Singapore

7 Chapter Accounting

-

-

1 Chapter Importance of Management by Regional Headquarters

1.1 Importance of Asian market

1.2 Regional management of the Asian market

1.3 Comparison of countries as headquarters

2 Chapter Regional Headquarters System and Utilization Examples

3 Chapter How to Utilize Regional Headquarters

3.1 Method of Consolidating Profit by Dividend and Making it as Reinvestment Base

3.2 Utilization as a Finance Company (Loan Function)

3.3 Example of Utilization of Efficiency by Consolidating Settlement Functions

3.4 Example of Reviewing Supply Chain Functions and Risks

4 Chapter How to Make Regional Headquarters

4.1 How to Set Up a Regional Headquarters

4.2 Singapore as a Business Base

4.3 Corporate Law in Singapore

5 Chapter Overseas Relocation of Head Office Functions

5.1 Head office relocation to low tax rate country

6 Chapter M&A

6.1 Trends in M & A in Singapore

6.2 Points to keep in mind when doing M & A

6.3 Laws and regulations concerning M & A

6.7 Investment regulatory environment of Singapore

7 Chapter Accounting

7.1 Accounting System in Singapore

7.2 Accounting Standard in Singapore

7.3 Disclosure System in Singapore

7.4 Accounting Audit in Singapore

8 Chapter Tax Risk of Regional Headquarters

8.1 Tax · Haven Countermeasure Tax System

8.2 Foreign Subsidiary Dividend Income Non-inclusion System

8.5 Taxation of Country of Residence and Double Taxation by Source Taxation

8.6 Tenuous Capital Tax System

9 Chapter Tax

9.2 Personal income tax in Singapore

9.3 Corporate income tax in Singapore

9.6 Singapore withholding system

9.7 International tax in Singapore

10 Chapter Labor

10.1 Work environment in Singapore

10.3 Social Security System in Singapore

10.4 Points to keep in bringing Japanese to Singapore

11 Chapter Q&A

-

-

-

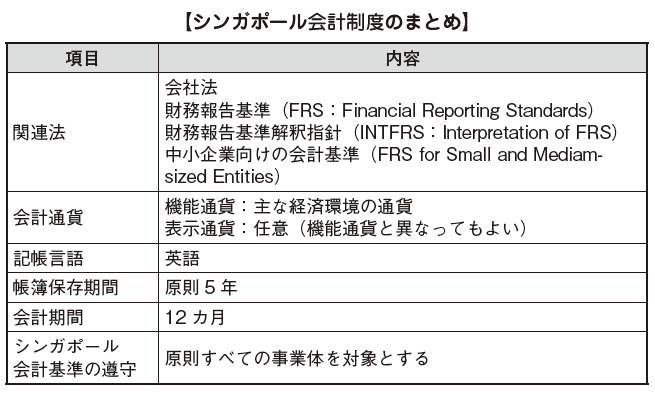

Accounting System in Singapore

When doing business in Singapore, they must comply with the Companies Act. Regarding accounting, in 199 to 204 of the Singapore Companies Act, the contents and procedures of financial statements included in the annual report are stipulated. In addition, they are requiring the preparation of financial statements in a truthful and fair manner in conformity with accounting standards set up by the Accounting Standards Council (ASC) under the jurisdiction of the Singapore Ministry of Finance as a concrete processing standard. However, the Corporate Law is a concise form stipulating only a general framework, and in fact it will be changed by notification.

Regarding accounting standards, they are establishing and operating the Singapore financial reporting standards based on the International Financial Reporting Standards (IFRS) creates a system to adapt internationally.

■Post period

The corporation can set the accounting period one year and set the account closing date freely. Since the tax year for corporate tax will follow the accounting period specified by the company, at the branch office, it is necessary to adopt the accounting period according to the fiscal year settlement date of the parent company. If it is not the same period, they may be required to explain to the Accounting Standards Council.

An ordinary general meeting of shareholders shall be held within six months from the settlement date or within 15 months from the last meeting of the general meeting of shareholders. Therefore, it is necessary to complete the audit within that period. In addition, they have to submit audited financial statements and annual reports within one month from the ordinary general meeting of shareholders.

In the case of the first year of establishment, it is necessary to hold an annual general meeting of shareholders within 18 months after establishment, so it is necessary to complete settlement and audit so far.

■Accounting book

Under Article 199, Paragraph 1 of the Corporate Law, all businesses, directors, and the management prepares an income statement and balance sheet that can fully explain the company's performance status and business transactions, keep documents and evidences including attachments. They must prepare the proper audits to be carried out. Also, under Article 199, Paragraph 2 of the Companies Act, they shall save that record for 5 years after the transaction is over.

Even in the case of taking these records outside Singapore, they shall keep copies in Singapore and be able to view them at the Board of Directors. Failure to abide by the provisions, companies and officers shall be penalized with a fine of 2,000 S dollars or imprisonment less than 3 months.

■ Language · Currency

Regarding disclosure documents, the language is in principle English.

Currencies in principle use the functional currency decided by the company. The functional currency is the currency in the major economic environment in which the company operates.

In determining the functional currency, the company considers the following items.

· Currencies affecting the main sales and sales

· Major currencies used for funds supply

· Currency used for purchase, selling and administrative expenses, salary, and other expenses

Accounting books shall be created in functional currency. For example, if they decide the functional currency as US dollars, even if they are trading in Singapore dollars, or Japanese yen denominations, other currencies, they shall follow the currency that they have already decided. If transactions are to be carried out in Singapore dollars in practice, it is necessary to construct an accounting system to convert from time to time or carry out a bookkeeping in Singapore dollars when transactions are carried out and remeasurement them all before the end of the term. There is some cases or way to do it.

Moreover, given the summation practices and etc. in the consolidated financial statements prepared by the parent company, there is also an advantage of separating the functional currency from the display currency. The display currency is the currency shown in the financial statements, but it does not necessarily have to be the same currency as the functional currency.

-

-

-

Accounting Standards in Singapore

In Singapore, there are corporate laws that companies shall comply with. When they operate, among which the obligation to comply with accounting standards is also stipulated (Article 201, paragraph 1A of the Companies Act).

The accounting standards are composed of financial reporting standards (FRS) and interpretive guidelines for financial reporting standards (INT FRS), both of which are revised, eliminated and set by the Accounting Standards Council (ASC) under the jurisdiction of the Ministry of Finance. -

Applicable Company of Singapore Financial Reporting Standard

Currently, all companies and foreign branches in Singapore, whether listed or unlisted, must prepare their financial statements in accordance with financial reporting standards. Although there are differences between financial reporting standards and international financial reporting standards. Most of them are attributable to differences in the timing of application and the two can be said to be nearly identical at this time. Regarding the relationship between accounting and tax laws, in Singapore, accounting and taxation processes are basically separated and adjustments necessary for the tax law are adjusted for the profit amount of the audited financial statements therefore Taxable income will be calculated.

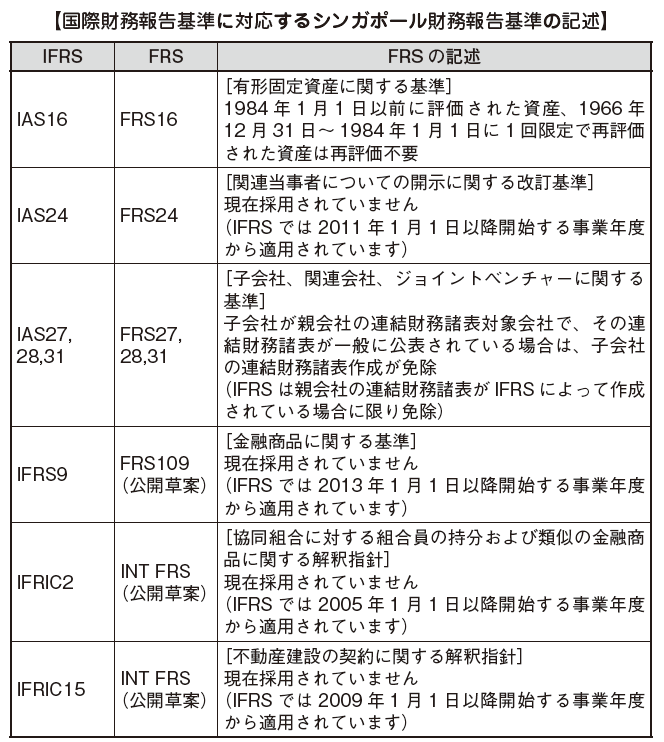

■Adoption of international financial reporting standards · Convergence situation

In Singapore, it was planned to administer international financial reporting standards (full convergence) for listed companies from FY 2012 onwards, but with the unlisted companies, clear date deadlines have been announced at the moment not.

■ Status of financial reporting standards for SMEs

Small and medium sized enterprises (SMEs) for small and medium enterprises can be applied for small and medium enterprises that satisfy the following two or more requirements from the fiscal year beginning on or after January 1, 2011.

· Annual sales less than S $ 10 million

· Total assets under S $ 10 million

· Less than 50 employees

In financial reporting standards for small and medium-sized enterprises, the method of evaluating the residual price of tangible and intangible fixed assets, which is considered to be a requirement that requires some cost, when implementing accounting standards for SMEs, such as segment information and per share information. They are relaxed about the criteria and so on regarding this.

■ Issues of International Financial Reporting Standard Adoption

The Accounting Standards Council announced in May 2009 that Singapore Financial Reporting Standards and International Financial Reporting Standards (IFRS) were to be fully converged by the end of 2012. However, reviewing the situation of Adaption (Full Convergence) revealed several issues, so in January 2012 I told the IFRS Foundation Board of Trustees and the International Accounting Standards Committee (IASB) As a result, the IFRS Foundation Board of Trustees and the International Accounting Standards Committee promised to support the Adoption (Full Convergence) to the Accounting Standards Council.

Originally, the current Singapore financial reporting standards are based on International Financial Reporting Standards therefore very similar to International

Financial Reporting Standards.

As a result, similar to the International Financial Reporting Standards, financial reporting standards are similar to the Interpretations of the International Financial Reporting Interpretations Committee (IFRIC) interpretive and interpretation guidelines (SIC: Standing Interpretations Committee) There are interpretation guidelines and the contents of each standard are also nearly the same as the current financial reporting standards and international financial reporting standards, so even if you make an adequate (full convergence) As for the contents of the previous page table, further examination is required in the future.

However, since the Company Law requires to comply with Singapore's financial reporting standards. not the IFRS, but the Singapore Financial Reporting Standards shall endorse.

-

-

-

Disclosure System in Singapore

■ Overview

Singapore also ensures high transparency in the corporate disclosure system which is also an important business infrastructure. In Japan, the financial statements of unlisted companies are not publicly disclosed, but in Singapore unlisted financial statements are also audited in principle and publicized on the Internet. Investors are able to acquire the financial statements of all companies and to check the financial condition and business performance are built up.

As a specific method of obtaining the contents of the financial report converted into XBRL (extensible Business Reporting Language) can be browsed through a search system called bizfile (URL: www.bizfile.gov.sg/). Anyone can obtain XBRLized financial statements through the Internet by registering and paying a fee.

In addition, since Singapore makes not only financial information but also a mechanism that allows viewing company information relatively fairly, anyone can collect information on the company's registered matters, the paid-up capital of the company, the address on registration, the latest general shareholders meeting day, the name of the director, the date of incorporation, the composition of shareholders, and the name of the accounting auditor, etc.

Therefore, when grasping the situation of account settlement and credit survey, there is no relationship between a public company and a nonpublic company and it is possible to use that mechanism for corporate research.

However, with respect to private companies, the statutory submission deadline of the financial statements is relatively slow, so it will take some time to obtain the latest information.

■Listing schedule

Singapore has a mainboard market and a catalytic market. Many companies that have already achieved certain results in the main board market are listed, and in the catalytic market there are many start-up companies that are expected to grow in the future.

In the case of listing on the main board market, it will take 12 to 16 weeks from the submission of the application form to the listing as it will be reviewed by the Singapore Stock Exchange (SGX: Singapore Exchange).

In the case of the catalytic market, "Sponsor" certified by the Singapore Stock Exchange, not the Singapore Stock Exchange will conduct a listing application of the applicant company. For that reason, the period from submission of the application documents to the listing is as short as 5 to 6 weeks compared to the main board, but sponsors are obliged to continue support of applicant companies for three years after listing.

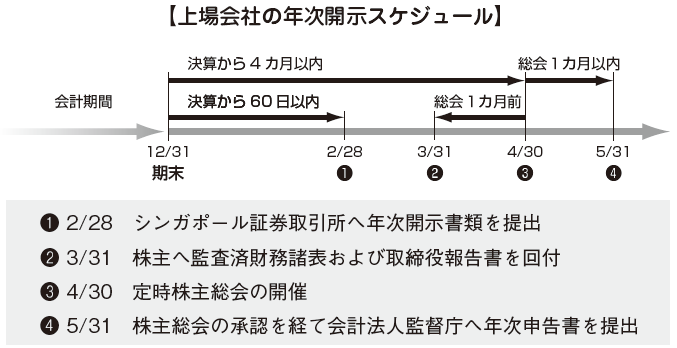

■ disclosure schedule

There is a corporate law, main board, and listing manual of each market of Catalyst as disclosure laws. Disclosure schedule described in the main board and catalog listing manual is basically the same contents.

[Listed company]

Listed companies shall disclose financial information on annual settlements to listed markets within 60 days after settlement (within 90 days in Japan). In addition, the semiannual report shall be disclosed within 45 days, and companies with market capitalization exceeding S $ 75 million shall disclose quarterly financial information within 45 days after quarterly settlement. The above disclosure report falls under the securities report and etc. in Japan.

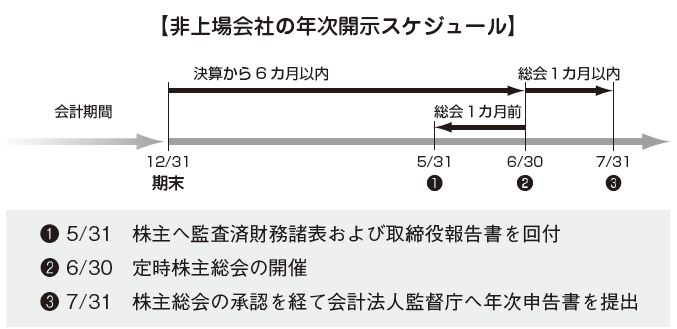

[Local Corporation]

A company in Singapore holds an ordinary general meeting of shareholders within six months after the close of accounts (companies listed on the Singapore Stock Exchange are within four months), submit an audited settlement statement and a director report, receiving and submitting this material to the Accounting and Corporate Regulatory Authority (ACRA) within one month from the date of publication, and along with the annual declaration form.

If neglected, companies and directors are punished by a fine of not more than 10,000 S dollars, or imprisonment of not more than two years.

[Branch]

In addition to the financial statements of the headquarters, the Singapore branch of a foreign company is obliged to submit the financial statements of the branch offices to the accounting corporation supervisory agency within two months after the annual shareholders' meeting of the head office.

Failure to submit will result in penalties of fines of up to $ 1,000 S and negligence for companies and directors and agents at the branches involved.

■ Content of Disclosure Material

In Singapore, the company shall hold an ordinary general meeting of shareholders within six months after the end of settlement and submit the director's report and the audited settlement to the accounting corporation supervisory agency. This is applicable to all companies, whether listed or non-listed companies.

① Director's report

· Business contents for the business year

· Profit and loss statement

· Dividend

· Shares owned by the directors (Including those of affiliated companies such as parent company, subsidiary company, affiliated company, other subsidiary, etc., specifying type and quantity)

· Increase / decrease of capital

· Increase / decrease of subsidiaries

· Contingent liability

② Statement by Directors

This is the oath for the fact that the financial statements prepared by the directors are created truthfully and fairly.

(3) Audit report (Independent Auditors' Report)

This is a certificate that the accounting auditor conducted the audit in accordance with the auditing standards. This is an opinion to the report.

④ Statement of Financial Position

⑤ Statement of Comprehensive Income

⑥ Statement of Changes in Equity

⑦ Cash flow statement (Statement of Cash Flow)

⑧ Notes (Notes of Financial Statements)

In general, it is said that "IFRS is a principle-based accounting standard", but also for Singapore's financial reporting standards. Because there is no detailed provision in the financial reporting standards, careful judgment is required for both companies and auditors who prepares the financial statements when adopting accounting for a specific transaction. Taking account of economic circumstances etc., and the accounting process is decided by management's judgment. Also, since the volume of the note is very large, and its content is also complicated in many cases, there seems to be a lot of companies struggling to create.

In the case of foreign companies, it is also permitted to disclose by applying international financial reporting standards and US GAAP in addition to Singapore financial reporting standards.

■ Consolidated financial statements

In Singapore and in principle, companies with subsidiaries or affiliates shall prepare consolidated financial statements.

[Companies subject to consolidation]

The company to be consolidated refers to a company mainly falling under the following items. If applicable to the following items, consolidated financial statements shall be prepared.

· If the parent company directly or indirectly owns a majority of the voting rights

· Even if the parent company does not own the majority of the voting rights, the parent company shall control all companies

· If you have the power to control a majority of voting rights by agreement with other investment companies

· If you have the ability to influence the company's financial policy and business policy through contract

· If you have the power to appoint or dismiss a majority of the members of the Board of Directors or equivalent organizations

· If you have a majority voting right at meetings of the Board of Directors or equivalent management period

[Companies subject to consolidation]

A company subject to consolidation exclusion refers to a company falling under the following items. If it falls under the following items, it will be excluded from the consolidated financial statements.

· In cases where ownership of a subsidiary is deemed temporary

· The subsidiary is managed for a long term under severe restrictions where remittance to the parent company is significantly hindered

[Exception rule]

If the company is a subsidiary of another company, preparation of consolidated financial statements shall be exempted if the following requirements are satisfied.

· In cases where the company is a wholly owned subsidiary of another company or is not a 100% subsidiary and all minority shareholders do not oppose not to prepare consolidated financial statements

· When the company's debt · capital securities are not traded in the public market

· The company has not registered or is not trying to register financial statements with the Securities and Exchange Commission or regulatory body to issue securities in the public market

· If another company that is a controlling shareholder prepares consolidated financial statements and it is generally available

-

-

-

Audit System

In the case of Japan, certified public accountant audits are not enforced on small companies other than listed companies and large companies.

Meanwhile, the accounting system of Singapore is regulated under UK law. Therefore, in principle, branches of all companies and foreign companies shall be audited by a certified public accountant. Singapore is subject to auditing by the accounting auditor based on the Company Law.

In Singapore, based on Article 207 of the Corporate Law, they shall appoint a certified public accountant as an accounting auditor within three months after the establishment of the company and have to receive an audit of the financial statements once each year. In other words, all companies are forced to conduct external accounting audits called certified public accountants. Also, in the case of branch offices, audits of certified public accountants are required.

However, with regard to the audit, as a special exception, companies with shareholders of not more than 20 individual shareholders, and those with sales of less than S $ 5 million per year or dormant companies shall be exempted from the audit. In other words, if the shareholder is not a corporate shareholder or a dormant company, an audit is required.

■ Content of audit

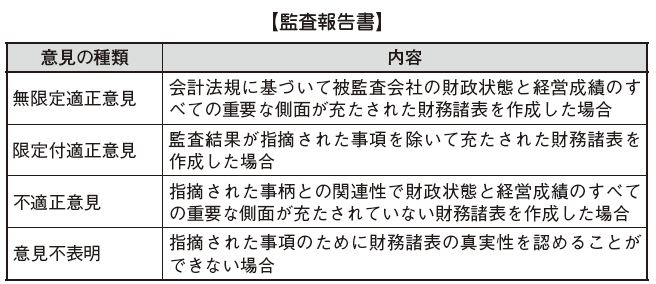

Four types of reports are expected for Singapore's audit report, as well as Japan's audit standards and international auditing standards.

[Forced installation of audit committee]

With the Asian economic crisis that occurred in 1997, Singapore has undergone various reforms on corporate governance of listed companies. In one of them, the Corporate Governance Council was set up in early 2010, and governance regulations have been reexamined. In Singapore's Corporate Law, the establishment of a board of directors is not enforced, but in the case of listed companies it is generally considered that a board of directors has been established, so the establishment of an audit committee in the Corporate Law (Article 201B) is compulsory.

According to the Corporate Law, as in Japan, independence is required to be maintained, and in cooperation with the accounting auditor, the audit plan and internal audit procedures are examined and the company's audit report and financial statements Balance sheet · profit and loss statement). The duties of the Audit Committee under the Companies Act do not include business audits, etc., and can be said to be only the function of accounting audit.

Meanwhile, the newly established governance regulations strengthen the obligation to monitor the accounting auditor, including the cost performance audit of the accounting audit, the necessity of considering whether the internal control is appropriate, etc. It is obliged the range of it is enlarged.

[From Singapore certified public accountant to Chartered Accountant]

In June 2013, the Singapore Accountancy Commission (SAC: Singapore Accountancy Commission) reviewed the educational system of accountants and introduced the Qualification Program (QP). The purpose of introduction is to improve the professional skills of accountants and to support overseas expansion. Also, due to this change, they changed the name of certified public accountant to Chartered Accountant (CA).

Traditionally, college graduates who have taken accounting sciences or accounting related qualification holders are recognized as certified public accountants only after three years of practical experience and intensive 5-day training and examination provided by the Institute of Certified Public Accountants of Singapore.

Under the new system, they can apply for a Chartered Accountant only if they are a college degree holder and have over 3 years of practical experience at Accredited Training Organization (ATO) as a training institution and have 6 courses (It is limited to those who took the examination in 5 courses).

There are currently about 30 accredited accounting firms, but the Singapore Certified Public Accountants Association seems to be planning to increase this number.

The certified public accountant (approximately 18,000) who was registered at the same time as the Singapore CPA is automatically exempt from application of the new system, and as of July 1, the same day as the name of the Chartered Accountant was changed.

The Singapore Accounting Committee has an agreement to mutually recognize membership with the Institute of Chartered Accountants in England and Wales (ICAEW), and since Chartered Accountants can engage in accounting work in the UK, the results shall substantial increase in the number of supported countries.

-

-

-

Reference

[1] AGC SINGAPORE

[2] NAC 国際会計グループ

[3] ACCOUNTING Financial & Tax

[5] 日本経団連企業会計部会・企業会計基準委員会・日本公認会計士協会「イン ド・シンガポールミッション報告」2010 年 3 月

[6] ACRA(Accounting and Corporate Regulatory Authority)

[7] KPMG 「シンガポール市場の概要」2011年 1月 18日

[8] First Spring International (「シンガポールの会計制度」参照)

[9] 有限責任監査法人トーマツ IFRS センター・オブ・エクセレンス「おさえて おきたい世界の IFRS 事情(第 4 回)――シンガポール」 企業会計 2011 年 4月号

[10] 金融庁「シンガポール基準と IFRS とのフルコンバージェンス完了の延期に関 するプレスリリース」

[11] 有限責任監査法人トーマツ 「平成 22 年度総合調査研究『会計基準改訂にか かる情報開示制度等に関する調査研究』報告書」2011年 3月 31日

[12] 林孝宗「シンガポールにおけるコーポレート・ガバナンス-取締役会の機能と 独立取締役の役割を中心にー」社学研論集 Vol.16

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya