Pakistan

3 Chapter Establishment

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.2 Investment regulation and incentives

3 Chapter Establishment

3.1 Characteristics of business base

3.3 Company liquidation and withdrawal

4 Chapter Corporate Law

4.4 REGULATORY BODY/BODIES AND AFFILIATED INSTITUTIONS

5 Chapter Accounting

5.1 Accounting system in Pakistan

5.2 Disclosure system of Pakistan

6 Chapter Tax

6.2 Individual Issues in Pakistan Domestic Tax Law

7 Chapter Labor

7.4 Points to keep in mind while having Japanese people in Japan

-

-

-

Characteristics of business base

When establishing a business base in Pakistan, it comply with the company regulation (Company Ordinance, 1984) in 1984. Three corporate types of nonpublic company, public company and foreign corporation are stipulated in this law. Specifically, in the case of establishing a local corporation, it will be the establishment of a private company and a public company.However, if it can be judged that the business strategy can be executed even with only a limited business, there is a possibility of establishing a branch office or a representative office. In any case, it is necessary to consider the form of advancement according to business strategy and purpose..png)

-

Local corporation

■ limited liability companyEquity limited liability company is equivalent to a Japanese company, and the responsibility of the member of company is limited to equity investment equivalent parts. It is the most commonly used company form.

[Private company]Private companies are those with restrictions on transfer of shares, 2. Number of shareholders is 50 or less, excluding employees of the company (persons who are in the employment of the company), 3. Public offering It is a company that meets the three requirements (prohibition of Article 3 28).In the case of a single shareholder, there is a definition under the Corporate Law called Single Company, which is different from a regular private company in terms of composition of executives and the scope of compliance obligations.

[Public company]Public company refers to a company that has nothing to do with listing or non-listing of shares and does not impose restrictions like private companies (Article 3 30).

Corporate form other than corporation[Guarantee limited liability company]The guarantee limited liability company is a corporate form that prescribes the maximum amount of shareholders' liability in advance in the articles of incorporation. The obligee can pursue the responsibility to the shareholders only when the company has liquidated, and the characteristic that the shareholders' responsibility is limited to the range prescribed in the articles of incorporation in advance.

[partnership]A partnership is established by two or more natural persons or two or more corporations entering into a partner contract. All partners will be solely responsible for the payment obligations the partnership owes. Distribution of profits is also made based on a separate partner agreement.The registration process is simple compared to the establishment of a company. You can submit the following documents to the Registrar of Firms and conduct business if the examination passes.

· Copy of partner agreement· Original document of public certificate (Challan)· Partner's identification card· Identity card of partner contract guarantor -

Branch office and representative office

In addition to establishing a local corporation, it is possible to set up a branch office or a representative office.In the case of opening a branch office or a representative office, it is necessary to obtain authorization from the Investment Bureau (BOI). Branches and representative offices can be established from 6 weeks to 8 weeks.

■ BranchBranch activities in Pakistan are limited and are allowed to be set up to fulfill contracts signed with public sectors or private companies. Therefore, we can not do other sales activities. If you are ordered a single project but you can not expect continuous work, you may choose to choose a branch type.

■ Representative OfficeThe representative office is permitted to set up for promotional activities, searching for affiliated parties, technical advice, export promotion, etc., and can not conduct any sales activities.

-

-

-

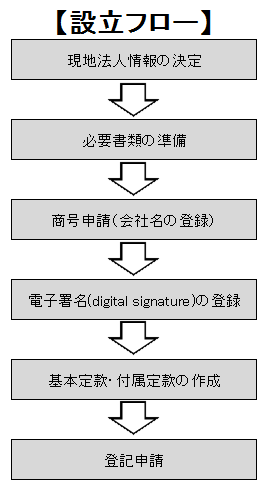

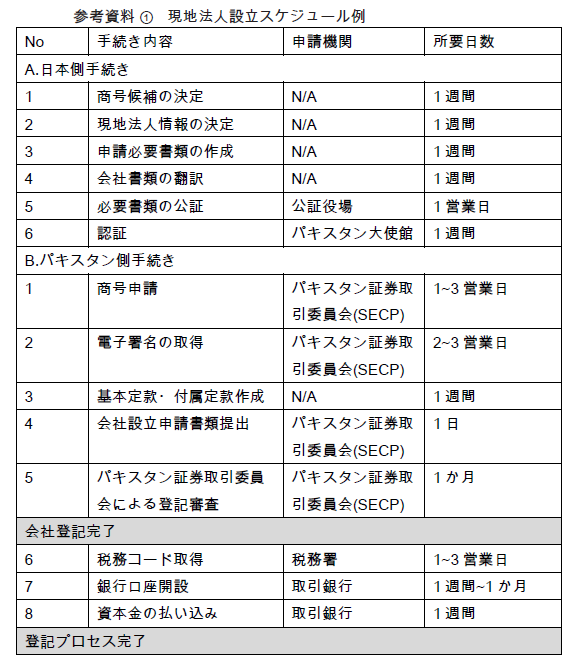

Procedure for establishing a private company

In the case of establishing a subsidiary in Pakistan, it is almost always the case to establish a private company. Procedures at that time can be broadly divided between the Japanese side and the local side, translating the information on the parent company that will become the shareholder or the person who will become the director of the new company, conducting the certification procedure at the Pakistan embassy in Japan etc. , It is characterized by many required documents.Also, it is not uncommon for administrative countermeasures to be delayed and take more time than anticipated. Therefore, establishing a company using an agency is the most effective way. In this case, the procedure on the site side can be delegated to the agent.

In the case of establishing a subsidiary in Pakistan, it is almost always the case to establish a private company. Procedures at that time can be broadly divided between the Japanese side and the local side, translating the information on the parent company that will become the shareholder or the person who will become the director of the new company, conducting the certification procedure at the Pakistan embassy in Japan etc. , It is characterized by many required documents.Also, it is not uncommon for administrative countermeasures to be delayed and take more time than anticipated. Therefore, establishing a company using an agency is the most effective way. In this case, the procedure on the site side can be delegated to the agent. -

Preparatory procedure to be done by the Japanese side

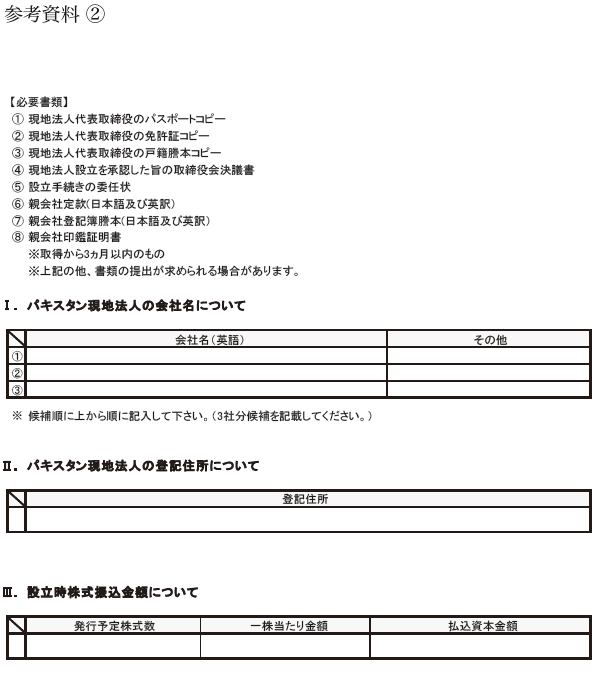

① Determination of local corporate information[Selection of trade name candidate]We select the company name (company name) of the local corporation. In choosing a company name, you must pay attention to the following points.In the 1984 company regulation, it is not possible to use names that are identical or similar to existing companies, names that are inappropriate and confusing, names that intend to harm religious susceptibilities of the people It is stipulated that it is not possible to use the name of the spelling different from that of the dictionary (Article 37 (1) (2)).Furthermore, it should be noted that there is a name that requires prior approval by the Pakistan Securities and Exchange Commission. It is a name suggestive of supporting past or current headquarters of Pakistan or a foreign state or a name related to the federal government, state government or government department or authority, a company established by federal or state law , Or the name suggesting support or relevance of foreign governments and international organizations.For example, the use of words such as "Association" and "Foundation" requires permission from Pakistan Securities and Exchange Commission. Also, "Authority", "Bureau", "Co-operative" etc. are not allowed to use them anyway.In addition, the judgment criteria for usability is stated in the guidelines (AvailabilityofNameGuide) on the availability of the trade name issued by the Pakistan Securities and Exchange Commission.Specifically, the differences between singular and plural are considered to be exactly the same company name. Also, I think that there is a high possibility that punctuation marks, uppercase letters, lower case letters, and articles are recognized, conjunctions or prepositions (conjunctions or prepositions as symbols or words) and pronunciation similarity are recognized as similar names I will.Risks concerning the selection of trade names are not limited to the use of trade names, as well as the possibility of being confused with the performance of other companies and the occurrence of civil lawsuits.

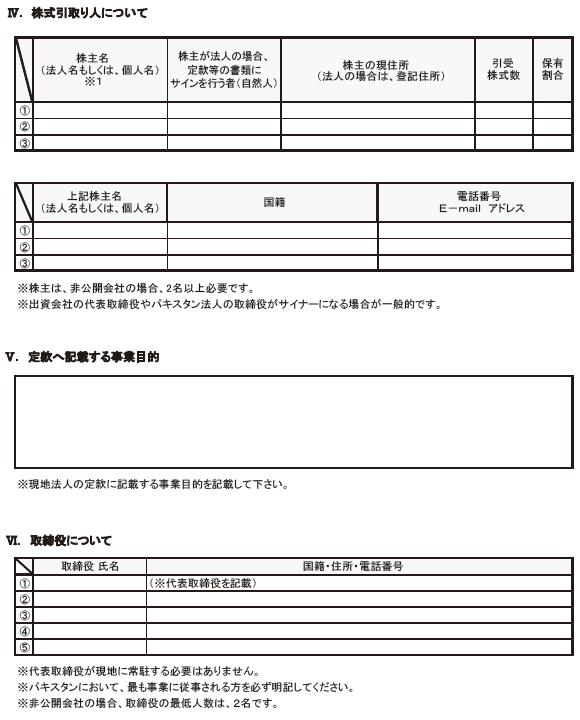

[Engine Design]When establishing a subsidiary in Pakistan, most companies will choose the form of a private company. When establishing a private company, the simplest organization design is two directors and one auditor.The director is the person responsible for the management of the company, and there is no requirement for nationality or habitability. However, when a person having a residence in India takes office as a director, there is a case that the review by the Pakistani authorities is prolonged and the establishment of the company is extended for a long time, so it is necessary to pay attention to this point.Also, the auditor is the person who performs the accounting audit of the company and must appoint a Pakistan accountant.

[Shareholders / capital]In Pakistan, the minimum capital amount has been set for some industries, so we must first check if the business type is the industry under the regulation of minimum capital.

[Registered address]Registered addresses are subject to checking by the Registration Authority, so there must be space in practice. Since general law firm offices and accounting firms provide address lending services, it is possible to use this service at the time of establishment and search the office to register for relocation at the time of full swing.

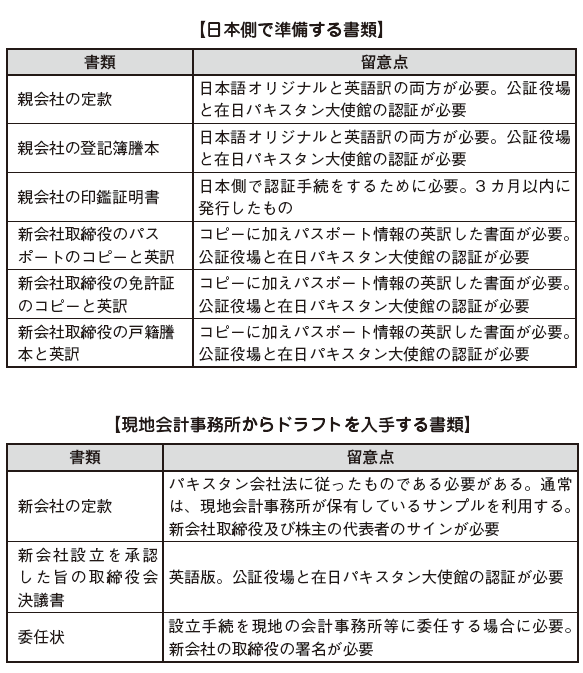

② Preparation of necessary documentsWhen applying for company registration registration in Pakistan, shareholder information and information of the new company officer are required. An English translation version is required for all documents, and a Japanese notary office proof that it is a public document and an embassy of Pakistan in Japan are required for the certification procedure.

[Authentication procedure]The certification procedure is a procedure necessary for publicly using legal documents created in Japan outside Japan. A certified copy of the company's register and family transcript is a transcript issued by a public agency that created the original. Such public documents themselves are not subject to certification.However, when translating this official document into a foreign language, signature is made by preparing a declaration (Declaration) stating that the translator is proficient in the language and that the contents of the attached document are translated faithfully Then, it is necessary to have the original and English translation attached and have the declaration certified by the notary. Therefore, in order to receive certification, it is necessary to prepare both Japanese and English translations. -

Preparatory procedure to be carried out locally

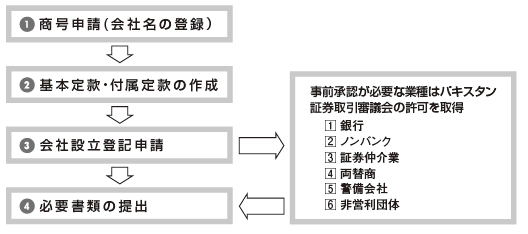

There is a step from the investigation of the company name to the application for registration of company establishment in the company establishment procedure.

❶ Application for company name (registration of company name)There are two ways to apply for the company name. Choose either an online application to be done on the Web or an offline application to go directly to the registration office and make an application on a paper basis.

[Online application]On the SECP website you will get your login ID and password. After logging in, click on the "Fill New Bank Challan Form" link and pay the application fee online. After that, we fill in the necessary information on the input form. The fee for online transactions is 200 rupees, which is less expensive than offline procedures.

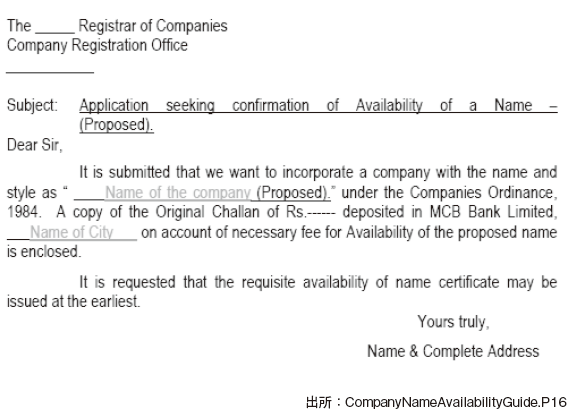

[Offline application]We will pay the fee at the bank specified by the company registration authority. In the case of offline application, fee is expensive compared to on-line application, because it charges 500 rupees for each name to apply. To do offline application, you need to submit the following letter to the registration office.

When the application is accepted, a notice of receipt will be sent by post. If you specify an e-mail address, you can receive contact via e-mail.The reason why the fee for online application is cheaper than off line application is because the Pakistan government encourages online application.If the trade name permission has not been received, the applicant can request reconsideration from the company registration authority. In that case, you must attach a public certificate (Challan), a copy of the Decision Letter of the company registration office, and a affidavit (Affidavit) to prove that you filed an application fee of 500 rupees.

② Creation of electronic signatureWe will apply for electronic signature (Digital Signature) to NIFT (National Institutional Facilitation Technologies) on the Internet or through Pakistan Securities and Exchange Commission office.To apply, you need electronic signature application form, identification card of director, corporate name booking certificate, fee payment certificate. Usually it will be completed in one day, but if you hurry you can also receive it in 1-2 hours by paying additional costs.

③ Preparation of the Articles of Association / Articles of AssociationWe prepare four basic articles of incorporation and attached articles of incorporation with signature, submit three offline and the other one online. The articles of incorporation corresponding to each industry are posted on the website of the Pakistan Securities and Exchange Commission. (Http://www.secp.gov.pk/CLD/cld_memo_article.asp) The articles of incorporation determine the fundamental rules of the company, even if you ask the accounting office etc. to create, translate it Then, you have to keep track of the content. Especially important is the provision on the business purpose of the company. I explain the absolute description matter of the articles of incorporation below.

[Company name clause]In the case of a public company, you need to include the word "Limited". In the case of a private company, the word "(Private) Limited" is required. In the case of a single company, the phrase "(SMC - Private) Limited" is required.

[Details of Registered Address]A provision on the company's registered address is required.

[Provision on the company's business purpose]As already mentioned, provisions on business purpose are the most important in the articles of incorporation. Because it is impossible to do anything other than the business stipulated for this project purpose. Generally, in order to broadly grasp the scope of the company's activities, "and the doing of all other such things incidental or conducting the environment of the above objectives", "Others incidental or related to the above purpose By doing the phrase "do business", I will keep the range of work.

[Scope of responsibility range]It is necessary to mention whether it is a stock limited company or guarantee limited company. It is to clarify the scope of responsibility when liquidating the company.

[Regulations concerning stocks]With the exception of the unlimited liability company and guaranteed limited liability company, we have to specify the total number of registered shares issued at the time of establishment of the company and their respective shares.Regarding the attached bylaws, provisions relating to the internal operation of the company are included. With regard to the Articles of Association, it is unnecessary to prepare the Articles of Association when operating the company in accordance with the provisions prescribed in Table A of the Company Ordinance in 1984.

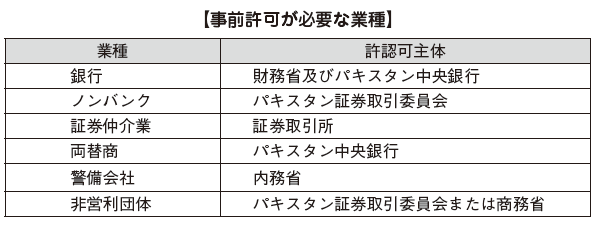

❸ Company registration registration applicationIt is the institution named SECP (Pakistan Securities and Exchange Commission) that manages company registration in Pakistan and applies for registration to SECP.However, for certain industries, do not acquire permission from relevant government agencies in advanceMust. Major industries include Bunking Company, Non-Banking Finance Company, Security Service Providing Company, Brokerage (Brokerage House), Currency Exchange (Money Exchange Company ), 1984 For non-profit corporations under Article 42 of the Company Ordinance, it is necessary to obtain prior permission from the competent government agency, so be careful.

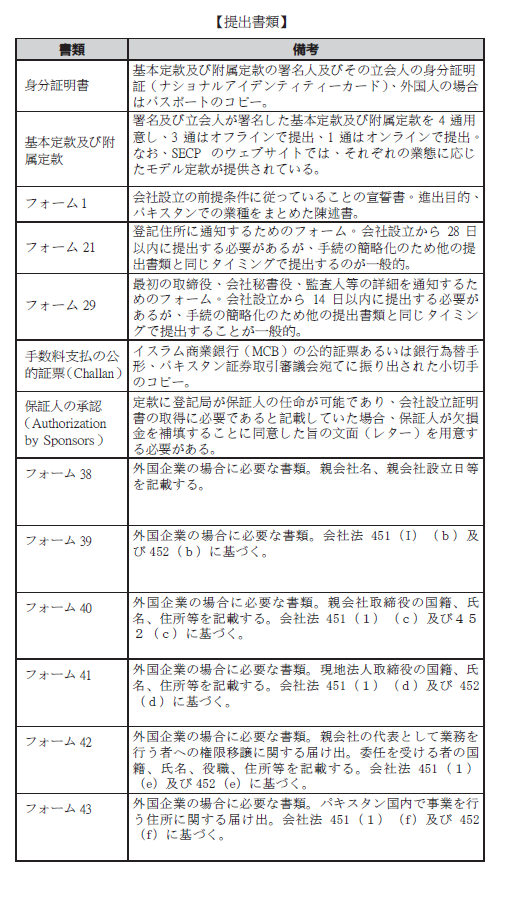

❹ Submission of required documentsDocuments to be submitted when applying for registration are as follows.

-

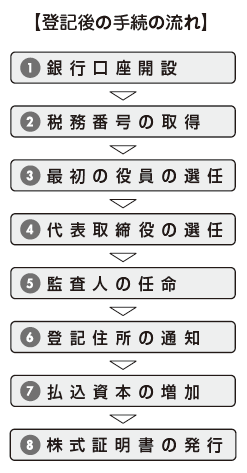

Procedure after registration

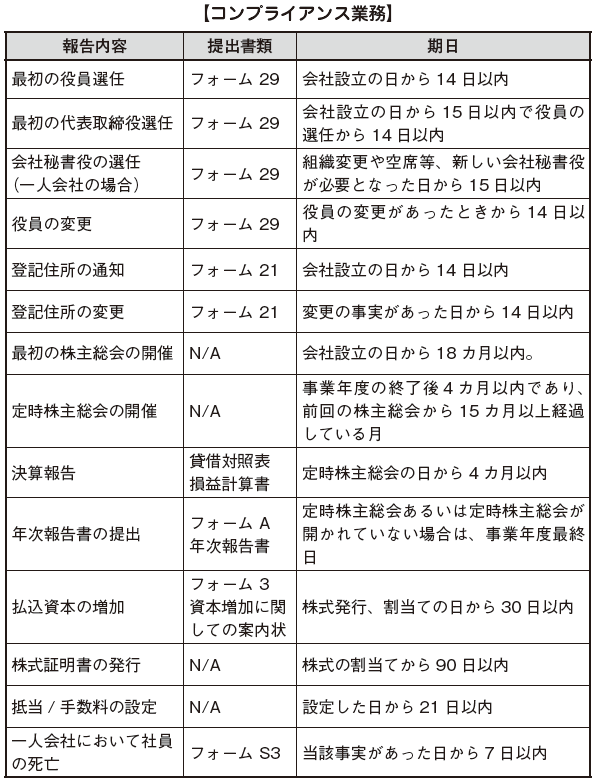

After completion of registration, the following procedure is required. ❶ Bank account openingAfter registration is completed, we will open a bank account. Required documents differ depending on the bank, but here is the case of HSBC Bank Pakistan Branch as an example.· Account opening application form· Resolutions of the Board of Directors· List of directors· Basic Articles of Incorporation and Articles of Incorporation (Certified)· Corporate foundation certificate (certified)· Copy of all the director's identification (NIC) or passport· Letter of introduction from the current customer of HSBC Pakistan or signed letter of an active Pakistan Bank Officer· GIF (GroupIdentificationForm) from HSBC Bank in a country with corporate status· Form QA22 (when opening a non-resident account or when one of the directors is a non-resident living in Pakistan)❷ Acquisition of tax numberEvery company must acquire a tax number (NTN: National Tax Numbers) and a sales tax number (Sales Tax Numbers) after the company is established. You can obtain these by submitting the application form that entered the company establishment registration number etc. to the Federal Tax Revenue Bureau (FBR) which is Pakistan's tax office.❸ Appointment of the first officerWithin 14 days from the establishment of the company, it is necessary to appoint in writing the number and name of the first director by form 29 by majority vote of the signer's signature. Until it is completed, the signatory of the articles of incorporation is considered the first officer. This appointment procedure will be held at the first General Meeting of Company.Also, afterwards, officers will be appointed at the General Meeting of Company, which will be held once every three years. In other words, the term of office of officers is three years. However, in the event of an accidental death, resignation or dismissal of an officer, a new officer will be appointed and will take over the remaining term of office of the predecessor.❹ Appointment of Representative DirectorWithin 15 days from the date of establishment of the company, the directors must appoint a representative director within 14 days from the election of officers.❺ Appointment of auditorWithin 60 days from the date of company establishment, the directors appoint an auditor.[Appointment of a company secretary in a single company]In a single company, a company secretary is appointed within 15 days from the establishment of a company on Form 29, when the company secretarial office becomes vacant or when the organization is changed to a single company.[Change of Officers]Appointment, appointment and change of directors, representative directors, auditors, advisors, etc will be notified by form 29 within 14 days from the time of the fact.❻ Notice of Registered AddressThe company must notify the registered address within 28 days from the date of establishment by form 21. In addition, when you change the registered address, it is necessary to notify similar documents on the same due dates.増 Increase in paid-up capitalIf the company increases the paid-up capital, it is necessary to issue new shares to existing shareholders (Article 86, paragraph 3). In that case, we need to send letters of invitation to all shareholders.Regarding the allocation, it is necessary to calculate based on the current shareholding ratio and submit Form 3 and invitation letter to the company registration office within 30 days.発 Issuance of stock certificateThe company must issue an equity certificate within 90 days from the date of the stock allotment or within 45 days from the application for the stock transfer.In addition, SECP requires various compliance services from the company, and penalties such as fines will be imposed if neglecting reporting obligation. Typical tasks are as follows.

❶ Bank account openingAfter registration is completed, we will open a bank account. Required documents differ depending on the bank, but here is the case of HSBC Bank Pakistan Branch as an example.· Account opening application form· Resolutions of the Board of Directors· List of directors· Basic Articles of Incorporation and Articles of Incorporation (Certified)· Corporate foundation certificate (certified)· Copy of all the director's identification (NIC) or passport· Letter of introduction from the current customer of HSBC Pakistan or signed letter of an active Pakistan Bank Officer· GIF (GroupIdentificationForm) from HSBC Bank in a country with corporate status· Form QA22 (when opening a non-resident account or when one of the directors is a non-resident living in Pakistan)❷ Acquisition of tax numberEvery company must acquire a tax number (NTN: National Tax Numbers) and a sales tax number (Sales Tax Numbers) after the company is established. You can obtain these by submitting the application form that entered the company establishment registration number etc. to the Federal Tax Revenue Bureau (FBR) which is Pakistan's tax office.❸ Appointment of the first officerWithin 14 days from the establishment of the company, it is necessary to appoint in writing the number and name of the first director by form 29 by majority vote of the signer's signature. Until it is completed, the signatory of the articles of incorporation is considered the first officer. This appointment procedure will be held at the first General Meeting of Company.Also, afterwards, officers will be appointed at the General Meeting of Company, which will be held once every three years. In other words, the term of office of officers is three years. However, in the event of an accidental death, resignation or dismissal of an officer, a new officer will be appointed and will take over the remaining term of office of the predecessor.❹ Appointment of Representative DirectorWithin 15 days from the date of establishment of the company, the directors must appoint a representative director within 14 days from the election of officers.❺ Appointment of auditorWithin 60 days from the date of company establishment, the directors appoint an auditor.[Appointment of a company secretary in a single company]In a single company, a company secretary is appointed within 15 days from the establishment of a company on Form 29, when the company secretarial office becomes vacant or when the organization is changed to a single company.[Change of Officers]Appointment, appointment and change of directors, representative directors, auditors, advisors, etc will be notified by form 29 within 14 days from the time of the fact.❻ Notice of Registered AddressThe company must notify the registered address within 28 days from the date of establishment by form 21. In addition, when you change the registered address, it is necessary to notify similar documents on the same due dates.増 Increase in paid-up capitalIf the company increases the paid-up capital, it is necessary to issue new shares to existing shareholders (Article 86, paragraph 3). In that case, we need to send letters of invitation to all shareholders.Regarding the allocation, it is necessary to calculate based on the current shareholding ratio and submit Form 3 and invitation letter to the company registration office within 30 days.発 Issuance of stock certificateThe company must issue an equity certificate within 90 days from the date of the stock allotment or within 45 days from the application for the stock transfer.In addition, SECP requires various compliance services from the company, and penalties such as fines will be imposed if neglecting reporting obligation. Typical tasks are as follows.

-

Establish branch office and representative office

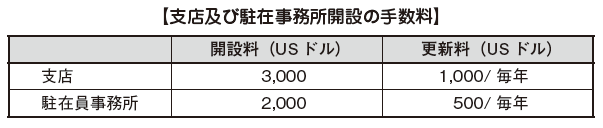

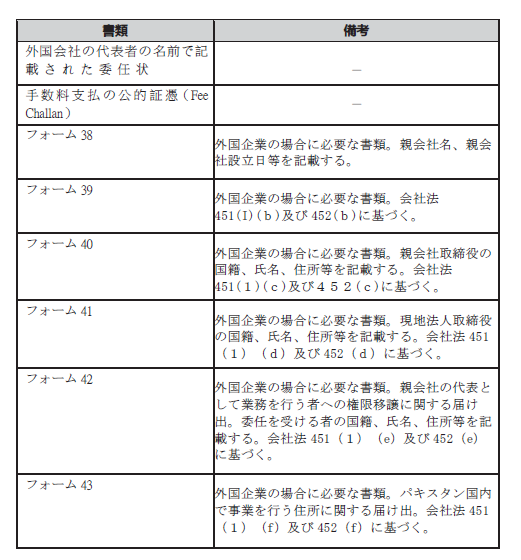

■ Application for BOIWhen a foreign company establishes a branch office and a representative office, it must obtain approval from the Investment Authority (BOI). The following documents are submitted for application.[Required documents]In addition to the prescribed application form, prepare 6 copies of the following documents and submit it to the Investment Authority (BOI).· Copy of a certified copy of the registry of the parent company certified by the Pakistan embassy· Copy of the articles of incorporation· (For branches) Copy of contract·Company Profile· Copy of the branch, the resolution deciding to open a representative office※ In addition, you may be asked to submit additional documents depending on the application content.[Examination by the Investment Authority (BOI)]After submitting the required documents above, we will review the establishment of the establishment such as examination of the document by the Investment Bureau (BOI) and review by related organizations.[Authorization from the Investment Authority (BOI)]After the Investment Authority (BOI) conducts the approval procedure from the relevant agencies, you can obtain permission to open a branch office or a representative office. If there is no inadequate document, it is said that permission will be received from 6 weeks to 8 weeks.The opening fee and renewal fee for branch office and representative office are as follows. ■ Registering with SECPForeign companies must register with SECP in order to start business. Documents to be submitted are as follows.

■ Registering with SECPForeign companies must register with SECP in order to start business. Documents to be submitted are as follows.

-

-

-

Company liquidation and withdrawal

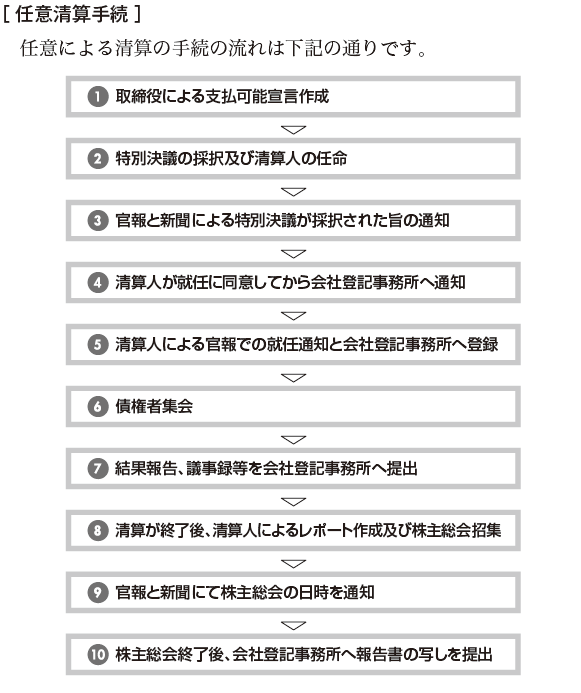

There are three ways to liquidate a company in Pakistan. The first is compulsory liquidation based on the court's decision, the second is voluntary liquidation, and the last third is voluntary liquidation by court supervision. I will explain the flow of each procedure.■ Liquidation by court decision[Liquidation reason by court]Pursuant to Article 305 of the Company Ordinance in 1984, a petition for liquidation will be made to the court if any of the following conditions are met.(1) In the event of a resolution of forced liquidation by a court by a special resolution(2) Failure to report to the Registration Authority(3) Failure to fulfill the obligation to hold a general shareholders meeting or shareholders meeting for the second consecutive term(4) If you did not start the project within one year from the establishment of the company or stopped the project for one year(5) If the shareholder falls below the minimum number under the Company Law (in the case of a private company it falls below 2, in the case of a public company it falls below 7)(6) When payment of obligation becomes impossible(7) When it is not listed company(8) If the court deems that the court should liquidate(9) Absence of shareholders(10) When the company conducts the act shown below· Illegal acts or fraud· Doing business other than the business stated in the articles of incorporation· We are improperly managing employees and minority shareholders by personnel assignment and promotion etc.· It is managed and operated by a person who was not able to maintain an appropriate and correct book, a person who made a fraud, or a person who committed a tampering act against the company· Memorandum · Articles of Incorporation · Persons who do not comply with the provisions of this law, judgment by the court · registration office · persons who do not comply with the requirements of the committee authorized under this lawThose who can file a petition for liquidation to the petitioner's court are as follows.· Company adopting a special resolution·a creditor·Investor· Company Registration Office· Authority authorized by the Pakistan Securities and Exchange Commission and the CouncilIn addition, when a person who authorized authority from the company registration office or the Pakistan Securities and Exchange Commission and the Council forced compulsory settlement, before clarifying to the court, it is clarified whether there is a fact corresponding to the grounds for the complaint I will. We can not file a petition unless the grounds for the complaint are clarified.■ Optional liquidation[Conditions for arbitrary liquidation]The company can file a voluntary settlement if the following conditions are satisfied.· When the duration of the company has been passed as stipulated in the articles of incorporation· When the liquidation condition of the company as stipulated in the articles of incorporation is fulfilled· When a special resolution is adopted within 5 weeks from payment declaration· When adopting a special resolution of voluntary liquidationSince it is understood that arbitrary liquidation was done at the stage when special resolution of voluntary liquidation was adopted, it is impossible to do business except for projects for beneficiaries concerning liquidation procedures. [Adoption of declaration of payment possible by directors] ... ❶The director makes a payment declaration form 107. In addition, we resolve to propose to shareholders at the Board of Directors meeting. And we will convene a general shareholders meeting.[Adoption of special resolution and appointment of liquidators] ... ❷We will adopt a special resolution to voluntarily liquidate the general meeting of shareholders and appoint a liquidator. At that stage the board will dissolve.[Notice to the effect that the special resolution by the Official Gazette and the newspaper was adopted] ... ❸Within 10 days from the date of adoption of the special resolution, we will notify the special resolution on the newspaper and the Official Gazette, together with the copy to the company registration office.[Notify the company registration office after the liquidator has agreed to take office] ... ❹The company notifies the company registration office within ten days from the time the liquidator consents to its inauguration. The same also applies if the liquidator has been changed.[Notice of inauguration in official gazette by the liquidator and registration in company registration office] ... ❺The liquidator will inform you of office in official gazette within 14 days after being appointed. Also, create form 110, submit it to company registration office, and register as a liquidator.[Creditors' meeting] ... ❻In the event that the liquidator judges that all obligee's obligations can not be repaid, we will prepare the details of the asset and liability and hold a creditors meeting. You must notify each creditor and company registration office about the convocation of the creditors meeting ten days before holding the creditors meeting.[Submit result report, minutes etc to company registration office] ... ❼Within ten days from the holding of the creditors meeting, notices, minutes of minutes and income and expenditure reports etc. concerned with it must be submitted to the company registration office.[Report preparation by liquidators and convocation of general shareholders meeting after liquidation is over] ... ❽After liquidation is over, we will report the result without delay, submit each minutes and report on the result of settlement as a result of liquidation. And we will create form 111 and call the final shareholders meeting.[Notice of General Meeting of Shareholders in Official Gazette and Newspaper] ... ❾The liquidator must notify the general meeting of shareholders in the Official Gazette and the newspaper at least ten days in advance.[Submit a copy of the report to the company registration office after the general meeting of shareholders] ... ❿After the general meeting of shareholders, we will prepare Form 112 within one week and submit a copy of the report.■ Optional liquidation proceedings by creditorsOptional liquidation by creditors is also possible. To that end, the company calls up a creditors meeting and collects creditors at the next day or two days after the general meeting of shareholders. The flow of concrete procedure is as follows.

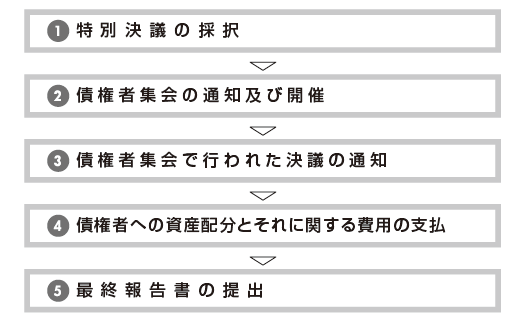

[Adoption of declaration of payment possible by directors] ... ❶The director makes a payment declaration form 107. In addition, we resolve to propose to shareholders at the Board of Directors meeting. And we will convene a general shareholders meeting.[Adoption of special resolution and appointment of liquidators] ... ❷We will adopt a special resolution to voluntarily liquidate the general meeting of shareholders and appoint a liquidator. At that stage the board will dissolve.[Notice to the effect that the special resolution by the Official Gazette and the newspaper was adopted] ... ❸Within 10 days from the date of adoption of the special resolution, we will notify the special resolution on the newspaper and the Official Gazette, together with the copy to the company registration office.[Notify the company registration office after the liquidator has agreed to take office] ... ❹The company notifies the company registration office within ten days from the time the liquidator consents to its inauguration. The same also applies if the liquidator has been changed.[Notice of inauguration in official gazette by the liquidator and registration in company registration office] ... ❺The liquidator will inform you of office in official gazette within 14 days after being appointed. Also, create form 110, submit it to company registration office, and register as a liquidator.[Creditors' meeting] ... ❻In the event that the liquidator judges that all obligee's obligations can not be repaid, we will prepare the details of the asset and liability and hold a creditors meeting. You must notify each creditor and company registration office about the convocation of the creditors meeting ten days before holding the creditors meeting.[Submit result report, minutes etc to company registration office] ... ❼Within ten days from the holding of the creditors meeting, notices, minutes of minutes and income and expenditure reports etc. concerned with it must be submitted to the company registration office.[Report preparation by liquidators and convocation of general shareholders meeting after liquidation is over] ... ❽After liquidation is over, we will report the result without delay, submit each minutes and report on the result of settlement as a result of liquidation. And we will create form 111 and call the final shareholders meeting.[Notice of General Meeting of Shareholders in Official Gazette and Newspaper] ... ❾The liquidator must notify the general meeting of shareholders in the Official Gazette and the newspaper at least ten days in advance.[Submit a copy of the report to the company registration office after the general meeting of shareholders] ... ❿After the general meeting of shareholders, we will prepare Form 112 within one week and submit a copy of the report.■ Optional liquidation proceedings by creditorsOptional liquidation by creditors is also possible. To that end, the company calls up a creditors meeting and collects creditors at the next day or two days after the general meeting of shareholders. The flow of concrete procedure is as follows. [Adoption of special resolution] ... ❶Prepare a draft of a resolution to make an arbitrary liquidation by creditors, and submit a copy thereof to shareholders 21 days before holding the general meeting of shareholders. At the general meeting of shareholders, we will approve three-quarters and adopt a special resolution and appoint a liquidator. Then, we create form 26 and submit it to company registration office.[Notification and holding of creditors meeting] ... ❷It is necessary to notify the holders of creditors meeting by postal mail to each creditor or by daily newspaper or Official Gazette at least 21 days before holding the creditors meeting. At the creditors meeting, we resolve to make an arbitrary liquidation by creditors, appoint a liquidator. If a person different from the liquidator appointed by the company is appointed, the liquidator appointed at the creditors meeting will be finally appointed.[Notice of Resolution held at creditors meeting] ... ❸The company must inform the company registration office within 10 days after the resolution is adopted. You must also submit an official approval sheet for the liquidator.[Asset allocation to creditors and payment for expenses related thereto] ... ❹The liquidator will allocate assets to creditors who convert their assets and are listed on the register of creditors and will pay compensation fees such as remuneration of liquidators.[Submission of final report] ... ❺The liquidator will report to the creditors the report on liquidation and the report on what kind of assets were disposed of in what manner. Also, the account will be audited by the auditor appointed to carry out the liquidation procedure.And we will hold a meeting between shareholders and creditors. First of all, we will send a notice of meeting holding and audit report within 10 days enclosed and mailed. Also we will notify you to the Official Gazette and the newspaper. We will submit a report and minutes of the meeting to the company registration office within one week after the meeting is held. Then, the company registration office scrutinizes its contents and makes registration. Three months later, the company is deemed to have been liquidated.■ Optional liquidation by court supervisionWhen a resolution of voluntary liquidation passes, the court can oversee voluntary liquidation by a petition filed by the company or judgment of the court. In that case is called optional liquidation by court supervision.In consideration of the intent of liquidators, investors and creditors and the terms and conditions of liquidation, the court will decide whether the court is forced liquidation or arbitrary liquidation by supervision.

[Adoption of special resolution] ... ❶Prepare a draft of a resolution to make an arbitrary liquidation by creditors, and submit a copy thereof to shareholders 21 days before holding the general meeting of shareholders. At the general meeting of shareholders, we will approve three-quarters and adopt a special resolution and appoint a liquidator. Then, we create form 26 and submit it to company registration office.[Notification and holding of creditors meeting] ... ❷It is necessary to notify the holders of creditors meeting by postal mail to each creditor or by daily newspaper or Official Gazette at least 21 days before holding the creditors meeting. At the creditors meeting, we resolve to make an arbitrary liquidation by creditors, appoint a liquidator. If a person different from the liquidator appointed by the company is appointed, the liquidator appointed at the creditors meeting will be finally appointed.[Notice of Resolution held at creditors meeting] ... ❸The company must inform the company registration office within 10 days after the resolution is adopted. You must also submit an official approval sheet for the liquidator.[Asset allocation to creditors and payment for expenses related thereto] ... ❹The liquidator will allocate assets to creditors who convert their assets and are listed on the register of creditors and will pay compensation fees such as remuneration of liquidators.[Submission of final report] ... ❺The liquidator will report to the creditors the report on liquidation and the report on what kind of assets were disposed of in what manner. Also, the account will be audited by the auditor appointed to carry out the liquidation procedure.And we will hold a meeting between shareholders and creditors. First of all, we will send a notice of meeting holding and audit report within 10 days enclosed and mailed. Also we will notify you to the Official Gazette and the newspaper. We will submit a report and minutes of the meeting to the company registration office within one week after the meeting is held. Then, the company registration office scrutinizes its contents and makes registration. Three months later, the company is deemed to have been liquidated.■ Optional liquidation by court supervisionWhen a resolution of voluntary liquidation passes, the court can oversee voluntary liquidation by a petition filed by the company or judgment of the court. In that case is called optional liquidation by court supervision.In consideration of the intent of liquidators, investors and creditors and the terms and conditions of liquidation, the court will decide whether the court is forced liquidation or arbitrary liquidation by supervision. -

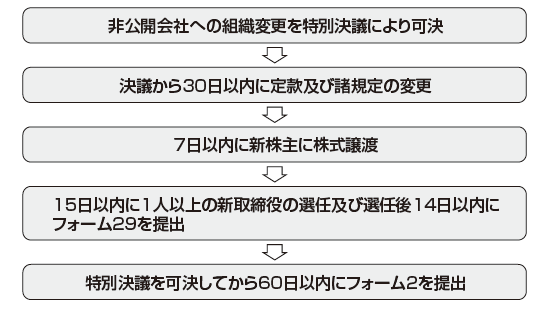

Organization change

Procedures for migrating from a single company (Private Company) to a private company follow the procedure below.

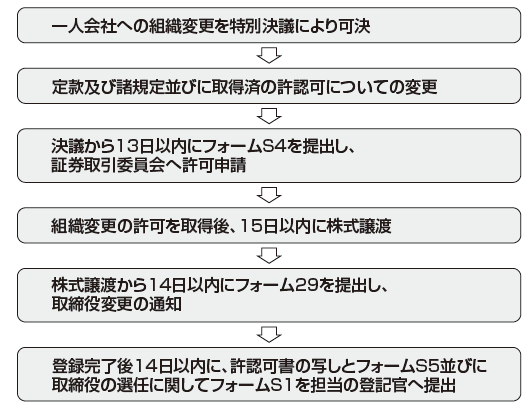

Organization change from private company to single company (SingleMemberCompany)It is also possible. The procedure in that case is as shown in the figure below.

-

-

-

References

・“PROMOTERS’ GUIDE” Securities & Exchange Commission of Pakistan・“Foreign Companies Guide” Securities & Exchange Commission of Pakistan・Companies Ordinance, 1984・Companies Rules, 1985

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya