China

7 Chapter Foreign exchange

-

-

1 Chapter Introduction

1.1 The history of Japanese companies entering the world

1.2 New business model in China

1.3 Advance scheme through Hong Kong

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.2 Province and region of China

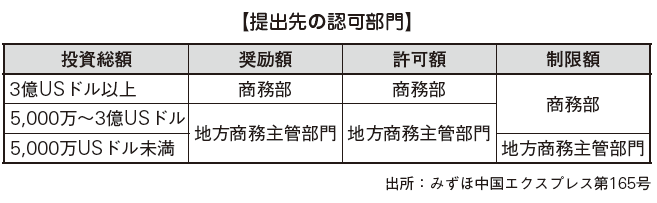

3.5 Investment incentives and regulations

4 Chapter Economic Environment

5 Chapter Establishment

5.3 Establishment of business base

5.4 Procedure after incorporation

6 Chapter Withdraw

7 Chapter Foreign exchange

7.1 Foreign exchange management system in China

7.2 Foreign currency management system of ordinary items

7.3 Foreign exchange control system of capital items

7.4 Foreign exchange control system in bonded area · Hong Kong

7.5 Individual foreign currency control system

8 Chapter M&A

8.2 Laws and regulations concerning M & A

8.5 Challenges after corporate acquisition

9 Chapter Corporate Laws

10 Chapter Accounting

11 Chapter Tax law

11.2 Representative Office Taxation

11.4 Individual Issues in China Domestic Tax Law

12 Chapter International taxation strategy

12.1 International tax relating to entering China

12.2 International taxation strategy

12.3 Individual Issues in International Taxation

12.4 Tax issues related to withdrawal

13 Chapter Transfer Price Taxation

13.2 Individual provision pertaining to transfer pricing taxation

13.3 Transfer price taxation and documentation

13.4 Transfer price survey in China

14 Chapter Labor

14.4 Points to remember when bringing Japanese

15 Chapter International Human Resources Management

15.1 Human Resources Labor Management

15.3 Personnel evaluation system

-

-

-

Foreign currency management system

Looking back on the history of regulations on foreign currencies in China, the foreign currency control system until 1979 was a very severe system. At that time in China, because foreign currency was very small, we forced domestic companies and individuals gained foreign currency to return to China state. First, the foreign currency received must be sold to the Chinese state. When foreigners (other than Chinese) shop in China, exchange foreign currency (foreign currency) and foreign currency convert tickets and exchange foreign currency I had to pay with a convert ticket. This foreign currency convert ticket is the currency issued by the domestic bank in case it is impossible to convert (convert) from the local currency to the foreign currency. In China, exchange from the Renminbi to foreign currency was banned until about 1994. In order to thoroughly manage foreign currency by the Chinese government, we prohibited possession of foreign currency in China and exchanged for foreign currency convert tickets.The provisional foreign exchange regulation was promulgated in 1980 and it began to balance the international balance of payments. Foreign exchange adjustment center (restricted to Chinese enterprises with the restriction with the aim of exchanging foreign currency with the renminbi established in 1980. It is set up in various cities in China to encourage introduction of foreign capital and trade etc. It plays a role and was abolished in 1998) and a Chinese company made a mechanism to exchange foreign currency / yuan freely. In addition, the State Foreign Exchange Administration Bureau has also created a mechanism to decide the announced exchange rate, which has become a dual exchange rate regime in which the actual exchange rate and the public exchange rate coexist.Since 1994, Chinese companies have been prohibited from holding foreign currency, while on the other hand, if it is a current expenditure item, it changed to a system that allows exchange of RMB and foreign currency at foreign exchange designated banks (see next paragraph). In addition, the system of banning exchange of foreign currency and RMB between foreign exchange adjustment center and Chinese enterprises, the People's Bank deciding market exchange rate based on the interbank foreign exchange market was adopted, and now the unified managed It became a floating exchange rate. In addition, in order to respond to the globalization of the economy, the introduction of a confirmation checking system for foreign currency receipts and payments (1990 's), the abolition of foreign currency convert tickets (1995), the establishment of the external debt registry system (2003) It was done. -

Ordinary items and capital items

The current foreign exchange control system in China is classified into ordinary items and capital items depending on the type of transaction. In principle, recurring items are convertible and capital items are partially restricted. Regarding ordinary items, banks will verify the transaction vouchers and conduct audits of the truth (screening is actually performed) every time receipt / payment. Regarding capital items, the Foreign Exchange Management Division is managing, and preliminary examination and post-registration confirmation are carried out.

-

-

-

Foreign currency management system of ordinary items

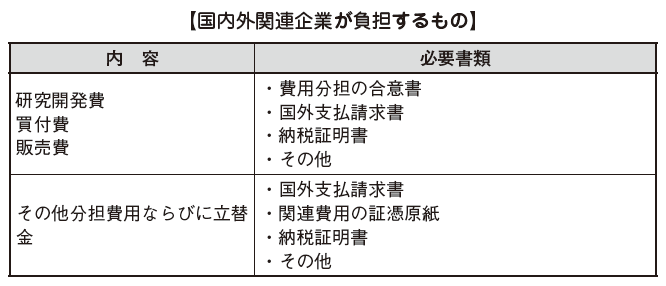

Ordinary items refer to transaction items occurring regularly in the balance of payments. In addition, ordinary items can be classified as trade transactions and non-trading transactions. Trade transaction refers to cargo export / import transactions. On the other hand, non-trading transactions are service provision, service underwriting, employee compensation and investment income, transfer without consideration. -

Trade transaction

As a foreign exchange management method related to trade transactions, a two-stage management system is adopted. First, off site inspection (monitoring system to be managed through observation of total inspection index) is carried out. Next, on-site inspection (field survey) will be conducted for companies showing outliers.

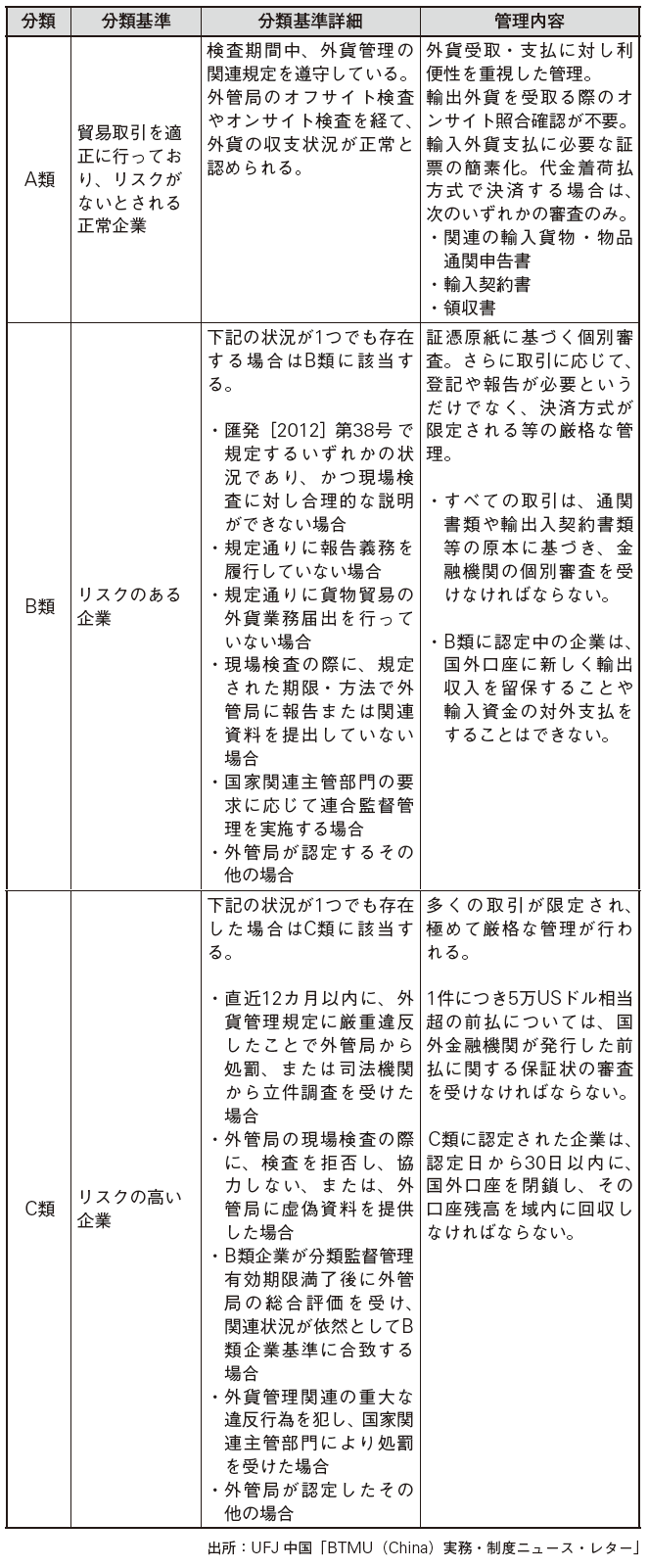

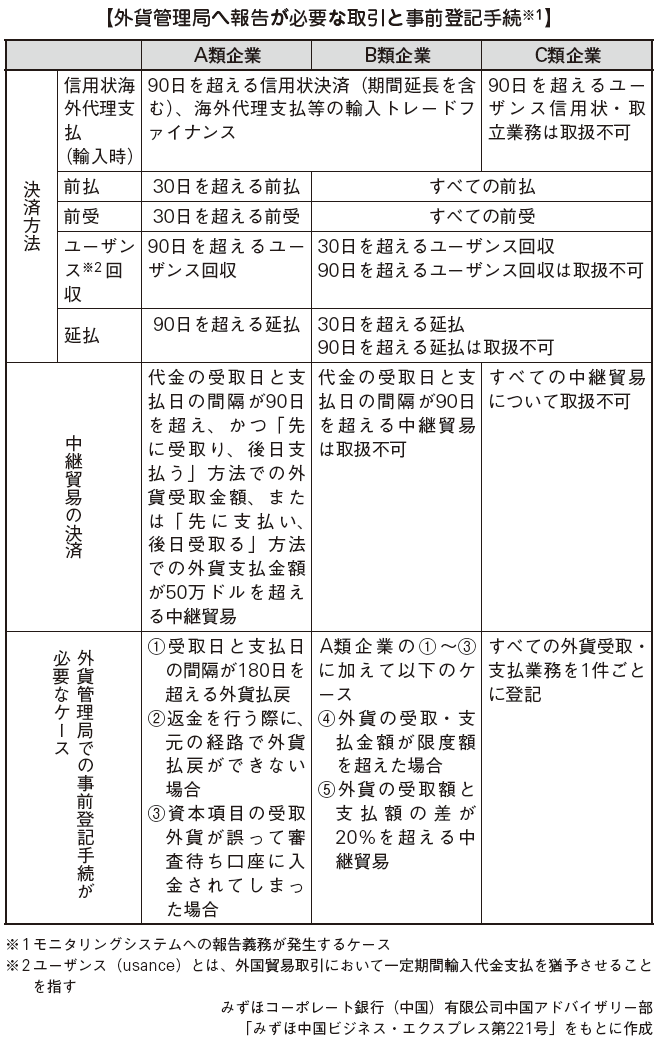

■ Classification management of companiesIn the announcement of the reform of cargo trade foreign exchange control system (Public Notice of State Foreign Exchange Administration Bureau [2012] No. 1) and the notification of problems related to freight trade foreign exchange control laws by the State Foreign Exchange Administration Bureau (Huifumi [2012] No. 38) We decided to classify and manage enterprises entering into three categories.Specifically, we divide all companies into ranks A, B, and C (see classification table below). We will simplify foreign currency receipt and payment procedures for Company A companies. Every time the rank drops B, C, we will stricten foreign exchange receipts, payment procedures and management.

Foreign currency payment at a bank can be made directly by a company A when paying foreign currency of a trade transaction by presenting a document (one of bills, contracts, evidence on customs performance) certifying the truth of the transaction . However, in reality, there are many cases that present vouchers on customs performance at the time of settlement, the following two reasons are considered.

· The difference between operation by banks and institutions· As in the past, if the settlement is done based on the evidence on the customs clearance record, there is a sense that there is no problem in the company side

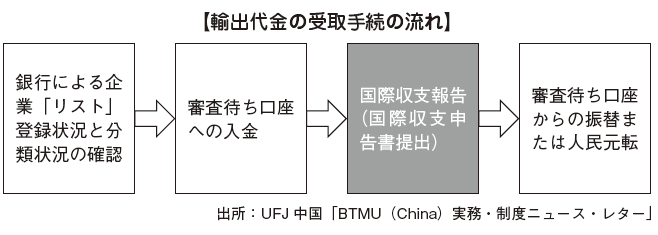

When receiving foreign currency, you can transfer money from the awaiting review account or switch to renminbi by depositing money in the waiting account and submitting the international balance of payment statement (exclusive revenue application). In the case of intermediary trade, you will be required to submit additional import and export contracts and revenue declaration evidence vouchers in addition.If the RMB conversion or transfer amount of intermediary trade revenue in the same contract transaction exceeds 20% of the proper expenditure amount, the relevant company needs to undertake the foreign currency business registration procedure at the foreign exchange administration authority.

Regarding B companies and C companies, strict supervision and management are carried out in various aspects such as certificate review of foreign trade balance, business type, settlement method and so on. Evaluation of electronic data will be carried out for companies of type B. Regarding C companies, it is stipulated that it is necessary to conduct trade transactions after registering to the Foreign Exchange Administration Bureau each time.By the way, the Foreign Exchange Management Bureau regularly organizes this classification. In case A company violates the Foreign Exchange Control Authority regulations, it is demoted to Class B or Class C, and if improvement of compliance situation of Company B company is not seen, it will be demoted to Class C. On the other hand, it is stipulated that for companies B and C, if compliance improvement is observed during the supervision period, it will be promoted to type A.

■ Transactions that need to be reported to the Foreign Exchange Administration and Pre-registration ProceduresFrom the on-site inspection to the total inspection at the off-site, the details to be reported to the foreign exchange control office (Article 37 of Implementation Guidance on Foreign Currency Trade Guide) and the items of pre-registration procedure (Article 40 of the same rule) It was. When certain transactions occur in Company A companies, it is obliged to report receipts and payment amounts or import / export date information to the Foreign Exchange Management Department within 30 days from the date of the transaction occurrence.

■ Payment of complaint feeWith the introduction of the new system, it is now possible to freely perform payment processing of complaint expenses (remittance from exports related complaints from China to overseas). However, in practice it has not changed much from before. It is thought that it is because the difference between the customs clearance record and the settlement record becomes large and there is a possibility of the penalty measures being taken by the foreign exchange control office if long-term offsetting acts are done.There are two types of payment of claim fee: offset payment and individual payment.In the case of offset payment (such as offsetting cargo price and claim cost), we will obtain it with permission from the Foreign Exchange Administration Bureau. This is because the basic agreement between the clearance value and the settlement amount (error within ± 5,000 US dollars per customs clearance is acceptable) was required. On the other hand, in the case of individual payment, there is no change from the conventional foreign currency control system, and it will be extremely difficult to respond.

In-place inspectionOn-site inspection will be carried out if the following transactions occur.

· Indicators of total assessment deviate by more than 50% from indicator tolerance in each district· Indicator of total assessment Exceeding index tolerance of each district for 4 consecutive years· The ratio of trade credit outstanding in each item of prospect, prepayment, collection of user sponsorship, and payment in advance is greater than 25%· Processing fare ratio in visit processing is over 30%· The difference in income and expenditure of brokerage trade exceeds 20% of expenditure ratio· The number of cancellation remittances exceeding 500,000 US dollars exceeds 12 cases· In cases other than the above cases, the Foreign Administration Bureau has determined that on-site inspection is necessary

On site inspection, presentation of transaction related materials, interviews with legal representatives, and other inspections deemed necessary by the Foreign Exchange Administration Bureau will be carried out. The above are excerpts from "Public notice of reform of cargo trade foreign exchange control system by National State Foreign Exchange Administration Bureau, National Taxation Bureau and Customs General Administration" and "Notice of Problems Related to Cargo Trade Foreign Exchange Control Regulations by National Foreign Exchange Administration Bureau" Some contents are unclear in content, so you need to check with each inspection agency in advance.

■ Renminbi-denominated trade contractAs a general rule, if a company possessing import and export management qualifications, export cargo trade settlement is possible with Renminbi. However, companies that are exceptionally listed in the priority management list can not settle in RMB. Notice on issues concerning corporate management in RMB export freight trade settlement (Silver Development [No. 23]) For companies in the priority management list, certain restrictions are set up such as strengthening the examination at the time of settlement procedure It is. As of June 2012, 9,502 companies are incorporated into the same list (Ginballo box [2012] No. 381), and there are announcements from the people's governments in various places.

Selection criteria for priority management listIf you do the following action within the last 2 months it will be included in the priority management list.

· Tax evasion of export tax refund, fraud, issuance of false invoice, receipt of exclusive invoice for value added tax· I underwent a case investigation from the tax agency, the Public Security Bureau, etc. for the above doubt· It committed a strict tax supervision and management violation such as smuggling· We committed a relatively strict control of financial management regulations· It committed a relatively strict trade related violation· It committed a relatively strict violation of other regulations

Measures for companies in priority management listFor companies included in the priority management list, the following measures are taken.

· Renminbi-denominated cross-border prohibition of RMB funds acquired through trade settlement work outside of China· On-site inspection of the RMB cross-border payment service provided to companies in the priority management list (implemented by the People's Bank)· Renminbi-denominated cross-border off-site inspection of trade settlement work (implemented by the People's Bank) -

Non-trading transactions

In China, it is possible to remit money to non-trade transactions (commissions, consulting fees, royalties, etc.) overseas. Procedures necessary for dealing differ.

■DividendAs a general rule, the year-end dividend is approved. However, if certain procedures are taken, an interim dividend is also possible. Dividend procedures are as follows (purchase / sale of foreign currency, regulation of external payment management and foreign currency sale of non-trading items, payment and operation rules for foreigners' balance management of residents).

[Appropriation of appropriation of profits]After the fiscal year ends, we will file an accounting audit, a tax return on the corporate income tax, and make a resolution on the appropriation of profits by the Board of Directors (see Chapter 8 "Corporate Law"). Regarding appropriation of retained earnings, we will actually determine the amount of dividends after we have compensated earnings and earnings in the previous fiscal year and funded the trinominal fund. The trinctual fund is the statutory reserve fund. The corporate development fund, which is one of the trinctual funds, refers to the preliminary retained funds of the company, and in the case of monopoly (100% equity), it is forced to accumulate at least 10% of the profit after tax.

[Documents necessary for dividend remittance]When remitting dividends you need to submit the following documents to the bank.

· Final return form· Accounting audit report (issued by an accounting master)· Resolution of the Board of Directors on appropriation of profits· Foreign currency registration certificate· Inspection Report at Capital Payment (Capital Inspection Report)· Others (Documents required by banks conducting remittance processing etc.)

[Dividends other than the end of the period (interim dividend)]If the following requirements are satisfied, dividends will be possible except at the end of the period in exceptional cases.

· The profit of the company paying dividends is good· No debt has already arrived· Prepares corporate income tax in accordance with regulations· There is a large profit· It is approved by the tax authority in charge

■ Non dividend[commission]If the remittance amount of one commission is less than 10% of the total amount of the contract, or even if it exceeds it, even if it exceeds 100,000 US dollars, the company can make external remittance with bank review only. If it exceeds the limit amount, it is necessary to apply and obtain the criminal document of the Foreign Exchange Administration Bureau (Notice concerning the issue concerning foreign exchange sales and payment policy adjustment under some service trade items: Huzhihua [2006] No. 73).

[Consulting fee]If the payment amount is less than 100,000 US dollars, you can conduct foreign currency conversion and external remittance by bank examination. Furthermore, if payment is less than 50,000 US dollars, remittance is possible if there is either contract, invoice or tax evidence. In other words, the procedure for presenting details on consulting services to the bank is omitted. Apart from bank review, if the amount of money exceeds 30,000 US dollars, you have to obtain prior permission from the tax bureaus (issues concerning tax proof on foreign remittances such as the service trade items of the National Foreign Exchange Administration and National Taxation Bureau Notice: Huifumi [2008] No. 64).

[technology transfer]You must obtain a registration certificate after obtaining the permission by submitting the contract to the Commerce Administration Department. By remitting the registration card to the bank, we can make remittance remittance. Documents required for acquiring the registration certificate are different depending on the type of technology and know-how to be imported (Foreign currency sale of non-trade items, payment and residents' individual foreign currency balance control operation regulations: trial, Huifumi [2002] 29th issue).

[royalty]Procedures similar to technology transfer are necessary for loyalty. When a foreign company in China pays royalties to investors, if the terms of payment on the royalty is stated in the articles of incorporation, you are required to present the articles of incorporation. In case of transferring or leasing a patent right / technology, you must register withholding tax withholding within 30 days from the signing date of the contract. Subsequently, withholding tax payment is made and tax payment certificate is offered to the bank at the time of remittance (Foreign currency sale of non-trade items, payment and operation rules for managing residents' foreign currency balance management: trial, Huifumi [2002] No. 29) .

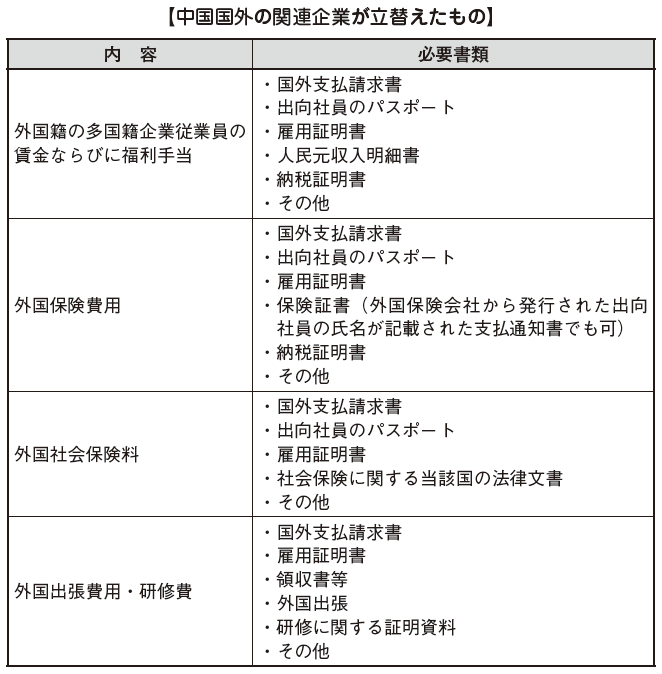

■ Remittances · Procedures are different between Shanghai and other parts of China other than Shanghai for external remittance of personnel expense reimbursement.

[Remittance remittance of foreign exchange (other than Shanghai)]External remittance of advance payment is not allowed in each region of China except Shanghai. As a result, it is impossible to reimburse expenses of foreign companies by companies in China, and expense of Chinese companies by foreign companies. The reason is that there is no item of advance payment in the provision that defines the remittance procedure concerning non-trade items, so it is impossible to remit the advance payment.Therefore, in practice, remittance is not a remittance but as a fee it is often the case to remit separately. However, in this case, there is an obligation to pay corporate income tax and business tax, as well as risks subject to tax investigation. There are two solutions to avoid these risks.

Become certified as a multinational company on foreign currency managementA multinational corporation in foreign exchange management refers to a group of companies that have affiliated companies in and outside of China and one of the related companies in China possess investment management functions in the whole world or region (including China). If accepted as a multinational corporation, deregulation of some ordinary items non-trade settlement is permitted. As a result, it becomes possible to postpone remittance of labor costs of seconded employees. Examples of external settlements accepted by multinational companies are as follows (Regulation on Foreign Currency Sales of Non-Trade Items, Payment and Operation Provisions for Personal Foreign Currency Budget Management: Trial, Huifumi [2002] No. 29).

How to receive the full amount of salary from the Chinese subsidiary and remittance to the Japanese account separately by the seconded employee (only for personal replacement payment)For individuals, a certain amount of external remittance is possible.

[Remittance to foreign remittance (Shanghai)]Foreign companies and domestic companies in Shanghai can purchase foreign currency and make payment for reimbursement at foreign currency designated banks if the remittance amount is less than 100,000 US dollars. If it exceeds 100,000 US dollars, it is necessary to present a certificate as a certified company or a certificate of remittance from the Foreign Exchange Administration Bureau. The accredited company is a company accredited by Shanghai Municipal Bureau of Foreign Exchange Management, specifically the following companies (the following companies fall under (Shanghai Municipal Organization's domestic institution's service trade items, related expenses related to external payment of sharing costs) Notice on Shiba Hifumi [2010] No. 192, December 31 issue).

· Multinational corporate regional headquarters· Research and development center of foreign capital· Foreign-invested companies (subject to being certified in the previous fiscal year)· Outsourcing Priority Companies· Service trade focus companies· Insurers and insurance brokers

-

-

-

Foreign exchange control system of capital items

When establishing a local subsidiary or a representative office in China, transactions related to capital items such as payment of investment and remittance of funds for activities will occur. -

Investment (capital and surplus)

■ Money that a foreign company contributesWhen a foreign company invests in a local subsidiary in China, it is funded in foreign currency in principle. Because the renminbi is not an external payment currency. However, there are cases where the investment in the RMB is permitted in exceptional circumstances. In the case of reinvesting the profit of the local subsidiary in China to a local subsidiary in China, corporate development fund and conversion of the reserve fund to capital. If a foreign company invests in Renminbi, it must be reviewed and approved by the foreign exchange control authority.A notice on related issues of the cross-border Renminbi FDI has been promulgated (October 12, 2011) and foreign investors have been able to invest directly in the RMB legally acquired. However, you must submit the following documents to each authorized department and obtain permission.

· Company establishment application form etc.· Certificate or instruction on the source of RMB funds· Cross-border Renminbi direct investment situation table

When investing in a specific type of business, the regional commerce department can submit cross-border renminbi direct investment situation table to the Ministry of Commerce, obtain the foreign investment company certificate after getting permission of the Ministry of Commerce. Specific industries are finance leases, foreign invested enterprises, foreign invested enterprise investment enterprises, etc.

■About the company establishment preparation accountIn China, you can open a temporary account to pay the pre-establishment fee of the local corporation (foreign companies without institution can open foreign currency accounts). Foreign currency in an account can not be converted into Renminbi (unless you obtain permission from the foreign exchange control office concerned). Foreign currency cash deposits and withdrawals are also restricted.Traditionally, special accounts of foreign investors were categorized as to be used (purchase, security class, investment category, expense account exclusive account), but it was partially abolished in 2012. However, detailed operation details are not stipulated. Practically, it is necessary to confirm with the foreign exchange management authorities in each place on a project basis (notification concerning further improvement and adjustment of direct investment foreign exchange control policy: Huifumi [2012] No. 59).

■ Conversion of capital to RenminbiProcedure After a certain procedure, foreign currency paid in as capital can be converted to RMB. In this case, it is necessary to obtain the capital payment certificate issuance procedure through the pamphlet accounting office. Capital usage is limited within the scope of business, and it is not permitted to use for domestic investment or purchase of real estate other than self-use. The cumulative amount to which capital can be withdrawn is within the total amount of capital payment certificate. Documents necessary for the process of conversion to the RMB are as follows.

· Foreign company's foreign currency registration IC card· Transfer instructions for the renminbi to convert· Renminbi use instructions to be converted (those with description of commercial contract, invoice etc.)· Capital payment certificate· Documents certifying that the previous RMB conversion funds were used according to payment instructions· When applying for RMB loan repayment, documents to prove that the loan was used within the management scope· Other documents required by the bank

However, if the price per change is less than 50,000 US dollars, you do not need documents to prove that the renminbi application manual and the previous RMB conversion funds were used as per the payment instructions.In addition, the State Foreign Exchange Administration Bureau promulgated a notice on reform of the renminbi conversion of foreign currency capital of foreign invested enterprises on January 20, 2015 (effective 1 June of the same year). With this notification, when converting foreign currency capital to the yuan, it becomes unnecessary to submit the necessary documents which had been required to submit so far, and the capital converted to renminbi is deposited in the dedicated waiting account It was decided to be done. For foreign invested enterprises, it is easy to convert capital into Renminbi, you can decide the timing of conversion after comprehensively judging the situation of your company.

■ treatment of surplus after liquidation[In the case of a local corporation]When liquidating a local subsidiary in China, surplus remittance can be sent outward. At the time of remittance, it is necessary to have completed liquidation procedures such as clearing approval, debt payment, payment of taxes, payment of employee salary, deletion of registration and so on. At the time of liquidation, it is necessary to submit the necessary documents to the foreign exchange control office concerned to the following (Fuwa [2013] No. 21) notifying on the foreign investor 's direct investment foreign direct investment management regulations and related provisions.

· Application form· Foreign currency registration certificate· Liquidation permit of commerce administration department· Clearing Resolution of the Liquidation Committee· Capital paid-in certificate issued from a certified public accountant office· Clearing report of Certified Public Accountant Office· Notice of opening foreign currency account at the present time· Certificate of Foreign Currency Account Balance at Completion Date· Tax registration deletion certificate· Other documents required by the foreign exchange control office concerned

[In the case of a representative office]If there is surplus at the closing of the representative office, remittance can be sent out. Since the representative office does not conduct sales activities, there is no theoretical surplus, there is no regulation on remittance of surplus in the Representative Office. As a result of proper deletion procedure etc., if there is surplus, foreign remittance can be made with permission of foreign exchange control authority. -

Loan

There are no restrictions on foreign companies getting borrowed in China. On the other hand, if a foreign company receives borrowing from outside China, registration of foreign currency debt is necessary. In addition, in case of conversion from borrowed money to capital, exemption of debt of loan, pooling work, you must obtain permission from Foreign Exchange Management Bureau.

■ Foreign Currency Debt RestrictionThe upper limit of the borrowing amount from overseas subject to registration of foreign currency debt (hereinafter referred to as foreign bond registration) is stated up to the amount obtained by deducting capital from the total investment amount in the articles of incorporation. Borrowing money subject to registration of foreign bonds is taken as the total amount of mid- to long-term foreign bonds and short-term foreign bonds outstandings. Since short-term foreign bonds are subject to balances, the upper limit of the borrowing amount frame will rise if repaying. On the other hand, cumulative amount is applicable for mid- to long-term foreign bonds, so paying attention is necessary because even if you repay it, the amount that can be registered for foreign bonds does not increase.When borrowing from a parent company (foreign company) in China local subsidiary it is necessary to register foreign bonds. Documents necessary for the registration process are as follows.

· Copy of the establishment permission of the local subsidiary in China and business license (3 copies each)· Capital payment certificate· Original and copy of loan agreement (2 copies)· Resolution of the Board of Directors on financing· Lawyer opinion on the validity of borrowing conditions (required for receiving loans from the parent company)

Foreign bond registration procedure will be completed when submitting loan agreement to foreign exchange control office within 15 days after concluding loan agreement. For deposits, refunds, interest payments on loans registered as foreign bonds, you will be asked to present a foreign currency debt registration certificate to the bank.

■ Conversion from borrowings to capitalThe act of converting borrowed money to capital (Deut · Ekti · swap) is also accepted in China. When converting, it is necessary to obtain permission to convert capital of foreign currency debt at the business administration department. After that, we submit to the Foreign Currency Control Authority a confirmation letter of conversion of capital of foreign currency debt issued by creditors and apply for cancellation of foreign currency debt (concerning making foreign money management business of foreign direct investment complete Notification: Huifumi [2003] No. 30).

■ Exemption of debt of loansLoan debt exemption is also allowed in China. When applying for exemption, you must obtain the permission of the Foreign Exchange Controlling Authority by submitting the necessary documents in addition to the notice of waiver of the claim created by the creditor. In some cases, due to absence of loan abandonment, it is necessary to prepare beforehand such as explaining to the foreign exchange control office that it is a loan assuming loan abandonment before financing.Although local subsidiaries that receive debt exemption frequently record tax loss carryforwards, the exemption gains arising from debt exemption may not be allowed to use this tax loss carryforward. Therefore, we recommend that you check with the tax office in advance about the use of tax loss carryforwards.

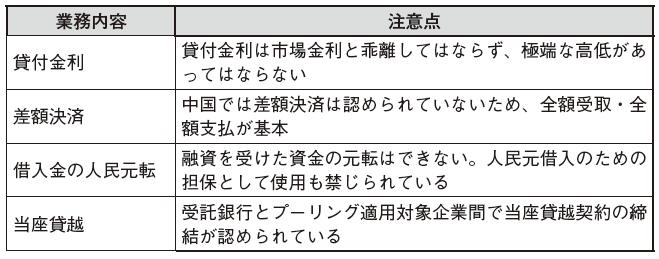

■ Pooling serviceIn China, foreign group companies in China are allowed to pool foreign currency funds. Foreign currency pooling means that a company in the group that a fund manager (a company that controls movement of funds) selects a trustee bank and opens up a dedicated account and conducts foreign-currency funds centralized management work among group companies I will point it. In order to do a pooling operation, you must submit the rules concerning the operation of pooling to the Foreign Exchange Administration Bureau for permission.Companies within the group "Companies founded under the law in China and that have 20% or more of equity relationships, or companies that have a capital contribution of less than 20% but are the largest contributors of the company" It is defined as(Notice concerning the promulgation of the foreign company's internal concentration management management regulation by internal company members inside the prefecture: Huifumi [2009] No. 49).

Points to be noted when carrying out foreign currency pooling business are as follows.

■ About financing among general corporationsIn China, loans between general corporations are prohibited, but for indirect financing through banks it is possible to finance (commissioned loan). In case of outsourcing loans, we will sign a loan agreement between the lessor, borrower and bank. Loan terms such as interest rate and repayment conditions can be freely decided, but it is assumed that there is no deviation from actual market conditions. Permission from the Foreign Exchange Management Bureau is unnecessary for outsourced loans. -

Other

Purchase of real estate and guarantee fee fall under the capital items, so permission from foreign exchange control authority is required.

■Purchase of Real Estate (Land Use Rights)Foreign companies can buy real estate in China (land use right) if it is intended for self-use, but purchasing is prohibited except for self-use purposes such as leasing purpose or investment purpose. Before 2005, foreign companies were allowed to purchase real estate for investment purposes, so real estate purchased by foreign companies at that time can be retained continuously. The prohibited ground provision is based on an opinion on the entry of foreign capital into the real estate market (Construction Tassel [2006] No. 171) and notification of problems concerning normativeization of foreign exchange management in the real estate market (Huifumi [2006] No. 47).When foreign companies purchase real estate for self-use purposes and convert funds remittered from foreign countries to renminbi, you need to present the following documents to the bank of China for permission.

· Real estate sales contract· Certificate of registration of Chinese branch and representative organization· Branch issued by the real estate administration department · Sales reservation certificate of the representative organization· Confirmation that the real estate to be purchased is suitable for private use

After obtaining permission at the bank, you can convert real estate purchase funds to Renminbi. The converted RMB will be transferred to the RMB account of the real estate development company, thereby purchasing real estate. If sales contract is not established, we will convert Renminbi to foreign currency.When re-cashing, submit the following documents to the bank and get permission.

· Application form indicating the reason why the transaction was not established· Documents to be submitted when converting from foreign currency to Renminbi· Certificate of cancellation of sales contract with real estate company

In the case of individual purchasing real estate, it is stipulated that foreigners who have worked or studying in China for more than one year are only able to use themselves for self-use (notification concerning related issues of foreign exchange management norms in the real estate market : Huifumi [2006] No. 47).

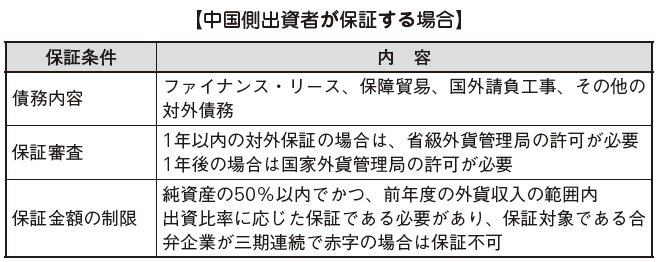

■ Guarantee feeThere are warranties by foreign companies and warranties by Chinese side investors in the guarantee. There are regulations separately.

[Guarantee by Foreign Company]A local subsidiary in China can pay a guarantee fee to a foreign company (Japanese parent company etc.). When a local corporation borrows from a bank, a foreign company may put a guarantee for borrowing. In this case, the local corporation can submit the following documents to the foreign exchange management office to a foreign company, and remit the guarantee fee remitted after getting permission.

· Application form· Notice of payment of guarantee fee· Warranty contract (requires Chinese translation)· Agreement concerning obligation on which guarantee was made· Tax certificate· Foreign invested company Foreign currency registration certificate (in case of applicant is foreign company)· Register foreign currency debt on debt· Other necessary documents

The obligation to be paid for this debt guarantee is limited to the debt registered for contingent liabilities. If a company in China receives a loan under the guarantee of a non-resident, it is mandatory for the financial institution to register the contingent liability. However, for accounts receivable guaranteed by nonresidents, there is no obligation to register contingent liabilities (notification of problems concerning improvements in foreign currency management: Huifumi [2005] No. 74).

[When guarantor by Chinese side investor (joint venture company)]If a joint venture company borrows overseas, investors in the Chinese side can also provide guarantees. Among them, in certain cases, it is necessary to obtain permission from the Foreign Exchange Management Authority and be guaranteed according to the shareholding ratio (Japan Agency's Foreign Collateral Control Act Law: Silver [1996] No. 302 )

-

-

-

Foreign exchange control system in bonded area · Hong Kong

In the bonded area, as a part of improving the environment for foreign capital introduction, it is managed with a foreign currency management system different from the general ward. -

Bonded area

■ Application control rulesIn bonded areas, foreign currency control provisions of general areas and foreign exchange control regulations of bonded areas are applied. If the contents of both regulations are different, the foreign currency control provisions of the bonded area will be preferentially applied.As foreign currency management provisions concerning bonded areas, the main provision is the customs supervised controlled area foreign exchange control valuation law (Huifumi [2013] No. 15). This provision applies to all bonded areas such as bonded areas, export processing zones, logistics parks, bonded logistics centers (type A, type B) etc.This provision was established with the intention of unifying the foreign currency management of the bonded area and the foreign currency management of the general area, but with regard to practical procedures in various transactions of the bonded area, the old provision before the establishment of the same provision, bonds It is operated in accordance with the supervision area foreign exchange control law law (Huifumi [2007] No. 52) etc etc.

■ Offshore tradingCompanies in bonded areas can do offshore transactions. Offshore trading refers to transactions that involve investment and procurement with nonresidents. For example, trading where cargo does not pass through China and transactions where bonded area companies buy and sell before cargo arrives in China are typical (import import clearance is done by cargo purchasing company).In offshore trading, import customs clearance and entry plan (cargo notice) in China are not implemented. Therefore, we can pay purchase price as proof of the truth of dealings payment of sales fee.

■ Bonded Region Business Transactions with Foreign CountriesIt is stipulated that the settlement of transactions between bonded-area companies and foreign countries is based on foreign currency calculations. When processing a payment from a bonded area company to a foreign company, the following documents must be presented.

· Foreign currency registration certificate of bonded area company· Sale contract· Invoice· Other required documents

■ Transaction between a bonded area company and a general area companyFreight trading of bonded area companies and general area companies is legally permitted for RMB or foreign currency settlement, but since it is a transaction involving import and export customs clearance, only foreign currency settlement is permitted in practice. Exceptionally, only for payment of service fees that are not cargo transactions, it is mandatory for RMB settlement.When a bonded area company purchases goods from a general area company, the following documents are required as evidence.

· Foreign currency registration certificate of bonded area company· Sale contract· Invoice· Original original of cargo import registration list or original export clearance certificate of general area company

General area When a company buys cargo from a bonded area company, necessary documents are as follows.

· Copy of foreign currency registration certificate of bonded area company· Sale contract· Invoice· Valid documentary evidence on payment method

■ Transactions between bonded area companiesIn the case of transactions between bonded area companies, it is permitted to apply foreign currency settlement and RMB settlement. If you choose foreign currency settlement, you need to process payment from your foreign currency, but you can not purchase foreign currency from the bank. Also, the necessary documents for settlement are as follows.

· Foreign currency registration certificate of bonded area company· Sale contract· Invoice· Other required documents

■ Transactions in which ownership moves within a bonded area When a bonded area company purchases cargo from a foreign company and makes payment within the bonded area, the following documents are necessary.

· Foreign currency registration certificate of bonded area company· Sale contract·Invoice· Original document of freight export application or other evidence of customs supervision· Certificate issued by a warehouse company in bonded area (document showing that ownership of warehouse storage contract cargo entered by a warehouse company in a bonded area with a foreign company belongs to a foreign company)· Other required documents -

Hong Kong

In Hong Kong, we have an economic partnership closing agreement (CEPA) with China and exchange of RMB and HK dollar is done freely compared with other countries. Specifically, the following Renminbi operations are lifted.depositHong Kong residents are allowed to open a RMB account in Hong Kong and can deposit RMB converted from Renminbi or HKD. Similarly for Hong Kong companies, it is possible to establish a RMB account if the necessity of RMB usage is recognized for business purposes.Personal RMB conversionFrom 17th November 2014, restrictions on exchanges to the Renminbi in Hong Kong were abolished.RMB conversion for tourismA restaurant, a shop, a hotel, such as a hotel, can convert the received RMB into HK dollars. Regarding the limitation, there is no specific amount stipulated and it is prescribed the amount according to the scale of the project.About RMB remittance Individuals with RMB accounts in Hong Kong can remit Renminbi to mainland China. However, the following restrictions apply.· It is within 50,000 RMB cumulative day· Hong Kong and the mainland Chinese account holders are identicalCredit and Debit CardsResidents in mainland China can use the RMB card issued in Mainland China to consume for tourism purposes in Hong Kong. A small amount of HK dollar withdrawal is allowed in Hong Kong ATM. Hong Kong residents can also withdraw a small amount of renminbi by consuming in mainland China and ATM by using RMB card issued in Hong Kong as well.

-

-

-

Individual foreign currency control system

Foreign currency management system for foreign individuals adopts more flexible management system than foreign currency management system for foreign companies. Regulations on account opening, conversion method, foreign money transfer etc. are as follows.

■Open an accountIf you present your passport to the bank, you can open a multi account with Renminbi / Foreign Currency Account (except when you enter the country twice or more within 15 days).

■ About withdrawal cash when entering or leaving JapanIn China, both foreign currency and Renminbi have restrictions on the amount that can be carried (except when entering twice or more within 15 days).

· With RMB 20,000 RMB (Public Notice of People's Bank of China [No. 18])· Foreign currency of 5000 US dollars or less (mobile foreign currency cash exit / border management interim valuation method [2003] No. 102)

If the amount exceeds the foreign currency carrying amount, procedures are necessary at the time of entry and departure. When entering Japan, you must declare it to customs. For departure from Japan, if there is a declaration at the time of entry, within the range, if exceeding that amount, you will ask the bank with the bank account to issue a mobile foreign currency departure permit. If the amount of foreign currency exceeds 10,000 US dollars, you need to obtain permission from the Foreign Exchange Management Bureau.

■ ExchangeThere are two kinds of cash: foreign currency to RMB and renminbi to foreign currency. Each regulation is stipulated.

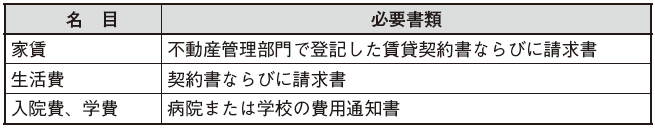

[Cash from foreign currency to Renminbi]Foreign nationals can freely make cash within 50,000 US dollars a year (detailed rules of implementation of personal foreign currency control valuation law: Huifumi [2006] No. 3). For example, if you are converting cash within 50,000 US dollars in a calendar year, you can cash by presenting your passport to the bank. In that case, the upper limit of the cash amount per conversion is about 5,000 to 10,000 US dollars. If it exceeds the upper limit of the annual cash amount, you need to present the following documents to the bank depending on the cash payment purpose.

In addition, if the foreign currency sales amount is more than 50,000 US dollars per item, we will transfer the exchanged renminbi directly to the RMB account of the billing address.

[Cash on from RMB to foreign currency]RMB income earned in China can be converted into foreign currency if the necessary documents (evidence with transaction volume, tax evidence etc) are offered to the bank. In the case of converting the renminbi acquired through conversion into a foreign currency, if the exchange amount is within 500 US dollars (within the airport, 1,000 US dollars), it can be cashed by presenting an identity card. In the case of redeeming money exceeding US $ 500, you must present the original currency conversion certificate and identity card within 24 months from the date of reversion.

■ Remittance remittanceIndividuals can do external remittance. Remittable amount differs between remittance from foreign currency account and remittance of foreign currency cash. Since there are cases where there is a separate provision for each bank, it is necessary to inquire details at each bank counter.

[External remittance from foreign currency account]If it is less than US $ 50,000 per day, remittance is possible by presenting the identity card to the bank. Presentation of documentary evidence is necessary when remittance amount of 1 day is over US $ 50,000.

[Transfer foreign currency cash]If it is less than US $ 10,000 per day, you can remit foreign currency cash by presenting your identity card to the bank. If the amount to be remitted exceeds 10,000 US dollars, a document indicating the transaction amount, an entry passenger luggage declaration form with customs seal, or a cash withdrawal certificate will be required (China People's Bank Public Notice [2004] No. 18 issue).

■ Credit card, cash card issued in ChinaYou can also use credit cards or cash cards issued in China even outside of the country. It is also possible to withdraw Yuan and foreign currency cash both domestically and internationally by cards of individual name. However, withdrawal of foreign currency at ATM in China is forbidden, so it must be done at the counter of the financial institution. The cash withdrawal limit is US $ 50,000. If the amount of the card used is high, the card issuing agency reports to the foreign exchange control office of the location, and if there is a problem, it is reported to the advanced foreign exchange management department. High price standards are as follows.

· If the total amount of overseas consumption and 1 month foreign currency cash withdrawal amount exceeds 20,000 US dollars· If the sum of overseas consumption amount and foreign currency cash withdrawal amount exceeds 40,000 US dollars per year.

-

-

-

Director and penalty

In China there is a foreign exchange management institution that oversees whether foreign currency management system is operated without problems and there are penalties for acts against the foreign currency management system. -

Supervision by Foreign Exchange Management Organization

Foreign currency control agencies will supervise, inspect and investigate according to the law. At the time of the survey, the number of investigative staff is set to two or more, and certificate documents indicating that they have inspection or investigative authority will be presented. Companies or individuals must cooperate in supervising surveys of foreign exchange control agencies. I have an obligation to explain the situation as it is in fact and to submit the required documents and materials. -

Penal provision

Penalties are stipulated according to the content of the violation when violating the foreign currency control provisions respectively. Typical penalties are as follows.■ Illegal foreign currency withdrawalContrary to the Foreign Currency Management Regulations, if you bring foreign currency in China outside China, you must return foreign currency to China within the time limit set by foreign exchange management agency. At that time, you will pay a fine of 30% or less of the amount of illegal contribution. If it is judged that more stringent measures are required, it may be imposed a fine of 30% or more of the illegal takeover amount. Criminal liability is pursued when it falls under criminal acts.■ Illegal foreign currency acquisitionForeign currency management regulations must be received in payment and receipts in foreign currency or in cases where illegal foreign currency is acquired from financial institutions by false documents, foreign currency is returned within the time limit set by foreign exchange administration agency , You will pay a fine of not more than 30% of the illegal acquisition amount. If it is judged that more stringent measures are necessary, it may be imposed a fine of 30% or more of the amount of illegal contribution. Criminal liability will be pursued if it falls under criminal activity.■ Illegal foreign currency remittanceForeign currency remittance to China contrary to the foreign currency control provision will result in a fine of not more than 30% of the illegal acquisition amount. In cases where it is judged that more stringent measures are necessary, a fine of 30% or more of the illegal amount may be imposed.■ I am illegally carrying foreign currency and entering or leaving JapanForeign currency carrying foreign currency contrary to the foreign currency control provision, entering or leaving China, a fine of 20% or less of the illegal amount will be imposed. In compliance with laws or administrative regulations, if there is provision of penal provisions.

-

-

-

Websites

[1]「10万ドル以下の送金は認可不要:上海が立替送金で規制緩和[金融]」NNA.ASIA中国、2011年1月20日

[2] 周暁英「海外コミッションに係る税金及び外貨政策について」

[3] 三菱東京UFJ銀行(中国)有限公司企画部調査課「国家外貨管理局、国家税務総局、税関総署による『貨物貿易外貨管理改革試行の公告』の公布」実務・制度ニュース・レター第38号(2011年9月26日)

-

Babiliography

[1] 高部一郎監修、KPMG・あずさ監査法人中国事業室編『中国子会社の投資・会計・税務〈第2版〉』中央経済社、2014年

[2] 水野真澄『中国・外貨管理マニュアルQ&A〈改訂版〉』エヌ・エヌ・エー、2013年

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya