Singapore

6 Chapter M&A

-

-

1 Chapter Importance of Management by Regional Headquarters

1.1 Importance of Asian market

1.2 Regional management of the Asian market

1.3 Comparison of countries as headquarters

2 Chapter Regional Headquarters System and Utilization Examples

3 Chapter How to Utilize Regional Headquarters

3.1 Method of Consolidating Profit by Dividend and Making it as Reinvestment Base

3.2 Utilization as a Finance Company (Loan Function)

3.3 Example of Utilization of Efficiency by Consolidating Settlement Functions

3.4 Example of Reviewing Supply Chain Functions and Risks

4 Chapter How to Make Regional Headquarters

4.1 How to Set Up a Regional Headquarters

4.2 Singapore as a Business Base

4.3 Corporate Law in Singapore

5 Chapter Overseas Relocation of Head Office Functions

5.1 Head office relocation to low tax rate country

6 Chapter M&A

6.1 Trends in M & A in Singapore

6.2 Points to keep in mind when doing M & A

6.3 Laws and regulations concerning M & A

6.7 Investment regulatory environment of Singapore

7 Chapter Accounting

7.1 Accounting System in Singapore

7.2 Accounting Standard in Singapore

7.3 Disclosure System in Singapore

7.4 Accounting Audit in Singapore

8 Chapter Tax Risk of Regional Headquarters

8.1 Tax · Haven Countermeasure Tax System

8.2 Foreign Subsidiary Dividend Income Non-inclusion System

8.5 Taxation of Country of Residence and Double Taxation by Source Taxation

8.6 Tenuous Capital Tax System

9 Chapter Tax

9.2 Personal income tax in Singapore

9.3 Corporate income tax in Singapore

9.6 Singapore withholding system

9.7 International tax in Singapore

10 Chapter Labor

10.1 Work environment in Singapore

10.3 Social Security System in Singapore

10.4 Points to keep in bringing Japanese to Singapore

11 Chapter Q&A

-

-

-

Trends in M & A in Singapore

Singapore has developed as the center of economic, logistics and finance in Southeast Asia. The movement of people, goods and money has become active as the center of the network with the Asian countries such as China, Thailand, Indonesia, etc. although the land area is small (almost the same area as Tokyo 23 wards).

In addition, some industries are subjected to the regulation of foreign capital inflow in order (foreign capital regulation) to seen in other Asian countries. This is because the Singaporean government encourages foreign enterprises to enter the country. Furthermore, since the corporate tax rate is 17%, depending on the type of industry, the reduced tax rate can be applied, so we can also save taxes. For these reasons, Singapore continues to draw attention as a location to establish a central base in Asia.

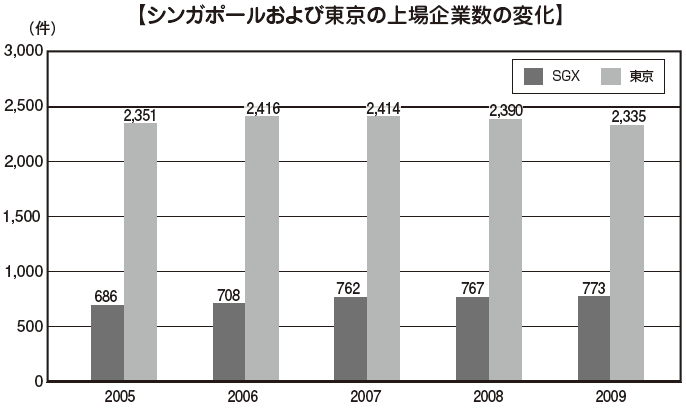

In Singapore, the listed market and the economic environment are more mature than other Asian countries. Therefore, in countries where business is based in Asian countries, there are increasing cases of listing shares in the Singapore Stock Exchange (SGX: Singapore Exchange) as a holding company or regional headquarters company in Singapore.

According to the Singapore Stock Exchange announcement, of the 770 listed companies as of October 2014, the number of foreign companies is about 300, accounting for about 40%. About half of foreign enterprises are occupied by Chinese enterprises, India and Southeast Asian countries are also listed, and the listing of these countries tends to increase in recent years.

.png)

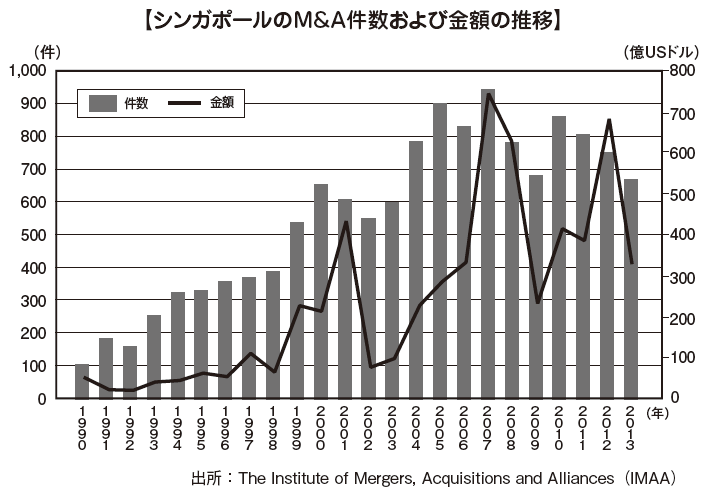

As you can see from the above figure, the number of listed companies is about three times of SGX on the Tokyo Stock Exchange, but it is decreasing year by year. On the other hand, the number of listed companies in Singapore has increased year by year. In other words, Singapore does not reach Tokyo in the size of the market size, but as the market growth rate is on an upward trend, a positive circulation that funds flow into the Singapore market and companies come from around the world for the purpose of financing it’s occurring. The following graph shows the trends in the number of M & A transactions published in Singapore during the period from 1990 to 2013. As mentioned earlier, the Singaporean government adopts a policy of actively taking in foreign capital, the motivation for foreign companies to invest in M & A is actively being carried out. For Japanese firms, it is also difficult for Japanese companies that the corporate tax rate in Singapore is lower than the corporate tax rate in Japan, the economic environment and public infrastructure are similar to Japan in comparison with other Southeast Asian countries it is a positive factor.

.png) ■ M & A cases of Japanese companiesThe number of acquisitions (In-Outs) by Asian companies by Japanese companies is 189 in 2012 and 202 in 2013, of which 7 M & A and S & M against Singapore are 15, respectively (according to Recoff).The following table is a case of M & A from Japan to Singapore held in 2012 and 2013

■ M & A cases of Japanese companiesThe number of acquisitions (In-Outs) by Asian companies by Japanese companies is 189 in 2012 and 202 in 2013, of which 7 M & A and S & M against Singapore are 15, respectively (according to Recoff).The following table is a case of M & A from Japan to Singapore held in 2012 and 2013.png)

.png)

-

-

-

Points to Keep in Mind when Doing M & A

■ Points to be noted in cross-border M & A

Cross-border M & A is not significantly different from domestic M & A. There are many common things in the mental attitude and points to keep in mind when proceeding with the project called M & A, the main difference being the technical part. Below are the main points to note.

Success at M & A does not mean that the procedure has progressed smoothly. It tends to make M & A itself self-purpose, but this is just one process. After the procedure, the aim is to increase the performance of the acquired company and bring synergies as expected to the group of acquiring companies.

For that reason, we must clarify the goals to be achieved by M & A from the beginning.

(For example, do you want to improve efficiency to build a sales network in that country? you want to acquire a company that has already been approved locally to obtain licenses, a low cost It is necessary to clarify the point that we want to make it as a manufacturing base that can be produced at.) Also, it is good to grasp the expected synergies quantitatively.

In other words, it is necessary to reduce the risk and cost by considering the structure of the most effective acquisition and concluding an appropriate acquisition contract. In addition, it is necessary to steadily implement integrated process and management (PMI: Post Merger Integration) to acquire synergies after M & A initially planned, and realize the business value assumed before acquisition.

■ Risks different from M & A in Japan

The differences from domestic M & A are as follows;

[Difference between Japan, Singapore and Hong Kong's legal system, tax system, accounting standard]

Because it is based on a different legal system, tax system, accounting standards from Japan, we need to consider them in order to proceed. It becomes a constraint to conclude the acquisition structure and contract, as well as the business activities and PMI after the acquisition.

[Longer negotiation time]

Compared to Japan, there are many cases in which it takes more time than anticipated until M & A contract is concluded. Regardless of the details of the negotiations, we should not be able to draw concessions of the negotiating partner quite easily, and we should consider that it will take a considerable amount of time to solve.

[Difficult negotiation]

In the case of acquisitions negotiations, in many cases the Japanese side is in charge of the Japanese side, whereas in many cases the top company, the lawyer, the accountant are the parties, and for the Japanese side to be forced to hard-negotiate You'd better put it.

[Invisible internal information]

Often we do not provide internal information until we sign a legally binding item such as an acquisition agreement and there is a great gap from Japanese practice.

[Ambiguous transfer pricing policy]

An appropriate transfer pricing policy is not set for the acquired company and there is a risk pointed out in the tax investigation.

[Correspondence to psychological resistance]

Because there is a case that there is a psychological resistance to the fact that there is a gap between social and cultural backgrounds and that they are acquired by foreign companies, there is a risk that special response to establishment of employees is necessary, Yes.

[Fund procurement after difficult acquisitions]

Because loan practices and regulations are different from Japan, we cannot think of fund procurement means in the same row as Japan. If funds are needed after acquisition, it would be better to set up countermeasures in advance.

[Low transparency]

It is difficult to obtain information on M & A, and it may be difficult for information to be gathered. It would also be better to think that the level of quality and transparency in financial statements is lower than in Japan.

[Business evaluation, difficulty in corporate evaluation]

As for the method of corporate valuation, it is often difficult to evaluate the business value by the discounted cash flow (DCF) method, as the quality of the business plan that the company creates is often low. In addition, there are constraints that corporate evaluation using the market approach also has limited similar company information because public information is limited.

[Market value evaluation of assets is difficult]

There are idle assets and inefficient assets as assets owned by the acquisition target, real estate with restrictions on assets with unknown ownership or land use rights restrictions, and it is difficult to evaluate the market value of assets. There are cases;

-

-

-

Laws and regulations concerning M & A

Singapore's M & A laws and regulations include the following four:.png)

-

Investment Regulation

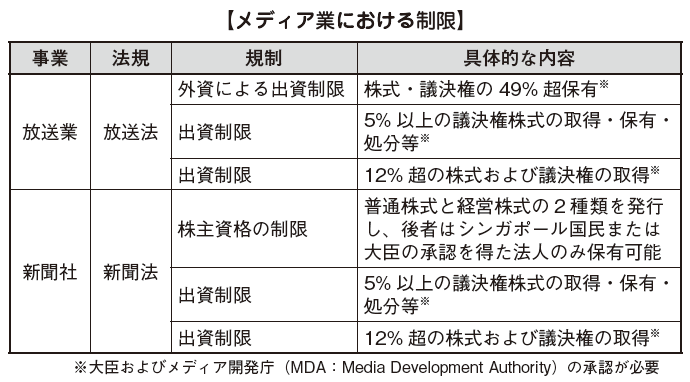

■ Media industry

In broadcasting and newspapers, restrictions on capital contribution by foreign capital and the appointment of foreign director are restricted. Regardless of domestic or overseas, prior approval is required when acquiring, holding or disposing of shares or voting rights exceeding a certain shareholding ratio.

.png)

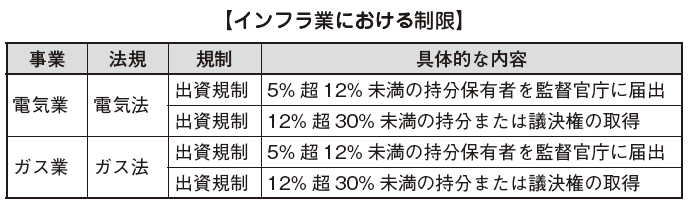

■ Infrastructure industryElectricity business and gas business do not limit the entry of foreign capital by law. However, the current situation that there is only one company in charge of transmission and distribution in Singapore is a barrier to entry of foreign capital..png)

-

Company Law

The Company Law has provisions of "business transfer", "issue of new shares" and "merger".

There is also an M & A method called "Scheme of Arrangement" as a system similar to organizational restructuring. For each M & A method, the Company Law has established separate regulations.

Business transfer

Business transfer is the transfer of assets and liabilities which are organized for a certain project purpose and have the function of organic unity. It is concluded between the transfer company that transfers business and the transfer company to which the business is transferred.

Under the Corporate Law, when practically transferring all property or business as a regulation on the side that transfers the business, the director cannot dispose of all property and business unless approval of the general meeting of shareholders (Companies Act 160 Article).

Issuance of new shares

Issuing new shares is to issue additional shares of the same type as those already issued. For the capital increase through the issuance of new shares, there is a third party allocation paid-in capital increase and a shareholder allotment increase.

Third Party Allotment, The capital increase is to acquire new shares to be issued by the target company in order to deliver new shares to certain companies. This will enable us to acquire a majority of the voting rights of the general shareholders' meeting, make the target company a subsidiary, and control its management rights.

The legal process of issuing new shares is different in Japan and Singapore. In Singapore, a general resolution of the general shareholders' meeting in principle is necessary. This ordinary resolution does not need to individually resolve specific stock issue but it is to be accepted in a comprehensive manner with respect to future issue of new shares (Article 161 (1) · 2 of the Companies Act ). The validity of this approval will be until the conclusion of the first ordinary general meeting of shareholders to be held after the general meeting of shareholders to which the resolution was made (Article 161 (3)).

Meanwhile, in Japan, it is necessary for a public company to issue a resolution of the Board of Directors (Article 201, Paragraph 1 of the Japanese Company Law) and a special resolution of the General Meeting of Shareholders in a private company (Article 199 2, 309 2.

In addition to the above-mentioned resolution requirements, the following points to be noted are in the issue of new shares in Singapore (in particular, issue of new shares based on comprehensive approval).

· Prohibition of issuance to major shareholders

· Third Party Allotment Maximum Number of Issued by Capital Increase

· Lower limit of the amount of consideration

· If the percentage of voting rights held is equal or greater than a certain level, a mandatory tender offer

[Major shareholder etc.]

Major shareholders etc., is not defined in the SGX Listing Regulations and subjected to the definition of the Company Law.

A major shareholder is a shareholder who owns, directly or indirectly, 5% or more of the voting rights of the number of shares issued, excluding treasury shares (Articles 7 and 81 of the Companies Act).

Major shareholders and the like mean direct or indirect ownership of 10% or more directly, indirectly by major shareholders, affiliated companies and affiliates such as the immediate family members of the directors, major shareholders and directors, parent companies and subsidiaries of major shareholders, directors and major shareholders Company (s) to be held (SGX Listing Rule 813).

Points to be noted about issuing new shares are stipulated by laws other than the Company Law, so we will explain them in the "Securities Futures Law" (see page 374).

Merger

Merger means that two or more companies are integrated into one company under a contract. In Singapore’s Corporate Law, absorption - merger and construction - merger are possible in the same way as Japan. Furthermore, since it is possible to transfer only part of the asset liability, it can be said that it includes the corporate separation system in Japan.

In the case of merger in Singapore, there are mergers requiring court approval and mergers requiring no court approval pursuant to the provisions of the Companies Act.

[Merger requiring court's approval (Singapore Companies Act 210, 212)]

When conducting absorption merger or consolidation merger in Japan, the Japanese Corporate Law calls for resolutions at the general shareholders' meeting, the right to demand share purchase by the opposing shareholders, and notification to the creditors. However, in Singapore, courts may need to be approved depending on who owns the initiative of proceedings with the same merger M & A (for details, see P.370 "Scheme of Arrangement").

[Merger where court approval becomes unnecessary]

There are mergers and abbreviated mergers in the merger where the approval of the court becomes unnecessary, and it is the same system as in Japan. Procedures necessary for such merger and summary merger are stipulated in Article 215 of the Companies Act A to J (Article 215 A of the Companies Act). Below we will see the flow of the merger procedure..png)

Making a merger proposal ... ❶

A merger agreement is concluded and a merger proposal is created based on that contract. Describe the merger agreement such as the address and the number of shareholders of the company to be merged, the trade name after the merger, the address, the handling of shareholders of the expiring company, especially the consideration for acquisition, in the merger proposal (Article 215 B of the Companies Act).

Notice to shareholders and creditors ... ❷

At the time of the merger, a general meeting of shareholders will resolve on the merger. In doing so, we will send copies of the merger proposal and copy of the director's declaration, etc. to the shareholders 21 days before holding the general meeting of shareholders concerning the merger so that the shareholders can judge appropriately.

Copies of the merger proposal will also be sent to the creditors of the companies involved in the merger (Article 215 C (4) (5) (a) of the Companies Act).

Public notice by daily newspaper... ❸

❷ Notify shareholders and creditors individually on merger by ❷ but further notify the company stakeholders. Therefore, we will publish information on the merger to the English daily newspaper published in Singapore by at least one paper, 21 days before the shareholders meeting concerning the merger. This announcement is intended to disclose company information, and you can view and copy the merger proposal within the company's business hours at the company's registration office and other place described in the public notice (Company Law 215 Article C (5) (b)).

Creation of payment capacity certificate of each merging company ... ❹

The directors (board of directors) of each merging company will prepare payment capacity certificates for each merging company and the surviving company after the merger (Article 215 C (2) (b) (c) of the Companies Act).

Shareholders meeting resolution accompanying the merger ... ❺

As a rule, approval by a special resolution of the general meeting of shareholders is required when merging. In addition, conditions may be attached that require approval by a third party when making a merger proposal. In this case, it is necessary to obtain approval by a third party at the same timing as the special resolution (Article 215 C (1) (2) of the Companies Act).

Regardless of the ordinary resolution or special resolution, the quorum requires attendance by two or more shareholders (Article 179 (1) (a)) as a resolution to resolve the special resolutions in Singapore under the Corporate Law of Singapore. A special resolution will be passed by approval of more than three quarters of the shareholders who participated in the resolution (Article 184 (1) (4) (5) ⑥).

Merger registration and notification ... ❻

After completing the procedure from ❶ to ❺, the created documents are registered in the Accounting and Corporate Regulatory Authority (ACRA). As a result, registration of the merger is completed, then a merger notice and a merger confirmation certificate will be issued from ACRA.

Regarding merger, if opposition of shareholder or creditor is in the court, the court prohibits the effect of the merger, changes the merger proposal, all the proposals for merger to the directors (board of directors) of the merging companies Or you can order to reconsider part (Company Law 215 E - G).

[Schematic Merger]

An abbreviated merger is a merger that can greatly simplify the requirements stipulated by the statutory when conducting the above-mentioned merger procedure in a merger agreement that meets certain requirements (Article 215 D). In order to be recognized as a summary merger, one of the following requirements must be satisfied.

· Merger of parent company and wholly owned subsidiary (provided, however, only when parent company becomes surviving company)

· Merger of wholly owned subsidiaries

In the event that it is judged to be a summary merger, the procedures for the above ❶ to ❻ are simplified as follows.

· Merger proposal need not be prepared

· A special resolution at the general meeting of shareholders is required at the time of the merger, but it is unnecessary if the contents stipulated in Article 215 D of the Company Law are stipulated in the articles of incorporation

· No need to prepare payment ability certificate

· No publication notice on newspaper

As mentioned above, it is uncomplicated than the ordinary merger procedure. This will be a provision to mitigate some regulations for the protection of shareholders and creditors of a merger-missing company in the ordinary merger, taking into consideration the situation that the surviving company controls the general shareholders' meeting of the merger dissolution company.

In Japan, if the parent company owns more than 90% of the voting rights, it is possible to reorganize the abbreviated organization (abbreviated merger etc.). We need to be aware of the differences in legal restrictions on short-form organization restructuring between Japan and Singapore.

■ Scheme of Arrangement

Scheme of arrangement is the organizational restructuring method used for various purposes and uses, such as corporate restructuring, interest adjustment with creditors and investors, merger or restructuring of group companies. Scheme of arrangement is used more often in Singapore than merger, but there are basic provisions in Article 210 of the Corporate Law, details are not stipulated under the Corporate Law.

In order to conduct the scheme of arrangement, the following procedures are carried out (Article 210, paragraph 3 of the Companies Act).

① Acquired companies shall file a creditors meeting by a creditor (whole or part) of a corporation or a general shareholders meeting by shareholders (in whole or in part) at a court in Singapore.

② Acquired companies will explain the acquisition scheme at creditors meeting or general shareholders meeting.

③ At the meeting of creditors and shareholders meeting, approval is passed with approval of over 75% of voting rights.

④ When the court approves and a copy of the approval is submitted to the Regulatory Authority of the Accounting Company, the legal effect of the acquisition scheme arises.

The scheme of arrangement is applicable only to companies established in Singapore, but there are clearly differences from other acquisition schemes. That is, the acquirer itself conducts procedures. If an acquiring company takes the initiative, even if M & A is established or not, there is a possibility that mutual relationships will collapse. However, in the case of a scheme of arrangement, it is not established unless the acquirer initiates the acquisition process led by the acquirer and the relationship between the acquiring parties is not friendly.

In addition, when Singaporean foreign enterprises acquire domestic companies in Singapore through a scheme of arrangement, it is practically assumed that the shares of the acquirers are issued if the shares of the foreign companies are not listed in Singapore not. This is because the stock of foreign companies is considered to be illiquid and the scheme of arrangement is likely to fail.

■ Right to sell shares

The right to sell shares is a system whereby acquirers forcibly purchase shares from minority shareholders after the acquisition of shares. Within (4) four months from the start of the acquisition, this system is expected to be acquired from holders of 90% or more of the target company's stock (excluding the shares owned by the acquirer and own shares at the start of acquisition) It is an application requirement to be approved to acquire shares and to notify the shareholders who oppose the acquisition within two months thereafter.

In the case of exercising the right to request the sale of shares, in principle, the acquirer must acquire the shares of the opposite shareholder (including the price) on the same conditions as those already acquired. In addition, the opposing shareholders may request the court to sell the shares to the court within one month from the day when the notice of exercise of the share sold right is received, or within 14 days from the acquisition of the list of opposed shareholders whichever is the longer It is permitted to file an objection to the exercise of the claim (Article 215 (1) of the Companies Act). Upon receiving notification of the exercise of the right to sell shares, the opposing shareholder may request the acquirer in writing to disclose the list of other opposing shareholders for a period of one month from the date of notification (The acquirer cannot exercise the right to request the sale of shares for 14 days from the sending of such a list.) In this case, it is left to the judgment of the court to decide whether to exercise the stock sale right.

The acquirer, "one month after the notice of the exercise of the stock solicitation has been made", "After 14 days from the dissenting shareholders obtaining the list of the opposing shareholders" "If the opposition to the court is ongoing Will send a copy of the notice of the exercise of the right to sell shares to the target company together with the certificate of transfer concluded with the person representing the opposite shareholder and the acquirer after the complaint procedure has been completed ". After sending, we will pay the target company. The consideration of the shares to be acquired by exercising the share sale right.

■ Squeeze Out

Under the Corporate Law of Singapore, if there is approval of 90% or more in the resolution of the general meeting of shareholders, it is possible to request the sale of shares owned by minority shareholders. However, in order to use this provision, you must set your own ownership ratio (ratio of voting rights) to 90% or more.

As a method of acquiring shares, there is acquisition by mandatory tender offer or acquisition by optional tender offer. The mandatory tender offer can only apply the condition that the acquirer applies for the number of shares holding more than 50% of the voting rights and it is impossible to acquire shares of 90% or more. On the other hand, in the case of voluntary tender offer, the lower limit of the number of applications is clearly stated in the purchase document, and the acquirer raises the lower limit of the number of applications by obtaining approval of the Securities Industry Association (SIC: Securities Industry Council) It is supposed to be able to do. By doing this, it is possible to set the lower limit of the number of entries to 90% or more.

■ Tender offer for shares in consideration of treasury shares

A public tender offer (TOB: hereinafter referred to as the own stock TOB) with treasury stock is a consideration that can be conducted in Japan and Singapore. However, in order to make our own stock TOB successful in Singapore, our stocks are required to be liquid, so it is a prerequisite that we are listed on the Singapore Stock Exchange.

■ Article 76 of the Companies Act of Singapore

In Singapore's Corporate Law, acquisition of parent company's stock is prohibited. Therefore, unlike Japan which is permitted to acquire when merging a parent company's shares for consideration, it is not possible to make a triangular merger. -

Securities Futures Law

Under the Securities Futures Law, there is provision for insider trading. Under the law, the Singapore Acquisition and Merger Agreement (Singapore Code on Take-overs and Mergers: hereinafter) and the Singapore Securities Market Listing Regulation (Singapore Exchange Securities Trading Limited Listing Manual: hereinafter referred to as SGX Listing Regulations) were promulgated It is.

The acquisition agreement entered into force pursuant to Section 321 of the Securities Futures Act by the Singapore Financial Management Authority. There is no legal effect and it is not applied to private companies. General principles and procedures for acquiring listed companies, etc. are stipulated.

This agreement applies in the following cases;

(A) In the case of acquiring a company listed in Singapore (including a company established in a foreign country)

(B) In the case of acquiring corporate control of a company with more than 50 shareholders and a net asset of more than 5 million S dollars, established in Singapore

The SGX Listing Rules regulate disclosure obligations of listed companies and necessary procedures for acquisition.

■ Insider trading regulation

Insider trading is strictly regulated in the Financial Instruments and Exchange Act, even in Japan. The regulations of insider trading in Singapore are as follows.

If the acquirer of shares possesses the stock price effect information of the target company and recognizes it as the stock price influence information, until the time when it is announced or the information is no longer stock price influence information, it is not possible to conduct target company stock trading (Securities Futures Act, 218 and 219). Stock price influence information is information that is not generally available, such as "unproven negotiated item" and if it is publicly announced it is information that has a serious effect on stock price (Article 218 (1) (b), 219 (1) (b)).

The information subject to insider trading restrictions is listed in the Securities Futures Law, but it is only an example enumeration (Article 214 Information).

Therefore, whether or not specific information is subject to regulation is virtually judged according to the criteria of whether or not it affects the stock price.

■ Acquisition terms

Acquisition terms are created by the Singapore Monetary Authority of Singapore (MAS) under the Securities Futures Act.

This provision establishes general principles and procedures, etc. when acquiring control of a company listed on SGX (including foreign companies). (e.g.; if a tender offer is made, this provision will be applied.)

[Compulsory Tender Offer] (Article 14 of the Takeover Agreement)

When acquiring the shares of listed companies in Singapore and acquiring more than a certain number of voting rights, the acquirer and the joint holders must make a tender offer.

Specifically, there are the following two provisions;

(A) If the acquirer acquires more than 30% of the voting rights of the acquired company, together with the shares owned or acquired by the co-owner (Article 14 (1) (a) of the acquisition agreement)

(B) If the acquirer and co-owner hold 30% or more and 50% or less of the voting rights of the acquired company and acquire more than 1% of the voting rights within the six-month period Article 14 (2) (b))

In principle, the mandatory tender offer must be accompanied by the conditions that the acquirer and the joint holders have accepted entries of shares that can hold more than 50% of the voting rights. Moreover, it is not possible to attach other conditions (Article 14 (2) (a)).

Consideration due to the mandatory tender offer is cash only, or cash and non-cash assets. In addition, the purchase price must be a price equal to or higher than the highest price of the price paid by the acquirer or joint holder during the six months immediately before the start of the tender offer (Article 14 (3)).

[Optional Tender Offer] (Article 15 of the Takeover Agreement)

In the absence of mandatory tender offer, the acquirer may voluntarily make a tender offer. This is referred to as Optional Tender Offer, as in the case of a compulsory tender offer, provided that the acquirer and the joint holders also accept the entry of the number of shares that can possess more than 50% of the voting rights it must be. Under the following conditions, you can raise the lower limit "50%" of the number of applications. (Article 15 paragraph 1 of the acquisition agreement)

· The upper limit of the number of entries is explicitly stated in the TOB document

· The acquirer sets a high limit on the basis of acts with good faith and obtains a certain evaluation from the Singapore Securities Business Council about that

In publishing the Tender Offer, the acquirer must disclose matters stipulated in Article 3, paragraph 5 of the acquisition agreement.

Specifically, it becomes the following matters;

· Conditions of the tender offer

· The most important controlling shareholder of the acquirer and acquirer

· Securities subject to the Tender Offer, details of securities that can be converted into target securities

· The details of the securities for which the following conditions (a) to (c) are agreed with in the option on the right to undertake the securities subject to the Tender Offer or such securities

(A) It is owned or controlled by the acquirer.

(B) It is held or controlled by the acquirer's joint holder.

(C) Apply for an acquirer or co-owner.

· All conditions attached to the tender offer

· Details of agreement on shares of purchasers or target companies that have a significant influence on the tender offer

· In the event that all or part of the consideration for the tender offer is cash, even if an application is made from all shareholders for a public tender by a financial advisor or a third party, the acquirer may ability to procure.

There are several practical practices when making a tender offer in Singapore. For example, in the case of friendly acquisitions, the acquirer and the target company (target) will jointly disclose the tender offer and the documents to the shareholders. Also, since the financial advisor will make a tender offer on behalf of the acquirer, documents will also be created and announced by the financial advisor as the agent's representative.

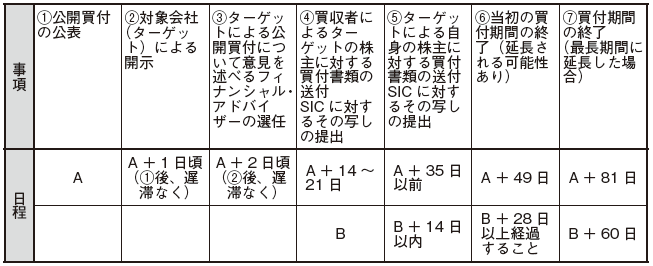

[Timetable] (Terms of acquisition 22 Article)

The following table shows the schedule of the tender offer in Singapore.

Send an offer document (public notice of public tender offer)

As a general rule, you must send an offer document within 14 to 21 days from the date you announced the offer. Also, the date of the offer document must be within 3 days of the sending date. If it cannot be sent within this period, the buyer must consult with the Securities Dealers Association (SIC) in advance.

Sending of the board of directors' circle of the acquisition target company

The board of directors must notify the company's shareholders the view on the offer within 14 days after the offer document has been sent.

Initial signing date

Offer must be released for a minimum of 28 days from the date the offer document was sent..png)

Determination of the next date of signing

When announcing the extension of the offer, we must decide the next date of signing. Also, if an offer is unconditionally accepted, you must express that the offer is still open until the next contact. In this case, for shareholders who do not accept offer, we must send a letter informing of the closing at least 14 days before the offer ends.

Exemption from extension obligation

Offers is not accepted on the first and subsequent offer signing dates and also, not obligated to extend it after that.

Offer disclosure after unconditional acceptance

After unconditional receipt of the offer, you need to publish the offer for at least 14 days. If the Offer Applicant notifies the shareholders in writing, the offer is to be completed before 14 days or earlier from the end date, before the offer is made or before unconditional acceptance, that rule will not apply. However, if there is competition, the written notice of the offer end will not take effect. This rule also applies before sending an offer document unless the applicant states that it will not extend beyond the initial end date to the offer document.

Prohibition of extension

If a document containing a statement on the end date is sent to shareholders of the acquisition target company, the applicant cannot extend the end date thereafter.

Publication by targeted companies

Directors of the acquire company must not disclose the results of the project, estimated dividends, asset value and major transactions for 39 days after the first offer document has been sent.

Last day rule

You cannot unconditionally accept offers after 5:30 pm on the 60th day after sending the offer document. However, if you get permission from the Securities Dealers Association, you can extend the 60 day period.

Time to satisfy other conditions

Except when there is permission from the Securities Dealers Association, the above-mentioned conditions must be satisfied. Offers must be completed within 21 days from the first closing date, or on the unconditional acceptance date, by the final day.

■ SGX Listing Rules

The SGX Listing Rules are rules created by SGX with the approval of the Singapore FSA under the Securities Futures Act and mainly stipulate disclosure obligations of listed companies and necessary procedures in acquisitions. (e.g.; there are the following provisions, which are points to keep in mind when issuing new shares.)

· Issuance of major shareholders, etc. for issue of new shares based on comprehensive approval is impossible (SGX Listing Rule Article 812 (1), 2).

· The maximum number of shares to be issued by third-party allocation, specifically, the total number of issued shares will be up to 20% (Article 806 (2)).

· At the lower limit of the price of consideration, specifically at the date of signing the principle underwriting agreement

It cannot be less than 10% lower than the weighted average of the stock prices of target companies traded on SGX (Article 811 (1)). -

Competition Law

The competition law (Competition Act) enacted in October 2004 in Singapore it is equivalent to Japan's antitrust law. The competition law committee (CCS: Competition Commission of Singapore) is responsible for enforcing the competition law. This Competition Law is designed to make the market function efficiently, strengthen the competitiveness of the Singaporean economy, protect consumers, and also includes provisions on M & A.

There are regulations on M & A after the Competition Law Article 54 and regulate M & A that will destabilize the balance of the Singapore market and markedly deteriorate market competitiveness.

When doing M & A, first self-evaluate. The acquirer makes a self-assessment based on the relevant rules of CCS Guidelines on Substantive Assessment of Mergers and CCS Guidelines on Market Definition issued by CCS, We will judge whether M & A violates competition law.

As a result, if the acquirer judges that there is a possibility of a violation of the competition law, the acquirer will ask the CCS whether the M & A is M & A that will significantly reduce the market competitiveness of the M & A (Competition Laws 57, 58). This is called a preliminary consultation procedure. Advance consultation is voluntary, so if you decide that there is no possibility of violation of the competition law at the stage of self-assessment, or it is judged to be infinitely low, the acquirer cannot give advice beforehand.

However, if there is a violation of the competition law without prior consultation procedures, there are the following sanctions from CCS.

· Cancellation of acquisition

· In case of intentional or negligence by a violating party, payment of a surcharge up to 10% of the highest sales figure of the violating party during the past three years (Competition law Article 69)

■ Prior consultation review

In the event of receiving prior consultation from the acquiring party, we will receive a primary review. The purpose of this primary review is to judge whether the concerned M & A is concerned about violation of competition law, because the examination at this point is only simple one, CCS aims to complete the review by 30 business days after the application.

If there is no fear of violation of the competition law as a result of the primary review, subsequent procedures will be omitted. However, it can’t be said that there is no fear of violation of the competition law, we will proceed to the secondary review.

In the secondary screening, we will review more detailed content, whether it violates the competition law. This secondary examination is the final examination, and we will evaluate the illegality of the M & A by reviewing the specified items in detail. -

Local Accounting Standard (International Accounting Standard Convergence)

In Singapore, we adopt our own accounting standard (FRS: Financial Reporting Standards). The major differences between FRS and International Financial Reporting Standards (IFRS) are: (1) Agreements for the Construction of Real Estate (IFRIC 15) and (2) interests of partners and similar financial instruments (IFRIC 2: Members' Shares in Co-operative Entities and Similar Instruments). Neither is a criterion directly related to M & A execution. Consequently, the accounting for M & A transactions will be in compliance with IFRS (IFRS 3 "Business Combinations", IFRS 11 "Jointly Controlled Arrangements", IAS 28 "Investments in Associates and Jointly-controlled Companies").

We also aimed for full convergence of accounting standards adopted by companies listed in our own country to IFRS by 2012, but it has not been implemented as of 2014, and in 2018 it is fully converged to listed companies It is scheduled to complete.

-

-

-

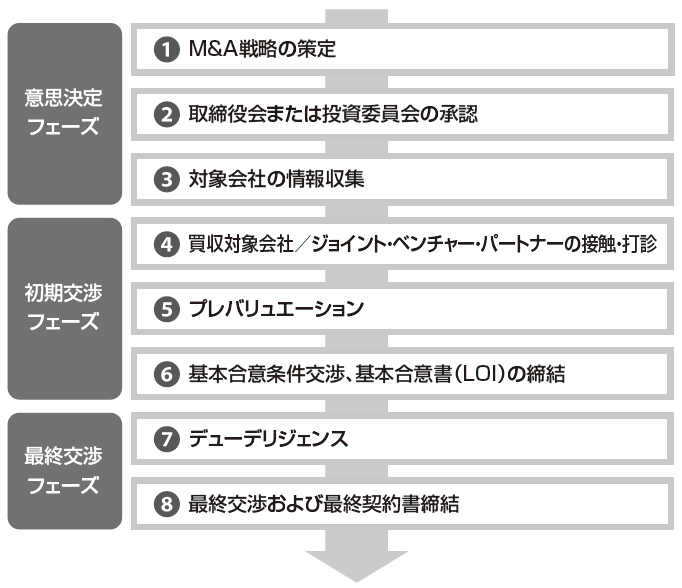

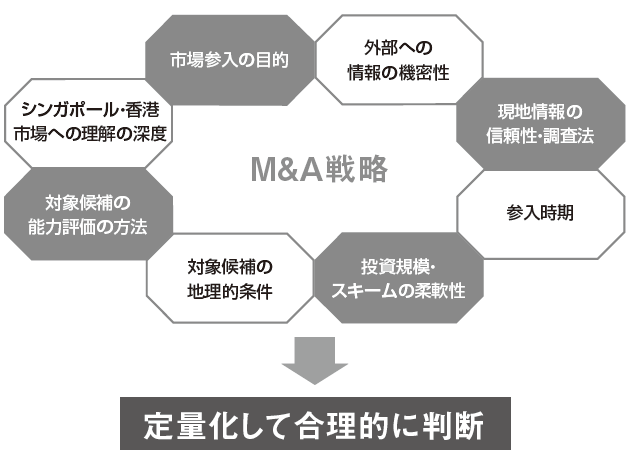

M&A Process

At the stage of M & A implementation, we need to take the above mentioned requirements into full consideration and work as quickly as possible. The basic process is not much different from the domestic process, but as a result of requiring a lot of time to make decisions, there are cases in which conditions are forced to be reviewed due to changes in economic situation. In this chapter, please examine the execution process of M & A and use it as reference for time schedule development. ■ Decision-making phase[Formulation of M & A strategy] ... ①In the decision-making process of entry into the new market by top management, we need to consider the following points and to make it concrete.

■ Decision-making phase[Formulation of M & A strategy] ... ①In the decision-making process of entry into the new market by top management, we need to consider the following points and to make it concrete.

At this stage, objectives and evaluations are likely to be qualitative and tend to obstruct information sharing among stakeholders. When a discrepancy arises in understanding the information of each person, unnecessary conflicts occur in the company and it is forced to reconsider the time schedule drastically, so we need to make efforts to quantify as much as possible and enable reasonable judgment Become.

Also from the viewpoint of confidentiality of information, it is also a matter of using external advisors from the feasibility study stage to manage information.

[Approval of Board of Directors or Investment Committee] ... ②

Top management will approve the investment amount and timing suitable for the purpose of entering its market by receiving reports from overseas project manager, project member and external advisor. In this case, depending on whether it is aggressive or follow-up, the conditions vary widely, but shareholders also share the evaluation method of withdrawal ability and withdrawal conditions.

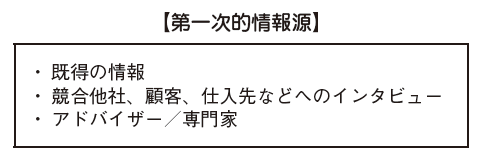

[Collection of target company information] ... ③

Under the approval of top management, the person in charge enters the stage to acquire the information of the acquisition company / joint venture partner candidate according to the M & A strategy using a wide range of information sources. In Europe and the United States where the economic environment is generally matured, lists of industry associations and administrations etc. are already published in many cases, but in Singapore and Hong Kong, it is necessary to collect information on their own company. In addition, because the movement of the economic environment is fast, it is difficult to judge existing information as an example. In particular, in the industry in the early period, it may happen that you cannot create a long list that covers a wide range of subjects, so you do not become too nervous about the information accuracy of the list itself, you need to go into a certain refinement under division there is. In this way, a short list focusing on a few target companies will be created, but based on this, we will be hitting the collection of local information. In this case, it is necessary to secure personnel who are proficient in English, Chinese, and Cantonese for acquiring primary information, but we also invest in the necessary cost of the person in charge going to the site and getting backed up.

Meanwhile, financial institutions always pooling certain information may receive introductions from many candidates. However, many screens are not screened, and the ability of their company to chew information is questioned. On the other hand, the use of consulting companies and M & A advisors provides a list of information that has undergone certain screening, and is often localized and easy to judge information, which has certain merits in the decision-making process.

■ Initial negotiation phase

[Target Company / Joint Venture Partner Contact / Consultation] ... ④

After creating the aforementioned short list, we will come into contact with companies on the list at last to explore the possibilities of acquiring / joint venture of foreign companies of candidate.

Non-disclosure agreement

In the early stages of negotiations, it is possible to make contact with anonymous by hiding the company name, but in the case where there is room for negotiation regarding acquisition / joint venture at the candidate destination, we will negotiate a confidentiality agreement.

Disclosure of company information

After concluding the confidentiality agreement, we will prepare a resume with at least the following information stated, and make first a statement by expressing our intention to the other party.

Matters subject to representation and warranty are shareholder relationships of the acquisition Target Company, financial situation, guarantee obligation, pendency of litigation, etc. in the case of a share transfer agreement.

Range of due diligence

There are various points to pay attention to, such as finance, tax, business, legal affairs, personnel, IT, intellectual property, environment etc. However, we have set up areas for due diligence according to the case.

Announcement

Regarding negotiations between the two companies, we will fix the parties to the negotiations until negotiation of the final agreement, and negotiate with imposing a ban on other words. Regarding information disclosure to stakeholders such as shareholders, employees, financial institutions, business partners, etc., we must set both the time, method and disclosure content of both.

Establishment of priority negotiation right

As M & A negotiations involve due time and expenses such as due diligence, economic loss will increase if more than one acquiring company participates at the same time. In order to avoid risk of entry of others during the negotiation period, we may establish a priority negotiation right including prohibition of condition negotiation to a third party.

Governing law, jurisdiction and language

In negotiations between Japan and Singapore / Hong Kong, based on an agreement between M & A parties to avoid mutual disadvantages between languages such as Japanese, English, Chinese and Cantonese, the language to be used.

■ Final negotiation phase

[Due diligence] ... ⑦

After concluding the LOI, we will make due diligence and create final conditions. Items to be generally considered due diligence in the acquisition / joint venture establishment are listed in the appendix.

[Final negotiation and concluding final contract] ... ⑧

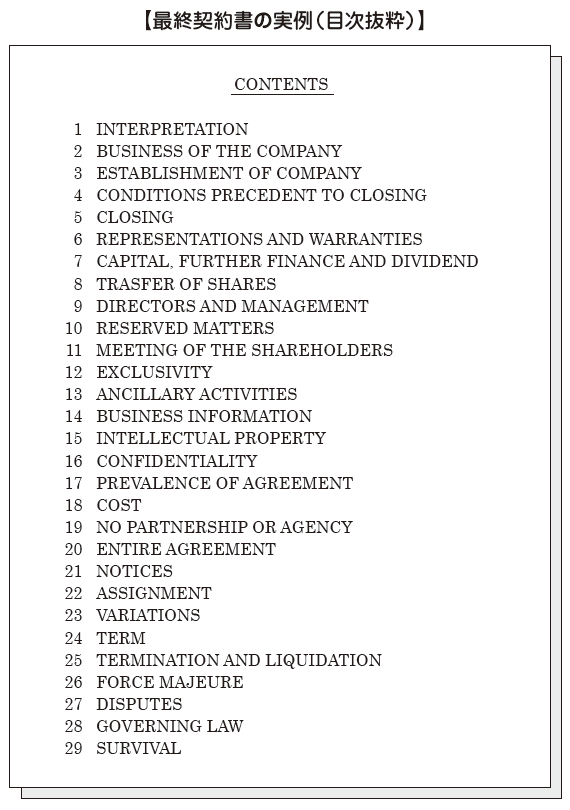

Based on due diligence, the final detailed condition will be arranged under mutual agreement. At this time, the acquiring side prepares a draft of the final contract (DA: Definitive Agreement) and presents it to the seller. The final agreement here refers to a stock transfer agreement when there is a share transfer. Next, I list the main items and the table of contents of the final contract in M & A.

-

-

-

Tax on M & A

M & A in Singapore can be roughly divided into methods to acquire assets and methods to acquire shares, but there are differences in the tax system involved in each method.

Acquisition of assets (business transfer)

There are income tax and stamp duty in the tax system related to asset acquisition. On the side of selling assets, income tax is levied on gains on sales of assets. Also, if the asset to be sold is a tangible asset, the stamp duty tax is imposed and it is common for the buyer to bear it unless there is agreement on both sides. There are also assets applicable to capital expenditure tax deductions, but depending on the conditions, the deduction may be canceled.

[Goodwill]

Amortization of goodwill cannot be deducted from taxable income.

[Capital expenditure tax credit (depreciation expense deduction)]

For the capital expenditure of assets used for taxpayer's business, the first time and annual deduction (depreciation expense) is permitted for tax purposes in the Income Tax Act (ITA).

The useful life of facilities and machinery in taxable capital expenditure tax deduction is divided into 5 years, 6 years, 8 years, 10 years, and 16 years. For the construction and renovation of certain buildings, 25% initial deduction and 5% annual deduction are possible.

Facilities and machinery (with exceptions) can be tax depreciated using the three-year accelerated depreciation method. Automation equipment such as robots and computers, power generation equipment installed in factories and offices, pollution prevention equipment, etc. can be depreciated by tax in one year. In addition, certain fixed assets of less than 1,000 S dollars can be depreciated taxably in one year as well. However, all together, up to 30,000 S dollars a year.

During 2011-2015, companies can receive productivity and innovation deductions. This means that for capital expenditure involved in a particular activity, you can additionally receive a triple capital expenditure tax deduction based on expenditures in the tax year. Base spending will be up to S $ 400,000. Also, if it is up to 1.6 million S dollars, you can receive an investment tax deduction with additional activities.

[Carryforward loss carryforward and carryover investment tax credit carryover]

In the case of acquiring assets, it is not possible to inherit the net operating loss carryforwards and tax credit carryover tax carryforwards of the target company.

[Goods and services tax]

Normally, goods and services of registered goods service tax companies are subject to 7% product service tax. If the transfer of assets is deemed to be a transfer of business to be continued in the future, it will not be taxed as it is not considered as offering goods or services. In order to prove the transfer of business to be continued in the future, the acquirer must use the assets for the same type of business as well as done on the transfer side, and the Singapore Internal Revenue Service (IRAS: Inland Revenue Authority of Singapore), if you can’t prove this, we will pay 7% product service tax on profit on sale.

Acquisition of shares

In 2010, the Ministry of Finance of Singapore introduced policies called M & A schemes for M & A's business growth in Singapore. As a part of that, there is what is called M & A deduction (M & A Allowance) and stamp duty relief (Stamp Duty Relief). This M & A scheme does not apply to asset acquisition (business transfer).

[M & A deduction]

M & A deduction means that between April 1, 2010 and March 31, 2015 M & A transactions that meet the criteria can amortize 5% of the acquisition price over five years. Up to 5 million S dollars each year (5% of 100 million S dollar) is the upper limit.

The requirements subject to the M & A scheme are as follows.

Shareholding ratio in Target Company

If the shareholding ratio of the target company owned by the acquired company is less than 50% before the acquisition, it must exceed 50% after the acquisition.

Also, if the shareholding ratio exceeds 50% and is less than 75% before the acquisition, it must be 75% or more after the acquisition.

A) Acquired company

① The acquiring company is established in Singapore and needs to be a tax resident (Tax Resident). If domination and management of enterprise's business is implemented in Singapore it will become a tax residence. In general, the Singapore branch of a foreign company will not be treated as a Singapore tax residence, as control and control belong to overseas parent company.

② If the acquiring company belongs to a group company, its ultimate holding company (Ultimate Holding Company) must also be established in Singapore and be tax residents.

③ It is necessary to conduct business in Singapore on the acquisition date.

④ It is necessary to hire at least three local employees (except directors) for 12 months back from the acquisition date. Also, it is necessary for two years from the acquisition date not to be related to the target company.

B) Acquisition

If M & A transactions completed between February 17, 2012 and March 31, 2015, even if the subsidiary is indirectly owned by the acquiring company, there is a possibility that the M & A scheme will meet the requirements subject to the M & A scheme Yes. In addition to meeting the requirements of ① to ③ below, its subsidiary company must be established for the purpose of holding other company's shares.

① The subsidiary of the acquired company must not take M & A deduction and stamp tax relief under the M & A scheme.

② The subsidiary of the acquired company should not conduct business in Singapore or any other place at the acquisition date.

③ It must be held directly or totally by the acquiring company at the acquisition date.

C) Target

① It is necessary to conduct business in Singapore or other countries at the date of acquisition.

② It is necessary to hire at least three local employees (except directors) for 12 months back from the acquisition date.

The above requirements may be met by subsidiaries owned directly or fully by the target company. In addition, M & A transactions completed between February 17, 2012 and March 31, 2015 may be satisfied by a subsidiary indirectly owned by the target company.

[Stamp duty relief]

With the 2010 budget plan, between April 1, 2010 and March 31, 2015, for M & A transactions that fulfilled the requirements, it was possible to receive stamp duty relief up to S $ 200,000 per year It was. Furthermore, in the 2012 budget proposal, the following stamp duty relief remedies were further strengthened. This strengthening is effective from February 17, 2012 to March 31, 2015.

① Acquisition through a subsidiary

Prior to the 2012 budget plan, the acquisition company was able to fulfill the requirement only when acquiring the target company through a directly or fully owned subsidiary. However, from February 17, 2012, it became possible to satisfy the requirements not only for subsidiaries, but also for acquisitions of target companies through companies that are below the fully owned sub-subsidiary companies.

② Requirement of target company (acquired company)

Prior to the 2012 budget plan, only the Target Company or directly or fully owned subsidiary was able to meet the stamp tax relief requirements. However, as of February 17, 2012, not only subsidiaries, but also companies in the hierarchy below the fully owned sub-subsidiary company can also satisfy the conditions.

③ Ultimate Holding Company

The acquiring company must be owned by the ultimate holding company, which is a tax residence established in Singapore. However, from February 17, 2012, in some cases this requirement will be exempted. This exemption is under jurisdiction by the Economic Development Board.

We need to pay stamp duty once stamp tax relief is finalized. The stamp duty paid by the Internal Revenue Service of Singapore will be refunded after the M & A transaction meets the stamp deductible relief requirement.

[Carryover losses]

Target company carryforward losses can be offset against future taxable income, but they are subject to shareholder continuity test. In the shareholder continuity test, 50% or more of the issued shares must be held by the same shareholder.

The intention of the shareholder continuity test is to prevent companies with tax loss carryforwards from being acquired for the purpose of tax benefits. In a situation where the composition of shareholders changes drastically, you can appeal to Singapore Treasury officials, etc. for exemption from shareholder continuity testing, but the Ministry of Finance will inspect the complaint based on the benefits of the province himself. As a result, even if you receive an exemption from the test, you are subject to the constraint that you can offset only the profit of the same business as the business that issued the deficit.

-

-

-

Overview

Singapore has developed the center of economic, logistics and finance in Southeast Asia. As Singapore becomes the center of the network with Asian countries such as China, Thailand, Indonesia and so on, movement of people, goods and money became more active even if the land area is small (almost the same area as Tokyo) .

There are also foreign investment restrictions that regulate the inflow of foreign capital as in other Asian countries, except for some industries. Here is the national policy that the government supports the entry of foreign capital into Singapore. In addition, the corporate tax rate is 17%, depending on the type of industry it is possible to apply the reduced tax rate, which is also a tax saving measure. Therefore, when establishing a central base in Asia, more companies will choose Singapore. -

Company Environment in Singapore

Singapore is a relatively mature listed market and economic environment than other Asian countries. Therefore, in countries where business is conducted mainly in Asian countries, there are many cases where Singapore's corporation is listed as a holding company or regional headquarters on the Singapore Stock Exchange (SGX: Singapore Exchange) in many cases.

According to Singapore's June 2011 Annual Report, the number of foreign companies out of 776 listed companies as of the end of June was 315 (about 41%).

Of the 315 companies, 152 companies are Chinese companies. In addition, Southeast Asian countries and companies in India are listed, and most foreign companies listed are companies in China, Southeast Asian countries, India.

As you can see from the above figure, the number of listed companies is about three times that of the Tokyo Stock Exchange, but listed companies are on a downward trend. On the other hand, the number of listed companies in Singapore has increased year by year. Analyzing the difference in this data, Singapore has not reached the size of Tokyo yet, but the growth of the market is on an upward trend. From this, it is the Singaporean market that funds flow into Singapore, and plus circulation that corporations gather from neighboring countries for the purpose of funds.

-

M & A Circumstances in Singapore

The following graph shows the trends in the number of M & A transactions published in Singapore during the period from 1990 to 2013. The number of M & A transactions in Singapore is larger than in other neighboring countries. The reason for this is considered to be mainly due to the fact that foreign companies are highly motivated to invest in companies in Singapore by taking a policy to actively incorporate foreign capital as mentioned above. For Japanese firms, it is also positive for Japanese companies that the corporate tax rate in Singapore is lower than the Japanese corporate tax rate, the economic environment and public infrastructure are closest to Japan in comparison with other Southeast Asian countries, and it is a factor.

-

-

-

Negative list (foreign capital regulation)

Singapore is taking a stance to attract foreign capital to its own country and regulations concerning foreign capital are not set except for some. Therefore, there is no difference between Singapore domestic capital and foreign capital regarding investment incentives.The industries subject to regulation are the following industries.■ Media industryIn broadcasting and newspapers, restrictions on capital contribution by foreign capital and the appointment of foreign director are restricted. Regardless of domestic or overseas, prior approval is required when acquiring, holding or disposing of shares or voting rights exceeding a certain shareholding ratio.

■ Infrastructure industry

Electricity business and gas business does not limit the entry of foreign capital by law. However, the fact that there is only one company responsible for power transmission and distribution in Singapore… and it’s a barrier to new entrants.

-

Status of Legal Improvement Concerning M & A

Procedures and regulations concerning M & A in Singapore are listed in the following;

■ Singapore Companies Act

When doing any M & A method, the basic legal regulation is stated in the Companies Act (hereinafter referred to as the Company Law). The stock exchange, stock transfer, company split prescribed in the Japanese Corporate Law are not stipulated in the Corporate Law of Singapore.

■ Securities futures method

Under the Securities Futures Law, there is provision for insider trading. Under the law, Singapore acquisition and merger agreement and listing restrictions on the Singapore securities market are promulgated.

The Singapore Acquisition and Merger Agreement (Singapore Code on Take-overs and Mergers: hereinafter referred to as "Acquisition Agreement") came into force in accordance with Section 3 2 1 of the Securities and Futures Act by the Singapore Financial Management Authority. There is no legally binding force. General principles and procedures for the acquisition of a listed company are stipulated. It is not applied to unlisted companies. This agreement applies to (a) a company listed in Singapore (including a company established in a foreign country), or (b) established in Singapore, with 50 or more shareholders and It is applied to acquire company control of a company with a net asset of more than 5 million S dollars.

The Singapore Securities Market Listing Regulation (Singapore Exchange Securities Trading Limited Listing Manual: hereinafter referred to as SGX Listing Regulation) regulates disclosure obligations of listed companies and necessary procedures in acquisitions. -

Company Law

The Company Law has provisions on business transfer, issue of new shares, merger. Also, as a system similar to organizational restructuring, there is an M & A method called a scheme of arrangement. For each M & A method, the Corporate Law has established separate regulations.

Business transfer

Transfer of business means transferring assets and liabilities that are organized for a certain project purpose and have the function of organic unity. This is a contract that conclude between the transfer company that transfers the business and the transfer company to which the business is transferred.

Under the Corporate Law, when practically transferring all property or business as a regulation on the side that transfers the business, the director cannot dispose all of the property and business unless approved by the General Meeting of Shareholders (Article 160).

Issuance of new shares

Issuing new shares is to issue additional shares of the same type as those already issued. This capital increase through the issuance of new shares includes a third party allocation paid-in capital increase and a shareholder allocation increase. Third Party Allotment The paid-in capital increase will result in the issuance of new shares to a specific person, by acquiring new shares issued by the target company, acquiring a majority of the voting rights of the general shareholders' meeting and selling the target company it is possible to control the management right as a subsidiary.

The legal process of issuing new shares is different in Japan and Singapore. In Singapore, a general resolution of the general shareholders' meeting in principle is necessary. This ordinary resolution does not need to individually resolve a specific issue of new shares, but it is comprehensively approved for issuance of new shares in the future (Article 161, paragraph 2 of the Companies Act). The validity of this approval will be from the general meeting of shareholders to be resolved until the conclusion of the ordinary general meeting of shareholders first held thereafter (Article 161 (3)).

In Japan, on the other hand, in a public company, a resolution by the Board of Directors (Article 201, Paragraph 1 of the Japanese Company Law). In a private company, a special resolution of the General Meeting of Shareholders is required (Article 99 (2)).

In addition to the above-mentioned resolution requirements, the following points to be noted are in the issue of new shares in Singapore (in particular, issue of new shares based on comprehensive approval).

· Prohibition of issuance to major shareholders

· Third Party Allotment Maximum Number of Issued by Capital Increase

· Lower limit of the amount of consideration

· If the percentage of voting rights held is equal to or greater than a certain level, a mandatory tender offer

[Major shareholder etc.]

Regarding major shareholders and major shareholders, it is not defined in the SGX listing regulations, but it depends on the definition of the Company Law.

A major shareholder is a shareholder who owns, directly or indirectly, 5% or more of the voting rights of the number of shares outstanding excluding treasury shares (Article 7, Article 81 of the Companies Act).

Major shareholders and the like are direct or indirectly 10% or more by major directors, major shareholders, nearest relatives of directors, major shareholders of major shareholders, affiliates such as parent companies and subsidiaries, affiliates, directors and major shareholders, (SGX Listing Regulation 813).

Since these points of concern are regulated by laws other than the Company Law, we will explain them in the "Securities Futures Law" part.

Merger

Merger means that two or more companies are integrated into one company under a contract. In Singapore's Corporate Law, it is the same as Japan, although it is possible to make an absorption merger and a merger, but it is also possible to transfer only a part of the asset liability. Therefore, it can be said that it includes the corporate division system in Japan.

When merging in Singapore, according to the provisions of the Companies Act

❶ Merger requiring court approval

❷ Merger where approval becomes unnecessary

There are two.

[Merger requiring court's approval (Singapore Companies Act 210, 212)] ... ❶

In the case of conducting absorption merger or consolidation merger in Japan, the Japanese Corporate Law calls for resolutions at the shareholders 'meeting, the right to demand shareowners' opposition shareholders, and a notice to creditors. However, in Singapore, courts may need to be approved depending on who grabs the leadership of the procedure even with M & A by the same merger.

[Merger where court approval becomes unnecessary] ... ❷

There are mergers and abbreviated mergers in mergers where court approval is not required. This is the same system as merger and summary merger in Japan. Procedures necessary for such merger and summary merger are specified in Article 215 A to J (Company Law 215 A).

Procedure of merger

① Preparation of merger proposal

A merger agreement is concluded and a merger proposal is created based on that contract. Describe the merger agreement such as the address of the company to be merged and the number of shareholders, the name of the company after the merger, the address, the handling of shareholders of the expiring company, in particular the acquisition consideration (merger proposal) (Article 215 B of the Companies Act).

② Notice to shareholders and creditors

At the time of the merger, a general meeting of shareholders will resolve on the merger. In doing so, it is necessary to send a copy of the merger proposal and a copy of the declaration of the director to shareholders 2 days before the general meeting of shareholders concerning the merger so that the shareholders can properly judge.

Copies of the merger proposal will also be sent to the creditors of the companies involved in the merger (Article 215 C (4) (5) of the Companies Act).

③ Publications by daily newspaper

According to ②, shareholders and creditors are individually notified of the merger, but further public notices need to be notified to the company stakeholders. Therefore, we will publish information on consolidation to English daily newspaper published in at least one or more Singapore before 2 1 day prior to the General Meeting of Shareholders on Merger. This announcement is intended to disclose company information, and you can view and copy the merger proposal within the company's business hours separately at the company registration office or other public notice (Company Law 215 Article C (5) (b)).

④ Creation of payment capacity certificate of each merging company

The directors (board of directors) of each merging company will prepare payment capacity certificates for each merging company and the surviving company after the merger (Article 215 C (2) (b) (c) of the Companies Act).

⑤ Resolution of general shareholders meeting due to merger

As a general rule, special resolution of the general meeting of shareholders is required when merging. In addition, there may be conditions subject to approval by a third party at the time of the merger proposal. In this case, it is necessary to obtain approval by a third party at the same timing as approval by a special resolution (Article 215 C (1) (2) of the Companies Act).

* Resolution on resolution of special resolutions in Singapore Regardless of ordinary resolution or special resolution under Singapore's Corporate Law, quorum must attend more than two shareholders (Singaporean Company Act Article 179 (1) (a)). A special resolution will be passed by approval of more than three quarters of shareholders who participated in the resolution (Article 184 (1) (4) (5) (6) of the Company Law of Singapore)

⑥ Merger registration and notification

Once all the procedures from ① to ⑤ are completed, the created documents are registered in the Accounting and Corporate Regulatory Authority (ACRA). As a result, registration of the merger is completed, then a merger notice and a merger confirmation certificate will be issued from ACRA.

Regarding merger, if an opposition to a shareholder or creditor is in the court, the court prohibits the effect of the merger, changes the merger proposal, adds to the director (board of directors) of the merger company the merged proposal You can order to reconsider all or part (Company Law 215 E to G).

Summary merger

An abbreviated merger is a merger that satisfies certain requirements and can greatly simplify the requirements stipulated by statutory in the case of conducting the above-mentioned merger procedure (Article 215 D).

In order to be judged as an abbreviated merger, one of the following requirements must be satisfied;

· Merger of parent company and wholly owned subsidiary (provided, however, only when parent company becomes surviving company)

· Merger of wholly owned subsidiaries

In the event that it is judged to be a summary merger, the procedures for the above ① to ⑥ are simplified as follows;

· No need to prepare merger proposal

· Although a special resolution at the general meeting of shareholders is necessary, it is unnecessary if the articles of incorporation provide for the contents stipulated in Article 2 15, D of the Companies Act

· No obligation to prepare payment ability certificate

· Public notice on newspaper is unnecessary

As mentioned above, it is simpler than the ordinary merger procedure. This is a provision for partially relaxing the regulations for the protection of shareholders and creditors of merger-missing companies in the ordinary merger, taking into consideration the situation that the surviving company controls the general shareholders' meeting of the merger dissolution company.

Since abbreviated organization restructuring (abbreviated merger etc.) in Japan is possible by the abbreviated procedure when the parent company owns more than 90% of the voting rights, the law of summary organization reorganization action between Japan and Singapore It is necessary to be aware of the differences in regulations.

■ Scheme of Arrangement

Scheme of Arrangement (SOA) is an organization reorganization method used for various purposes such as corporate restructuring, interest adjustment with creditors and investors, merger or restructuring of group companies, is. Under the Companies Act there are only basic provisions in Article 210 and details are not stipulated in the Company Law.

In order to carry out the scheme of arrangement, the following procedures will be carried out step by step. These procedures are also prescribed by the Corporate Law (Article 210 (3)).

① The Acquired Company shall file a creditor meeting or a shareholders' meeting (in whole or in part) by the oblige of the company (in whole or in part) at a court in Singapore to hold a general meeting of shareholders

② The acquired company explains the acquisition scheme at creditors meeting or general shareholders meeting

③ At the meeting of creditors and shareholders meeting, it is decided upon approval of over 75% of voting rights

④ When the court approves and a copy of the approval is submitted to the accounting firm regulatory agency, the legal binding force of the acquisition scheme arises

Although the Scheme of Arrangement is applicable only to companies established in Singapore, there are obvious differences from other acquisition schemes. That means that the acquirer itself conducts procedures. If the acquisition company takes the initiative, even if M & A is established or not, there is a possibility that the relationship with each other's acquiring party will be lost. However, in the case of a scheme of arrangement, the acquirer takes the initiative led by the acquirer and will not be established unless there is a friendly relationship between the acquiring parties. As a result, in Singapore, schemes of alignment are more used than mergers and the like.

When a Singaporean foreign company acquires a Singaporean domestic company through a scheme of arrangement, if the shares of the foreign company are not listed on Singapore, it is not practically assumed to issue shares of the acquirer. It is because there is a high possibility that the scheme of the arrangement will fail because the stock of overseas companies is judged to be illiquid in Singapore.

■ Right to sell shares

The right to request the sale of shares is a system that allows acquirers to forcibly acquire shares from minority shareholders after the acquisition of shares. Within four months from the start of the acquisition, this plan will be acquired by the owner of 90% or more of the shares of the target company (excluding the shares held by the acquirer and own shares at the beginning of acquisition) It is the application requirement to notify the shareholders who oppose the acquisition within two months from the approval.

In the case of exercising the right to request the sale of shares, in principle, the acquirer must acquire the shares of the opposing shareholders under the same conditions (including the price) as those already acquired. In addition, the opposing shareholders may request the court to sell the shares to the court within one month from the date of receiving the notice of the exercise of the share sold right, or until the due date falling within 14 days after acquiring the list of opposed shareholders It is permitted to file an objection to the exercise of the claim (Article 215 (1) of the Companies Act).

Upon receiving notice of the exercise of the right to sell shares, the opposing shareholder must request the acquirer to disclose the list of other opposing shareholders in writing for one month from the date of receiving notification (The acquirer cannot exercise the right to request the sale of shares for 14 days from the sending of such a list.) In this case, it is left to the judgment of the court to decide whether to exercise the stock sale right.

The acquirer says "after one month since the notice of the exercise of the stock sale right", "after 14 days after the opposing shareholder acquires the list of the opposing shareholders" "The appeal against the court is ongoing. In the case where the complaint procedure has been completed ", a copy of the notice of the exercise of the right to sell shares is sent to the target company together with the certificate of transfer concluded with the person representing the opposite shareholder and the acquirer . After sending, we will pay to the target company the consideration of the shares to be acquired by exercising the share sale right.

■ Squeeze Out

Under the Corporate Law of Singapore, if there are approvals of 90% or more in a resolution of a general meeting of shareholders, it is possible to request the sale of shares owned by minority shareholders. However, in order to use this provision, you must set your own ownership ratio (ratio of voting rights) to 90% or more. As a method of acquiring shares, there are acquisitions through a mandatory tender offer or an optional tender offer.