Sri Lanka

6 Chapter Accounting

-

-

1 Chapter Coming Soon

2 Chapter Basic knowledge

2.1 Basic knowledge of Sri Lanka

3 Chapter Investment Environment

3.2 Investment regulation, incentives

4 Chapter Establishment

4.1 Characteristics of business base

4.3 Company liquidation and withdrawal

5 Chapter Company Law

5.2 Shareholders (shareholders meeting)

6 Chapter Accounting

6.1 Accounting system of Sri Lanka

6.2 Disclosure system of Sri Lanka

7 Chapter Tax

7.2 Individual Issues in Sri Lanka Domestic Tax Law

8 Chapter Labor

8.3 Social security system and social insurance law

8.4 Points to keep in mind while having Japanese people in Japan

-

-

-

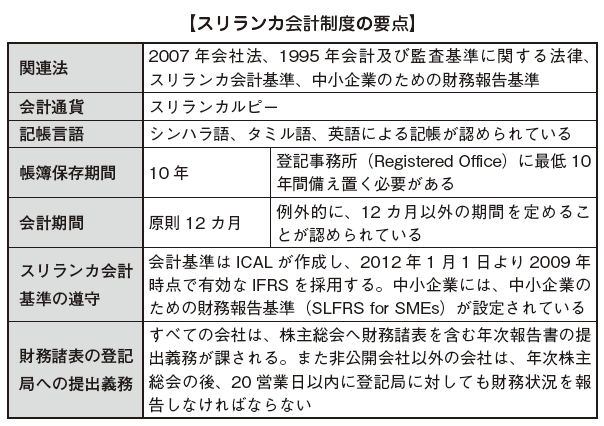

Accounting system of Sri Lanka

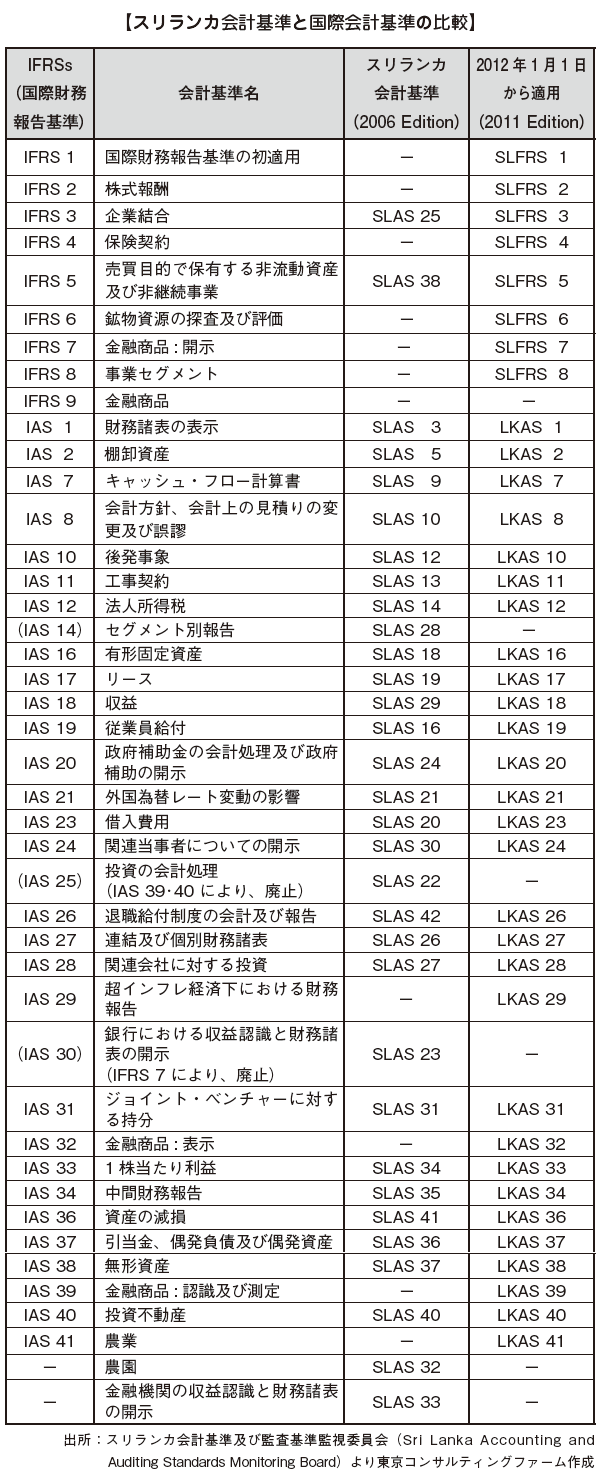

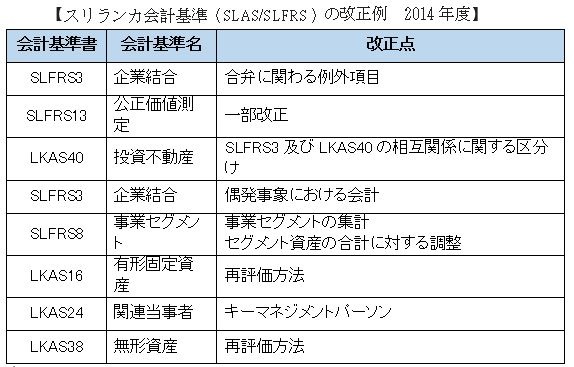

■ Outline of accounting systemThe accounting and audit system of Sri Lanka started with the influence of Britain. At present, international accounting system is being developed, including international accounting standards.When Sri Lanka became independent in 1948, a specialized agency was established in 1959 by the advice of the Independent Committee, and in 1970 the accounting standard came into force.Since then, the financial crisis that occurred in the late 1980s and the early 1990s raised demands for disclosure of financial information and stricter audits, and adopted international accounting and auditing standards.In 1995, Sri Lanka's accounting and auditing standards law was enacted, Sri Lanka Accounting Standards and Auditing Standards Monitoring Board (Sri Lanka Accounting and Auditing Standards Monitoring Board) were established, and the revision of accounting standards will proceed.Following the development of such accounting system, the accounting system of Sri Lanka today was formed.Accounting PeriodIn principle, the accounting period is 12 months, but if there are special circumstances such as the first year of establishment, you can set a period that is not exceptionally 12 months.The taxation year under the tax law is stipulated as one year from April 1 to March 31 of the following year.[Accounting book]All companies are obliged to book accounting books. This accounting book assures that the company's financial condition can be confirmed at any time accurately, that directors can prepare financial statements based on the Company Law and that appropriate financial statement audits can be carried out easily (Article 148 (1)).In addition to the above, it is provided for daily receipt and payment of cash, records on assets and liabilities of the company, records concerning trading records and stocks of goods in the case of business dealings with goods, and services providing services It is mandatory to record the service and its related claims (Article 148 (2)).In the case of violating this provision, a company and officers who neglected their duties will be subject to a fine of not more than 200,000 rupees (Article 149 (3)).This account book must be kept in registry office (Registered Office) for at least 10 years (Article 116 (1) k).[Currency / Language]In Sri Lanka, booking in three languages of Sinhala (Sinhala), Tamil (Tamil), English is permitted, the currency will be posted in Sri Lanka Rupee.[Preparation of financial statements]All companies are obliged to prepare financial statements prescribed by the Company Law within six months after the balance sheet date (within the period if the registration authority grants the extension) and disclose it to shareholders and others.Companies with subsidiaries as of the balance sheet date must prepare consolidated financial statements (Articles 152, 153). Copies of the prepared financial statements and consolidated financial statements must be kept in the registration office for a minimum of 10 years (Article 116 (1) h).Details of disclosure etc. will be described later in the disclosure system section. ■ Sri Lanka Accounting StandardsAccording to the Sri Lanka Accounting and Auditing Standards Act enacted in August 1995, the SRI Licensed Chartered Accountants of Sri Lanka (ICAS) was granted the right to set the accounting standards.The Sri Lanka Chartered Accountant Association, which was the subject of the Sri Lanka Accounting Standards Association, has been working on the development and revision of accounting standards as a member of the International Accounting Standards Committee (IASC).As a member of the International Accounting Standards Committee, the Association of Chartered Accountants of Sri Lanka is obliged to cooperate with the International Accounting Standards Committee, and in particular, it has been required to incorporate international accounting standards into Sri Lanka accounting standards.[Introduction of IFRS]In 2009, the Sri Lanka Chartered Accountants Association made a critical decision to adopt IFRSs. As a result, effective IFRSs began to be adopted as of 2009 as from fiscal year starting on or after 1 January 2012.This does not exactly match IFRS as of January 1, 2012. Therefore, differences will arise from international accounting standards set after 2009, such as IFRS 9, but it is planned to make them consistent with the latest standards in order.

■ Sri Lanka Accounting StandardsAccording to the Sri Lanka Accounting and Auditing Standards Act enacted in August 1995, the SRI Licensed Chartered Accountants of Sri Lanka (ICAS) was granted the right to set the accounting standards.The Sri Lanka Chartered Accountant Association, which was the subject of the Sri Lanka Accounting Standards Association, has been working on the development and revision of accounting standards as a member of the International Accounting Standards Committee (IASC).As a member of the International Accounting Standards Committee, the Association of Chartered Accountants of Sri Lanka is obliged to cooperate with the International Accounting Standards Committee, and in particular, it has been required to incorporate international accounting standards into Sri Lanka accounting standards.[Introduction of IFRS]In 2009, the Sri Lanka Chartered Accountants Association made a critical decision to adopt IFRSs. As a result, effective IFRSs began to be adopted as of 2009 as from fiscal year starting on or after 1 January 2012.This does not exactly match IFRS as of January 1, 2012. Therefore, differences will arise from international accounting standards set after 2009, such as IFRS 9, but it is planned to make them consistent with the latest standards in order.

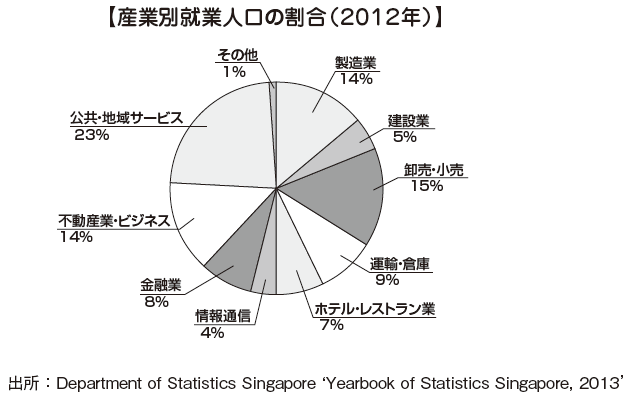

[Accounting Standards for SMEs]Apart from Sri Lanka accounting standards (SLAS / SLFRS), financial reporting standards (SLFRS for SMEs) for SMEs are set up. Small and medium enterprises play an important role in job creation, entrepreneurial development, and income generation in the domestic economy.Accounting standards for SMEs are designed according to their demands and abilities and are criteria for partially modifying and simplifying Sri Lanka's accounting standards in order to reduce the financial reporting burden of SMEs .The primary objective of setting this standard is to improve the financing of small and medium enterprises. Although it is not a complete accounting standard, it is expected that strengthening the credit with lenders by conducting financial reporting according to this standard.■ Issues of Sri Lanka accounting system[Response to IFRS application]Sri Lanka agreed to apply IFRS (International Financial Reporting Standards) effective January 1, 2012, and it is required to disclose a very wide range of information.Many companies are currently busy with this response. The accounting office is putting emphasis on education and training in order to respond to the new standards, and an excellent consultant is required.[Abundant accounting human resources]There are many professional accountants in Sri Lanka. There is a background that during the civil war during which the social situation was unstable, even when escaping outside of Sri Lanka, the occupation to be employed in the work was an accountant.Currently it is gaining attention as an outsourcing destination for accounting services of global companies internationally, but this is due not only to a large number of accountants, but also to a large number of English speaking population and higher literacy rate.It is attractive that the accountant's personnel expenses are low. The average annual income of the US accountant is about US $ 59,000, while Sri Lanka is about 1 / 10th of US $ 5,900 (November 29, 2011 / New York Times) .With the influence of the civil war that had been continuing until 2000, there is no enclosure of talented personnel, and it is said that it is relatively easy to secure talent for a while.

[Accounting Standards for SMEs]Apart from Sri Lanka accounting standards (SLAS / SLFRS), financial reporting standards (SLFRS for SMEs) for SMEs are set up. Small and medium enterprises play an important role in job creation, entrepreneurial development, and income generation in the domestic economy.Accounting standards for SMEs are designed according to their demands and abilities and are criteria for partially modifying and simplifying Sri Lanka's accounting standards in order to reduce the financial reporting burden of SMEs .The primary objective of setting this standard is to improve the financing of small and medium enterprises. Although it is not a complete accounting standard, it is expected that strengthening the credit with lenders by conducting financial reporting according to this standard.■ Issues of Sri Lanka accounting system[Response to IFRS application]Sri Lanka agreed to apply IFRS (International Financial Reporting Standards) effective January 1, 2012, and it is required to disclose a very wide range of information.Many companies are currently busy with this response. The accounting office is putting emphasis on education and training in order to respond to the new standards, and an excellent consultant is required.[Abundant accounting human resources]There are many professional accountants in Sri Lanka. There is a background that during the civil war during which the social situation was unstable, even when escaping outside of Sri Lanka, the occupation to be employed in the work was an accountant.Currently it is gaining attention as an outsourcing destination for accounting services of global companies internationally, but this is due not only to a large number of accountants, but also to a large number of English speaking population and higher literacy rate.It is attractive that the accountant's personnel expenses are low. The average annual income of the US accountant is about US $ 59,000, while Sri Lanka is about 1 / 10th of US $ 5,900 (November 29, 2011 / New York Times) .With the influence of the civil war that had been continuing until 2000, there is no enclosure of talented personnel, and it is said that it is relatively easy to secure talent for a while.

-

-

-

Disclosure system of Sri Lanka

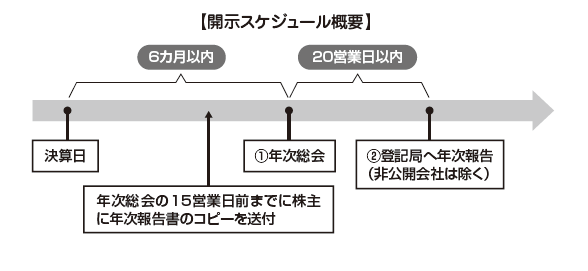

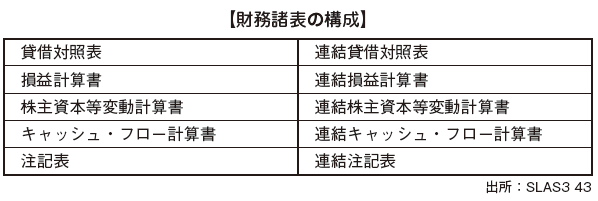

■Disclosure schedule and contentsThe company is required to periodically report the activities of the company, financial condition and business performance to shareholders, registrars, etc. who are the shareholders. Disclosure ScheduleAnnual report to shareholdersThe company director must hold an ordinary general meeting of shareholders once a year. Ordinary shareholders' meetings must be held within six months from the balance sheet date and within 15 months from the previous meeting date (Article 133 (1)).Directors must send copies of annual reports to shareholders at least 15 business days before the annual general meeting of shareholders is held.In the case of violating this provision, a fine not exceeding 100,000 rupees will be imposed on the director who neglected the duty (Article 166 (2)).Annual report to Registration AuthorityCompanies other than nonprivileged companies need to submit copies of financial statements and audit reports to the Registry Bureau within 20 business days after approval at the Annual General Meeting (Article 170 (1)).In the case of a private company, in principle, there is no obligation to submit to the Registration Authority, but if there is a request from the Registration Authority, a copy of the financial statements etc must be submitted (Article 170 (2)).The financial statements to be submitted to the Registration Authority must be certified by two directors of the company (one person if there is only one director) (Article 170 (3)).[Disclosure details]The annual report to be submitted to the general meeting of shareholders must be in writing and must include the following contents (Article 168 (1)).(1) Explanation of events that may affect shareholders(2) Signed Financial Statements and Consolidated Financial Statements(3) Audit report on financial statements and consolidated financial statements(4) Changes in accounting policy(5) Statement on income for the current fiscal year(6) Remuneration of directors and various allowances(7) Amount of donation(8) Name of director at the end of the term, name of director who retired during the term(9) Amount of audit fee to be paid to the auditor and amount of remuneration for non-audit work(10) Details on the relationship between the company and the auditor(11) Signature of two directors (one in the case of one director), signature of the secretarial officerIf there is a subsidiary, it is required to include the above information of (2) to (10) of the subsidiary (Article 168 (2)).The financial statements included in the above annual report must include the balance sheet, income statement, statement of changes in shareholders' equity, cash flow statement, notes table (SLAS Article 343).The consolidated financial statements also include consolidated balance sheets, consolidated income statement, consolidated statement of changes in net assets, consolidated statements of cash flows, and notes to consolidated financial statements.

Disclosure ScheduleAnnual report to shareholdersThe company director must hold an ordinary general meeting of shareholders once a year. Ordinary shareholders' meetings must be held within six months from the balance sheet date and within 15 months from the previous meeting date (Article 133 (1)).Directors must send copies of annual reports to shareholders at least 15 business days before the annual general meeting of shareholders is held.In the case of violating this provision, a fine not exceeding 100,000 rupees will be imposed on the director who neglected the duty (Article 166 (2)).Annual report to Registration AuthorityCompanies other than nonprivileged companies need to submit copies of financial statements and audit reports to the Registry Bureau within 20 business days after approval at the Annual General Meeting (Article 170 (1)).In the case of a private company, in principle, there is no obligation to submit to the Registration Authority, but if there is a request from the Registration Authority, a copy of the financial statements etc must be submitted (Article 170 (2)).The financial statements to be submitted to the Registration Authority must be certified by two directors of the company (one person if there is only one director) (Article 170 (3)).[Disclosure details]The annual report to be submitted to the general meeting of shareholders must be in writing and must include the following contents (Article 168 (1)).(1) Explanation of events that may affect shareholders(2) Signed Financial Statements and Consolidated Financial Statements(3) Audit report on financial statements and consolidated financial statements(4) Changes in accounting policy(5) Statement on income for the current fiscal year(6) Remuneration of directors and various allowances(7) Amount of donation(8) Name of director at the end of the term, name of director who retired during the term(9) Amount of audit fee to be paid to the auditor and amount of remuneration for non-audit work(10) Details on the relationship between the company and the auditor(11) Signature of two directors (one in the case of one director), signature of the secretarial officerIf there is a subsidiary, it is required to include the above information of (2) to (10) of the subsidiary (Article 168 (2)).The financial statements included in the above annual report must include the balance sheet, income statement, statement of changes in shareholders' equity, cash flow statement, notes table (SLAS Article 343).The consolidated financial statements also include consolidated balance sheets, consolidated income statement, consolidated statement of changes in net assets, consolidated statements of cash flows, and notes to consolidated financial statements. ■ Audit systemIn Sri Lanka, all companies are obliged to establish an accounting auditor under the Corporate Law and are required to undergo audits on financial statements. The auditing standards of Sri Lanka are in compliance with international auditing standards, and a system that is internationally consistent has been established as a system.Please refer to the Corporate Law page 539 for the auditor's requirements and how to appoint and dismiss.

■ Audit systemIn Sri Lanka, all companies are obliged to establish an accounting auditor under the Corporate Law and are required to undergo audits on financial statements. The auditing standards of Sri Lanka are in compliance with international auditing standards, and a system that is internationally consistent has been established as a system.Please refer to the Corporate Law page 539 for the auditor's requirements and how to appoint and dismiss.

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya