Pakistan

7 Chapter Labor

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.2 Investment regulation and incentives

3 Chapter Establishment

3.1 Characteristics of business base

3.3 Company liquidation and withdrawal

4 Chapter Corporate Law

4.4 REGULATORY BODY/BODIES AND AFFILIATED INSTITUTIONS

5 Chapter Accounting

5.1 Accounting system in Pakistan

5.2 Disclosure system of Pakistan

6 Chapter Tax

6.2 Individual Issues in Pakistan Domestic Tax Law

7 Chapter Labor

7.4 Points to keep in mind while having Japanese people in Japan

-

-

-

Working environment

■ Recent work environment in PakistanThe population of Pakistan is about 188 million (as of 2014), which is larger than the population of Japan, but as the birthrate rises every year, the population is expected to increase further.The fact that the mortality rate and the infant mortality rate are decreasing by 1 to 10% every year also contributes to population growth, partly due to expansion of medical facilities and advancement of plague control measures. In addition, compared to Japan, the ratio of younger generation is higher, and it is expected that the number of labor force population will increase in the future.Another feature of Pakistan is the fact that women have fewer employment. It is said that the habit of "Purdah" is influenced by this background. Pada is a social custom of female isolation, and women's labor itself tended to be tabooed socially in Pakistan. Even now, the influence remains, and even if women are working, there are cases where they do not appear in numerical figures, such as not reporting in statistical surveys.This is a reversal of the fact that there is not enough employment in the country, and the number of low-income workers and incomplete workers who are forced to work for a short time due to adverse conditions has become a serious problem.

■ Labor force populationAmong the total population of Pakistan, the labor force population (over 15 years old) is about 61.55 million, and as a composition of industrial workers' population, 44% for primary industry, 22% for secondary industry, 3rd Industry is 33%.Regionally, the population is concentrated in Punjab and Sindh province, with Punjab province 55.5%, Sindh state 22.9%, both states 78.4% of the population reside. The capital city of Islamabart has a population of less than one million people in the metropolitan area.

■ Unemployment rateThe unemployment rate in Pakistan as of 2014 is 6.8% on a national average. Stagnation of agriculture is the cause of the deterioration in the unemployment rate in Pakistan. Also, in Pakistan there are people called low-workers who are obliged to work for a brief period due to adverse conditions.According to the Pakistani government's definition, low-employed workers are workers with a working time of less than 35 hours per week. Even workers who work only one hour a day are not considered unemployed and are statistically included in the working population as low-employed workers.It is said that low-workers account for more than 10% of the working population, and adding low-workers increases the substantial unemployment rate. Meanwhile, the proportion of employed workers who work 50 hours or more per week is 41.8%, and the difference in lengths of working hours is increasing by workers. Many low-employed people exist in rural areas, and phenomena that flow into urban areas are occurring. Also, it can be said that there are many child labor in carpet weaving factories and others, and there are many migrant workers in Middle East oil-producing countries in particular.Because service industry and manufacturing industry are not advanced in Pakistan, the unemployment rate in urban areas is high, especially among women. However, it is unusual for women to work so it is sometimes excluded from the survey. Therefore, survey results on women may not reflect the actual situation properly.

■ Employment obligation of local peopleDepending on the country, in establishing a subsidiary, there are occasions stipulating employment obligations of locals, but in Pakistan there are no employment obligations of local people and no restrictions on the number of foreign workers.

■ Features of Pakistani workersIt is said that in Pakistani workers, there are many people who are generally self-assertive. For this reason, it is necessary for expatriates to receive direct negotiations on their own evaluation from workers, so it is necessary to set up opportunities for evaluation systems and interviews firmly.Moreover, responsibility is strong for my work, and there is a tendency to receive even things I can not do immediately for the job I requested. When assigning work, it is desirable to understand what kind of procedure to proceed or what kind of schedule to do and manage it. -

Labor disputes and labor unions

Background of Labor DisputesAccording to the Labor Law, workers are said to be able to participate in the management of companies or factories. In addition, companies with 50 or more employees are required to be installed the Labor Relations Commission, is possible to solve the dispute in the talks by the representatives of management and workers has become the main role of the Labor Relations Commission . Pakistan of labor and management, although it is said that distrust of each other remains deep-rooted, in recent years, labor and management is the recognition that there is a need to cooperate for the sake of economic growth was strong.Labor unions in Pakistan are generally organized by companies and are on a small scale.■ Case examples of labor union formationThe labor union of Coca-Cola Pakistan Faisalabad factory in Coca-Cola · Multan in 2010 was officially registered. This union was organized with the support of the IUF-affiliated National Food and Beverage Tobacco Workers' Federation. This has made great progress for Coca-Cola workers in Pakistan.Coca-Cola trade union of Faisalabad in 2002, received a violent suppression, but the union has disappeared, Faisalabad factory workers after eight years, Karachi Coca-Cola trade unions and the newly of the labor union which was formed in Gujiranwara With assistance, we organized democratic labor unions again. Currently, as a member of the FFBTW of the IUF-affiliated, Karachi Coca-Cola trade union, there are five of Coca-Cola trade union of Rahi Muya Khan Coca-Cola trade union, Multan Coca-Cola trade union, Gzira down straw Coca-Cola trade union, Faisalabad Coca-Cola trade union.

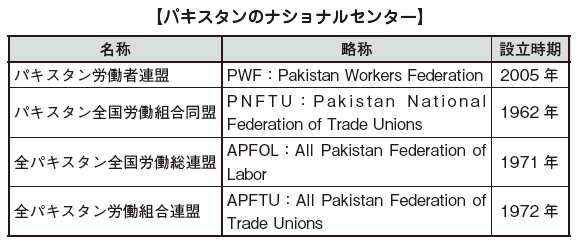

■ National CenterIn Pakistan there were three national centers, mainly in the lower part of the following table, all of which were members of the International Confederation of Freedons of Freedom (ICFTU) and the Asia Pacific Region Organization (ICFTU - APRO).

Today, the three national centers are integrated and act as Pakistan Workers Federation (PWF).As a user organization, there is the Pakistan Management Federation (Employers' Federation of Pakistan). The Pakistan Management Federation was founded in 1950 and is a member of state, private and multinational companies.

■ Conditions of Labor DisputesIn accordance with fiscal problems, etc., there are few labor unions actually acting, and the number of cases of labor disputes tends to decrease.In addition, there are regional bias in the number of labor disputes, the state with the most strikes is Punjab. This is one reason why more than half of Pakistan's population concentrates in Punjab province.

■ Solving the labor disputeSince many of the workers in Pakistan are low educated, they do not have knowledge about the procedures of industrial relations courts. For this reason, negotiations are not conducted in discussion, and there are cases where illegal labor disputes are caused, so guidance to workers is also important, especially in companies with labor unions.

-

-

-

Labor Standards Related Laws

Currently there are more than 70 labor-related laws in Pakistan, the governmentWe are promoting integration and systematization. Among them, the laws that set the main labor standards are "Factories Act, 1934" for the manufacturing industry and "The West Pakistan Shops and Establishments Ordinance, 1969" for the non-manufacturing industry.Other labor-related laws and regulations include "The West Pakistan Industrial and Commercial Employment (Standing Orders) Ordinance, 1968" applicable to 20 or more establishments, "Industrial Relations Act, 2012 "EmployeesCostofLiving (Relief) Act, 1973" stipulating the payment of living expenses, and other laws concerning payment of wages. Below, we will look at the outline of each law.

■ Factory Act Factories Act, 1934The factory law is applied to all factories, and when there is a manufacturing process, it is applicable regardless of the presence or absence of power. The items stipulated are as follows, but the applicable clause differs depending on the number of workers.

· Legal hours worked·Break time· Week holidaySubstitute holiday· Extra wage·paid holidays· Congratuation holidays and injuries vacation· Protection regulations for adolescents· Health and well-being

■ West Pakistan Store and Facility Act West Pakistan Shops and Establishments Ordinance, 1969The West Pakistan Store and Facility Act applies to all commercial facilities regardless of the number of employees. The prescribed items are as follows.

· Legal hours worked·Break time· Week holiday·Overtime·paid holidays· Congratuation holidays and injuries vacation· Protection regulations for adolescents·bonus· Dismissal

■ West Pakistan Industry Employment Law The West Pakistan Industrial and Commercial Employment (Standing Orders) Ordinance, 1968West Pakistan Commerce Industry Employment Law, all business with more than 20 employeesIt applies to the place. Specifically, it covers advertising industry, hotels, restaurants, banks, insurance companies and other commercial facilities. Regarding more than 20 workplaces, the provisions of "West Pakistan Shops and Establishments Ordinance, 1969" mentioned above apply to basic working conditions such as working hours, breaks, supervised work, bonuses, retirement and dismissal.In the West Pakistan Commerce Industry Employment Law, the following matters are stipulated.

· Posting important itemsLabor hours, holidays, salary days and wage rates shall be posted at the establishment.· If there are two or more shifts for shift work, changes to other shifts must be notified more than a month ago.· Group incentive plants or establishments with more than 50 workers shall evaluate the results for each group and grant special allowance, paid leave or both.· If you make a profit for the payment of bonus, you must pay bonus in addition to regular wages to workers who were employed for 90 days or more in that year.· Personnel Reduction In order to reduce personnel, it is necessary to reduce in order from persons with short working hours.· Reemployment after Reduction of Employment If you intend to hire workers within one year after reducing personnel, notify the personnel reduction target and give opportunities for reemployment.- Departure from company housing Workers who are providing housing from users shall surrender their residences within two months from the day when personnel reduction, dismissal, dismissal or service has ended.

■ Employee Living Expenses Act"Employees Costof Living (Relief) Act, 1973" is applied to all employees and stipulates the amount of living expenses paid by employment period and employment conditions. The amount to be paid is stipulated as 100 rupees per person per month, and all employees were supposed to pay 100 rupees for living expenses unless they exceed 4,065 rupees. If it exceeds 4,065 rupees, it was necessary to make it more than 4,165 rupees, including living expenses.From June 1998, all employees have been revised to be paid 300 rupees except pay restrictions and other restrictions.

■ Other labor relations laws and regulationsOther labor-related laws and regulations include the following laws stipulated in wages, minimum wages and childbirth allowances.Payment of Wages Act, 1936Minimum Wages Ordinance, 1961Maternity Benefit Ordinance, 1959

■ Work restrictions for children and womenIn Pakistan, we have ratified the Convention on the Working Age and the Convention on the Protection of Child Labor prescribed by the International Labor Organization (ILO), and the law that prohibits forced labor and child labor "Pakistan Bonded Labor System (Abolition) Act , 1992 ", but as a matter of fact it is often violated, especially in rural areas there are also cases where the labor of the child is in a normal state.Child labor at the production site of soccer balls is regarded internationally and international organizations and sports organizations are engaged in activities to eradicate illegal child labor and forced labor.

■ Regulations on safety and healthThe following are the laws related to occupational safety and health in Pakistan.

Mines Act, 1923Workers 'Compensation Act Workmen' s Compensation Act, 1923Harbor Labor Act Law Dock Laborers Act, 1934Factory Act Factories Act, 1934Dangerous occupation law Hazardous Occupations Rules, 1963State Employee Social Security Act Provincial Employees Social Security Ordinance, 1965Pakistan Small-scale store law West Pakistan Shopsand Establishments Ordinance, 1969State Factory Regulations Provincial Factories Rules

In each of the above laws, we have established rules concerning safety and health, but there is no comprehensive law concerning occupational safety, etc. as in the Occupational Safety and Health Act of Japan. Therefore, depending on industry type and region, the law of occupational safety to be referenced is different, so pay attention. -

Employment contract and employment rules

Outline of employment contractUsers of all industrial and commercial companies in Pakistan who employ more than 20 workers must create formal employment contracts when employing employees. However, in the case of the above-mentioned commercial employing 20 or more workers, workers of non-industrial companies, housekeeping assistance, farm workers, single contractor (one person's owner), employment contracts are not generally created Hmm. In this case, labor conditions etc are based on negotiation and past habits, so in case of trouble it will be resolved through the court.In employment contracts, it is necessary to determine the employment period and other employment conditions (job scope, working hours, salary and benefits, other benefits etc). In Pakistan, employment rules and employment contracts are sometimes created in Urdu which is the national language of Pakistan, but there are many cases to create in English.

■ Termination of employment contractIn case of dismissing a worker who is not stipulated in the period, the employer is required to pay salary in lieu of advance notice or notice. However, if it is clear that it is a retirement due to a reason attributable to him / her, prior notice or salary payment will be unnecessary.Also, if a worker hiring a fixed period of time has expired, the employer may dismiss it without prior notice or payment equivalent to one month 's salary.In this way, the concept of fixed term employment contracts and indefinite employment contracts and dismissal relating to them are similar to those in Japan.

■ obligation to create employment rulesIn Pakistan, all offices that employ more than 20 workers must create work rules. For Japanese companies entering Pakistan, it is preferable to prepare employment rules even if it is less than 20 in order to prevent trouble in labor management.When creating the employment regulations and the above-mentioned employment contracts, the West Pakistan Shops and Establishment Ordinance, the Factory Act (Factories Act, 1934) or the West Pakistan Industrial, Commerce and Industry Employment It must be prepared in accordance with one of the labor standards of the law (The West Pakistan Industrial and Commercial Employment (Standing Orders) Ordinance, 1968).

The items stipulated in the Employment Contracts and Employment Regulations include the following provisions.

· Employment contract period· Working hours (including shift shift)·holiday· Various holidays (annual paid vacation, national holiday, condolence vacation, injured vacation)· Extra wage rate· Time management· Payment of wages· Payment of bonuses· Punitive provision· Retirement, dismissal· Business closure

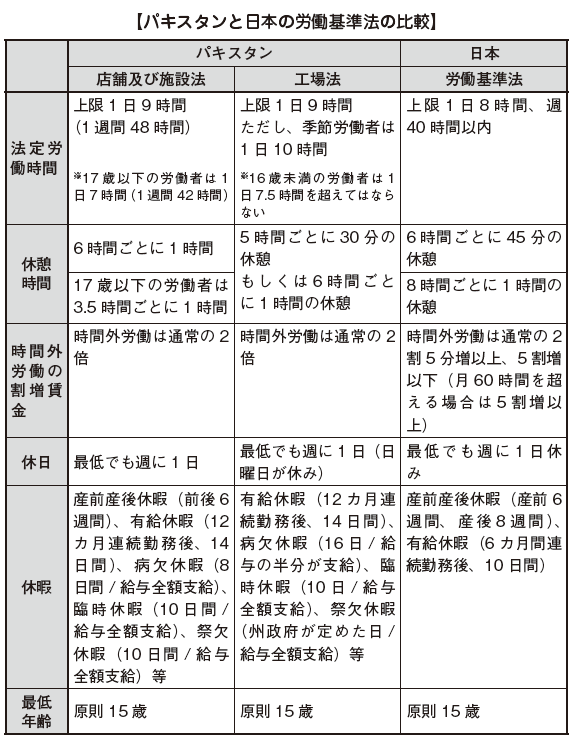

■ Comparison of working conditions between Japan and PakistanWhen describing working conditions in employment contracts and employment rules, it is necessary to prepare according to the labor law of Pakistan.A comparison between each law and the Japanese Labor Standards Law is as follows.

The main difference is that the extra wage on overtime work doublesIt is understood that it is very expensive compared with Japan's Labor Standards Act.In addition to paid vacation, it is necessary to pay attention to full payment or full payment of salary for temporary leave, sick leave and festive leave as well.

■ Wage Payment Law Payment of Wages Act, 1936The Wage Payment Law has the same purpose as the provision of the Five Principles of Wage Payment under the Labor Standards Act of Japan and is a law to compensate payment for wages to workers. The following items are stipulated.

· Payment due date: Once a month, payment must be made within 7 days from the wage deadline.· Payment method: As a rule, you have to pay with cash.· Deduction item: Deduction from salary is prohibited in principle. However, the following items can be deducted from salary. Various insurance, personal income tax, absenteeism deduction, actual expenses burden of damages etc.

In addition, Pakistan's minimum wage is 13,000 Pakistan Rupee (as of 2015) monthly except for some areas. However, as mentioned earlier, there are many workers with short working hours, so there are many workers less than this standard in monthly income.

-

-

-

Social insurance system

In Japan and other countries, the composition of social insurance is generally four, medical insurance, old-age pension, worker's accident insurance, employment insurance, but Pakistan's social security system also encompasses these by the following four laws. However, with regard to medical insurance and old-age pension, only a part of civil servants and so on is applied, and many private enterprises are not covered by the current situation.Provincial Employees' Social Security Ordinance (Medical Insurance)Employees' OldAge Benefits Act, 1976 (Public Official Old Age Pension)Workmen's Compensation ActWorker 's Welfare Fund Ordinance (Welfare Fund)■ Medical Insurance (Provincial Employees' Social Security Ordinance)[Overview]It is a system aimed at medical insurance and has the same purpose as Japanese health insurance and national health insurance. We also compensate in cases of illness, childbirth, occupational accidents, deaths, etc. of workers and also work as occupational accident insurance.[Scope of application]Government official agencies, mosques, financial institutions, non-governmental organizations, philanthropic projects, etc. are eligible.[Insurance fee]The insurance fee will be borne by the user in full. The burden of the user is insurance premium up to 6% with an upper limit of 10,000 Pakistan Rupee / month per employee.[Insurance benefits]The insurance benefits are as follows.· Prenatal postpartum allowance· Injury and disease allowance· Medical allowance· Maternity benefit· Disability pension (allowance)· Death benefit■ Employee Old Age Pension (Employees' Old Age Benefits Act, 1976)[Overview]It is a system aimed at the payment of pension due to old age, disability etc. Companies that employ more than five employees are subject to this law. In recent years' revision, its scope of application has expanded to financial institutions such as banks. For insurance premiums, companies pay 5% of employee's salary, employees pay 1% of salary.[Scope of application]As stated above, this law applies to establishments hiring five or more employees. Applicable to companies that are employed by 5 or more people or employing 5 or more employees over the last 12 months (including industrial, commercial and banking). Once this law is applied, even if the number of employed workers becomes 5 or less, it will continue to be an applicable business establishment.The management institution of the pension system is carried out by EOBI (Employees' Old-Age Benefits Institution). EOBI is a quasi independent agency that is active under the auspices of the Ministry of Labor and Manpower. The administration of EOBI is managed by the board of directors attended by the government, workers, and employees.However, as a matter of fact it is not applied to private enterprises, but it is covered by some civil servants. In private enterprises, some companies have their own social security systems such as pensions.[Insurance fee]The employer pays a premium of 5% of the wage of the monthly worker. Also, workers pay 1% premium of wages.[Insurance benefits]· Provided when old-age pension works for more than 30 years· Pension for disability pension disability· When the survivor pension dies or is retired, 50% of the pension is paid to the bereaved family· Payment as a lump sum in the case that the old-age allowance subscription period is insufficient and the old-age pension is not receivedCurrent status of the pension system and future movementsPublic pensions and related allowances are applied only to civil servants as a matter of fact. Therefore, the number of elderly people who currently receive pension is limited to a limited number, and many elderly people working in the private sector are not eligible for payment of old age pension etc. Also, the amount of pension payments currently paid by some countries to some retired people is excessive in light of international standards, so there is concern that future financial resources will be secured.In order to solve these problems, the Government of Pakistan is considering expansion of the Target Company, reduction of pension payment amount, stricter pension receiving requirement, age raise etc. Consideration is being made to increase the number of years of subscription necessary for receiving from 30 years to 35 years. -

Labor Insurance Act

■ Workmen's Compensation Act[Overview]The Workers' Compensation Compensation Act stipulates guarantee responsibilities to employers when employees suffer injury or illness during their employment period. The target injury or illness is injury or illness during work and injury caused by employment. Applicable range is company (Commercial / Industrial) with 10 or more employees, railway, mine, transportation affiliates etc.This Act provides for compensation for death, permanent or temporary labor incompatibility, compensation amount will vary according to the degree of impossibility. Employers are not obliged to pay for their injuries when employee injury or illness is within 4 days, but compensation is required in case of after 5th day. The benefit for death or permanent disability is Rs. 200,000.

■ Worker's Welfare Fund Ordinance (Worker's Welfare Fund Ordinance)[Overview]The Workers Welfare Fund Ordinance is a fund established for welfare of workers, promotion of education and training, etc. It has the same purpose as employment welfare business of employment insurance in Japan.

[Scope of application]All workplaces are applicable to the Workers Welfare Fund Ordinance.

[Insurance fee]If the annual gross income is over 500 thousand rupees, a 2% contribution will be imposed. In addition, the government contributes 100 million rupees. There is no upper limit for the insurance premium of the Workers Welfare Fund Ordinance.

[Use of Fund]This law is aimed at the welfare of workers. There are five main uses as follows.

· Projects involving the construction of houses, workers' houses· Financing for welfare of workers· Fund management and expenditure conference· Repayment of loans raised by the Board· Investment in securities approved by the government

-

-

-

Points to keep in mind while having Japanese people in Japan

■ Working visa and business visaForeigners who intend to work in Pakistan need to get either a working visa or a business visa. A work visa is a long-term visa, which allows engineers and administrators who can provide valuable knowledge and skills to Pakistan for visa application and acquisition. On the other hand, the business visa becomes a short-term visa and the acquisition requirement is comparatively moderate compared to the working visa.

[work visa]The validity period of a work visa is two years. The company applying for registration must first register with the online visa application system, scan the following documents, and send it along with the application form to the BOI.

· Pages with photographs of passport, entry record page, latest visa page· Color photograph·employment agreement· Company registration certificate· A written document indicating the period of visa· Company's document certifying the qualification of the expatriate (5 copies)

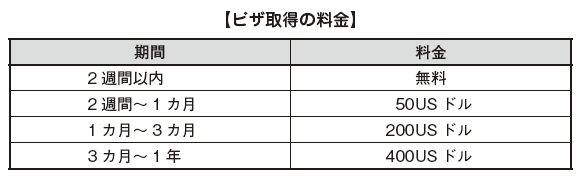

After receiving the above data, the BOI will make inquiries such as unknown points. If you can not obtain the answer within 4 weeks from the company applying, the application will be rejected.In addition, costs for the work visa, but up to 2 weeks free of charge, for more than two weeks, and looks like the following depending on the period.

[Business visa]If your stay is less than 3 months you can work with a business visa. The business visa is issued within 24 hours after the application and the validity period is 5 years. You can enter and leave the country as often as long as you do not exceed 3 months for each stay during the period. One of the following documents is required for application.

· Letter of recommendation from METI· Invitation letters from Pakistan's trade bodies and associations concerning this industry· Letter of recommendation from Honorary Investment Adviser of BOI· Invitations from embassies and consulates in Pakistan -

駐在員の給与設計と計算事例

■ Problems of salary inequality between Japan and PakistanIn paying salaries to expatriates who are assigned to Pakistan, there are differences in payroll method and tax rate applied in Japan and Pakistan, so even for that payment can not be the same as Japan uniformly, Consideration of payment form etc. is necessary.There is a difference in applicable tax rates between Japan and Pakistan, so if you pay the same salary as in Japan, the salary may be lower.

■ Japan Pakistan Tax Rate Comparison Chart.png)

.png)

.png) (Unit: Pakistan Rupee)In case■ Example of income tax calculation in Japan and Pakistan(Preconditions)40-year-old male Annual income in Japan: 6.48 million yen Dependent: None Estimated scheduled date of assignment: 3 years* Social insurance fee will not be considered here.※ 1 yen = 1.15 Pakistan Rupee

(Unit: Pakistan Rupee)In case■ Example of income tax calculation in Japan and Pakistan(Preconditions)40-year-old male Annual income in Japan: 6.48 million yen Dependent: None Estimated scheduled date of assignment: 3 years* Social insurance fee will not be considered here.※ 1 yen = 1.15 Pakistan Rupee.png)

.png)

In this way, when an employee with an annual income of 6.48 million yen receives a salary in Pakistan, it is necessary to consider the payment in advance since the amount of about 660,000 yen handover will be small.

-

-

-

References

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya