China

1 Chapter Introduction

-

-

1 Chapter Introduction

1.1 The history of Japanese companies entering the world

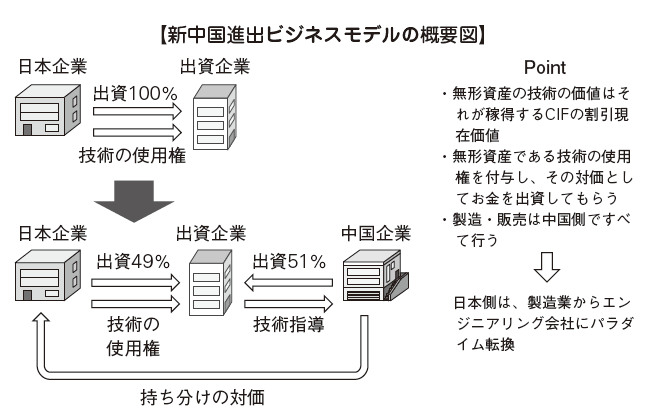

1.2 New business model in China

1.3 Advance scheme through Hong Kong

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.2 Province and region of China

3.5 Investment incentives and regulations

4 Chapter Economic Environment

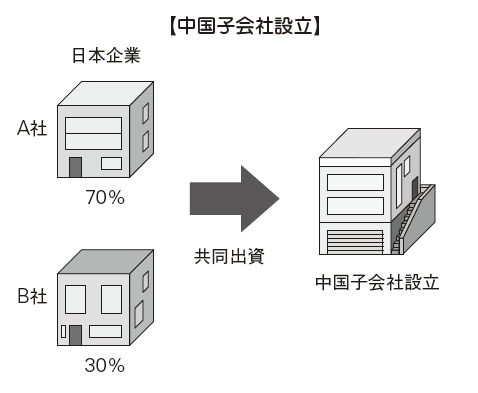

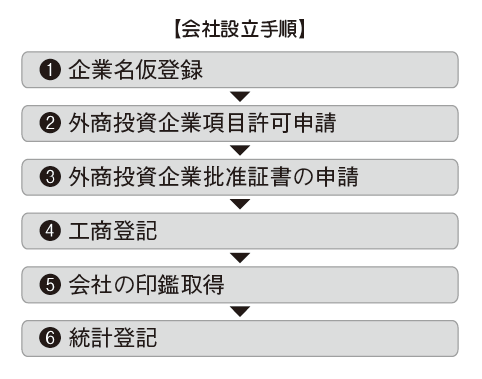

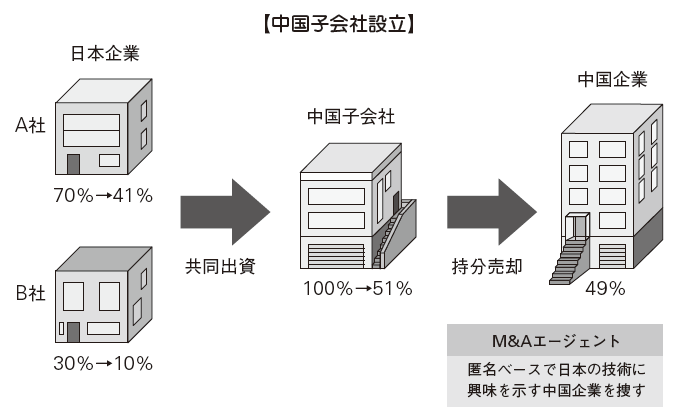

5 Chapter Establishment

5.3 Establishment of business base

5.4 Procedure after incorporation

6 Chapter Withdraw

7 Chapter Foreign exchange

7.1 Foreign exchange management system in China

7.2 Foreign currency management system of ordinary items

7.3 Foreign exchange control system of capital items

7.4 Foreign exchange control system in bonded area · Hong Kong

7.5 Individual foreign currency control system

8 Chapter M&A

8.2 Laws and regulations concerning M & A

8.5 Challenges after corporate acquisition

9 Chapter Corporate Laws

10 Chapter Accounting

11 Chapter Tax law

11.2 Representative Office Taxation

11.4 Individual Issues in China Domestic Tax Law

12 Chapter International taxation strategy

12.1 International tax relating to entering China

12.2 International taxation strategy

12.3 Individual Issues in International Taxation

12.4 Tax issues related to withdrawal

13 Chapter Transfer Price Taxation

13.2 Individual provision pertaining to transfer pricing taxation

13.3 Transfer price taxation and documentation

13.4 Transfer price survey in China

14 Chapter Labor

14.4 Points to remember when bringing Japanese

15 Chapter International Human Resources Management

15.1 Human Resources Labor Management

15.3 Personnel evaluation system

-

-

-

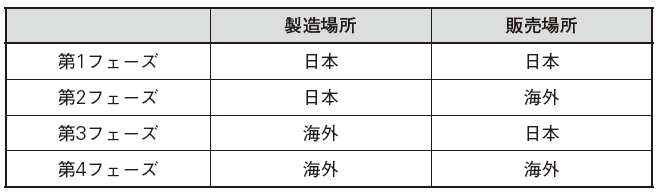

Changes in the form of overseas expansion by Japanese companies

Looking at changes in the form of overseas expansion of Japanese companies, they can be roughly divided into four phases.

The first phase is a business model that manufactures product in Japan and sells it inside Japan also. Any company will start from this phase.

The second phase is a business model that manufactures product in Japan and exports the same overseas. The export destination in this phase are Western countries. After the war was a great success for Japanese companies, since the value of Japanese yen was low, it was possible to manufacture products with high quality at very low cost.

The third phase is a business model that manufactures product overseas and imports the same to Japan. The production place here is mainly China, Thailand, Indonesia. Companies located in China also belong to this business model. Moreover, many Japanese companies included in this one have been successful one.

The fourth phase is a business model that manufactures products overseas and sells them overseas. Japanese companies belong in this phase are said to be having deficiency in management. In particular, sighting as examples are the companies located in the west part of India, you can see that most of them have failed.

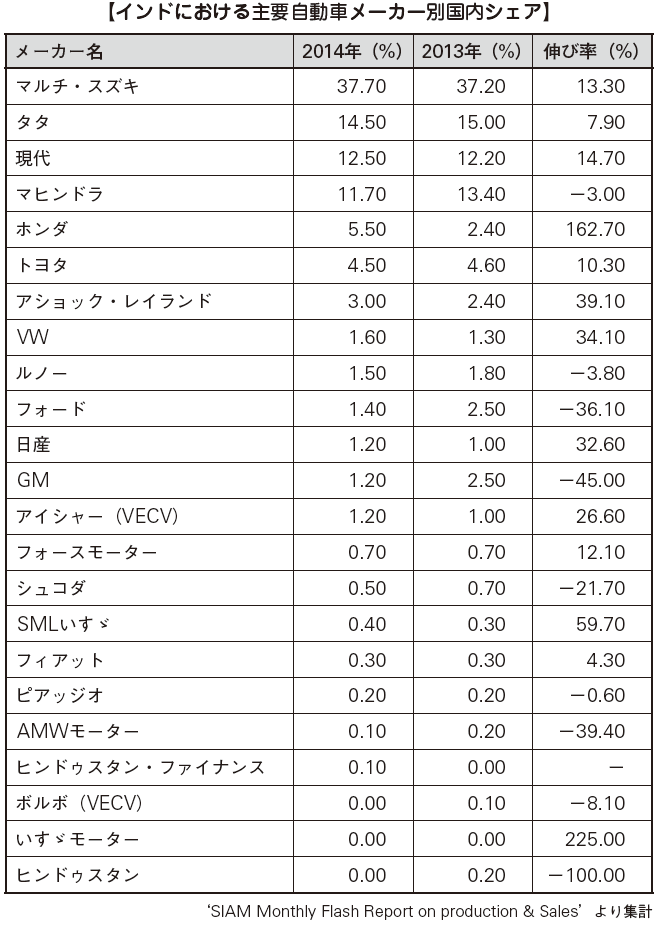

Even though 40% in India, Russia and South America are companies engaged in automobile manufacturing, many of them were not able to be profitable. In India, although Suzuki cars has been successful, as of now Toyota, a global automobile manufacturer, has a market share of only about 5%. Even at home appliances, Japanese companies are struggling to surpass the market share of Samsung Korea and LG Electronics. For example, in market share of televisions, Samsung accounts for 28%, LG Electronics accounts for about half of 2 companies, while Japanese manufacturers account for only 7%, Sony's to be the highest (2012 10 ~ December, amount basis).

-

Reasons for Japanese companies failing to enter overseas

Why are Japanese companies failing in Phase 4? The reason for this is the belief that the idea of a Japanese company remains on the third phase business model. The big difference between the third phase and the fourth phase business model is that the sales destination has changed from Japan to overseas. Overseas means from Japan emerging to other countries. In other words, the change is the destination, from a developed country market of Japan emerging to other country market. Despite the necessity of an idea corresponding to emerging markets, we cannot escape from the previous successful model.

For example, Japanese companies thinking overseas expansion will try to compare wage levels of each country as much as possible. This idea is the idea of the third phase business model., It is very effective to compare the production costs of Japan and overseas in the third phase model since the sales destination is Japan. The competition in the third phase business model is not stiff because competitors are still Japanese companies. However, the main competitors in the fourth phase business model are companies in China, Korea, Taiwan, and local companies in that country. Despite the structural transformation of the market, Japanese companies enters overseas market without being able to properly know the status of competition. As a result, Japanese products are expensive, these are not acceptable to local consumers and eventually, they lose to competitors who manufacture cheap products.

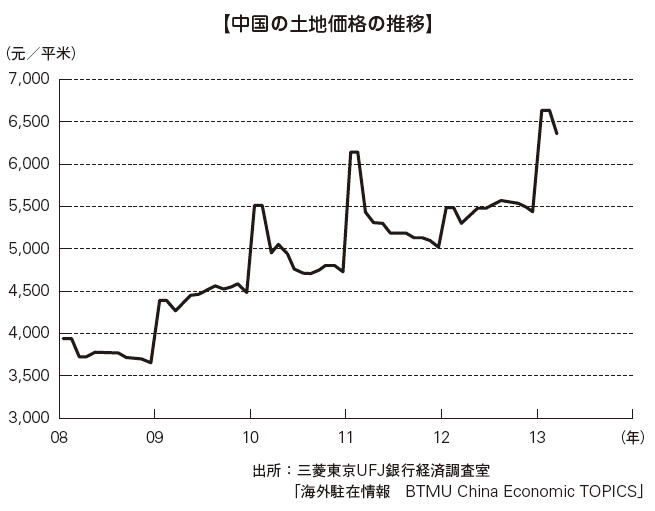

The major reasons why Japanese products are expensive are because of the fee that they have to pay on land and personnel. There is an illusion that the price of the product is cheap when manufactured abroad, but making it cheaper than local companies is very difficult.

■ Cost of Land

When a Japanese company intends to begin manufacturing overseas, it has to lease the land for 50 to 99 years. Land fee bubbles are just happening in emerging countries and leasing fees are very expensive.

Naturally, expensive land fee is reflected in product price. It is because we must return the amount of our investment. Also, if you try to recover the amount of investment in a short period of time, you must set the product price at higher amount. On the other hand, the land of a competitor local company has almost no acquisition cost since it was just transferred from earlier generations. Therefore, the land cost has minimal influence in the product price.. As mentioned above, Japanese companies entering overseas will be overwhelmingly disadvantageous compared with local companies, as they will pay expensive land fee. This is true in Japan as well. There are very few companies that will start manufacturing in Japan in the future because land prices are so expensive that it is difficult to start a new manufacturing company.

■ Personnel Expenses

For Japanese companies there is an illusion that personnel expenses will be lower when entering overseas market compare with the Japanese personnel expenses. However, since the competitor is a local company, it is necessary to compare the labor cost with the cost of local company.. For example, suppose a Japanese company will enter India. The initial salary of a college graduate Indian is about 30,000 yen. However, when a Japanese company hires talent locally, he will try to hire talent who can speak English. As a consequence, personnel expenses for person who can speak English increase 1.5 to 2 times than the ordinary cost. This is the same not only in India but also in any country. People who can speak English in Thailand, Vietnam, Indonesia and China tend to have high labor costs. By the way, if you try to hire talented people who can speak Japanese in India, the personnel expenses will jump for about four times. Meanwhile, you can secure talent with average local salary if a local language speaker is sufficient for the company. . The competitor is not a Japanese company but a local company. Nevertheless, Japanese companies will focus only on things like technicians and managers if they do not verify the comparison between Japan and local companies.

If you check the wage level of local companies, you can see that wages of Japanese companies' workers are higher compare to them. This case is overwhelmingly disadvantageous to Japanese companies.

Comparing Japanese companies with local companies, in general, Japanese companies are overwhelmingly disadvantageous in terms of land costs and labor costs. As a result, Japanese products will be expensive and will be hard to be accepted in the local market, thus they will \ lose to local companies. Based on these current circumstances, it is necessary for Japanese companies to reconsider the structural transformation to export model wherein product from Japan to be sold overseas occur and to have a business idea accordingly. -

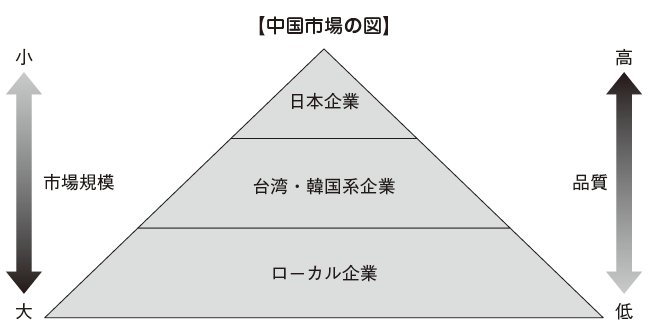

Importance of marketing

In the fourth phase, when comparing Japanese companies and local companies, we found that Japanese companies are disadvantageous in terms of cost. In order to overcome this bottleneck, Japanese companies should strengthen marketing. It is important to accurately grasp targets and competitors. For example, in China, competitors can be broadly divided into local, Taiwanese / Korean, and Japanese companies. This together with market size and quality must belinked. First of all, even though local companies have the lowest quality of products, they have the largest share in the market. On the other hand, Taiwanese or Korean companies have smaller share in the market but the quality of their product is said to be in the middle category. Moreover, Japanese companies create products with the highest quality but with the smallest part in terms of share in the market. Market looking for products with high quality are good to Japanese companies. In ASEAN region and other parts, the quality of Japanese cars and appliances was highly evaluated and being sold well. Currently, Japanese companies are losing to Taiwan and Korean companies in the middle market. It said that i it is impossible to the cost product planning of Japanese products to easily enter the middle market.

The biggest reason why product planning of Japanese products is not sufficient is because Japanese companies have only the idea of the third phase business model. In the third phase business model, where products are manufactured overseas and imported to Japan, product planning was not necessary. It is because there will be no problem by just manufacturing the same product as if was manufactured in Japan. However, in the business model of the fourth phase where the sales destination is an emerging country, since the market structure changes, it is necessary to review the structure of product planning, pricing and other matters. Nevertheless, it will result in high cost product if you will try to match the quality of the products manufactured in Japan. Products that were originally made in Japan were manufactured in Thailand and China and will be sold subsequently in the local market will result in lower product prices. However, because there is a limit in cost reduction of the buyer, high-priced products were not accepted locally, resulting to decrease in profit margins of Japanese companies.

The main reason why Toshiba failed to enter China in the mobile phone industry in 2005 is the lack of product planning that fits the Chinese market. In China's mobile phone market, mobile phones with low quality and low price were mainstream. Meanwhile, the mobile phone sold by Toshiba, a joint venture of Chinese enterprises and Hong Kong companies, Nanjing Futenmao Toshiba Communication Co., Ltd. was with high-quality, high-priced product with a video mail function etc. After all, since high-priced products were not accepted in the Chinese market, Toshiba had no choice but to withdraw from the Chinese mobile phone business in less than a year.

Meanwhile, Korea Samsung focused on marketing, by grasping the needs of the market and producing low quality products, the company succeeded in emerging countries. Korea Samsung made a free warranty for home electronics for 5 years. Japanese products are known to have high quality and are not prone to breakage but are expensive. Korean products are inferior in quality compare to Japanese products but low in price. As you can see from this, it is important to identify what customers really need. For Indians, their preference is not whether it is durable or not orwhether it costs maintenance fee or not. For customers, Korean products with a 5 year free warranty are more highly rated although there is a possibility that it will be damaged than Japanese products with a one year warranty that are durable. However, in reality, even if the product contains a free warranty for five years, it cannot be damaged so easily and will not need to be repaired for quite a long time. Since Japanese companies have been manufacturing for the Japanese market so far, it has been believed that making products that are high in quality and cannot be easily broken is the top priority.

Even after a massive defeat at the middle market, Japanese companies believe that customers will switch to Japanese products if they continue to make high quality one. In reality, Taiwanese and Korean companies also gradually introduce high-quality products. Taiwanese and Korean companies are gradually entering high-quality markets that have been dominated by Japanese companies, because they have accumulated experience in middle markets where customers are easy to make. -

Future skills of Japan in the future

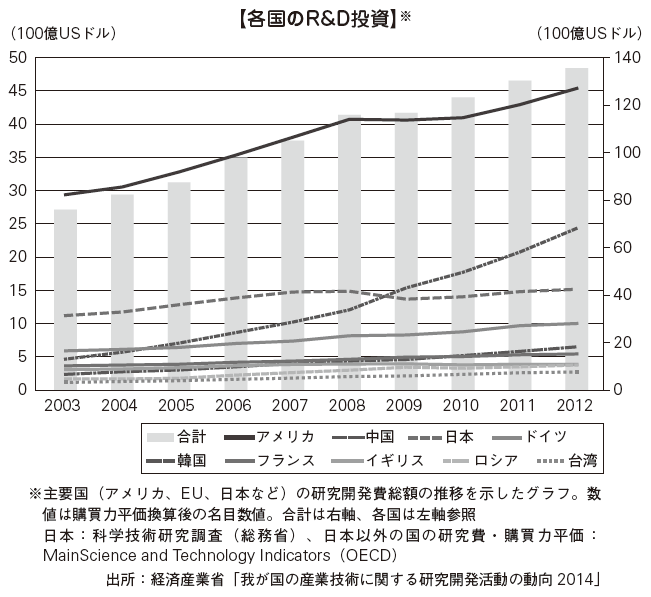

Considering the total investment, the quality of products is an important indicator of past investment in R & D (research and development). Total investment in R & D will ultimately be determined by national strength. The national strength depends on the population. For example, the total R & D investment in the United States, whose population is about 2.5 times of Japan, is overwhelmingly larger than in Japan. In other words, the how large or small the population will determine the quality of products in that country. In general, the product quality of China is said to be low, but as the total R & D investment increases, the quality of Chinese companies' products will increase anyway. In the long term, investment in R & D will depend on future national strength. It is completely an illusion to think that Japanese companies will win China with high quality product as its advantage in the future. Korean companies such as Samsung Korea who invest over 1 trillion yen in R & D understand that ultimate competitiveness will be decided by product capabilities and total R & D investment.

The high technology possessed by Japanese companies is a heritage of success in the past and there is no guarantee that this technology can be maintained in the future. For this reason, we must compete while technological strength exists.

The high technology possessed by Japanese companies is a heritage of success in the past and there is no guarantee that this technology can be maintained in the future. For this reason, we must compete while technological strength exists. -

Secure market share in emerging countries

The amount of R & D investment depends on the profit of the company. Companies with more profits can invest more in R & D. Profits are generated by sales, and sales are generated by the market. In the abundance of population, Japan is nowhere compare to China and India, it is possible through gaining more profit in emerging markets to continue with the technical superiority by devoting its cost to R & D investment.

However, Japanese companies tend to focus more on profits than sales. This is because we have carried out cash flow management which regards that profit in the business model that they are in as the most important in the past 20 years.

When Japan was in the period of high economic growth, many Japanese companies put importance on sales. For example is the company Daiei.'. Daiei was doing well until the economic bubble collapsed. Management made land as collateral and increased the number of stores. Although there was little profit, sales increased. Emerging countries are in a state like the high economic growth period of Japan.

The most important thing in business in emerging countries is not securing profits but securing market share. Share can be said to be a source of profits, that is, to generate future profits. By taking a share, sales will rise and profits will rise as sales increase. And companies gaining profit can invest in R & D, eventually they will be able to lead the industry by securing technical capabilities.

In Japanese management style, if we will be focusing on profits, we will reluctantly invest in companies. Investment will not raise profits at the beginning and will only generate losses. Too much emphasis on short-term profits which eye only on the goal of wiping its competitors is not the real end of the business. Taking market share at an early stage is such a coward’s act. It will be difficult for new entrants to beat the market share established by Taiwan and South Korea. It is said that basically the new market share will be dominated by the top three companies, as a general image, 50% as the first, 25% second, 13% third part of the shares, the remaining percentage of shares belong to with other companies. A strategy that can quickly secure market share in emerging markets is very important.

-

-

-

New business model

As mentioned above, there are two major problems Japanese companies are facing in recent years. The first is that there is a limit to cost reduction in the former way that cost of land and labor costs is required, and the second is the lack of product plan that matches Chinese local market. We have to solve these two problems and build a business model that can speedily take market share.

In addition, another problem that may arise is the difficulty in managing local staffs. Management is ultimately the president’s responsibility. Human resources capable of president’s responsibility is very rare in Japanese companies. We also need to solve a series of management issues, such as other companies entering overseas and hiring local staff to educate. -

Reasons why Japanese companies failed to enter China

In the past, strict regulations were being imposed on foreign companies entering China. Depending on the type of industry, authorities prohibit the establishment of a monopolist enterprise and protect Chinese enterprises from foreign capital. Nowadays deregulation has progressed, and companies are entering China with 100% independent financing. However, for Japanese companies who enter China, joint ventures are often used. Although there are merits such as being able to use the sales network of Chinese company side in the joint venture, there are more disadvantage in fact. The main disadvantages are the following three.

· Problems that cannot be resolved by oral discussion

· Land problem

· Royalty issues

■ Issues that Cannot be Resolved by Oral Discussion

Japanese companies tend to think that all problems can be solved if they discussed it orally, but in fact there are problems that cannot be solved through this way.

As a case, there is a joint venture between Rakuten and Baidu. Rakuten has signed a joint venture agreement with Baidu, the largest Internet search service company in China. The joint venture company "Rakuten" was established in January 2010 with a stake of 51% Rakuten and 49% Baidu, and started its operation in October of the same year. After that, Rakuten closed at the end of May 2012, Rakuten and Baidu dissolved the alliance. One of the reasons for dissolving the alliance is said to be a disagreement in the direction of management policy between Rakuten and Baidu. Rakuten values importance of ROI (return on invested capital), while Baidu emphasized increasing market share. Sometimes the priority of Rakuten's management policy that emphasizes profit-oriented management and Baidu 's policy of giving priority to expanding share is finally creating a deep groove in the relationship between the two.

Another example which confronted a similar problem though not China is Honda in India.

Honda has signed a joint venture with Indian car company Hero Cycle in 1984 to acquire the market in India and entered India as a Hero Honda brand. After that, Hero Honda succeeded in India. The product also sold well and took market share. After success in India, the hero side was able to manufacture cheap bikes, so the company thought of entering Europe for sales, but Honda himself had already advanced Honda brand in Europe. If Hero Honda enters Europe, it will be a main competitor of Honda. Honda thought that it wanted to win the market with Honda alone, not as a Hero Honda. This problem was not solved by oral discussion, and in December 2010 the company has reached the end of its joint venture. After all, Honda sold all its shares on the Hero Honda to the Hero group. In the end, Honda was forced to enter again the market as a 100% independent Indian subsidiary, wholly owned by Honda.

Be cautious that not all joint ventures disagreements can be solved by oral discussion.

■Land Problem

In the case of a joint venture between a Japanese company and a Chinese company, it is a typical pattern that Japanese companies contribute cash and the Chinese side invests land as investment in kind. Because Japanese companies do not need to buy land, we have the illusion that costs are lower than starting a business from zero. If you start a joint venture company with 50% equity investment, Japanese companies need to contribute an amount equivalent to land valuation. The appraisal value is the fair value of the land, and despite the fact that the land owned by the Chinese side is the considered no value at all or may be considered zero as the book value, the value jumps up at a stretch as the market price is evaluated, and as a result It will be the same as purchasing the land.

■ Royalty Issues

Products cannot be manufactured with land and money alone. Therefore, Japanese companies need to technology as investment. Since the relationship in investment ratio between Japanese companies and Chinese companies is equal with 50% investment individually, by additional investment to be made by the Japanese side, its investment ratio will increase. In that case, Japanese companies will receive royalties as a consideration for the technology invested. However, this royalty becomes a problem since there are many cases that the Chinese side does not pay royalties to be paid for various reasons.

At the beginning of the manufacturing operation the issue regarding royalty is still manageable. However, the Chinese side will be reluctant to pay royalty until it turns out to be totally uncollectible. After about three years, the Chinese side also began to understand the technology of the Japanese company side, "Although the Chinese are the one engaged in actual manufacturing operation and the Japanese side is passive in terms of this matter, Japanese can still demand for its share in profits. So Chinese side claim to pay for lower royalty or even refuse to pay completely. Since technology that is being used by the ventured company is the result of huge investment by Japanese side, it is normal for Japanese companies to receive royalties. However, the problem is that Chinese companies do not want to pay royalties or do not pay royalties at all because it is more advantageous on their part.

Even though high end technology means higher amount royalties to be received by Japanese firms, they only transferred low, simple and rudimentary one to avoid technology leakage. Even if Japanese company cannot collect higher royalty, they were able to make profits by purchasing their own products from China. First, they will manufacture general purpose goods in China, export those goods to Japan by setting partition value of low quality general purpose goods. As a result, most of the profits could be received by Japanese companies.

However, the Chinese government noticed the issue of transfer pricing, and introduced the transfer pricing taxation system in 1991 so as not to set the dividing value freely. Based on this system, in order to make transactions between Japanese parent company and Chinese subsidiary the same profit ratio must apply just like between independent company transactions. Also, since saving on labor cost is being enjoyed by the Japanese side (China has low profit margin of Chinese subsidiary due to low labor cost), based on the idea of the theory to be appropriate, the Chinese subsidiary began to demand higher profit margins. Furthermore, if the Chinese authorities do not comply with the request, they are now subject to penalties as arbitrary income transfers.

As mentioned above, the problem of royalty is serious, Japanese companies are preparing various measures to collect royalties, but in reality many companies are struggling. -

The value of technology

A joint venture with a Chinese company has many disadvantages, and Japanese companies are struggling hard. Below is a method for Japanese companies to overcome such handicap.

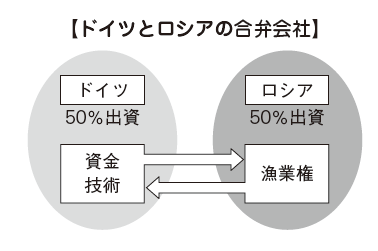

■ A Joint Venture Between Germany and Russia

A German company invested funds and technology in a Russian company operating a fishery. On the other hand, Russian company provided German company with fishing rights. German company have noticed the intangible assets of this fishery right.

Intangible assets are valued by the discounted present value of future cash flows to be obtained. For example, calculate future amount to be obtained from total catch of fishes of the company. Calculate profits etc. from the amount obtained above, then calculate the corporate value of the company. We can evaluate fishery right from corporate value. However, Russian companies have no old ships and bad webs that can catch many fish. We thought that if the German company focused there, investing their own funds and technology, purchasing new ships and introducing big nets, the catch will increase. In other words, the value of the original fishery right owned by Russian company is believed to increase by fusing the German company's funds and technology. As a result, the value of fishing rights owned by Russian companies will increase sharply. By combining technology that Russian companies do not have with the technology of German companies, new value is born. In this regard, German companies judged the possible investment recovery.

■ How to Convert Technology into Money

In a typical Chinese joint venture model, mainly money and tangible assets are the subjects of contribution. Since Japanese technology cannot be considered as subject of contribution, it is necessary to collect royalties as consideration.

Technologies cannot be subject to investment. For example, there is collaboration as one form of advancement to China. In the cooperation of the companies, it is possible to make a capital contribution other than the actual technology such as technical know-how and provision of labor service. The management has given the freedom to decide on dividend share to be paid to the venture regardless of the investment ratio. However, when making a business venture with Chinese who has a high negotiation skill, collaboration was not often used because the Japanese side were often entered into an unfavorable contract.

The collection of the royalty is this case is based on the trademark right usage fee collection model which was done by a company with a national brand. For example, Coca-Cola, Nestle etc collects a few percent of sales from companies as brand royalties when using their brand name.

Because the national brand has its own value and can makes the company visible, it gives a strong binding force to the company who use it. Using the brand name of one company without permission and even stealing it is prohibited. However, because technology is hard to see, it is relatively easy to be stolen, and as a result it is difficult to collect royalty, which is the consideration for the usage fee.

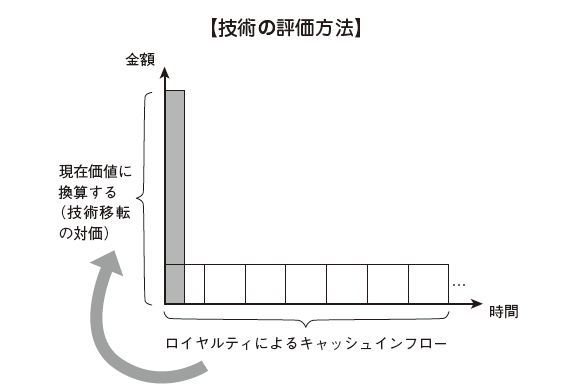

However, the essence of royalties as a consideration for technology transfer is that it is actually payment through installment for the sales of technology. Installment sales is a form of sales where in trade price was being divided and paid over a certain period of time. In other words, the present value of earnings to be collected from the future installments should be the fair value that the technology possesses.

For example, when a trading company collectively acquires digging rights in Saudi Arabia, the valuation of oil mining rights is decided as follows. Calculate the present value of the future cash to be obtained when the oil mined there is sold, and decide the valuation of the mining right. In other words, the valuation of intangible assets is the present value of the future cash inflows.

Japanese companies have traditionally invested in intangible assets in the form of technology for a long period of time receiving royalties as consideration in return, but by calculating the present value, it is possible to evaluate the current fair value. In other words, it is possible to recognize technology as an intangible asset.

■ How to Properly Evaluate Technology

In the method of obtaining the amount of royalties as consideration for technology transfer, since the recovery of the amount of technology transferred may be paid for a longtime, the Chinese side may not pay it. In order to avoid this risk, it is necessary to first evaluate the technology at fair value and on the basis of this valuation consider the method of investing it in kind. This makes it possible to avoid the problem of collection of royalty. It means that Japanese companies will switch industries from manufacturing to engineering.

From Manufacturing to Engineering

The fact that a manufacturing company in Japan conducts engineering abroad is, as it were, a conversion from a manufacturing company to a service company. The real core competence of Japanese companies (the ability to overwhelm our competitors) is technology, but essentially it is their engineering ability. For example, when constructing a building, there are carpentry riders and workers. The essence of the function of the ridge beam is engineering. Japanese companies make use of their skills like entrails to advance as an engineering company.

So far, the joint venture model in China was an investment as a manufacturing company. The Chinese side will invest the land in this joint venture model, but the Japanese side will invest the buildings and machinery. There is only a small number of Japanese worker in the building, mostly are Chinese. Companies established through a joint venture are manufacturing, but in essence, the work of the Japanese is engineering. In other words, there is no need to enter the manufacturing industry. -

Japanese technology required by China

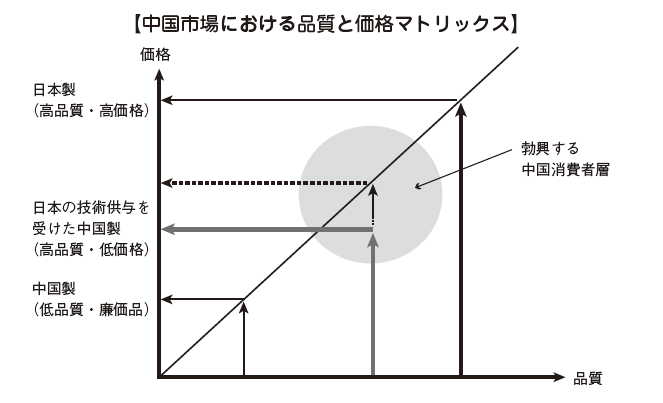

Looking at the Chinese market from the two perspectives of quality and price, the market with low quality and low price is growing very large. On the other hand, it can be said that Japanese products are of high quality but also high price.

■ High Quality · High Price Market

Success in high-quality, high-priced markets is related to agriculture and fishery industry in Japan. There are also rich Chinese people who are health conscious, , to them Japanese agricultural products and marine products are being sold in a very high price. In the case of agriculture, there are many business that are being managed individually, even though they are considered as small scale business, the farm owners have succeeded on exporting Japanese agricultural products to China. However, products that are being exported are limited. Furthermore, it is expected that the market of high quality and high price will be expanded locally in the future. But as of now, such market is still not growing in China.

■ Low Quality and Low Price Market

Low quality and low price products are considered as the biggest part who occupied the market. This market also exists for a very long time. In China, since personnel expenses are soaring, it is no longer cheap and is difficult to manufacture products.. Chinese owners have already gained share and monopolized the market, so it is difficult for new entry to get a share in the market.

■ Japanese Technology Required by Wealthy Chinese People

Wealthy people in China can be categorized into two. One is a business owner and the other is a powerful politician. Business owners gains profits by selling many products at low price. Since business owners have capital strength, they are willing to invest in Japanese companies in the future. However, many of the managers of Japanese companies are conservative that they don’t want to transfer technology to Chinese companies. That is why M & A in this circumstance does not match well.

■ Middle Market

The most remarkable thing in China is the rapidly growing middle market. We can make great use of Japanese technology in big market called Middle Market. While maintaining quality, it is beneficial to reduce costs through production in China and target low price middle market. Nevertheless, many Japanese companies prioritized cost reductions, spared technology and have not planned to be at the middle market.

However, as shown in the figure on the previous page, if we can make products cheaply in China while maintaining quality by utilizing Japan's high technology, we will be able to supply products that meet the needs of the middle market. -

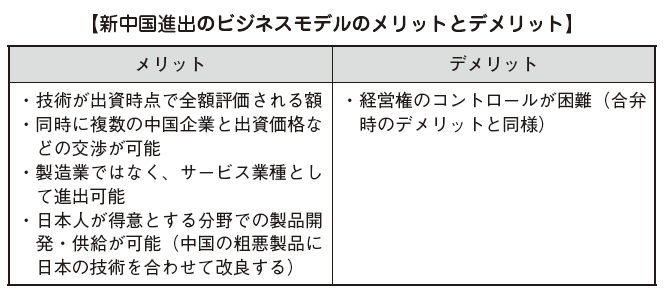

New business model in China

Japanese companies are accustomed to joint ventures with Chinese companies and they can’t resist to work together with them.. Also, wealthy people are increasing in China, and the Chinese side has plenty of room to invest. Based on the above assumptions, we will draft the outline of the new business model for entering China (hereinafter referred to as "new business model"), wherein the other main party are small and medium Japanese manufacturing enterprises.

■ Establishment of a Subsidiary in China (Service Company)

The establishment of an engineering company in China is considered as a service company. A service company is a Chinese subsidiary with 100% capital investment from Japan. Japan side grants the Chinese subsidiary the right to use the technology of the Japanese parent company (permits the use of parent company's technology). By letting China's subsidiary to use the technology that the parent company possesses, the Chinese subsidiary becomes an engineering company. The right to use this technology is evaluated at the fair value of intangible assets.

In China, Japanese technology is a means to earn profits. However, in Japan, no matter how high technology a company possesses the market is still shrinking more and more.

Meanwhile, in China there are sufficient funds and markets, but there is lack of technology. Therefore, by combining Japanese technology with Chinese market and funds, a favorable value will be achieved. Why did the German company mentioned in the previous example invest in a small fishing company in Russia? The reason is that German judged that they can combine German technology and Russian market.

Regarding the establishment procedure of a company in China, we will temporarily register the company name at Industrial and Commercial Administration Bureau (completed in about 5 business days). It is necessary to receive a review of the project (work content) plan to be done in China and submit an application form for establishing a foreign investment enterprise to the national or local government (completed in about 20 business days). Since approval of investment project is required, it is necessary to undergo enterprise establishment review, so we will file an application for approval certificate of foreign investment enterprise to the Ministry of Commerce (completed in about 3 months). After the certificate is issued, we can establish a company by doing business registration, company stamp seal, foreign currency application, tax number registration, statistical registration etc. The period of establishment for a new company in China is about 8 months including preparations of required documents at the Japanese side.. Procedures and documents required to be submitted may change depending on where you register your company (see Chapter 6, "Establishment").

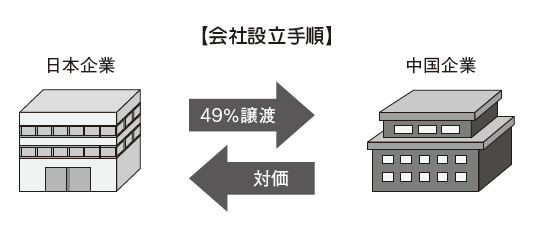

■ Selling of 49% of Subsidiary Shares

After establishing the company, the Chinese company granted the right to use the technology of the Japanese parent company will sell 49% of its shares at the fair value of the granted technology. To decide for the amount of selling the shares, first we have to establish a business plan that takes into consideration the market size and future profits of Japanese companies applying their technology to Chinese business. Then calculate the fair value of the technology with the discounted present value of the future cash flow that will be obtained by the business plan. Next, I will list the Chinese companies that will sell 49% of their shares. In this model, it is possible for Chinese enterprises to sign a partner agreement equally with Japanese companies and try to see if they feel like starting a venture.

The joint venture model so far can be compared to a Chinese duck carrying green onion to any Chinese company. For example, on the Chinese side, it is possible to evaluate the value of the land even though they do not incur any amount to purchase the same and invest it as investment in kind in the future. In addition, there is also a tendency for Chinese side to increase the personnel expenses by having the joint venture employ a lot of Chinese relatives and others.

As example of failure of Japanese companies, the joint venture funds usage is being diverted by the responsible Chinese side, and the Chinese side companies are using the joint venture fund to repay its personal debt. However, if it is a new business model, there are few such risks.

In case of joint venture, we had to negotiate with a single Chinese company., but in the new business model we can compete several Chinese companies and form the most advantageous one. The new business model is essentially a seller's model of M & A. As far as Japanese companies have overseas expansion, it was almost a matter of thinking about models as buyers, but the M & A buying model has many disadvantages. For example, if you are trying to buy a company at M & A, you need a lot of money and you may be competing with another buyer. If more than one Japanese company competes, Japanese companies will grab high prices. Because of the merit of buying time with M & A, the M & A buying model is advantageous for Japanese companies. If the financial situation of the acquiree is bad, you may be able to buy it cheaply, but there is a risk that you can grab a high price in M & A expansion.

On the other hand, because the new business model is due to the sale of shares, even if the investment amount is zero, it is also possible to buy a selling M & A model. Since the sale of the shares in the new business model is up to 49%, it is possible for Japanese companies to maintain a majority shareholding and to have management rights. Therefore, it is possible to prevent technology leakage beforehand. Chinese business owners have many lands and factory buildings and factories, so we have everything we need to manufacture our products. In other words, Japanese side will not be involved in the actual manufacturing operation. Chinese side will operate the company through the right given to them to use the Japanese technology in consideration of stocks.

Regarding concrete procedures for the sale of shares, first of all, we will evaluate the corporate value of the subsidiary and decide on the terms of assignment of the equity. Then, we will resolve changes in the company's articles of incorporation in connection with the selling of stocks with the Board of Directors of the acquired enterprise and obtain shareholders’ approval. In order to apply for approval of the Commerce Department (completed in about one month), obtain first the approval reply and acquire the new Certificate. For external remittance or when Chinese investor need to transfer funds to Japanese investor in exchange of the shares to be purchased, they need to get the the permission of the Foreign Exchange Administration Bureau. Completing supporting documents for the receipt of equity transfer consideration and issuance of contribution certificate, registering change of investor name, investment ratio and company form at Industrial and Commercial Administration Bureau, and obtaining a new business license will be done in about two weeks..

■ Management of Workers

The Chinese side will manage the workers. There is a high probability that Japanese will fail to manage Chinese people. When Japanese companies enter to China, they are confronted with labor-management problems. It can be said that labor disputes occurring in China often occur in foreign companies. Therefore, Chinese business owners can lower the incidence of labor disputes by managing Chinese workers. Employees are obedient in companies with strong Chinese business owners. Japanese companies are like models with headquarters function in their Chinese subsidiaries, leaving the site to the Chinese side. However, Japanese side will also be involved in managing the product planning and management etc. As long as the company is engage in service industry, there will be problem even if it moves its headquarter outside Japan. If you use Japanese cheap land and labor costs to introduce Japanese technology, you can produce cheap products tailored to product planning.

■ Product Customization

Japanese companies has continued in development to improve poor quality cheap products after the war and has succeeded by improving quality. On the other hand, they are unfamiliar with lowering both cost and quality for products that already have improved quality. New product planning is necessary in order to do the latter. So far, Japanese companies is in the process of "switching from low quality products to high quality one".

Now, the problem that Japanese companies is facing in the Chinese market is that there are no products that can be sold in the middle market. As in this new business model, adding Japanese technology to high-quality Chinese products that are not available in the market for a long time can be considered a specialty of Japanese companies.

-

Business model comparison

When Japanese companies enter overseas, it is important to conduct a feasibility study after comparing and examining the following five expansion models.

For companies that have already made overseas expansion, t is necessary to evaluate whether the form of advancement chosen is really the best. Unless you change the structure of the business model, you need to realize the difficulty of situation of the present model in terms of cost competition and product planning. This situation is is obvious from the current status of Japanese companies that are stalling after entering emerging countries. In the future, as we move into emerging countries, we should first consider the entry model that can respond to the new era.

■ Expansion Model with 100% Monetary Fund

Some Japanese companies entering overseas have to invest r 100% exclusive funds absolutely. For example, companies that need to acquire market share at once in companies like Toyota Motor Corporation should make 100% investment with their own capital. It is because if you are a top class company in Japan, you are required to acquire the same status even if you go abroad. If it is a 100% proprietary entry model, management can be controlled only by the people inside the company and its status as being on top can be maintained.

However, a disadvantage of a 100% investment model is that the company must accept all possible risks. It is important whether you are ready to accept the risks or not since the time of investment recovery will also be relatively long and more costs will be incurred.

■ Conventional Joint Venture Model

There are not many cases where a company who joint venture with a Chinese company succeeds. An increasing number of Japanese companies noticed that even if they have a joint venture with a Chinese company, they cannot easily succeed in the market. These companies eventually gave up the merger with Chinese companies and make a joint venture with a Taiwanese company. Many Taiwanese manufacturing companies have factories in China, as Taiwan's home market is small. Manufacturers in Taiwan do not have high technology as well as Chinese companies, so many of them want to join with Japanese companies.

■ Acquisition Model by M & A

The acquisition model based on M & A is very effective when you want to emphasize speed.

If you try to start a business from scratch it will take two to three years until you can start the actual operation completely . However, if you acquire a Chinese company you will have what you need in a short period of time. It is difficult for companies who start from the start in entering overseas to succeed. As already explained, as long as the competitors are in a state of expansion, speed must be emphasized as it must earn market share quickly. M & A should be actively utilized as it helps a company entering at a later stage.

■ OEM Model

OEM has been well utilized as a model for overseas expansion of medium-sized enterprises.

OEM is similar to the new business model where Japanese companies enter into a service company with a 100% shares, manufacture products on the Chinese side, and sell their products on the local market. The biggest disadvantage of OEM is that it cannot maintain the quality required by customers. It is difficult to control the quality of the product since the contractor has to secure the profit by fixing value of its share in in the manufacturing company’s profit. For example, if a subcontractor has a share in the ng value of the company, the subcontractor will try to reduce costs in order to generate as much profit as possible. This means quality degradation. In other words, it is impossible for OEMs to maintain the quality of products required by end users.

■ New Business Model

In the new business model, after collecting funds for the first time, it is necessary to ensure cost management. Cost management is used to clarify the contractual relationship with the company to which the stock is sold and manage so that the profit can be properly shared.

There are many Japanese companies that have failed to enter China as a result of not clarifying the contractual relationship with the Chinese side. A Japanese company exporting home appliances to China has signed a joint venture agreement with a Chinese company for the purpose of cost reduction. Contents of the joint venture agreement was that Japanese companies were responsible for factory management and technical provision of the joint venture companies and that Chinese enterprises were responsible for product sales. As a result, although the cost reduction succeeded, since the sales right of the product was in the Chinese company, the Japanese company will sell to the Chinese company side at a price with low mark-up added to the cost. Therefore, Chinese side will be benefited by larger amount of the profits. Since the joint venture has a fix term of 15 years, Japanese companies tried to dissolve the joint venture by all means but Chinese executive officials intentionally skip attending any meeting set for the dissolution. This case is an example of an existing failed joint venture model. However even in the new business model, it is necessary to clarify the contract relationship with the Chinese side and ensure to manage the profit sharing reliably.

It is also important to conduct feasibility studies for the option to combine the advancing models described above. For example, considering the combination of 100% monopolist and conventional merger. First of all, after entering with 100% equity investment, a method to make a joint venture between the subsidiary and the Chinese company is possible. A joint venture model directly between the Japanese head office and the Chinese enterprise, risk can be avoided, since there is a possibility of losing all of the market when a trouble with the joint venture Chinese company occurs. If you take the form of a joint venture between a subsidiary and a Chinese company, even if there are problems, it is possible to rebuild the advanced model with the parent company as the subject. In this way, verification by combining multiple advanced models is very useful. Also, especially in the new business model, we will make 100% investment at the beginning, so we can freely combine with other models.

-

-

-

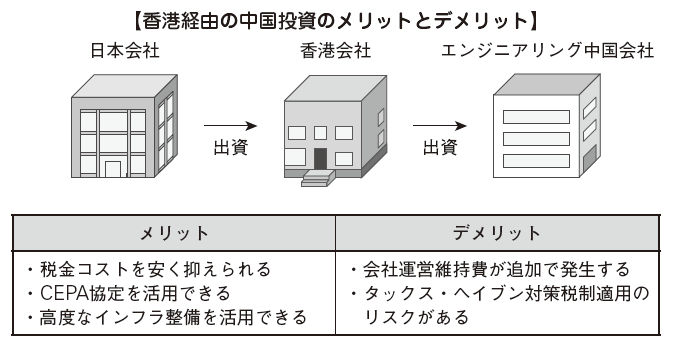

Advance scheme through Hong Kong

In the new advance model mentioned above, entering China via Hong Kong is also one important way to consider. I will describe the merits and disadvantages of advancing to China via Hong Kong.

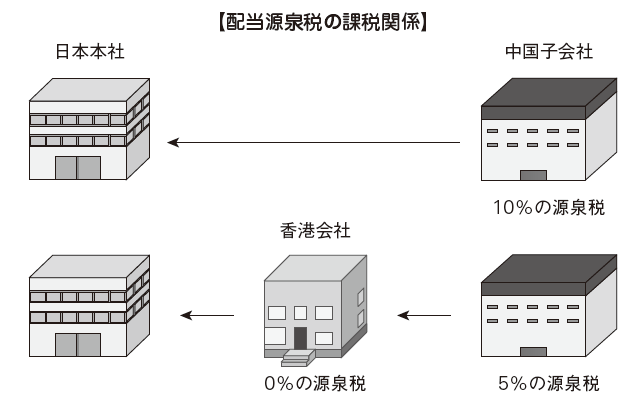

■ Dividend Withholding Tax

Dividend withholding tax being imposed may be able to be made cheaply if entering via Hong Kong. If the parent company is a Japanese company, the dividend withholding tax of 10% will be imposed on the Chinese side for the dividend from the Chinese subsidiary. On the other hand, if the Hong Kong company is a subsidiary of China, China being the parent company, the dividend withholding tax will be 5% according to the tax treaty signed between China and Hong Kong. Furthermore, since the dividend income in Hong Kong is not subject to taxation in accordance with corporate tax law, it is possible to remit the entire amount to Japan. In other words, if you receive a dividend from a Chinese subsidiary via Hong Kong, you can keep the dividend withholding tax low by 5%.

However, if the Chinese tax authorities judged that the Hong Kong company is a dummy company (not only at the time of establishment but also after operation), the dividend withholding tax rate from China to Hong Kong company will be 10% as usual.

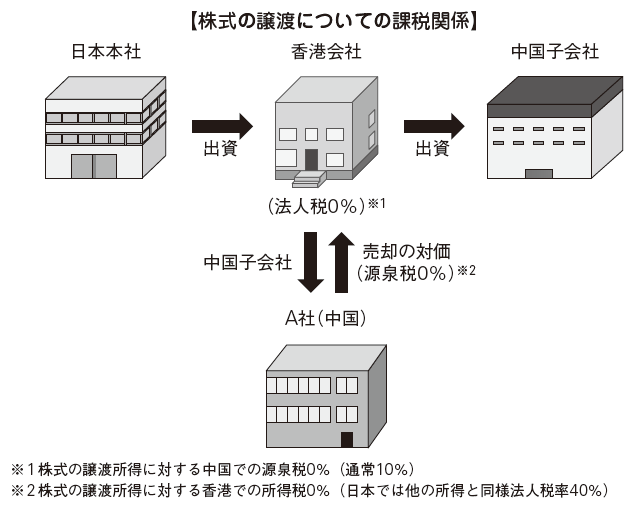

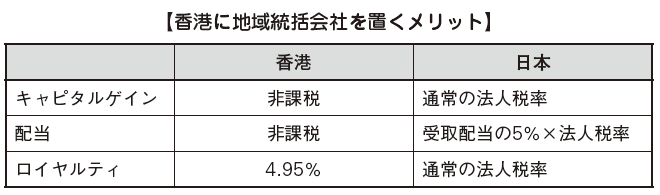

■ Taxation on Gains in Transfer of Shares

In the new business model, we transfer a part of the stock of the engineering company founded in China to a Chinese company. This is also beneficial in terms of tax to be imposed on gains on transfer of shares as with dividend withholding tax. In the case of transferring the shares of a Chinese subsidiary, 10% of the transferred profit will be withheld in China. However, if the assignor is a Hong Kong company, the withholding tax on the Chinese side will be exempted due to the tax treaty between Hong Kong and China. Gains on transfer of shares will be considered as taxable income in the transferor's home country (in the case of Japan, approximately 40% tax), but capital gains are not subject to taxation in Hong Kong. Therefore, in Hong Kong, no tax is imposed on income obtained from the sale of shares.

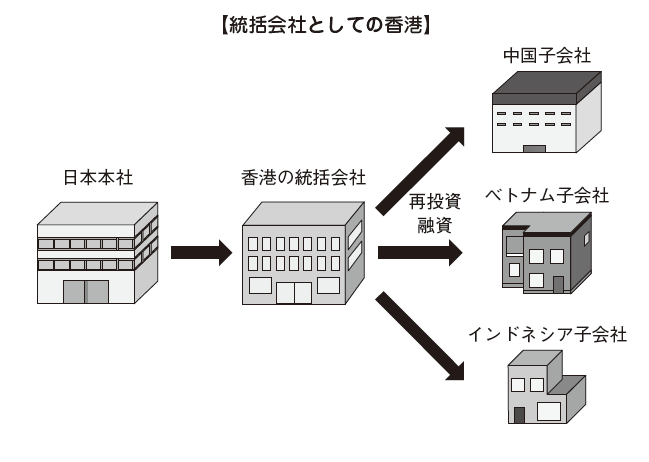

■■Hong Kong subsidiary can be effectively utilized as a regional headquarters. I will pool the profits of Chinese subsidiaries and subsidiaries in Vietnam into the headquarters in Hong Kong and reinvest the profits in the managed company in China and Vietnam. In other words, it is possible to reduce the tax cost by circulating profits abroad without paying dividends to Japan. One of the advantages of the tax system is that capital gains and dividends are tax exempt. For example, if capital gains occurred when a Chinese subsidiary was sold, if Hong Kong was the parent company of a Chinese subsidiary, tax exemption for that capital gain is possible. Dividends from China can also be tax-exempt. In addition, a low tax rate of 4.95% applies to royalties paid by Hong Kong to Japanese investors.

However, it is necessary to consider the disadvantage that additional costs (office expenses and labor costs) will arise due to establishment of base in Hong Kong. There is also a risk that may arise because of tax havens, so it is necessary to pay sufficient attention.

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya