China

6 Chapter Withdraw

-

-

1 Chapter Introduction

1.1 The history of Japanese companies entering the world

1.2 New business model in China

1.3 Advance scheme through Hong Kong

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.2 Province and region of China

3.5 Investment incentives and regulations

4 Chapter Economic Environment

5 Chapter Establishment

5.3 Establishment of business base

5.4 Procedure after incorporation

6 Chapter Withdraw

7 Chapter Foreign exchange

7.1 Foreign exchange management system in China

7.2 Foreign currency management system of ordinary items

7.3 Foreign exchange control system of capital items

7.4 Foreign exchange control system in bonded area · Hong Kong

7.5 Individual foreign currency control system

8 Chapter M&A

8.2 Laws and regulations concerning M & A

8.5 Challenges after corporate acquisition

9 Chapter Corporate Laws

10 Chapter Accounting

11 Chapter Tax law

11.2 Representative Office Taxation

11.4 Individual Issues in China Domestic Tax Law

12 Chapter International taxation strategy

12.1 International tax relating to entering China

12.2 International taxation strategy

12.3 Individual Issues in International Taxation

12.4 Tax issues related to withdrawal

13 Chapter Transfer Price Taxation

13.2 Individual provision pertaining to transfer pricing taxation

13.3 Transfer price taxation and documentation

13.4 Transfer price survey in China

14 Chapter Labor

14.4 Points to remember when bringing Japanese

15 Chapter International Human Resources Management

15.1 Human Resources Labor Management

15.3 Personnel evaluation system

-

-

-

Withdraw

A Japanese company that entered China may be forced to withdraw due to difficulties in continuing business for various reasons. The main reasons for withdrawal include the stagnation of management due to deteriorating business performance due to intensified competition and the discrepancy between management philosophy and management policy with the partner. There is a lot of practical hurdles to withdraw from China, and it is actually not going smoothly.There are cases where a company that made a business in China without assuming withdrawal will suffer much more than expected if it withdraws. In order to avoid such a situation, it is important to prepare strategies for withdrawal in advance in case of emergency.In this chapter, we will describe the procedural flow when withdrawing from China, points to pay attention to, etc.

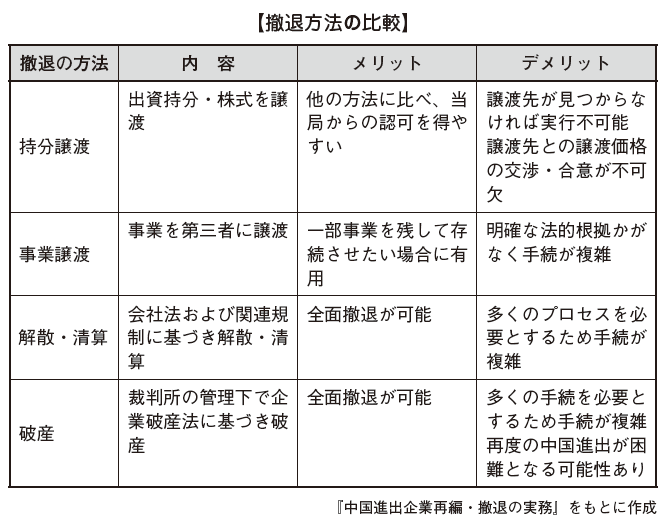

There are four possible methods of withdrawing a subsidiary company: transfer of equity, business transfer, dissolution / liquidation, bankruptcy. Taking into consideration each legal requirement, effect, etc, decide which method should be selected.

-

Equity transfer

Transfer of equity is a method by foreign investors to transfer investment interests of foreign invested enterprises and withdraw from foreign investment enterprises. This method is often used not only for withdrawal but also for reorganizing China business within the group.The merit of the transfer of equity is that there is no need for complicated procedures such as liquidation of overseas affiliates. Since the overseas affiliate has already been established with approval as a foreign company, it is unlikely that it will not be approved for transfer whether the third party at the transfer destination is a Chinese company or any other foreign company.On the other hand, if you can not find the transferring company, you can not transfer. There is also a disadvantage that withdrawal will be postponed unless the desired conditions are satisfied because transfer price and other terms of agreement are necessary. It is also necessary to pay attention to the fact that if it is a joint venture company, approval of Board of Directors must be attached regarding conditions such as transfer price.The rationale for the transfer of the equity interests of foreign investors is a slight provision concerning changes in equity of foreign investment enterprise investors promulgated by the Foreign Trade and Economic Cooperation Department (now the Ministry of Commerce) and the State Industry and Commerce Administration Administration. -

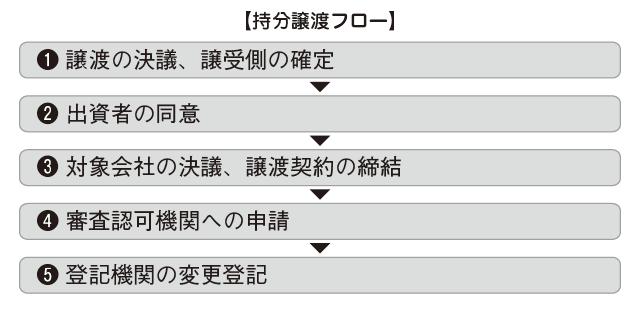

Procedure of assignment of equity

The flow for doing an equity transfer is as follows.

■ Resolution of assignment, finalization of assignee side ... ❶After calculating the transfer price and preparing the transfer agreement, we will resolve by the Board of Directors.

■ Consent of the investor ... ❷To do the equity transfer, the consent of other investors (Article 4 of the joint venture corporation law, Article 10 of the cooperative enterprise law, excluding foreign capital monetary fund) is necessary. Normally, in a joint venture or collaborative enterprise, when one party transfers an equity, the opponent often has the right to preferentially purchase the interest, so if a third party other than the joint venture / cooperative acquires the interest, It is necessary to prepare a document stating both the consent to the transfer of the other's equity and the waiver of the preferred purchase right.

■ Resolution of the target company, concluding a transfer agreement ... ❸In order for this resolution to change the Articles of Incorporation, consent of all attending veterans is required at the Board of Directors attended by more than two-thirds of the Tung. In the transfer agreement, the assignor and the assignee will summarize and conclude the terms of transfer of the equity (the amount, the timing of assignment, etc.) in the transfer agreement.

■ Application for Approval Approval Organization ... ❹We will apply to change the investor to the approval authority for the examination when the company is established. The approval decision will be made within 30 days after the application.

■ Registration Change Registration ... ❺Companies are required to change the approval certificate (certificate of approval) of a foreign-invested enterprise with an approval authority within 30 days from the day the approval authority approves the change of equity interest. If the Chinese side investor gets all the shares of the company, the approval institution must return the certificate of approval to the approval authority within 30 days from the day the approval authority approves the transfer of the equity and perform the cancellation procedure.The name of the investor is a matter described in the business permit, and it is mandatory to legally make a change registration when transferring the equity.Companies need to change the registration of foreign invested enterprises or return and return the registration certificate of foreign investment enterprises within 30 days from the date of cancellation, and change procedures of registration according to relevant provisions at Industrial & Commercial Administration Administration Bureau. -

Application documents

When transferring an equity interest, a foreign investment enterprise submits the following documents to an approval agency.

· Application form for equity transfer of equity participants· Joint venture · cooperation agreement, articles of incorporation and Board of Directors Resolution on the change· Company's authorization certificate and business license (copy)· Resolution of the Board of Directors concerning the transfer of the equity interest of the investor· List of members of the board of directors after the investor has transferred the equity interest· An agreement transfer agreement concluded by the assigning party and the transfer receiving side and signed by other investor or other written agreement· If the transfer destination is a foreign corporation, the certified credential document of the Chinese embassy or consulate of the country where it was notarized by the notary organization of the country of residence· Other documents required by the regulatory body

Foreign invested enterprises must submit the following documents to the approval agency when the Chinese side investor who has invested state-owned assets transfers the equity.

· Opinion of the branch department in charge of the investor concerning the Chinese-affiliated investor signing the equity transfer agreement· Asset valuation report of State-owned Assets Evaluation Organization issuing transfer rights· Confirmation of state-owned assets management department concerning issue of asset evaluation report -

Equity transfer agreement

The following matters are stated in the equity transfer agreement.

· Name and address of transferee, name of legal representative, duties, nationality· Transfer share amount and its price· Deadline and method of handover of equity· Rights and obligations of the transferee listed in the joint venture agreement and the articles of incorporation· Fraudulent liability· Applicable law, Dispute settlement method· The validity of the agreement · termination condition· Date and place of establishment of the contract

It is important to note that the equity transfer agreement, the joint venture / cooperation agreement and the consultation on change of the articles of incorporation will come into effect as from the day the change of the approval certificate of the foreign investment enterprise is approved. Only after obtaining approval the provisions of the changed contract and the articles of incorporation will be in force and related rights and obligations will arise. -

Transfer price etc.

There is no restriction on the transfer price when transferring the equity from the foreign investor side to other foreign investors. However, it is necessary for the asset valuation office registered in the state-owned assets management division to receive an evaluation of the equity transfer that changes the ownership ratio of the Chinese-affiliated investor holding state-owned assets and investing. As for the result of the evaluation, you must ask the state-owned assets management department to confirm. The evaluation result will be the basis for the transfer price of the equity interest.

-

-

-

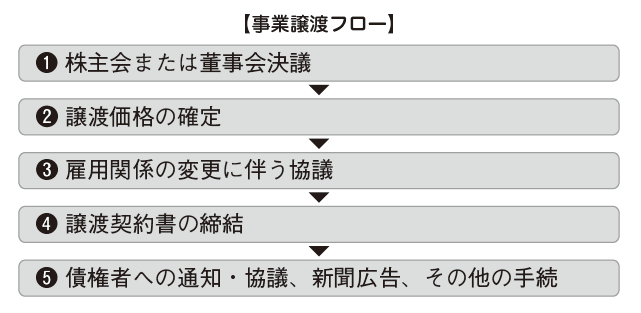

Business transfer

Business transfer means to transfer the business to another company while keeping the corporate status of the company as it is. In Japan, this method is used for business restructuring and other purposes, but in China there is no law clearly stipulating business transfer. Therefore, in general, it will be an individual assignment of company property.

■ Shareholders' Meeting or Board of Directors Resolution ... ❶As business transfer is an important decision-making matter of the company, we will make a resolution on the property to be transferred, the transfer partner and the transfer price at the shareholders' meeting or the board of directors, which is the supreme decision-making body.

■ Confirmation of transfer price ... ❷In order to determine the transfer price, in addition to financial due diligence and legal due diligence, risk assessment peculiar to the transferred business is carried out as necessary, and the price is confirmed after negotiations with the transferor / acquirer. If assets to be transferred include state-owned assets, valuation of state-owned assets is also required.

■ Consultations accompanied by changes in employment relations ... ❸When an employee becomes an employment relationship with a transferee company together with the transfer business, it is necessary for the employer to agree on consultation with employees, as the employer will be changed. We also need to negotiate the case of canceling employment contract with employees through business transfer and pay economic compensation with agreement. Especially when negotiations may be difficult to negotiate when contracts are canceled for employees who are not planned to be hired from both the assignment side and the transferee side, or when labor conditions such as work place and wages change You should be very careful.

■Conclusion of transfer agreement ... ❹We will conclude a contract with the assignor side and the assignee side with the property to be transferred and details thereof, the transfer date, the transfer price, the method of payment of the transferred amount, etc.

■ Notification / consultation to creditors · ❺If the transfer company owes a liability to a third party, in order to inherit this debt to the transfer company, it is necessary to obtain the consent of the creditor (contract law 84). In addition, regarding the succession of contracts that had been concluded with a third party, we will negotiate between the three parties as necessary and make a contract.

-

-

-

Dissolution · liquidation

Dissolution / liquidation is a method of withdrawing from a foreign-invested enterprise based on the Company Law and the Mitsui corporate law. Dissolution and liquidation of foreign invested enterprises can be classified into liquidation by administrative process and liquidation by judicial process. The liquidation procedure by the administrative process is further classified into ordinary liquidation procedure and special liquidation proceeding.Liquidation of foreign invested enterprises including joint venture companies is mainly applied by the Ministry of Commerce (Foreign Trade and Economic Cooperation) Foreign Investment Company Clearing Regulation Act. In addition, provisions relating to general rule of civil law, liquidation of civil procedure litigation law, etc. are also applicable. -

Reason for dissolution / liquidation

Under the Company Law and the Three-Capital Corporate Law, certain requirements are necessary in order to conduct dissolution and liquidation procedures. The process of liquidation / dissolution varies depending on each reason.

Liquidation by administrative processThere is liquidation by the administrative process as a normal clearing process. The reasons for liquidation in this process are as follows.

· When the cause of dissolution occurs in the articles of incorporation, joint venture agreement or cooperation agreement· Serious defects occurred enough to make management difficult to continue· If you suffer a serious loss due to natural majeure such as natural disasters or war, making it difficult for the business to survive· In cases where the management objective can not be achieved and there is no prospect of further development· It is difficult for the joint venture / cooperative company to survive the management due to a breach of the contract of the other party of the joint venture or cooperation· The shareholders' meeting resolved to dissolve· Company merger · When it is necessary to dissolve for corporate division

Liquidation by judicial processFor liquidating other than the administrative process, there is a method of getting a judgment ordering to dissolve by the People's Court (Court of China). In this process, the following items are listed as liquidation reasons.

· The company can not hold the shareholders' meeting or the general meeting of shareholders for more than two years, and a significant difficulty arises in the management of the company· In the vote by shareholders, it is impossible to reach the number of customers as stipulated by the court or the Articles of Incorporation of the Company, and it is not possible to make a resolution of the shareholders' meeting or shareholders meeting effective for two or more consecutive years, When it occurs· Company director conflicts over a long period of time and can not be solved by the shareholders 'meeting or general shareholders' meeting, and significant difficulties arise in management of the company· In the case of significant management difficulties arise, continuing the company to continue has a serious loss to the shareholders' interests

Shareholders who hold shares of foreign invested enterprises and more than 10% of shares if there is the above grounds can request the People's Court (Chinese court) to dissolve the company (Article 181 (5) of the Companies Act , Article 183). It is extremely difficult to prove the requirement of liquidation in this process and it is practically difficult to be recognized.

Reason for not requiring advance approvalFor the following reasons, prior approval is not required.

· Expiration of management period· The business license is canceled and the company is ordered to close or cancel the company -

Liquidation committee

Paragraph 2 (when resolving to dissolve at the shareholders 'meeting or shareholders' meeting), paragraph 4 ((1) of the Company Law, Article 181 (1) (when the term specified in the Articles of Incorporation expires or when other dissolution events specified in the Articles of Incorporation occur) When the cancellation of the business license, the closure order is accepted or abolished by the Act), when it is dissolved under the provision of paragraph 5 (when the People's Court is dissolved by a petition by a judicial process), from the day when the dissolution occurred Within 15 days, it is necessary to establish a clearing committee (liquidation group) and start liquidation (Article 184 of the same law).The contents are slightly different from ordinary payment and special payment.Foreign invested enterprises Either normal clearing procedure or special liquidation proceeding will be applied depending on whether the board of directors of the enterprise can organize the liquidation committee or there is a big trouble based on the liquidation regulation law of foreign enterprises.In cases where companies can organize their own clearing committee and liquidate themselves, they adopt ordinary liquidation procedures. On the other hand, if a company organizes a clearing committee itself and can not be liquidated, decision making institutions, investors, creditors, etc. of companies such as Board of Directors apply for special liquidation to the screening authority. This also applies to liquidation in accordance with the provision of ordinary liquidation, even if serious obstacles (such as companies being charged with serious legal liability) arise.

■ ordinary settlement procedureThe liquidation procedure of most enterprises is done by the normal liquidation method. Approval by the approval organization of the foreign invested enterprise is required. It is almost the same procedure as when the company was founded, but the submitted materials differ depending on the application reason (Article 181 (1) - (4) of the Companies Act).

★ china-7-4.png

The liquidation period is stipulated within 180 days by the Foreign Investment Corporation Clearing Department Act but can be extended by 90 days by obtaining approval from the Commerce Bureau etc. A company can not perform new business activities during the liquidation period. It will be invalid if you do the following acts in 180 days before the start of liquidation.

· Free transfer of property, low price transfer· Set up collateral· Debt prepayment· Waiver of debt

[Resolution of the Board of Directors] ... ❶It is necessary to make a resolution by unanimous vote of the attending director at the board meeting where Mr. Tung of more than two-thirds of the companies attended the liquidation.

[Establishment of the Clearing Committee] ... ❷Within 15 days from the commencement date of the liquidation, the Board of Directors must organize a clearing committee with three or more members. External experts can be included in the committee members of the Liquidation Committee. The settlement start date can be either the expiration date of the management period, the clearing authorization date of the approval period, the People's Court or the arbitration agency's decision date.

[Notice of liquidation to administrative agencies etc ...] ❸Within seven days from the commencement date of liquidation, we will notify the following organizations in writing the liquidation reason etc.

· Main department and review authority· Customs· Foreign Currency Administration Bureau, Account Opening Bank· Finance, tax agencies· Industry and Commerce Administration Administration Bureau

[Creditor Protection Procedure] ... ❹At the same time, the Clearing Committee shall notify the creditors known in writing within 10 days from the commencement date of liquidation, and at the same time, it must publish it through a nationwide paper and one newspaper in the province or the city Times public announcement). After that, at least 1 additional notice is required within 50 days.Within 30 days from the date of receipt of the notice, the creditor should notify the creditor to the liquidation committee within 90 days from the 1st announcement date, with the certificate on the claim attached I will declare it.

[Confirmation of receivables and finalization of payment order] ... ❺Credit determinationClaims notified by creditors shall be registered at the Liquidation Committee and assessed, after which the creditors will be informed of the assessment result in writing. If there is any objection to the assessment result, the obligee may request reassessment from the liquidation committee within 15 days from the date of acceptance of the written notice. If there is any objection to the result of the reassessment, arbitration and litigation can be filed within 15 days from the date of receipt of the written notice of the reassessment result.

Payment rankWhen liquidating, the order of payment of debt is as follows.

Secured claim· Clearing expenses (attorneys' fees etc. of liquid property management etc)· Labor Obligations · Taxes· Other general obligations

[Disposition of residual assets and liquidation report] ... ❻If there is residual assets, it will be distributed to the investor according to the investment ratio. After the liquidating work is completed, the Liquidation Committee prepares a liquidation report and notifies the following contents to the screening authority.

· Liquidation reason, duration, course· Processing result of credit obligation· Processing result of liquidation property

[Registration deletion procedure] ... ❼Within 10 days from the date of submitting the Clearing Report to the Approval Authorization Organization, the Clearing Committee will deal with the deletion of their respective registrations by tax authorities and customs. The Clearing Committee submits it to the Industrial and Commercial Administration Bureau with a certificate of report and tax authority, a certificate of deletion of customs deletion attached, within 10 days from the day of termination of the tax registration procedure. After completion of the deletion procedure, it is necessary to publish the end of the company with one national newspaper paper and one province of the province or city newspaper.

■ Special liquidation proceedingsIn cases where a company can not organize its own clearing committee and can not liquidate it or there is a serious obstacle to conducting ordinary liquidation, special liquidation proceedings can be conducted by obtaining approval from the Commerce Bureau etc. I will. The differences from the ordinary settlement procedure in this case are mainly the following two.

Liquidation committeeIn the special liquidation, a clearing committee is established, consisting of the audit authority or the delegated department of the investor, the representatives of related organizations and their related experts.For the Clearing Committee, one chief is appointed, the appraisal authority or the delegated department designates it. The head of the Liquidation Committee exercises the authority of the legal representative of the company during the special liquidation period and the liquidation committee exercises the authority of the power authority of the company. The Liquidating Committee will report the administrative processing concerning liquidation to the reviewing authority.

Protection of creditorsThe Clearing Committee can convene a meeting of the power authority of the enterprise and a creditor meeting and consider specific matters concerning liquidation.Establishment of a creditor conference is one of the features of special liquidation proceedings. All creditors become members of the creditor conference and have voting rights. The Clearing Committee must notify the creditors in writing by 15 days prior to holding the creditors meeting. A creditor who is unable to attend a creditor meeting must attend a proxy with a letter of attorney.The creditors meeting will:

· Certificate data on credits submitted by creditors and amounts of receivables, assessment of collateral status· Understand the debt repayment situation, submit opinions of creditors to the liquidation committee on liquidation plan and debt repayment situation

Regarding the liquidation method, in the case of ordinary liquidation, it is only a report to the approval authority, but special liquidation requires approval.

-

-

-

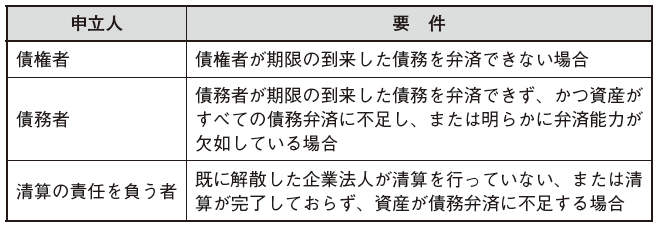

bankruptcy

The corporate bankruptcy law (hereinafter referred to as the bankruptcy law) came into force on 1st June 2007, and the traditional corporate bankruptcy law (trial) was abolished. Bankruptcy law is applied when organizations can not repay their due obligations and if they do not meet the obligations of all of the assets or obviously lack the ability to repay the obligation.In order to file a bankruptcy it is necessary to fulfill one of the following requirements (Article 2 of the same law).

-

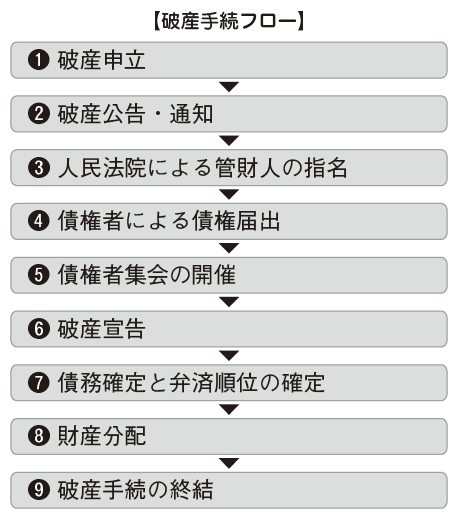

Bankruptcy proceeding

The bankruptcy proceedings are carried out as follows.

■ Bankruptcy petition ... ❶Bankruptcy claims can be made by creditors, obligors, and persons responsible for liquidation (bankruptcy law Article 7). The items to be filed for bankruptcy application are as follows.

· A petitioner, a respondent· Purpose of application· Fact and reason for the complaint· Other documents that the People's Court deems necessary

In the case where the obligor is claiming bankruptcy, in addition to the bankruptcy filing letter, the explanation on the property situation, the debt list, the receivable list, the related financial statement, the employee arrangement plan and payment of employee salary, the document on the payment status of social insurance premium It is necessary to submit.

■ Bankruptcy announcement · notification ... ❷When bankruptcy motion is accepted, within five days from the date of acceptance decision, notify the petitioner and appoint a trustee. The People's Court notifies and publicly notifies known creditors within 25 days from the date of acceptance decision.In the case of non-acceptance, within five days, notify the complainant to that effect and explain why it was not accepted.The debtor will file an opposition to the People's Court within seven days if the petition is meaningful and the People's Court will decide whether to accept it within ten days from the expiration date of the opposition proceeding period.If the obligor has no objection to the complaint or the obligor makes a claim for his own bankruptcy, the People's Court must decide whether to accept it within 15 days from the date of accepting the bankruptcy motion. If there is a special reason and it is necessary to extend the decision acceptance period, it can be extended to 15th by approval of the People's Court of the first grade (bankruptcy law Article 10).

■ Nominating a trustee by the People's Court ... ❸The trustee is nominated by the People's Court, but if the creditors meeting is dissatisfied with the creditors, you can ask the People's Court for the dismissal.A trustee can organize a clearing team according to personnel in the affiliated department (agency) and can be in charge of mediation by law firms, accountant offices, clearing offices, etc. The responsibilities of the trustee are responsible for the storage, arrangement, evaluation, disposal, and distribution of bankruptcy property, and necessary civic activities.

■ Report of claims by creditors ... ❹After the People's Court accepts the bankruptcy motion, we decide the creditor reporting agency of the creditor. The People's Court will decide the deadline of creditor notification of creditors in the range of 30 days to 3 months from the date of public notice.The obligee will submit the claim to the People's Court, in writing, within the due date of the claim report, explain the amount of the claim and the presence of collateral, and submit the related proof material. If there is no notification even after the deadline has expired, you can notify the additional claim until the final distribution of the bankruptcy property. However, we can not adjust the receivables already distributed.

■ Holding creditors meeting ... ❺The First Creditor Conference shall be convened by the People's Court and held within 15 days after the lapse of the period for notifying the claim. The first and subsequent meetings were held when the People's Court deemed it necessary, or when proposing holding of creditors meeting by creditors, obligee committee, creditors accounting for more than a quarter of total claims I will. Creditors' meeting will examine and resolve debt review, selection of trustee, processing and distribution method of supervising property, distribution plan or rehabilitation plan, settlement proposal etc etc. Resolutions of the creditors meeting are equally binding to all creditors.The creditor conference can establish a creditors' committee consisting of creditors representative and one obligor employee representative (or worker association representative) to supervise the obligor's property management, disposal, and distribution of bankruptcy property I will.

■ Bankruptcy Declaration ... ❻When the People's Court awards the bankruptcy declaration of the obligor under bankruptcy law, within five days from the date of ruling of bankruptcy declaration, an arbitrator is sent to the obligor and the trustee, and within 10 days to the known creditors Notice and public notice. After declaring bankruptcy of the obligor, the obligor is a bankruptor, the property of the obligor is bankrupt property, and the obligation to the obligor at the time of filing the bankruptcy claim is called bankruptcy claim.

■ Confirmation of debt and finalization of payment order ... ❼The property assignment submitted by the trustee is executed by the administrator after being debated and adopted by the creditors meeting and after ruling by the People's Court. The order of payment is as follows.

① secured debt② Bankruptcy expenses and public debt③ Labor Obligation④ taxes⑤ Other general bankruptcy obligations

■ Property distribution ... ❽The property assignment submitted by the trustee is executed by the administrator after being debated and adopted by the creditors meeting and after ruling by the People's Court.

■ Conclusion of bankruptcy proceedings ...In the event that the distribution of bankrupt property has been completed, the administrator shall submit a distribution report on bankruptcy property to the People's Court and file a petition for termination of bankruptcy proceedings. The People's Court awards whether or not the bankruptcy proceedings will be closed within 15 days from the date of receipt by the trustee of the petition for termination of bankruptcy proceedings. Within ten days after the conclusion of bankruptcy proceedings, the trustee will delete the registration at the original banking organization of the bankrupt. -

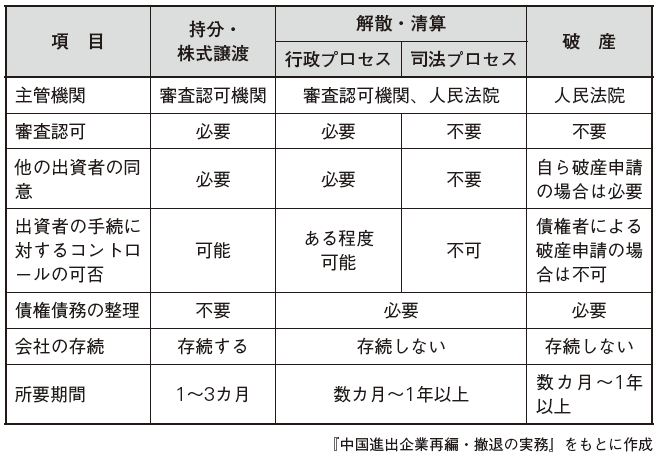

Comparison of each withdrawal method and points to keep in mind

For each method of withdrawal, its requirements and effects are compared, as shown in the following table (excluding business transfer because there is no legal provision).

When choosing a withdrawal scheme, it is necessary to select the most appropriate one taking comprehensive consideration of the company's governance situation and the cost to complete withdrawal.

Labor problems and conflicts between labor and management are examples of problems commonly occurring in each method when withdrawing. In order to achieve smooth withdrawal it is necessary to know how to solve.

■ Labor problemsIn withdrawal and business restructuring, it is necessary to reduce workers and make various adjustments. In China, we are taking measures to maintain workers' employment and secure employment opportunities, so there is the possibility of conflict of interests with workers themselves. When withdrawing, we must carefully deal with workers.

The system for reduction and organization of workers in China is as follows.

[Termination of labor contract]For fixed-term employment contractors, the contract will be terminated unless it is renewed at the end of the term (Article 14 of the Labor Contract Act). In this case, we need to notify the workers in writing that they will not be updated and obtain confirmation of acceptance. At this time, economic compensation must be paid according to the employee's years of service (Article 46 of the same law).With regard to indefinite employment contractors, labor under the agreement between the employer and the employeeYou can cancel the contract (Article 36 of the same law). Withdrawal usually requires payment of economic compensation as well as non-renewal of fixed term employment contract in order to offer cancellation from employer side.At the time of withdrawal, a preliminary announcement of thirty days ago as a case where "a serious change occurred in the objective situation of the enterprise assumed at the time of conclusion of labor contract, and the contract could not be executed" as stipulated in Article 40 of the Labor Contract Act You can cancel the labor contract by paying monthly wages. Even in this case, payment of economic compensation is required.

[Comprehensive personnel reduction]DismissalIf there is a significant change in the company's bankruptcy or the objective situation of the enterprise that was supposed at the time of entering into a labor contract, and the contract can not be executed, the employee or employee 30 days before the employee is dismissed I will listen to all the explanations and opinions, and report to the labor administration administration department in the jurisdiction. This will allow more than 20 employees or more than 10% of the employees to be dismissed (Article 41 (1) of the Labor Contract Act). Even in this case payment of economic compensation is necessary.

Dismissal · Dismissal due to liquidationWhen a company dissolves / liquidates, the labor contract between the company and the employee will also be terminated (Article 44 (1) (5) of the Labor Contract Act). In principle, notification is made to the approval institution and dissolution is realized when it is accepted, but in some cases it may be necessary to coordinate with the labor administration administration department of the jurisdiction concerning the handling of employees. In case of dismissal and dismissal due to liquidation, payment of economic compensation is required.

Other placement changeIn accordance with the withdrawal of a company, if it becomes necessary to change labor contracts due to change of worker's placement or transfer to another company in the group, you will be dismissed with an agreement with the employee. Since there are costs and risks such as stopping employment and dismissing, there are costs and risks such as economic compensation payment and developing labor dispute, so we need to consider the interest adjustment with employees in advance using such a method.

Temporary workers' termination of contractIn dispatching workers, workers are dispatched based on labor dispatch contracts between dispatched agencies (temporary staffing companies) and companies to be dispatched. When we withdraw the contract, we will process based on the contents of labor contract. There is no legal obligation for the dispatched company to pay economic compensation, but there is a possibility that troubles may arise due to the fact that workers do not understand that fact.It is necessary to confirm and consider beforehand about countermeasures to dispatch companies in preparation for trouble occurrence.

Dispute resolutionConflicts may arise with related parties in the arrangement of debts and obligations following the withdrawal of foreign companies and distribution of residual assets. Below, I will describe each system of lawsuit and arbitration concerning China's civil and commercial dispute.

[Civil litigation system]In China, we adopt the second trial system, and if one party disagrees with the hearing of the People's Court (court) under the jurisdiction, it will be the final judgment with the judgment of that advanced People's Court. Court of competent jurisdiction may be determined by agreement between the parties only in the first instance but unless the agreement is invalid unless certain conditions such as the place of address of the defendant and plaintiff, the place of execution of the contract, the place of signing the contract etc. are not met . If you do not declare the People's Court of the competent jurisdiction, the People's Court of the jurisdiction will judge in consideration of the seriousness of the case and the regional nature.Although it is also possible to request a retrial with an appeal of the second instance judgment, cases that are admitted are rare. Under such circumstances, there are cases in which the parties to the counterparty raise a trial with a malicious intent to a company that is liquidating, prolonging the completion of the liquidating procedure, such as appealing appeals and requests for retrial. It is important to resolve conflicts as quickly as possible and at low cost through mediation and arbitration system.

[Arbitration system]Regarding matters brought into civil litigation, mediation is called agreement between parties and settlement of disputes under the administration of the People's Court before the judgment comes down. This system does not have spiritual damage due to winning or losing, it also reduces cost and time. It is a case that is often seen in China to conclude litigation.

[Arbitration system]It is the arbitration that the parties concerned settle the dispute to the arbitration committee and resolve the dispute, not by the lawsuit in the People's Court. Regarding international arbitration, because both Japan and China are members of the New York Treaty established for foreign arbitration practices, arbitration institutions in any country can make arbitral awards. As the main arbitration institution, there are the China International Economic and Trade Arbitration Commission (CIETAC) and the Japan International Institute of Arbitration. Arbitration in China is based on the arbitration law. In the ordinary arbitration process, the arbitrator will be selected by the parties and hearings will be held. After that, judgment of dispute and expenses will be given.

-

-

-

Babiliography

[1] 劉新宇編著『中国進出企業再編・撤退の実務』商事法務、2012年

[2] トーマツ編『中国の投資・会計・税務Q&A〈第3版〉』中央経済社、2007年

[3] 遠藤誠・孫彦『中国ビジネス法務の基本がよ~くわかる本〈第2版〉』秀和システム、2012年

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya