foreign banks or companies. The total investment is calculated as follows.

Registered capital + borrowings from foreign banks + loans from foreign companies

■ Investment methodShareholders can invest in the company with money, and can also invest in those that can evaluate the contribution amount by cash such as spot, intellectual property rights and land use rights. In addition, you can valuate assets other than monetary assets that can be transferred according to the law value (Article 27 of the Company Law).In the case of investing with non-monetary assets, we must confirm the assets through evaluation by an evaluation organization established under the Company Law etc. in China. The evaluation at that time may not be too high or too low. If you invest in nonmonetary assets, you must do ownership transfer procedure.However, shareholders are not permitted to evaluate and invest in services, services, credit, names of natural persons, commercial credit, franchise rights or collateral. Conversion between foreign currency and RMB as company registration capital, or between foreign currency and foreign currency is calculated according to the median value of the exchange rate of the People's Bank of China, which is announced on the day of payment. -

Representative office

Chinese representation of the representative office is "foreign company resident representative organization", Chinese representation of the representative office manager is "chief delegate". For the headquarters, the representative office can provide supplementary and preparatory work such as information gathering, liaison work and market research.As a first step for Japanese companies to enter China, it is conceivable to establish a representative office. Representative offices of foreign companies in China engage in activities other than direct sales activities in the country of China and represent business related business within the management scope of the company, product introduction, research on the market and technical exchange You can do and etc.If the representative office carries out direct sales activities, a fine of not more than 20,000 yuan will be imposed (Foreign corporate resident representative organization registration regulation, national letters [1983] Article 28 15). When the resident committee office hires employees locally, it must be done through a recruitment agency (FESCO etc.) designated by the Chinese government. In that case, in principle, employment of foreigners and Chinese who do not have formal family register is prohibited.Since the representative office does not have goodwill on the site, we can not conduct sales activities. For this reason, corporate income tax is considered not to be taxable, but the contents of work corresponding to indirect sales activities are taxable and subject to estimated taxation. -

Branch / minute company

■ Branch of a foreign corporationA branch of an overseas affiliate means a business office or a service providing place. In China, the branch is considered not to have corporate status, and when an overseas affiliate establishes a branch office in China there is a legal limitation (revised company law in October 2005), the method of approval of the branch is The State Council separately stipulates. Because there is no clear provision of branch establishment, in practice it is difficult to set up branches other than foreign banks and insurance companies. When establishing a branch, it is necessary to approve the supervising agency or the approval period and register the national industrial and commercial administration bureau.■ Affiliates of local subsidiariesA branch established by a local subsidiary in China is called a branch office. You can perform business activities within the approved business scope. However, since it does not have a corporate law personality, the company has no external responsibility on its own, and the headquarters is responsible for all responsibilities.The sales performance company can manage business activities and sales activities similar to the business scope of the company.Non-sales partnerships are capable of major operations such as contacting and after-sales service with the company, sales acts or related activities are prohibited. -

Investment property company

There is investability company (investment company) as a type of overseas affiliate. Investment property company is a limited liability company engaged in foreign investment in China in a joint venture with a foreign investor in China or a joint venture with Chinese investors and is also called umbrella company. A company established by investment by the investment property company is regarded as a foreign invested enterprise, a certificate of foreign enterprises investment enterprise is issued from the Ministry of Commerce of the People's Republic of China, and a foreign investment enterprise business license is issued from the National Industry and Commerce Administration Administration.

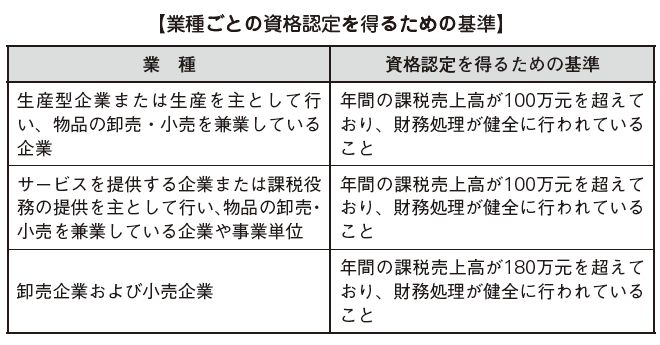

■ Establishment requirement of investability companyAs a requirement for foreign investors establishing investability companies, there are qualifications of foreign investors and minimum registered capital. In particular, the registered capital is conditioned to be over US $ 30 million.

-

-

-

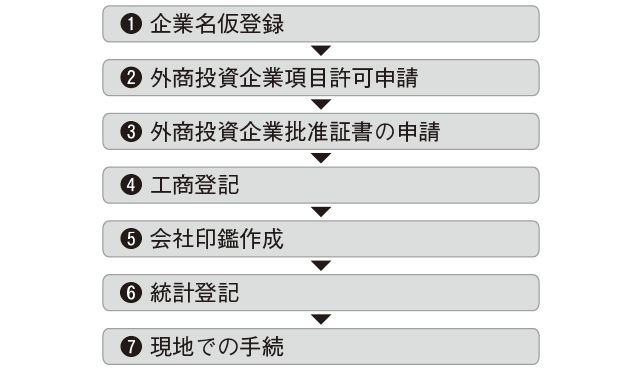

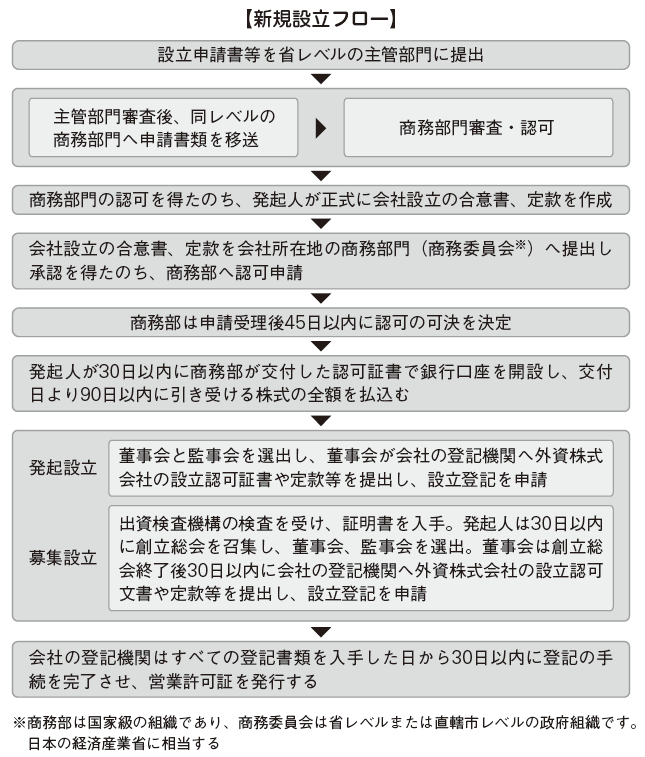

Establishment procedures of three capital enterprises

The establishment procedures of the three capital enterprises (monopolized enterprises, joint ventures, cooperative enterprises) are almost the same in both forms. However, the law that relies on is different.When establishing a monopolist enterprise, it depends on the People's Republic of China People's Republic of Indonesia corporate law and the PRC law of the People's Republic of China. When establishing joint venture companies and cooperating enterprises, the implementation opinions concerning the slight problem of application of the law in the examination approval and registration management of foreign-invested enterprises which is the China-foreign joint venture corporation law of the People's Republic of China, the Chuo-kai collaborative corporate law and its implementation We will rely on detailed rules etc.In case of establishing a cooperative company, in principle, confirmation of investment project by foreign investor, selection of partner in China, merger · cooperation (limited partnership with Chinese domestic economic organization and foreign economic organization) After doing application by concluding a consultation letter, we will establish the same establishment procedure as monopolized enterprise.After receiving the ratification by the judging organization, the applicant must perform the registration procedure at the industrial and commercial office of each location of the merging company and the cooperating company based on the certificate of approval within 90 days from the date of obtaining the certificate of approval . -

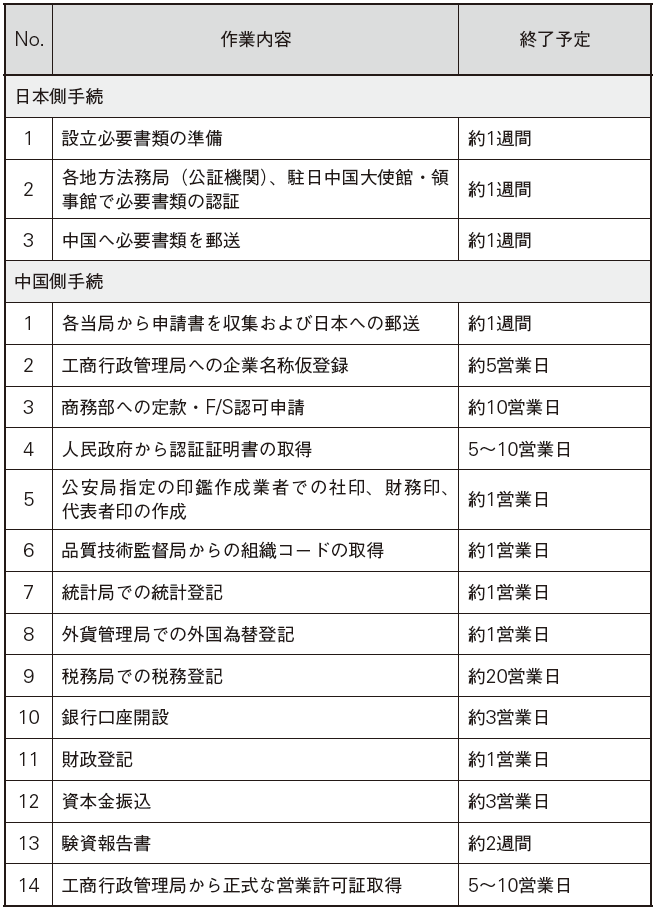

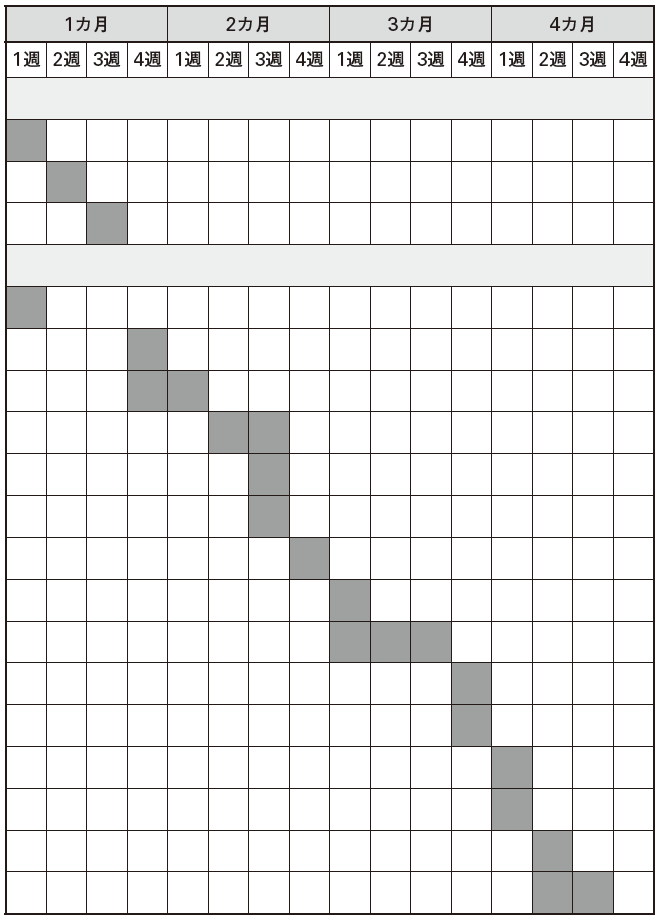

Procedures of Japan side

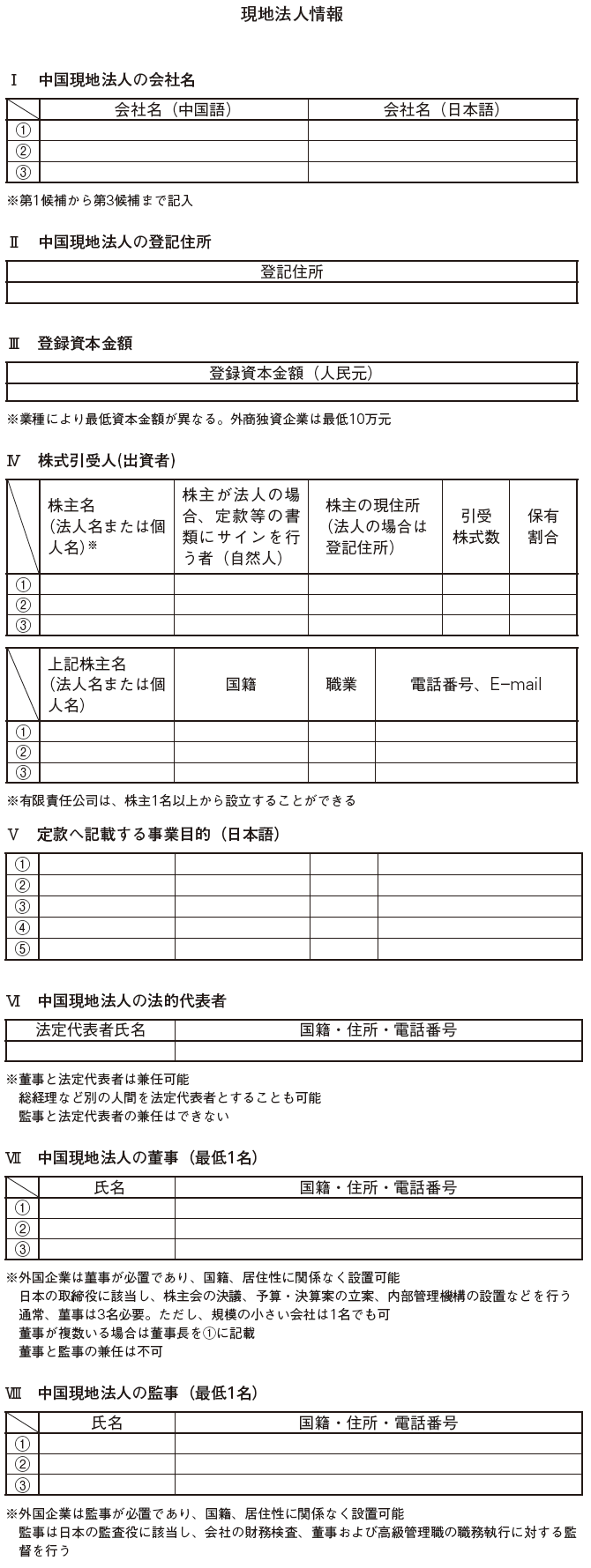

■ Determination of local corporate information ... ❶[Selection of trade name candidate]We select the company name (company name) of the local corporation. If it is a limited liability company, "limited liability company" or "limited company", if it is a company, "stock company Co., Ltd." or "honch Co., Ltd." must be listed in the trade name. In addition, the company name must be written in Chinese (kanji) notation.

[Engine Design]In establishing a local subsidiary in China, the majority are examples of choosing the form of a limited liability company. In establishing a limited liability company, the simplest organization design is one director (executive vice president) and one auditor (auditor) (Article 51, Article 52 of the Companies Act).

[Capital]Although there was a minimum capital requirement so far, it was revised in 2013 (Article 26 of the company law), legally, it became possible to establish capital even if it is 1 yuan. However, in practice, securing necessary funds to do business is required at the time of applying for company establishment. In the case of foreign capital, there are many cases that minimum capital is more than 30,000 RMB for any type of business.

[Registered address]Double registration is not allowed in China's registered address. Therefore, if you already have an office in China before establishing a subsidiary, you can not register that office as the registered address of the local corporation. Therefore, take one of the following methods.

① Separate the office space and make it independent including the real estate title② The address different from the office shall be the registration address

① The landlord's consent and cooperation are necessary. Companies borrowing multiple rooms in bulk can choose, but registration procedures will be required.On the other hand, ② is selected when the owner's consent can not be obtained or when the office space can not be divided. This method generates a new rent cost.

■Preparation of required documents ... ❷In order to establish a company, ratification by the screening institution and various registration are required. The documents prepared by the Japanese side are as follows.

· Investor qualification certificateThe notary of the notary institution of the location of the investor and the certification of the Chinese embassy / consular office in Japan are required. The notary and the certification of the Japanese Foreign Office and the certificate of the Chinese embassy must be treated with caution. In the event that any problems occur due to removal of staples etc. at the time of copying, the parties will be responsible for all the legal responsibilities.· Feasibility study report jointly signed by all shareholdersBy listing only the essential items of the articles of incorporation, you can reduce the frequency of holding unanimous shareholders' meeting resolutions when changes occur.· Bank capital credentials (original) of each shareholder, certificate of registration registration and proof of legal representative (both copies) If the foreign investor is an individual, an identification card shall be submitted.· Invoices of each party Investment statement with audit report for the most recent year after accounting auditor's audit· Foreign invested enterprises to be established · Import and export commodity list of commerce enterprises, list of board members of the board of directors and appointment director of investment parties· Documents describing company director, auditor, general manager's name, address, and delegation dispatch· An appointment letter etc. stating the address etc.· An authorization document or certification document for the signatory owner issued by a foreign company· Pictures of statutory representatives

Also, the documents prepared by the Chinese side are as follows.

· Application Form for Registration of Establishment of a Foreign Company· Company Constitution· Capital inspection certificate issued by capital inspection agency *· Proof of transfer of property rights (in case the first investment is carried out with non-monetary assets) Completion documents· Address certificate of new company (original of rental agreement, copy of real estate certificate)· Other documents required by Chinese government agencies (Commercial Bureau, Taxation Bureau, etc.)※ China's accounting specialist office will conduct the inspection and issue inspection certificate -

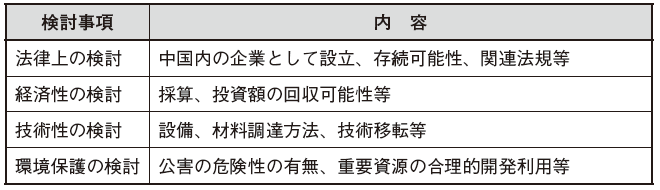

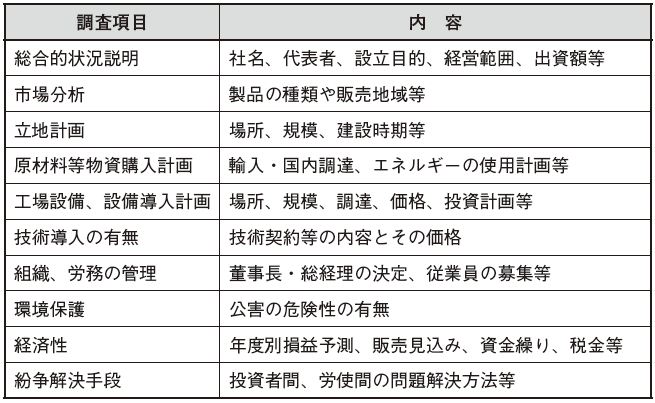

Feasibility study report

Feasibility study report (feasibility study) is to investigate and consider the feasibility of project in advance. Sometimes abbreviated as "F / S". It is one of the most important documents for foreign investment application and can roughly be divided into the following four.

We will create a project team for both Japan and China to gather information and negotiate survey items from the above four considerations. It is important to understand the effective Chinese law at the time of writing the report and consider whether it is practical or not. Since feasibility study reports are planning documents, you should avoid assertive numerical values and expressions.Feasibility study reports for application are usually created in a checklist manner. Such a form is sufficient as a document to obtain permission, but in some cases, a separate detailed feasibility study report will be prepared and studied for use in investment decision making in Japan. -

Report by foreign-invested enterprises

Before applying for the establishment of a monopolized enterprise, a foreign-invested enterprise will submit a report of a certain content to the provincial people's government of prefecture-level or prefecture-level or higher planned to establish a monopolized enterprise. According to Article 9 of the Detailed Regulations on the Implementation of the Foreign-owned Enterprise Law, reports on the prefectural or prefectural level of the People's Government where the monopoly enterprise is to be established shall include the purpose, scope, scope, product, technology There are provisions to describe the contents of facilities, land area and requirements, conditions and quantity of necessary water, electricity, coal, gas or other energy, requests for public facilities etc. The local people's government who received the report of establishment application will reply to foreign investors in writing within 30 days from the date of receiving the report submission. -

Procedure at the site

■ Company name temporary registration ... ❶If the application for establishment is approved by the local people's government, we temporarily register the company name. In the province of Industry and Commercial Administration Bureau of the provincial municipal office, it is necessary to consider the trade name listed in the application form up to the third candidate in preparation for cases where there are other companies in the same industry with a trade name similar to the company name you intend to select (Kanji 2 If it duplicates more than characters, registration will be denied).A company name preliminary examination permission notice will be promulgated after receiving government approval for company name. The company name provisional registration is applied to the Industrial and Commercial Administration Bureau of the location where it is planned to establish and is normally registered in 5 business days.

■ Foreign invested enterprise item permission application ... ❷After applying for company name, we will apply for feasibility study report and permission for company's articles of incorporation etc. Each document is submitted to the national or regional development planning department approval agency, the commercial department, or the regional external economic and trade administration department. Judging organizations are usually screened in 2 business days from the viewpoint of market, location planning, facilities, environmental protection, production etc.

■ Application for approval certificate of foreign investment enterprises ... ❸❷ Appraisal by ❷, apply to the Ministry of Commerce, after approval period of approximately 3 months, a certificate of foreign investment enterprise is issued. The competent government department of this procedure is the Ministry of Commerce or the Regional Foreign Economic and Trade Administration.

■ Industrial and commercial registration ... ❹Within one month after obtaining the certificate of approval for foreign investment enterprises, we will do registration procedure (industrial registration) with Industry and Commerce Administration Bureau. Registration details here are mainly sales license items. Once this registration is completed, a sales license will be issued and you will be able to do business in China. Procedures usually take three business days. If the procedure is not completed by the deadline, the effectiveness of the license will automatically expire, so caution is necessary.

■ Creating a company seal ... ❺In China, the company seal has big external legal effect external to the symbolic symbol of corporate rights. In order to obtain a seal, we submit an application form with the original police station (Public Security Bureau) with the business license, the identity card of legal representative and the original and copy of the member list of Board members. If there is a power of attorney, you can also apply by proxy. A permit to create a seal is issued in one business day after the application, and a seal seal creator designated by the Public Security Bureau can create a corporate seal (public seal), a seal of responsible person and a financial seal with this permit.

■ Statistical registration ... ❻We have the following documents and apply to the Bureau of Statistics.

· Statistical registration application table (using statistical authority designation form)· Copy of business license· Copy of organization organization code card

All copies to be submitted will require a seal of a corporate seal (public seal), and it will take about one business day for the procedure. With this registration, it is possible to analyze investment amount etc on the Chinese government side. -

Various registration procedures

After the industrial registration is complete, the temporary business license is received, and after the statistical registration is completed, the following procedure will be carried out.

■ Organization Mechanism Code Acquisition ... ❶Organization code is allocated to companies in China for each company. Organization mechanism code is created by China National Quality Technology Supervision Department. If you submit the required documents to the competent geological mass technical supervision department, the organization organization code and its certificate will be promulgated in one business day.

· Organization code code certificate application table· Business license· Copy of identification card of statutory representative· Identity certificate of the local corporate officer· Corporate seal

■ Foreign exchange registration ... ❷After acquiring a business license, within 30 days, apply for foreign exchange control registration at the foreign exchange control office of the jurisdiction. The required period is one business day. The main documents required at the time of application are as follows.

· Application form· Certificate of ratification· Organization code code· Company Constitution· Business license· Bank account opening certificate

■ Tax Registration ... ❸Just like Foreign Exchange Registration, after acquiring a business license, within 30 days the tax office of the competent jurisdiction registers tax registration and obtains the tax registration book. The required period is about 20 business days. The necessary documents are as follows.

· Business license· Legal representative's identity card or passport· Organization code code· Certificate of ratification· Company Constitution

At the time of tax registration, the treasurer of the Chinese subsidiary must receive a tax class. If you do not take classes, approval for tax registration application will not go down and you can not issue a value-added tax invoice.

■ Opening a bank account ... ❹China has its own foreign currency management system. The Chinese bank account has a foreign currency account and a RMB account. Two foreign currency accounts must be opened: a foreign currency account for capital transactions and a foreign currency basic account for ordinary transactions.Foreign currency accounts are used for capital transactions, borrowing, repayment of borrowings, transfers of real estate and other assets. Types of accounts include foreign currency capital accounts, foreign currency borrowing accounts, foreign currency borrowing payment accounts, foreign currency temporary special accounts, and so on.Normally, after completing the procedure for establishing a corporation, within 30 days foreign currency registration authority of the company's location will be registered, foreign currency registration certificate and foreign currency IC card will be obtained. Then, present them to the account opening bank and open a foreign currency capital account. In addition, we will acquire the external debt registry certificate, foreign currency borrowing registration certificate, etc from the Foreign Exchange Administration Bureau, and open other foreign currency special account.After establishing a foreign currency special account, you can open a foreign currency basic account and a RMB account with a designated bank (a bank in the company's location, a different bank than the special account). The period until the opening of a foreign currency account is three business days. Documents necessary at the time of application are as follows.

· Business license· Certificate of ratification· Foreign Exchange Control Registration Certificate and other related documents· Copy of legal representative's passport· Organization code code· Tax payment register -

Establishment procedure of foreign investment corporation

Foreign investment corporation (foreign capital corporation) is similar to a Japanese company in the form that all the capital is composed of equal shares and the shareholders take responsibility of the company with up to the stock underwritten as the upper limit. However, there are various conditions when establishing foreign investment corporation in China.

· At least one foreign shareholder is required· Shareholders in Japan and overseas jointly hold shares and held by foreign shareholders· One fourth or more of the registered capital of the company is required· The minimum registered capital amount is 30 million yuan

There are rare cases where Japanese companies advance in the form of foreign invested enterprises. As a merit of advancing in this form, as with Japanese corporations, we may be able to procure funds by listing in the future. Besides, as investment amount increases, reliability from outside increases, which makes it easy to receive loans from banks. There is a demerit that the establishment permission does not go down if the capital amount is small.

Establishment of foreign-invested enterprises can be roughly divided into two methods: new establishment and change establishment, and other than capital participation which takes over a quarter of the registered capital of the shares of the corporation issued by foreign investors There is also establishment.

■ New establishment New establishment is a method to be established as a foreign investment corporation from the beginning, divided into establishment of foundation and establishment of recruitment.

[Incorporation foundation]Incorporation establishment is a method in which the founders undertake the whole of the shares issued by the company and establish a company (Article 78 of the Company Law). In case of establishing a new company by establishing an initiative, all of the following conditions must be satisfied.

- Two or more organizers and not more than 20 people, of which more than half have domestic addresses (Article 79 of the same law)· At least one of the founders is a foreign shareholder (provisional provision 6 for a slight problem concerning the establishment of a foreign investment company)

[Recruitment establishment]Recruitment establishment is a method in which the incorporator assumes part of the shares issued by the company and the other part is public offering or recruiting for a specific target person and establishing the company (Article 78 of the Company Law). In the case of new establishment through recruitment establishment, all of the following conditions must be satisfied.

- Two or more organizers and not more than 20 people, of which more than half have domestic addresses (Article 79 of the same law)· At least one of the founders is a foreign shareholder (provisional provision 6 Article)· At least one of the founders has a record that has earned profits consecutively for three consecutive years before the offering of stock (Article 6 of said provision). In addition, if the same person is a foreign shareholder, it is necessary to submit an audit report by the accounting professor in the location. After the founders agree to establish the company, it is possible to delegate the establishment procedure in cooperation with one founder Change establishedChange Establishment is a method to change the structure of a foreign investment enterprise in the form of an existing limited company to a foreign-owned company.

Change establishedChange Establishment is a method to change the structure of a foreign investment enterprise in the form of an existing limited company to a foreign-owned company.

[Establishment requirement]When establishing a new establishment through change establishment, there are the following requirements besides investors and minimum capital stock etc.

· More than three years have passed since the establishment of a foreign-invested enterprise and profit has continuously been raised for the last three consecutive years· The investor of the initial foreign investment company becomes the founder of the foreign-affiliated company, creates the company's establishment agreement, the articles of incorporation, and is subject to the examination of the original licensing agency· All the rights and obligations of the initial foreign invested enterprise will be undertaken by Foreign Investment Co., Ltd.

[Documents to be submitted]The following documents are necessary when making change establishment procedures.

· Contract of the original foreign invested enterprise, the articles of incorporation· Resolution on the change of the organization of the company of the original foreign invested enterprise· Resolutions regarding the termination of the contract, the articles of incorporation of investors of the original foreign invested enterprises· Asset valuation report of initial foreign invested enterprises· Founder's agreement form· Company Constitution· Business license of original foreign invested enterprises· Company establishment application form· Credentials of founders· Feasibility Study Report

[Change Procedure]The original investor of the foreign invested enterprise will submit to the approval agency of the location of the initial foreign invested enterprise after signing the agreement and the articles of incorporation of the company's organization as the initiator. After the approval of the primary examination, apply for approval by the Ministry of Commerce, the promoter receives the approval certificate, and after completion of payment of the investment amount undertaken, the registration change procedure to the company registration organization is carried out.

[Reference material ①] Establishment schedule of foreign-funded enterprises

[Reference material ②] Information necessary for establishment of foreign-funded enterprises

-

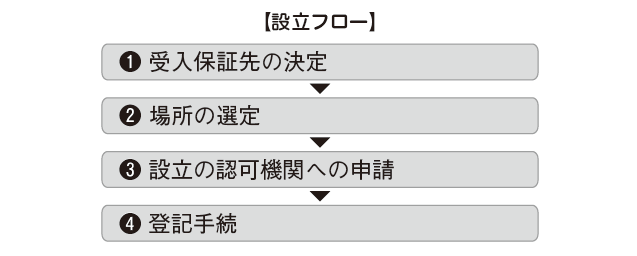

Establishment of Representative Office

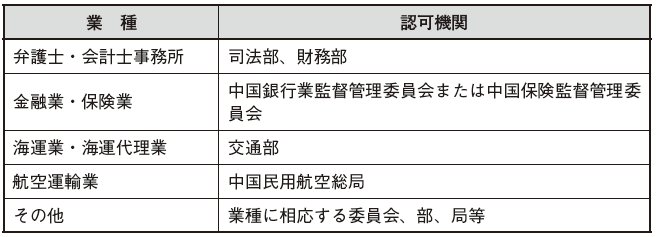

Establishment of a representative office follows provisional enforcement provisions concerning the management of the representative organization resident of a foreign company. The provision was promulgated by the State Council in 1980, and the detailed by-laws were announced in 1995. Since regulations differ depending on the type of industry, confirmation to the Ministry of Finance is necessary at the time of establishment. ■ Determination of receipt guarantee destination ... ❶An acceptance guarantor is equivalent to the identity guarantee of the organization that will establish a representative office from now on. The receipt guarantee destination (entertainment unit) is almost determined by the type of industry, and it is decided as a Chinese company or a foreign affairs organization that traded in the past. However, certain industry types (banks, insurance companies, etc.) need no guarantee receipt.■ Selection of location ... ❷A representative office of a foreign company is permitted to open only in office buildings and hotels that are permitted to be opened by the institution designated by the Chinese government or the institution (the external economic and trade commission etc) Yes. After deciding where to open the office, sign the rental agreement of the office location office. Selection of the location of the representative office will be carried out simultaneously with ❶.■ Application for approval of establishment ... ❸[Application organization]After ❶, we will apply for approval to each division (authorized body) by industry type.。

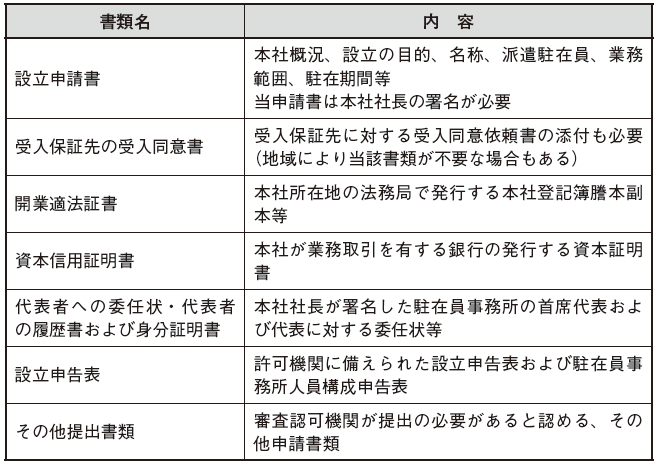

■ Determination of receipt guarantee destination ... ❶An acceptance guarantor is equivalent to the identity guarantee of the organization that will establish a representative office from now on. The receipt guarantee destination (entertainment unit) is almost determined by the type of industry, and it is decided as a Chinese company or a foreign affairs organization that traded in the past. However, certain industry types (banks, insurance companies, etc.) need no guarantee receipt.■ Selection of location ... ❷A representative office of a foreign company is permitted to open only in office buildings and hotels that are permitted to be opened by the institution designated by the Chinese government or the institution (the external economic and trade commission etc) Yes. After deciding where to open the office, sign the rental agreement of the office location office. Selection of the location of the representative office will be carried out simultaneously with ❶.■ Application for approval of establishment ... ❸[Application organization]After ❶, we will apply for approval to each division (authorized body) by industry type.。 [[Document submission]Upon application for permission, we submit the following documents etc. to the above permission agency.

[[Document submission]Upon application for permission, we submit the following documents etc. to the above permission agency. ■ Registration Procedure ... ❹After the end of the approval procedure, the approval institution of the foreign representative in China in China will be issued and the notice thereof shall be issued, and within 30 days from the effective date, it must apply for registration to the industrial and commercial administration bureau at the location of the representative office not. The main documents required for registration application are as follows.· Registration Office Application Registration Form· Authorization certificate issued by the authority· Representative institution authorization certificate of foreign companies in ChinaIn many cases, we also apply for registration of individuals as well as these applications. Within a certain period after applying for registration, representative organization representative organization registration card will be delivered to the representative office and representative card will be given to the resident individuals.Within 30 days after the registration process it is necessary to bring an approval certificate, registration certificate and representative card, and conduct related procedures at departments such as public security organs, financial institutions, tax agencies and banks.Previously, foreign companies could not establish a representative office in China unless authorized and registered by the supervising government agencies. In other words, it was first decided to obtain the approval from the approval authority, then carry out the registration procedure at the Industrial and Commerce Administration Bureau, and then complete the establishment of the Representative Office for the first time. With the amendment of the Registration Ordinance Ordinance of Foreign Enterprises Resident Representative Organization (China State Council Ordinance [2011] 584, enforced on March 1, the same year), the establishment procedure has been simplified considerably, no approval by an examination agency is required for many industries, Basically it can be established only by the registration process at the Industrial and Commercial Administration Bureau.

■ Registration Procedure ... ❹After the end of the approval procedure, the approval institution of the foreign representative in China in China will be issued and the notice thereof shall be issued, and within 30 days from the effective date, it must apply for registration to the industrial and commercial administration bureau at the location of the representative office not. The main documents required for registration application are as follows.· Registration Office Application Registration Form· Authorization certificate issued by the authority· Representative institution authorization certificate of foreign companies in ChinaIn many cases, we also apply for registration of individuals as well as these applications. Within a certain period after applying for registration, representative organization representative organization registration card will be delivered to the representative office and representative card will be given to the resident individuals.Within 30 days after the registration process it is necessary to bring an approval certificate, registration certificate and representative card, and conduct related procedures at departments such as public security organs, financial institutions, tax agencies and banks.Previously, foreign companies could not establish a representative office in China unless authorized and registered by the supervising government agencies. In other words, it was first decided to obtain the approval from the approval authority, then carry out the registration procedure at the Industrial and Commerce Administration Bureau, and then complete the establishment of the Representative Office for the first time. With the amendment of the Registration Ordinance Ordinance of Foreign Enterprises Resident Representative Organization (China State Council Ordinance [2011] 584, enforced on March 1, the same year), the establishment procedure has been simplified considerably, no approval by an examination agency is required for many industries, Basically it can be established only by the registration process at the Industrial and Commercial Administration Bureau. -

Establishment procedure of investment company

In applying for the establishment of an investment company, foreign investors will review and agree on the application documents by the Ministry of Commerce of the province, autonomous region, direct jurisdiction city or planned single row city located at the location of the investment company scheduled to be established , You must receive the examination and permission of the Commerce Department (Article 6 of the investment company). Documents necessary for application are as follows (Regulation 17 on foreign investor establishing investment property company).

· Applications, contracts, companies, articles of association of various people who established a joint venture company. Application form for the investor who established the monopoly, research report with possibility of execution, articles of incorporation· Certificate of Investor's Certificate (Including Corporate Certificate) or Certification of Chinese Embassy Approved by National Certified Organization Identification Form· Approval certificate (copy) already approved as foreign capital, business card (copy)· Capital Validation Report (copy)· Balance sheet for past 3 years· Written guarantee made based on the provisions of Article 5 on foreign investors establishing investability companies· Advance notice of company name· Certificate of use of registered address· Board members' members list, commission letter, identification and resume· Consignment letter (when there is a consignor)· Other literature designated by the Ministry of Commerce· List of documents submitted by the applicant and contact information (telephone, facsimile, mobile phone number, mail address)

The Ministry of Commerce implemented a notice on the consignment of the authority to approve review on the establishment and operation of an investment company by foreign investment on March 1, 2006, and granted authority to approve the establishment of an investment company with registered capital of 100 million US dollars or less We delegated to the department of Commerce. -

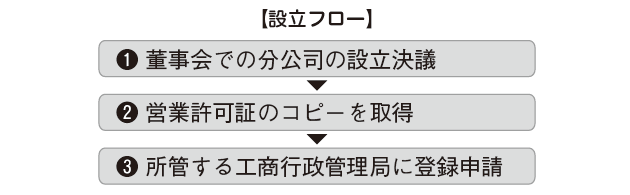

Establishment of branch office of branch office (branch office)

Establishment of a branch of a foreign company is not prohibited by law, but it is generally not permitted to establish a branch office except for a special industry such as a bank like a bank. I will describe the establishment of a branch office of a local corporation here.

[Establishment conditions]As a general rule, the conditions for establishing the minute corporation are as follows.

· The parent company has been in operation for more than 1 year and full registered capital is paid· Production activities are normally operated and already selling products

■ Establishment of a division of company at Board of Directors Resolution ... ❶The establishment of a new branch office will have a major impact on the company. Therefore, a resolution by the board of directors is required.

■ Acquire a copy of the business license ... ❷With the consent from the Industry and Commerce Administration Bureau under the jurisdiction of the headquarters, we obtain a copy of the business permit stamping the branch organization establishment consent notice and the official seal of the industrial and commercial administration bureau.

■ Application for Registration to Industrial and Commercial Administration Bureau concerned ... ❸Apply for registration to the Industrial and Commercial Administration Bureau that is in charge of the establishment of the minute company and acquire a business license to the company.Subsidiary submits the application to the supervising agency of China with relevant documents such as the company's articles of incorporation and company registration certificate, approves it, after registering with the company registration authority according to the law, by receiving business license You can establish a branch office in China (Company Act 193).The State Council has stated that the provision of the examination permit concerning the establishment of the branch is separately determined, but by the promulgation of the foreign direct investment bank management ordinance and the management ordinance of the foreign capital insurer company to date, it is the bank and the bank that the establishment of the branch is permitted as the local corporation Since only insurance companies, manufacturers and service industries etc. have no clear legal basis, it is not possible to establish branches in China (Article 193 (2) of the same law). Establishment of branches of banks and insurance companies is based on laws and regulations, both of which meet the stringent conditions, after approval by the Bank Administration Administration Agency (Silver Association) and the Insurance Regulatory Commission (Safety Committee), respectively, It is necessary to obtain a corresponding business license and register it with the industrial and commercial administration agency.With deregulation by the accession to the WTO, the establishment of branches of banks and insurance companies is rapidly increasing. With regard to the banking business, due to enforcement of foreign direct investment banking regulations and enforcement bylaws thereof, the renminbi retail business for the Chinese can be made subject to the condition of local corporation, so foreign branch branches are gradually becoming local companies is. As branches can operate, funds corresponding to activities and management activities must be provided (Article 194 of the same law). Because the branch does not have corporate status, the local corporation will bear the civil liability for management activities done in China (Article 196 of the same law).

-

-

-

Procedure after incorporation

■ Paid-in capitalPayment of capital can be divided into several times. There is no restriction on the number of divisions etc. when paid capital in division. However, it is necessary to receive an investment investment audit (audit by Chinese accountant) for each payment. In that case, you must state the deadline for payment of funds in the application form for establishing a foreign-funded enterprise and the articles of association of foreign-funded enterprises.For foreign-funded enterprises, restrictions are imposed on investment by intangible assets such as industrial property rights and non-patented technology (Article 27 of the detailed rules of implementation of the Foreign-owned Enterprise Law). The evaluation of the industrial property rights and know-how must conform to the usual evaluation principles in the world, and the evaluation value should not exceed 20% of the registered capital of a foreign company.Regarding industrial property rights and know-how that we have invested in price evaluation, we have detailed information including copies of ownership certificate, circumstances of effective period, technical performance, practical value, evaluation basis and criteria, etc., It must be submitted to the approval agency as an accompanying document of the establishment application form.

Payment deadlineThe final investment will be paid within 3 years from the date of promulgation of business license.The first investment shall not be less than 15% of the investment amount agreed to be accepted by foreign investors, and it is necessary to complete it within 90 days from the date of promulgation of foreign-funded enterprise business license (Foreign-owned enterprises Article 30 of the Law for Implementing the Act).If the payment of 30 days investment is delayed without justifiable reasons, the validity of the foreign-funded enterprise business license will be lost. When seeking postponement of the contribution payment date, you must notify the industrial and commercial administration agency with consent of the approval agency (Article 31 of the same rule).

■ Investment reporting procedureThe investment report is also called an investment certificate or investment verification report. After the qualified accounting firm checks the truth and legality of the client's paid-up registration capital and related assets / liabilities It will be promulgated.In order to prepare this report, the following documents are required along with the certificate documents issued by the Foreign Exchange Administration Bureau.

· Company name Nuclear notification· Articles of association· Shareholder identification (individual shareholder: identity card, corporate (company) shareholder: enterprise corporate management license)· Shareholder investment bank Bank advance book (check) or cash payment

The amount of the fee required at the time of preparing this report depends on the amount of stated capital.

■ Financial Bureau Registration Procedure The following documents are required when applying for a fiscal registration certificate to the Finance Bureau. A corporate seal (public seal) is required for each document copy.

· Financial Registration Application Form (using the form specified by the Finance Bureau)· Copy of business license· Copy of approval certificate· Copy of corporate code number certificate· Copy of tax registration certificate

Application for renewal of business licenseEven if the Industrial and Commercial Administration Administration approves the application for registration of the local corporation registration, a business license will be issued. Since this is a provisional business license, it is described as "no practical capital" in registered capital money. Therefore, it is necessary to rewrite the fact that it is the original in the registered capital after receiving the certificate of investment.

■ Customs RegistrationThe official name of the customs registration is the registration registration of the import / export cargo consignee shipper.Imports of equipment and raw materials, procedures necessary for doing export of products, because it varies slightly depending on each section, you must confirm with the customs of each section before registration. Required documents are as follows. Just as with the Finance Bureau registration, a copy of each document requires a corporate seal (a public seal).

· Customs Registration Application Form (Use Customs-Specified Form)· Original license and copy of business permit· Copy of approval certificate· Foreign Trade Manager 's Registration Form· Copy of organization organization code number certificate· Copy of tax registration certificate· Copy of RMB basic account permit (RMB account number)· Copy of the articles of incorporation· Copy of land use right purchase contract (company consultation) or building lease contract (consultation document) of company location certifying business location (2 copies)· Copy of Real Estate Right Certificate (Bison Industrial Prosecution) at the lease contract site (2 copies)· Public seal seal of the company

■ Value Tax General Tax Payment ApplicantVAT is a tax applied when selling goods, providing services, and importing goods. We classify taxpayers who are permitted to issue their own votes on purchase deductions · export refunds · incremental tax invitations to general tax payment obligors and taxpayers not allowed for small tax payment obligor. For this reason, whether or not it falls under the general tax payment obligation is an important issue. In order to confirm this, a company that meets certain criteria must apply to the taxing department of the jurisdiction.

Documents necessary for general tax payment qualification acquisition application are as follows.

· VAT Included Taxpayer application (certification) examination table· Copy of business license certificate copy· Copy of tax registration certificate· Tax return filing card· The original of the vote purchase book (to be received from the tax bureau after registering the tax, record notes at the time of vote purchase, for examination)· Copy of investment report· Copy of the certificate of the upper Grant (permission to engage in accounting work) certificate of accounting personnel (2 people) qualified as above· Distribution agreement (monthly average sales amount is 200 thousand RMB or more)· Copy of lease contract (or contract for sale) at the registered place

-

-

-

Websites

-

Babiliography

[1] 遠藤誠・孫彦『中国ビジネス法務の基本がよ~くわかる本〈第2版〉』秀和システム、2012年

[2] 有限責任監査法人トーマツ中国室編『中国の投資・会計・税務Q&A〈第5版〉』中央経済社、2013年

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya