Singapore

1 Chapter Importance of Management by Regional Headquarters

-

-

1 Chapter Importance of Management by Regional Headquarters

1.1 Importance of Asian market

1.2 Regional management of the Asian market

1.3 Comparison of countries as headquarters

2 Chapter Regional Headquarters System and Utilization Examples

3 Chapter How to Utilize Regional Headquarters

3.1 Method of Consolidating Profit by Dividend and Making it as Reinvestment Base

3.2 Utilization as a Finance Company (Loan Function)

3.3 Example of Utilization of Efficiency by Consolidating Settlement Functions

3.4 Example of Reviewing Supply Chain Functions and Risks

4 Chapter How to Make Regional Headquarters

4.1 How to Set Up a Regional Headquarters

4.2 Singapore as a Business Base

4.3 Corporate Law in Singapore

5 Chapter Overseas Relocation of Head Office Functions

5.1 Head office relocation to low tax rate country

6 Chapter M&A

6.1 Trends in M & A in Singapore

6.2 Points to keep in mind when doing M & A

6.3 Laws and regulations concerning M & A

6.7 Investment regulatory environment of Singapore

7 Chapter Accounting

7.1 Accounting System in Singapore

7.2 Accounting Standard in Singapore

7.3 Disclosure System in Singapore

7.4 Accounting Audit in Singapore

8 Chapter Tax Risk of Regional Headquarters

8.1 Tax · Haven Countermeasure Tax System

8.2 Foreign Subsidiary Dividend Income Non-inclusion System

8.5 Taxation of Country of Residence and Double Taxation by Source Taxation

8.6 Tenuous Capital Tax System

9 Chapter Tax

9.2 Personal income tax in Singapore

9.3 Corporate income tax in Singapore

9.6 Singapore withholding system

9.7 International tax in Singapore

10 Chapter Labor

10.1 Work environment in Singapore

10.3 Social Security System in Singapore

10.4 Points to keep in bringing Japanese to Singapore

11 Chapter Q&A

-

-

-

Latest News & Updates

【GDP Growth Rate of Q2 in 2016】

GDP growth rate of Singapore Q2 was announced as 2.1%. As of June, 2.0% growth rate was expected, and it was almost what they are expecting.

The growth rate through 2016 is expected to be 1.8%, and this forecast has not been changed even when Q2 is over.Sectors where there were certain fluctuations from the survey at June were as follows.· Manufacturing 0.0 (June) → 0.7 (Q 2)· Finance & Insurance 2.9 (June) → 2.0 (Q 2)· Private Consumption 2.5 (June) → 3.0 (Q 2)Although there is an increase in the item of personal consumption, it is expected that this will decrease markedly in Q3 and will again increase in Q4.

【About economic growth in Singapore】Trade and Industry (Trade) Minister, Lim Hng Kiang said at the Diet that the Singapore economy could experience negative growth during the next quarter, although there is no prospect of a major recession.As Mr. Lim said concerning that the economic recession may be approaching from the deterioration of the figures seen from the latest economic data,, "Although it is not a major economic recession in our standard forecast, it is on a quarterly basis We cannot rule out the possibility of negative growth."

Compared to the first half, the GDP growth rate in the second half is expected to fall to about 2.1%.

According also to Mr. Lim,the international economy grows, the government continually monitors the situation and makes efforts to deal with the recession of the economy.

With the system like the SME Working Capital Loan Scheme where companies receiving business deterioration are being asked for assistance, government support is also being considered, and as a company, we need to pay attention to the corporate support of the Singaporean Government in the future.

While explaining that Singapore is a "small open economy", Mr Lim suggests that Singapore will not end up being affected by external factors such as the 2008 economic crisis that will cause the economy to decline.

In the short term, the decline of the global economy is expected to continue due to the slump in developed countries such as the decline in China's growth and the price cut of oil. Also, the UK 's EU vote, which took place in June, is undermining the uncertainty in global growth.As per Mr. Lim, influenced by the global economic backlash, outdoor-oriented industries such as Finance and Insurance and wholesale are stagnant, and these may continue to be affected by the wind clash. Even in the manufacturing industry, despite this two-quarter growth, business performance is getting worse due to the slump in external demand. The industry belonging to the Marine and Offshore Engineering industry and Precision Engineering and others is expected to continue its slump due to oil price cuts, and the domestic-oriented Food Services and Real Estate industries are expected to maintain the current state.

However, as the number of tourists increases, the tourism industry is positively affected. Based on the growth of Education, Health and Social Services, IT and Information Services industry, growth in other industries such as Information and Communication industry will be resilient.

Even in the future o decline of the global economy, "making efforts for more continues growth by productivity and innovation" becomes important. .

GDP forecasts for developed countries by MTI will be announced at 8 o'clock on October 14th, there is a forecast for growth in November, and attention is paid to future economic trends. Also, on 14th of October there will be an announcement of Monetary Policy Decision by MAS. -

Japanese companies entering Asia

■ Asian gigantic market to riseIn recent years, with the rapid development of the Asian economy, middle classes are rapidly increasing in Asian countries. Consumption by the middle class has also increased remarkably, and it is expected to see a steady economic development in the future.

As you can see from the automobile industry, markets are changing from Japan to Europe to the BRICS in the 2000s, and now in Asia, it was centered on Thailand and Indonesia. In addition, the population of Asia including both China and India is currently about 400 million, which accounts for about 60% of the world population, attracting attention from foreign companies in the rapidly growing Asian market.

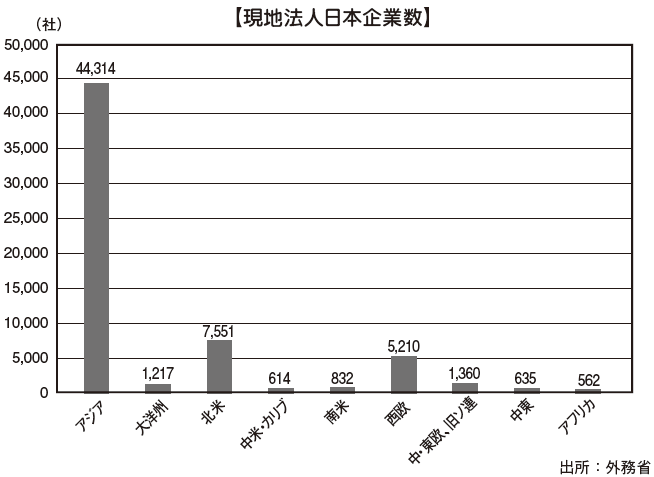

While Japanese markets are declining, Japanese companies are finding their way to the Asian market. Especially after the global financial crisis in 2000, triggered by the subprime mortgage crisis, the economic downturn in each country, especially in Europe, has expanded in a chain and the demand from Western countries has fallen. As a result, Japanese companies are increasing their supply to Asian countries where high growth rates and demand growth are expected, and rapidly shifting manufacturing and sales centers to the Asian market.■ Number of Japanese companies in AsiaAccording to the Ministry of Foreign Affairs' "Number of overseas residents Japanese survey statistics summary version Heisei era 27 summary edition" out of a total of 68,573 Japanese affiliates in Japan, the number of companies in Asian countries has become an overwhelming large number of 48,203 companies (70.29%). Looking at the number of Japanese companies in Asian countries, China has 32,667 companies which accounts for approximately 68% of Asia as a whole, and it is overwhelmingly large, but the ratio tends to decrease year by year. . Outside of China, there are more than 1,000 companies in India, Indonesia, Thailand, the Philippines, Malaysia, Vietnam and Taiwan.

Looking at the number of Japanese companies in Asian countries, China has 32,667 companies which accounts for approximately 68% of Asia as a whole, and it is overwhelmingly large, but the ratio tends to decrease year by year. . Outside of China, there are more than 1,000 companies in India, Indonesia, Thailand, the Philippines, Malaysia, Vietnam and Taiwan.China has a population of more than 1.4 billion people and the income level is rapidly improving. In the past, it was seen that the market is a manufacturing base, but since 2000, market is not only considered as a manufacturing base, but also sales base has increased, therefore calling it as the world market.

Looking at the trends in the number of Japanese companies in other countries, the number of companies in India, which is a huge market next to China, is conspicuous. However, the number of companies in Asian countries is increasing and among Japanese companies, you can see that the expansion into the market is also accelerating. In particular, as a manufacturing base, there is an increase in exports to Thailand, Indonesia, Vietnam and Malaysia. I think that one company is accelerating its expansion not only among Asian countries but also in several countries outside Asia.

In particular, as a manufacturing base, there is an increase in exports to Thailand, Indonesia, Vietnam and Malaysia. I think that one company is accelerating its expansion not only among Asian countries but also in several countries outside Asia. -

Asian market focus of Japanese companies

Japanese companies have bases in various parts of Asian countries, and it is expected that their importance will increase more and more in the future.

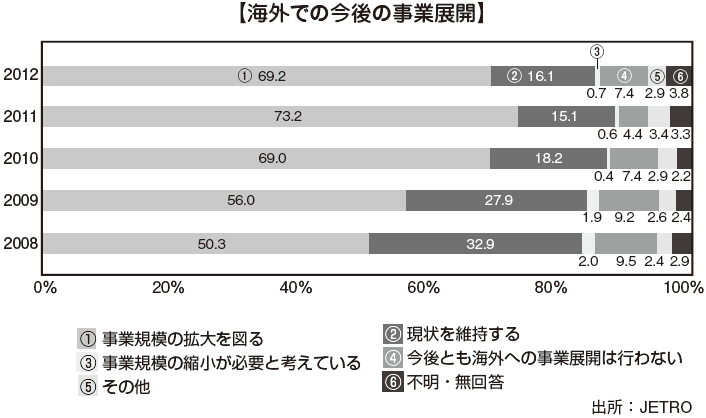

According to JETRO's "Questionnaire survey on overseas business development of Japanese companies in FY2005 FY05" (March 2016), If we will discuss overseas business development (new investment, expansion of existing bases) in the future (about 3 years), 53.3% of enterprises respond. "We will expand the scale of our business". 63.8% in large companies and 50.5% in small and medium-sized enterprises are aggressive in overseas business development, so it is expected that SMEs will continue to expand into Asian countries.

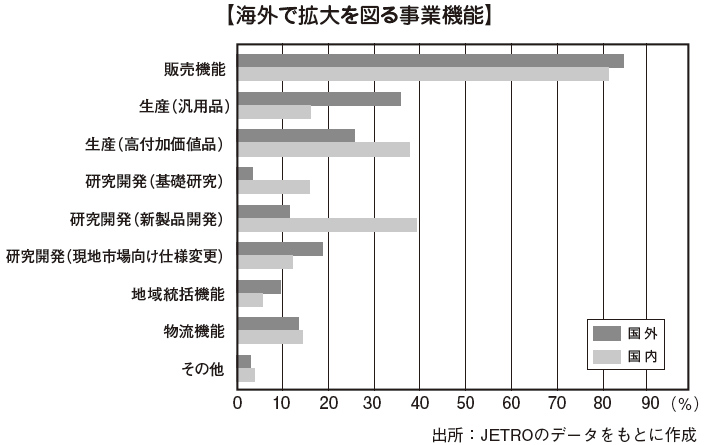

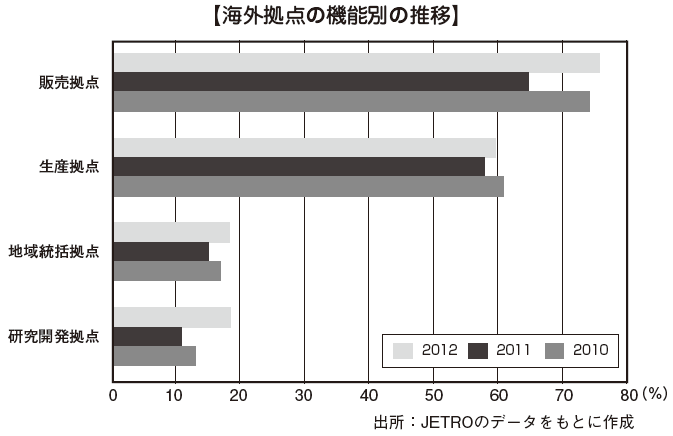

Among the companies that responded "To expand the scale of the businessoverseas”, regarding the function to expand concretely, "sales function" is the highest percentage at 83.9%, followed by "production (general-purpose goods)" at 33.7%. From this, it is expected that growth and demand growth in Asian countries will be great in the future. For that reason, it became increasingly important to consider the overall management strategy, such as transferring the sales strategy that emphasizes the Asian market and especially the production of general-purpose goods to Asian countries where labor is less expensive than Japan.

Among the companies that responded "To expand the scale of the businessoverseas”, regarding the function to expand concretely, "sales function" is the highest percentage at 83.9%, followed by "production (general-purpose goods)" at 33.7%. From this, it is expected that growth and demand growth in Asian countries will be great in the future. For that reason, it became increasingly important to consider the overall management strategy, such as transferring the sales strategy that emphasizes the Asian market and especially the production of general-purpose goods to Asian countries where labor is less expensive than Japan. -

Increasing Regional Headquarters

In order to expand the sales base and production base to Asian countries, it is important to promptly formulate and execute strategies tailored to the needs of the Asian market. To do this, it is necessary to set up bases in Asian countries to oversee the Asian region, rather than to do it at the headquarters in Japan andto make faster business decisions.

■ Functions of Asian basesAccording to JETRO 's "Outline of questionnaire survey on overseas business development of Japanese companies in FY2005" when considering the function of Japanese companies entering Asian countries, the sales base is 7.5.6% and the production base is 56.1% It is getting.Currently, Asian countries have grown "middle class" due to sustained economic growth rate, and purchasing willingness is improving. Since we can expect to grow from "middle class" to "high net worth" in the future, we can expect to reach the Japanese income level, so the possibility to complement the sluggish Japanese market by incorporating that "wealthy" You can expect.As price competition is intensifying due to the rise of China, it is difficult to reduce production cost in Japan with high labor costs, and it is inevitable to transfer production base to Asian countries with lower labor cost .2 0 1 3 - 2 0 Looking at trends by site functions in 15 years, the sales base and production base are nearly flat. However, although the total number is small, the regional headquarters and R & D bases are on an increasing trend.From this result, we can see that we are trying to find a good way to the Asian market where high growth rate can be expected, and that we are trying to reduce production cost by utilizing low labor force. Regarding the regional headquarters, it is tough that more and more companies are setting up to strengthen sales strategies of the Asian market, which is expected to grow in the future. Regarding research and development bases, it seems that companies that are trying to reduce R & D expenses are increasing by securing excellent talent with low labor costs from Japan.

Japanese companies that have regional supervisory functions and have entered Asian countries account for 18.1% of the total, which has increased since the previous fiscal year.

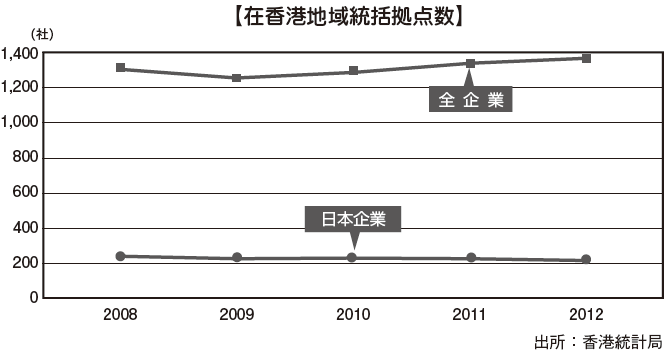

Among the Asian countries, we have selected some particular countries where the company can take advantage of incentives such as tax incentives by establishing regional headquarters and access to neighboring countries, etc. These countries are Singapore and Hong Kong.As for Singapore, according to JETRO "Questionnaire survey on regional supervisory function of Japanese affiliated companies in Singapore" (December 2015), 90 companies which accounted for 48.6% out of 185 effective responses, "have regional supervisory function ". There are 52 companies or 28.1% answered "There is no regional supervisory function, but we are considering setting up in the future" . In other words, in the future, more than 70% of Japanese companies in Singapore are actually supposed to have regional supervisory functions in Singapore.According to the Hong Kong Bureau of Statistics, as of June 2002, the number of regional headquarters in Hong Kong has been announced as 1,367 companies, and it is increasing steadily. Meanwhile, the number of regional headquarters of Japanese companies in Hong Kong is 2 1 9 companies, which is decreasing year by year.

-

-

-

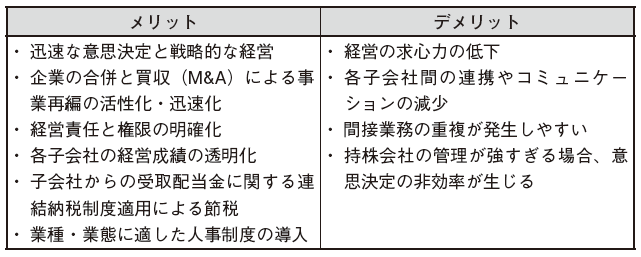

From domestic reorganization to international reorganization

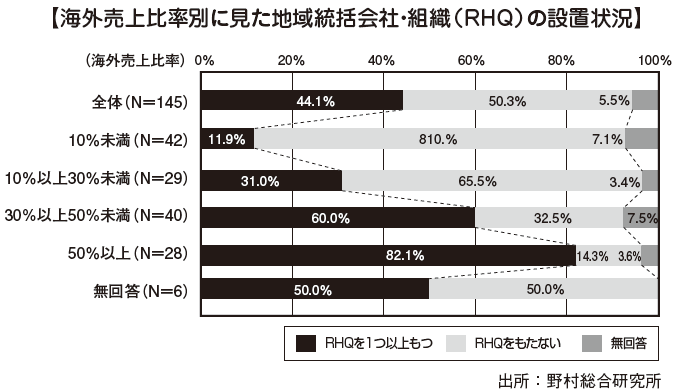

Foreign direct investment in Japan began with permission to establish a US company of a trading company in 1951. Since then, we have expanded with the steep liberalization measures, the Foreign Exchange law revised, and the sharp appreciation of the yen due to the Plaza agreement as opportunities.The business of Japanese companies overseas in the 1970s mainly focused on exports of products, and the international competitiveness of the products produced in Japan was a major concern. Afterwards, when the expansion to overseas becomes popular, from the export business, dispatching people from Japan, hiring employees locally, procuring raw materials etc. to develop production activities and sales activities, etc. Head office function Localization has been carried out.In this way, the globalization of corporate business activities has made corporate structure complicated, making it difficult to grasp the actual situation of the entire enterprise. Since we had no choice but to shift to a management strategy that focused on the entire corporate group from the traditional headquarter-oriented management strategy, we will centrally manage fund procurement, taxation strategy, exchange rate risk management, etc. at overseas business bases from the perspective of the entire group Necessity is required.In addition, as the change from domestic management to international management is required, the necessity of international reorganization by the holding company (holding company) is increasing in order to improve the efficiency of the entire business.In the prewar Japan holding company, companies such as Mitsubishi, Sumitomo and so on were dominated directly by key industries such as finance, and had a great influence on politics as well. For this reason, in order to prevent revival of pre-war chaebol after the war, Article 9 of the Antimonopoly Act, the establishment of a holding company was prohibited.However, as companies compete fiercely, business efficiency and revitalization will become necessary. Therefore, in 1997, the Anti-Monopoly Law was amended and the establishment of the holding company was lifted in order to smoothly distribute the business risk and reorganize the industry through mergers and acquisitions (M & A). First of all, the reorganization of financial institutions such as banks and securities beyond the boundaries of business divisions has accelerated, and the introduction to trading companies that run various businesses also started full-scale. Accordingly, a new tax payment system that can reduce tax burden within the group was introduced.Previously, it was a holding and company system that was used to reorganize domestic businesses, but as overseas expansion is prosperous, the number of overseas bases will also increase, corporate activities will be globalized, including overseas subsidiaries Reorganization of international business is required to improve the efficiency and revitalization of the project.The advantages and disadvantages of the holding company system are as follows. As overseas bases are expanding to North America, Europe, Asia, etc., the necessity of establishing a holding company as a regional headquarters to oversee business by region, and to increase international competitiveness It is growing. From the viewpoint of business management, it is necessary to use "global optimum" that takes advantage of the cost reduction in global management and the dispersion merit of the production process, and "regional optimum" which implements products and marketing strategies suited to the regional market I will come.Therefore, it is possible to avoid inventory risk, transaction risk, etc. by centrally managing dispersed production bases / markets for each region, quickly grasping the movement of each regional market and making decisions.The role of regional headquarters, a holding company that manages group companies in each country / region and develops business strategies in each region, has become more important than ever before.According to the "Questionnaire survey on how the global headquarters function should be" by Nomura Research Institute, the overseas sales ratio is over 30%, the necessity of regional supervisory function dramatically increases.

As overseas bases are expanding to North America, Europe, Asia, etc., the necessity of establishing a holding company as a regional headquarters to oversee business by region, and to increase international competitiveness It is growing. From the viewpoint of business management, it is necessary to use "global optimum" that takes advantage of the cost reduction in global management and the dispersion merit of the production process, and "regional optimum" which implements products and marketing strategies suited to the regional market I will come.Therefore, it is possible to avoid inventory risk, transaction risk, etc. by centrally managing dispersed production bases / markets for each region, quickly grasping the movement of each regional market and making decisions.The role of regional headquarters, a holding company that manages group companies in each country / region and develops business strategies in each region, has become more important than ever before.According to the "Questionnaire survey on how the global headquarters function should be" by Nomura Research Institute, the overseas sales ratio is over 30%, the necessity of regional supervisory function dramatically increases. In this way, as the trend of restructuring and consolidation of corporate overseas bases has accelerated, we will concentrate the monetary, money and information of each region at the regional headquarters and reinvest in local areas therefrom Financial and financial strategies for building a structure are also full-fledged.

In this way, as the trend of restructuring and consolidation of corporate overseas bases has accelerated, we will concentrate the monetary, money and information of each region at the regional headquarters and reinvest in local areas therefrom Financial and financial strategies for building a structure are also full-fledged. -

Management by regional headquarters

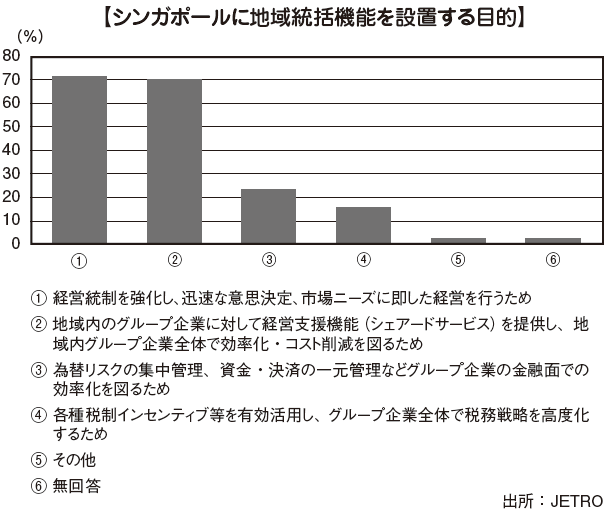

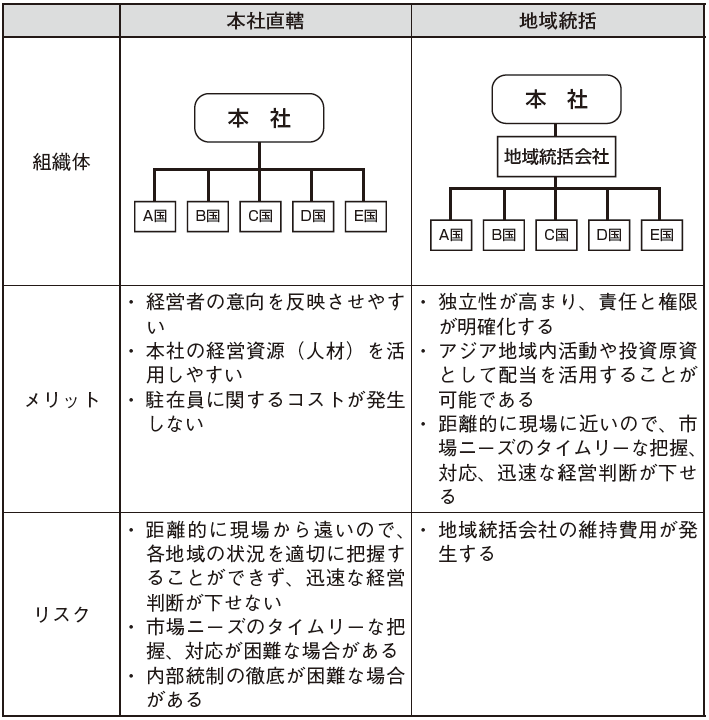

Although I mentioned the importance of the establishment of the regional control system of the Asian market, when examining the purpose of establishing a company that has established regional headquarters in Singapore actually, "Third Regional Management of Japanese-affiliated companies in Singapore In the questionnaire survey on functions "report, 71.4% answered" To strengthen management control, to make prompt decision making, manage in line with market needs "," Management support to group companies in the region To provide functions (shared services) and to improve efficiency and cost reduction among group companies within the region "accounts for 70.1%. As for the Asian regional supervision form, it is divided into two, directly under the headquarters that manages from the headquarters in Japan and management from the site in the Asian region.Advantages directly under the headquarters are the ability to manage the business from a global perspective, easy to utilize the management resources of the headquarters (especially human resources), problems can not be grasped precisely on the site situation, timely to market needs It is said that correspondence is difficult.Advantages of regional supervision are cost reduction by strengthening business in the Asian market, timely market response, aggregation of functions dispersed among overseas subsidiaries in each country, and as a matter of increasing administrative costs (the number of personnel resident from the headquarters Cost etc.), shortage of human resources (especially local management talent).It is classified as the organization body of the form of regional supervision as follows.

As for the Asian regional supervision form, it is divided into two, directly under the headquarters that manages from the headquarters in Japan and management from the site in the Asian region.Advantages directly under the headquarters are the ability to manage the business from a global perspective, easy to utilize the management resources of the headquarters (especially human resources), problems can not be grasped precisely on the site situation, timely to market needs It is said that correspondence is difficult.Advantages of regional supervision are cost reduction by strengthening business in the Asian market, timely market response, aggregation of functions dispersed among overseas subsidiaries in each country, and as a matter of increasing administrative costs (the number of personnel resident from the headquarters Cost etc.), shortage of human resources (especially local management talent).It is classified as the organization body of the form of regional supervision as follows. The optimal form of supervision for Asian market focus strategy is considered to be different depending on each business model of Asian business.For businesses with a high degree of the following two points, management of regional supervision will make it possible to strengthen Asian business, make rapid decisions, and realize timely market response.· Need to customize goods or services targeting the Asian market· Degree of supply chain completion within the Asian regionOn the other hand, as a business with a low degree of capital investment, there are large capital expenditures, global production division of production and production bases in Asia like semiconductor, but products are becoming global standards, the Asian market There is a case that there is no need to customize it for the purpose.In this case, it is considered effective to conduct global management centered on the business axis directly under the head office, not management in Asia's regional axis.Besides the business model, the Asian regional supervisory function may be different depending on the scale of Asian business and type of industry. If the sales of the Asian business are on a certain scale, it is characterized by many cases that fulfill functions directly linked to business such as business management and sales / sales marketing.As the scale of the business becomes larger, the functions directly linked to the business are delegated to local subsidiaries in each country, and corporate functions such as personnel management, compliance and internal control tend to be strengthened.In the case of the manufacturing industry, we will strengthen functions that will timely support production optimization as export production base for the Europe and North America markets, and business oversight functions centering on sales marketing as sales to the Asian market increase. After that, the business supervising function is delegated to the local subsidiary of each country, and the pattern that the corporate function which was the head office function of Japan shifts can be seen.Along with the expansion of the Asian market, regional supervisory functions will become headquarters, and it is thought that it will shift to a system that can respond more quickly and timely.

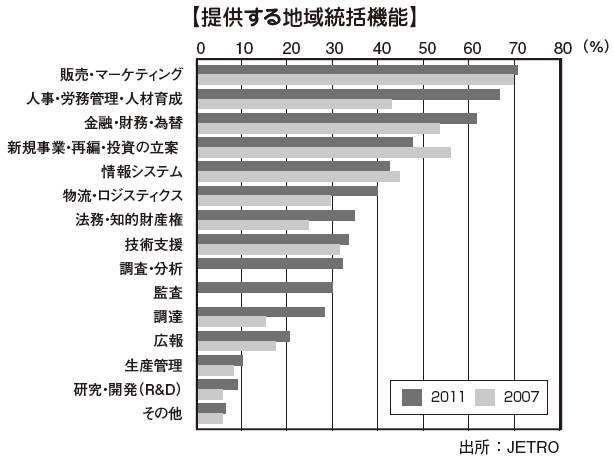

The optimal form of supervision for Asian market focus strategy is considered to be different depending on each business model of Asian business.For businesses with a high degree of the following two points, management of regional supervision will make it possible to strengthen Asian business, make rapid decisions, and realize timely market response.· Need to customize goods or services targeting the Asian market· Degree of supply chain completion within the Asian regionOn the other hand, as a business with a low degree of capital investment, there are large capital expenditures, global production division of production and production bases in Asia like semiconductor, but products are becoming global standards, the Asian market There is a case that there is no need to customize it for the purpose.In this case, it is considered effective to conduct global management centered on the business axis directly under the head office, not management in Asia's regional axis.Besides the business model, the Asian regional supervisory function may be different depending on the scale of Asian business and type of industry. If the sales of the Asian business are on a certain scale, it is characterized by many cases that fulfill functions directly linked to business such as business management and sales / sales marketing.As the scale of the business becomes larger, the functions directly linked to the business are delegated to local subsidiaries in each country, and corporate functions such as personnel management, compliance and internal control tend to be strengthened.In the case of the manufacturing industry, we will strengthen functions that will timely support production optimization as export production base for the Europe and North America markets, and business oversight functions centering on sales marketing as sales to the Asian market increase. After that, the business supervising function is delegated to the local subsidiary of each country, and the pattern that the corporate function which was the head office function of Japan shifts can be seen.Along with the expansion of the Asian market, regional supervisory functions will become headquarters, and it is thought that it will shift to a system that can respond more quickly and timely. In the service industry, unlike the manufacturing industry, it starts with sales marketing function for market development. Human resources who provide services will become the center of competition, so utilization of local human resources will be important as regional supervisory function. The functions offered by Singapore's regional headquarters are 63.3% for "sales and marketing", 60.0% for "finance, finance, exchange and accounting", and 54.4% for "management planning", strengthening Asian business, We are seeking to realize prompt decision-making and timely market response. "Management planning" has been rising from the time of the previous survey, while "Human Resources, Labor Management and Human Resource Development", which was second highest in the previous survey, fell from 67.5% to 46.7%.

In the service industry, unlike the manufacturing industry, it starts with sales marketing function for market development. Human resources who provide services will become the center of competition, so utilization of local human resources will be important as regional supervisory function. The functions offered by Singapore's regional headquarters are 63.3% for "sales and marketing", 60.0% for "finance, finance, exchange and accounting", and 54.4% for "management planning", strengthening Asian business, We are seeking to realize prompt decision-making and timely market response. "Management planning" has been rising from the time of the previous survey, while "Human Resources, Labor Management and Human Resource Development", which was second highest in the previous survey, fell from 67.5% to 46.7%. -

Issues of Regional Headquarters

In order to capture the growth of the Asian market, further localization is required such as promotion of local human resources, local close marketing, delegation of authority to the site, thorough procurement of local parts materials, product development in the field .However, management based on regional supervision has the following problems.· Talent shortage· Privilege delegation is limited· The controlled company is a joint ventureIn other words, due to the lack of global human resources, delegation of authority to the site becomes limited, and it may be inevitable to rely on a joint venture company etc. as resources of other companies, not their own resources. Because there is no global talent to shift to regional supervisory management, there are many companies that utilize the management resources of the head office under the direct control of the headquarters.Companies that have regional headquarters in Singapore have "9.7%" strengthening the personnel structure "as" issues to be solved within the company in order to maximize the effect of regional supervisory functions "," Delegation of decision-making authority "accounted for 48.1%," 0.3% of group companies' review of the organizational structure of group companies including strengthening the holding function of regional headquarters "accounted for 4 0.3%, strengthening of talent shortage and delegation of authority emphasized as an issue It is becoming.Companies with regional headquarters in Singapore list the following items as concerns.· Rise in personnel expenses· Office rent, rising expatriate cost· Tightening the issuance of work visas

Other than that, establishing a regional headquarters in cooperation with the headquarters, such as not transferring authority from the headquarters, is pointed out as a problem. Among them, issuance of work visas has become severer in recent years, increasing the number of Japanese expatriates does not advance, and problems that can not properly arrange personnel that we were thinking at the business planning stage are getting worse..png)

-

-

-

Country of establishment of regional headquarters

The following conditions can be cited as points for selecting the headquarters for the Asian region.· Access to neighboring countries· Transparency of administrative and legal system· Maintained infrastructure etc.From these viewpoints, Singapore, Hong Kong, and Thailand are attracting attention as headquarters."Questionnaire survey on the regional supervisory function of Japanese companies in Singapore in the 3rd Singapore", "To the group companies in the region, the holding function, the financial supervisory function, sales, production, logistics, procurement, research and development, personnel affairs · The ratio of Japanese affiliated companies that responded that they have regional supervisory functions defined as "various functions of business such as legal affairs / management support (provision of shared services)" is 36.2%.According to the Hong Kong Bureau of Statistics, it is announced that there are 1,3 6 7 regional headquarters including Hong Kong's Japanese companies as well as 1,67 companies as of June 2002, The company is also increasing. Despite the serious deterioration of the business environment due to the slowing global economy, we can see that the importance of Hong Kong is not declining.The reason why Japanese companies select Singapore or Hong Kong as the overseas base is to thoroughly deregulate business such as simplification of various procedures and liberalization of financial transactions, reduction of taxation costs including corporate tax, various tax exemptions · It is thought that it is inevitable to negotiate policies for attracting and holding foreign companies, such as tax reduction schemes.According to the World Bank and the International Finance Corporation annually announced, "Current Business Environment 2013", Singapore ranked No. 1 (10 consecutive years) in Hong Kong ranked 5th in the overall rankings.Among the evaluation criteria, the two countries are very important items in the location of Asian Regional Headquarters such as "International Trade", "Construction / Installation Permit", "Investor Protection", "Access to Loans", "Tax" , Both received high evaluation within 5th place. Four countries are in the top five in the world in East Asia and the Pacific region, with Singapore as the lead.

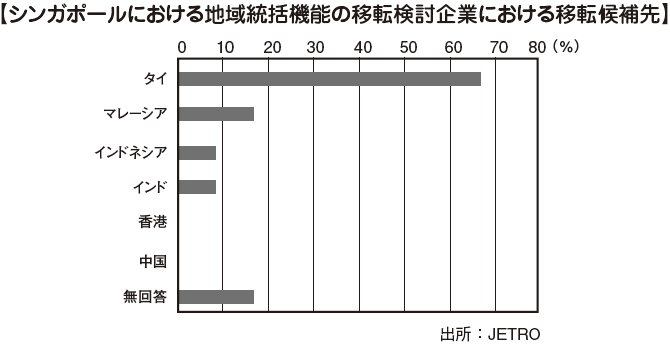

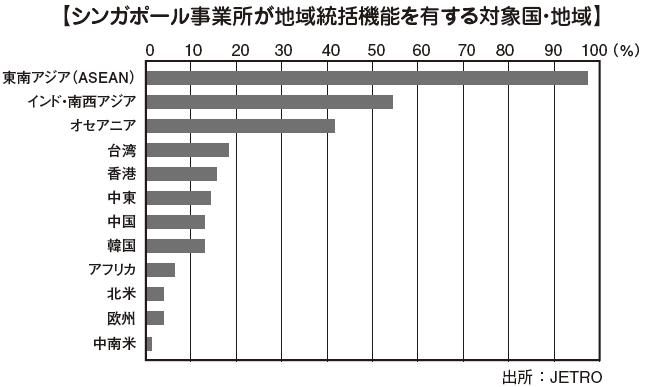

In the present situation, it seems that the superiority of Singapore and Hong Kong is overwhelming as the establishment place of the Asian headquarters, but recently there are an increasing number of Japanese companies establishing regional headquarters in Thailand.Thailand has the highest number of countries that have regional supervisory functions in Singapore and companies considering relocation of supervisory functions to other countries consider them as relocation destinations. Recently, in Thailand, legislation such as providing tax incentives in order to attract regional supervisory projects has been promoted. Geographically, Thailand is called the gateway to Indochina and is adjacent to Malaysia, Laos, Cambodia and Myanmar. In this way, it is in the limelight as a hub of the ASEAN countries.For Japanese companies, it can be said that the range of choice is expanded for the country where the regional headquarters are set up according to the business form. Therefore, among manufacturing industries, division functions are divided according to the characteristics of the installed country, such as putting in charge functions such as business oversight functioning mainly in production in Thailand and Singapore with functions such as finance, finance, personnel, and compliance There are also cases.■ SingaporeSingapore, with its strategically superior position in Asian countries and outstanding infrastructure, is the center of financial and regional trade and is widely recognized as an attractive management base with the world's busiest harbor. Looking at the target area controlled by Singapore's business establishment, ASEAN is overwhelmingly overwhelmingly at 97.4%, followed by India and Southwest Asia at 5 4.5%. In other words, it seems that there are many cases where you are overseeing ASEAN and the Indian region.

Recently, in Thailand, legislation such as providing tax incentives in order to attract regional supervisory projects has been promoted. Geographically, Thailand is called the gateway to Indochina and is adjacent to Malaysia, Laos, Cambodia and Myanmar. In this way, it is in the limelight as a hub of the ASEAN countries.For Japanese companies, it can be said that the range of choice is expanded for the country where the regional headquarters are set up according to the business form. Therefore, among manufacturing industries, division functions are divided according to the characteristics of the installed country, such as putting in charge functions such as business oversight functioning mainly in production in Thailand and Singapore with functions such as finance, finance, personnel, and compliance There are also cases.■ SingaporeSingapore, with its strategically superior position in Asian countries and outstanding infrastructure, is the center of financial and regional trade and is widely recognized as an attractive management base with the world's busiest harbor. Looking at the target area controlled by Singapore's business establishment, ASEAN is overwhelmingly overwhelmingly at 97.4%, followed by India and Southwest Asia at 5 4.5%. In other words, it seems that there are many cases where you are overseeing ASEAN and the Indian region. There are three main functions of the Regional Headquarters in Singapore (see the graph on page 26).· Sales · Marketing· Corporate Planning· Finance · Finance · Foreign ExchangeWith these functions, you can have international-level business facilities and efficient labor, so supply chain management, strategic planning, business development, human resources management, training, technical support, marketing and research and development Etc. are taking place.Together with the possibility of funds use and the protection of good intellectual property rights, the regional headquarters in multinational companies is a vibrant base for high-tech start-ups. Many technology companies have moved to Singapore in search of capital, customers and business partners in order to internationalize the business.According to "Questionnaire survey on regional supervisory function of Japanese affiliated companies in Singapore", the reason for setting regional supervisory functions in Singapore as "reasonable access to the surrounding area" is 9.1% It shows that there are many geographical advantages over Asian countries.

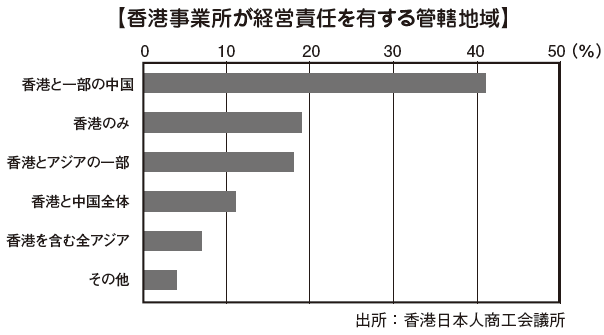

There are three main functions of the Regional Headquarters in Singapore (see the graph on page 26).· Sales · Marketing· Corporate Planning· Finance · Finance · Foreign ExchangeWith these functions, you can have international-level business facilities and efficient labor, so supply chain management, strategic planning, business development, human resources management, training, technical support, marketing and research and development Etc. are taking place.Together with the possibility of funds use and the protection of good intellectual property rights, the regional headquarters in multinational companies is a vibrant base for high-tech start-ups. Many technology companies have moved to Singapore in search of capital, customers and business partners in order to internationalize the business.According to "Questionnaire survey on regional supervisory function of Japanese affiliated companies in Singapore", the reason for setting regional supervisory functions in Singapore as "reasonable access to the surrounding area" is 9.1% It shows that there are many geographical advantages over Asian countries. Therefore, the attraction to establish regional headquarters in Singapore is considered to be the following three.· Easy access to neighboring countries (Asian countries) (Including airport convenience and infrastructure development including port facilities)· Improvement of various business environments (political stability, preferential tax system, strict regulations on bribery, etc.)· Secure talented personnel■ Hong KongHong Kong, like Singapore, has outstanding business infrastructure and is recognized as an attractive management base, especially as a financial center.According to the Hong Kong Japanese Chamber of Commerce and Industry's "Questionnaire Survey on the Business Environment in Hong Kong and China in 2007", "Hong Kong and some China" accounted for 41% It is becoming the most popular. In other areas, "Hong Kong only" is 19% and "Hong Kong and part of Asia" is 18%, while Singapore oversees the ASEAN and Indian regions, while Hong Kong It is thought that the mainland of China is supervised and the territorial jurisdiction is different.

Therefore, the attraction to establish regional headquarters in Singapore is considered to be the following three.· Easy access to neighboring countries (Asian countries) (Including airport convenience and infrastructure development including port facilities)· Improvement of various business environments (political stability, preferential tax system, strict regulations on bribery, etc.)· Secure talented personnel■ Hong KongHong Kong, like Singapore, has outstanding business infrastructure and is recognized as an attractive management base, especially as a financial center.According to the Hong Kong Japanese Chamber of Commerce and Industry's "Questionnaire Survey on the Business Environment in Hong Kong and China in 2007", "Hong Kong and some China" accounted for 41% It is becoming the most popular. In other areas, "Hong Kong only" is 19% and "Hong Kong and part of Asia" is 18%, while Singapore oversees the ASEAN and Indian regions, while Hong Kong It is thought that the mainland of China is supervised and the territorial jurisdiction is different. Hong Kong is now regarded as one of the world's three largest financial centers alongside London and New York, and its importance is increasing as one of the world's leading global cities. According to the "Wall Street Journal" announced "2 0 3 3 Economic Freedom Index", it has been named "the world's most free economic body" for ninety consecutive years.Since Hong Kong was originally a base for Britain's trade with China in the UK colonial era, trade has been developed to export imported things as they are. Although transferred to sovereignty to China in 1997, the capitalist system, which became a system of one system in two countries, continued as "Hong Kong special administrative district" until 2004, within one socialist country, China It is supposed to be adopted.In 1949, when the People's Republic of China was established, a large population flowed from the Chinese mainland to Hong Kong, resulting in the situation that the population has been increased to about four times by 1950 By utilizing it as an inexpensive labor force, labor-intensive industries such as the textile industry and the plastics industry developed and escaped the crisis.In the late 1970s, Hong Kong's industry shifted from the textile industry center to the manufacturing center of high-value added products such as the electronics industry and precision machinery. Along with these industrial changes, the Hong Kong Government has started to develop residential housing development and transportation infrastructure, and the Hong Kong economy has developed rapidly.As a result of China's reform and opening policy, from the 1980's, the traditional manufacturing industry moved to Pearl River Delta including Guangdong Province, Hong Kong shifted to financial centers and logistics centers in southern China and Southeast Asia, We have strengthened our competitiveness in international markets.Hong Kong Special Administrative Region Basic Law "based on British legal system is still maintained even after China's return of China in 1997. In addition, there are many European and American companies establishing Asian market headquarters functions as it is an economic structure of low tax rate and preferential tax system, and there are many talented people with high education level and English proficiency.Regarding logistics infrastructure as well, container handling volume in 2010 is the third largest in the world, after Shanghai and Singapore, the world's No. 1 cargo volume handled by air transport, importance as a hub port, gate port is extremely high It is high.After China's opening to the outside and returning in 1997, the relationship between them has developed dramatically. In 2003, the CEPA was signed between mainland China and Hong Kong, and supplementary consultations were held and concluded thereafter.The trade share with mainland China has also been expanded by CEPA, and the function as a business center in the southern part of China has become important.■ ThailandThailand has made remarkable progress as a production base in Southeast Asia. On July 2, 1997, I also experienced trials such as being hit by Thailand's 'Asian currency crisis' (199 - 1999), but in a spectacular way We have recovered, and since then we have continued steady economic growth. The expansion of Japanese companies is remarkable, and in 2012 the number of registered members of the Bangkok Japanese Chamber of Commerce is 1,371 companies.In order to attract foreign companies, the Thai government is promoting various measures including taxation. As "Toyo's Detroit", we are focusing particularly on training the automobile industry, and ambitious training programs are being taken.The advantage of based in Thailand was that it was common to utilize cheap labor. However, as labor wages are rising recently, cheap labor is not necessarily attractive, but it is not necessarily a country with other low-level wages Highly skilled workforce, a broad base of subcontractors There is a merit that is indispensable for the business activities of the manufacturing industry, such as the accumulation of electric power, the infrastructure improvement without complaints of power shortage and water shortage, and the smooth logistics as the export base to third countries. Therefore, despite being damaged by the flooding in Thailand in 2001, according to the Thai Investment Committee (BOI), the number of direct investment in Thailand (licensed basis) by Japanese firms in 2002 is, It was 7 6 1 cases, an increase of 5 7.2% over the previous year.Since the Thai government's investment preferential policy also aims to cultivate industries in a wide range of fields from manufacturing, information communication, energy, fashion, even entertainment and healthcare industries, we plan to expand into industries other than manufacturing You can also expect.

Hong Kong is now regarded as one of the world's three largest financial centers alongside London and New York, and its importance is increasing as one of the world's leading global cities. According to the "Wall Street Journal" announced "2 0 3 3 Economic Freedom Index", it has been named "the world's most free economic body" for ninety consecutive years.Since Hong Kong was originally a base for Britain's trade with China in the UK colonial era, trade has been developed to export imported things as they are. Although transferred to sovereignty to China in 1997, the capitalist system, which became a system of one system in two countries, continued as "Hong Kong special administrative district" until 2004, within one socialist country, China It is supposed to be adopted.In 1949, when the People's Republic of China was established, a large population flowed from the Chinese mainland to Hong Kong, resulting in the situation that the population has been increased to about four times by 1950 By utilizing it as an inexpensive labor force, labor-intensive industries such as the textile industry and the plastics industry developed and escaped the crisis.In the late 1970s, Hong Kong's industry shifted from the textile industry center to the manufacturing center of high-value added products such as the electronics industry and precision machinery. Along with these industrial changes, the Hong Kong Government has started to develop residential housing development and transportation infrastructure, and the Hong Kong economy has developed rapidly.As a result of China's reform and opening policy, from the 1980's, the traditional manufacturing industry moved to Pearl River Delta including Guangdong Province, Hong Kong shifted to financial centers and logistics centers in southern China and Southeast Asia, We have strengthened our competitiveness in international markets.Hong Kong Special Administrative Region Basic Law "based on British legal system is still maintained even after China's return of China in 1997. In addition, there are many European and American companies establishing Asian market headquarters functions as it is an economic structure of low tax rate and preferential tax system, and there are many talented people with high education level and English proficiency.Regarding logistics infrastructure as well, container handling volume in 2010 is the third largest in the world, after Shanghai and Singapore, the world's No. 1 cargo volume handled by air transport, importance as a hub port, gate port is extremely high It is high.After China's opening to the outside and returning in 1997, the relationship between them has developed dramatically. In 2003, the CEPA was signed between mainland China and Hong Kong, and supplementary consultations were held and concluded thereafter.The trade share with mainland China has also been expanded by CEPA, and the function as a business center in the southern part of China has become important.■ ThailandThailand has made remarkable progress as a production base in Southeast Asia. On July 2, 1997, I also experienced trials such as being hit by Thailand's 'Asian currency crisis' (199 - 1999), but in a spectacular way We have recovered, and since then we have continued steady economic growth. The expansion of Japanese companies is remarkable, and in 2012 the number of registered members of the Bangkok Japanese Chamber of Commerce is 1,371 companies.In order to attract foreign companies, the Thai government is promoting various measures including taxation. As "Toyo's Detroit", we are focusing particularly on training the automobile industry, and ambitious training programs are being taken.The advantage of based in Thailand was that it was common to utilize cheap labor. However, as labor wages are rising recently, cheap labor is not necessarily attractive, but it is not necessarily a country with other low-level wages Highly skilled workforce, a broad base of subcontractors There is a merit that is indispensable for the business activities of the manufacturing industry, such as the accumulation of electric power, the infrastructure improvement without complaints of power shortage and water shortage, and the smooth logistics as the export base to third countries. Therefore, despite being damaged by the flooding in Thailand in 2001, according to the Thai Investment Committee (BOI), the number of direct investment in Thailand (licensed basis) by Japanese firms in 2002 is, It was 7 6 1 cases, an increase of 5 7.2% over the previous year.Since the Thai government's investment preferential policy also aims to cultivate industries in a wide range of fields from manufacturing, information communication, energy, fashion, even entertainment and healthcare industries, we plan to expand into industries other than manufacturing You can also expect.

-

-

-

Websites

[2] 外務省領事局政策課「海外在留邦人数調査統計」2012 年度速報版

[3] JETRO 海外調査部「平成 22 年度日本企業の海外事業展開に関するアンケート調査」2011年 3月

[4] JETRO「平成 23 年度日本企業の海外事業展開に関するアンケート調査概要~ジェトロ海外ビジネス調査~」 2012 年 3 月 1 日

[5] JETRO 海外調査部国際経済研究課「2012 年度日本企業の海外事業展開に関 するアンケート調査~ジェトロ海外ビジネス調査~」2013年3月

[6] JETRO「第 3 回在シンガポール日系企業の地域統括機能に関するアンケート 調査報告書」2012年3月27日

[8] 株式会社野村総合研究所「真のグローバル化に対応する本社機能の再構築が不可欠」NRI メディアフォーラム第 172 回(2012年 4月24日)

[9] 関根栄一、岩谷賢伸「日本企業のアジアにおけるキャッシュマネジメントの現状と展望」資本市場クォータリー 2009 Winter

[11] 久保光太郎「西村あさひのリーガル・アウトルックアジア地域の地域統括会社をどこに設立すべきか」法と経済ジャーナル、2011年6月15日

[12] 山口銀行国際部「香港の概況と投資環境」2012年10月

[13] 藤原完、森永さよこ、松川亜紗子「アジア地域の統括形態に関する考察――アジア市場重視戦略に最適な地域統括形態とは」Mizuho Industry Focus Vol.92(2011年 1 月 27 日)

-

Babiliography

[1] 江藤祐一郎、菊井隆正、石田仁司「アジア地域統括会社(4)――シンガポー ルにおける地域持株会社設立に伴う税制」国際税務、2006 年 5 月号

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya