Pakistan

2 Chapter Investment Environment

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.2 Investment regulation and incentives

3 Chapter Establishment

3.1 Characteristics of business base

3.3 Company liquidation and withdrawal

4 Chapter Corporate Law

4.4 REGULATORY BODY/BODIES AND AFFILIATED INSTITUTIONS

5 Chapter Accounting

5.1 Accounting system in Pakistan

5.2 Disclosure system of Pakistan

6 Chapter Tax

6.2 Individual Issues in Pakistan Domestic Tax Law

7 Chapter Labor

7.4 Points to keep in mind while having Japanese people in Japan

-

-

-

Investment environment

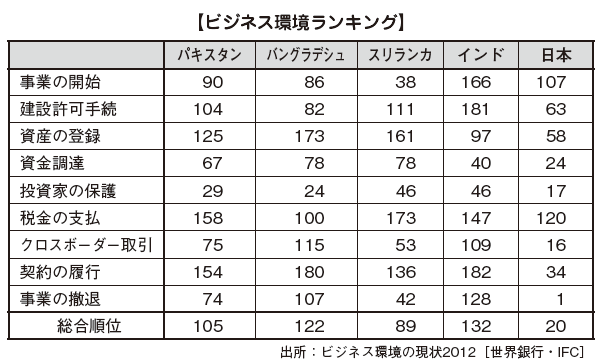

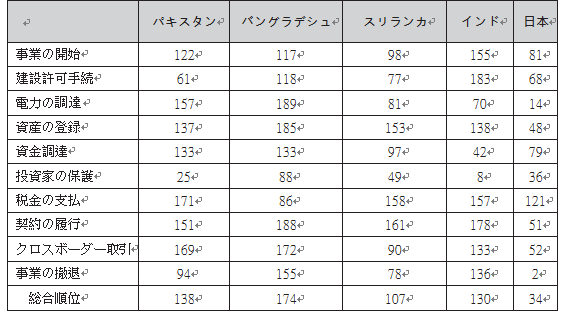

Because of Pakistan's political instability, there are not many people who have the impression of investing country. However, although the World Bank announces annual indicators showing the ease of investment, it is ranked 128th in the world in the ranking of 2014 and in the South Asian region (142 in India and 99 in Sri Lanka) ) Has been ranked.However, in the 2016 version it ranks down to 138th place. Especially procurement of electricity and tax payment are negative factors. また下記は、2016年版のビジネス環境ランキングとなります。

また下記は、2016年版のビジネス環境ランキングとなります。 Since the official discount rate has reached around 14%, there are many favorable conditions except for deterioration of security, such as overseas funds are flowing in, foreign exchange reserves are high and stock prices are rising. Although certainly negative impressions are preceded, it is also true that potential investment opportunities are overlooked. In particular, in the passenger car division, which accounts for the majority of Japanese affiliates, the number of automobiles recorded in Pakistan domestically (from FY 2014 - FY 2003) is about 180 thousand, which is 28% higher than the previous year, exceeding about 150 thousand vehicles.Exchange rateAs a long-term trend, Pakistan Rupee is on a downward trend and has declined to 0.86 PKR as of November 2003.

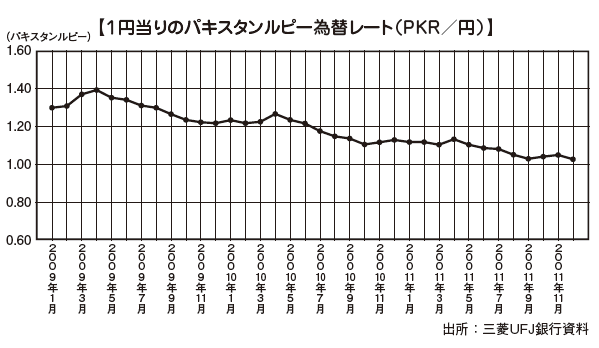

Since the official discount rate has reached around 14%, there are many favorable conditions except for deterioration of security, such as overseas funds are flowing in, foreign exchange reserves are high and stock prices are rising. Although certainly negative impressions are preceded, it is also true that potential investment opportunities are overlooked. In particular, in the passenger car division, which accounts for the majority of Japanese affiliates, the number of automobiles recorded in Pakistan domestically (from FY 2014 - FY 2003) is about 180 thousand, which is 28% higher than the previous year, exceeding about 150 thousand vehicles.Exchange rateAs a long-term trend, Pakistan Rupee is on a downward trend and has declined to 0.86 PKR as of November 2003. In addition, the following will be the exchange rate after 2012.

In addition, the following will be the exchange rate after 2012. As a result of the disappointment of the sharp decline in the reserve ratio of foreign reserves from 2008 to 2009, the depreciation of the Pakistan Rupee sharply advanced. Factors of a sharp decline in the foreign reserve reserve ratio include political instability such as the assassination of former Prime Minister of the end of 2007 and resignation of President Musharraf in 2008, a decline in foreign investment due to deterioration of security, the soaring crude oil price from 2007 to 2008 In June 2008, it recorded the highest historical value of 140 US dollars, as a result of the sharp burden of imports of crude oil, the economic downturn stemming from subprime loan withdraw funds from Pakistan You can do what has been done.Moreover, the decline from 2010 to 2011 is considered to have the greatest impact of the flood.If security is stable in the future, foreign investment will increase, if the economy is activated, the currency will be stabilized, but the outlook is often uncertain.■ Direct finance (stock) marketThere are three stock markets in Pakistan: Islamabad, Karachi, Lahore. In particular, the Karachi Stock Exchange (KSE), the largest and oldest stock exchange in Pakistan established in 1947, is currently located in the center of the business district of Karachi.The KSE 100 index consists of 100 stocks with the highest market capitalization from each of the 34 industries of the Karachi stock exchange and further adding the top 66 market capitalization, regardless of industry. The market capitalization of 100 stocks of common stock is calculated as 1,000.

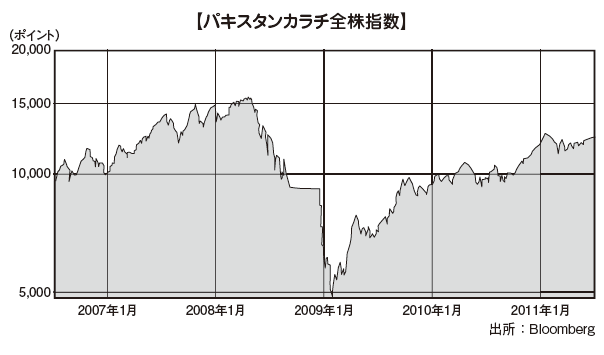

As a result of the disappointment of the sharp decline in the reserve ratio of foreign reserves from 2008 to 2009, the depreciation of the Pakistan Rupee sharply advanced. Factors of a sharp decline in the foreign reserve reserve ratio include political instability such as the assassination of former Prime Minister of the end of 2007 and resignation of President Musharraf in 2008, a decline in foreign investment due to deterioration of security, the soaring crude oil price from 2007 to 2008 In June 2008, it recorded the highest historical value of 140 US dollars, as a result of the sharp burden of imports of crude oil, the economic downturn stemming from subprime loan withdraw funds from Pakistan You can do what has been done.Moreover, the decline from 2010 to 2011 is considered to have the greatest impact of the flood.If security is stable in the future, foreign investment will increase, if the economy is activated, the currency will be stabilized, but the outlook is often uncertain.■ Direct finance (stock) marketThere are three stock markets in Pakistan: Islamabad, Karachi, Lahore. In particular, the Karachi Stock Exchange (KSE), the largest and oldest stock exchange in Pakistan established in 1947, is currently located in the center of the business district of Karachi.The KSE 100 index consists of 100 stocks with the highest market capitalization from each of the 34 industries of the Karachi stock exchange and further adding the top 66 market capitalization, regardless of industry. The market capitalization of 100 stocks of common stock is calculated as 1,000. In addition, the following will be the all-stock index figures after December 31, 2012.

In addition, the following will be the all-stock index figures after December 31, 2012. Between 2008 and 2009, the KSE 100 index of the Karachi Stock Exchange exceeded the value of 15,000 for the first time, reaching the highest historical value of 15,737 on April 20, 2008.However, the Gilani Cabinet, which was founded in March of the same year, failed to cope with inflation, trade deficit, fiscal deficit and political instability, which caused the stock price to plummet. Trading volume was the lowest in history, and so that police officers surrounded the building, developed so that angry investors could not be brought close. Since then, Lehman shock hit, so in January 2009 I interrupted 5,000 points at a time. Even after 2011, the all-stock index continues to be updated on the right, and on August 7, 2015 it has recorded a record high of 25,235.97 points.■ Foreign Direct Investment (FDI)

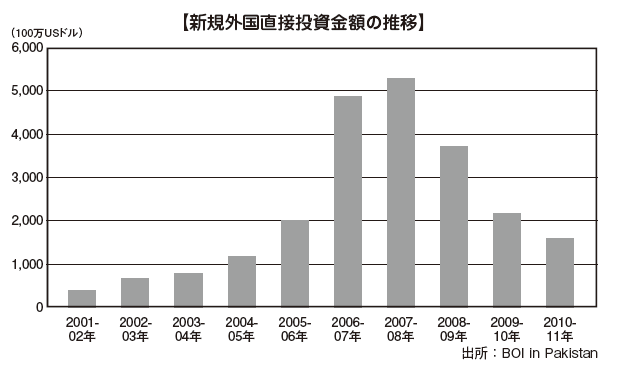

Between 2008 and 2009, the KSE 100 index of the Karachi Stock Exchange exceeded the value of 15,000 for the first time, reaching the highest historical value of 15,737 on April 20, 2008.However, the Gilani Cabinet, which was founded in March of the same year, failed to cope with inflation, trade deficit, fiscal deficit and political instability, which caused the stock price to plummet. Trading volume was the lowest in history, and so that police officers surrounded the building, developed so that angry investors could not be brought close. Since then, Lehman shock hit, so in January 2009 I interrupted 5,000 points at a time. Even after 2011, the all-stock index continues to be updated on the right, and on August 7, 2015 it has recorded a record high of 25,235.97 points.■ Foreign Direct Investment (FDI) In addition, the following will be the trend of inward direct investment from 2011 onwards.Fiscal year amount (1 million USD)2011 1,326.002012 859.002013 1,333.002014 1,747.00The amount of Foreign Direct Investment increased steadily in the 2000s, but it has been declining at the peak of exceeding US $ 5 billion in 2007-08. Political instability due to terrorism is the biggest factor of course, but there are multiple factors overlapping, such as an increase in budget deficits, a global recession, and a flood in 2001. In 2012, it reached a record low of US $ 859 million, but it started to recover from 2013, it continued to pick up in 2014 and reached US $ 1,74.7 million. Still, the fact that foreign capital is still few is the present condition.

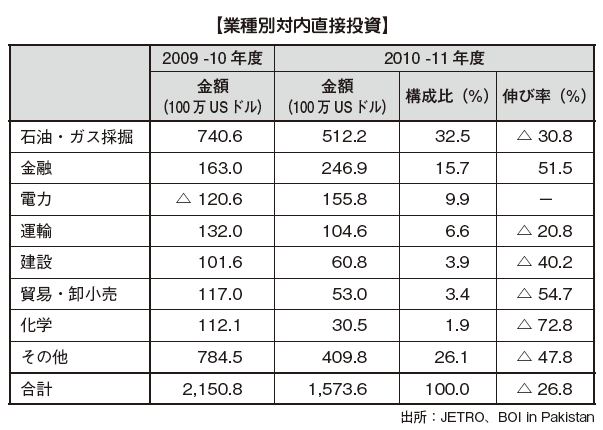

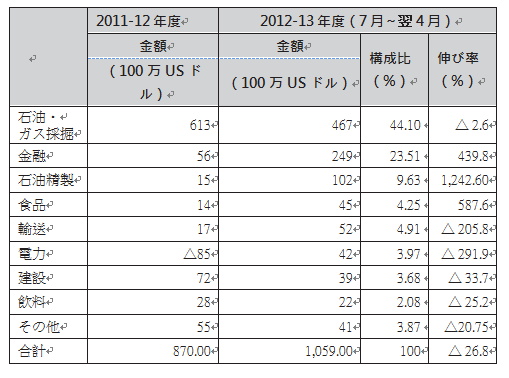

In addition, the following will be the trend of inward direct investment from 2011 onwards.Fiscal year amount (1 million USD)2011 1,326.002012 859.002013 1,333.002014 1,747.00The amount of Foreign Direct Investment increased steadily in the 2000s, but it has been declining at the peak of exceeding US $ 5 billion in 2007-08. Political instability due to terrorism is the biggest factor of course, but there are multiple factors overlapping, such as an increase in budget deficits, a global recession, and a flood in 2001. In 2012, it reached a record low of US $ 859 million, but it started to recover from 2013, it continued to pick up in 2014 and reached US $ 1,74.7 million. Still, the fact that foreign capital is still few is the present condition. The following will be the trend of inward direct investment by industry in 2011 and beyond. One of the features is that the direct reflow to oil refining and the financial sector is prominent.

The following will be the trend of inward direct investment by industry in 2011 and beyond. One of the features is that the direct reflow to oil refining and the financial sector is prominent.

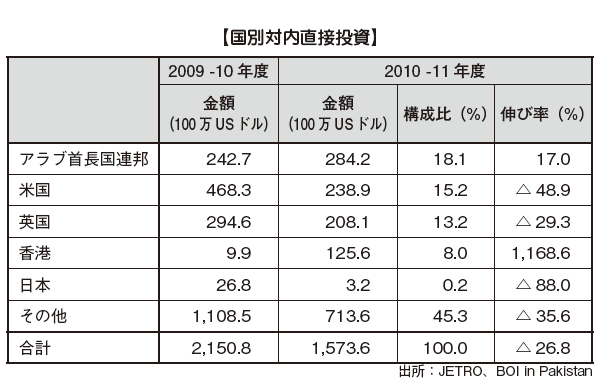

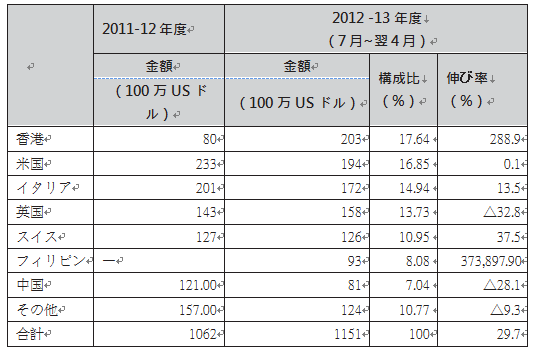

In addition, the following will be the figures for inward foreign direct investment by country after 2011.

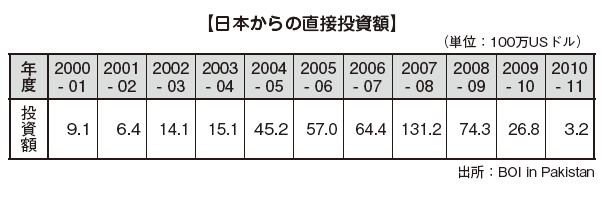

In addition, the following will be the figures for inward foreign direct investment by country after 2011. [Direct Investment from Japan]Direct investment in Pakistan for 2010-11 will be US $ 3.2 million. This investment amount will be the minimum amount in the past 10 years, and the share of the investment will be only 0.2%. We recovered up to 22.8 million US dollars in 2011 - 2012, but it will be low as before. In addition, investment from new countries such as the Philippines and Italy is increasing in FY 2012 - 13.The enterprises entering from Japan are mainly in the automobile industry, but due to relaxation of import restrictions on second-hand cars, there may be no movement to expand local production until security is stable and infrastructure is in place . However, since it has a population of over 100 million people, we can say that there is a possibility of entering the market.

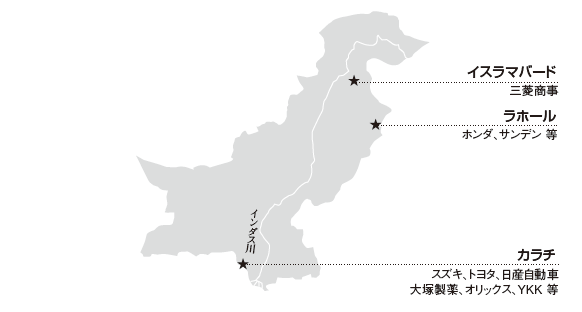

[Direct Investment from Japan]Direct investment in Pakistan for 2010-11 will be US $ 3.2 million. This investment amount will be the minimum amount in the past 10 years, and the share of the investment will be only 0.2%. We recovered up to 22.8 million US dollars in 2011 - 2012, but it will be low as before. In addition, investment from new countries such as the Philippines and Italy is increasing in FY 2012 - 13.The enterprises entering from Japan are mainly in the automobile industry, but due to relaxation of import restrictions on second-hand cars, there may be no movement to expand local production until security is stable and infrastructure is in place . However, since it has a population of over 100 million people, we can say that there is a possibility of entering the market. There are 69 companies (as of 2014) according to the JETRO survey from Japan Japan.In addition to the Suzuki Motor Company, which is expanding into India, Honda, Toyota, Hino Motors, etc. are expanding, mainly in the automobile industry. In addition, ORIX (87 years, leasing industry), Otsuka Pharmaceutical Co., Ltd. (Pharmaceuticals in 1988), Asahi Glass Co., Ltd. (Merged with Mitsubishi Corporation in 1997, vinyl chloride resin), etc. are based.By location, most companies concentrate on Karachi, the central city of the economy.

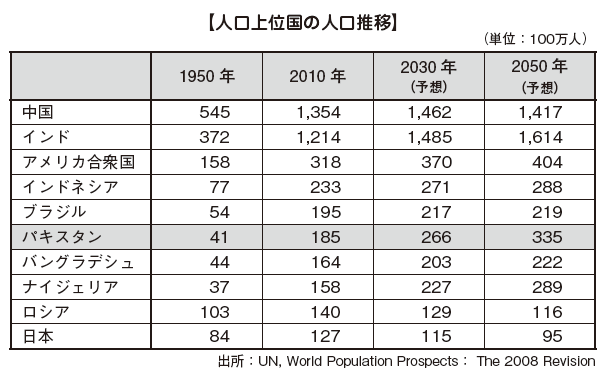

There are 69 companies (as of 2014) according to the JETRO survey from Japan Japan.In addition to the Suzuki Motor Company, which is expanding into India, Honda, Toyota, Hino Motors, etc. are expanding, mainly in the automobile industry. In addition, ORIX (87 years, leasing industry), Otsuka Pharmaceutical Co., Ltd. (Pharmaceuticals in 1988), Asahi Glass Co., Ltd. (Merged with Mitsubishi Corporation in 1997, vinyl chloride resin), etc. are based.By location, most companies concentrate on Karachi, the central city of the economy. Furthermore, in fiscal 2015, more than 75 Japanese companies enter the market, and the manufacturing industry, especially automobiles, continues to be active.■ Investment BenefitsAs mentioned above, it has 186.29 million people and has the world's 6th largest population, having a huge domestic market and easy to secure the necessary workforce is a big advantage. Due to recent economic growth, middle classes are also increasing, and demand is increasing in areas where Japanese companies such as motorcycles and automobiles compete.[Abundant labor force]The population of Pakistan will be 266,000,000 in 2003 and 335 million in 2005, which will be the world's fourth largest population It is expected to be. This abundant labor force due to the large population, the size of the domestic market has become a big attraction of Pakistan.

Furthermore, in fiscal 2015, more than 75 Japanese companies enter the market, and the manufacturing industry, especially automobiles, continues to be active.■ Investment BenefitsAs mentioned above, it has 186.29 million people and has the world's 6th largest population, having a huge domestic market and easy to secure the necessary workforce is a big advantage. Due to recent economic growth, middle classes are also increasing, and demand is increasing in areas where Japanese companies such as motorcycles and automobiles compete.[Abundant labor force]The population of Pakistan will be 266,000,000 in 2003 and 335 million in 2005, which will be the world's fourth largest population It is expected to be. This abundant labor force due to the large population, the size of the domestic market has become a big attraction of Pakistan. Also, since English is the official language, I am blessed with fluent English proficiency. Because it is a country based on agriculture, we are good at collective behavior and collective work, and human resources who work at factories etc are abundant both in quality and quantity.Geographically, it is located in the center of Asia and it can be used as a gateway to Central Asia with abundant energy, financially rich Gulf countries, and the Far East with advanced economic power. In the future it is also suitable as a production and export base for the area.As mentioned earlier, Pakistan is one of the fastest growing economies in the world in the last few years. As stock prices rise, foreign reserves are also very high, and investment liberalization, deregulation, privatization, and simplification are promoted to promote investment.■ Investment DisadvantagePakistan's country risk is high as compared with other foreign countries. The majority of the country risk accounts for problems of security and political unrest, and because of historical background, it seems to be difficult to solve. Even if security problems are left, various risk factors exist in the country for doing business.One of them is irrational domestic production request. Particularly in the manufacturing industry, it is required to achieve the domestic production rate at a high rate by domestic production request from the country, and there is also the case that the local production is costly in reverse. In addition, smuggled goods and copied products are also risk factors. Due to high tariffs, smuggled goods are rampant and it is an impediment to business expansion (example: 25% tariff + 16% sales tax + 6% pre-tax income tax = 47% in case of color TV). In light of the fact that light-industrial products such as inexpensive Chinese electric appliances, clocks, toys, bicycles, shoes and footwear such as inflated smuggling and under-declaration have flown in the market at present, and in the motorcycle market where demand has been rapidly increasing in recent years Honda, which boasted a high share, dropped its share by Chinese copy vehicles.Inadequacy of basic living infrastructure such as electricity, water, transportation etc. is a risk factor. As power outages occur daily in Pakistan and the water network also does not cover the whole country, it is necessary to purchase water from the distribution tank in some areas.Most of the opinions are that it is difficult to proactively invest or advance without solving these problems or coping with countermeasures. However, on the contrary, the barriers to entry of other companies in the same industry are high, Suzuki and others that have advanced to the earliest stage and have remained in the country while undergoing numerous political changes accounted for more than 50% of the market. Although the influence of the risk factor as mentioned above is thought to gradually weaken with the growth of the country, it is expected that for the time being, Japanese companies will not reach the satisfied level for the time being. It is also true that a company that has solved problems after entering the market has been successful, rather than waiting for the problem to be solved.

Also, since English is the official language, I am blessed with fluent English proficiency. Because it is a country based on agriculture, we are good at collective behavior and collective work, and human resources who work at factories etc are abundant both in quality and quantity.Geographically, it is located in the center of Asia and it can be used as a gateway to Central Asia with abundant energy, financially rich Gulf countries, and the Far East with advanced economic power. In the future it is also suitable as a production and export base for the area.As mentioned earlier, Pakistan is one of the fastest growing economies in the world in the last few years. As stock prices rise, foreign reserves are also very high, and investment liberalization, deregulation, privatization, and simplification are promoted to promote investment.■ Investment DisadvantagePakistan's country risk is high as compared with other foreign countries. The majority of the country risk accounts for problems of security and political unrest, and because of historical background, it seems to be difficult to solve. Even if security problems are left, various risk factors exist in the country for doing business.One of them is irrational domestic production request. Particularly in the manufacturing industry, it is required to achieve the domestic production rate at a high rate by domestic production request from the country, and there is also the case that the local production is costly in reverse. In addition, smuggled goods and copied products are also risk factors. Due to high tariffs, smuggled goods are rampant and it is an impediment to business expansion (example: 25% tariff + 16% sales tax + 6% pre-tax income tax = 47% in case of color TV). In light of the fact that light-industrial products such as inexpensive Chinese electric appliances, clocks, toys, bicycles, shoes and footwear such as inflated smuggling and under-declaration have flown in the market at present, and in the motorcycle market where demand has been rapidly increasing in recent years Honda, which boasted a high share, dropped its share by Chinese copy vehicles.Inadequacy of basic living infrastructure such as electricity, water, transportation etc. is a risk factor. As power outages occur daily in Pakistan and the water network also does not cover the whole country, it is necessary to purchase water from the distribution tank in some areas.Most of the opinions are that it is difficult to proactively invest or advance without solving these problems or coping with countermeasures. However, on the contrary, the barriers to entry of other companies in the same industry are high, Suzuki and others that have advanced to the earliest stage and have remained in the country while undergoing numerous political changes accounted for more than 50% of the market. Although the influence of the risk factor as mentioned above is thought to gradually weaken with the growth of the country, it is expected that for the time being, Japanese companies will not reach the satisfied level for the time being. It is also true that a company that has solved problems after entering the market has been successful, rather than waiting for the problem to be solved.

-

-

-

Investment regulation and incentives

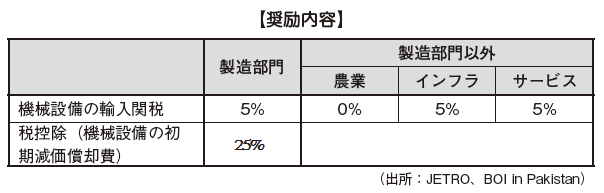

Investment regulationIn Pakistan, the Foreign Private Investment (Promotion and Protection Act) in 1976 (Foreign Private Investment (Promotion and Protection Act)), the Act on the Promotion and Protection of the Economic Reform in 1992 (Furtherance and Protection of Economic Reforms Act) , And changes are made from time to time according to the investment policy announced by Pakistan Investment Authority (BOI: Board of Investment).Pakistan has no restrictions on foreign capital investment, and 100% foreign capital entry is allowed in all sectors. The agricultural sector is limited to 60%, except for agricultural management corporations established under the Corporate Law.There are no conditions of industry type, geography, scale and you can start business without government permission. However, with regard to the four categories of weapons / ammunition, explosives, radioactive materials, securities printing / banknote printing, and money casting, government approval is required on the grounds of national security and religious restrictions, with regard to alcoholic beverages and alcoholic beverages Can not build manufacturing equipment.[Regulation by Industry Type]Agriculture sectorIn the Cabinet decision dated 19th June 2002, the "CAF (Corporate Agriculture Farming) Policy" was communicated and domestic companies or foreign companies established by the 1984 company regulation were agricultural management corporations (CAF corporations) The right is granted. The CAF corporation can make 100% foreign capital investment and the capital is US $ 300 thousand is the minimum investment amount. Investment in the agricultural sector other than the CAF corporation is permitted to invest capital of up to 60% of foreign capital.Service departmentInvestment in service sector, in principle foreign investors can own 100% capital. However, there is regulation of the minimum capital and a capital of 150,000 US dollars is required.In addition, the telecommunications business other than the following must be opened in collaboration with Pakistan Telecommunication Corporation Line (PTCL).· E-mail, Internet, electronic information· Data communication network· Trunk radio·mobile phone· Information communication by push type telephone· Voice mail· Prepaid telephone· Group network for banking business· Operation of international satellite for domestic data communication· Calling service· Vehicle tracking system· Security System· International mobile phone communication systemInfrastructure and social divisionsIn the infrastructure and social divisions, there is a minimum capital restriction of US $ 300,000.The infrastructure sector includes roads and highways, bridges, railroads, ports and Yusen, airports and commercial land development. In the social division, there are education, technical training, vocational training, personnel development, hospital, medicine, medical service and so on..png) ■ Exchange control regulation[Legal basis for foreign exchange management]In Pakistan, in addition to the "1947 Foreign Exchange Control Law", in addition to the "Foreign Exchange Manual (Eighth Edition 2002)" in Foreign Exchange Manual (Foreign Exchange Manual (Eighth Edition 2002)), the government of Pakistan and the central bank established regulations It is announced in the Official Gaze every time.[Regulation on Borrowing]Under the Foreign Exchange Control Law, we have established a definition of "foreign management company" and restrict borrowing. A foreign management company is a branch of a foreign company, a company owned by a foreigner of 50% or more of capital, and a majority of executives are foreign companies.Foreign management companies can borrow in Pakistan Rupee through foreign exchange banks. Also, through foreign exchange banks, you can borrow foreign currency from foreign countries. In the case of borrowing from overseas, for financial resources for capital expenditure, the central bank must obtain permission and the repayment period is within 12 months, the interest rate is limited to LIBOR + 1% or less.[Transfer to overseas]Payment of royalty etc.Royalty and hula for providing technology and know-how from foreign companiesAs for the payment of the fee fee, the upper limit of the amount is set as follows.· In case of royalty payment to a foreign company providing know-how fee or branding fee, the payment of the first lump sum is limited to US $ 100,000· The remittance of franchise fee in food industry is limited to 5% of net sales (excluding sales tax). It is not permitted to pay both royalties and franchise fees· For other nonmanufacturing projects, up to 5% of net sales (excluding sales tax)Transfer branch office profitsTo remit profits from a branch of a foreign company other than the banking industry to a head office located outside the country, you must submit Form M and the following documents. In the case of banking business, please note that some documents may be different.· Audited financial statements· Audited financial statements of the head office· Head office account· Results of tax calculation for this fiscal year and previous year· Auditor's proof or tax payment certificate that the accrued tax amount is appropriate· Final Taxation Order for Previous Year· Auditor's certificate on accrued liabilities· Details of miscellaneous income· Basis for calculating head office expenses / Letter from tax authorities over the past three years· Fixed asset details· Remittance requiring bank loan· Business licensePayment of dividends to nonresident shareholdersIn addition to the application form, the auditor must submit the audited financial statements, the shareholders' meeting resolutions to which the dividends have been made, etc. to the transaction bank in the event of paying a dividend.■ Investment incentives[Incentives by Industry Sector] Encouragement IndustryIn Pakistan, energy related businesses such as oil, gas, mining, electric power,Industry such as IT and communication service industries, manufacturing of electronic equipment, tourism, infrastructure industry, agriculture, housing and construction industry, industries such as automobile and metal products, privatization of oil, gas, infrastructure and electric power, etc. are encouraged It has been with.Encouragement contentsThe content of incentives will be changed by individual notification. Below are some examples of specific examples, but checking the latest information is essential when considering usage.· Import tariffs on factory equipment, machinery etc not manufactured in Japan ... 0% ~ 5%· Sales tax of factory equipment, machinery etc not manufactured in the country ... Exemption tax· Equipment and machinery etc. manufactured in Japan ... Notify by customs order form each time· C & F price exceeding 50 million dollars when establishing a new factory in the country ... 0% to 5%· Import duties on raw materials in export industries ... tax free· Import of machinery ... Exemption tax· First year depreciation cost of factory equipment, machinery etc. (excluding used, transportation vehicles, furniture) ... 25%

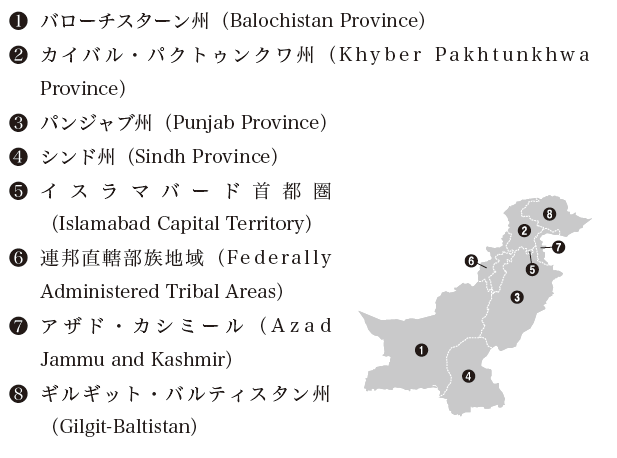

■ Exchange control regulation[Legal basis for foreign exchange management]In Pakistan, in addition to the "1947 Foreign Exchange Control Law", in addition to the "Foreign Exchange Manual (Eighth Edition 2002)" in Foreign Exchange Manual (Foreign Exchange Manual (Eighth Edition 2002)), the government of Pakistan and the central bank established regulations It is announced in the Official Gaze every time.[Regulation on Borrowing]Under the Foreign Exchange Control Law, we have established a definition of "foreign management company" and restrict borrowing. A foreign management company is a branch of a foreign company, a company owned by a foreigner of 50% or more of capital, and a majority of executives are foreign companies.Foreign management companies can borrow in Pakistan Rupee through foreign exchange banks. Also, through foreign exchange banks, you can borrow foreign currency from foreign countries. In the case of borrowing from overseas, for financial resources for capital expenditure, the central bank must obtain permission and the repayment period is within 12 months, the interest rate is limited to LIBOR + 1% or less.[Transfer to overseas]Payment of royalty etc.Royalty and hula for providing technology and know-how from foreign companiesAs for the payment of the fee fee, the upper limit of the amount is set as follows.· In case of royalty payment to a foreign company providing know-how fee or branding fee, the payment of the first lump sum is limited to US $ 100,000· The remittance of franchise fee in food industry is limited to 5% of net sales (excluding sales tax). It is not permitted to pay both royalties and franchise fees· For other nonmanufacturing projects, up to 5% of net sales (excluding sales tax)Transfer branch office profitsTo remit profits from a branch of a foreign company other than the banking industry to a head office located outside the country, you must submit Form M and the following documents. In the case of banking business, please note that some documents may be different.· Audited financial statements· Audited financial statements of the head office· Head office account· Results of tax calculation for this fiscal year and previous year· Auditor's proof or tax payment certificate that the accrued tax amount is appropriate· Final Taxation Order for Previous Year· Auditor's certificate on accrued liabilities· Details of miscellaneous income· Basis for calculating head office expenses / Letter from tax authorities over the past three years· Fixed asset details· Remittance requiring bank loan· Business licensePayment of dividends to nonresident shareholdersIn addition to the application form, the auditor must submit the audited financial statements, the shareholders' meeting resolutions to which the dividends have been made, etc. to the transaction bank in the event of paying a dividend.■ Investment incentives[Incentives by Industry Sector] Encouragement IndustryIn Pakistan, energy related businesses such as oil, gas, mining, electric power,Industry such as IT and communication service industries, manufacturing of electronic equipment, tourism, infrastructure industry, agriculture, housing and construction industry, industries such as automobile and metal products, privatization of oil, gas, infrastructure and electric power, etc. are encouraged It has been with.Encouragement contentsThe content of incentives will be changed by individual notification. Below are some examples of specific examples, but checking the latest information is essential when considering usage.· Import tariffs on factory equipment, machinery etc not manufactured in Japan ... 0% ~ 5%· Sales tax of factory equipment, machinery etc not manufactured in the country ... Exemption tax· Equipment and machinery etc. manufactured in Japan ... Notify by customs order form each time· C & F price exceeding 50 million dollars when establishing a new factory in the country ... 0% to 5%· Import duties on raw materials in export industries ... tax free· Import of machinery ... Exemption tax· First year depreciation cost of factory equipment, machinery etc. (excluding used, transportation vehicles, furniture) ... 25% Export Processing Zone (EPZ: Export Processing Zone)Various incentives are taken at the EPZ, it is outside the application of exchange control to export and the export of products is free. Import duties such as machinery, parts, spare parts, raw materials and the like necessary for production are exempt from tax, exempt from sales tax of electric gas fee, free transfer of capital and profit to home country etc are permitted.■ Regional information[Major city]In Pakistan there are four administrative districts under the jurisdiction of the state government and two administrative districts controlled by the federal government. Besides, there are two administrative districts where Pakistan is effectively controlled in the Kashmir region.

Export Processing Zone (EPZ: Export Processing Zone)Various incentives are taken at the EPZ, it is outside the application of exchange control to export and the export of products is free. Import duties such as machinery, parts, spare parts, raw materials and the like necessary for production are exempt from tax, exempt from sales tax of electric gas fee, free transfer of capital and profit to home country etc are permitted.■ Regional information[Major city]In Pakistan there are four administrative districts under the jurisdiction of the state government and two administrative districts controlled by the federal government. Besides, there are two administrative districts where Pakistan is effectively controlled in the Kashmir region. [Karachi]Location: Capital city of Sind Province. It is the largest city in Pakistan and located on the coast of the Arabian Sea in southern Pakistan.In 1947 Pakistan's independence, Karachi, which became the capital, was underdeveloped in a weak social infrastructure and economically. However, now industries and businesses have developed and developed as a commercial and financial center in Pakistan.The population of Karachi in 2015 is about 20 million, known as one of the world's largest metropolises, boasting the tenth city concentration in the world.It is also famous as the bank, industry, economic activity and trade center of Pakistan, including the largest in Pakistan, including those involved in textiles and transportIt is also becoming a corporate collective place of. Approximately 30% of Pakistan's investment in the manufacturing sector is in Karachi, Karachi's GDP accounts for 20% of Pakistan's total GDP. Karachi still continues building rush, not only residential and commercial buildings, but also high-end restaurants and mini department stores are on the rise.To Karachi, a railway runs besides Jinnah International Airport (Kaide-Asam International Airport), and Karachi Kant, the hub station of Pakistan National Railway, is connected to major cities in Pakistan by trains arriving everyday.According to JETRO's Survey on the Activities of Japanese-affiliated Companies in Asia and Oceania in 2014, the second place (50%) of problems on the production side is insufficient electric power · Inadequate logistics · Difficulty in procuring raw materials locally There are also points to be improved because there are others.In addition to domestic companies, IBM Karachi, IBM's leading IT firm Chevron (CVX), and U.S. pharmaceutical company Abbott Laboratories (ABT), have offices in Karachi. In addition, Japanese companies such as Mitsubishi Tokyo UFJ Bank, GS Yuasa Corporation, Hino Motors, Honda, Toyota Motor, NYK Line, ORIX, Otsuka Pharmaceutical, Suzuki, Marubeni, YKK and others are also expanding.In Karachi, Mitsubishi Corp. has established a PVC (PVC) facility and a salt electrolysis / vinyl chloride monomer (VCM) facility and started full-scale operation in October 2010. Due to the integrated production system from this raw material, further cost increases are anticipated as compared with imported VCM and further increase in sales is expected.In addition, in October 2011, YKK announced the addition of a factory in the Karachi export processing zone to strengthen the production capacity of clothing fasteners.We have invested a total of US $ 1.167 million and have set sales targets of $ 45 million in 2016.On the other hand, in June 2014 there was also negative news that armed groups raided Karachi International Airport and casualties appear.In October 2015, the Pakistan Investment Seminar 2015 was held at the Pakistan Embassy, and Suzuki and Yamaha Motor Company, which had already advanced, introduced the height of Pakistan's potential and the actual environment to promote attracting.[Lahore]Location: Punjab (Punjab). A city located on the bank of the River River in northern Pakistan.Lahore is the second largest city after Karachi, and it is a city with a population of 7.4 million people near the border with India. Many legacy of the Mughal Empire remains and has aliases such as "Mughal's Garden" and "Garden City". The world's largest "Birdshawe Mosque", "Lahore Fort" Fort and "Daughter and Ganzibakh" saints' temple built in the 17th century are crowded with many Muslim visits.The agricultural department for the production of wheat · cotton etc. and the processing of agricultural products is based, and it is the area where not only Japanese companies but also overseas enterprises have advanced to many areas.The Lahore International Airport is located 15 km from the center of Lahore city, and the terminal is expanded in March 2010.From July 2006, Honda is running a new motorcycle factory in Lahore city. The investment amount was about 2.4 billion Pakistan Rupee, and it became possible to reduce the liquid stock inventory of parts. Further improvement of quality is expected by introduction of electrodeposition painting.Industrial area[Special Economic Zone for Japanese Companies (JSEZ)]The Pakistan government has announced the Special Economic Zone (JSEZ) concept aimed at attracting Japanese companies in Binh Kasim Industrial Site near Karachi. As a result, besides technology transfer and employment creation, we aim to increase international competitiveness and increase revenues.In JSEZ, Japanese companies can secure at least 50 acres of land within Pakistan, and it will be possible to quickly establish the manufacturing industry within the National Industrial Park.[Textile Industry Specialized Industrial Park]The industrial park specializing in the textile industry is an industrial area specialized in textile processing and related industries, which has 1,250 acres in total area "Pakistan Textile Town(PTC: Pakistan Textile City) project.PTC expects exports of value-added textiles and employment of 80,000 people instead of providing cutting-edge environment, uninterruptible power supply, clean water source, natural gas, wastewater treatment and efficient transportation system to textile processing industry It will be.

[Karachi]Location: Capital city of Sind Province. It is the largest city in Pakistan and located on the coast of the Arabian Sea in southern Pakistan.In 1947 Pakistan's independence, Karachi, which became the capital, was underdeveloped in a weak social infrastructure and economically. However, now industries and businesses have developed and developed as a commercial and financial center in Pakistan.The population of Karachi in 2015 is about 20 million, known as one of the world's largest metropolises, boasting the tenth city concentration in the world.It is also famous as the bank, industry, economic activity and trade center of Pakistan, including the largest in Pakistan, including those involved in textiles and transportIt is also becoming a corporate collective place of. Approximately 30% of Pakistan's investment in the manufacturing sector is in Karachi, Karachi's GDP accounts for 20% of Pakistan's total GDP. Karachi still continues building rush, not only residential and commercial buildings, but also high-end restaurants and mini department stores are on the rise.To Karachi, a railway runs besides Jinnah International Airport (Kaide-Asam International Airport), and Karachi Kant, the hub station of Pakistan National Railway, is connected to major cities in Pakistan by trains arriving everyday.According to JETRO's Survey on the Activities of Japanese-affiliated Companies in Asia and Oceania in 2014, the second place (50%) of problems on the production side is insufficient electric power · Inadequate logistics · Difficulty in procuring raw materials locally There are also points to be improved because there are others.In addition to domestic companies, IBM Karachi, IBM's leading IT firm Chevron (CVX), and U.S. pharmaceutical company Abbott Laboratories (ABT), have offices in Karachi. In addition, Japanese companies such as Mitsubishi Tokyo UFJ Bank, GS Yuasa Corporation, Hino Motors, Honda, Toyota Motor, NYK Line, ORIX, Otsuka Pharmaceutical, Suzuki, Marubeni, YKK and others are also expanding.In Karachi, Mitsubishi Corp. has established a PVC (PVC) facility and a salt electrolysis / vinyl chloride monomer (VCM) facility and started full-scale operation in October 2010. Due to the integrated production system from this raw material, further cost increases are anticipated as compared with imported VCM and further increase in sales is expected.In addition, in October 2011, YKK announced the addition of a factory in the Karachi export processing zone to strengthen the production capacity of clothing fasteners.We have invested a total of US $ 1.167 million and have set sales targets of $ 45 million in 2016.On the other hand, in June 2014 there was also negative news that armed groups raided Karachi International Airport and casualties appear.In October 2015, the Pakistan Investment Seminar 2015 was held at the Pakistan Embassy, and Suzuki and Yamaha Motor Company, which had already advanced, introduced the height of Pakistan's potential and the actual environment to promote attracting.[Lahore]Location: Punjab (Punjab). A city located on the bank of the River River in northern Pakistan.Lahore is the second largest city after Karachi, and it is a city with a population of 7.4 million people near the border with India. Many legacy of the Mughal Empire remains and has aliases such as "Mughal's Garden" and "Garden City". The world's largest "Birdshawe Mosque", "Lahore Fort" Fort and "Daughter and Ganzibakh" saints' temple built in the 17th century are crowded with many Muslim visits.The agricultural department for the production of wheat · cotton etc. and the processing of agricultural products is based, and it is the area where not only Japanese companies but also overseas enterprises have advanced to many areas.The Lahore International Airport is located 15 km from the center of Lahore city, and the terminal is expanded in March 2010.From July 2006, Honda is running a new motorcycle factory in Lahore city. The investment amount was about 2.4 billion Pakistan Rupee, and it became possible to reduce the liquid stock inventory of parts. Further improvement of quality is expected by introduction of electrodeposition painting.Industrial area[Special Economic Zone for Japanese Companies (JSEZ)]The Pakistan government has announced the Special Economic Zone (JSEZ) concept aimed at attracting Japanese companies in Binh Kasim Industrial Site near Karachi. As a result, besides technology transfer and employment creation, we aim to increase international competitiveness and increase revenues.In JSEZ, Japanese companies can secure at least 50 acres of land within Pakistan, and it will be possible to quickly establish the manufacturing industry within the National Industrial Park.[Textile Industry Specialized Industrial Park]The industrial park specializing in the textile industry is an industrial area specialized in textile processing and related industries, which has 1,250 acres in total area "Pakistan Textile Town(PTC: Pakistan Textile City) project.PTC expects exports of value-added textiles and employment of 80,000 people instead of providing cutting-edge environment, uninterruptible power supply, clean water source, natural gas, wastewater treatment and efficient transportation system to textile processing industry It will be.

-

-

-

References

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya