Sri Lanka

7 Chapter Tax

-

-

1 Chapter Coming Soon

2 Chapter Basic knowledge

2.1 Basic knowledge of Sri Lanka

3 Chapter Investment Environment

3.2 Investment regulation, incentives

4 Chapter Establishment

4.1 Characteristics of business base

4.3 Company liquidation and withdrawal

5 Chapter Company Law

5.2 Shareholders (shareholders meeting)

6 Chapter Accounting

6.1 Accounting system of Sri Lanka

6.2 Disclosure system of Sri Lanka

7 Chapter Tax

7.2 Individual Issues in Sri Lanka Domestic Tax Law

8 Chapter Labor

8.3 Social security system and social insurance law

8.4 Points to keep in mind while having Japanese people in Japan

-

-

-

Tax Law System in Sri Lanka

The tax law of Sri Lanka does not have legal systems such as this law, enforcement orders, enforcement regulations, basic notice in tax item units like Japan. Regarding income tax, it is enacted in No. 38 of 2000 of the Internal Revenue Tax Law in 2000, VAT law No. 14 in 2002, and it is renewed sequentially by the subsequent revision. The amendment is announced within the presentation of the draft budget.The laws of each tax law are issued by the National Assembly, and then the details of the law are prescribed by the government ordinance by the government cabinet. Furthermore, the rules that clearly show practical guidelines will be announced as Ministry of Finance Ordinance (Circular).There was a major revision of the Income Tax Law, Value Added Tax (VAT) Law in 2011, but due to policy reasons such as the economic situation of Sri Lanka, the impact of social situation, etc., revision is being carried out from time to time, In practice, we must always pay attention to tax system trends, practical treatment etc.This chapter focuses on individual taxes in Sri Lanka. -

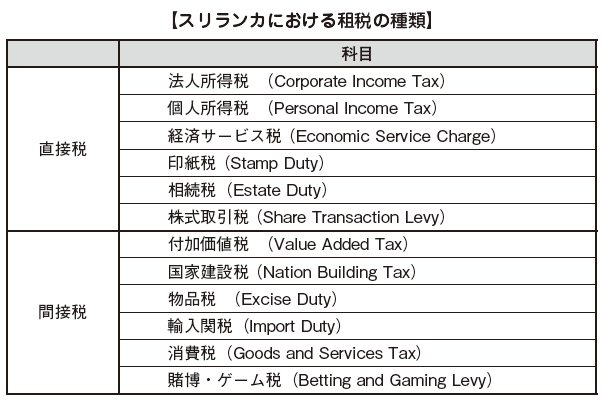

Types of taxes in Sri Lanka

Types of taxes in Sri Lanka

Regarding the tax system, it is divided into "national tax" and "local tax", among which it is further divided into "direct tax" and "indirect tax".

■ National tax and local tax[National Tax]Regarding taxes in Sri Lanka, the majority of tax items are national taxes, and the Internal Revenue Service within the Ministry of Finance collects and handles income taxes on individuals and corporations, value added tax, economic service tax, state construction tax, stamp duties, etc. I will.

[Local tax]Local taxes are taxes that are taxed on individuals and corporations and are obligated to pay to local governments. In Sri Lanka there are local government taxes, local public taxes, and entertainment taxes.

■ Direct tax and indirect tax[Direct tax]Direct tax is the tax that taxpayers who pay tax and those who actually pay taxes are the same. In Sri Lanka, personal income tax, corporate income tax, economic service tax, etc. fall under this category.

[Indirect tax]Indirect tax is a tax different from paying tax payers and people actually borne, unlike direct taxes. It is called indirect tax because the burden of tax is indirectly paying taxes to the country through other taxpayers, not directly. In Sri Lanka, VAT, State Construction Tax, Goods Tax, etc. fall under.

-

-

-

Personal Income Tax

■ Outline of personal income taxIndividual income tax in Sri Lanka is subject to the provisions of Article 10 of the Internal Revenue Code, which came into force in 2006, followed by Article 10, amended in 2007 under the Internal Revenue Reform Act, Article 9, revised in 2008, 2009 It is taxed based on Article 19, amended as amended Article 19, 2011.

According to the Internal Revenue Code, it is stipulated that there is legal authority to charge, collect, and gather income tax for every person whose profit or income is recognized by the annual survey that started on April 1, 2006.

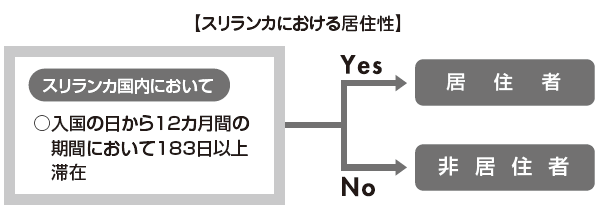

When calculating personal income tax, it is important to judge whether the person to be calculated is "resident" or "nonresident", that is, judging the subject's comfortableness. Due to this comfort, income taxable income range will vary.■ Habitability and scope of taxation[Tax year]Taxable year refers to the period subject to income tax calculation. In Japan, the individual taxable year is the calendar year of January 1 to December 31, but in Sri Lanka, 12 months from April 1 to March 31 of the next year will be the taxable year .[Determination of Habitability]Regarding the classification of habitability in Sri Lanka, it is said to be a "resident" when staying in Sri Lanka for 183 days in a period of 12 months from the date the individual first entered Sri Lanka. For the calculation of the length of stay, the date of entry and departure will be calculated in one day. In many countries, we decide on living qualities based on the number of days of stay within the taxable period, but in Sri Lanka caution is necessary as it will be different standards.

If it does not fall under the above definition of residents, it will be categorized as non-resident.

However, foreigners employed by Sri Lankan companies are classified as non-residents for three years starting from the start of employment.

What we have to pay attention to here is that judgment of living qualities in Japan is mainly judged by "whether you have an address in Japan for over 1 year".

If a resident who left Japan from a short-term schedule within one year stayed in the country for more than 183 days in Sri Lanka, it will be treated as a resident in both Japan and Sri Lanka.

In such a case, based on the tax treaty concluded between Japan and Sri Lanka, we will decide which one is comfortable as a matter of fact and declare it as a resident in one of the countries.

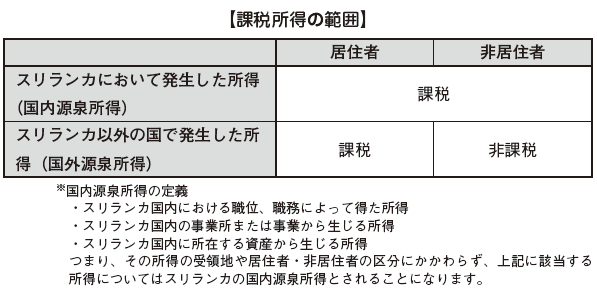

Tax extent by residential category

The range of income taxed by the classification of resident, nonresident is as follows.

If it does not fall under the above definition of residents, it will be categorized as non-resident.

However, foreigners employed by Sri Lankan companies are classified as non-residents for three years starting from the start of employment.

What we have to pay attention to here is that judgment of living qualities in Japan is mainly judged by "whether you have an address in Japan for over 1 year". If a resident who left Japan from a short-term schedule within one year stayed in the country for more than 183 days in Sri Lanka, it will be treated as a resident in both Japan and Sri Lanka.

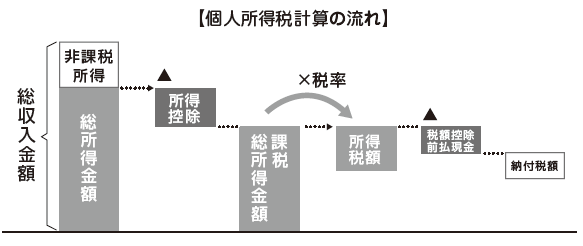

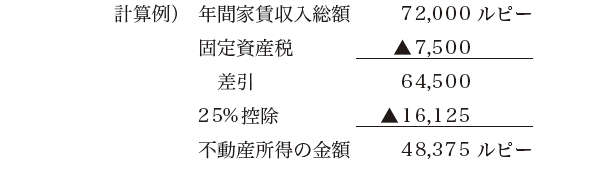

In such a case, based on the tax treaty concluded between Japan and Sri Lanka, we will decide which one is comfortable as a matter of fact and declare it as a resident in one of the countries.Tax extent by residential categoryThe range of income taxed by the classification of resident, nonresident is as follows.■ Tax calculationThe income tax calculation in Sri Lanka is calculated by the procedure shown below. ■ Gross income amountFirst of all, we need to grasp the income that is subject to taxation from all income in that year. The taxable income is listed in Article 3 of the Internal Revenue Code. I will explain the main income subject to personal income tax.Employment incomeSalary income includes not only salary received by cash but also part not directly provided by direct cash such as salary to be paid in kind and life insurance fee and transportation expenses paid by the company.Business incomeBusiness income is the portion of earnings derived from the income earned by the project minus all expenses incurred to obtain that income. However, income generated by dealing with shareholders is not included in business income.Real estate incomeRent income earned by leasing housing is subject to taxation. In calculating real estate income, you can deduct the property tax paid by the lessor from the total rent income and further deduct 25% of the remaining amount.

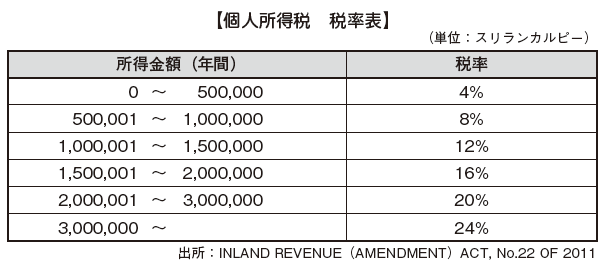

■ Gross income amountFirst of all, we need to grasp the income that is subject to taxation from all income in that year. The taxable income is listed in Article 3 of the Internal Revenue Code. I will explain the main income subject to personal income tax.Employment incomeSalary income includes not only salary received by cash but also part not directly provided by direct cash such as salary to be paid in kind and life insurance fee and transportation expenses paid by the company.Business incomeBusiness income is the portion of earnings derived from the income earned by the project minus all expenses incurred to obtain that income. However, income generated by dealing with shareholders is not included in business income.Real estate incomeRent income earned by leasing housing is subject to taxation. In calculating real estate income, you can deduct the property tax paid by the lessor from the total rent income and further deduct 25% of the remaining amount. Dividend incomeDividend income is recognized as income when dividends are resolved. However, if a company specifies a certain date in the future as a payment date, it will be recognized as income on that payment date. For dividends, a 10% withholding tax is imposed and the taxation relationship is completed there (source withdrawal taxation).Interest incomeRegardless of whether you actually receive interest income or not, the full amount will be included in the income amount. In addition, if the withholding tax is deducted at a tax rate of 10% or less with interest received from a financial institution such as a bank, the taxation relation is completed there (Source separation taxation).pensionThe pension is also subject to income taxation. However, those pensions received by individuals over the age of 60 will be tax exempt if they satisfy certain requirements.Other incomeIn addition to the above, there are insurance premiums, prize money, victory money, subsidies, donations and so on. If you have these incomes, you need to provide details at tax return.We calculate the total income amount (Total Statutory Income) by adding up all the above incomes. Then, we calculate the total income amount (Assessable Income) by deducting the loss by business activity from the total income amount. Also, of the losses in the previous fiscal year, the portion that could not be deducted from the previous year's tax return can be offset against the loss for the current fiscal year. In this case, the deductible loss amount is up to 35% of the total income amount.■ Income Deduction AmountBased on the above total income amount, we will calculate the taxable income (Taxable Income) by deducting the following expenditure amounts. From April 1, 2011, the basic deduction has been raised from 300,000 rupees per year (25,000 rupees per month) to 500,000 rupees a year (41,177 rupees per month). Also, basic deductions will be applied to Sri Lankan citizens who do not live in Sri Lanka.· Basic deduction (500,000 rupees)· Donation to sick and charity organizations and government organizations on poverty· Payment amount of social insurance, life insurance, medical insurance etc.· Purchase for housing purchase· 50% of equity investment (limited to investment of 500,000 rupees or more)· Other fixed expenses■ Tax calculationCalculate the income tax amount by multiplying the taxable gross income amount obtained above by the personal income tax rate. The tax rate of personal income tax in Sri Lanka is stipulated as follows according to the classification of income amount.

Dividend incomeDividend income is recognized as income when dividends are resolved. However, if a company specifies a certain date in the future as a payment date, it will be recognized as income on that payment date. For dividends, a 10% withholding tax is imposed and the taxation relationship is completed there (source withdrawal taxation).Interest incomeRegardless of whether you actually receive interest income or not, the full amount will be included in the income amount. In addition, if the withholding tax is deducted at a tax rate of 10% or less with interest received from a financial institution such as a bank, the taxation relation is completed there (Source separation taxation).pensionThe pension is also subject to income taxation. However, those pensions received by individuals over the age of 60 will be tax exempt if they satisfy certain requirements.Other incomeIn addition to the above, there are insurance premiums, prize money, victory money, subsidies, donations and so on. If you have these incomes, you need to provide details at tax return.We calculate the total income amount (Total Statutory Income) by adding up all the above incomes. Then, we calculate the total income amount (Assessable Income) by deducting the loss by business activity from the total income amount. Also, of the losses in the previous fiscal year, the portion that could not be deducted from the previous year's tax return can be offset against the loss for the current fiscal year. In this case, the deductible loss amount is up to 35% of the total income amount.■ Income Deduction AmountBased on the above total income amount, we will calculate the taxable income (Taxable Income) by deducting the following expenditure amounts. From April 1, 2011, the basic deduction has been raised from 300,000 rupees per year (25,000 rupees per month) to 500,000 rupees a year (41,177 rupees per month). Also, basic deductions will be applied to Sri Lankan citizens who do not live in Sri Lanka.· Basic deduction (500,000 rupees)· Donation to sick and charity organizations and government organizations on poverty· Payment amount of social insurance, life insurance, medical insurance etc.· Purchase for housing purchase· 50% of equity investment (limited to investment of 500,000 rupees or more)· Other fixed expenses■ Tax calculationCalculate the income tax amount by multiplying the taxable gross income amount obtained above by the personal income tax rate. The tax rate of personal income tax in Sri Lanka is stipulated as follows according to the classification of income amount.

In addition, we calculate taxable income by subtracting 500,000 rupees annually from gross income as a basic deduction.

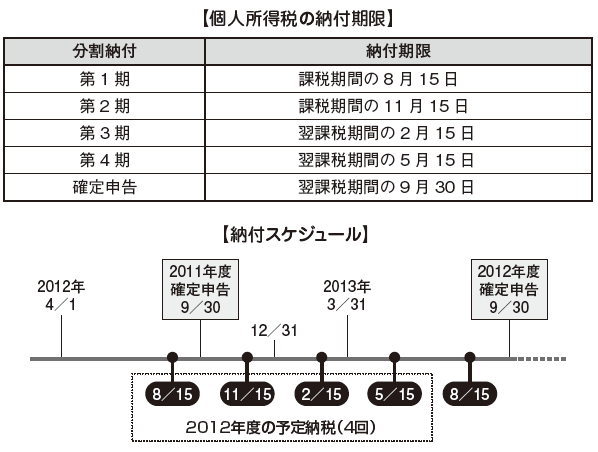

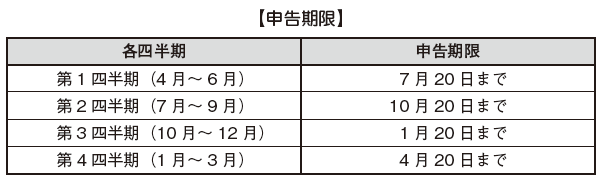

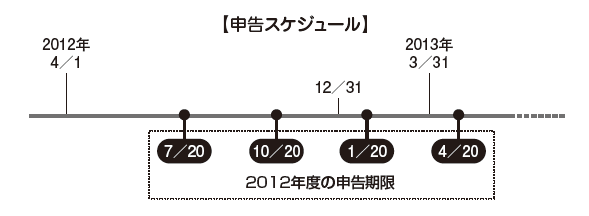

Also, depending on the type of income, there is another tax rate instead of the above progressive tax rate. For example, the tax rate on income earned from lotteries and gambling is 40%, airline pilot's tax rate is less than 20%, the travel industry and the construction industry that fulfills certain requirements and the business promoting agriculture is less than 15%.■ Declaration / Payment TermAll residents in Sri Lanka must submit a tax return by September 30 of the year following the tax year. In addition, couple who are in spouse relationship need to submit income tax return separately.In addition to the final return declaration, you have to make a planned declaration four times a year based on the income tax amount in the previous taxable year. Calculated based on the estimation criteria so that the split payment from the first to fourth period is not less than one quarter of the income tax in the previous taxable year and the difference between the final annual tax amount and the split payment amount is 9 You must pay by 30th of the month.Tax reduction by early payment10% of the tax amount will be deducted if the self-assessed income tax is paid one month prior to the due date of the payment. For example, if the payment due date is August 15, if payment is made by July 15th one month in advance, it is possible to receive a special exemption of tax reduction by early payment.

Calculated based on the estimation criteria so that the split payment from the first to fourth period is not less than one quarter of the income tax in the previous taxable year and the difference between the final annual tax amount and the split payment amount is 9 You must pay by 30th of the month.Tax reduction by early payment10% of the tax amount will be deducted if the self-assessed income tax is paid one month prior to the due date of the payment. For example, if the payment due date is August 15, if payment is made by July 15th one month in advance, it is possible to receive a special exemption of tax reduction by early payment. -

Corporate income taxes

■Tax durationThe taxable period of corporate income tax in Sri Lanka, like individuals, is from April 1 to March 31 of the following year.

■ TaxpayerCorporations that are taxpayers of corporate income tax in Sri Lanka are largely categorized as "domestic corporations" and "foreign corporations". A company that fulfills the following requirements is judged to be a "domestic corporation" and not only domestic source income but also all world income is taxed in Sri Lanka.

· Companies with headquarters in Sri Lanka· Companies managed and managed in Sri LankaIf it does not meet the above requirement, it is considered a "foreign corporation", unlike a domestic corporation, corporate income tax is imposed on domestic source income generated in Sri Lanka. For example, if you branch out in Sri Lanka, corporate income tax is imposed only on domestic source income, but if you set up a local subsidiary, in addition to domestic source income, including foreign source income Corporate income tax is levied on global income.

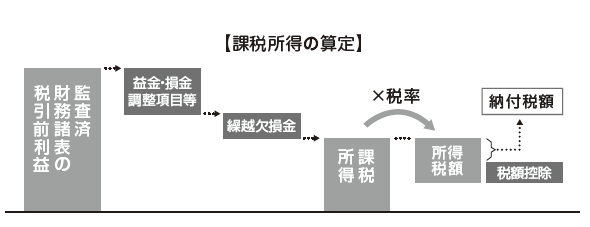

■ Taxable IncomeRegarding to the calculation of taxable income, the fixed earnings principle is adopted. Foreign-affiliated companies in Sri Lanka are required to conduct statutory audits, and pre-tax profits of audited financial statements are used as the basis of taxable income calculation, and tax adjustment items such as non-deductible items and tax loss carryforwards are added and subtracted and taxable income is calculated.

In order to calculate taxable income, as with personal income tax, we need to grasp the income for each income category below. Then, we sum these to calculate the total income amount.

· Profit from business activities (main business)· Interest, dividend income· Rent revenue· Pension, royalty· Other interests

Regarding the following income, separate provisions are stipulated in calculating income amount.

Interest and dividendsIn principle, the income of the interest and dividends will be taxable income, but interest and dividends already with 10% withholding tax deducted at the time of receipt, dividends received from the listed company etc. are calculated for taxable income Above, it is not included in the income amount.

Rent incomeThe rental income earned by a company by leasing or leasing a commercial facility is included in income generated from business activities. The expenses spent for repair of the facility are included in the amount of deductible up to 25% of the rent income. Rent income other than the above is classified and recognized separately from profit from business activities.

■ Deductible provision on income calculationThe amount of deductible expenses that can be deducted from the amount of gross profit for the business year is, in principle, all costs incurred in connection with the business. However, for items that are separately prescribed in the Income Tax Law, it is necessary to calculate the amount to be included in the amount of deductible money pursuant to that provision. Below we will explain the main deduction rules stipulated under the Income Tax Law.

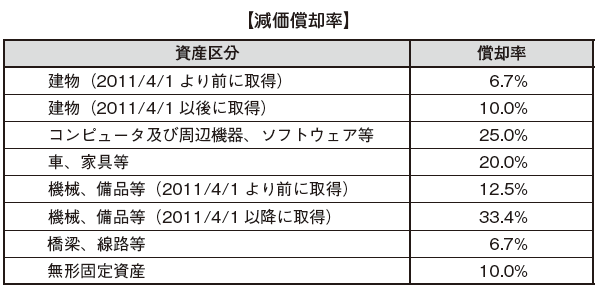

Depreciation costFor accounting purposes, either the straight-line method or the book value method can be selected as depreciation method. However, the tax depreciation method is limited to the straight-line method, and the depreciation rate is also specified for each type of asset. Amortization rates of major assets are as follows.

DonationRegarding donation, in principle, it is not included in the amount of deductible expenses, but for donations to national and local public bodies a certain amount can be included in deductible amount.Calculate the total income amount by totaling the income calculated above. Then, if there is a loss in the current fiscal year, or if there is a carryforward loss from the previous term, the gross income amount is calculated by deducting the total amount from the total income amount of the current term. The amount of loss that can be deducted is limited to 35% of the total income amount for the current term, and losses that can not be deducted can be carried forward to the next fiscal year.Then we calculate taxable income by deducting income deduction from total income amount. As for income deduction, the provisions applied in personal income tax apply mutatis mutandis.

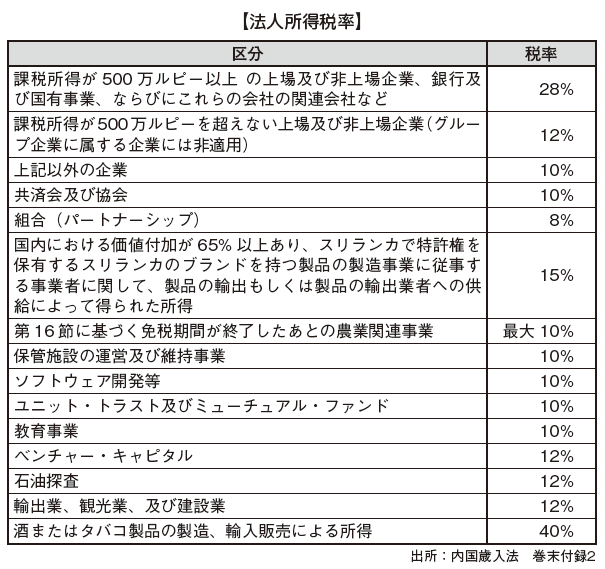

■ Corporate income tax rateCalculate the tax amount by multiplying the taxable income calculated above by the tax rate corresponding to the following company classification.

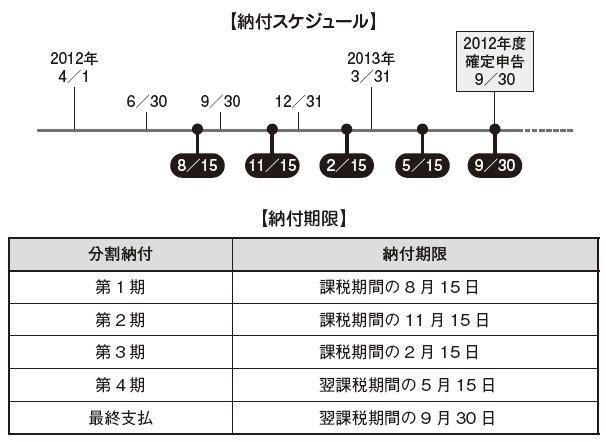

■Declaration paymentFor tax returns, you must submit a tax declaration by November 30 of the year following taxable year. The declaration form of the representative director must be attached to the tax return form to the effect that the declaration was correctly prepared based on the truth.Payment of taxes will be planned evenly quarterly according to the following schedule.Quarterly payment must be at least one quarter of the tax payment in the previous term and if the annual tax payment due to tax return at the end of the fiscal year exceeds the total amount of planned tax payments made every quarter , Additional tax payment will be made for the difference. The deadline for additional tax payment is September 30 of the next taxable period.

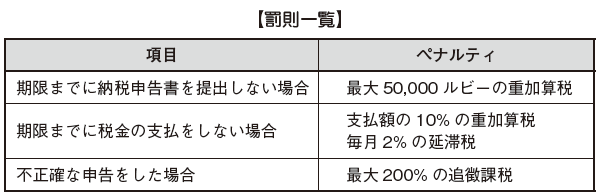

If the annual tax payment amount falls below the planned tax payment amount, we apply for refund to the director of the tax office within three years from the end of the business year, and the difference will be refunded upon approval.■ Penal ProvisionsIn the event of violating the laws relating to declaration tax payment prescribed in the Internal Revenue Code, the following penalty will be imposed.

■ Incentive tax incentive measuresIn Sri Lanka, various tax incentives exist for the purpose of increasing employment opportunities for the public by stimulating investment in the country, and raising income. Tax holiday (tax incentive measures), tax rate mitigation measures and tariff exemption etc.

Specifically, there are tax exemption periods and tax reduction periods for companies that invest in a certain amount or more in agriculture and industrial related business, enterprises engaged in pioneering businesses, companies that conduct infrastructure projects, etc. , See P.494). -

Value-added tax

VAT (Value Added Tax) is taxes subject to added value in Sri Lanka and has the following characteristics.

· It is an indirect tax imposed on the consumption of goods and services· Tax burden is the ultimate consumer· Intermediaries do not pay taxes, but they are obligated to pay taxes· Monthly filing and payment obligation

Like consumption tax in Japan, 12% VAT is taxed in Sri Lanka as a rule in selling goods and providing services.

■ TaxpayerAlthough the burden of VAT is the final consumer, it is the business operator (VAT registrant) that provides sales of VAT-taxable goods or services and importers of goods, and individuals and corporations that are obliged to pay VAT Tax obligation will occur regardless of.VAT taxpayers are obliged to register with the Internal Revenue Service as a VAT registrant. Documents necessary for registering VAT are as follows.Taxpayer identification number (TIN) certificate

· Business registration certificate· Copy of the identification of the director· Sales details and bank statement· Certificate of continuously exporting

In the case of a limited liability company, the following documents are further required.· Memorandum and memorandum· List of Directors· Certificate of corporation establishment

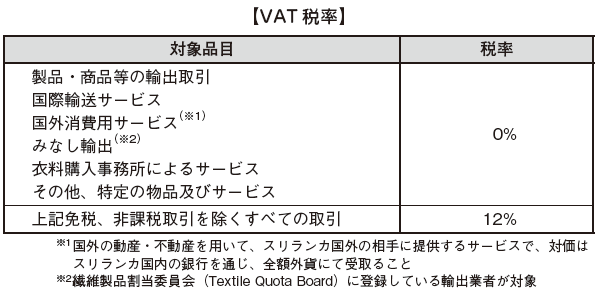

■ Tax rateThe tax rate of VAT is stipulated as follows according to the classification of transactions subject to taxation.

The VAT rate is basically 12% since January 1, 2011, but the VAT of the export transaction of goods or services is 0% taxable transaction. In other words, it means that VAT is not taxed for transactions that end consumers are outside Sri Lanka. This is because the export destination of goods is generally subject to the value added tax etc. of the country at the time of import clearance, even if the country of origin of goods is also taxed VAT, it becomes double taxation, export goods It is a measure that is being carried out in order to hinder the international competitiveness of the country. In order to apply this 0% tax rate, documents that prove that goods were taken out of the country (export customs clearance documents etc) in each company must be preserved firmly.

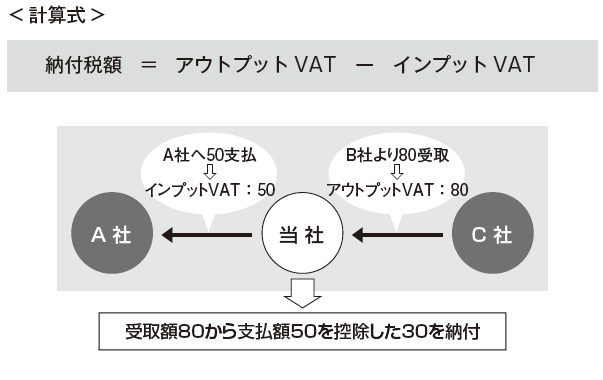

■ Calculation of payment tax amountSri Lanka adopts a deduction method as a calculation method of VAT. The deduction method is a method of paying the difference obtained by deducting the input VAT paid from the output VAT received every month. The VAT to be paid is the difference between the output VAT and the input VAT.

Output VATThe seller will charge VAT to the buyer when selling taxable goods or taxation services. This VAT is output VAT (provisional reception VAT, sales VAT) from the standpoint of the seller.

Input VATBuyer must pay VAT to seller when purchasing taxable goods or taxation service. From the viewpoint of the buyer, this is input VAT (provisional payment VAT, purchase VAT).This input VAT can be offset with the buyer's output VAT if the purchased taxable product or taxation service is within the scope associated with the buyer's business. Likewise, the seller can offset the output VAT and the input VAT paid when purchasing a taxable product or taxation service.

■Declaration paymentThe business operator collects VAT for the sale of products and the provision of services (sales). From the total tax amount collected at the time of sales, VAT paid at the time of import or purchase (purchase) will be deducted and the difference will be paid to the Revenue Service. If the payment VAT exceeds the receipt VAT, the excess tax will be refunded. For deduction of input VAT, it is necessary to declare within 12 months from invoicing date (in the case of import, deduction of purchase tax amount is within 24 months from customs declaration date).There are two tax payment methods. As a first method, tax payment will be paid to each branch of Ceylon Bank by declaring it by 20th day of the next month along with the payment of value added tax.Another way is to pay every quarter by the end of the quarter by the 20th day of the following month. At this time, it is necessary to declare directly to DPRA (Date Preparation Revenue and Accounting) Unit. -

Import and export duties

By the Sri Lanka Customs Law, goods that are allowed to import and export across the Sri Lankan borders are subject to import and export duties.

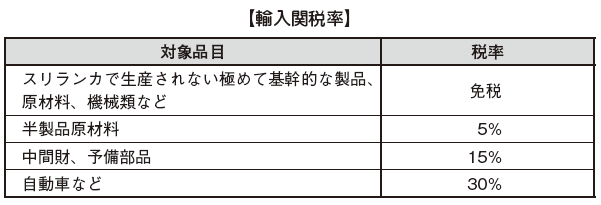

■ Import dutiesThe import tariff rate of Sri Lanka is classified into four as follows. In the 2012 budget draft, the tariff rate raise for many items

Preferential measures such as exemption from tariffs are stipulated for imported items for specific purposes and imported items of a specific agency.

■ Export dutiesExport tariffs are imposed only on the export of tea, coconut, raw rubber and several other items.The tax amount is classified into items based on physical units such as the weight and quantity of goods and items based on the stated price such as the selling price of goods, and the tax amount is calculated. -

Economic service charge (ESC)

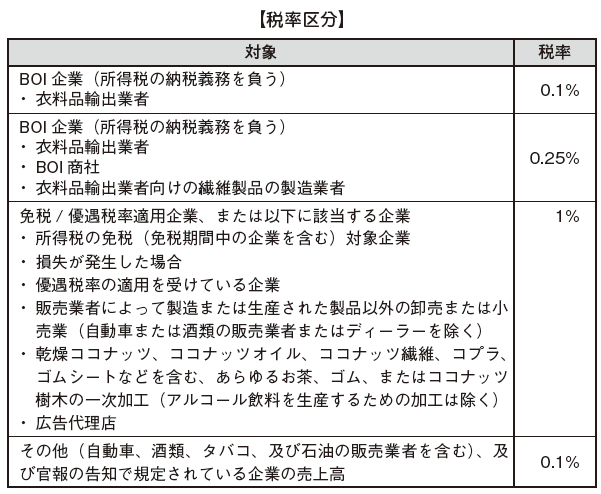

Economic service tax is a tax that is taxed on taxable sales by a transaction when an individual, corporation, partnership deals in Sri Lanka.

■ TaxpayerEconomic service taxes are subject to tax obligations every quarter if net sales in any quarter exceed Rs. 50 million, regardless of income tax obligation.However, the following corporations and organizations are exempted from tax liability for Economic Service Tax.

·Corporation· Airline companies and shipping companies (nonresidents)· Local Government·Government agency※ Starting April 1, 2012, the standard of sales has changed from 25 million rupees to 50 million rupees (2012 budget plan)

■ Tax rateEconomic service tax is classified into the following four categories and is calculated by multiplying sales by each tax rate.

Taxation, which is the taxation standard when calculating tax amounts, includes all transactions, regardless of whether they actually receive consideration. Also, it does not include the gain on sale of VAT or capital assets, and if there is a credit loss, the amount of loss is deducted from the sales which becomes the tax base.

■Declaration paymentEconomic service tax must be declared and paid quarterly. When paying, it is necessary to correctly describe the date of payment and the payment for every quarter on the designated form and submit it to the tax office of the jurisdiction by the 20th day of the following month of the last month in each quarter.The highest collected tax for each quarter is expected to be Rs 30 million.

Economic service tax paid can be offset against accrued income tax on corresponding year. For parts that can not be offset, refund processing is not carried out and carry forward for 4 years is possible. -

National Construction Tax (NBT: Nation Building Tax)

The national construction tax came into effect on February 1, 2009 with the aim of securing financial resources for reconstruction of infrastructure equipment affected by terrorist acts etc. in the civil war.

■ TaxpayerThe national construction tax is applied to importers, manufacturers and service providers in Sri Lanka when quarterly sales exceed 500,000 rupees.However, with regard to the following businesses, caution is required as sales per quarter exceed 25 million rupees.

· Management of hotels, inns, restaurants, or similar projects· Added value agricultural products in each region, products based on rice· Educational institutions in each region· Supply of labor (personnel) or employment· Agricultural products produced in each region

The taxpayer of the national construction tax is obliged to register with the Internal Revenue Service as an NBT registrar. However, importers pay tax on the national construction tax to the Customs Department at the time of import, so there is no need to register with the Internal Revenue Service.

■ Tax calculationTax on national construction tax is calculated by multiplying sales per quarter by a tax rate of 2%. From 1 January 2011 onwards, the range subject to taxation will be expanded to wholesale and retail, but by that amount 50% of the sales will be deducted from the sales to be taxed. In addition, certain goods and services are tax exempt.

Declaration payment

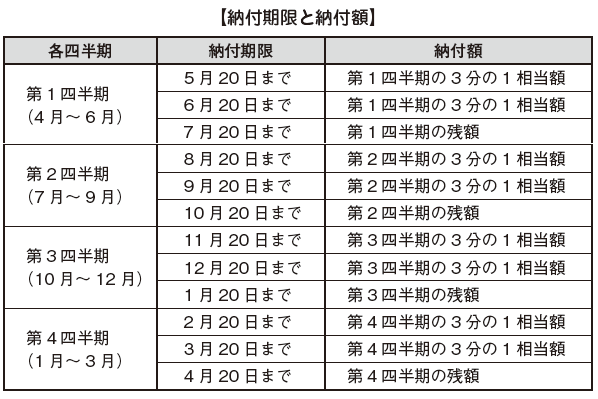

The national construction tax declaration adopts a system that pays the tax amount for each quarter in three divisions.

The first payment shall be made until the 20th day of the second month in each quarter, the second payment until the 20th day of the third month, and the third (final) payment will be due within 20 days of the first month in the next quarter.

In addition, the first and second payments shall be paid equivalent to one third of each quarter and the third (final) payment shall be paid the remainder of each quarter. The equivalent of one third of each quarter is estimated from the sales in the previous fiscal year in each quarter or the sales in the first month in each quarter of the previous fiscal year.

-

Japan-Sri Lanka tax treaty

Regarding the tax treaty, I mentioned the outline in the preceding paragraph, but here we will look at the details of the tax treaty signed between Japan and Sri Lanka.■ Definition and Taxation of PE (Sri Lanka Tax Treaty Article 2)In Article 2 of the Japan-Sri Lanka DTA, the definition of permanent establishment (PE: Permanent Establishment) is stipulated as follows.· Branch office, administration office, factory and other place to do business· Places where mines, quarries, other mined natural resources exist· Construction similar to construction, assembly work, etc. that lasts for more than 183 daysIn addition, if you have a distributor in Sri Lanka, the agency has comprehensive authority when concluding the contract, and when you conduct these acts on a recurring basis or possess stocks for permanent orders If it is, it will be included in the permanent establishment. Conversely, if the agency does not meet these requirements, it will not be certified as an independent PE.For business in Sri Lanka, especially when you do not set up a branch office or corporation in the site, depending on the business content PE is recognized and there is a possibility that income taxation may be done from the tax authorities, so it is necessary to be careful .■ Special Affiliated Companies (Japan Sri Lanka Tax Treaty Article 4)The provisions concerning transfer pricing taxation are prescribed by the Ordinance of the Ministry of Finance, but also between Japan and Sri Lanka is prescribed under the Tax Treaty.As a content, if a company or the same person of one Contracting Party is directly or indirectly participating in the business management, control or capital of another Contracting Party, the terms of the transaction are When it is different from the terms and conditions, if it is assumed that there is no such condition, taxation will be imposed on one of the Contracting Parties concerning the profit which the enterprise etc of one Contracting Party would have originally obtained. In summary, it states that "When you do business between affiliates, you must obey third party terms and conditions".In the text, it is a comprehensive provision such as "to take appropriate measures for transfer pricing between bilateral countries", so practical consideration is required on a legal basis.■ Taxation on royalty (royalties etc.) (Article XXII of the Sri Lanka tax treaty)There are cases in which royalties etc. are received as consideration for the provision of know-how etc. between Japan and Sri Lanka.For this use fee, in the tax treaty it is said that "you can tax in the country where the fee was generated". In other words, if royalties are paid from Sri Lanka to Japan due to technical provision from Japan, tax will be levied by withholding upon payment.In the tax treaty, it is said that it will be reduced by an amount equal to 50% of the amount of royalties, so at the time of payment, the withdrawal amount will be collected by multiplying half of the consideration by the withholding tax rate .■ Personnel service income for short-term residents (day 11 Sri Lanka tax treaty Article 11)In the tax treaty, it is stated that salary income is taxed only in the country where actual work is being carried out. In other words, if work that is the source of salary is not done, taxation will not be applied to salary income in that country, and tax will be imposed on the actual work place.When traveling from Japan to Sri Lanka, if the following three requirements are satisfied, Sri Lanka side will not be taxed on remuneration or salary paid.· The number of days stayed in the taxable year shall not exceed 183 days· That services are provided for residents of Japan or on behalf of them· Taxation is taxed in Japan against salaries etc.However, these provisions do not apply to remuneration for actors, entertainers, etc., and are mainly regulations for business travelers and others.■ Elimination of double taxation (Article 15 of the Japan-Sri Lanka tax treaty)Regarding the method of double taxation exclusion between bilateral countries in Sri Lanka and Japan, the clause states that. Each allows the deduction from the amount of tax to be paid in each country to the extent of the tax amount calculated based on the tax laws of each country.In addition, if Japanese companies reduce or exempt taxes in Sri Lanka due to dividend from Sri Lanka or special investment incentive measures, the tax amount paid by the Japanese company in Sri Lanka It is possible to make a foreign tax credit on the Japanese side. This system is called "deemed foreign tax credit system".■ Mutual consultation on double taxation (Article XXI of the Sri Lanka tax treaty)In accordance with the tax laws of either Japan or Sri Lanka, if taxation authorities receive taxation that does not conform to the provisions of this tax treaty, you can file a complaint against an authorized authority in your country of residence .In this case, the competent authorities of both countries will keep in touch with each other and hold mutual consultation with each other to eliminate taxation that does not conform to the provision of this tax treaty.In cases where this provision is not stipulated in the tax treaty or where a tax treaty is not concluded with Sri Lanka, taxation will be carried out based on the domestic law stipulated in each country.

-

-

-

Websites

[1] JETRO

-

Babiliography

[1] スリランカ税務局[2] Parliament of the Democratic Socialist Republicof SriLanka“Inland Revenueact ACT,No.10 of 2006”

[3] Parliament of the Democratic Socialist Republicof SriLanka“Value Added Tax (Amendment)ACT,No.8 of 2006”

[4] 鈴木康二『アジアビジネスの基礎』(発行年月:2007/04)

[5] 新日本アーンストアンドヤング税理士法人『アジア各国の法人税法ハンドブック』(発行年月:2008/10)

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya