Sri Lanka

8 Chapter Labor

-

-

1 Chapter Coming Soon

2 Chapter Basic knowledge

2.1 Basic knowledge of Sri Lanka

3 Chapter Investment Environment

3.2 Investment regulation, incentives

4 Chapter Establishment

4.1 Characteristics of business base

4.3 Company liquidation and withdrawal

5 Chapter Company Law

5.2 Shareholders (shareholders meeting)

6 Chapter Accounting

6.1 Accounting system of Sri Lanka

6.2 Disclosure system of Sri Lanka

7 Chapter Tax

7.2 Individual Issues in Sri Lanka Domestic Tax Law

8 Chapter Labor

8.3 Social security system and social insurance law

8.4 Points to keep in mind while having Japanese people in Japan

-

-

-

Working environment

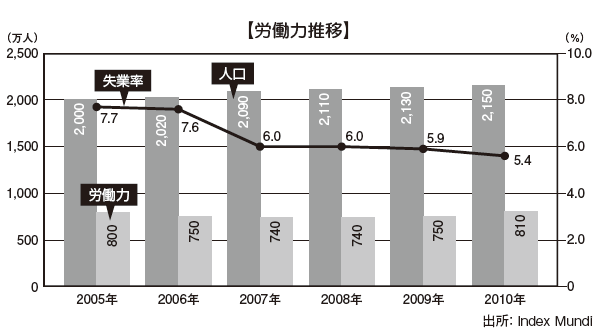

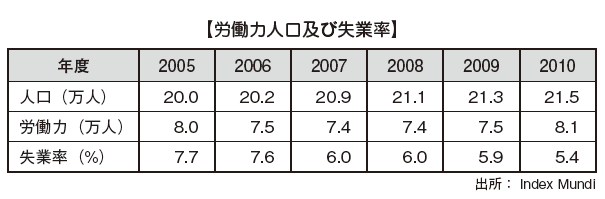

■ Labor force population, number of employed people, number of unemployed and unemployment rateThe total population of Sri Lanka is approximately 20.63 million (as of 2011 / State Bureau of Statistics of Sri Lanka), of which the labor force population is about 7.5 million and the workforce is about 7 million (excluding seasonal workers). Approximately one-third of the employed workers are engaged in agriculture by industry. Sri Lankan workers are generally diligent with high literacy rate, willingness to work and labor. The literacy rate was around 70% in the 1970s, but now it has improved to 98% (Department of Census and Statistics, SriLanka).

About half of the labor force population is over 40 years old. Due to the increase in life expectancy, we face the problem of aging even in Sri Lanka. The average life expectancy is 70.7 years in 2001 and 71.7 years in 2006.Approximately 10% of the labor force is engaged in unpaid work and workers working in family-based agriculture and micro enterprises are applicable. These workers have many types of temporary contracts and temporary employment, and the work content is also dominated by simple labor.

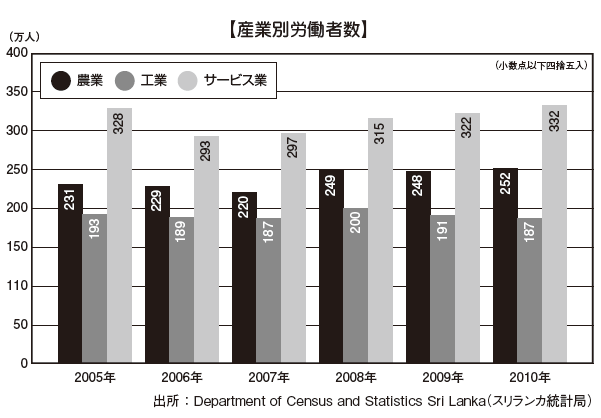

■ Number of workers by industryIn Sri Lanka, about 30% of the labor force works in the agricultural field, and since 2003 it has increased slightly year by year. In the industry, the growth of the labor force population is slower than in the service industry. Stagnation of the domestic manufacturing industry can be attributed to the declining population engaged in industry. On the other hand, the labor force population of wholesale and retail trade, various repair services, and other service industries is on the rise.

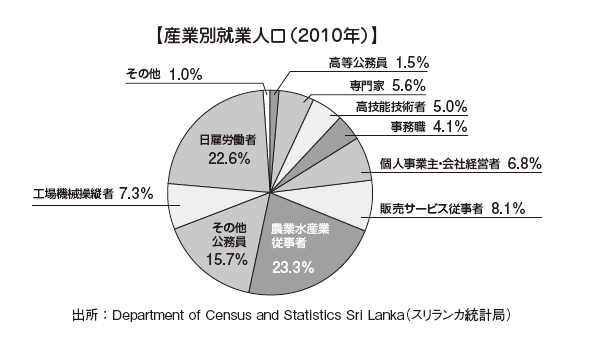

■ Working Population by Job CategoryIn Sri Lanka, many of the workers are day laborers and agricultural fishery workers. However, with the economic growth in the future, the proportion of sales service personnel is expected to increase.

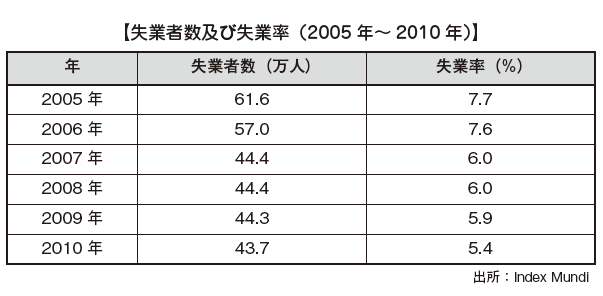

■ Unemployment rateAs of 2005, the unemployment rate, which was 7.7%, fell to 5.4% in 2010. The number of employees has improved markedly over the past three years, and the current number of employees is 7.9 million. Among them, the number of female employees is 2.7 million and the number of men is 5.2 million.The unemployment rate of females tends to be higher than that of men, according to statistics of 2010, the unemployment rate of women is 8.1% and the unemployment rate of males is 3.8%. Looking at the employment situation, some companies have deteriorated business performance, especially exporting industries such as apparel, and companies are forced to reduce human costs. For that reason, there are cases where we are dealing with freezing new employment and introducing voluntary retirement scheme.

■ Wage levelAs mentioned above, the wage level of Colombo in Sri Lanka is nearly the same as Jakarta in Indonesia and Ho Chi Minh in Vietnam. Employers' wages are on the order of US $ 120 for workers (regular workers), US $ 343 for engineers (mid engineers), and US $ 696 for middle managers (department manager level departments). In Southern Asia the wage level of Sri Lanka is lower than that of India and Pakistan where wages are lower and it can be said that there is superiority in terms of labor cost.However, in Sri Lanka, wages continue to rise with economic growth. In addition, wages in the countries of the Association of Southeast Asian Nations (ASEAN) countries also increased significantly in Malaysia in 2010 by 33.8% and Thailand by 15.2%. It is expected that prices will continue to rise in various Asian markets in the future, and it is expected that the wage increases for workers aiming to improve their lives will be strengthened.

■ Employment of local people[Employment obligation of Sri Lankans]In other countries, there are cases where there are regulations on foreigners' employment obligations of local people and the ratio of local people to foreign workers, but there are no such provisions in Sri Lanka.

[How to recruit workers]The method of recruiting workers in Sri Lanka has gazettes, advertisements for recruitment of newspapers, the Internet and employment placement offices. For private enterprises, it is common to use newspapers, the Internet, and job placement centers. The Sunday Observer, the most read newspaper in Sri Lanka "is also being recruited for recruitment.

[Features of Sri Lankan workers]Workers in Sri Lanka are generally said to be relatively calm, but their sense of responsibility tends to be weak. Therefore, it can be said that it is desirable to manage work by clarifying task responsibilities and role sharing. -

Labor disputes with labor unions

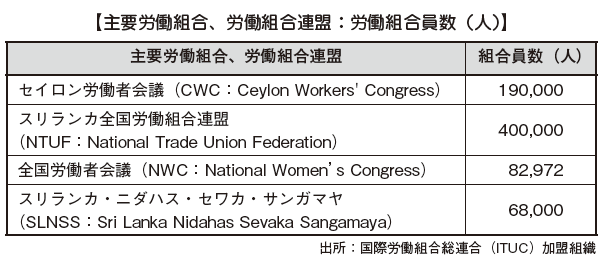

■ Outline of labor unionIt is said that the organization rate of labor unions in Sri Lanka is 20 to 25%. It is said that the labor union organization rate in Japan is about 18%, so Sri Lanka is a little higher. The labor union is formed and freedom of subscription is guaranteed to workers, and if more than seven workers gather, it is possible to form a union.Sri Lanka has ratified the international labor standards prescribed by the major International Labor Organization (ILO), and the Constitution permits citizens "freedom of association" and "freedom of participation in the labor union" . It is common for users to make decisions on working conditions by concluding collective agreements with labor unions.There are the following 4 issues as labor union problems in Sri Lanka.

· Organization of informal departments· Securing facilities for implementing unique university educational programs· Improvement of labor practices in the plantation division· Gender issue of simple workers

As an effort to solve these problems, Pakistan's labor union is involved in the expansion of educational programs for workers, establishment of a women's committee in factories, loans for children who can not go to school, and technical training programs We are engaged in the implementation of a scholarship system.As a foreign-affiliated company entering Sri Lanka, there are petroleum industry, apparel, automobile, beverage, food and hotel industry. Even in foreign-affiliated companies, labor conditions are stipulated above average on workers with labor unions.

■ Representative labor unionThe largest labor union in Sri Lanka is the Ceylon Workers' Congress (CWC), with approximately 190,000 members. CWC has eight regional organizations, 48 district offices, headquartered in Colombo. In the plantation industry and the financial industry, the labor union organization rate is high, especially the labor union organization rate of the plantation industry is about 80%, of which CWC accounts for more than 40%.Other major labor unions and trade union federations that are members of the International Union of Trade Unions (ITUC) are as follows.

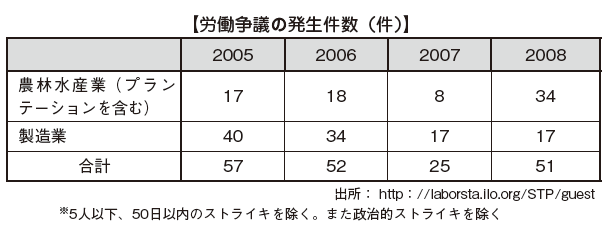

■ Conditions of Labor DisputesIn Sri Lanka, labor disputes tend to decrease. The reasons for this are raising the educational standard of workers and being negotiated due to discussions between labor and management.In the case of layoff, dismissal, business closure, etc. by the user, notification to the labor relations department of the BOI is required in advance. Meanwhile, regarding strikes by workers and labor unions and the closure of business establishments, we must give advance notice to users before 21 days. In addition, in case of labor dispute, labor-management committee (Labor Commissioner) intervenes between labor and management, and there are cases where arbitration and voluntary arbitration by arbitration are performed.

■ Labor Arbitration CourtThe labor arbitration court is an organization established for the early resolution of labor disputes. In labor arbitration courts, there are many cases where troubles concerning payment of employment contracts and wages are received from workers.The decision of the Labor Arbitration Court will be the final decision unless it is appealed to the Regional High Court within 30 days. If the user appeals the order of the Labor Arbitration Court, he / she must pay to the Labor Arbitration Court an amount equivalent to 12 months' salary of the worker.In addition, users or workers who are dissatisfied with the decision of the High Court may appeal to the Supreme Court.

■BenefitsIn Sri Lanka, bonuses are paid one to two months a year and are generally paid before Christmas at the end of the year. Other welfare programs include vacation allowances paid to workers who worked on holidays, festival preliminary loans that lend money for festivals with prepayment, medical expenses subsidies, corporate travel, sports competitions, etc. I will.

-

-

-

Labor standards related laws

It is said that 50 labor laws exist in Sri Lanka. The main labor laws include the following laws.

· "Laws concerning stores and office workers" (Shop and Office Employees (Regulation of Employment and Remuneration) Act)· "Factory Act" (The Factories Ordinance No.14 of 1935)· "Wage Boards Ordinance No. 19 of 1941"· "Termination of Employment of Workman (Special Provisions) Act No. 45 of 1971)· "Trade Unions Order" (Trade Unions Ordinance No.14 of 1935)· "The Labor Dispute Act" (TheIndustrial Disputes Act No. 43 of 1950)

■ Shop and Office Office Employees (Regulation of Employment and Remuneration)Act Regulations concerning shops and office workers regulate the employment of workers at workplaces and offices, working hours, remuneration . Store in this law refers to retail and wholesale business, including sales at restaurants, restaurants, barbershops, beauty salons, laundry machines, photo shops and other houses. The office includes all facilities that do administrative work in the office. However, these laws do not apply to the state government. For this reason, civil servants are not applicable and private companies are applicable.

■ Factory Act (Factories Ordinance)The Factory Law is a law stipulating the rights and obligations between workers and employers as well as the laws concerning stores and office workers. We stipulate minimum standards relating to workers, working hours, breaks, vacation, safety and health management. This law applies to factory premises or to all workers employed within that area.A worker referred to in this Act is a person who conducts all the labor accompanying the cleaning or manufacturing process used in the manufacturing process or the machinery used in the manufacturing process and who is directly employed, broker or employer hired through a contractor Says.

■ Wages Boards Ordinance (Wages Boards Ordinance)The Wage Commission Law stipulates workers' wages and other working conditions. Based on this law, the government appoints the committee members from each industry.However, the following companies and institutions are excluded.· State Government, Government Companies· Training institutions such as orphans, handicapped persons Under the Wage Committee Act, the authority of the wage committee and the obligations of employers and workers are stipulated as follows.

[Powership of Wage Committee]· Determination of minimum wage, minimum hourly wage and overtime premium rate· Determination of working hours per day and week· Determination of meal time and break time on work day

[User obligation]· Minimum wage payment· Compliance with wage payment date· Record of wage payment and other working conditions prescribed by laws and regulations

[Obligation of workers]· Follow the instructions of the user· Compliance with working hours· Be faithful and productive by observing the obligation of other workers

■ Termination of Employment of Workman (Special Provisions)The dismissal law stipulates reductions in employment, temporary closure and dismissal. While this law recognizes the right to increase productivity and reduce costs in the workplace of employers, it also stipulates to reduce the huge number of employment to workers and to protect employment from temporary closure.

However, this law does not apply when the following applies.· In the six months before the termination of employment contract, dismissal etc. at workplaces where average number of employed workers is less than 15· Dismissal of workers who work only for less than 180 days out of 12 months of continuation· Dismissal of civil servants

In the event that a worker is dismissed in violation of this law and the dismissal is made unfair at a later date, the violating user will either return the worker to the original workplace, or pay wages and benefits that the worker would have obtained You may be ordered to pay. -

Employment contracts and employment rules

■Outline of employment contractIn Sri Lanka, employers are obliged to prepare employment contracts in writing under the laws concerning stores and office workers. Employment contracts must include details of employment conditions such as the following:

[Examples of items described in employment contract]· Name· Grade and position·Employment status· Employment contract period·Trial period· Working hours and break time· Salaries and other wages· Salary payment form· Extra wagePay rise· Preparation fund, annuity, retirement allowance etc.· Other working conditions

Employment contracts must be written in a language that workers can understand. Normally, it is created with either official language Sinhala or Tamil, but there are also cases created by both, or cases where it is translated into English or Japanese. Also, in Sri Lanka, users usually have an obligation to receive receipts from workers and store them when they give employment contracts from workers.

■ Termination of employment contractIn hiring foreign workers, the Sri Lankan government creates a format for employment contracts (Contract Agreement of Employment Form 1). Among them, there are statements on the termination of employment contracts as below, and similar provisions can be included in the case of employment of local people.

· In case of project, business termination· When a worker performs an act that does not comply with serious misconduct or workplace rules· Where a worker deliberately or in a regular negligence in his / her duties· When a worker performs fraud, assault or other criminal act against another worker who works at the same establishment

The termination of employment contract is stipulated in the dismissal law.

■ obligation to create employment rulesIn Sri Lanka, prior notice to labor and labor committee is required when preparing rules for company / office as a whole. Although there is no obligation to create, in Japanese companies, it can be said that it is preferable to prepare employment rules to prevent employment problems.In addition, the BOI of Sri Lanka has created a format of employment rules. The items specified in this are as follows.· Preamble (Policy Statement)· Definition of workers (Employment)· Working hours (Hours of Work)· Wages and extra wages (Wages and Overtime Payment)· Holidays (Holidays)· Various leave (Leave)· Safety and health and welfare of workers (Industrial Safety, Industrial Hygiene & Workers' Welfare)· Employment Injury· Trade union and collective bargaining rights (Trade Union and Collective Bargaining Rights of Employee)· Labor Council (Employees' Council)· Information management regulations (Communications Policy)· Grievance and Grievance Adjustment Procedure· Disciplinary Procedure· Termination of Employment· Dispute resolution procedure (Collective Bargaining and Dispute Settlement Procedure)· Old retirement benefits (Superannuation Benefits)· Date of enforcement (Dateof Commencement)

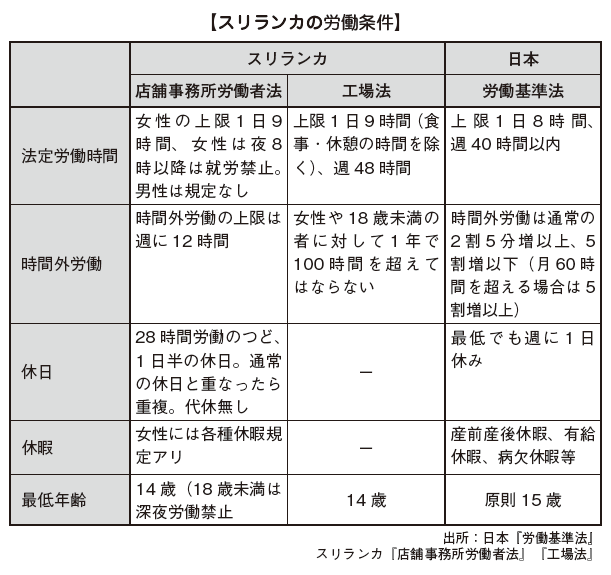

■ Comparison of working conditions between Japan and Sri LankaWhen describing working conditions in employment contracts and employment rules, it is necessary to prepare according to the labor law of Sri Lanka. The main working conditions are as shown in the table on the next page.Working hours must be prescribed within 9 hours a day, within 48 hours a week. If you want to work beyond this, you will need to pay extra wages. In addition, women's late night work after 8 pm is not permitted except for specific industries (In some industries, ladies' late-night work is permitted if written consent obtains). In addition, when dismissing a worker, it is necessary to notify beforehand one month in advance.The retirement age is different for men 55 years old, female 50 years old for men and women.

■ Wage provision[Payment of wages]Even in Sri Lanka, there is a provision concerning the payment of wages. Wages must be paid once a month. Also, please do not deduct from wages other than what is stipulated, such as personal income tax.

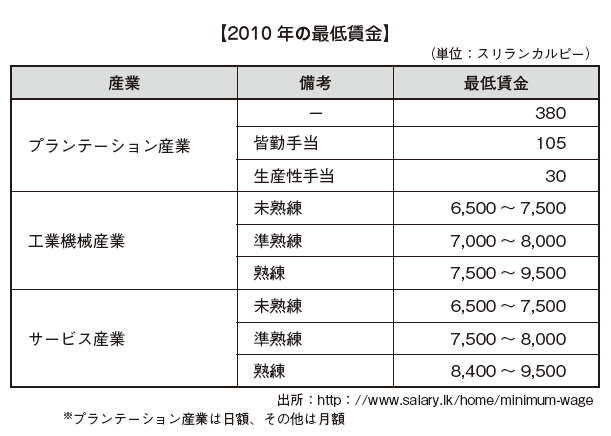

[minimum wage]The minimum wage of Sri Lanka is decided by the wage committee every year, and the minimum wage is rising as economic development and living expenses rise. In particular, the wage rise rate of plantation with active labor union activity tends to be high.

In addition, if salary is increased by raising minimum wage, it will lead to an increase other than salaries paid every month such as overtime payment, pension, retirement allowance, etc., and the burden of the company will increase.

-

-

-

Social security system and social insurance law

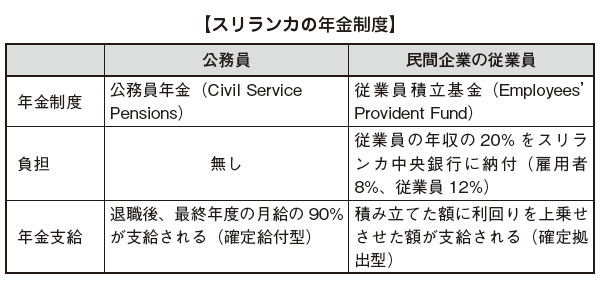

■ Scope and overview of social insuranceAll private workers in Sri Lanka can receive retirement pensions by joining the Employees' Provident Fund (EPF). With the EPF, workers from private and public organizations can receive retirement pension benefits from the funded fund and borrow mortgages with the EPF account as collateral.[Social insurance premium]In Sri Lanka, employers pay social insurance fees as reserve funds, 8% of salary as workers, 12% as burden. The employer is obliged to remit the reserve fund equivalent to 20% of the total of the employer's share and the worker's share by the end of the month to the central bank of Sri Lanka every month. Users who failed to remit their reserve funds by the end of the month will be charged 5 to 50% additional charge, except in the case of force majeure.[Social Insurance Benefit]Payment of retirement pension benefitsPension benefits after retirement are paid under the following conditions.· Those who retired at the retirement age (male is 55 years old, woman is 50 years old)· Retired women after marriage· Person who retired due to permanent labor disability (proof that medical institution is unable to work)· Person who retires and comes homeHousing loanWorkers who are enrolled in the EPF can borrow mortgage loans from state-owned banks, using personal accounts for EPF management as collateral.Civil servants will join Civil Service Pensions (CSP) instead of EPF. Civil servants have no burden of insurance premiums and 90% of the last salary received can be pensionable.

-

Workers compensation law

■ Outline of workers compensation lawThe Workers Compensation Law stipulates that employers are obligated to compensate for workers who suffer from disability or illness due to business reasons. The Workers Compensation Act is under the jurisdiction of the Ministry of Labor and is managed by the Director of Workers' Compensation Bureau. In the amendment in 1990, there was increase in allowance for injured people and expansion of coverage of compensation for disability / illness in work."Worker" in the Workers Compensation Act refers to a person who has an employment contract with a user, regardless of the work content or contract form. However, those who fall under any of the following are not included in the workers.

· Military personnel (excluding employees etc. employed as civilians)A policeman

■ Responsibility of employers in occupational accidentsAs mentioned above, if workers suffer from disasters and diseases due to operational disasters, the employer must compensate the medical expenses etc. of the workers.However, we will not be obligated to compensate if any of the following applies.

(1) When the period of inability to work due to disability / illness is less than 3 days(2) It is not a fatal disability / illness, and the direct cause of labor accident is as follows

· In the event of a disaster, the worker was drinking alcohol and taking drugs· If the worker did not intentionally obey the instructions and rules issued for the purpose of ensuring worker safety· In cases where a worker intentionally removed a safety device or did not properly use a safety device or the like installed for the purpose of ensuring the safety of workers

■ compensationThe Workers Compensation Act provides for compensation for death, permanent or temporary labor injury, and compensation is calculated based on monthly salary. In the case of permanent labor inability, it is calculated based on loss of income amount. The proportion of compensation money is specified in the range of 20 to 100% depending on the degree of disability / disease.In the case of temporary labor incompetence, compensation for half of the labor incapacity period salary will be compensated. The compensation period is a maximum of 5 years. Some private enterprises are voluntarily insured for compensation to workers, in which case it is said that employers only pay the difference of insurance payment. In Sri Lanka there is no provision for official workers' compensation insurance.Also, in the event of a business disaster, you must report it to the committee under the jurisdiction of the Ministry of Labor within two days after the accident. -

Employment insurance etc.

■ Employee Trust Fund (ETF: The Employees' Trust Fund)Sri Lanka does not have provision of employment insurance. However, there is an ETF for the purpose of compensation for unemployment or retirement.The employer will transfer 3% of salary for workers to the ETF worker's account. ETF is not burdensome for workers. If a worker with an account in the ETF is unemployed, the worker can withdraw the amount and interest paid by the employer to the worker's account.

■ Payment of Gratuity ActIf a person who has worked for more than 5 years retires, the employer must pay severance payment to the workers. The employer must pay severance payment within 30 days from the day the worker retires or from the date of death and, if delayed, make additional payment. Depending on monthly salary or daily salary, the amount of retirement allowance is as follows.

· Monthly salaried workers: half of the last monthly salary· Daily labor: 14 days worth

However, the following workers are not eligible for payment of severance pay.

· Persons who work at business establishments of 15 people or less· Persons qualified for pension· Persons whose period of employment is 5 years or less

-

-

-

Points to keep in mind while having Japanese people in Japan

■ obligation to obtain a visaVisas are required to enter Sri Lanka. From January 2012, visa application is required even for visits of less than 30 days for sightseeing purposes. When traveling to Sri Lanka on a business trip, you must obtain either a business visa or a residence visa.

■ Business visaBefore entering the country for business stay in Sri Lanka, it is necessary to obtain business visa (stay permitted number of days 30 days) by the following procedure. Also, if you plan to stay longer than 30 days, you will need to extend the procedure at the local immigration bureau.

[Visa application procedure (outline)](1) Please access the website (www.eta.gov.lk) dedicated to Electronic Travel Authorization (ETA), which will be operated from January 1, 2012 and enter necessary information(2) Information on payment of visa application fee according to traveling purpose input(3) Application receipt notice is issued instantly(4) ETA approval notice or notification under review will be received within 24 hours(5) Print an ETA approval notice and submit it together with passport etc. documents at the time of entry into Sri Lanka. In the event that a notice of pending review arrives, inquire at the nearest Sri Lankan diplomatic mission(6) Log in to the ETA website or inquire at the ETA office (+ 94-719967888) about the situation under application

The applicant must satisfy the following conditions.

· Passport remaining valid for more than 6 months· Airline or shipping service booking confirmation / certificate etc· Travel expenses Proof of ability to pay

[Extension of short-term stay permission]If you wish to extend the stay permission, you can apply for extension at the Immigration Bureau of Sri Lanka to extend your stay to 90 days from the date of entry. Furthermore, it is permitted up to the extension of up to 90 days, and it is possible to stay for a maximum of 180 days.

Documents required for extension application

·passport· Copy of passport's identification page· Photo 3.5 × 4.5 (4 pictures)· Travel expenses materials certifying payment ability· Certificate to return to address or visa to the next destination

■ Residence VisaIf you are staying in Sri Lanka for more than 6 months you will need to obtain a residence visa. A residence visa is permitted for renewal every year, for a maximum of 5 years. Since immigration is a multiple visa free, you do not need to obtain a re-entry permit. After obtaining immigration visa issued by the Sri Lankan embassy in Japan beforehand, after entering the country, alien registration will be made at the foreign office and a document showing the purpose for residing will be submitted to the Immigration Bureau and applied.However, please note that you can not switch to a resident visa on-site when you enter the country with a business visa.

[Main subject of resident visa]· Staff of general corporations· Personnel certified in overseas human resources employment program managed by BOI in Sri Lanka· Bank staff· Volunteers and non-governmental organization staff· Organizations that have a diplomatic mission in Sri Lanka, staff of the Association, etc.

[Application method]· Inquire application form from Immigration Bureau· Submit the application form, the articles of incorporation, the recommendation letter of the provincial government to the immigration bureau -

駐在員の給与設計と計算事例

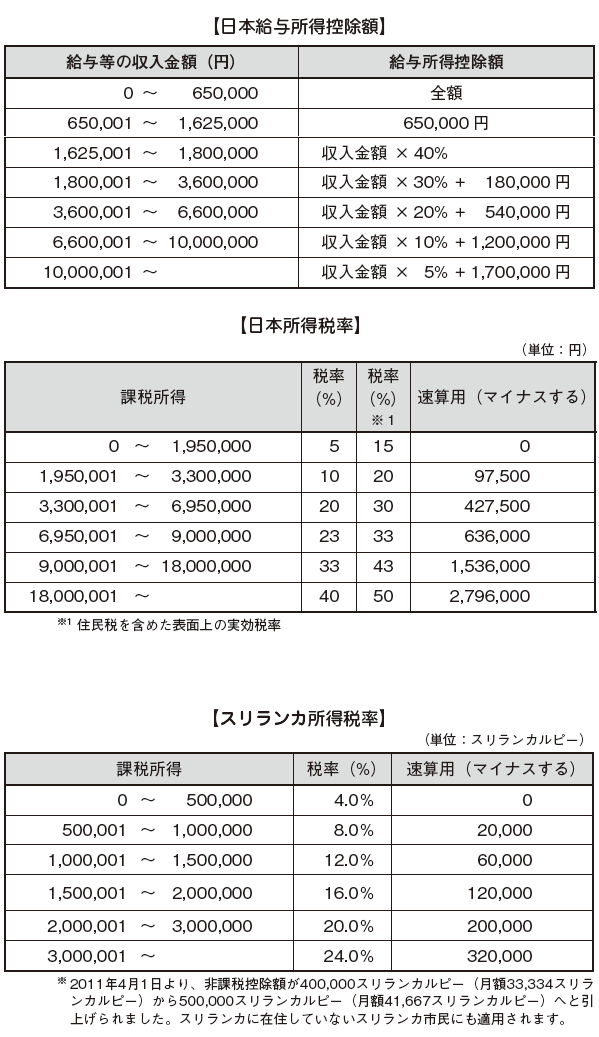

■ Problem of salary inequality between Japan and LyslinkaIn paying salaries to expatriates who are assigned to Sri Lanka, the payroll method and the applicable tax rate differ between Japan and Sri Lanka and it can not be said that uniform payment can be the same for Japan, so set and pay salary Consideration of form etc. is necessary.There is a difference in applicable tax rates between Japan and Sri Lanka, so if you pay the same salary as in Japan, the salary may be lower.

■ Japan Eastern Limbaka Tax Rate Comparison Chart

In Japan, as long as the taxable income does not reach 18 million yen, 40% of the highest tax rate will not apply, but in Sri Lanka the maximum tax rate will be applied at 3 million Sri Lanka rupees (about 4,390,000 yen), so the salary amount to be paid Even if you receive the same amount of salary, the amount you take in Sri Lanka will be lower, unless it gets higher, such as about 9 million yen or more.For this reason, there are many cases where a gross-up calculation is made to compensate for the takeover amount in case of letting a representative to be transferred to Sri Lanka.Let's compare the taxable amount when Japanese expatriates actually receive salary in Sri Lanka with Japan.

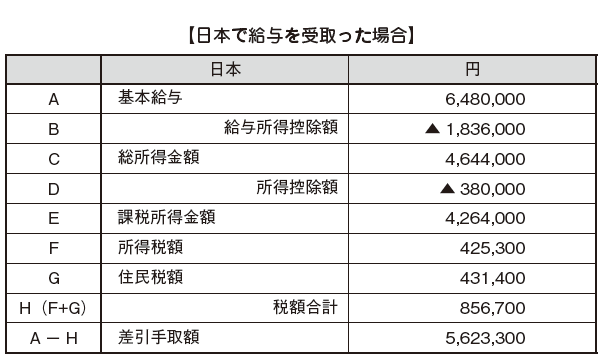

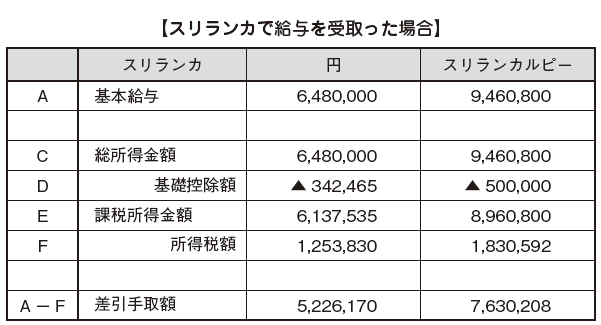

■ Example of income tax calculation in Japan and Sri Lanka(Prerequisite) 40-year-old maleAnnual income in Japan: 6,480,000 yenDependent: NoneProposed date of assignment: 3 years1.00 JPY / 1.46 LKR* Social insurance fee will not be considered here.

Thus, if the expatriate with an annual income of 6.48 million yen receives a salary in Sri Lanka, the amount of about 400,000 yen handover will be reduced.

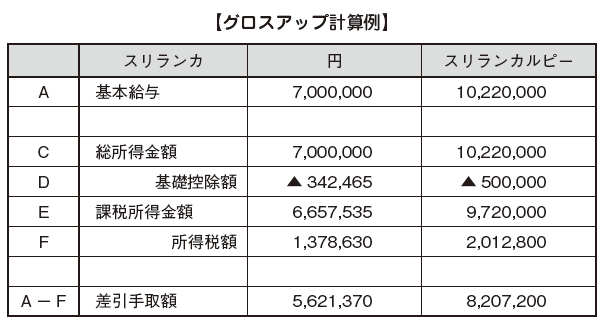

■ Gross Up Calculation Matching Committed AmountsAs mentioned above, unless the salary is very high due to the difference in income tax rate between Japan and Sri Lanka, there are many cases where the takeover amount decreases by assigning to Sri Lanka.Therefore, there are cases where gross-up calculation to compensate for the take-off amount received in Japan is made before assignment. Here, we will see how much payment is needed to receive the same amount as the above-mentioned amount of 6,232,300 yen in Japan for the expatriate whose annual income is 6,480,000 yen.As in the table on the next page, in the case of salary of 7 million yen, the amount received will be 562,137 yen, which is almost the same amount. In other words, you need to pay 7,000,000 - 648,0000 = 520,000 yen added. The amount to be added varies depending on the amount of salary, but in most cases it will be necessary to add about 500,000 yen or more, so it is necessary to consider the amount to be paid in advance.

-

-

-

Websites

[1] 日本『労働基準法』

[2] スリランカ『店舗事務所労働者法』

[3] スリランカ『工場法』

[5] スリランカ統計調査局『スリランカ労働統計広報2010第4四半期』

[6] 世界労働統計ネットワーク

[7] スリランカ給与賃金統計

[8] スリランカ出入国管理局

[9] 財団法人海外職業訓練協会

[10] スリランカ政府HP

-

Other

[1] JETRO労働許可証

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya