Singapore

2 Chapter Regional Headquarters System and Utilization Examples

-

-

1 Chapter Importance of Management by Regional Headquarters

1.1 Importance of Asian market

1.2 Regional management of the Asian market

1.3 Comparison of countries as headquarters

2 Chapter Regional Headquarters System and Utilization Examples

3 Chapter How to Utilize Regional Headquarters

3.1 Method of Consolidating Profit by Dividend and Making it as Reinvestment Base

3.2 Utilization as a Finance Company (Loan Function)

3.3 Example of Utilization of Efficiency by Consolidating Settlement Functions

3.4 Example of Reviewing Supply Chain Functions and Risks

4 Chapter How to Make Regional Headquarters

4.1 How to Set Up a Regional Headquarters

4.2 Singapore as a Business Base

4.3 Corporate Law in Singapore

5 Chapter Overseas Relocation of Head Office Functions

5.1 Head office relocation to low tax rate country

6 Chapter M&A

6.1 Trends in M & A in Singapore

6.2 Points to keep in mind when doing M & A

6.3 Laws and regulations concerning M & A

6.7 Investment regulatory environment of Singapore

7 Chapter Accounting

7.1 Accounting System in Singapore

7.2 Accounting Standard in Singapore

7.3 Disclosure System in Singapore

7.4 Accounting Audit in Singapore

8 Chapter Tax Risk of Regional Headquarters

8.1 Tax · Haven Countermeasure Tax System

8.2 Foreign Subsidiary Dividend Income Non-inclusion System

8.5 Taxation of Country of Residence and Double Taxation by Source Taxation

8.6 Tenuous Capital Tax System

9 Chapter Tax

9.2 Personal income tax in Singapore

9.3 Corporate income tax in Singapore

9.6 Singapore withholding system

9.7 International tax in Singapore

10 Chapter Labor

10.1 Work environment in Singapore

10.3 Social Security System in Singapore

10.4 Points to keep in bringing Japanese to Singapore

11 Chapter Q&A

-

-

-

Regional supervision system in Singapore

Singapore places importance on industrial policy to attract foreign companies to enter the domestic market and raise the productivity of economic activities. For this reason, under the jurisdiction of the Economic Development Board (EDB)a program called Headquarters Program was developed. This program aims to focus on attracting regional headquarters and applying a preferential taxation system to companies of a certain size.

All companies can apply regardless of the scale of business, type of business, geography, location, etc. The companies under the headquarters system are required to do the following operations:

· Formulation of business plan

· Business administration

· Sales plan and brand management

· Intellectual property (IP) management

· Education and training and personnel management

· R & D and test production · sales

· Shared service

· Research and analysis on economic and investment

· Technical support

· Material procurement and distribution

· Financial Advisor

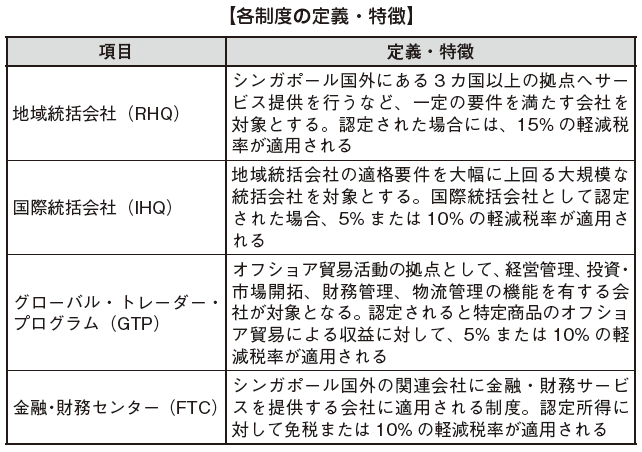

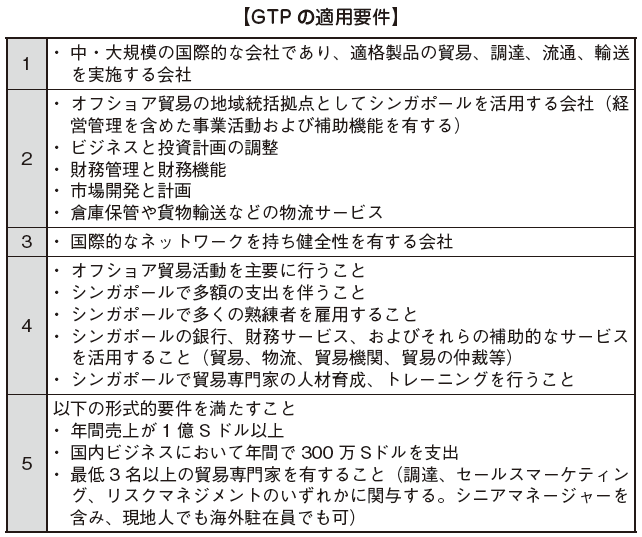

There are two types of headquarters system, Regional Headquarters (RHQ: Regional Headquarters) and International Headquarters (IHQ: International Headquarters). If a multinational company has a business plan that greatly exceeds the qualification requirements as a regional headquarters, it will be certified as an international headquarters and will receive further reduced tax rates and incentives.

In addition to regional headquarters and international headquarters systems, Singapore also promulgated preferential treatment measures in the Global Trader Program (GTP) for trading companies, the Financial and Treasury Center (FTC) for financial services companies, etc.

ビジネス向け Google 翻訳:翻訳者ツールキットウェブサイト翻訳ツール

-

Regional Headquarters

Regional headquarter (RHQ) refers to a company that has a central office in the Asian region country with low tax rate. This company is permitted to apply for the preferential treatment system (RHQ Award) including corporate tax reduction.

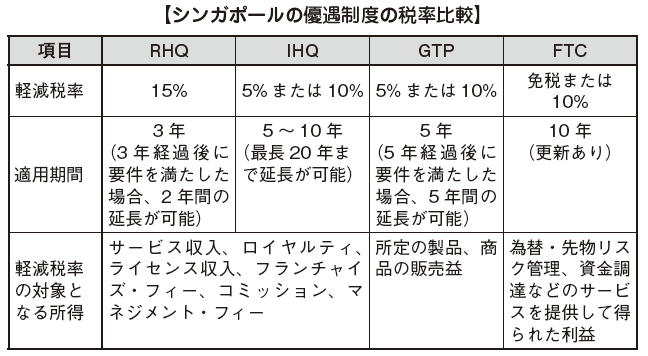

■ Requirements for Taking Advantage of RHQ

In order to receive RHQ certification, it is necessary to satisfy the following external requirements as a regional headquarters:

· A company founded or registered in Singapore

· A company of a corporate group with a certain level of performance and scale within the industry

· It has central institution in the directive command system of the group and has clear management supervision function

· Meet the requirements of the following table (requirements of RHQ)

On the financial aspect, the minimum amount of capital and expenditures is stipulated. Moreover, in addition to that, the service provider must be in more than three countries. On the personnel side, employing more than 10 professional staff within three years and the average annual income of the top five high paying personnel must be at least 100 thousand dollars.

■ Preferential Contents of RHQ

If a company that satisfies all of the above requirements receives RHQ certification from the government, in principle the corporate income tax rate of 15% will apply for overseas eligible income (service, loyalty etc) for 3 years. In addition, after three years has elapsed and the company still meets the minimum requirement above, the preferential period will be extended for another two years for qualified income such as overseas management fee, service fee, royalty etc. -

International Headquarters

Application Requirement of IHQ

A large headquarter that substantially exceeds the qualification requirements of RHQ can apply as an international headquarters (IHQ). The awarding of IHQ certification is decided in consultation with EDB. The awarding of the IHQ certification will be affected by the contribution of companies to the Singapore economy, the appeal to EDB, and the bargaining power of the company.

■ Preferential Contents of IHQ

When a company qualified as an IHQ, Incentive Package (IHQ Award) will be applied. A reduced tax rate of 5% or 10% will be applied to the increment of income of the company such as management fee, service fee, sales income, trade and royalties for 5 to 10 years (maximum 20 years)IHQ company exampleP Corporation

In 2005, P · Asia · Pacific was certified as "International headquarters". The group has 11 subsidiaries in Singapore and has been certified as an international headquarters for being recognized in investing in Singapore for a long time.

Taking advantage of Singapore's strengths, including geographical advantages, excellent logistics capabilities, advanced information communication infrastructure and outstanding human resources, the company as headquarter is acting as an important center with different functions such as in supply chain, finance, IT, human resources, human resource development andengineering.

-

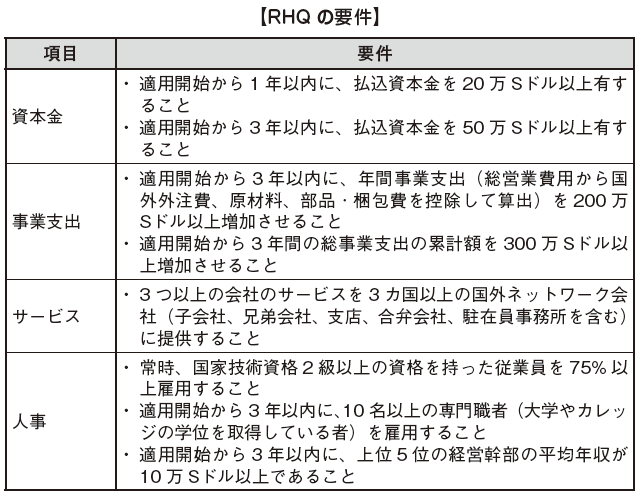

Global Trader Program

■ Application Requirements of GTP

The Global Trader Program (GTP) is a preferential treatment system for companies that have headquarters which are engaged in wholesale in Singapore as a base for offshore trade activities. This system is being applied to companies that conduct international trade transactions on energy products, agricultural products and foodstuffs, industrial products etc. and utilize Singapore as a trade center in the surrounding area. Details of application requirements are as follows.

■ Preferential Contents of GTP

Companies that were granted with GTP certification will be subject to a reduced tax rate of 5% or 10% for five years for the profits arising from the trading activities of certain goods and products. After that, by satisfying the application requirement, extension for 5 years will be possible.

-

Finance / Finance Center

The Financial and Treasury Center (FTC) is a preferential tax system applied to multinational companies that provide financial and treasury services to affiliates in the Asian region.

This system was established by the Singaporean government as it aims to become the global financial center. Preferential taxation such as a 10% reduced tax rate will be applied if the following requirements are met:

■ Application requirements of FTC

Details of requirements are as follows.

· Operate business with annual expense of over 750,000 S (excluding interest expense)

· Hire three or more professional staff

· Provide more than three financial services to 3 or more subsidiaries

The above requirements are only guide and the content of financial services is stipulated as follows.

· Arrangement of credit facilities (credit facilities) by financial institutions in Singapore or funds from surplus of group companies

· Financial · Advisory

· Guarantee and Securities · Services related to the provision and remittance of preliminary letter of credit

· Arrangement of derivative transactions

· Cash management of affiliated companies outside Singapore

· Survey and analysis on economic and investment

· Management and control of credit information

· Management tasks in general

· Formulation of business plan

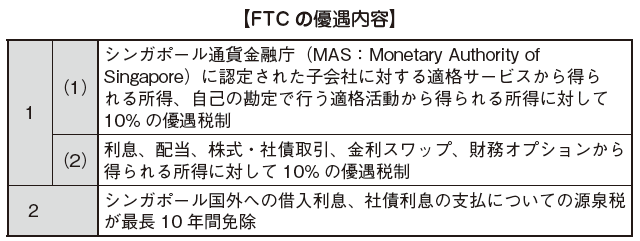

■ Preferential Contents of FTC

If the application requirements of the FTC are met, a 10% preferential tax system will be applied for income and dividends arising from finance, cash management and procurement services for up to 10 years.

-

Examples of utilization of regional headquarters in Singapore

■ I Corporation IIn 2012, I Co., Ltd. established "I Asia-Pacific Holdings" (100% subsidiary) in Singapore as a regional headquarters. In addition to selling and marketing of drinking water, with the goal of developing products that will meet the consumers need in the region the company will oversee other regional headquarters to collect information on consumer trends and tastes within the region. In addition, in October of the same year, with strong sales, channel development, and distribution I Asia Pacific Holdings with 90% ownership jointly invested "I Singapore" and "B Holdings Pte. Ltd." as sales company, For the time being the company will sell things imported from Japan, but they are planning to build a factory in Myanmar and Vietnam in the near future and use it as a manufacturing base.

* In establishing a manufacturing base in Myanmar and Vietnam as a controlled company, it is necessary to restructure the new subsidiaries after the establishment with the investment from the regional headquarters or the investment by the parent company.

【Business composition using Singapore Regional Headquarters】

[Funding by repayment method using reduced tax rate and its contents · merit]

In application of the reduced tax rate in the Singapore Regional Headquarters, it is important how to revert the funds acquired through the company’s sales. I will explain the repayment of funds by taking I company as an example.

Service Fee

I's regional headquarters are conducting marketing and market research, etc. in addition to selling goods, and it seems that they are collecting funds from subsidiaries as service fees for these services. In addition, at the Singapore Regional Headquarters, the reduced corporate tax rate is being applied, as well as withholding tax exemptions on service fees and trade income. In the case of I company this time who also do sales operation it is necessary to stay on sales but not to the extent that it will become a conflict with regulation of regional supervisory.

Royalty

If the Regional Headquarter conducts technology transfer etc. to the subsidiary, it will receive royalties as consideration. In this case, since foreign source income received in Singapore is subject to tax, the company needs to pay certain tax on the royalties received.

Dividend

Dividend distribution is a common method of returning profits earned by overseas subsidiaries to its home office or regional headquarter. If funds are reverted through dividends, withholding tax upon payment of dividend is usually impose in the source country. If dividend income was received, being subject to taxation in Singapore and withholding tax in the source country at the same time, double taxation may occur. In this case, tax relief is permitted as remedy measures. The applicable requirements for reduction and exemption of tax on dividend are as follows.

· The maximum corporate tax rate of the source country is at least 15%

· The tax on dividend paid was withheld on foreign country which is the source of income

For example, if the location of the headquarters is in Indonesia or Vietnam and the income is taxed in the withholding country, the above conditions will apply and be subject to tax exemption.

[Benefits of Establishing Other Regional Headquarters]

Regarding the merit of the regional headquarters, it is common to utilize the reduced tax rate as shown above. But you can also take advantage of the location of Singapore and the merit of the regional headquarters system itself. I will use Myanmar and Vietnam as manufacturing bases in the future as a strategy that fully utilize these merits.

Reduction of Distribution Cost by Asian Neighborhood

In Singapore, we intend to import products from Japan for the time being, but in the future we intend to utilize Myanmar and Vietnam as manufacturing bases. Since Singapore is geographically located in the center of Asia, it is possible to reduce the distribution cost. In addition, it is possible to reduce the cost associated with foreign exchange transactions. Details are explained in the next section.

Reduction of Foreign Exchange Risk by Ownership of Foreign Currency Funds

For example, when sending products from Myanmar as the manufacturing base to Thailand who operate sales to the market, trading is done with Myanmar "Chat" and Thai "Baht", so the foreign exchange gains / losses will occur.

On the other hand, in Singapore it is possible to open multiple foreign currency accounts. Therefore, logistics is made directly between Myanmar and Thailand, and by having Singapore intervention, it is possible to reduce management risk by offsetting transactions and improving management efficiency and convergence of foreign exchange gains and losses.

[Risk in Utilization of Regional Headquarters]

There are some risks to be aware of when you enjoy the reduced tax rates and other benefits mentioned above. In setting up and operating the Regional Headquarters, it is necessary to grasp these risks and take countermeasures in advance.

Transfer Price Taxation

For details, please refer to Chapter 6 "Tax Risk of Regional Headquarters". However, transfer price taxation applies if it was judged that the regional headquarters is used as the logistics base and the price in the intercompany transaction at that time is not appropriate. Specifically, if the amount of tax payable when transactions are made at an incorrect price is less than the amount of tax payable in the case of trading at a reasonable price. In that case, that difference will be recognized as income.

Investigation of transfer pricing taxation is becoming severe year by year, and preparations of "transfer pricing document" and "document related to inter-company price calculated by corporation for overseas related transactions" are necessary.

Tax Haven Countermeasure Tax System

Tax / Haven countermeasure tax system is a system that regulates the act of avoiding taxation by companies with overseas subsidiaries. In Singapore there is no tax hike regulation, but there is provision on the Japanese side, which is a risk that should be dealt with beforehand like transfer pricing taxation system.

Tax / Haven countermeasures is the point where the tax system on the transfer pricing taxation is decisively different its application requirements. While the transfer pricing taxation system verifies the uncertainties such as the validity of the price, the applicable tax and haven tax system clearly specifies its application requirements. Therefore, countermeasures are simpler than transfer pricing taxation. In addition, the provision of "exclusion from tax and haven countermeasures taxation system" is also established. For details, refer to Chapter 6 "Tax Risk of Regional Headquarters".

-

-

-

Websites

[1] シンガポール経済開発庁

[2] JETRO「シンガポール 税制」

[4] JETRO・シンガポール、シンガポール日本商工会議所、在シンガポール日本国大使館「第3 回在シンガポール日系企業の地域統括機能に関するアンケート調査(要旨)」2012 年3月27日

[5] Deloitte「シンガポール2013 年度予算案の解説」2013年3月5日

-

Babiliography

[1] PWC「タイ国税務小冊子(2012年)」

[2] 江藤祐一郎、菊井隆正、石田仁司「アジア地域統括会社(4)――シンガポールにおける地域統括持株会社設立に伴う税制」国際税務、2006年5月号[3] 山岡耕志郎、石田仁司「アジア地域統括会社(5)――タイにおける地域統括持株会社設立に伴う税制」国際税務、2006年6月号

[4] 新日本アーンストアンドヤング税理士法人編『アジア各国の法人税法ハンドブック』大蔵財務協会、2008年

[5] 税理士法人トーマツ編『アジア諸国の税法〈第8 版〉』中央経済社、2013年

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya