Sri Lanka

5 Chapter Company Law

-

-

1 Chapter Coming Soon

2 Chapter Basic knowledge

2.1 Basic knowledge of Sri Lanka

3 Chapter Investment Environment

3.2 Investment regulation, incentives

4 Chapter Establishment

4.1 Characteristics of business base

4.3 Company liquidation and withdrawal

5 Chapter Company Law

5.2 Shareholders (shareholders meeting)

6 Chapter Accounting

6.1 Accounting system of Sri Lanka

6.2 Disclosure system of Sri Lanka

7 Chapter Tax

7.2 Individual Issues in Sri Lanka Domestic Tax Law

8 Chapter Labor

8.3 Social security system and social insurance law

8.4 Points to keep in mind while having Japanese people in Japan

-

-

-

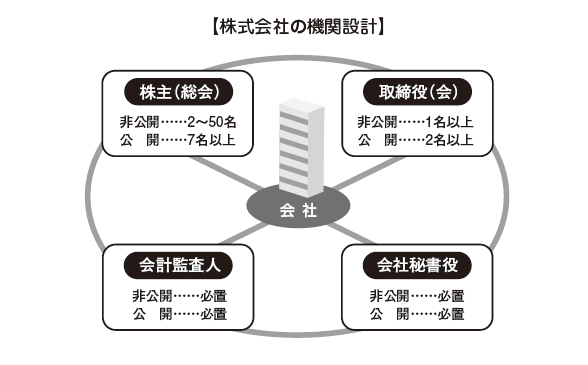

Institutional structure

In Sri Lanka, the Company Law was enacted in 1982, and the revision was made in 2006 afterwards. In 2007, the new company law No. 7 was enacted, and a company established in Sri Lanka will manage the company's institutional design, stocks, dividends etc. in accordance with the same law.

-

-

-

Shareholders (shareholders meeting)

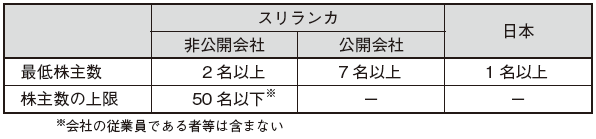

■Number of shareholdersIn the case of a private company, if there are at least two shareholders, we can establish a company. The maximum number of shareholders is stipulated as 50 (27 b). If it exceeds this number, it will not be a privately held company (Article 28). On the other hand, in the case of a public company, a minimum of seven shareholders is required.

■ Shareholder rightsShareholders' rights are roughly divided into self-interests and common-interest rights. The right to self-interest is the right to receive dividends and the distribution of residual assets. Meanwhile, the common interest right refers to the right to participate in management by participating in the general meeting of shareholders and exercising voting rights. Protection provisions of minority shareholders are set up as part of the common interest rights, and it is stipulating the right to demand share purchase by opposing shareholders for certain resolutions (Article 93).

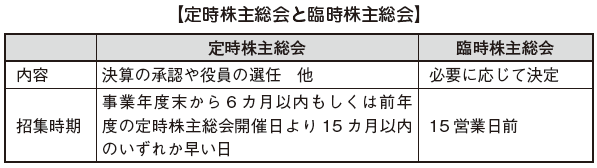

■ General shareholders meeting[Types of General Meeting of Shareholders]There are an annual shareholders' meeting (Annual General Meeting) and an extraordinary general meeting (Extraordinary Meeting) at the shareholders meeting.

The annual general shareholders meeting must be held at least once in one calendar year. In addition, the annual general shareholders meeting must be held either within 6 months after the balance sheet date, or within 15 months after the previous year's general shareholders meeting was held, whichever comes first (133 (1)). However, it is said that the first ordinary general meeting of shareholders after establishment of the company should be held within 18 months from the date of establishment (Article 133 (2)).If matters to be resolved at the Ordinary General Meeting of Shareholders are being made by written resolution, there is no need to convene and hold an ordinary general meeting of shareholders.If they do not comply with these provisions, it is necessary to pay attention to penalties being imposed on companies and officials (Article 133 (6)).Meanwhile, extraordinary shareholders' meetings can be held any time the directors deem it necessary.If two or more shareholders who hold 10% or more of the total number of voting rights request the holding of a general meeting of shareholders, the directors must hold an extraordinary general meeting of shareholders (Article 136 b). In this case, the General Assembly must be convened within 15 business days from the date of request from the shareholders and the General Assembly shall be held within 30 business days (Article 134 1).In the event that the Directors do not call the General Meeting despite this request, the shareholders who requested the convocation or shareholders who hold a majority of the voting rights may convene an extraordinary shareholders' meeting by themselves (Article 134 (3) ). However, it can not be convened after three months from the date mentioned above (same clause).

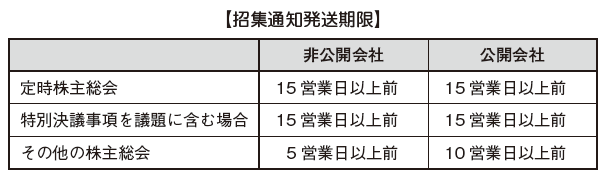

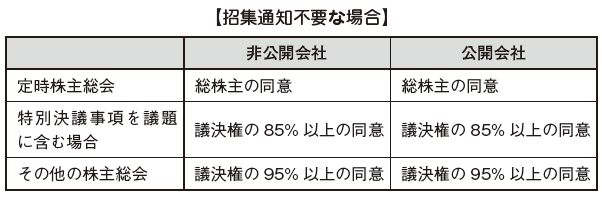

[Convocation Notice]In holding the shareholders' meeting, the company will send a notice of convocation to the shareholders. In the convocation notice, it is necessary to describe the agenda, business report, etc., and convocation notice must also be sent to the registration office at the same time (Article 137 (2)).In the case of resolving an ordinary general meeting of shareholders or matters of special resolution, it is necessary to notify at least 15 business days prior to the holding date of the general meeting (Article 135, Article 143 (1) b), in case of other general shareholders meeting, it is not disclosed If it is a company it should be notified five business days before, in the case of a public company it should be notified 10 business days before (Article 135).

Convocation notice unnecessary systemIf consent of certain shareholders is obtained in advance, the above convocation notice becomes unnecessary (Article 135). In the case of the ordinary general meeting of shareholders, there is no need to send a convocation notice when there is consent of all shareholders.

[Chairman of the shareholders meeting]Shareowners who are present at the general meeting of shareholders under the Companies Act are only allowed to serve as chairpersons, and there is no particular provision about the chairperson. In addition, the chairman must sign the minutes.

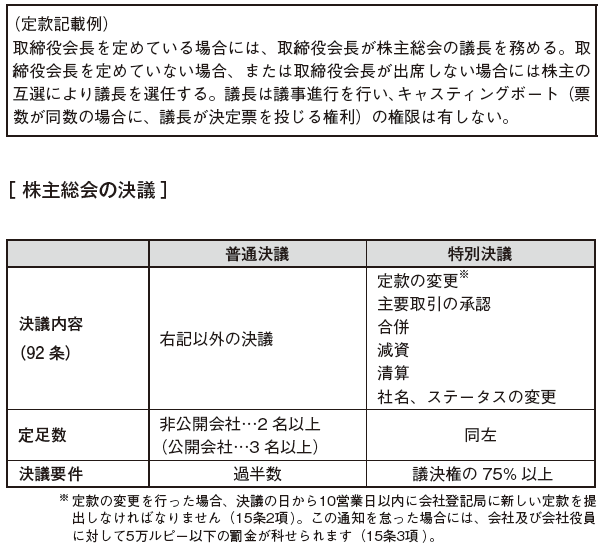

* If you amend the articles of incorporation, you must submit new articles of incorporation to the company registration office within 10 business days from the date of resolution (Article 15 (2)). Failure to do so will result in a fine of not more than 50,000 rupees for companies and corporate officers (Article 15, paragraph 3).

Quorum (Quorum)More than two shareholders in case of a private company and three or more shareholders in the case of other companies must attend (Article 136 c). It is permitted to weight the requirements by stipulating in the articles of incorporation (in the case of a private company more than two shareholders and the attendance of shareholders who hold a majority vote).

Resolution requirementIn case of an ordinary resolution, a resolution will be passed by approval of a majority in accordance with the principle of the council system. On the other hand, in the case of a special resolution, it will be passed by approval of over 75% of the voting rights.

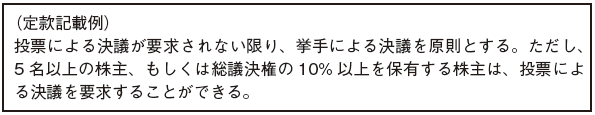

Voting rightsAs long as there is no provision in the articles of incorporation, the method of giving voting rights to shareholders varies according to the voting method (Article 136).· Hand raising method ......... 1 person 1 voting right· Voting system ......... 1 share 1 Voting rightTherefore, the method of giving voting rights suitable for the company must be stated in the articles of incorporation in advance. Provided, however, that the provisions of the Articles of Incorporation, such as (1) not giving shareholders the right to demand a resolution by voting, (2) not allowing the shareholder who holds at least 10% of the shareholders or more of the total voting rights to vote, Article 1).This is considered to be a provision based on the purpose of handling shareholders according to the contribution contribution of contribution. It is stated as follows in the example described in Attachment 1 of Attachment 1 of the Company Law.

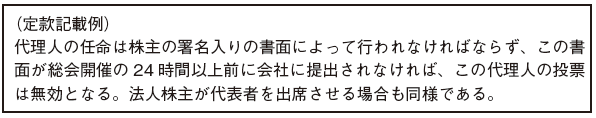

In addition, voting rights are not allowed for shares that have not been paid in (Article 136 e).Proxy voting systemShareholders can exercise their voting rights by attending an attendance at a general meeting (proxy exercise).

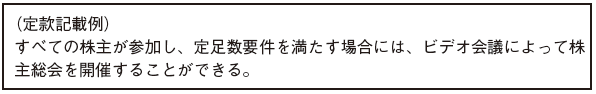

Document resolution and video resolutionIf there is consent of shareholders who hold shares of 85% or more of the voting rights, a written resolution can be made (Article 144 (1)). However, it is necessary to prescribe in advance in the articles of incorporation. Therefore, if all resolutions to be resolved at the ordinary general meeting of shareholders can be resolved by written resolution, there is no need to convene and hold an ordinary general meeting of shareholders (Article 144 (3)).After the written resolution has been made, within five business days a document stating the content of the resolution must be sent to all shareholders (Article 144.5). Penalties are imposed on companies and officials if neglecting this notice. In the case of a secretary to the Treasur (in the case of a shareholder, a written resolution can not be made unless the person who is the treasurer is consented (Article 144.8).In addition, according to the example of the articles of incorporation in the separate table of the Companies Act, it is interpreted that video resolutions can be incorporated by the articles of incorporation.

[Preparation of minutes]All companies must prepare the minutes of the general meeting of shareholders and the chairperson must sign (Article 147).

[Duty to report to the Registration Authority]When resolving to amend the articles of incorporation by a special resolution, the company must notify the Registration Authority with the amended articles of incorporation within 10 business days (Article 15 (2)). Failure to do so will result in a fine being imposed on the company and officers of the company (Article 15, paragraph 3).

-

-

-

Board of directors

■ Director

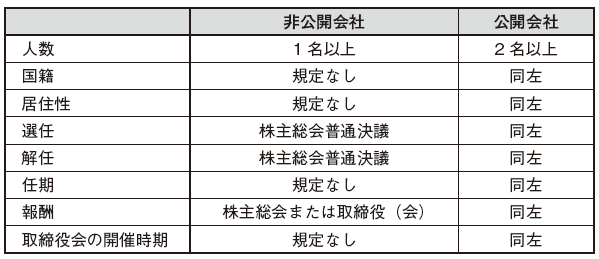

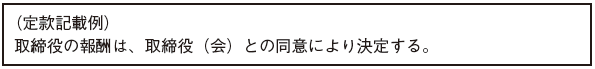

■ Director [Number of Directors]In the case of a private company, one or more directors are required. On the other hand, in the case of a public company, at least two directors are required (Article 201).[Nationality and habitability of directors]Regarding nationality and habitability, there is no stipulation on the company law. In practice, it is interpreted that even those who are not Sri Lankan citizens or who are not residents can become directors.[Appointment / dismissal of directors] appointedDirectors appointed at the time of incorporation will take on the duties of directors from the date of establishment. After that, unless otherwise stated in the articles of incorporation, it will be appointed by ordinary resolution of shareholders meeting (Article 223).After election, you must prepare a written consent form for taking office as a director and proof that there are no ineligibility requirements below (Article 203).Ineligibility requirementsThose who fall under the following requirements can not become directors (Article 202).·Under 18· Subscriber· Persons who violate the law· People with mental abnormalities·Corporation· Persons stipulated in the company's articles of incorporationAge restriction of directorsIn principle, if the age of the director reaches 70 years, the company can not appoint the director as a director (Article 211). However, if you are approved by shareholders at a general shareholders meeting, you can appoint a person who is over the age of 70 as a director (same article).DismissIf there is no special provision in the articles of incorporation, the directors may be dismissed at the ordinary resolution of the general meeting of shareholders. However, the agenda for the dismissal of the directors must be stated in the notice of convocation of the general meeting of shareholders.In addition to the above, in the event of any of the following reasons, the director must resign his / her position.· When resigning oneself· When stipulated in laws and regulations or the articles of incorporation· Case of disqualification reason· In case of death· In case you quit your job pursuant to the other articles of incorporationIn the case of a single director, in order for the director to resign, it is necessary to hold a general shareholders meeting and appoint a new director (Article 208).[Remuneration of Directors]Remuneration for directors can be decided by the directors (meeting) (Article 216) if there is a provision in the articles of incorporation, or if approval is received in advance by ordinary resolution of the general meeting of shareholders.

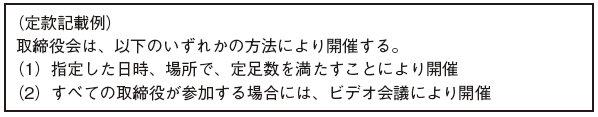

[Number of Directors]In the case of a private company, one or more directors are required. On the other hand, in the case of a public company, at least two directors are required (Article 201).[Nationality and habitability of directors]Regarding nationality and habitability, there is no stipulation on the company law. In practice, it is interpreted that even those who are not Sri Lankan citizens or who are not residents can become directors.[Appointment / dismissal of directors] appointedDirectors appointed at the time of incorporation will take on the duties of directors from the date of establishment. After that, unless otherwise stated in the articles of incorporation, it will be appointed by ordinary resolution of shareholders meeting (Article 223).After election, you must prepare a written consent form for taking office as a director and proof that there are no ineligibility requirements below (Article 203).Ineligibility requirementsThose who fall under the following requirements can not become directors (Article 202).·Under 18· Subscriber· Persons who violate the law· People with mental abnormalities·Corporation· Persons stipulated in the company's articles of incorporationAge restriction of directorsIn principle, if the age of the director reaches 70 years, the company can not appoint the director as a director (Article 211). However, if you are approved by shareholders at a general shareholders meeting, you can appoint a person who is over the age of 70 as a director (same article).DismissIf there is no special provision in the articles of incorporation, the directors may be dismissed at the ordinary resolution of the general meeting of shareholders. However, the agenda for the dismissal of the directors must be stated in the notice of convocation of the general meeting of shareholders.In addition to the above, in the event of any of the following reasons, the director must resign his / her position.· When resigning oneself· When stipulated in laws and regulations or the articles of incorporation· Case of disqualification reason· In case of death· In case you quit your job pursuant to the other articles of incorporationIn the case of a single director, in order for the director to resign, it is necessary to hold a general shareholders meeting and appoint a new director (Article 208).[Remuneration of Directors]Remuneration for directors can be decided by the directors (meeting) (Article 216) if there is a provision in the articles of incorporation, or if approval is received in advance by ordinary resolution of the general meeting of shareholders. [Board of Directors]Although it is not mentioned about the obligation to set up the board of directors under the Corporate Law, in the case of a single director, it is considered that the director will make decisions. In the case of multiple directors, the Board of Directors will decide the company's decision by consultation (Article 529 interpretation).However, certain significant transactions that deal with amounts exceeding 50% of the total assets of the company must obtain shareholder approval by a special resolution of the General Meeting of Shareholders unless otherwise specified in the articles of incorporation ( 185).In Sri Lanka's Corporate Law, there are few provisions regarding the Board of Directors. However, there is an example described in Attachment 1 of Schedule 1 of the Company Law, and you can understand the standard rules of Sri Lanka. Here is an example of the description.Place of Board of DirectorsThere is no special provision under the Company Law. According to the example stipulated in the Articles of Association of the Company Law Announcement, it can be accepted that it is done in a normal conference format or an electronic conference such as a video conference.

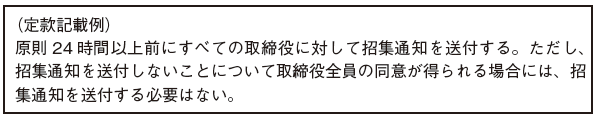

[Board of Directors]Although it is not mentioned about the obligation to set up the board of directors under the Corporate Law, in the case of a single director, it is considered that the director will make decisions. In the case of multiple directors, the Board of Directors will decide the company's decision by consultation (Article 529 interpretation).However, certain significant transactions that deal with amounts exceeding 50% of the total assets of the company must obtain shareholder approval by a special resolution of the General Meeting of Shareholders unless otherwise specified in the articles of incorporation ( 185).In Sri Lanka's Corporate Law, there are few provisions regarding the Board of Directors. However, there is an example described in Attachment 1 of Schedule 1 of the Company Law, and you can understand the standard rules of Sri Lanka. Here is an example of the description.Place of Board of DirectorsThere is no special provision under the Company Law. According to the example stipulated in the Articles of Association of the Company Law Announcement, it can be accepted that it is done in a normal conference format or an electronic conference such as a video conference. Convocation of the Board of DirectorsThere is no special provision under the Company Law regarding the convocation of the Board of Directors. Therefore, the company will convene by the method stipulated in the articles of incorporation.

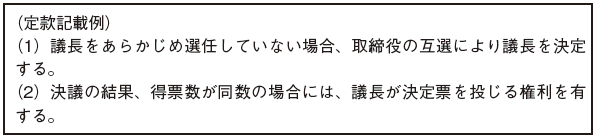

Convocation of the Board of DirectorsThere is no special provision under the Company Law regarding the convocation of the Board of Directors. Therefore, the company will convene by the method stipulated in the articles of incorporation. Chairman of the BoardThere is no provision under the Company Law regarding how to appoint the Chairman of the Board and the authority of the Chairman. In the example stated in the articles of incorporation, the chairperson shall give the chairman the right to cast a decision vote (casting boat) when the number of votes is the same.

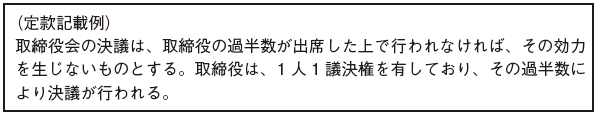

Chairman of the BoardThere is no provision under the Company Law regarding how to appoint the Chairman of the Board and the authority of the Chairman. In the example stated in the articles of incorporation, the chairperson shall give the chairman the right to cast a decision vote (casting boat) when the number of votes is the same. Resolution of the Board of DirectorsThere is no special rule on the resolution of the Board of Directors, but according to the description example, you can see that a majority vote is planned for one person by one majority voting rights.

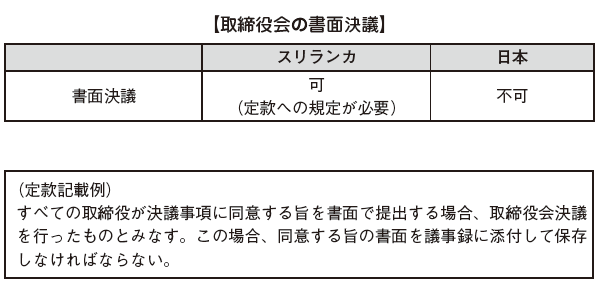

Resolution of the Board of DirectorsThere is no special rule on the resolution of the Board of Directors, but according to the description example, you can see that a majority vote is planned for one person by one majority voting rights. Document resolution of Board of DirectorsThe document resolution of the Board of Directors is a system prohibited by the Japanese Corporate Law. It is to vitalize management by active discussion among directors. On the other hand, there is no provision in Sri Lanka's Corporate Law, so if you decide in advance in the articles of incorporation, you can do a document resolution

Document resolution of Board of DirectorsThe document resolution of the Board of Directors is a system prohibited by the Japanese Corporate Law. It is to vitalize management by active discussion among directors. On the other hand, there is no provision in Sri Lanka's Corporate Law, so if you decide in advance in the articles of incorporation, you can do a document resolution [Delegation of Director Authority]The Board of Directors may establish a committee composed of directors and delegate authority to the committee. In addition, certain authority can be delegated to specific directors, employees, etc. (Article 186).

[Delegation of Director Authority]The Board of Directors may establish a committee composed of directors and delegate authority to the committee. In addition, certain authority can be delegated to specific directors, employees, etc. (Article 186).

-

-

-

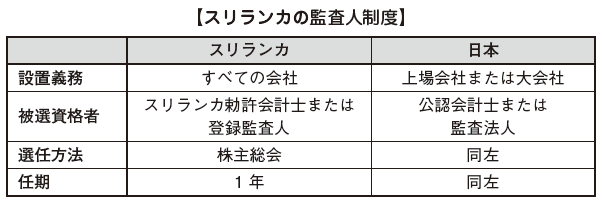

Accounting auditor

■ Accounting AuditorAs a general rule, all companies have to set up an auditor (Auditor). The auditor is the person who audits the financial statements prepared by the company and creates an audit report. [Requirements of the Accounting Auditor]The person appointed to the auditor must be a member of the Sri Lanka Chartered Accountants of SriLanka or a Registered Auditor (Article 157 (1)). However, in the case of a public company, it is necessary to be a member (Chartered Accountant) of the Association of Chartered Accountants of Sri Lanka (Article 157 (2)).Any person who falls under the following requirements can not be an auditor (Article 157 (3)).(1) Company partners, directors, or employees(2) liquidator of the company, trustee(3) Corporation(4) Partners, directors, employees, liquidators or trustees of affiliates(5) Those who were (1), (2) within the past two years[Appointment / dismissal]The company must appoint an auditor by a resolution of the annual general shareholders meeting, basically assuming reappointment (Article 154 (1)).It is possible to dismiss the auditor without re-appointment, but in this case, the opportunity to express an opinion on dismissal after notifying the auditor at least 20 business days before the written, oral, or proxy It is necessary to give (Article 160 1).Also, if vacancies occur in the auditor due to a sudden retirement or death of the auditor, a new auditor must be appointed within one month from the date of vacancy occurrence.If the auditor is not replenished within one month of the vacancy, The Registrar can appoint an auditor on behalf of the company (Article 154 (3)).Appointment of auditor at company establishment (First Auditor)The Auditor at Incorporation may be appointed at the Board of Directors before the first Annual General Meeting of Shareholders. The term of office will be until the first Annual General Meeting of Shareholders (Article 159).[Authority of Accounting Auditor]Obtain company informationThe auditor can view accounting records and related documents and, if necessary, have the right to request explanations from directors and employees. Despite receiving these requests from the auditor, the directors and employees will be fined if they fail to respond to the request or if they make false reports (164 Article).Attendance at shareholders meetingThe auditor can attend the general meeting of shareholders. Therefore, the directors must inform the auditor of the venue and the opening time of the general meeting of shareholders.In addition, the director must provide the auditor with an opportunity to ask questions to the shareholders.In the event of a violation of the above provision, the directors are subject to a fine of not more than 100,000 rupees (Article 165).[Determination of Remuneration]Remuneration of the auditor is to be decided by the appointed person. In the case of appointing an auditor by resolution of the General Meeting of Shareholders, the amount of remuneration will be determined by the method decided at the General Meeting of Shareholders or the General Meeting of Shareholders. In the event that the Board of Directors is appointed, if the Board of Directors or the Registrar is appointed, the Registrar Bureau will determine the remuneration amount of the auditor (Article 155).

[Requirements of the Accounting Auditor]The person appointed to the auditor must be a member of the Sri Lanka Chartered Accountants of SriLanka or a Registered Auditor (Article 157 (1)). However, in the case of a public company, it is necessary to be a member (Chartered Accountant) of the Association of Chartered Accountants of Sri Lanka (Article 157 (2)).Any person who falls under the following requirements can not be an auditor (Article 157 (3)).(1) Company partners, directors, or employees(2) liquidator of the company, trustee(3) Corporation(4) Partners, directors, employees, liquidators or trustees of affiliates(5) Those who were (1), (2) within the past two years[Appointment / dismissal]The company must appoint an auditor by a resolution of the annual general shareholders meeting, basically assuming reappointment (Article 154 (1)).It is possible to dismiss the auditor without re-appointment, but in this case, the opportunity to express an opinion on dismissal after notifying the auditor at least 20 business days before the written, oral, or proxy It is necessary to give (Article 160 1).Also, if vacancies occur in the auditor due to a sudden retirement or death of the auditor, a new auditor must be appointed within one month from the date of vacancy occurrence.If the auditor is not replenished within one month of the vacancy, The Registrar can appoint an auditor on behalf of the company (Article 154 (3)).Appointment of auditor at company establishment (First Auditor)The Auditor at Incorporation may be appointed at the Board of Directors before the first Annual General Meeting of Shareholders. The term of office will be until the first Annual General Meeting of Shareholders (Article 159).[Authority of Accounting Auditor]Obtain company informationThe auditor can view accounting records and related documents and, if necessary, have the right to request explanations from directors and employees. Despite receiving these requests from the auditor, the directors and employees will be fined if they fail to respond to the request or if they make false reports (164 Article).Attendance at shareholders meetingThe auditor can attend the general meeting of shareholders. Therefore, the directors must inform the auditor of the venue and the opening time of the general meeting of shareholders.In addition, the director must provide the auditor with an opportunity to ask questions to the shareholders.In the event of a violation of the above provision, the directors are subject to a fine of not more than 100,000 rupees (Article 165).[Determination of Remuneration]Remuneration of the auditor is to be decided by the appointed person. In the case of appointing an auditor by resolution of the General Meeting of Shareholders, the amount of remuneration will be determined by the method decided at the General Meeting of Shareholders or the General Meeting of Shareholders. In the event that the Board of Directors is appointed, if the Board of Directors or the Registrar is appointed, the Registrar Bureau will determine the remuneration amount of the auditor (Article 155).

-

-

-

Company Secretary

■ Company Secretary (Secretary)Every company must establish a company secretary (Article 221 (1)).A company secretary is a person who is responsible for company compliance such as constituting a company's organization as well as a director and signing an external document.

[Requirements for Company Secretary]The company secretarial officer must be a person who possesses certain qualifications, such as being a member of the Association of Scripture of Sri Lanka Secretariat (Article 222).In the case of (1) a public company, (2) a private company whose annual sales are over 1 million rupees, and (3) a private company whose statutory capital (Stated Capital) is more than 500 thousand rupees, the following requirements (1) and It must be a person who satisfies.

(1) Person who is a citizen of Sri Lanka and lives in Sri Lanka(2) Who satisfy one or more of the following requirements·lawyer· Member of the Institute of Chartered Accountants of Sri Lanka· Members of the Association of Certified Secrets of Sri Lanka· Member of Sri Lanka Management Accountants Association- In addition to the above, members of organizations that have received approval from the Minister· Others who have qualifications approved by the Minister etc

[Appointment / dismissal]In cases where there is no other provision in the articles of incorporation, the director (society) has the authority to appoint and dismiss the company secretary (Article 221 (4)). The first company secretary must be established from the date of establishment registration. In appointing, you must sign a consent form describing the name, address, appointment date, etc. of the secretary and attach a document certifying that it meets the aforementioned requirements.In addition, when there is a change in secretarial officer, you must notify the Registration Authority within 20 business days (Article 223). The notice must include the date of the change, the name of the new secretary, the address, the reason for the change, etc., and must be accompanied by a letter of consent and a certificate of qualification. Failure to do so will result in a fine to the company and all officers (Article 223 (4)).

[Determination of Remuneration]There is no special provision under the Companies Act regarding the determination of the amount of remuneration, so it is decided by the method stipulated in the articles of incorporation.

-

-

-

Stock

■ Type of sharesIn addition to common shares, the Company may issue the following shares (Article 49 paragraph 3).· The point of redemption redemption is determined by establishing in the articles of incorporation one of (1) the company's decision, (2) the shareholder's decision, and (3) a predetermined date (Article 66 (1)).· Dividend Preferred Stock· Shares with regulations that differ from ordinary shares regarding voting rights■ Issue new stockThe company must immediately issue shares after establishment registration (Article 50 paragraph 1).In addition, in accordance with the provisions of the Articles of Incorporation, shares can be issued by decision of the directors (association) (Article 51 (1)). First, the type of shares to be issued must be decided by the directors (association) (Article 51 (2)). After that, within 20 business days, you must notify the registration office by a prescribed form describing the number of shares issued, the amount of consideration, the amount of authorized capital (Stated Capital), etc. (Article 51 (4)). Failure to comply with this provision will result in a fine to the company and company officers.In addition to cash, consideration for stock payment can also be made by physical contribution by providing property or services (Article 52 (2)).After that, we will present quotas to existing shareholders (Article 53 (1)). Existing shareholders who do not notify that they will accept under the period lose the right to undertake (Article 54 (2)).When application is made from shareholders, notify the Registration Authority within 10 working days (Article 55 1) and approve the issuance of shares by the Directors (Association) (In the case where it is not stipulated in the articles of incorporation, the shareholders meeting Normal resolution) (Article 56 (1)). It is necessary to conduct a payment capacity test and obtain a certificate of payment ability from the auditor.This payment ability test is said to satisfy the following requirements (Article 57 paragraph 1).· The obligation is paid within the payment deadline· The assets of the company exceed the total of the liabilities and the capital (Stated Capital) (calculated from the most recent financial statements, taking into consideration the events affecting the asset situation)Capital reductionThe company can reduce capital by special resolution of the shareholders meeting (Article 59 (1)). In this case, we have to notify you more than 60 days before the resolution is made (Article 59 (2)).When defining the conditions for capital reduction with creditors in advance, in case it violates the conditions, it is necessary to pay attention to points that are invalid even if approved by a special resolution (Article 59 (3)).After getting approval by a special resolution, you must notify the registration authority within 10 business days that the capital reduction has been made (Article 59 paragraph 5).■ Treasury stockThe company can acquire the shares issued by the company in the case of redemption of the redemption preference shares, or by a method such as the decision of the directors (meeting) (Article 63). If stipulated in the articles of incorporation in advance, you can acquire treasury stock at the decision of the director (society) (Article 64 (1)). In the case of acquiring treasury shares, we must notify the number of shares and type of shares acquired to the Registry Bureau without delay (Article 63 (4)). Failure to do so will result in a fine to the company and officers (Article 63 (5)).■ DividendCompanies can distribute profits from business activities to shareholders (Article 60 (1)). The Board of Directors (shareholders) must decide the amount equally for each share, but in cases where it is stipulated in the articles of incorporation in advance or if there is consent of shareholders, pay dividends with different amounts for each share (Article 60 (2)).If you do not meet the requirements of the payment capacity test at the time of dividend, you can request payment of dividends from shareholders who are good-will to that (Article 61 (1)). The portion that can not be collected due to the return from shareholders is obliged to be paid by the directors to the company (Article 61 (2)).In addition, as stipulated in the Articles of Incorporation, if profits are sufficiently posted, an interim dividend can be made at any time during the term due to the decision of the directors (meeting) (according to the example described in Attachment 1 of the Companies Act).

-

-

-

Websites

[1] JETRO

[2] http://www.ide.go.jp/Japanese/Research/Region/Asia/Srilanka/index.html

[3] 外務省

[4] コロンボ証券取引所

[5] スリランカ各国情勢

[7] スリランカ株式投資情報

[8] BOI

[9] MSN天気予報

[10] TheWorldBank

-

Babiliography

[1] ARCレポート2006スリランカ

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya