China

12 Chapter International taxation strategy

-

-

1 Chapter Introduction

1.1 The history of Japanese companies entering the world

1.2 New business model in China

1.3 Advance scheme through Hong Kong

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.2 Province and region of China

3.5 Investment incentives and regulations

4 Chapter Economic Environment

5 Chapter Establishment

5.3 Establishment of business base

5.4 Procedure after incorporation

6 Chapter Withdraw

7 Chapter Foreign exchange

7.1 Foreign exchange management system in China

7.2 Foreign currency management system of ordinary items

7.3 Foreign exchange control system of capital items

7.4 Foreign exchange control system in bonded area · Hong Kong

7.5 Individual foreign currency control system

8 Chapter M&A

8.2 Laws and regulations concerning M & A

8.5 Challenges after corporate acquisition

9 Chapter Corporate Laws

10 Chapter Accounting

11 Chapter Tax law

11.2 Representative Office Taxation

11.4 Individual Issues in China Domestic Tax Law

12 Chapter International taxation strategy

12.1 International tax relating to entering China

12.2 International taxation strategy

12.3 Individual Issues in International Taxation

12.4 Tax issues related to withdrawal

13 Chapter Transfer Price Taxation

13.2 Individual provision pertaining to transfer pricing taxation

13.3 Transfer price taxation and documentation

13.4 Transfer price survey in China

14 Chapter Labor

14.4 Points to remember when bringing Japanese

15 Chapter International Human Resources Management

15.1 Human Resources Labor Management

15.3 Personnel evaluation system

-

-

-

International Taxation General

After the war, due to the globalization of the Japanese economy, tax problems occurred, so a new tax system has been developed to deal with that problem. I will review the history of changes in the economic environment and tax system in our country.Taxation rights of each country has become the biggest problem as international transactions have increased. Since each country has its own tax laws of each country, it is a problem which country has taxation rights for income etc. generated by international transactions. Therefore, it is important to understand the taxation provisions and tax treaties of each country, to clearly recognize the taxation right of each country, to avoid unnecessary additional taxation or double taxation between the international countries.A series of tasks for paying taxes while comparing and considering the taxation provisions and tax treaties of each country including how to handle profits generated by international transactions is called international taxation. As international trade continues to grow more and more, the necessity of international taxation is greater than ever.

■ Foreign tax credit systemSoon after World War II Japan recovered with rapid momentum. However, as domestic demand for goods for economic activity was small, transaction volume with overseas increased. Double taxation is the problem here. For example, when selling domestically manufactured products at a subsidiary established overseas, income generated overseas will be taxed in total two times in overseas and in Japan. Therefore, a foreign tax credit system to eliminate international double taxation was established (revision of corporate tax law in 1953). This is a system that can be deducted from Japanese corporate tax that should pay income tax paid abroad.

■ Tax / Haven countermeasure tax systemThe Japanese economy continued to develop, becoming the world's second largest economic power in GNP (Gross National Product) in 1968. While Japanese companies are becoming multinational as the economy develops, subsidiaries, etc. are established in countries (tax and haven countries) which have a very low tax burden, and by transacting with the country, it becomes multinational Some companies have intentionally mitigated the tax burden of the entire enterprise. Tax avoidance by such multinational corporations is a serious problem from the viewpoint of impartiality of tax burden and securing Japanese taxation right. In order to prevent such tax avoidance behavior, tax tax haven taxation system was introduced (corporate tax revision in 1978). Tax · Haven countermeasures Tax system will be described in detail in "Individual Issues of International Taxation" (P.489).

■ Transfer price tax systemAs Japanese companies are becoming multinational, the number of companies seeking to avoid taxes through special accounting has increased, in order to escape from corporate taxes at high tax rates in Japan. Special accounting is the process of transferring profits to cheap countries by manipulating the transaction prices that occur between enterprise groups. This tax system is similar to tax tax haven taxation system, but it is a major feature that it is also done in dealing with countries other than tax and haven countries. However, such tax evasion is a very serious problem as well as tax and anti-tax countermeasures.The transfer pricing tax system was enacted to solve this problem (corporate tax revision in 1986). Transfer pricing taxation means that if the income of a Japanese corporation declines because the transaction between the Japanese corporation and the foreign corporation is lower or higher than the normal transaction price (transaction price between independent companies), the transaction It is a system that deems it traded at a normal price and calculates corporate tax (see Chapter 12 "Transfer Pricing Taxation").

■ Tiny capital tax systemIf not only foreign direct investment but also inward direct investment in the Japanese economy are increasing, a new tax problem has occurred. When a foreign company conducts business in Japan, there are "investment" and "borrowing" as a method of raising funds, but usually you can not deduct the payment of dividends on investment. However, since interest on borrowing can be deducted, companies increasing the tax avoidance by borrowing excessive interest-bearing debt instead of reducing the investment from foreign companies' parent company has increased.In order to cope with such problems, a tiny capital tax system was introduced (corporate tax revision in 1992). For details, please refer to "Individual Issues of International Taxation" (P.489). The under capital tax system is a system in which if borrowings of a subsidiary such as a foreign company existing in Japan exceeds a certain multiple of the amount of stated capital, the corresponding interest expenses etc. can not be deducted under the Corporation Tax Law.

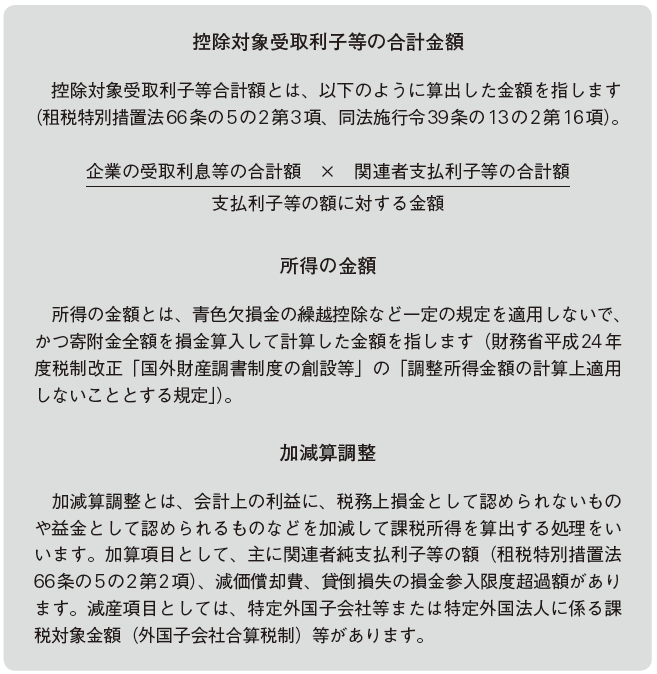

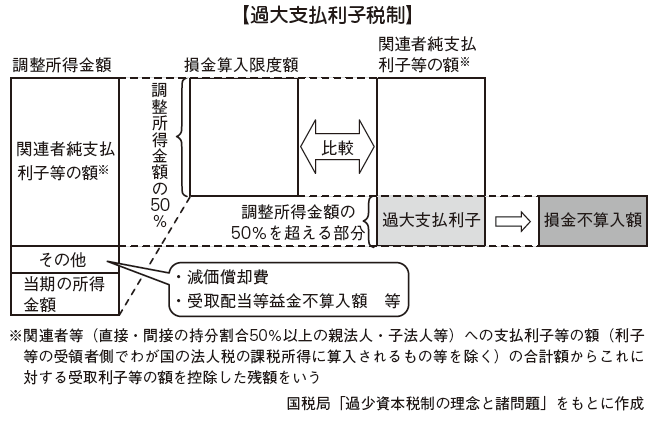

■ Overpaid interest tax systemTax avoidance that compresses the tax burden by inclusion of interest payment into deduction is possible, so major leading industrialized countries tend to strengthen measures to limit deduction of interest paid. In addition, the introduction of a tax exemption system of interest with the withholding country country tax exemption system is advanced in the tax treaty, but even in the amendment of the Japanese tax treaty it is possible to expand the withholding country tax exemption system from the viewpoint of promoting international investment exchange .However, under the source duty exemption system of interest, there is concern about the risk of tax avoidance acts compressing tax burden due to excessive interest payment. In addition to the above transfer pricing taxation and undercapital taxation, in addition to the above-mentioned taxation system of taxation, in addition to the above taxation system, as a measure to seal the avoidance of tax avoidance by paying interest to affiliates deeply related to the company, An overpaid interest tax system has been established to limit deductibility of interest payments. From the necessity of adjusting the double taxation by applying this system and the application of the under capitalized tax system and applying the combined taxation system of foreign subsidiaries, the respective systems are also being revised (see "Individual Issues of International Taxation" on page 489 ). Relevant persons are the following persons.

① A person whose proportion of direct or indirect ownership with a company is 50% or more② Persons who are in real relationship / controlled relationship with companies③ Third parties who receive debt guarantees by persons who fall under (1) and offer funds to the company -

Points to be noted by advancing form

When entering China, points to keep in mind for taxation in common with all tax systems are as follows.

· Basic Understanding of Chinese tax system· Understanding the basic contents of the Japan-China Tax Treaty· Understanding whether tax incentive system exists and contents· Refund scheme for profits generated by a Chinese subsidiary· Collection of new information such as tax system revision

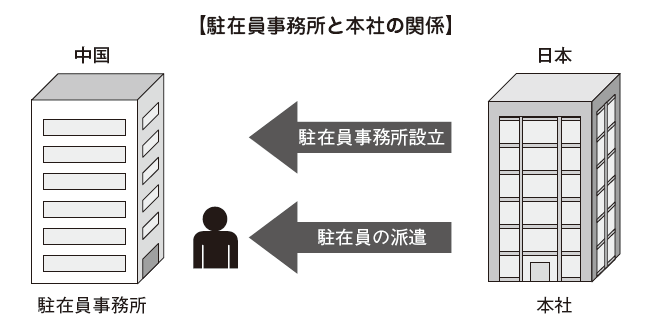

There are several forms of advancement when starting a business in China, but it can be roughly divided into two cases of not establishing a base and establishing a base. If you do not have a base, there is a consignment processing, a small investment in an existing Chinese company, etc. On the other hand, if you are planning to set up a base, you will have the presence of a representative office, branch office, or subsidiary company. It is important to choose the type of advancement that fits the company's purpose. Because tax provisions differ depending on the form of entry, it is important to consider planning beforehand after reviewing the merits and demerits. I will explain the relationship between entry form and tax regulations.

■ When doing a business without establishing a baseIf you are doing business without setting up a base in China, such as when exporting or consigning products, you will not be subject to corporate income tax. However, with regard to income earned by permanent establishment (PE: Permanent Establishemt) business income tax will be imposed on China domestic source income without establishing a base.

■ When doing a business with a baseThere are three forms of doing business with a base in China as follows.

· Representative office· Branch· Local corporation

[When establishing a representative office and activities]Because the Representative Office is prohibited from engaging in profit-making activities (penalty of illegal acts may be subject to a fine of up to 500,000 RMB), except for interest income etc., it is basically a company Income tax will not occur.However, if there are acts deemed to be sales activities in the activities of the representative office, taxation will be imposed. In fact, in many Chinese representative offices, corporate income tax is taxed in practice.

The taxation and declaration method of corporate income tax at the representative office is as follows.

Principle wayThe Chinese representative office must accurately calculate taxable income and taxable income of the representative office and declare and pay corporate income tax within 15 days after the end of the quarter.

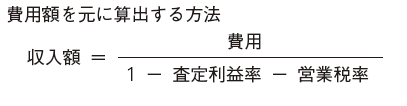

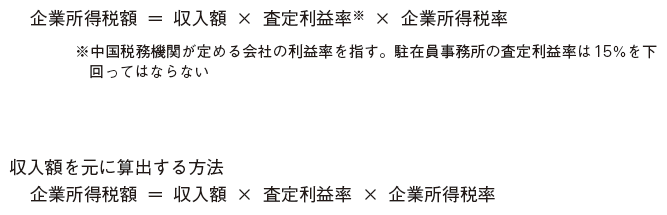

When the book is incompleteBecause the book is incomplete due to insufficient management, the tax authority in China, which can not declare / pay tax on computed income based on actual results, based on the expense amount or based on income You have the authority to adopt the method of calculating to.

In practice, it is common to calculate based on expenses. In accordance with the corporate tax law of Japan, we will deduct the expenses from the income generated at the representative office, and if income remains, we will be subject to corporate tax. Regarding the income of expatriates dispatched from Japan, it is necessary to confirm in advance about the representative office and salary burden problem in Japan and payment / declaration method of withholding tax on site.

[When establishing branch offices and activities]Regulation of branch establishmentThe branch office is an intermediate base between the representative office and the overseas affiliate, and it is called the corporate officer in Chinese. It is classified as a branch of a foreign company (a company established by a foreign law) and a branch of a foreign-invested enterprise (a company founded in China's law = a Chinese subsidiary).Regarding branches of foreign companies, it is said that the specific authorization rules for establishment are left to the State Council (Article 193 (2) of the Companies Act), and banks and insurance companiesIt is subject to permission only (Foreign Capital Bank Management Ordinance 7 and Foreign Investment Insurance Company Management Ordinance 7). Regarding other fields, there is no clear provision, and the establishment of the branch office is virtually not allowed.Branches of foreign-invested enterprises are classified as Sales Segmentation Company and Non-Sales Partition Company. Sales Value Distribution Co., Ltd. refers to a branch office that conducts business activities similar to the management scope of the head office (local corporate headquarters). Non-marketability corporation refers to a branch that can not operate because it carries out only ancillary operations such as administrative contact procedures of the head office.

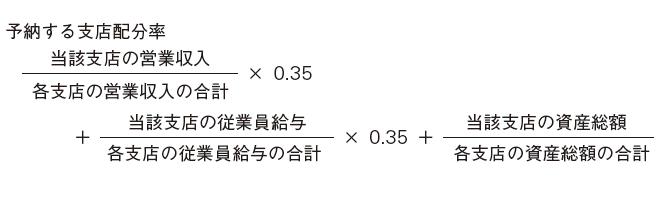

Prepayment obligation of corporate income taxForeign-invested enterprises with branches meeting certain requirements calculate the taxable income and payment amount of the head office at a time and calculate 50% as the enterprise income tax amount to be paid by each branch office. After that, at the location of each branch office, the corporate income tax must be prepaid on a monthly or quarterly basis based on allocation calculation (branch allocation ratio to be prearranged). After the end of the fiscal year (after the end of December), we will file a final tax return at each headquarters, and will make additional payment for the shortfall or receive refund for excess payment (Treasury [2012] No. 40).A branch that meets certain requirements refers to a secondary branch (main branch office or branch office under the head office) having major production management functions, and the headquarters or head office directly integrates and performs financial calculation and personnel management, etc., It is defined as the branch that received the corporate business license. Calculate the allocation ratio of corporate income tax for branches to be prepaid as follows. Prepaid payment for the newly established branch is unnecessary in the first year of establishment.

Prepaid payment for the newly established branch is unnecessary in the first year of establishment.

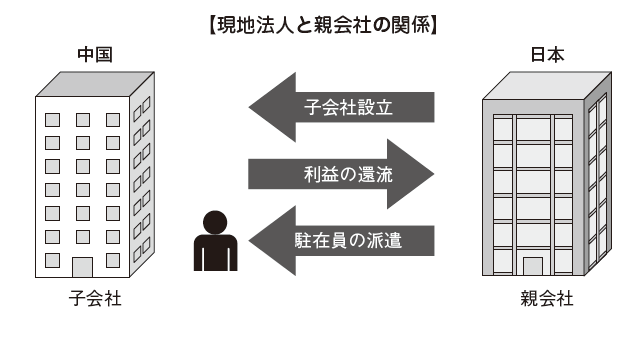

[When establishing an overseas affiliate to conduct activities]

If you set up a subsidiary in China, income generated will be taxable regardless of whether you are in China or abroad (global income tax). The enterprise income tax rate in China is basically 25%. However, due to the tax incentives set by the State Council of China, it is possible that 15% of high-tech enterprises, etc. that the state needs to focus on, such as agricultural new technology, new technology on energy and material savings, technology for contributing to environmental pollution prevention Yes.The payment deadline for corporate income tax is within 15 days from the end date of the month or quarter. Judgment of whether payment will be made monthly or quarterly will be decided by assessment by Chinese tax agencies. This assessment is carried out irregularly not only at the time of establishment but also after establishment, and the frequency of tax payment is determined each time.

-

-

-

Tax strategy on financing and refunding money

■ Funding methodThere are four ways to raise funds when entering China.

· Capital increase· Borrowing· Deferred transaction· Lease

Since there is no obligation to repay the capital increase, there is a merit that the financial base is stable. However, there are also demerits such as influencing the increase / decrease of voting rights (management rights) and not being allowed to pay dividends as deductible (expenses under the corporate income tax law).With respect to borrowing, deferred payment transactions and leases, there is no effect on the increase or decrease in voting rights, and there is a merit that the tax cost can be kept low because interest expense is recognized as deductible. As a disadvantage, there are obligations to repay, interest is generated irrespective of the profit of the company.

[Capital increase]Investment funds are basically funds that do not need to be repaid unless the company liquidates, so the capital increase is the most stable funding method. However, there are points to be aware of in the procedure.For example, it is necessary to obtain a new business license from the Chinese government and receive fundraising investment, so you can not use the funds promptly.Also note that capital reduction by foreign invested enterprises is prohibited as a general rule (detailed regulation of foreign corporation monopoly enterprise law enforcement ordinance, juxtaposed enterprise law enforcement ordinance). However, only when the necessity is confirmed, capital reduction is permitted with the approval of the approval agency, but it is very difficult to obtain permission.

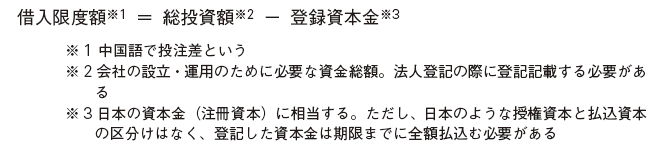

[Borrowing]There are two kinds of borrowing from overseas and borrowing from China. In case of borrowing from overseas, we will comply with provisional provision on the ratio of registered capital and total investment of Chugai and foreign joint venture enterprises (Industrial Corporation's Plan [1987] No. 38 Order). This regulation is applied to foreign companies and was established to make foreign exchange management more strict. According to the provisions, the ratio of the total investment amount and the registered capital at a foreign company is stipulated, and borrowing denominated in foreign currency exceeding the upper limit is not allowed.

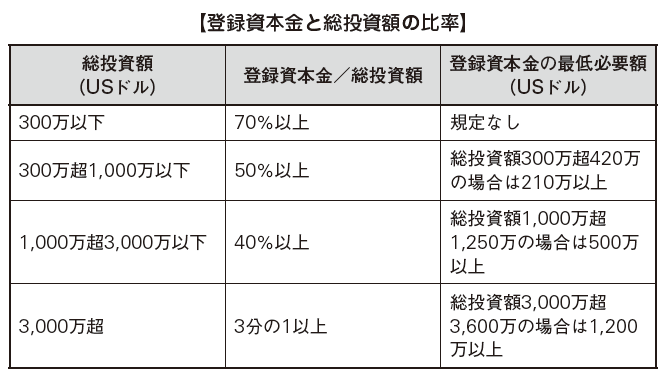

Borrowing from China can be done freely in practice. Regulation target of foreign currency borrowing limit amount is borrowed from overseas only (Domestic Foreign Capital Bank External Bond Management Control Law Article 3). Regardless of which fundraising method is chosen, it is important to prepare strategic plans beforehand, as China can not raise funds freely like in Japan, where foreign capital management is difficult. [Deferred transaction]There is also a method to raise funds by utilizing extended payment slots in a separate frame from the overseas borrowing frame. Extended Foreign Bond Fund is the borrowing from overseas, regardless of overseas borrowing frame, if the Chinese subsidiary imports machinery and parts from overseas, within 10% of the import amount in the previous fiscal year.

[Deferred transaction]There is also a method to raise funds by utilizing extended payment slots in a separate frame from the overseas borrowing frame. Extended Foreign Bond Fund is the borrowing from overseas, regardless of overseas borrowing frame, if the Chinese subsidiary imports machinery and parts from overseas, within 10% of the import amount in the previous fiscal year.

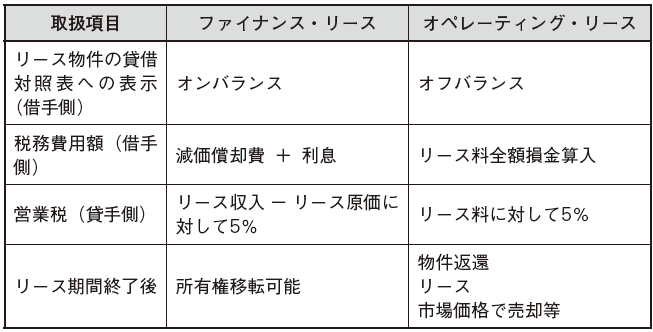

[lease]Leases can be divided into finance leases and operating leases, but in China, attention is required as they differ in the balance sheet display, tax expenses, business tax amount, and accounting treatment after the lease term ends, respectively .

Many companies entering China are using sale and leaseback which once sells assets purchased by their own company to leasing companies and signs lease contracts. In addition to the merit of being able to secure the working capital by the local subsidiary of China itself, there is also the effect of curbing the tax cost. In Sale and Leaseback, business tax at the time of sale of the asset is exempted, and depreciation and interest and interest are recognized as tax expense. -

Cash collection from subsidiary

As a method of collecting funds from subsidiaries by the parent company, there are collection by liquidation / dissolution, collection by transfer of shares, loan interest between parent and subsidiary companies, etc. However, what is mainly done is collection by capital (capital transaction) (Profit and loss transaction). In choosing the method of withdrawing funds, it is important to establish a close strategy to maximize investment recovery and minimize tax risks.In the method based on dividends, since there is no adjustment of the transaction price, there is the merit that there is no risk in transfer pricing taxation, but there is a disadvantage that dividends become impossible if there is no disposable profit. On the other hand, because the method by transaction between parent company and subsidiary company can adjust the amount of transaction, there is a merit of being able to collect funds without being affected by the disposable profit of subsidiary, but there is a disadvantage that there is a risk in transfer pricing taxation

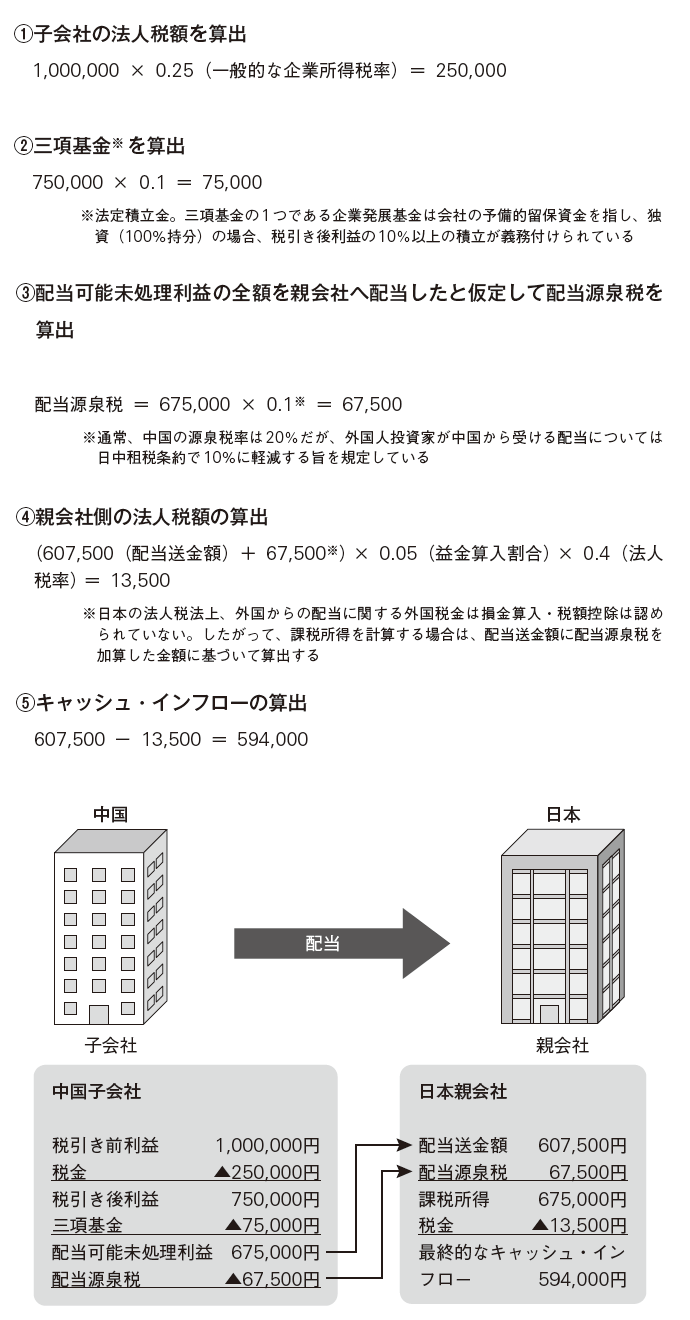

■ Return to parent company through dividendWhen returning profits to the parent company through dividends, the Chinese side and the Japanese side may pay attention to each.

[Points to be noted on the Chinese side]On the Chinese side, the dividend to the Japanese parent company from the profit of the Chinese subsidiary is taxed by the withholding tax rate of 10%. However, dividends from profits recorded in fiscal years prior to January 1, 2008 are tax-exempt. This is because there was a preferential tax system for foreign enterprises (property tax [2008] No. 1, Notice on some preferential policies of corporate income tax).Therefore, caution is necessary as it is decided whether or not to be taxed by the time when the profit of the Chinese subsidiary is recorded.

[Points to be noted at the Japanese side]On the Japanese side, processing differs depending on the investment holding requirement for the Chinese subsidiary of the Japanese parent company. 95% of the dividend from the Chinese subsidiary holds a 25% or more ownership interest in the Chinese subsidiary of the Japanese parent company and continues to hold it for six months before the date on which the payment obligation is determined, It will be included (dividend duty free). The remaining 5% is regarded as revenue corresponding to the subsidiary management expenses in the Japanese parent company and is included in the benefits. In other cases it will be tax included, but if the holding period is less than 6 months by the date when payment obligation such as dividend is finalized, foreign tax credit can be used.

[Case Study] Dividends from subsidiariesThe following figure assumes a case of returning profits generated by a Chinese subsidiary to a parent company of 100% equity by dividend (the parent company holds the stock of the subsidiary for six months or more). . g

g

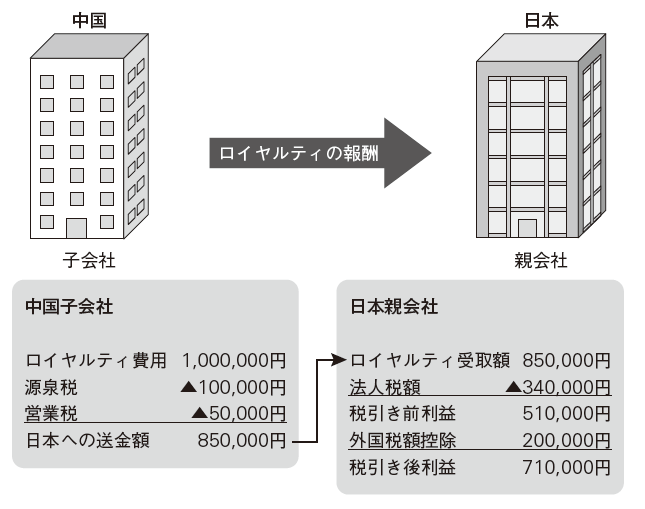

■Reflux through transaction with parent companyThere are ways to effectively return the profits to the parent company when a Chinese subsidiary imports from the parent company or a Chinese subsidiary pays royalty etc. This method has a tax benefit (deemed foreign tax credit). However, because transactions with overseas affiliates are subject to transfer pricing taxation (excluding donations), prepare materials to prove that they are reasonable prices or tax rates in preparation for pointing out from tax authorities It is important.

[Case 1] When receiving a royalty fee from a subsidiaryThe following figure assumes a case where the Japanese parent company signs a license agreement with a Chinese subsidiary and the Japanese parent company receives a royalty fee. Royalty's remuneration amount is 1,000,000 yen, and the business tax rate is 5%.

Depending on the content of the service subject to royalty, there is a case that the value-added tax is imposed rather than the business tax, but in this case it is treated as a business tax.

Depending on the content of the service subject to royalty, there is a case that the value-added tax is imposed rather than the business tax, but in this case it is treated as a business tax.

① Calculation of withholding tax on royalty fee (royalty income seen from parent company)1,000,000 (Royalty cost) × 0.1 * = 100,000

※ In principle, the withholding tax rate is 20%, but the royalty income is stated to reduce to 10% by the Japan-China DTA

② Calculation of business tax on royalty income1,000,000 × 0.05 * = 50,000※ Business tax rate of 5% is imposed on income from lending of intangible fixed assets

③ Calculation of royalty receipts1,000,000 - 100,000 (withholding tax) - 50,000 (business tax) = 850,000

④ Calculation of corporate tax amount in Japan850,000 × 0.4 = 340,000

⑤ Calculation of Japan's deemed foreign tax credit *1,000,000 x 0.2 = 200,000* Things that can be deducted from foreign taxes, assuming that a certain amount of tax has been paid in China. In case 1, the actual amount of tax paid was 100,000 yen (10% of income), but 200,000 yen (20% of income) was considered paid and 200,000 yen could be deducted. This deduction was also allowed for dividends received from foreign subsidiaries, but was abolished after the transitional measures due to the 2009 tax reform

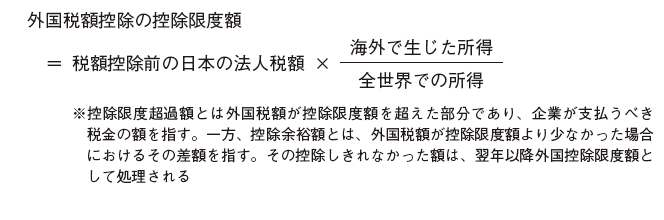

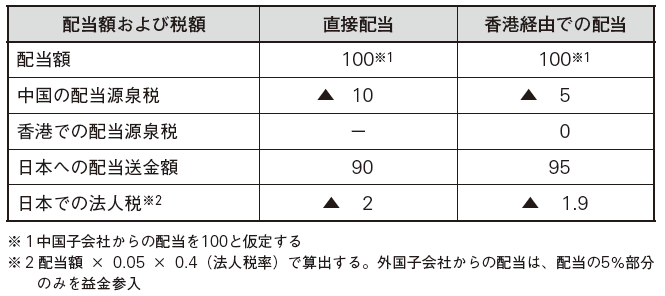

⑥ SupplementIn case 1, it is calculated that the total royalty receipt amount is 850,000 yen and the total amount of 1,050,000 yen of the foreign tax credit 200,000 yen is larger than the actual royalty income 1,000,000 yen. However, since the foreign tax credit has the deduction limit, etc., the calculation amount may differ in practice.As a basic idea of foreign tax credit, the amount calculated by the following formula is taken as the limit of foreign tax credit. Deductible limit excess * and deductible margin * can be carried over for the next three years from the following year.

[Case 2] If the foreign income tax amount (80) in the previous year is below the deductible limit amount (100) and this year the foreign income tax amount (150) exceeds the deduction limit amount (100)

(1) Deduction margin 20 (previous year's deduction limit of 100 - the amount of foreign income tax of the previous year 80) will occur during the previous year's treatment in the previous year.

Deduction margin = 100 (deduction limit) - 80 (amount of foreign income tax) = 20

② Process in this yearIn this year, you can subtract the deductible margin 20 of the previous year from the total amount of excess deductible limit of this year 50 (deductible limit amount of this year 100 - foreign income tax amount of 150 this year).

150 (Foreign income tax amount of this year) -100 (deduction limit of this year) -20 (deductible amount) = 30 -

Investment through third countries

There are companies that are investigating China investment through third countries, which are tax-haven countries such as Hong Kong, Taiwan, and the Cayman Islands. Many of them are considering utilizing various merits such as low foreign corporation tax rate, enjoying other tax incentives and utilizing existing foreign subsidiaries. Investment through tax country / haven countries has such merits, but as a disadvantage, due to the corporate tax law of Japan, the income of companies established in Tax · Haven countries is subject to the risk that the tax / It is cited. Therefore, it is important to judge not only tax benefits but also tax risks.

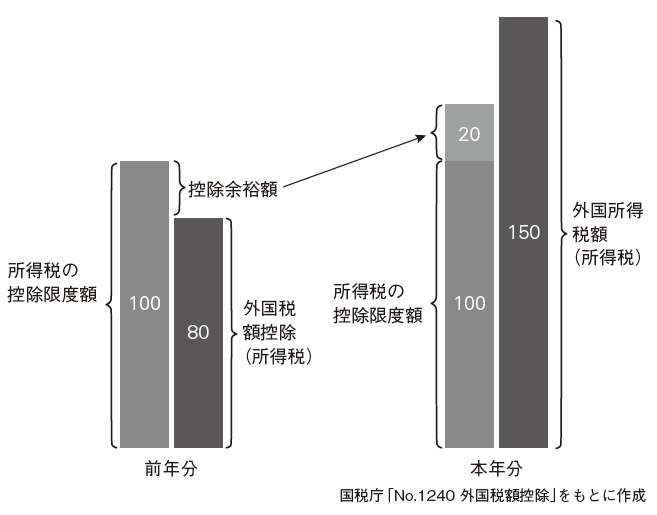

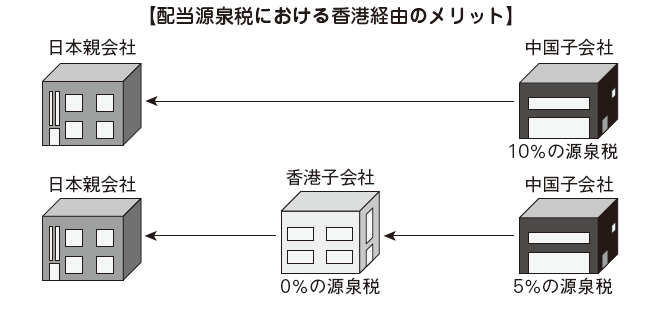

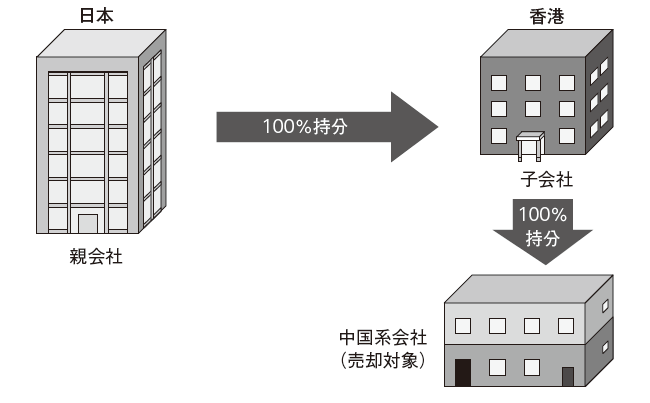

■ Investment in China via Hong KongHong Kong is often used in China investment through third countries. Here are the advantages and disadvantages of investing in China via Hong Kong.There are three main advantages. The first is to keep the tax cost cheap. The corporate tax rate of Hong Kong, which is a tax-haven country, is 16.5%, and the interest on stock dividends, capital gains and deposits is not subject to taxation, so if you can make good use of the Hong Kong tax system, you can reduce the tax cost.The second is to utilize the CEPA (Closer Economic Partnership Arrangement) Agreement on Hong Kong-China Economic Trade. CEPA is an agreement aimed at strengthening economic relations between China and Hong Kong. Utilizing this agreement, you can enjoy preferential treatment when entering China via Hong Kong. There are two major types of incentives: exemption from tariffs on Hong Kong products and relaxation of entry restrictions for Hong Kong companies entering China. Several replenishment agreements have already been concluded and additional incentives are set up, which is a remarkable agreement when considering investment in China via Hong Kong.The third is to be able to utilize advanced infrastructure development. Hong Kong has one of the world's leading Gulf container facilities and convenient Hong Kong International Airport. In addition, Hong Kong is an unknown financial center and financial services are substantial.Hong Kong was developed as a base for British trade with China during the British colonial period, and a trade trade that exports imported things was done as it was. With such a historical background, Hong Kong is a country that is very easy for foreign companies to enter and has little regulation on foreign capital. Moreover, it is possible to establish a company from 1 HK dollar, and the establishment procedure etc are relatively easy.The disadvantage is that corporate maintenance expenses will occur after establishing a company in Hong Kong. If the tax / anti-emergency tax system is applied to the income from a Hong Kong subsidiary, the income of the Hong Kong subsidiary is combined with the income of the Japanese corporation, and the tax cost of the tax may increase due to taxation of the Japanese corporation tax.Below, we will examine the tax treatment in China when investing specifically through Hong Kong.

■ Withholding tax on dividends received via Hong KongIf the parent company in Japan receives a dividend from the Chinese subsidiary through Hong Kong, if the certain requirements are met, the dividend withholding tax can be kept lower than the direct dividend from the Chinese subsidiary.If you receive a direct dividend from a Chinese subsidiary, a dividend withholding tax of 10% will be levied in China. On the other hand, in the case of dividends received from a Chinese subsidiary via Hong Kong, a dividend withholding tax of 5% (tax treaty concluded between China and Hong Kong) is imposed in China.Furthermore, in Hong Kong, dividends are not subject to taxation under the Corporation Tax Law, so it is possible to remit all of the dividends received in Hong Kong to Japan. In other words, if you receive a dividend from a Chinese subsidiary via Hong Kong, you can keep the dividend withholding tax low by 5%.There is a notice that if a Hong Kong subsidiary is a paper company that does not have actuality (a company that exists in the registry but the office does not exist), it is not permitted to apply a dividend withholding tax of 5% in China (National Tax Authority [2009] 601 Notification). If the Chinese tax authorities decide that it is a paper company, the dividing withholding tax rate from China to a Hong Kong subsidiary will be 10%, so in order to receive dividends via Hong Kong, consult with a Chinese accountant office etc. in advance Is important.Due to Japanese corporate tax law, 95% of the dividend will be non-profitable if the dividend from foreign countries meets certain requirements.

■ Sale of the shares of the sub-subsidiary company via the Hong Kong subsidiary In the case that a Hong Kong company sells the shares of the Chinese company, there is an advantage that the gain on the share transfer is not taxed on Hong Kong tax exemption, but occurred when transferring the equity Expenses will not be deducted. This is because in Hong Kong, capital gains acquired from stocks and real estate are tax-exempt under corporate tax law.

However, in Hong Kong authorities, if it is determined that the sale of an equity interest is for resale, it is not treated as a capital gain and may be subject to taxation. Although it is not clearly stipulated, it is treated as a capital gain in the holding period of 5 years or more as a judgment of the Hong Kong authorities, gray zone holding period of 1 year or more and less than 5 years is considered as a resale object for less than 1 year It tends to be.In this way, capital gains are regarded as corporate tax exemption in Hong Kong, so if investing in selling or withdrawing shares in a Chinese subsidiary, investment in China via a Hong Kong subsidiary is effective.The disadvantage is that the establishment and maintenance expenses of Hong Kong subsidiary occur and the Hong Kong subsidiary may be subject to the Tax · Haven countermeasure tax system. Therefore, a long-term strategy that takes demerits into account is necessary.

■ Hong Kong as a Regional HeadquartersBy setting up Regional Headquarters in Hong Kong and using it, it is also possible to reduce the amount of taxation. If you pool the profits of a Chinese subsidiary or a Vietnam subsidiary in the Hong Kong headquarters and reinvest the profits in the supervising company, you can manage the funds without being taxed in Japan.Furthermore, if a company that oversees overseas affiliates that satisfy certain requirements, there is a high possibility of escaping the application of tax and anti-tax measures. Certain requirements refer to the following three.

· A company supervising the surrounding area overseas is directly or indirectly holding 100% of the shares by the Japanese head office· A company that oversees the surrounding area holds shares etc. of two or more controlled companies and is in charge of supervising operations· A company supervising the surrounding area overseas owns facilities and personnel to carry out fixed supervisory work at the location of the controlling company

If all these requirements are met, companies overseeing the surrounding areas overseas are deemed to be "management company" in terms of tax / anti-tax measures and are treated as exemptions regardless of business standards. Business criteria are one of exclusion criteria for tax / anti-measures taxation system. Since the main business of the company can not meet the exclusion criteria in case of holding of shares or leasing business etc., tax incentive measures taxation system must be applied for income of the company (P .494 "Tax · Haven countermeasure tax system").

-

-

-

Tax treaty

Tax treaty is a rule concerning tax treatment negotiated between countries, aimed at avoiding international double taxation and prevention of tax evasion. Currently, there are more than 60 countries that have a tax treaty with Japan. There are various arrangements such as foreign tax credit and withholding tax rate as contents of the tax treaty. Basically, if the contents of the tax treaty and domestic law are different, the tax treaty will be preferentially applied. However, there is also provision that preferential domestic law can be prioritized if domestic law is tax cut (preservation · close).

■ Japan-China Tax TreatyJapan and China entered into an agreement with the Government of Japan and the People's Republic of China on September 6, 1983 to avoid double taxation on taxes on income and to prevent tax evasion (June 26, 1984 Effective). The scope of this agreement is mainly corporate income tax and personal income tax in China. Distribution tax such as value added tax and business tax is out of the scope of application and these can be treated as deductible in accordance with the Japanese corporate tax law.

■ Validation by transaction exampleWhether tax withholding or not will be charged is a tax problem in transactions between Japan and China. We will examine through the following three cases.

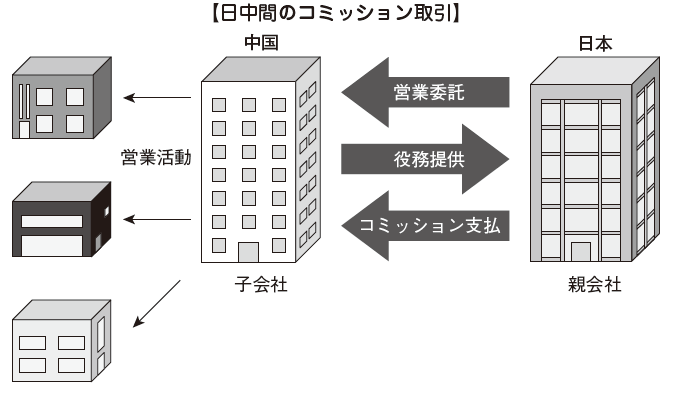

[Case 1] withholding tax on commission (sales commission)

Machine dealership attempting to enter the world established a subsidiary in China. The Japanese parent company entrusts sales activities to a Chinese subsidiary and verifies the case of paying a commission (sales commission) according to the order as compensation.

The first thing to consider when determining withholding taxes is whether or not they have habitability. Since the Chinese subsidiary is established in China, it is judged that there is no habitability in Japan and it is regarded as a foreign corporation in terms of taxation in Japan.Foreign corporations will be withheld if there is payment of source income generated in Japan. The sales activities that the Chinese subsidiary is conducting is a human-service offering in China, so it is considered to be a source income generated in China. Therefore, the commission paid by the Japanese parent company to the Chinese subsidiary does not correspond to withholding income generated in Japan, withholding tax for this commission payment will not be collected due to taxation in Japan.

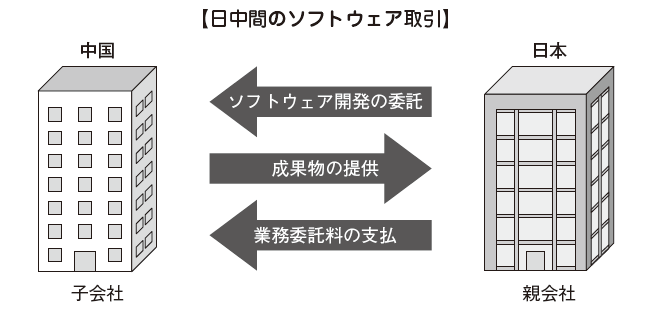

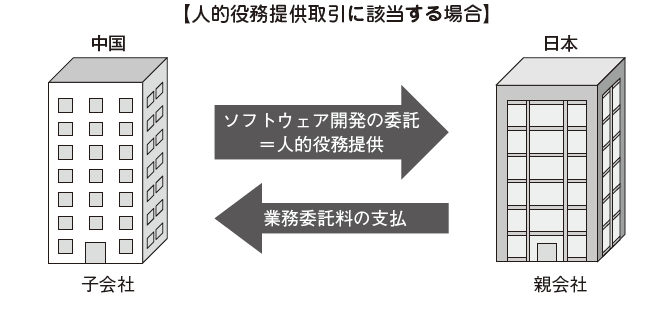

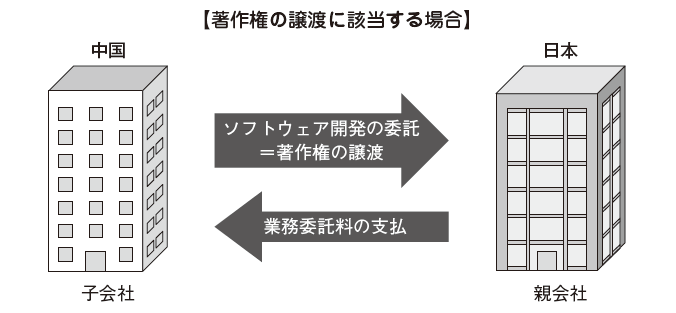

[Case 2] withholding tax through software transaction

We will verify the cases where the Japanese parent company entrusts software development to the Chinese subsidiary and pays business commissions. The copyright of the developed software is owned by the Japanese parent company and will sell the software in Japan.As in case 1, the Chinese subsidiary is treated as a foreign corporation. However, because Case 2 involves copyright, the processing varies depending on whether the business contractor falls under the Human Services Provisioning Transaction or the Transfer of Copyright.

With regard to human service offering transactions, withholding tax will not be levied on Japanese corporate tax law. That is because the development work (income source) made by the Chinese subsidiary is done in China.

In the case of copyrights being transferred, in the Japan - China DTA, the consideration for transfer of copyright becomes transfer income and taxation in source country is not restricted. Therefore, due to the corporate tax law of Japan, business commission is considered as income from transfer, withholding tax is 20%.

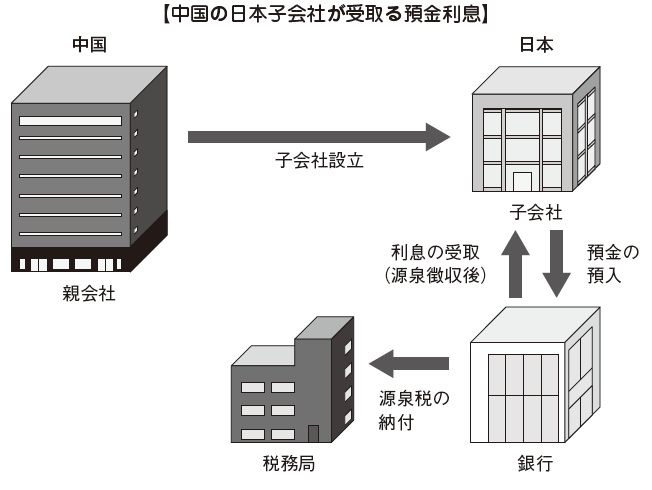

[Case 3] Interest withholding tax and tax treaty

Suppose a Chinese company has established a subsidiary in Japan. After depositing the profits acquired by this Japanese subsidiary in the bank, we will verify the case where the interest on the deposit is paid from the bank to the Japanese subsidiary. Because this Japanese subsidiary has a location in Japan, it is recognized as a resident enterprise in Japan. Interest received by resident enterprises is withheld as income accrued in Japan.According to the Japanese tax law, the withholding tax rate on interest income on banks is 20%.On the other hand, it is stipulated that the withholding tax rate of interest does not exceed 10% under the Japan - China DTA. Therefore, the interest received by the Japanese subsidiary in Case 3 is considered to be withheld with a 10% tax rate on the face value of interest. Bank interest received by a Chinese subsidiary of a Japanese company will also be withheld at a 10% tax rate by the tax treaty.As mentioned above, the question as to whether or not withholding tax is important is to fully understand the tax treaty and the tax system of each country after accurately grasping the actual condition of the transaction. -

Tax · Haven countermeasure tax system

One of the tax systems that you should pay attention to when establishing a business base in China, especially when setting up a subsidiary in China, is tax and air pollution tax control.Tax · Haven is a tax avoidance area, meaning a country or area that attracts companies, property owners etc from overseas by extremely reducing tax burden. As famous tax · haven there are the Cayman Islands, Dubai, Singapore and others.Tax / Haven countermeasure tax system is a tax system to prevent Japanese residents and domestic corporations from intentionally avoiding Japanese tax burden by establishing a company in a country where the tax burden is extremely low. Depending on the shareholding ratio of overseas subsidiaries, we consider taxable income to be the income of Japanese shareholders under a certain calculation together with their shareholders' income. In the past, China was regarded as a target country for tax and air pollution measures, but now it is a non-target country. This is because the tax system revision in FY 2010 reduced the target countries of tax tax havens to 25% from the corporate tax rate of 20% or less (current corporate tax rate in China is 25%).At present, tax tax haven taxation system does not directly affect Chinese subsidiary, but when establishing a regional headquarters in Hong Kong or Singapore to oversee China subsidiary, the profit of the regional headquarters is Tax · Haven countermeasures Taxation may be subject to application. However, not all companies are subject to the Tax · Haven Countermeasure Taxation. Regional headquarters that meet certain requirements are exempt from application (see page 487).

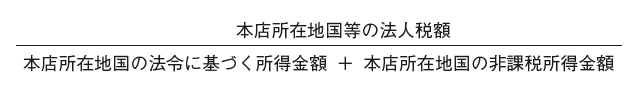

■ Application targetA foreign company (foreign affiliated company) holding a stock, etc. of more than 50% by a resident in Japan or a domestic corporation and having a corporate tax rate of 20% or less in the country of residence is called a specified foreign company. Shareholders of a specified foreign subsidiary or the like will be subject to a combined tax considering the amount of retained earnings of foreign subsidiaries multiplied by the ownership percentage as income.The corporate tax rate is calculated as follows.

■ Application exclusionIn the event that a specified foreign subsidiary or the like is engaged in a business involving entities and it is found to have economic rationality to do business in the head office where the head office is located,It is excluded from application of tax and anti-tax measures. Specifically, specified foreign subsidiaries and others that satisfy all of the following requirements are excluded.

· Major business contents are ownership of stocks / bonds, industrial property rights · copyright provision, ships and aircraft leasing etc. (business standard)· Having fixed facilities such as offices, shops and factories in the country where the target subsidiary's head office is located (Entity standard)· A specified foreign subsidiary or the like actually manages, controls, and operates the business itself in the country where the head office is located (standards of control and control)· More than 50% of transactions are conducted between non-affiliated persons * (based on non-relevant persons) or the target subsidiary is engaged in the main business in the country where the head office is located (based on the country of the address)* Tax / Haven countermeasure Taxation refers to an affiliated company that does not own 5% or more of the company's stock in the target country

When a holding company etc. (oversea company), which is an overseas subsidiary, carries out supervising work to two or more manufacturing companies or sales companies, etc. (managed company), regardless of business standards, the exclusion of application of a tax / It will be. Furthermore, if the main business is a wholesale business, the transaction between the controlling company and the controlled company will not be treated as related party transactions.If a person who meets the exclusion criteria of a specified foreign subsidiary or the like has an asset income, it adds to the income of domestic corporations, etc. according to the holding ratio of the shares etc. involving the domestic corporation concerning that asset income (Taxable income tax income system). Asset income means the following.

· Income due to income or transfer (limited to the transfer of shares etc. at exchanges or over-the-counter) relating to dividends etc. of shares etc. (less than 10%· Income related to interest on bonds, margin for reimbursement, income from transfer (limited to the transfer of bonds etc. at exchanges or shops)· Income from providing industrial property rights and copyright (including publishing rights and neighboring rights *) (excluding income arising from things developed by specified foreign subsidiaries etc)* Copyright adjacent rights are generic names of rights concerning transmission and modification of copyrighted work· Income from ship or aircraft leasing

Tax · Haven countermeasure Similar to the tax system, there is also an application exclusion criteria in the taxable income tax system.

· Dominimas standard (small income exclusion criteria)When the amount of income of asset income is 10 million yen or less, or when the asset income is less than or equal to 5% of the pre-tax income of a specified foreign subsidiary etc· Income business standard income arising from projects (such as the financial industry) that are fundamental and important and can not be lacked due to the nature of the projects (excluding projects listed in business standards) conducted by specified foreign subsidiaries -

Foreign tax credit

Foreign tax credits can be used when Japanese companies paid foreign taxes at overseas branches, etc.Companies with headquarters in Japan are subject to taxation on income earned throughout the world under Japan's corporate tax law and will pay corporate taxes to Japan. For income earned in foreign countries, foreign corporation tax must be paid overseas (source country) based on foreign corporation tax law.Foreign tax credit is deducting such foreign foreign corporation tax paid abroad from Japanese corporate tax. Foreign tax credits were negotiated to avoid double taxation. In Japan, there is a foreign tax credit method that directly deducts corporate tax paid abroad from Japanese corporate tax amount and a foreign tax deductible method that deducts corporate tax amount paid abroad. Since foreign tax credit method can be deducted from directly calculated tax amount, most companies adopt it.

■ Foreign tax creditsForeign tax credits are subject to taxes that are taxed on income as a tax base. When we receive interest, dividends, royalties etc., the withholding tax is also covered.

When applying foreign tax creditForeign tax credit is applied for the fiscal year to which the planned payment date of foreign corporation tax belongs. However, it is also possible to apply a foreign tax credit to the fiscal year in which the date on which the foreign corporation tax amount fixed as payment by the domestic corporation has been recognized as expenses, only when it is deemed to be applicable continuously and reasonably applicable to taxation is. The timing of occurrence of foreign income and the time of foreign tax credit against that income do not necessarily agree.As a general rule, payment confirmed timing conforms to the regulations of each country, but in case of uncertainty judge as follows.

Declaration payment method: the day on which the tax return declaration was submittedImposition taxation method: the date on which the charge decision notification was madeWithholding method: Payment such as royalties subject to withholding taxThe day it was done

■ Foreign Tax Credit Scheme in ChinaThere is a foreign tax credit system in China as well as Japan.A foreign tax credit system is established based on the notification of problems relating to the foreign tax credit of the enterprise's foreign income tax by the National Taxation Bureau of the Ministry of Finance.

Deductible limit of foreign tax amount The foreign tax credit limit amount is to be calculated separately for each country or region.

If you can not calculate the limit that can be deducted for each country or region due to undeveloped documents etc, the tax amount paid in that country / region will be outside the application of foreign tax credit and can not be deducted by carryover even in the following period.

Foreign tax amount to be deductedForeign tax amount to be paid according to foreign tax law and already paid is subject to deduction. Interest, penalties, and arrears resulting from delay payment or underdraft payment due to foreign taxes can not be subject to deductions. There are also items that are not subject to deduction.

Criteria for applying indirect foreign tax creditsIndirect Foreign Tax Deduction is a system that allows you to deduct the portion corresponding to dividends received by domestic corporations among foreign taxes paid by foreign subsidiaries etc. In China, there is a provision that the subsidiary in China must directly hold over 20% of foreign companies' equity in order to receive indirect foreign tax credit. In Japan the indirect foreign tax credit system has already been abolished. -

Tenuous capital tax system

If a subsidiary in Japan receives funds from a group company such as a foreign parent company, you can choose to accept capital by issuing shares or accept borrowings such as by loans. In the former case, the procurement costs are paid in the form of dividends and therefore do not affect taxable income. However, in the latter case, since the procurement costs are paid in the form of interest, the use costs can be deducted. In general, the latter can reduce the taxable income by the interest amount, so you can reduce the tax burden. Therefore, incentives to receive funds by loans etc. will work instead of issuing shares. In this way, in order to avoid acts that intentionally alleviate tax burden, it was an undercapital taxation system established in Japan.A similar system is also in force in China. In China domestic tax system, dividend exemption is abolished, and 10% of income tax withholding tax will be taxed uniformly. Interest expense is also subject to withholding tax withholding income of 10%, but interest can be said to be relatively more advantageous than dividends because it can be deducted if certain requirements are met.The facility import exemption system is also abolished, and the capital increase incentive to acquire the duty-free import frame is becoming ineffective. Rather, it is not surprising that companies that try to reduce taxable income by increasing borrowings from related persons and including interest expense included in deductible expenses. In order to halt such tax evasion behavior, it can be said that introduction of an undercapital taxation system was attempted in China.In principle, in China, if the liabilities of overseas controlling shareholders, etc. and the equity interest ratio (debt outstanding ÷ capital interest on domestic corporations such as overseas controlling shareholders) exceeds 300% (600% in the case of financial companies) It is not possible to include deduction of the interest payment amount corresponding to the amount exceeding 300% (600% in the case of a financial company) of the equity interest of overseas controlling shareholders, etc.In China, the ratio of capital to total investment is severely restricted, and it is obliged to pay a certain proportion of capital according to the size of the total investment. As a result, the maximum amount of debt, such as borrowings, is automatically determined as the difference between the total investment and registered capital. The proportion of borrowings is limited to twice the capital at most. From this, it is thought that the direct impact of the undercapital taxation system is limited in developing business in China. -

Overpaid interest tax system

The undercapital tax system limits excess interest paid to capital. On the other hand, the overpayment interest tax system has an excessive payment rate against the income amountIt is a system to restrict children. Specifically, when the amount such as net interest payment of related persons exceeds 50% of the adjusted income amount, the excess amount can not be included in the deduction for the relevant business year. Related net paid interest, etc. means the amount deducting the total amount of deductable interest income etc. from the total amount of interest paid for related persons. Adjusted income amount is the amount added / subtracted based on the amount of income. Affiliates are parents with a direct / indirect share of 50% or moreIt refers to a corporation, a subsidiary corporation, etc.

If you can calculate the non-deductible amount in both the overpaid interest taxation system and the undercapitalization tax system, whichever of those with a larger amount of non-deductible will be applied. -

Information exchange regulations and mutual consultation

For information exchange regulations, rules are set forth that enable tax experts of Japan and China to exchange information on taxes with each other. In mutual consultation, if a Japanese company decides to pay tax against the taxation agency of China against tax treaty or refuses it, the company will be dissatisfied with this and seek relief from the Japanese tax bureau I can do it. -

Tax incentives

There are various tax incentives in China. In order to realize efficient and maximizing investment recovery, it is important to understand and utilize these tax incentives correctly.Handling differs according to industry type and region, and industries that receive preferential treatment also change according to notification, so it is important to always obtain the latest information.

■ Tax exemption for imported equipmentWhen foreign invested enterprises purchase imported equipment used for production activities within the total investment amount, import duties generated by the purchase may be exempted. However, subjects for tax exemption are limited to industries and projects encouraged by China. The targeted projects, companies and facilities are as follows (Public Notice of Customs General Administration [2008] No. 103).

· Domestic investment projects that China encourages development and facilities and technologies, parts, spare parts etc. that are imported by foreign investment projects and used by them· Foreign government loan project and international finance organization loan project import equipment and technology, parts etc.· Equipment not setting prices provided by foreign countries in processing trade (lending facility provided free of charge by foreign countries), technology, parts etc.· Foreign invested enterprises and foreign import investment research and development center * import equipment for technical modification (including equipment renewal), incidental technology, parts etc.· Midwest District Foreign Investment Foreign Investment Projects Foreign Investment Projects Approved by Industry Inventory Imported and Used for Self, Facilities, Supplementary Technologies, Parts, etc.· Equipment imported by companies producing software, incidental technology, parts etc· Equipment imported by companies producing integrated circuits, incidental technology, parts etc.· Equipment imported by Urban Traffic Transportation Project, incidental technology, parts etc.· Other enterprises that execute by referring to the notice on taxation policy adjustment of import facilities of the State Council, equipment imported by the project, incidental technology, parts etc.* A research organization that specializes in R & D (research and development) established by a foreign-invested enterprise alone or inside the company. Tax exemption will be applied if the above conditions are met even without this center

■ Technology transfer income reduction exemption measuresTechnology transfer income means income obtained by deducting technical costs and related expenses from the income that transferred the technology. Revenues from transferred equipment, parts, raw materials, etc. can not be included in technology transfer income. Revenues from technical consulting, technical services, technical training etc. can not be accounted for as technology transfer income. Technical transfer cost refers to the net amount of transferred intangible assets. In other words, it is the balance obtained by deducting the accumulated depreciation from the amount of intangible fixed assets on tax. Related tax expense refers to taxes and other expenses incurred when transferring technology.

Technical transfer income is calculated as follows.

Technology transfer - Cost of technology transfer - related tax expense

The technology transfer income which meets certain requirements in the calculation of corporate income tax is said to be tax exemption for an amount not exceeding 5 million RMB in one tax payment year, the amount exceeding it will be halved. Certain requirements are as follows.

· The company transferring technology must be a resident enterprise in China· The transfer of technology must be a transfer within the range prescribed by the State Taxation Bureau· In the case of technology transfer in China, you must be certified by the Ministry of Science and Technology of more than the provincial level· In the case of technology transfer outside China, you must be accredited by the Ministry of Commerce over the provincial level· Other conditions of the State Council's tax affairs department

Foreign investment enterprises that receive incentive for transferring technology transfer income must be clearly categorized into technology transfer income and other income and calculated and the period cost of the company must be reasonably allocated proportionally ( National Tax Bureau [2009] No. 212: Notice on Problems on Reduction of Corporate Income Tax on Technology Transfer Income).

■ Preferential treatment at the time of employment of persons with disabilitiesIf a foreign investment company employs a person with disabilities, the actual deductible amount of wage for persons with disabilities is deducted from the calculation of corporate income tax amount, and 100% additional deduction can be made. However, it is conditional to conclude employment contracts for 1 year or more, to have basic facilities for persons with disabilities, to pay wages above the minimum wage, and so on.

-

-

-

Points to keep in mind when withdrawing from business

Withdrawal from business in China is often accompanied by difficulties. The reason is that Chinese authorities do not like to withdraw investment, local connection is indispensable because there are areas where humanitarianism still remains, and Chinese courts are reluctant to resolve disputes among investors, There are many favorable court decisions on the Chinese side. In withdrawing, it is important to prepare a solid strategy in advance and to take appropriate measures while also including experts such as lawyers and accountants. -

Tax considerations

There are two methods of withdrawing from the Chinese business, roughly divided into dissolution, liquidation and transfer of equity.

■ Dissolution · LiquidationOf the methods of withdrawing Chinese business, we will explain issues to be noted at the time of dissolution / liquidation according to form of advancement, various taxes related to liquidation, tax treatment at investor side.

[subsidiary]In the liquidation of the Chinese subsidiary, the Chinese subsidiary, which had been subject to tax reduction tax incentive treatment, may incur additional taxes. A subsidiary that has received corporate income tax reduction tax measures (tax exemption for two years and 50% tax reduction for three years), if the project period is less than 10 years, the preferential treatment will be canceled and the total amount of tax reduction tax so far We have to pay. A subsidiary that had received import tax exemption (import value added tax and customs duty) of imported equipment, if it is within 5 years from the day of customs clearance and resells it to a domestic company in China, part of the tax-exempt amount (Foreign invested enterprises overseeing export and import cargoes and Article 18 of the tax collection valve law).

[Representative Office]In liquidation of a representative office, if there is clearing income, it is necessary to pay corporate income tax. Also, even for a representative office that is tax-exempt certified, it is necessary to certify to the taxing department that there was no income (National Tax Bureau [2010] No. 18, Foreign Corporate Representative Office Tax Revenue Management Interim Valve Method).

[Branch]Regarding the liquidation of the branch office, the head office must pay the corporate income tax up to the present year (collecting corporate income tax that runs across the district and collectively pay taxes) Article 5 (1) (4) of the temporary valuation method.

[Clearing Income Tax and Various Taxes]Before liquidationIn the course of the fiscal year, in case of terminating and liquidating business activities, you must file a tax return of the current corporate income tax to the tax authorities within 60 days from the end date.

After liquidationIn the liquidation process after the end of the management activity, distribution tax such as value added tax, business tax etc. occurs when property is transferred. As a result of liquidation, if clearing income occurs, in principle the tax will be levied on that liquidation income. Clearing income is the net realizable value of all assets, or the balance obtained by deducting net assets, clearing costs and related expenses from the transaction price.The settlement income tax is imposed on the above taxable income by deducting the tax loss carryforward from the previous year and a standard tax rate of 25%. The preferential tax rate is not applicable during the liquidation period.

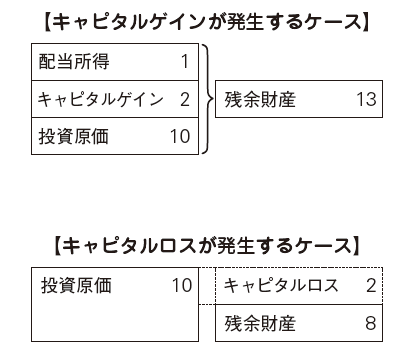

[Investment process]Of the residual assets acquired by the investor of the liquidation company based on the dividend, the portion calculated based on the shareholding ratio of the investor in each of the liquidating company's retained earnings retained earnings and retained earnings surplus is the dividend income. Capital gains (gains on transfer) will be taken if the amount obtained by deducting dividend income from residual assets exceeds the investment cost. If residual assets fall below the cost of investment, it will be capital loss(transfer loss).

■ Equity transferIf you have established a wholly-owned subsidiary or a joint venture, you have the option of transferring the equity as a way to withdraw. I will explain matters to be noted and how to calculate transfer income by advance form.

[Whole subsidiary]100% Stakeholder When assigning a share of a subsidiary in China, it is necessary to change the registration at the registrar, with approval of the approval authority. According to some regulations concerning equity change of foreign invested enterprise investors, concrete processing procedures are as follows.First of all, we create an equity transfer agreement, and if there are investors other than the parties, we will obtain agreement of all of them. Next, you will apply to the approval authority at the time of establishment, change the change of the certificate of approval (rewrite of the business license) and register the change to the customs office of the tax office, the Finance Bureau, and the competent jurisdiction.Attention should be paid if the company has undergone a preferential policy of exemption for 2 years or halving for 3 years if the company changes from a foreign capital company to a domestic capital company through a share transfer. In the case that the company is less than 10 years, there is an obligation to return part or all of tax reduced or exempted for the period that received the preferential policy.

[Joint Venture]Cases to be transferred to China investorsIn the case of transferring a joint venture's interest to a Chinese investor, the joint venture will be reorganized into a Chinese company, so tax relief tax incentives enjoyed by the Chinese joint venture as well as a wholly owned subsidiary will be canceled. As a result, there is a possibility that an additional tax liability may arise as in the case of the Chinese subsidiary being dissolved or liquidated.In the case that the investment ratio of foreign capital is less than 25%, there are disadvantages such as being unable to enjoy the tax incentive measures, so the partner in China often refuses to transfer the contribution of foreign capital. When transferring an equity interest, it is necessary to obtain approval from an authorized body in China.

Case of transferring to a third partyIn the case of transferring a joint venture's shares to a third party, the consent of the Chinese investor is necessary. There is provision that each investor has priority purchasing right of the equity interest and consent right (Chugai foreign enterprise enterprise law enforcement regulation). If the third party is a foreign company and the equity ratio of the Chinese invested company that invests the unique asset is changed, the transfer of the equity will be evaluated by the asset evaluation office registered with the inherent asset management agency Additional processing such as must be done.

[Calculation of Assigned Income]Transfer income is calculated by subtracting transfer cost from transfer income. A 10% corporate income tax is imposed on transferred income. Income tax on corporate income is recognized in Japanese corporate tax law, but corporate income tax in China is subject to foreign tax credit.

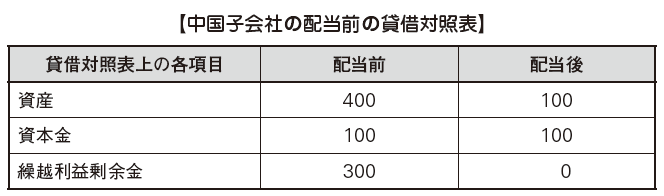

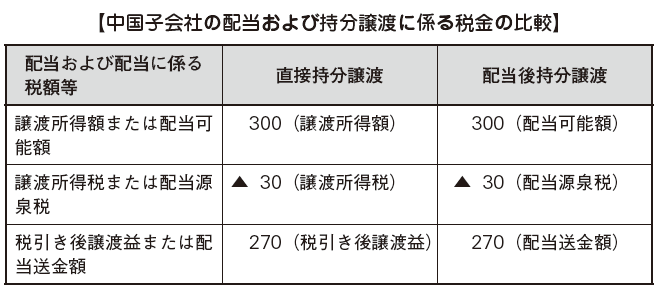

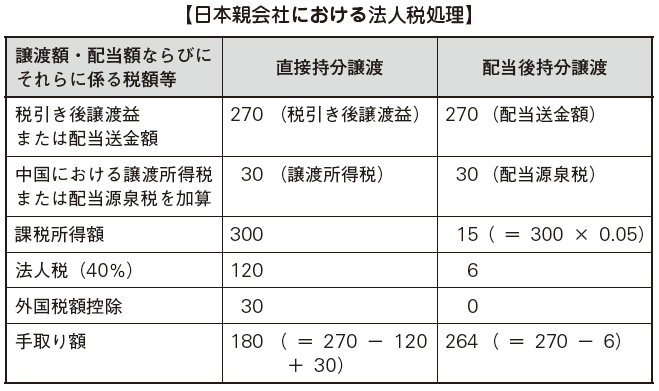

[Strategic equity transfer]If you pay a dividend before you transfer the equity, you can reduce the tax burden. Dividend processing is due to affecting the condition of the transfer of equity, which is not always a good idea, but it is an effective means. Below, we will compare and verify the case of transferring the equity directly without dividing and the case of transferring the equity after dividing. The relationship between the Japanese parent company and the Chinese subsidiary shall be 100% equity and the dividend shall be 300.

In case of direct transfer of equity interestIn the case of directly transferring the equity interest, the transferred income amount will be 300 (transfer profit 400 - transfer cost 100) and a transfer income tax rate of 10% will be imposed. Thereafter, according to the Japanese corporate tax law, the taxable income amount 300 (profit after tax transfer 270 + transfer income amount 30) is calculated and 40% corporate tax is imposed.Furthermore, the corporate income tax amount on transfer income in China is deemed as a foreign tax credit amount, and the takeover amount will be 180 (transfer profit 270 - corporate tax 120 + foreign tax credit 30).

In case of transfer of equity after dividendIn the case of transferring an equity interest after dividends, a 10% dividend withholding tax is imposed on the dividend. Thereafter, according to the Japanese Corporate Tax Law, only 5% is taxed on dividends from foreign countries, so the taxable income amount 15 ({dividend remittance amount 270 + dividend withholding tax 30} × 0.05) is calculated and 40% It will be. As a result, the takeover amount will be 264 (dividend remittance amount 270 - corporate tax amount 6).

VerificationAs a result of the above, it can be seen that, in the case of transferring the equity interest after dividends, the takeover amount is 84 (264-180) more than in the case of directly transferring the equity interest. If the profit that will be the source of the dividend is the profit that occurred before January 1, 2008, dividend withholding tax in China will be tax exempt based on the preferential tax system, which is effective in reducing tax burden.

-

-

-

References

[1] 国税庁「外国子会社配当益金不算入制度に関する質疑応答例」2010年7月5日

[3] 横江隆弘「駐在員事務所への課税強化について」2010年6月10日

[4] りそな銀行法人ソリューション営業部国際業務室「中国における外国企業の駐在員事務所への管理強化について」りそな銀行アジアニュース、2010年5月21日

[5] 簗瀬正人「中国・シンガポール租税条約解釈通達の影響と留意点及び日本企業に対する徴税強化の現状と対応〈下〉」国際税務、2011年1月号

[6] 日本貿易振興機構(JETRO)青島事務所「外資投資企業の終止(撤退)における法的注意事項」2008年3月

[7] 川村真文「No8.中国での拠点設立」平成22年8月26日

[8] オリックス株式会社「第1回企業支援のための三度目の中国進出」2008年10月28日

[9] 「中国税務及び投資速報(抄訳)2011年7月」JBSニュースレター2011年

[10] NAC国際会計グループ「[全訳]《地区を超えて経営し一括納税する企業所得税の徴収管理暫行弁法》の公布に関する通知」2008年5月2日

-

Babiliography

[1] 有限責任あずさ監査法人中国事業室・KPMG編『中国子会社の投資・会計・税務』中央経済社、2011年

[2] 簗瀬正人著、税理士法人プライスウォーターハウスクーパース編『中国投資リスクマネジメント─継続と撤退の税務・財務管理と内部統制』中央経済社、2008年[3] 近藤義雄『ポイント解説!中国会計・税務』千倉書房、2011年

[4] 渡辺基成編著『最新中国進出ビジネスQ&A─中小企業のための税務・労務』三協法規出版、2011年

[5] 佐和周『海外進出・展開・撤退の会計・税務Q&A』中央経済社、2011年

[6] 東京青山・青木・狛法律事務所編、ベーカー&マッケンジー外国法事務弁護士事務所(外国法共同事業)編『アジア・ビジネスの法務と税務─進出から展開・撤退まで』中央経済社、2011年

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya