Sri Lanka

4 Chapter Establishment

-

-

1 Chapter Coming Soon

2 Chapter Basic knowledge

2.1 Basic knowledge of Sri Lanka

3 Chapter Investment Environment

3.2 Investment regulation, incentives

4 Chapter Establishment

4.1 Characteristics of business base

4.3 Company liquidation and withdrawal

5 Chapter Company Law

5.2 Shareholders (shareholders meeting)

6 Chapter Accounting

6.1 Accounting system of Sri Lanka

6.2 Disclosure system of Sri Lanka

7 Chapter Tax

7.2 Individual Issues in Sri Lanka Domestic Tax Law

8 Chapter Labor

8.3 Social security system and social insurance law

8.4 Points to keep in mind while having Japanese people in Japan

-

-

-

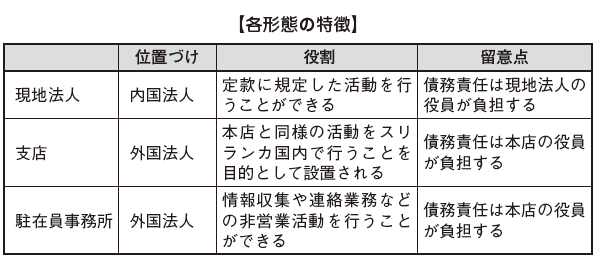

Characteristics of business base

When setting up a business base in Sri Lanka, from the local corporation, branch office, representative office etc., you must grasp their respective characteristics and choose the appropriate business form.

-

Local corporation

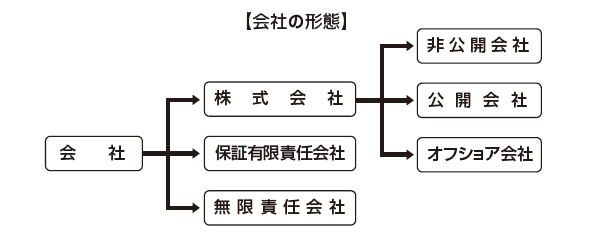

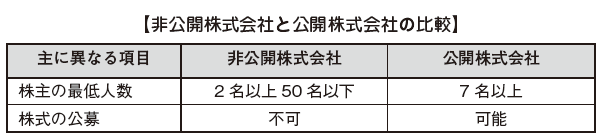

In establishing a subsidiary, you must select a company form based on the Sri Lanka Company Law. In the most common case, you will be selecting the company form as well as in Japan. ■ Limited CompanyA corporation is divided into a public company, a private company, and an offshore company in a form that all shareholders have limited liability limited to the amount of contribution.Private Limited CompanyPublic Limited CompanyOffshore CompanyPublic Co., Ltd. is a stock company premised on listing of shares and solicitation of shares is done through the stock exchanges. In order to raise funds it is necessary to recruit shareholders. Only this form can be listed on the Colombo Stock Exchange, it is mandatory to submit financial statements to the Registrar of Companies. The financial statements of the public corporation can also be viewed by general investors.On the other hand, private companies can not offer public offering of shares. In addition, the number of shareholders is limited to 2 or more and 50 or less.

■ Limited CompanyA corporation is divided into a public company, a private company, and an offshore company in a form that all shareholders have limited liability limited to the amount of contribution.Private Limited CompanyPublic Limited CompanyOffshore CompanyPublic Co., Ltd. is a stock company premised on listing of shares and solicitation of shares is done through the stock exchanges. In order to raise funds it is necessary to recruit shareholders. Only this form can be listed on the Colombo Stock Exchange, it is mandatory to submit financial statements to the Registrar of Companies. The financial statements of the public corporation can also be viewed by general investors.On the other hand, private companies can not offer public offering of shares. In addition, the number of shareholders is limited to 2 or more and 50 or less. [Offshore Company]

[Offshore Company]An offshore company is not established in the domestic business but is established for the purpose of managing foreign affiliated companies. Foreign investment restrictions are loose mainly, and countries with a low corporate tax rate become the target country for the establishment of an offshore company. For example, it is an image of establishing a company in an area called tax · haven such as Macao and Samoa, and managing overseas affiliated companies from there. Sri Lanka is also used in the same sense. In other words, domestic companies in Sri Lanka also foreign companies established outside Sri Lanka register as offshore companies in Sri Lanka and control overseas affiliates.

It seems to be a particularly effective form when you want to effectively utilize the benefits of Sri Lanka's tax system and incentives for foreign companies. However, if you register as an offshore company, you can not conduct business activities in Sri Lanka.■ Guarantee limited liability companyThe guaranteed limited liability company is similar to a corporation in that it is a limited liability system in which the investor is responsible up to the amount prescribed in the articles of incorporation in advance, but the form of investment is not a stock, It differs in that it gives assets and takes responsibility. -

Form of expansion other than local subsidiaries

■ Branch of foreign companyBranch office is established in Sri Lanka in order to develop business similar to the head office.

There is no special requirement for registering the installation of the branch office in Sri Lanka. By applying to the company registration office, it is possible to set up a branch office. The period from application to permission is about one month, and you have to obtain various licenses from relevant ministries and agencies if necessary.

The big difference with the local corporation is that if the local corporation defaults, the parent company, the shareholder, will have limited liability limited to the amount of contribution. On the other hand, because the branch does not have corporate status, the head office is obliged to pay full obligation for the payment obligation assumed by the branch office.

In the case of a branch office, the profit and loss generated at the branch office will be summed up with the parent company to prepare financial statements, so if the branch is in the red, you can deduct losses incurred at branches from the profits of the head office and you can have the benefits that you can save tax on corporate tax that is taxed in Japan.Representative office (Liaison / Representative Offices)The representative office is an office registered for the purpose of conducting limited "non-sales activities" mainly for gathering information. Like the branch office, the representative office does not have corporate status. The difference from the branch is that we can not conduct sales activities and investment activities.Specifically, it is allowed to do "non-sales activities" as below.· Arranging goods or services for the head office· Survey and management of product quality and quantity· Provide advice on products sold by headquarters to agencies and consumers· PR for new products and services at head office· All reports to the head officePlease note that if you conduct activities outside of these ranges, it is PE approved and penalty may be imposed.■ Joint Venture (Joint Venture)· Jointly controlled operationsJointly with foreign-funded enterprises or companies in Sri Lanka, we will utilize existing assets and conduct business. As a joint project, we do not have a corporate status, we will reflect the revenues and liabilities derived from that business in the financial statements of each company. In that case, compensation and contribution will depend on the content of the agreement.· Jointly controlled assetsIt has a common asset and raises profits. For example, it is a pipeline business of oil. By jointly investing and building a pipeline, you can get continuous profit after completion. The costs and profits that occur will be based on an agreement between the parties.· Jointly controlled entitySeveral companies in foreign capital or Sri Lanka establish an entity (joint venture) for a certain business. Except for the special meaning of establishment through joint investment with other companies, it is equivalent to other companies.

-

-

-

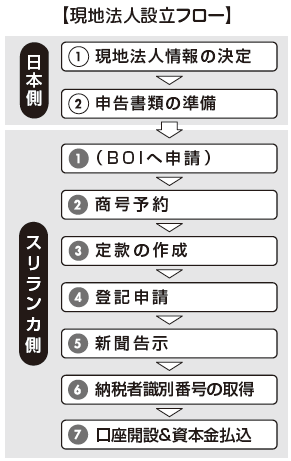

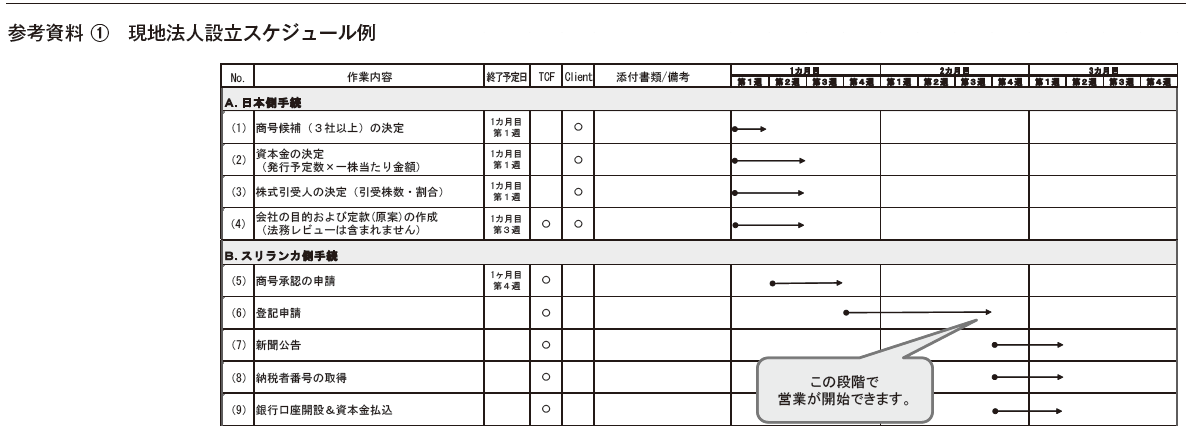

Establishment procedure

■ Establishment process of private companyIn establishing a company in Sri Lanka, there is no need to proceed with procedures such as opening a bank account, paying capital and acquiring a taxpayer number in advance. Also, as is normally assumed, when a parent company in a foreign country becomes a shareholder, there is no need to submit a certified copy of the registry of the parent company or the articles of incorporation, and no certification procedure at the notary office or the embassy is required, compared with the case, the procedure for establishing a corporation is considerably easier. Procedures to start business are as follows.

-

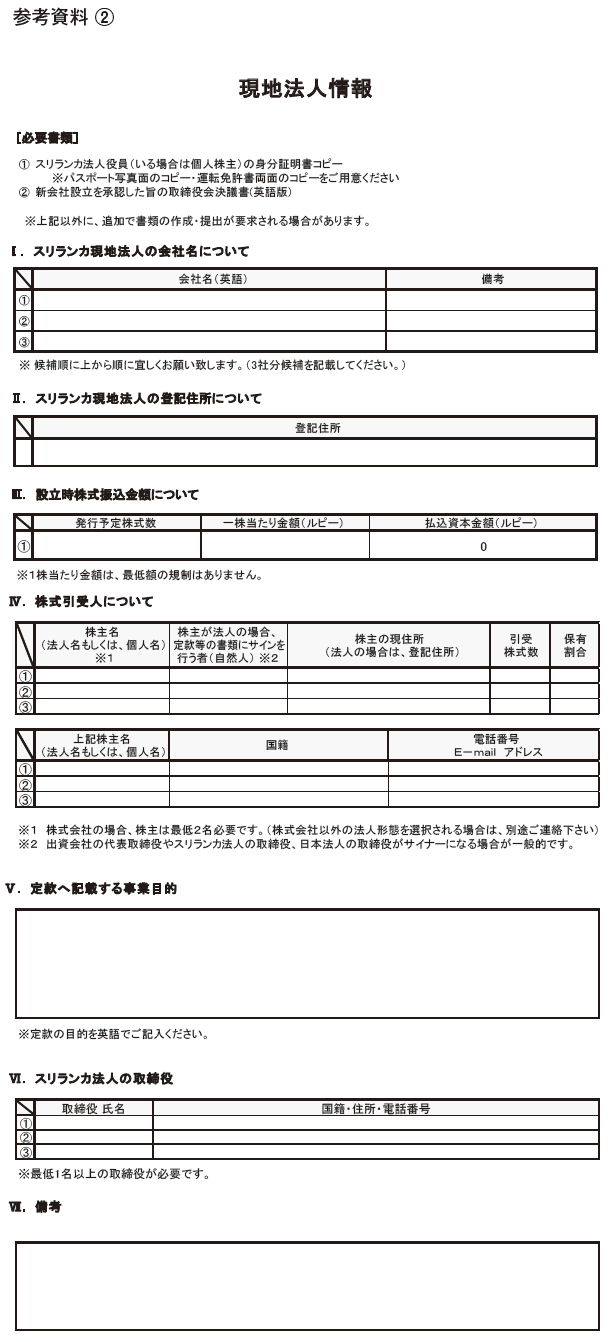

Preparatory procedure to be done by the Japanese side

① Determination of local corporate information[Company name]If it is the same company name as an existing company or it is judged to cause misunderstanding, it is not possible to use the trade name. For example, it is prohibited to use trade names that signify a business name, Sri Lanka state, union, etc. that are related to the government.[Shareholders / capital]Regarding the capital setting, it is necessary to clear the minimum capital. Also, procedures for capital increase and capital reduction are troublesome and costly, so you must prepare a cash plan in advance and set appropriate capital. Normally, the necessary funds until the cash flow of operating cash flows will be set as capital.After determining the capital amount, we will decide shareholders. In Sri Lanka, in the case of a private company, the minimum number of shareholders is stipulated as two or more. Therefore, in the case of establishing a wholly-owned company, two companies out of the group companies will be selected as shareholders, or the parent company will assume 99% of the issued shares and the remaining 1% as the director (or group company) It is necessary to devise such as possessing.[Company officer]When Japanese companies establish a subsidiary in Sri Lanka, most cases choose privately held companies. In a private company, it is necessary to select at least a director, a company secretary and a single accounting auditor. A company officer may be responsible personally if the company violates the law, and there are also heavy sentences such as imprisonment etc, so it is necessary to appoint an officer after recognizing this point.Directors are the people responsible for the management of the company and are the most important institutions. There is no requirement for nationality or residential nature, but it is not permitted to appoint a bankrupt, a minor, or a person prescribed in the articles of incorporation.A company secretary is a person who is responsible for company compliance, such as signing external documents. As it is necessary for the company secretary to be a member of the Association of Secretaries of Sri Lanka and the Association of Chartered Accountants, it is normal practice to ask an accounting firm that asks for establishment agency etc.The accounting auditor is the person who audits the appropriateness of the financial statements prepared by the company and prepares audit reports. I must be a member of Chartered Accountant in Sri Lanka and can not hold concurrent positions with directors and employees.[Registered address]In addition to the registered address of the company, the Registration Application Form requires a director's address in Sri Lanka (Resident Address). When registering, you can borrow and register the address of the accounting office etc. requesting substitution, then you can change the registered address after you decide the office. In this case, we will keep the local address of the director along with the address of the office.[Purpose of the company]We will decide the business purpose described in the articles of incorporation of the new company. In principle, the acts that are not included in the corporate purpose are invalid and the effect is not attributable to the company. Therefore, it is necessary to carefully consider whether the description of company purpose covers all the project purpose of the new company.At the same time, if it falls under the regulated industry type, the establishment itself of the company can not be done. In such cases, it would be better to consult with experts and consider the purpose of the company.② Preparation of application documentsWe will prepare the necessary documents for each procedure to be described later, such as application form, new company constitution and resolution of board of directors. Furthermore, notarization in Japan is required for the articles of incorporation, directors' lists, resolutions, etc. of the parent company of the Japanese corporation.

① Determination of local corporate information[Company name]If it is the same company name as an existing company or it is judged to cause misunderstanding, it is not possible to use the trade name. For example, it is prohibited to use trade names that signify a business name, Sri Lanka state, union, etc. that are related to the government.[Shareholders / capital]Regarding the capital setting, it is necessary to clear the minimum capital. Also, procedures for capital increase and capital reduction are troublesome and costly, so you must prepare a cash plan in advance and set appropriate capital. Normally, the necessary funds until the cash flow of operating cash flows will be set as capital.After determining the capital amount, we will decide shareholders. In Sri Lanka, in the case of a private company, the minimum number of shareholders is stipulated as two or more. Therefore, in the case of establishing a wholly-owned company, two companies out of the group companies will be selected as shareholders, or the parent company will assume 99% of the issued shares and the remaining 1% as the director (or group company) It is necessary to devise such as possessing.[Company officer]When Japanese companies establish a subsidiary in Sri Lanka, most cases choose privately held companies. In a private company, it is necessary to select at least a director, a company secretary and a single accounting auditor. A company officer may be responsible personally if the company violates the law, and there are also heavy sentences such as imprisonment etc, so it is necessary to appoint an officer after recognizing this point.Directors are the people responsible for the management of the company and are the most important institutions. There is no requirement for nationality or residential nature, but it is not permitted to appoint a bankrupt, a minor, or a person prescribed in the articles of incorporation.A company secretary is a person who is responsible for company compliance, such as signing external documents. As it is necessary for the company secretary to be a member of the Association of Secretaries of Sri Lanka and the Association of Chartered Accountants, it is normal practice to ask an accounting firm that asks for establishment agency etc.The accounting auditor is the person who audits the appropriateness of the financial statements prepared by the company and prepares audit reports. I must be a member of Chartered Accountant in Sri Lanka and can not hold concurrent positions with directors and employees.[Registered address]In addition to the registered address of the company, the Registration Application Form requires a director's address in Sri Lanka (Resident Address). When registering, you can borrow and register the address of the accounting office etc. requesting substitution, then you can change the registered address after you decide the office. In this case, we will keep the local address of the director along with the address of the office.[Purpose of the company]We will decide the business purpose described in the articles of incorporation of the new company. In principle, the acts that are not included in the corporate purpose are invalid and the effect is not attributable to the company. Therefore, it is necessary to carefully consider whether the description of company purpose covers all the project purpose of the new company.At the same time, if it falls under the regulated industry type, the establishment itself of the company can not be done. In such cases, it would be better to consult with experts and consider the purpose of the company.② Preparation of application documentsWe will prepare the necessary documents for each procedure to be described later, such as application form, new company constitution and resolution of board of directors. Furthermore, notarization in Japan is required for the articles of incorporation, directors' lists, resolutions, etc. of the parent company of the Japanese corporation. -

Establishment procedures to be carried out locally

❶ Application for investment to Sri Lanka Investment Authority (BOI)If you receive investment incentives such as corporate tax cuts or businesses with certain restrictions on foreign investment, you must apply for investment to BOI before approval of establishment and get approval. If neither applies, this procedure is not necessary.

· Applying for Investment Authorization to BOI· Submit draft of the articles of incorporation to BOI· Open an account at a commercial bank

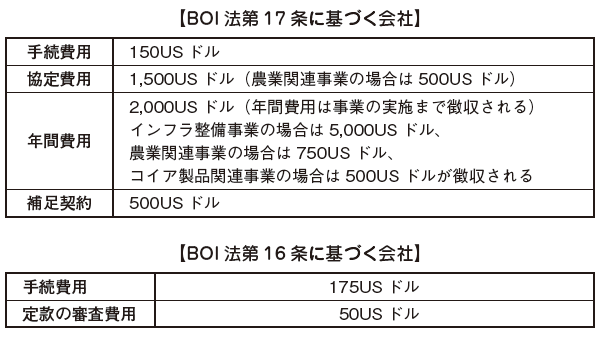

The fee paid when applying for BOI is as follows.

❷ Reservation of trade nameI will apply for trade name reservation of the company that is going to be established. At the window of database search or registration office, confirm that the company name to be applied has not already been used.After confirming the availability of the company name, usually fill out the form on the form A16 on the web and submit it. When the company name is approved, the company name approval number will be notified by e-mail. Normally, approval will come down on the next day. The trade name you reserved will be valid for three months from application.

❸ Preparation of the articles of incorporationThe characteristic of Sri Lanka is that the description example (ModelArticles) of the company's articles of incorporation is stated in Schedule 1 (First Schedule) of the Company Law. This description example can be applied as it is or it can be decided on its own.The articles of incorporation shall contain the following content.

· Business objectives of the company· Shareholder rights and obligations· Corporate institution design (director, secretary)· How to issue shares· General shareholders meeting (convocation method, quorum, chairperson, resolution method, minutes etc.)· Accounting and auditing· Company liquidation· Others

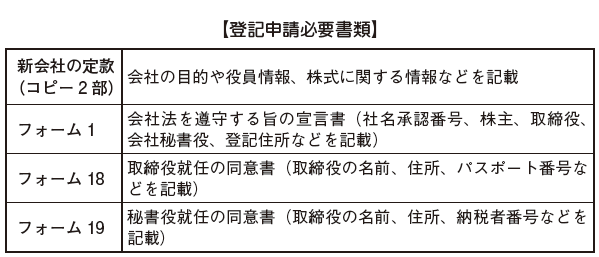

❹ Registration applicationWe will submit necessary documents and register fee to the company registration authority. Documents that need to be submitted are as follows. The form can be downloaded from the web of the registration authority. (Http://www.drc.gov.lk)

If the contents of the document are correct, the company registration certificate will be issued by the company registration agency (Article 5.1). In the establishment certificate, the name of the company, the registration number of the company, the type of company (private company or public company) is stated (Article 5.2).

❺ Publication of newspaperWithin thirty days after registration of the establishment of the company, you must publish the fact that the company was founded by entering the company name, company registration number, registered address in the Official Gazette or daily newspaper with at least one minimum paper (Article 9 (1)). If this advertisement is neglected, the company will be subject to a fine of not more than 50,000 rupees (Article 9, paragraph 3).

❻ Acquisition of Taxpayer Identification Number (TIN)You must apply for acquisition of tax identification number (TIN) and VAT registration number (VAT Registration Number) to the Inland Revenue Department. If there is no incompleteness in the application documents, you can obtain it within the day.In principle, the directors themselves will go to the Internal Revenue Service, but the proxy can also apply. In this case, you will be required to submit a letter of attorney to the agent and a copy of the proxy's identification card.In case of a private company, the required documents are as follows.

· Establishment certificate (Form 2A)· Application for registration (Form 1, certified copy issued by company registration office)· Articles of association (with signature of directors)· Copy of the identification of the director· BOI registration certificate (for BOI registered companies only)

The value-added tax registration number here is temporary, and when we submit a document certifying that sales for 3 months exceeded 500,000 rupees, obtain the official VAT registration number You will be doing.

❼Opening a bank accountDocuments to be submitted by the bank differ. Here, you will find the documents necessary for opening a bank account at HSBC Bank. We submit original documents and copies of all documents and the original will be returned after bank check.

Documents required to open current account (Current Account)

· Request form· Establishment certificate

・ Form 1, 20, 48· Resolutions of the Board of Directors (with a chairman and secretary signature)· Articles of association· Business description (You can download on the HSBC website, describing simple company information in regulation form such as business contents, director information, number of employees etc)

Required documents for establishing an ordinary account (Saving Account)

· Request form· Establishment certificate· Form 48· Resolutions of the Board of Directors (with a chairman and secretary signature)· Copy of all the director's identification (NIC) or passport(Source: HSBC Sri Lanka)

-

Branch installation procedure

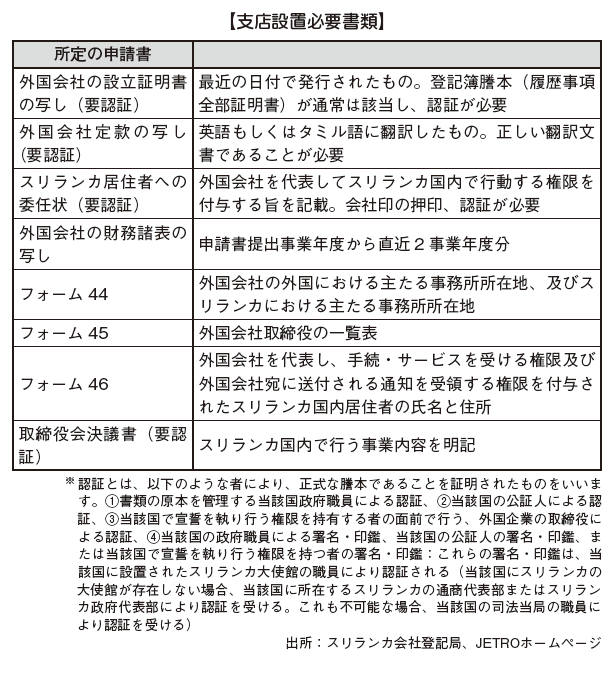

■Application to the company registration officeA foreign company can open a branch office in Sri Lanka. We will submit the default application form to the company registration office. Unlike overseas affiliates, it is a branch office of a foreign company to the last, so in addition to the company's articles of incorporation and registry of the foreign enterprises that are the subject of the project, you must submit copies of finance tables to prove that it is in a proper financial condition in carrying out the project.

Documents necessary for application are as follows.

Once the documents are submitted and installation is approved, an installation certificate will be issued and foreign companies can open a sales office in Sri Lanka.In addition, when a foreign company registers a business location in Sri Lanka, it is necessary to pay Rs. 25,000 to the company registration office.

■ Acquisition of taxpayer identification number (TIN)Documents necessary for acquiring the taxpayer identification number are as follows.

· Form 42 (installation certificate of branch)· Form 44· Form 45· Form 46· Articles of Association (with signature of director)

-

-

-

Liquidation of private company

The settlement procedure of Sri Lanka is prescribed in Chapter 9 and Chapter 10 of the Company Law. We will conduct clearing procedures as specified and eventually a clearing certificate (Death Certificate) will be issued. In Sri Lanka, there are liquidation by the court, voluntary liquidation, liquidation by court supervision as a liquidation method.Winding-Up by the CourtIf the conditions below are met, it will be a liquidation reason by the court (Article 270).· When the company passes a special resolution to the effect that the court will liquidate· When the payment becomes unpayable· If you did not do business at all for one year from the establishment, or stopped the project for one year· In case of falling below the number of statutory shareholders· When no one director is present· When the court approvesThe flow of the settlement procedure by the court is as follows.[Submission of petition (Article 272)] ... ①Company, certain shareholders (for example, holding shares continuously for more than six months within the last 18 months), the creditors will submit a petition for liquidation to the court.[Appointment of a liquidator (Article 285)] ... ②The court appoints a liquidator to carry out the liquidation of the company.Permission of the liquidator (Article 292)The liquidator has the following authority under the sanctions of either the court or the inspection committee.· Lawsuit action by name of private company· Execution of business as much as necessary for liquidation· Sales of assets of private companies· Enforcement of items necessary for liquidation[Notice to Registration Authority (Article 278)] ... ③We will immediately send you a copy of your petition to the Registration Authority (Article 278).[Appointment of bankruptcy trustee (Official Receiver) (Article 281)] ... ④We appoint a bankruptcy trustee (Article 281).[Document submission to the bankruptcy trustee (Official Receiver) (Article 283)] ... ⑤(In the case of appointing provisional liquidator) From the date of appointing provisional liquidator or within 14 days from the date of request for liquidation, a document stating the company's asset and liability and details of the creditor is a bankruptcy trustee .[Document submission from the bankruptcy trustee (Official Receiver) to the court (Article 284)] ... ⑥After the bankruptcy trustee receives the document, it submits a provisional report to the court in accordance with the order of the court.[End of liquidation (Article 316)] ... ⑦After applying for liquidation procedure from the liquidator, the court will complete the liquidation of the company.[Notice to Registration Authority (Article 316 (2))] ... ⑧The liquidator must submit a copy of the application form to the Registration Authority within 15 days after the application date for termination.Voluntary Winding-UpIf the conditions below are met, the company can voluntarily liquidate (Article 319).· Resolution of voluntary liquidation passed at general shareholders meeting- Resolution of voluntary liquidation through special resolution passed· There was a special resolution to the effect that the project can not be continuedThe flow of voluntary clearing procedures is as follows.[Resolution of general meeting of shareholders (Article 319)] ... ①At the General Meeting of Shareholders, one or more liquidators must be appointed for the company's asset allocation (Article 326). Unless the conditions of dissolution are stipulated in the articles of incorporation, we resolve to liquidate the company by a special resolution of the General Meeting of Shareholders (Article 319).[Newspaper advertisement (320 articles)] ... ②Within 14 days after the general shareholders meeting resolution, notify the Official Gazette and the daily newspaperThere is no doubt (Article 320 1, 346). Failure to do so will result in a fine to the company and officers (Article 320, paragraph 2).[Preparation of oath (Article 324)] ... ③The directors make a statement (Statutory Declaration) stating that they can pay the obligation within 24 months. However, it will be unnecessary in certain cases, such as when payment of debt is completed within 5 weeks.[Notice to creditors (Article 329)] ... ④If the liquidator judges that payment of the obligation will not be completed within the period declared in the oath, immediately the creditor meeting shall be held and the document on the assets and liabilities of the company must be provided to the creditors not.[Holding general meeting of shareholders (Article 330)] ... ⑤If the liquidating procedure lasts more than one year, the general meeting of shareholders must be held on the day one year has passed since the commencement of the liquidating procedure. Even then, we have an obligation to call up more than once a year.[Convocation of final general shareholders meeting (Article 331)] ... ⑥After the liquidation procedure is completed, the liquidator must convene a general shareholders meeting and explain the settlement procedure, asset breakdown and so on. This General Assembly must be notified to the Official Gazette (Gazette) more than a month before the opening date.[Notice to Registration Authority (Article 331)] ... ⑦Within one week from the final general shareholders meeting, the liquidator must send a copy of the minutes to the registration office (Article 331 (3)).Winding-Up Subjectto Supervisionof Court by court supervision

In liquidation by court supervision, creditors and investors will file a petition to the court in the process of voluntary liquidation. However, there are cases in which the number of courts' petition for liquidation itself is small

and is almost unable to get permission. This is because it is necessary to prove that the liquidator making the existing procedure is ineligible.

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya