Thailand

3 Chapter Incorporation

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.1 Strong Economic in Thailand

2.2 Trade Liberalization in Thailand

2.5 Advantages of Investment in Thailand

3 Chapter Incorporation

3.1 Characteristics of business base

3.4 Investigation of entry schemes for each business type

3.5 How to establish a regional headquarters

3.6 Establishment of business base

3.7 Company liquidation and withdrawal

4 Chapter M&A

4.2 General M&A regarding to Corporate Law

4.3 Summary of applicable Laws for M&A

4.4 Difficulty of business and corporate evaluation

4.5 Foreign Investment Restriction

4.8 Securities and Exchange Act B.E. 2535

5 Chapter Corporate Law

5.1 Types of Thailand Business Structures

5.2 Annual General Shareholders’ Meeting in Thailand

5.3 Director and Board of Director

5.6 Dividend and Legal Reserve

6 Chapter Accounting System

6.1 Overview of accounting system

6.2 Person Responsible for accounting record

6.4 Problem and accounting system

6.5 Disclosure system and disclosure practice

7 Chapter Tax

7.2 Several issues on domestic tax law

7.3 File a Tax Return and Payment

8 Chapter Labor

8.1 Labor environment in Thailand

8.3 Social security system in Thailand

8.4 Points to keep in mind while having Japanese people in Japan

9 Chapter Q&A

-

-

-

Characteristics of business base

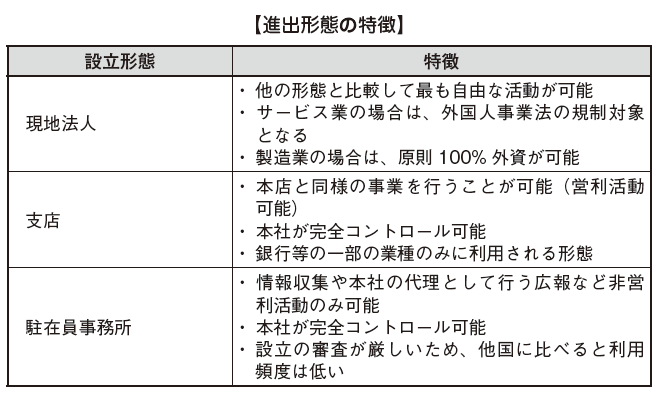

When establishing a business base in Thailand, it is important to establish the base in what form according to the commercial trading law, the foreign business law (revised 1999, enforced in March 2000).

In Thailand, the establishment of overseas affiliates, branch offices and expatriate offices are permitted and these can be selected for the purpose of advancement.

-

Local corporation

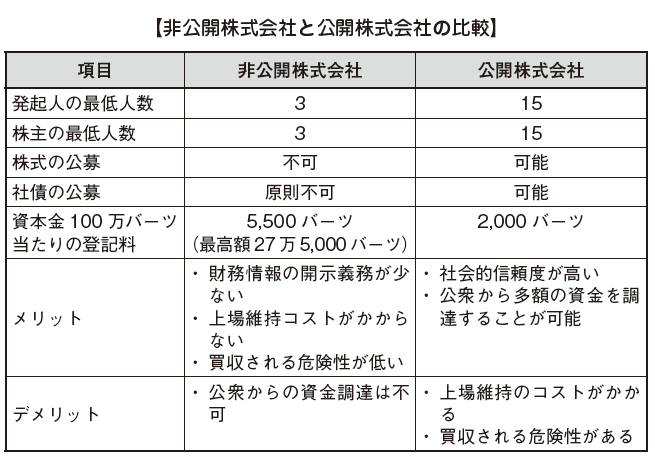

■ Co., Ltd.The company system in Thailand adopts the corporate system as well as in Japan. Limited Company is a form in which all shareholders assume an indirect limited liability and can be divided into private companies and public companies depending on whether or not the transfer of shares is restricted.

· Private Limited CompanyPublic Limited Company

Nonpublic corporation refers to a company which restricts the transfer to all shares by the articles of incorporation.Public Co., Ltd. is a stock company premised on listing of shares, solicitation of shares through the stock exchange, capital raising calls for shareholders from the public. There are 657 companies listed on the Thai Stock Exchange as of October 27, 2014.

[Comparison between private company and public company]Requirements concerning the establishment of private company and public company are as follows.

-

Branch office

A branch is an office that is established as necessary to develop sales operations similar to the head office mainly in an area remote from the head office, and the point that it is a form of advancement in which sales activities are possible will be described later It is different from the representative office. In order for foreign branch offices to obtain business approval, it is necessary to bring at least 3 million baht to Thailand as activity funds. In addition, there are restrictions imposed by the Foreign Investment Business Law, and it is the current situation that there are not many cases where installation other than banking and other financial services is permitted. In addition, in the construction industry, in case of advancement by a joint venture (JV) for each project, the case of setting up a branch is approved.Besides, tax and legal responsibilities of branches are complicated across Thailand and Japan. If the headquarters of a foreign company gains direct income from Thailand it may be deemed to be subject to taxation in Thailand by the Revenue Department.The disadvantage is that there is a risk that such legal responsibility extends to the head office. -

Representative office

The representative office is an office registered for the purpose of carrying out limited "nonprofit activities" mainly such as information gathering. In addition, it is not regarded as "permanent establishment (PE)" as a tax treaty, it is not subject to corporate tax levies, it has no authority to earn income or to conduct negotiations with individuals or corporations in Thailand, which we can not do commercial business.

The limited "nonprofit activities" are as follows.

· Arranging goods or services for the head office

· Survey and control of the quality and quantity of products purchased or contracted from the head office

· Provide advice on products sold by head office to agents and consumers in Thailand

· PR for new products and services at head office

· Report business trends in Thailand to the head office

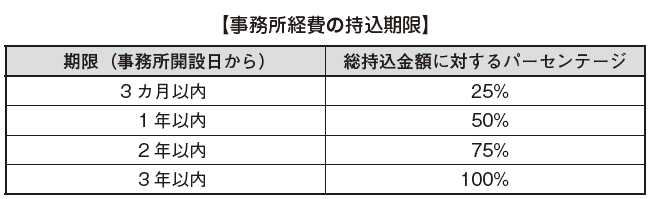

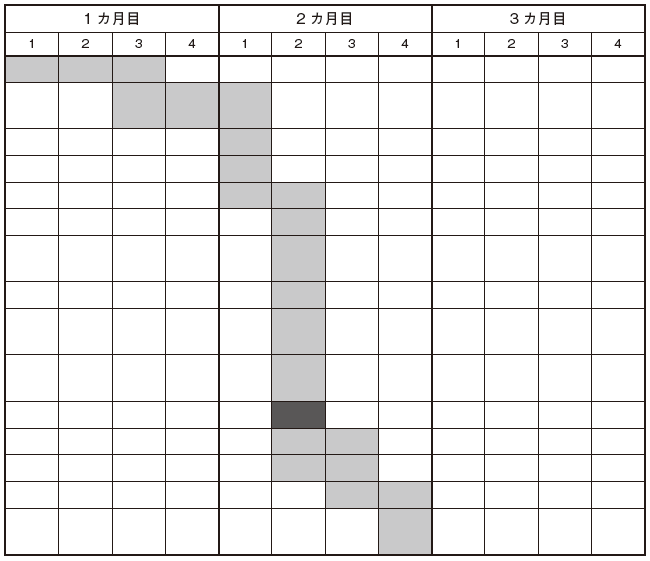

Recently, reviewing the establishment of a representative office has become strict in order to prevent sales activities from being held as a representative office. Also, as in the case of the branch form mentioned above, it is also necessary for the representative office to bring in office expenses of at least 3 million baht or more in order to acquire a foreign business license (FBL: Foreign Business License) It is stipulated as. The expenses must be brought in within 3 years, and more than the percentage (for the total carry-in amount) determined within the prescribed period will be paid. Regarding the period of bringing such expenses, it is as follows.

Since the scope of the representative office is limited to approved ones, if you do other profit activities, you are subject to PE certification and there is a risk that corporate income tax will be levied. Also, it is necessary for the representative office to obtain the taxpayer number of the corporation even without the tax payment amount, prepare the financial statements, and submit the final return to the tax office.

-

Other business forms

In case of entering Thailand, most enterprises will set up a local corporation or establish a representative office, but because the Commercial Code also allows other forms of business, I will wright down as a reference.

■ Individual business

An individual business (Sole Proprietorship) is a business owned by one individual and refers to an entity without corporate status. In Thailand, individual business under Japanese name is not allowed. Therefore, when entering into a personal business form, you will be doing business under the name of a reliable Thai friend or Thai spouse. However, there is a possibility that individuals and companies are equated, so that all business and personal assets of business owners may be subject to legal actions such as seizure in connection with the business There is a need to pay attention.

■ Partnership

Partnerships are defined as "contracts for two or more people to join together to form a joint venture for the purpose of profit." It is an image close to a Japanese equity company.

Normal partnership (Registered Ordinary Partnership)

Limited Partnership

Normal partnership is the form that all partners assume unlimited liability (employee's responsibility is not limited to contribution amount). By registering with the Ministry of Commerce, we have a separate corporate status separate from each of our constituent partners. It is a corporate form close to a partnership company in Japan.

As unlimited liability is a prerequisite, it is rarely used in Thailand as well, as it is rarely used in Japan.

The limited partnership consists of unlimited liability employees and limited liability employees (the responsibilities of employees are limited to the amount of contribution). Since there is "Limited", all employees have an impression like limited liability, but it is a form close to the Japanese joint-stock company. In legal terms, there is a risk that all partners must bear unlimited liability until registration is completed, regarded as an ordinary partnership.

Since July 1, 2008 the incorporators established by the Corporation have been relaxed from seven to three, the merit of the establishment of a limited partnership has almost disappeared and it has not been used much in recent years.

■ Non Registration Ordinary Partnership

Unregistered Ordinary Partnership is not a registered company because it does not have a registered corporation and contracts between partners become private so that all partners jointly and unlimited liability for all obligations It is defined as having a form with.

■ Joint venture

A joint venture (JV) generally refers to a company created by a plurality of companies brought in the company's specialty fields of technology, marketing capabilities, brands and the like in order to execute a specific business, the people In the Commercial Code joint venture is not yet recognized as a corporation.

However, under the Revenue Code, even if it does not have a corporate status, it is taxed as well as a company, so it is not legally completely denied.

In addition, joint venture is used when developing projects on a project basis under the mutual agreement of both parties, etc. If one is a foreign company, temporarily register the branch during the project period and operate.

-

-

-

Investment regulation

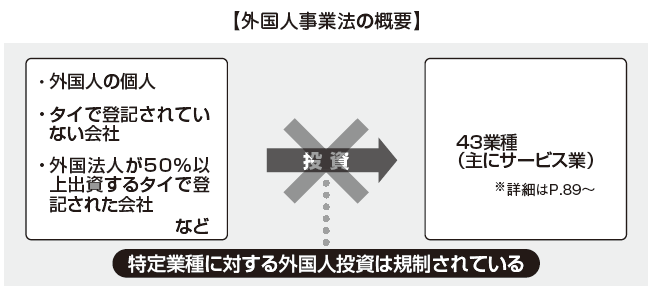

In Thailand, there is regulation by the Foreign Business Act (FBA) in order to protect and nurture their own capital.The Thai government realizes the conflicting objectives of foreign investment attraction policy and domestic capital protection policy by using the two laws of "Investment Promotion Act" and "Foreign Business Act", and encourages their economic development . -

Foreign investment regulation by foreign business law

■ Foreign business law

The Foreigners Business Act was enacted in 1972 for the purpose of regulating the businesses of foreigners under the military regime, but was drastically revised in 1999 to promote the introduction of foreign capital and technology, 2000 It took effect from March. The Foreigners Business Law is a very important law as it greatly affects the investment ratio when entering Thailand. Under this law, regulated industries are divided into 43 industries and three regulated industries are regulated entry of "foreigners (see definition of foreigners below") to those industries.

■ Restricted industries

As stated above, in the Foreign Business Act, regulated industries are divided into three groups, Type 1, Type 2, and Type 3.

The manufacturing industry is basically not subject to regulation, but as service industry is said to be "other service industry" in the 3rd type list, all service industries are subject to regulation by the law . This applies not only to overseas affiliates, but also to branch offices and representative offices. In principle, you can not do business if the business you intend to do in Thailand falls under the regulated industries, with foreign capital of 50% or more (see the definition of foreigners). However, if it falls under category 2 or 3, if you obtain a foreign business license from the Department of Commerce or you obtain the approval of the Thai Investment Committee (BOI), a company with 50% foreign capital It is also possible to establish.

The details are as follows.

[Regulated Industry under Foreign Business Law]

Type 1

The first type is a type of business banned for "foreigners" for special reasons, and in principle "foreigners" can not enter.

· Newspaper business, radio broadcasting business, television broadcasting business

· Animal husbandry

· Rice crops, field crops, gardening

· Wood processing of forest and natural forest

· Fishery in territorial waters and economic zones of Thailand

· Processing of Thai herbs

· Sales and auction of antique art goods in Thailand country's historical value

· Buddha statue and bowl manufacturing

· Land transactions

Type 2

Type 2 is a business related to national security or security, or industries that affect Thai traditional culture, crafts, natural heritage, environment. These are said to allow "foreigners" to do business if they obtain permission from the Minister of Commerce with the approval of the Foreign Business Committee or obtain permission of BOI, but entry barriers are high.

Industry concerning national security and stability

· Manufacture, sale and repair of the following

- guns, bullets, gunpowder, explosives

- Parts of guns, bullets, explosives

- Battle weapons, military aircraft and vehicles

- various battlefield equipment, parts

· Onshore, maritime, aircraft transportation and domestic aviation industry

Industry that affects art, tradition, crafts

· Trading of Arts and Crafts in Thailand

· Manufacture of wooden sculpture

· Production of sericulture, Thai silk, Textile of Thai silk or printing of Thai silk cloth

· Manufacture of Thai instruments

· Manufacture of gold products, silver products, artificial products, inlaid gold products, lacquerware

· Manufacture of bowls, dishes or ceramics which are traditional crafts in Thailand

Industries that affect natural resources or the environment

· Sugar from sugarcane

· Salt production at salt field

· Salt from rock salt

· Mining including blasting, crushed stone

· Wood processing for manufacturing furniture and tools

Type 3

The third type is an industry that has not yet been competitive with "foreigners", approved by the Foreign Business Committee and approved by the Director of the Business Development Department, or under the encouragement of the BOI, "Foreigners "Can do the business.

· Milling from milled rice, rice and grain

· Hatchery Fish

· Afforestation

· Manufacture of plywood, bay plate, chip board, hard board

· Manufacture of lime

· accounting firm

· a law office

· Building office

· Technology office

· Construction (excluding the following)

- Construction industry that provides basic services to citizens concerning public facilities or telecommunications transport, with minimum capital of foreigners of 500 million baht or more, requiring special equipment, machinery, technology and expertise

- Other construction industry specified by ministerial ordinance

· Brokerage business, agency business (excluding the following)

- Securities trading brokerage, agency business. Futures trading of agricultural products or financial securities

- Brokerage, mediation, substitution, or service necessary for manufacturing within the same enterprise, services required for manufacturing, technical services

- Intermediary or agency business for buying and selling products imported from Thailand with a minimum capital amount of 100 million baht for foreigners, cultivation of domestic and foreign markets, sales business

- Other intermediary, agency business specified by ministerial ordinance

· Auction business (excluding the following)

- Thailand's art, crafts, artifacts, auctioned by international bidding of Thai historically valuable antique, antique art, or art work

- Other auctions specified by ministerial ordinance

· Domestic transactions of local agricultural products not prohibited by law

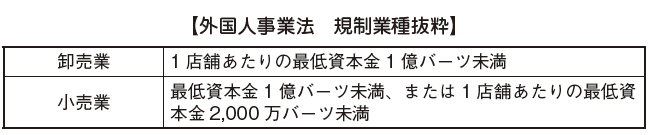

· All types of retailers with minimum capital including all including less than 100 million baht, or minimum capital amount per shop less than 20 million baht

· Wholesale of all products with minimum capital amount per store less than 100 million baht

· Advertising

· Hotel business (excluding services for hotels)

· tourism

· restaurant

· Seedlings and breeding industry

· Other service industries (excluding industries specified by ministerial ordinance)

■ Definition of "foreigners" subject to regulation

It is most important to understand the definition of "foreigners" subject to regulation. Under the Foreign Business Law, the definition of "foreigners (Con · Turndao)" is as follows (Foreigners Business Act Article 4).

· Natural people who do not have Thai nationality .................................... ①

· Corporations not registered in Thailand .................................... ②

· Those that are legal entities registered in Thailand but fall under the following forms ...........................................................

A corporation in which a person falling under (1) or (2) holds more than half the shares as a capital, or a person falling under ① or ② has invested more than half of the total capital

A person who falls under (1) is a joint-stock company or a partnership company registered as a business executing employee or manager

· A corporation in which a person falling under ①, ② or ③ is registered in Thailand and a corporation holding more than half the shares as a capital or a person falling under ① or ③ invests more than half of the total capital ................. ④

In other words, if foreign capital accounts for more than 50% of the total capital, it is considered a "foreign corporation". Meanwhile, if you establish a joint venture with 51% of Thailand and 49% Japan, it will be "Thai corporation" and will not be subject to foreign business law as it does not fall under "Foreign corporation".

If the business planned to be deployed in Thailand falls under the regulated industry category, in case of entering with 50% or more of investment form, it will be subject to such regulation, so it is necessary to check in advance. Also, since most of regulated industries are industries other than manufacturing industry, we must consider carefully especially when entering outside of manufacturing industry.

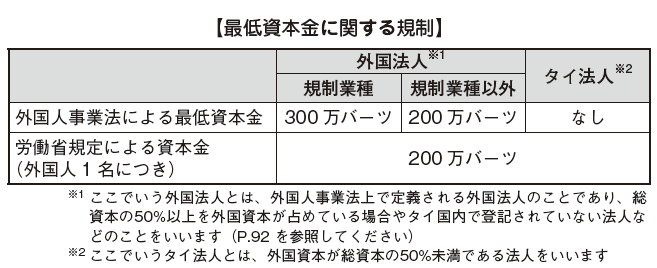

■ Regulations concerning capital

Under the Foreign Business Law, in principle, minimum capital of 3 million baht or more is required when foreign companies acquire special approval for regulated industries mentioned above and conduct business.

However, the minimum capital of foreign companies is over 2 million baht if they do not fall under regulated industries. In addition, 2 million baht is required to obtain a work permit for one foreigner regardless of foreign corporation or Thai corporation. For corporations that are encouraged by BOI, additional minimum capital requirement is added, and one million baht is required except for land and working capital.

-

Regulation on land ownership

In the Land Act (Established in 1954, revised in 1999 and 2008), foreigners or foreign corporations (in cases where foreigners have more than 49% of capital or more than half of foreign shareholders) own land In principle, we prohibit it.However, in the case of a company located in an industrial estate certified by a BOI encouraging company or Thailand Industrial Estate Authority of Thailand (to be mentioned later), land acquisition is possible regardless of the foreign ownership ratio. As a result of the amendment in 1999, if foreigners invested over 40 million baht from foreign countries, if it is less than 1 Rai (1,600 m 2 = approximately 485 tsubo), it is now possible to own the land for the residence. In this way, although deregulation has been gradually relaxed, the actual situation is that restrictions on land ownership by foreign capital are still severe. -

Regulation by factory law

The purpose of the factory law (Established in 1969, revised in 1979, 1979, 1992) is to secure workers' safety and prevent pollution, and factories that use power sources of roughly 50 horsepower or higher are regulated by this law It must be covered and it is necessary to obtain a permit (validity period 5 years) before operation. Generally, when a factory is newly established, a contractor acts on behalf of obtaining a license, but it is necessary to confirm whether or not the substitute firm firmly obtain permission. In addition, permission application is required even when changing or expanding facilities in the factory. -

Regulations concerning employment of foreigners

■ Regulations on employment of foreigners

The Working of Aliens Act (Established in 1978, revised in 2008) sets out 39 industries for which foreign workers are prohibited in Thailand and the basis for acquiring work permits for foreigners (work permit) It is a law. In recent years, problems such as illegal work have occurred due to an increase in the number of workers from neighboring countries, and it is enacted for the purpose of strengthening crackdown on such foreign workers. For details, see "Labor".

■ Employment obligation of local people

In order to establish a local subsidiary in Thailand, foreign nationals are obliged to employ four Thai people for one foreigner in order to obtain a work permit. Traditionally, there were only provisions and practical operation was not so strict, but in recent years there have been instances in which the number of office desks and employee lists are overturned and investigated. In the case of a company operated on a small scale, it is often difficult to hire four Thai people, so by hiring secretaries, maids, drivers, messenger boy etc. as regular employees, as a countermeasure, some companies are making evasions.

Meanwhile, when conducting business in BOI encouraged industries and IEAT industrial parks, the requirement for obtaining foreign work permits is relaxed.

-

Regulation by Foreign Exchange Control Law etc.

■ Legal basis for foreign exchange managementIn Thailand, regulations are established by the 1942 Foreign Exchange Control Act (Exchange Control Act. B. E.2485), 1954 Ministerial Regulations No. 13 B. E.2497, Central Bank Notice, etc.

■ Trade TransactionThere are methods such as prepayment remittance, import letter of credit, bills to be collected (D / P, D / A), postpay as settlement methods, and payment currency for both receipt and payment is not specified.

[export]For exports of more than US $ 50,000 equivalent in foreign currency, exporters are obliged to settle immediately after receipt of foreign currency or within 360 days from the date of export, and residents are required to pay foreign currency by export and other transactions If acquired, you must either sell foreign currency or deposit it in foreign currency deposit within 360 days after acquiring foreign currency.In the case of exporting foreign currency whose receipt amount is 1 piece or more equivalent to 500 thousand baht, the exporter needs to make a predetermined notification to the customs.

[Import]Importers can purchase foreign currency freely or withdraw money freely from foreign currency deposit if there is a document that can prove actual demand.

■ Non-trade transactionsIn case of remittance (receipt) to Thailand, there is no limit as long as remittance with Bahts. If receipts in foreign currency are over US $ 5,000 and it is not export payment receipt, it is necessary to report to Thai central bank via exchange bank.Remittance (payment) from Thailand to foreign countries is free regardless of baht or foreign currency denomination. However, if remittance in foreign currency is over US $ 50,000 and it is not payment for import fee, it is necessary to report to Thai central bank via exchange bank.

[Capital transaction]In principle, direct investment in indigenous companies in Thailand, indirect investment, lending to a Thai subsidiary is free. With the documentation of direct investment funds, you can collect from foreign countries, collect loans, collect interest, and collect profits freely. However, if it exceeds 50,000 US dollars in a foreign currency, it is necessary to report it to the central bank via a foreign exchange bank.When investing directly in a foreign company from Thailand, there is no upper limit on the investment amount if you own 10% or more of the foreign company's interests. There is no restriction on direct investment and lending to overseas group companies. Regarding loans to non-Overseas Group companies, approval from the Thai Central Bank is not required for loans up to US $ 50 million per year.Regarding the above investment and lending, except for transactions with some parts of Vietnam and Thailand neighboring countries, in principle it is limited to transactions in foreign currency.

■ Acceptance of foreign currencyForeign currency acceptance is free, but you must either sell it to a foreign exchange bank within 360 days, or deposit it in a foreign currency deposit, except for passengers, embassies and international organizations staying within 3 months.

■ Foreign Currency DepositResidents can open foreign currency savings accounts in foreign exchange banks in Thailand, and if they can prove actual transactions on bahts owned domestically in addition to those received from foreign countries regarding funds to deposit from Baht You can exchange it for foreign currency and fill it.For non-residents you can also open a foreign currency savings account in Thai domestic foreign exchange bank. However, for deposits from Thailand, borrowing from domestic banks, etc., it is necessary to submit documents showing actual demand.

-

-

-

Investment incentives

In Thailand there are several investment incentives to promote investment. Typical examples are incentives by the Thai Investment Committee (BOI) based on the Investment Promotion Act and the Thai Industrial Complex Authority (Thailand) based on the Industrial Estate Authority of Thailand Act (Thailand) There is an incentive by IEAT).In addition to tax incentives such as corporate tax cuts and tariff reductions, there are many merits such as the possibility of acquiring land which foreign investment normally does not allow, so in the case of entering Thailand, these preferential treatments It is necessary to consider whether to use measures. The current BOI Investment incentive measures are revised in 2015 1 year. -

New investment incentive measures

Introduce new investment incentive plan

The Thai Investment Committee (BOI) approved a new investment incentive plan from 2015 to 2021 at this committee chaired by Prime Minister Prayuth on November 25, 2014, and has been in effect since January 1, 2015. Changes include the abolition of zone-specific incentive schemes and the narrowing down of encouraged industries, which may affect foreign-funded enterprises.

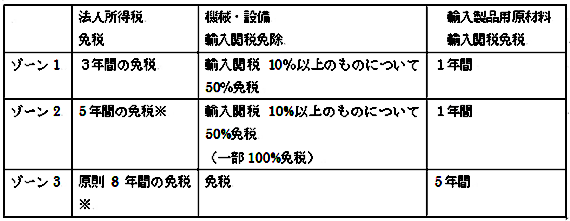

■ Abolition of privilege system by zone

Regarding taxation incentives for traditional BOI, incentive measures were set for each zone by dividing the whole country into three zones. However, in the new investment incentive plan (2015 - 2021), this zone system has been abolished and changed to a way to change the contents of benefits depending on the type of industry.

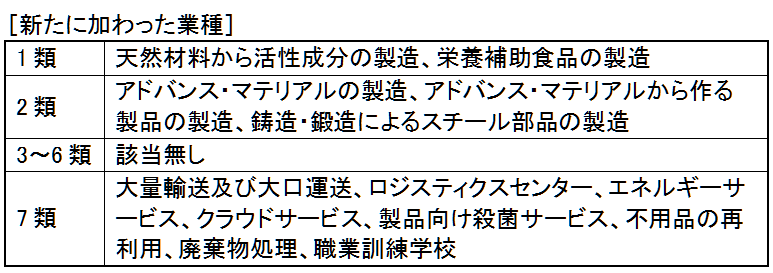

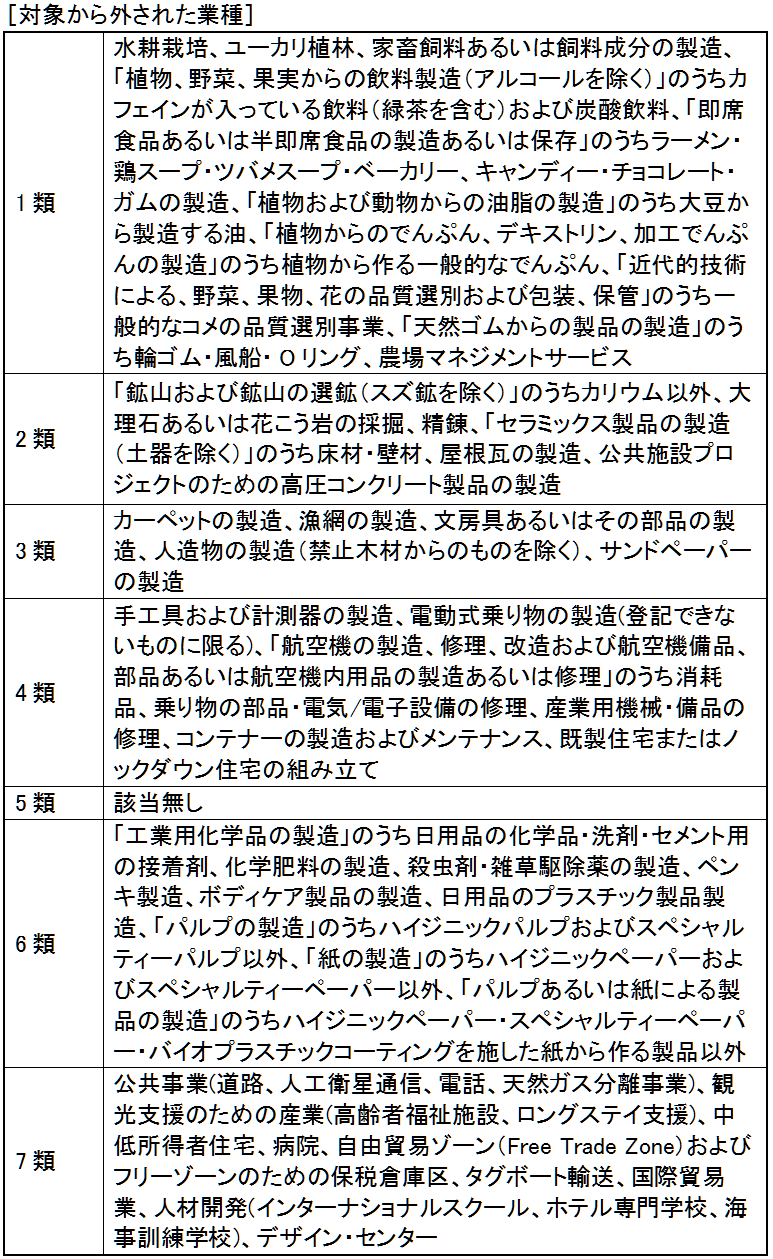

■ Narrow down the encouraged industries

In the New Investment Incentive Plan (2015 - 2021), we are reducing investment promotion industry. From the encouraged industries targeted up to the past, it has been narrowed down to "businesses that are extremely important for economic structural reform in Thailand".

As a field to be encouraged as usual there are agriculture and agricultural products, manufacturing industry, mining, ceramics, basic metals, light industrial products, metal products, machinery, transportation equipment, electronic and electrical equipment, chemical industry, paper and plastics, services, although it will be a public works project, it is necessary to note that there are industries that are excluded from incentives among these fields.

Specifically, the target industries newly joining in the new investment incentive plan and the industries excluded from the target are as follows.

Japanese companies and foreign companies that are considering business in Thailand need to pay close attention to whether their business falls under the incentive industry and how much benefit can be obtained if they fall under the encouraged business category.

-

Benefits of using investment incentives and points to keep in mind

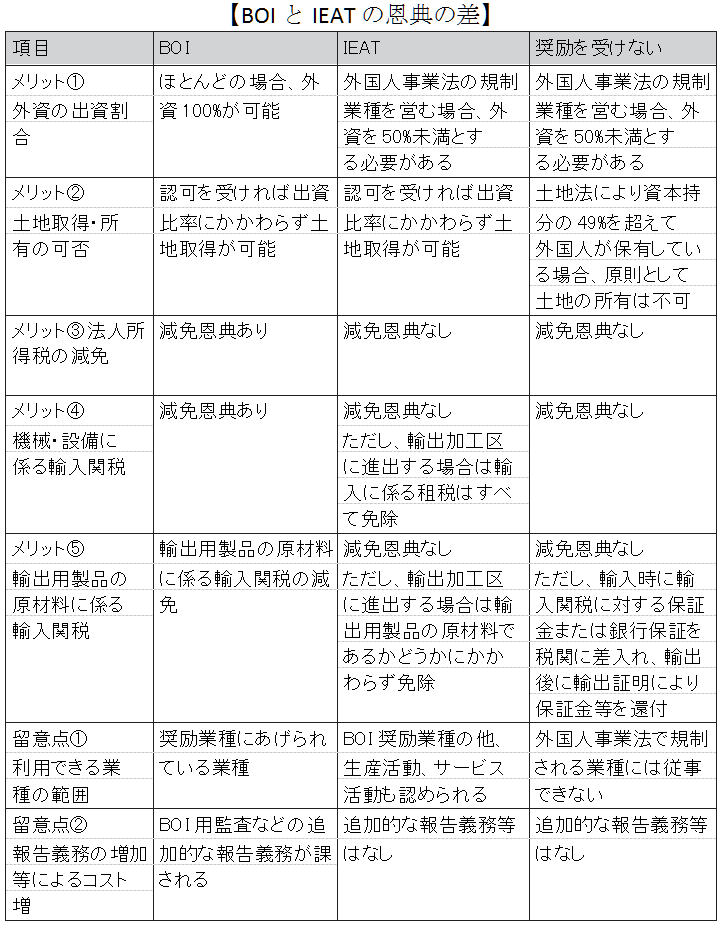

As mentioned above, there are large investment incentives by BOI and IEAT, but the merits and points to keep in mind by using these incentives are summarized as follows.

[Benefits ① Percentage of ownership of foreign capital]

When establishing a sales company or a service company in Thailand, the proportion of foreign capital ownership is limited to less than 50% by the regulation of the Foreign Business Act. However, if you can receive the encouragement of BOI, in most cases 100% foreign capital will be accepted.

[Advantages (2) Acquisition of land]

In Thailand, a company with a foreign capital exceeding 49% can not acquire land under the regulation of land law. However, if you can obtain the approval of BOI or IEAT, you can acquire the land even if you have a company with a foreign capital exceeding 49%.

[Merit (3) ~ (5) Preferential treatment in terms of taxation]

If we can obtain approval of BOI, we can receive reduction and exemption for corporate tax and customs duty. Also, if you enter the industrial park (limited to the free zone) under the jurisdiction of IEAT, you can receive the customs benefits.

[Points to remember ① Scope of industries that can be used]

Encouragement of BOI will be approved for business benefits for Thailand. Therefore, it is necessary to be a business that meets the purpose of introducing new technology, expanding employment, acquiring foreign currency.

[Points to remember ② Cost increase due to an increase in reporting obligation etc.]

If you are encouraged by BOI, there are many merits as mentioned above, but on the other hand there is a disadvantage of increasing management costs. For example, if it is a usual account settlement, you should prepare financial statements, but companies that have received BOI approval should prepare a production report, etc., and whether the project is appropriately managed and managed as planned You have to be checked. As a result, management costs will rise.

Utilization of these incentive measures will greatly contribute to not only reducing investment risk by shortening the investment collection period but also improving the business activity environment for business development in Thailand, as there is also a disadvantage of increased management costs, when doing so, it is absolutely necessary to consider the effect of these incentives. Here we describe the requirements and benefits of receiving BOI and IEAT incentives. Each application procedure will be described later.

-

Investment incentive policy by BOI

■ What is Investment Promotion Act

The Investment Promotion Act (Established in 1977, revised in 1991 and 2001) is for the promotion of industries in Thailand, encourages new businesses and grants benefits for investments that meet the conditions. Benefits include tax benefits as well as the possession of land for the launch of the business and the provision of accommodation for foreign labor permits.

It is applied equally not only to launching new business by foreign-funded enterprises but also to new business of domestic enterprises, but the object to be encouraged is limited to corporations. Also, in order to receive incentives, you must apply to the BOI and get approval after receiving the review.

Many foreign companies will first apply for investment encouragement to BOI because they can enjoy various benefits (taxation and non taxation) as long as they conform to the conditions of the Investment Promotion Act. If foreign capital holds more than 50% capital, certain industries will be subject to entry regulations and business regulations by the Foreign Business Act, but for businesses approved by BOI it will be out of regulation and entry into foreign capital at 100% It is a great merit that it is recognized.

The content of this BOI benefit changes greatly depending on whether it is an industrial park operated by IEAT, an industrial park operated by a private company approved by BOI, or whether it will enter an industrial park not undergoing any certification. In particular, considering the influence of the factory on neighboring residents such as pollution, we encourage the operation within the industrial estate, so it is assumed that the benefits are extremely thin when operating outside the industrial estate. Therefore, it is necessary to examine individual details to be described later and think about a method to utilize investment encouragement well.

■ What is the Thai Investment Committee?

The Thai Investment Committee (BOI) is in charge of implementing the Investment Promotion Act. The BOI is an agency that provides incentives to promote investment in Thailand, with the Prime Minister as chairperson, the Minister of Industry as vice chairman, besides economic relations ministers, representatives of the Thai Industry Federation, major private organizations, consists of advisory committee members.

The BOI decides and changes the industry to be encouraged, investment conditions, benefits based on the Investment Incentive Law, and the Office of the Board of Investment, the actual organization of the BOI, makes specific decisions on the BOI concretely Preliminary examination to propose investment projects to committees, subcommittees, guidance and approval of licensing projects, surveillance of investment environment, dissemination, domestic and foreign investment promotion activities, licensing business, to enterprises entering Taiho from now on We support a wide range of activities, such as support activities.

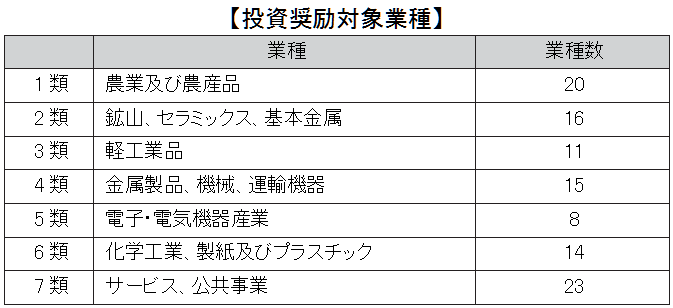

■ Target Industry

As of January 2015, the number of industries subject to investment promotion is seven types 107 industries. The target industries and the number of industries are as follows.

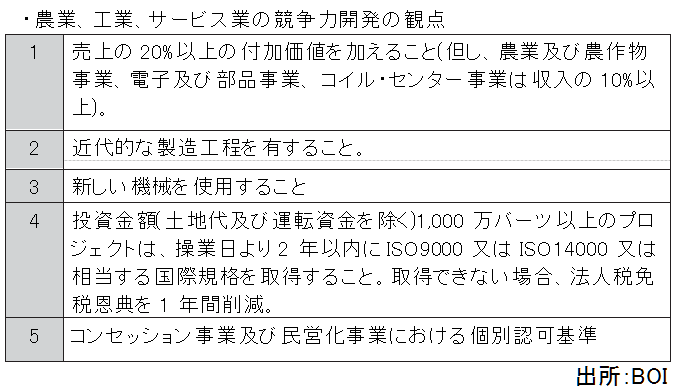

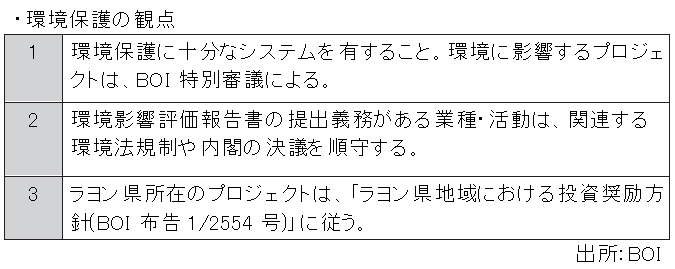

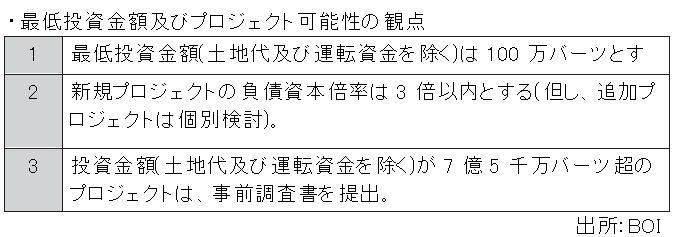

■ Requirements for receiving incentives by BOIThe requirements for receiving benefits of BOI are defined as follows from three viewpoints.

In Thailand, there is no under-capital tax system, but as for BOI's licensed project, as shown in "2 of the viewpoint of minimum investment amount and project possibility", financing by borrowing is only 3 times the amount of capital Because it is not allowed, attention is necessary.

■ Contents of preferential treatment by BOIThe contents of incentive measures can be broadly divided into taxation and non taxation aspects..png)

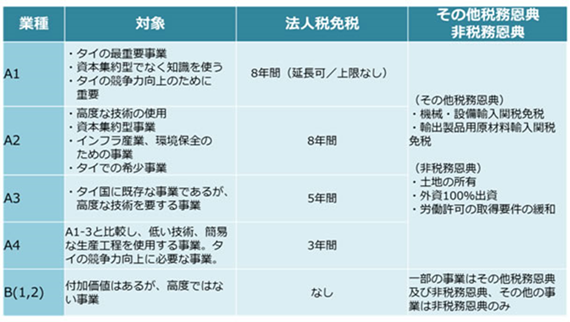

Among them, the tax benefits will change depending on the type of industry as follows, regarding tax preferential treatment.[Preferential treatment system by encouraging new BOI]

In addition, the former system was not a type of industry, but the contents of benefits were different depending on the zone as follows.

【Preferential treatment system by encouraging former BOI】

-

Encouragement by IEAT

■ What is Thai Industrial Estate Public Corporation

The Thai Industrial Complex Authority (IEAT) is responsible for the development of the industrial estate and is the Ministry of Industry Ministry responsible for the purpose of spreading industrial development across Thailand by running an industrial estate.

We are implementing incentive policies only for the investment in industrial estates that are operated based on Thai Industrial Estate Public Corporation Law.

[One stop service]

IEAT has a close relationship with the Ministry of Industry as an organization under the direct control of the Ministry of Industry and has provided a one stop service to act as a substitute for a series of tasks originally carried out by the Ministry of Industry's Factory Bureau regarding factory establishment permission and factory operation permission .

Specifically, IEAT has set up a one-stop service center to purchase and rent land, consult on appropriate factory construction sites, various permission / authorization applications necessary for factory establishment, and collaboration of industrial estates We make it possible to do all the procedures related to IEAT, such as development, with one stop.

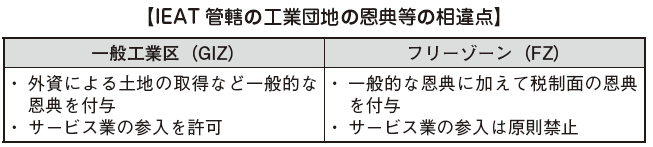

[General industrial zone and free zone]

The industrial park area is divided into two types: general industrial zone (GIZ: General Industrial Zone) and free zone (IEAT Free Zone). If you enter the Free Zone you can receive tax benefits.

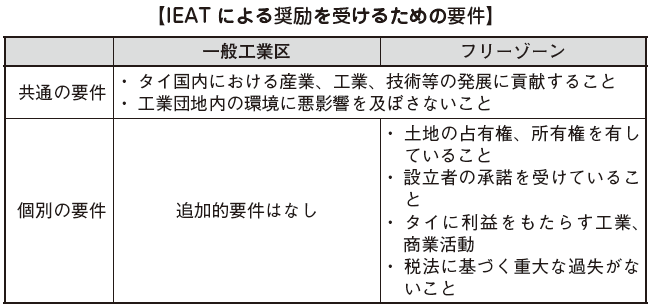

■ Requirements for receiving encouragement by IEAT

In order to be encouraged by the IEAT, it is necessary to enter the industrial park under the jurisdiction of IEAT. As mentioned above, industrial parks under the jurisdiction of IEAT are divided into general industrial zones and free zones. In addition to the requirements common to both industrial zones, there are individual requirements for entry into free zones.

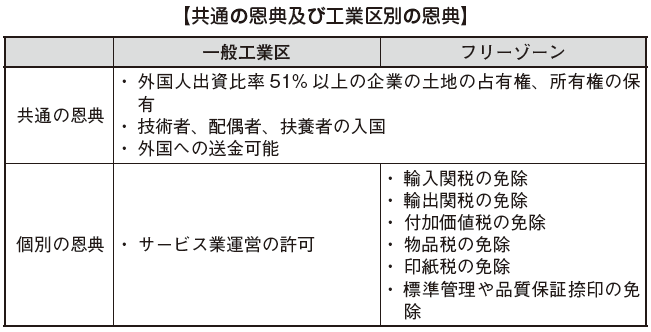

■ Content of incentive measures by IEAT

When entering an industrial estate under the jurisdiction of IEAT, enterprises in charge can enjoy benefits from IEAT regardless of whether or not approval is obtained by BOI. In addition to the benefits recognized in both the general industrial zone and the free zone, each industrial district has different benefits.

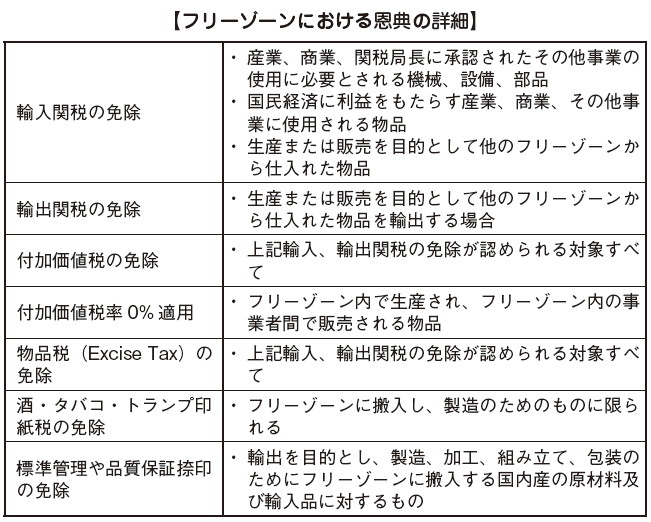

Businesses in the free zone are granted rights and benefits from IEAT and are eligible to receive duty free measures such as tariffs, value added taxes, and excise taxes.

Taking the location of the free zone as an example, there are the Nava Nakorn Industrial Estate, Port Too Sri Racha, Santi Lin, Amata Nakorn Industrial Estate, Eastern Sea Board Industrial Park, High Tech (Bang Wa) Industrial Park and others.Details of benefits in the industrial estate are as follows.

[Points to keep in mind when entering the IEAT industrial park]

Companies applying for IEAT are also generally required to apply for encouragement of investment in BOI as mentioned above. In the case of industries in which enterprises entering the industrial estate also conform to the encouraged industries by BOI at the same time, more benefits There are many cases where it is desirable to apply for investment encouragement to BOI at the same time that you apply for advancement.

-

-

-

Investigation of entry schemes for each business type

As mentioned above, when a foreign company conducts business in Thailand, there are regulated industries under the Foreign Business Act, encouragement and benefits by the Investment Promotion Act of Thailand Investment Committee (BOI), benefits of Thai Industrial Estate Authority (IEAT) Considering the possibility of acquisition etc., it is necessary to consider form of advancement. Consideration items and notes differ between "manufacturing industry" and "non manufacturing industry", so we will confirm the selection method of advanced form assuming a specific case. -

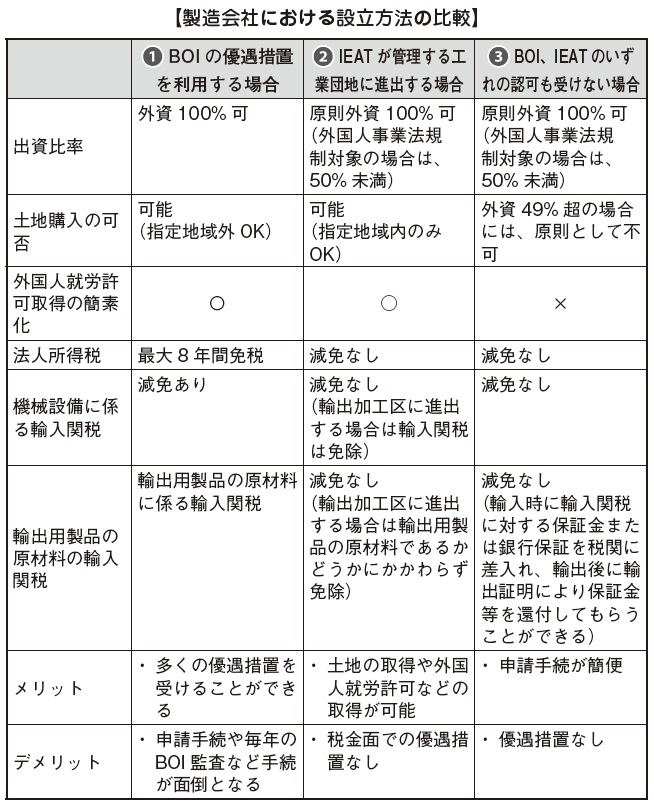

How to establish a manufacturing company

In principle, when manufacturing industry advances, it is not subject to regulation by foreign business law. Therefore, in most cases it is possible to establish a local affiliate of 100% foreign capital. It is not necessary to pay special attention to the contribution structure like sales companies and other service industries.

In the case of the manufacturing industry, it is necessary to consider whether to use preferential treatment of BOI.

■ When using preferential treatment of BOI ... ❶

In many cases, how to obtain benefits such as corporate tax exemption under the Investment Promotion Act of BOI, tax exemption for machine import duties, reduction and exemption of import duties on raw materials is considered as a matter of consideration (contents of the incentive reference).

In order to obtain the approval of BOI, it is the most important examination criterion whether it is a business that benefits Thailand, such as employment expansion, technology transfer, etc. Besides that, it is also required to satisfy the outline requirement that the added value ratio is 20% or more (see above for requirement of obtaining BOI approval).

When applying for BOI, you will be asked to submit a detailed business plan for three years. It is necessary to prepare business plans including securing machinery, personnel and business partners to be carried in.

[Location of factory]

BOI's tax benefits greatly depend on investment location (zone). In addition, it is necessary to determine the location of the factory in consideration of the distance to the business partner and the distance from the main transportation (airport, port etc.).

If it is a business of domestic demand, it is interesting to the BOI 3 zone where the benefits of Bangkok and neighborhoods, major customers, or tax system are great, and if it is an export-type business, the neighborhood of Suvarnabhumi Airport and Laem Chabang Port And the industrial park in the southeastern part of Bangkok where access to the expressway is convenient. Recently, more companies are considering areas with less possibility of flood damage considering the flood that happened in 2011.

However, the properties of the industrial estates in these popular areas quickly become sold out, and it is becoming difficult to secure places that meet the desired location conditions. In addition, as problems such as increase in sale price and lack of human resources are occurring, we recommend that you check the latest situation beforehand.

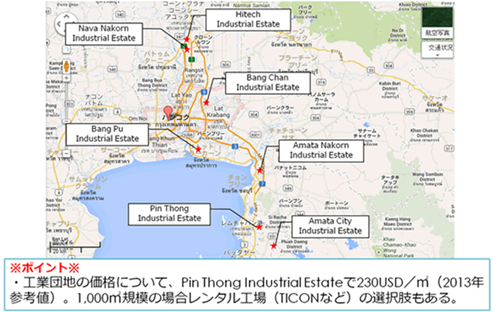

Bangkok (including neighboring Samut Prakan): Bang Chan Industrial Estate, Bang Pu Industrial Estate

Rayong: Amata City Industrial Estate

Chonburi: Amata Nakorn Industrial Estate, Pin Thong Industrial Estate

Ayutthaya (including neighboring Pathum Thani): Hitech Industrial Estate, Nava Nakorn Industrial Estate

In examining the industrial estate, it is necessary for multifaceted consideration such as logistics, price, supplier and labor force securing in addition to ground and land conditions.

■ When entering an industrial estate managed by IEAT ... ❷

Some companies do not use BOI preferential treatment. In that case, if you go to an industrial park under the jurisdiction of IEAT or do not do it, you will be doing business without receiving any benefits etc. As BOI promoting companies are obliged to report annually to BOIs, management tends to be complicated, so relatively small companies may not apply for BOIs in some cases.

Even if you do not receive the incentive of BOI, you can get non-tax benefits such as getting foreign labor permission and acquiring land if entering the industrial park of IEAT.

When entering the free zone of IEAT management, you can receive tax benefits such as tariffs.

■ If you do not receive the approval of either BOI or IEAT ... ❸

If you do not receive the incentive of BOI and do not advance into the industrial park of IEAT management, you will enter the industrial park managed by the private sector. Besides not having incentives, there are disadvantages that the infrastructure level such as equipment is inferior to the industrial park managed by IEAT, but on the other hand, as compared with companies that received BOI encouragement, various application procedures at the time of establishment as annual reporting obligation is reduced, management costs can be reduced. In addition, there is also the merit that workers can be easily secured.

-

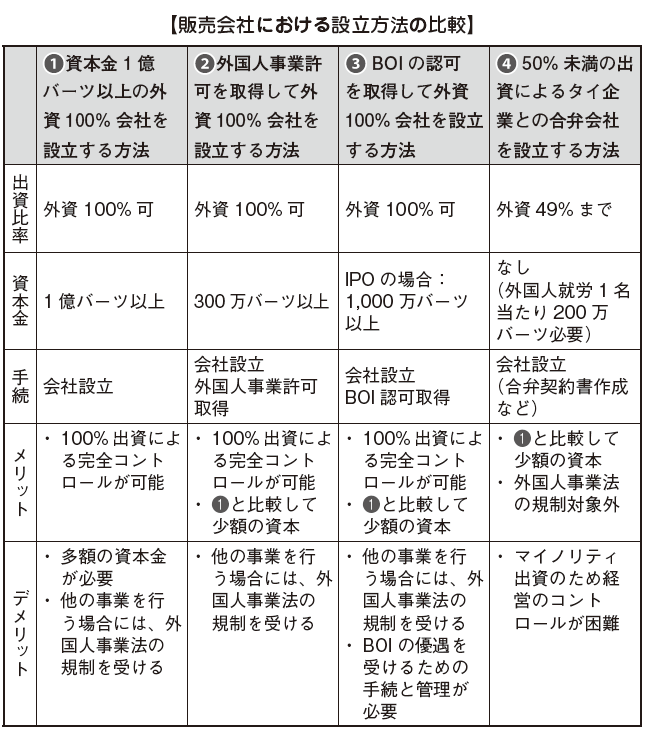

How to establish a sales company (wholesale, retail)

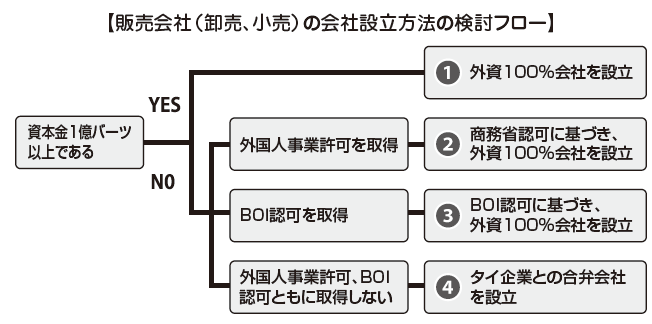

I will consider the case of setting up a sales company next.Here, wholesale business and retail business that sell tangible goods are referred to as "sales company". For service industries other than sales of goods such as advertisement and service industry, please refer to "How to set up a service company other than dealer company".Sales companies are regulated industries under the Foreign Business Law, but if you invest a minimum capital of 100 million baht or more, you can establish a 100% foreign capital company.

Even if you can not fulfill the minimum capital requirement above, you can establish a 100% foreign-owned company if you can acquire foreign business license or obtain BOI's approval.

■ How to establish a 100% foreign-owned company with a capital of 100 million baht or more ... ❶If you capitalize more than 100 million baht in capital, it will not be subject to the regulations of the Foreign Business Act, so you can establish a company with a 100% foreign capital contribution. Regarding the capital referred to here, it was debated whether it was "registered capital" or "actual paid-in capital", but the Business Development Authority said "it must be actually paid", clearly It shows a view.In addition, when conducting wholesale and retail at the same time, it is interpreted that it is necessary to pay a capital of 200 million baht or more.It is easier than the other methods described below (since the company establishment procedure is described later) because it can start a business with ordinary company establishment procedure only.

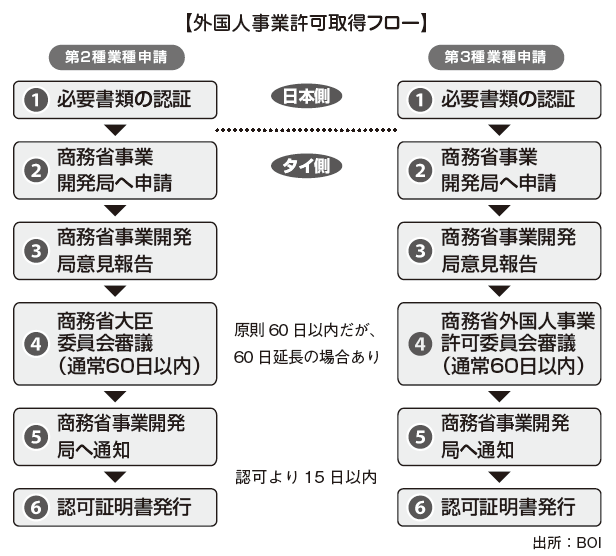

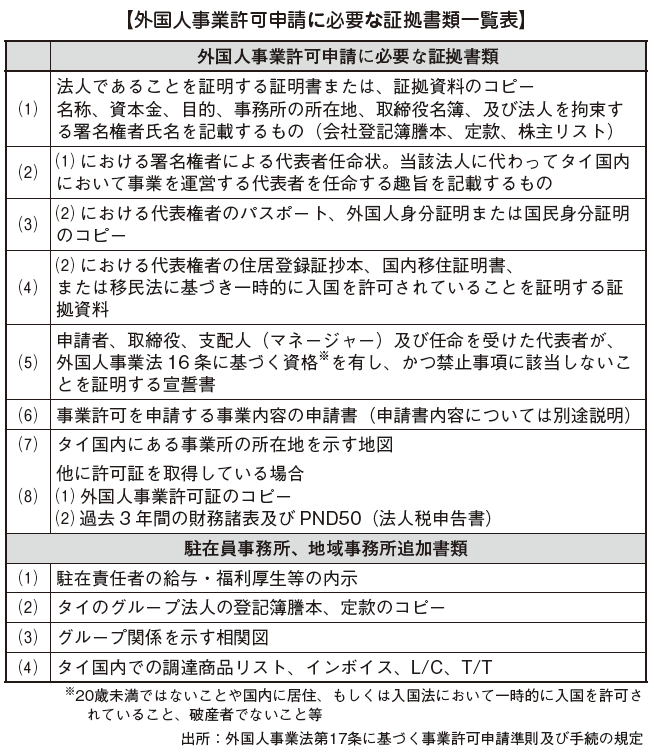

■ How to establish a foreign company 100% company by acquiring foreign business license ... ❷Even if you can not fulfill the capital requirement of ❶, you can establish a 100% foreign-owned company if you obtain foreign business permission.However, it is said that it is difficult to obtain foreign business permits in practice. In order to acquire a foreign business license, it is necessary to become Thailand's national interest, not to damage the interests of existing domestic enterprises, to create employment, to innovate, to be a business for foreign-owned enterprises in Thailand or overseas etc. It is necessary to clear the screening criteria in terms of. Procedures for acquiring foreign business permits will be described later.

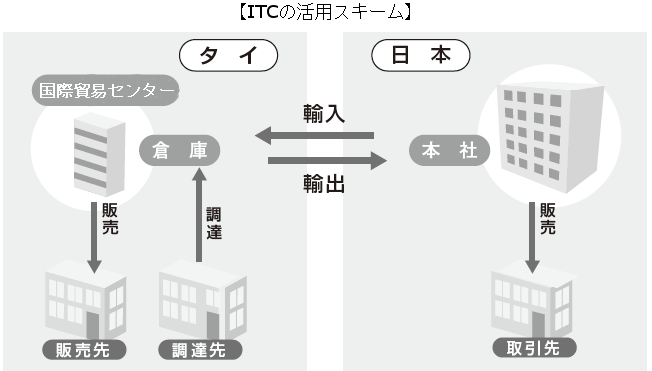

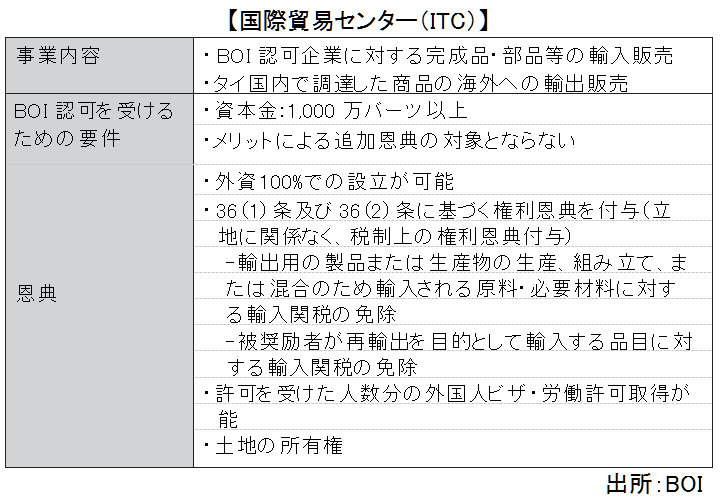

■ How to establish a 100% foreign-owned company by obtaining approval of BOI ... ❸For businesses conducting wholesale business such as trading companies, BOI has a system called the International Trading Center (ITC) (newly established as an incentive plan for investment (2015 - 2021)).

[What is the International Trade Center]The International Trade Center (ITC) can obtain approval when selling finished goods and parts etc. imported to Thai domestic BOI authorized companies as the main. It is also possible to sell exported goods procured in Thailand overseas. The main difference with the IPO (International Procurement Office: International Procurement Office) encouraged by the former BOI is that IPOs now include handled products that were limited to parts and raw materials as finished products. Below is a summary of ITC business contents, conditions, benefits.

In addition, ITC does not prescribe the requirement of ownership of warehouses and domestic sales destinations included as a requirement of IPO. The advantage of acquiring ITC is that it makes it easier to establish a 100% owned company with foreign capital. Under the regulations of the Foreign Business Law, capital of 100 million baht or more is required for wholesale business, but by receiving ITC promotion from BOI, the minimum capital amount will be reduced to 10 million baht or more. In addition, you can receive an exemption from customs duties on imports.■ How to establish a joint venture with a Thai company with less than 50% investment ... ❹If any of the above requirements can not be met, we will have to establish a joint venture with a capital contribution of less than 50% through a joint venture with a Thai corporation. In this case, it is necessary to select a partner company and create a joint venture agreement.■ Sales companies easy to accept foreign business permits and BOI approval, difficult sales companiesAs can be seen from ❷, in cases like Thai national interest, you can obtain foreign business permits or BOI approval. Conversely, if these are not applicable, you will have to choose a joint venture with a Thai company ❹ to invest capital of 100 million baht or more of ❶.If you stick to a 100% foreign capital company, there are cases where you build a business scheme according to a form that is easy to approve.

Common things to get approval are that there is no conflict of interest with Thai enterprises, bringing about technology transfer. Therefore, there is a tendency for a trading company that sells to foreign-affiliated companies that are entering Thailand to be approved rather than cases sold for domestic companies in Thailand.From the viewpoint of bringing about technology transfer, it is also possible to obtain authorization by holding regular classes at our company or school.If the scheme is judged to be beneficial to Thailand, you can proactively promote business by proactively utilizing approval.

-

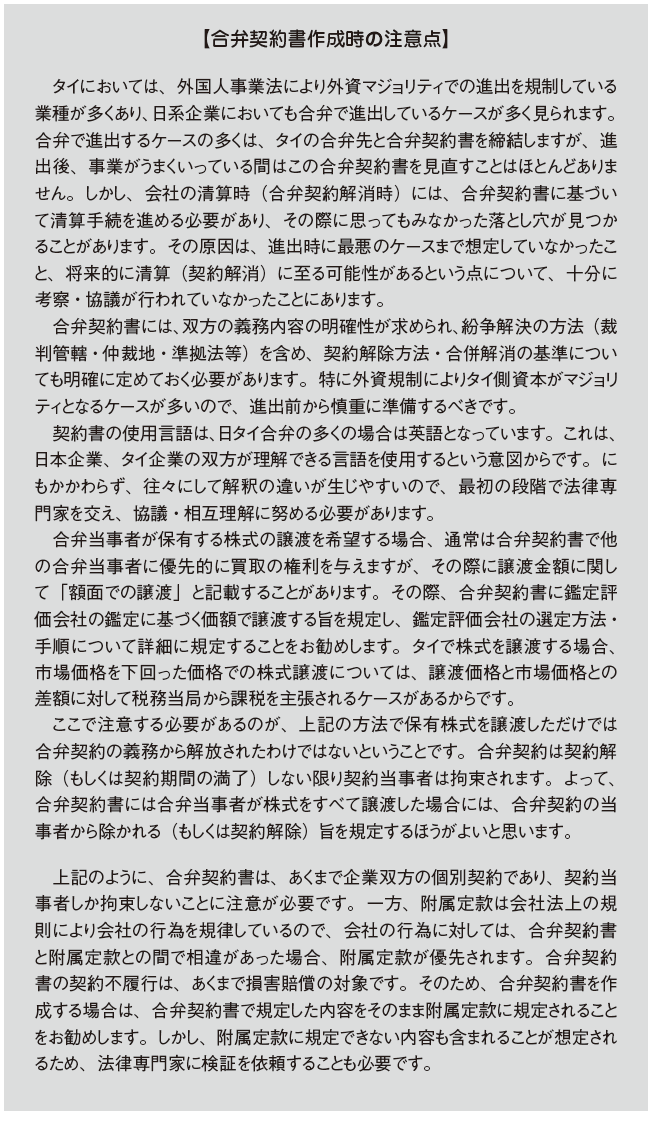

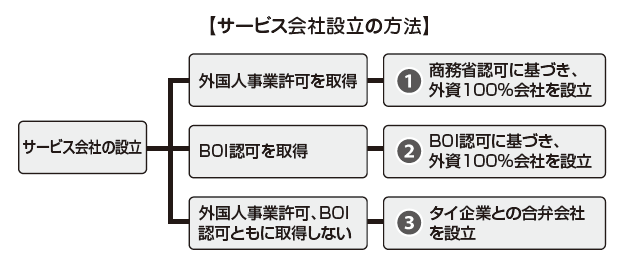

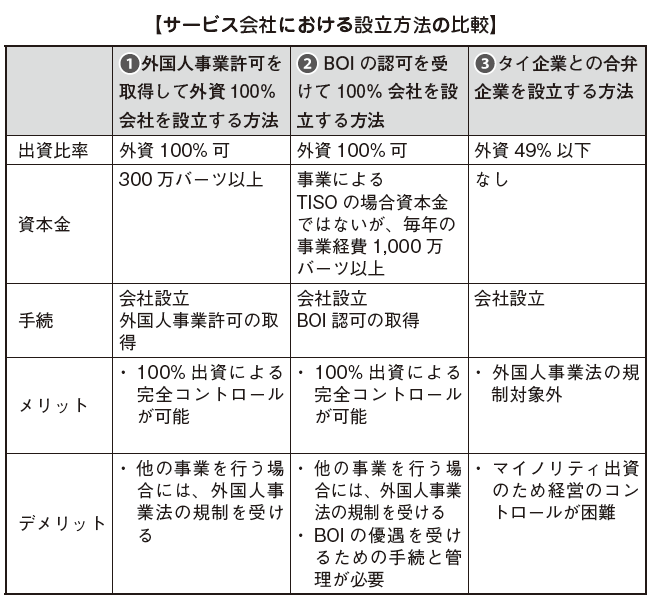

How to establish a service company other than a sales company

Then consider the case other than the selling company (wholesale, retail).Since Listing 3 of the Foreigners Business Law states "(20) Other service industry", all service businesses except manufacturing industry are regulated industries under the Foreign Business Act. Therefore, the establishment of a service company is, in principle, restricted to companies with a capital contribution of less than 50% foreign capital.

■ How to establish a 100% foreign-owned company by acquiring foreign business license ... ❶In the list of regulated industries under the Foreign Business Law, "When the foreign capital is 50% or more, approval of the Minister of Commerce with approval of the foreign business committee is required for Type 2, further approval by the Foreign Business Committee And the authority of the director of the business development department. " This does not mean that you can take any industry if you apply, it means that different requirements are set for each industry.

■ How to establish a 100% foreign-owned company by obtaining approval of BOI ... ❷Manufacturers are mainly engaged in BOI's approved industries, but there are industries that are encouraged among service industries. In a recent case, the call center has been appraised as giving birth to a large amount of employment, and has joined the BOI's encouraging industry. In addition, biotechnology business, BPO business, research and development, etc. are also included. Even if it is not currently listed on the incentive list, there is still room for consideration if you think Thailand has a national interest project (employment expansion, technology inflow, etc.).

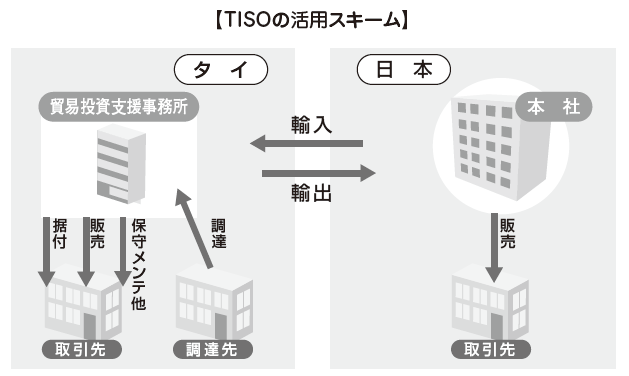

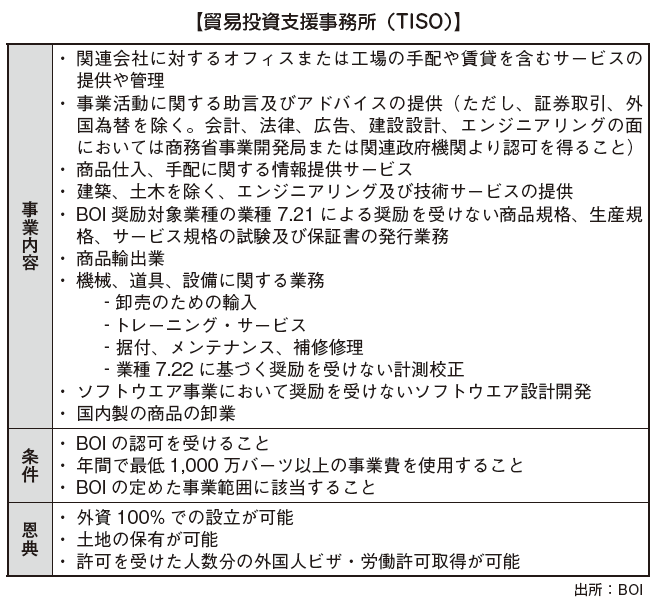

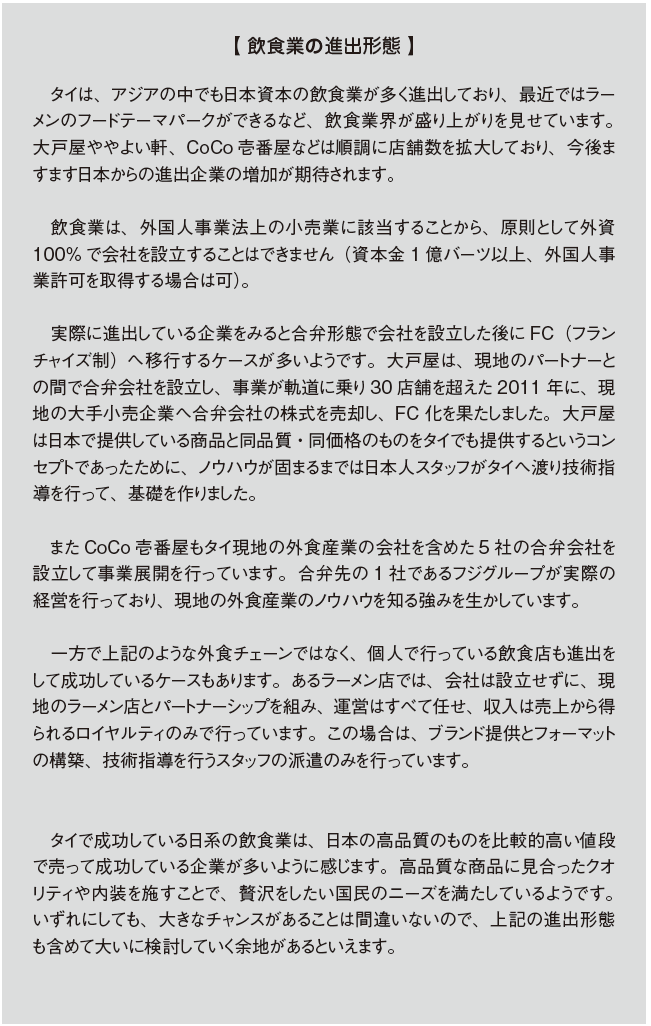

[What is Trade Investment Support Office]Many Japanese companies are investing in facilities in Thailand, but installation and maintenance service when importing equipment is extremely important at the production site of high-tech enterprises, and the Trade and Investment Support Office (TISO: Trade and Investment Support Office) is expected to fulfill the function that responds to these needs.As in the case of ITC, we will not directly enter the domestic market, but we will provide installation maintenance service of machinery equipment for foreign-affiliated companies that have advanced to Thailand.

The advantage of TISO is that you can establish a 100% foreign capital company. However, as a requirement, we must spend over 10 million baht a year as business expenses annually.

The advantage of TISO is that you can establish a 100% foreign capital company. However, as a requirement, we must spend over 10 million baht a year as business expenses annually.

■ How to establish a joint venture company with a Thai company ... ❸If neither of the above methods can be adopted, a joint venture company will be established with a Thai company and invested in foreign minority. This is the same as the method of establishing a sales company.

-

-

-

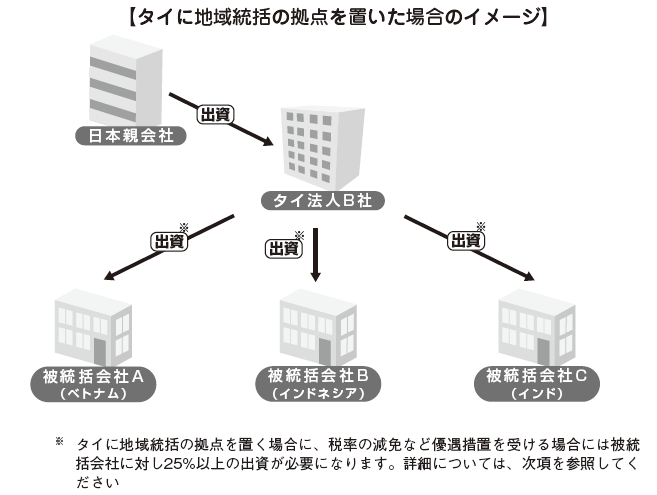

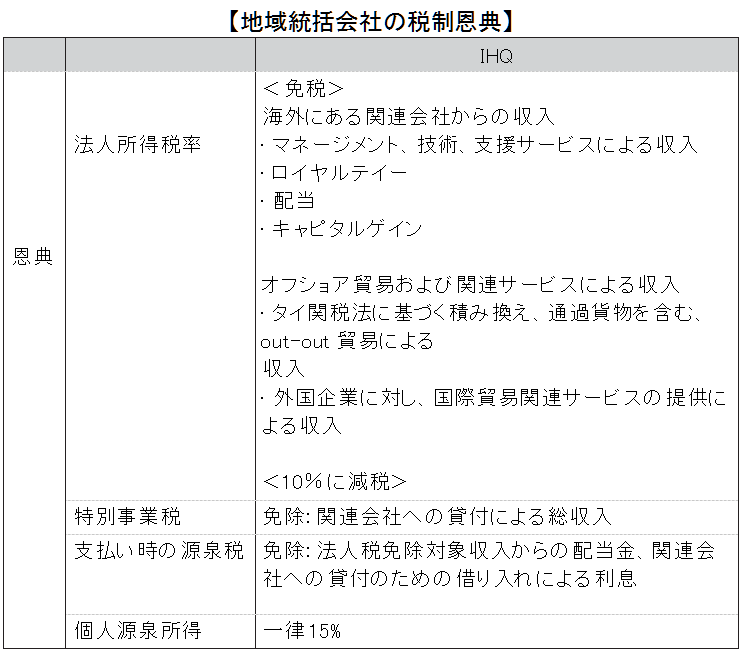

How to establish a regional headquarters

In recent years, we have many overseas subsidiaries within one corporate group, and the necessity of establishing a central base for each region such as Asia, the EU, the United States has increased.Singapore is by far the largest established country in Asia, with Hong Kong following it. Common to these countries is that there are few regulations on foreign capital and the corporate tax rate is low.Recently, there have been cases where a regional headquarters (IHQ: International Hedquarters) is established in Thailand. This is because the Thai government has given tax benefits to regional headquarters. Originally for Japanese companies, Thailand is being used as an export base in the Asian region. It is expected that companies that have regional headquarters in Thailand will continue to increase as it is considered that there is certain merit for enterprises to have a regional headquarters in Thailand, the center of manufacturing. In the old system, the name was Regional Operating Headquarters (ROH).In general, the advantage of utilizing regional headquarters is to reduce the effective tax rate for the entire group by establishing it in a light tax country. It also has the effect of reducing foreign exchange risks, streamlining logistics, increasing the efficiency of fund procurement.

-

Requirements and benefits of regional headquarters

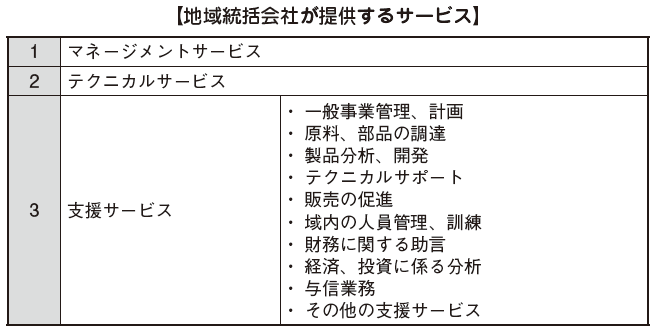

In establishing a regional headquarters in Thailand, it is necessary to satisfy the establishment requirements established by Thai laws and regulations. Establishment requirements include services to be offered, minimum capital, service provision for more than one country, etc. In addition, we can receive tax benefits if specific sales conditions are satisfied. In addition, although it was necessary for the old system to provide service to more than 3 countries, it has been relaxed.

■ Requirements for receiving benefits[Services provided by regional headquarters]In Thailand, in order to receive the benefits of the regional supervision system, it is necessary to first confirm whether it belongs to the target business. The details are as follows.

The regional headquarters must provide the above services to affiliates in Thailand and abroad (including branches). A related company (controlled company) is a company that meets the following requirements.

Holding standard(1) Companies with more than 25% of total capital · Partnership(2) Companies and partnerships in which IHQ owns 25% or more of its total capital or is a partner(3) Companies / partnerships in which the companies / partnerships in (1) own 25% or more of their total capital or become partners

Management rights standard(1) A company or partnership that oversees or manages the management of IHQ(2) Companies or partnerships where IHQ oversees or manages the management(3) A company or partnership in which the company or partnership in (1) oversees or manages its management

■ Contents of benefitsIn the case where the above requirements are satisfied (in the case of the new law also satisfies the sales conditions similar to the old law), the regional headquarters can receive the following benefits.

-

-

-

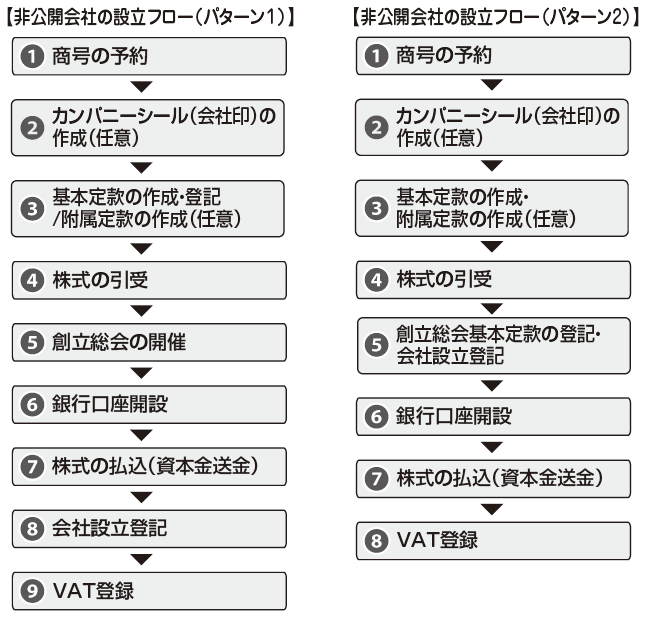

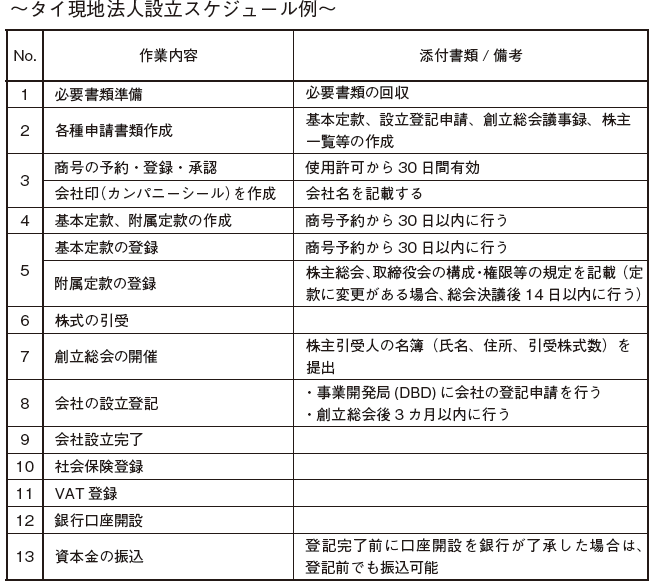

Procedure for establishing a private company

I will explain the procedure for establishing a private company that is common in Japanese companies. When establishing a private company, there are two major establishment flows. The difference between the two flows is whether to apply for registration of the basic articles of incorporation, general assembly of the foundation and company registration at once or not. The flow of procedure of a private company is as follows.

The quotation clause in this section will be "Party Ship and Company Law", Part 4 of the Commerce Code of Civil Code, "Company Limited (March 2008 amendment, promulgated in March 3)" unless otherwise specified.

The company registration application is "Department of Business Development of Department of Commerce (DBD: Department of Business Development)" ("Business Development Department"), and registration procedure on the Internet can also be done. All documents, materials, etc. submitted to the Business Development Department must be translated into Thai language.

■ Reservation of trade name ... ❶

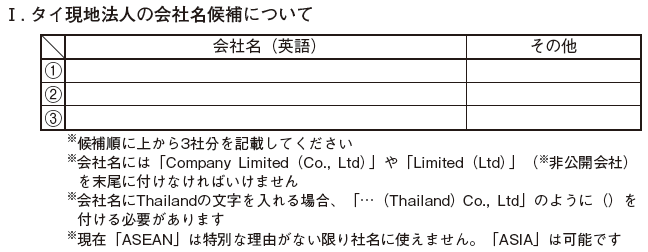

The trade name reservation must be made by the company's founder. Since it is not possible to use the same company name and similar company name, we confirm that there is no identical, similar company name in the Business Development Department in advance.

For this judgment, all corporate trade names registered in Thailand are covered, and in this respect it differs from Japanese company name registration. If there is no identical, similar company name, you will apply for reservation to the authorities and you will have permission to use it as the trade name of the new company. In addition, it is necessary to note that the founders must prepare two alternate names in addition to the name of the company they are requesting at the time of the reservation application. Generally it will take a couple of days to obtain permission from the company name. The trade name approved by the authorities is valid for 30 days from the use permission and it is necessary to apply for the registration of the basic constitution during that period. If you do not register the basic articles of incorporation within the valid period of 30 days, the right to use the trade name disappears and you have to reschedule again, so be careful.

[Points to be noted about determination of trade name]

Since the company name is a combination of English and Thai language, you need to check the spelling and so on. The Thai language is expressed in a combination form of consonant letters and vowel letters with tone marks, and it may be possible to spell more than one even if it is the same sound.

The problem that arises is that if more than one affiliated company in Thailand is entering, the trade name in Thai will differ among related companies. In addition, because Thai language notation is written as it reads Thai language as a rule in principle, English notation may not be able to be expressed in Thai even though it is soundable. In this case, it is probable that the registrar will be refused the reservation, so it is better to change to the spelling that can be written in Thai language and apply for reservation. However, as the application does not necessarily pass through this measure, it is better to have the registrar check in advance.

"Company Limited (Co., Ltd.)" Or "Limited (Ltd.)" As the trade name and "Public Company Limited" in the case of the public corporation must be attached at the end. Also, when using "Thailand" in the trade name, you need to include "Thailand" in the parenthesis at the end of the name. Furthermore, the use of royal family-related names, government-related names, names of international organizations, and other designated names (ASEAN etc.) is prohibited.

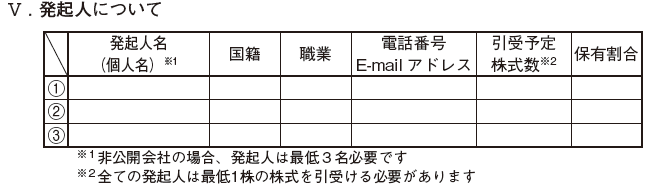

[About the organizer]

A person who registers a company in the Department of Commerce (MOC) is defined as a company founder and must be a natural person (other than a corporation) who is over 20 years old who can sign documents at the time of registration.

In addition, the number of founders is three or more in the case of a private company, each becoming the first shareholder of the company immediately after the company registration, must have at least one share, but then other shareholders or It can be transferred to a third party. Also, it is unnecessary for a person who becomes an organizer to live in Thailand.

Legal liability for incorporators

Regarding the founder's legal liability, there is charge liability for registration and limited liability to shares. However, if you approve of the former responsibility at the founding general meeting, there may be cases where the company pays the expenses to the founders after registration.

■ Creating a company seal (company seal) (optional) ... ❷

Creating a company seal is optional, but in general there are many companies to create. In the case of registering a company seal, application will be necessary at the same time registration is established, so we will create a company seal as soon as we are permitted to book the company name. The company sign must represent at least the trade name (Thai language) that you reserved. It is also possible to include English names and logos. As a shape, round, elliptical, rectangular are common.

■ Creation / Registration of Basic Articles of Incorporation ... ❸

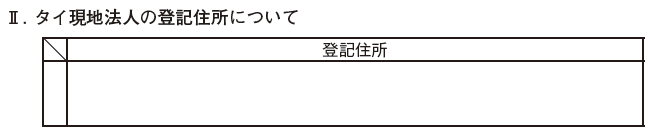

The basic constitution shall prepare at least two original documents, signed by the initiator and further proved by two witnesses. Regarding the basic articles of incorporation created, registration is required at a registry office located in a location that is the location of the company in Thailand (Commercial Code of 1099).

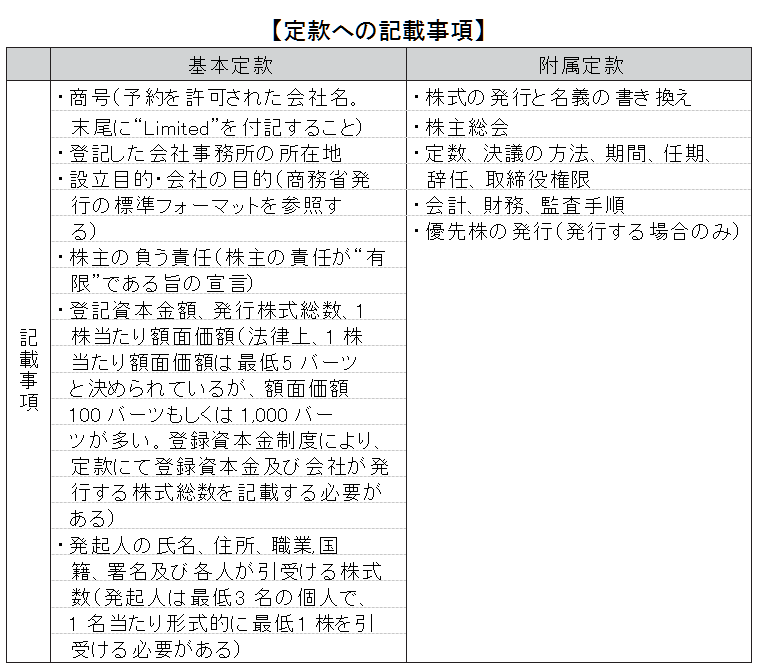

We will register the articles of incorporation signed by all the founders to the Business Development Department. The articles of incorporation are composed of the Memorandum of Association and the Articles of Association, and the basic articles of incorporation establish the basic matters of the company such as company name, head office location, business purpose, number of shares issued, we will describe detailed matters such as the composition and authority of the Board of Directors which is the institution in the Articles of Association.

In Thailand, it was necessary to apply for the registration of the basic constitution and company registration on separate days, but in the case of certain conditions by amendment in FY 2008, the basic articles of incorporation and company registration will be made on the same day It became possible to do (Ministry of Commerce Code 1111 1 paragraph). Certain conditions are as follows.

· All the stockowners of the company that performs registration are complete

· The founder and the shareowner participated in the founding general meeting for reviewing the work under Article 1108 of the Commercial Code, and the initiator and the shareowner agreed to the agenda at the General Assembly

· The founders inherit all business from the directors

· The director requests the payment of shares pursuant to Article 1110 of the Commercial Code of Japan, and the invoice amount has been paid

[Items stipulated in the Articles of Incorporation

Items that must be stated in the Articles of Association are as follows (Commercial Code of Japan Code 1098).

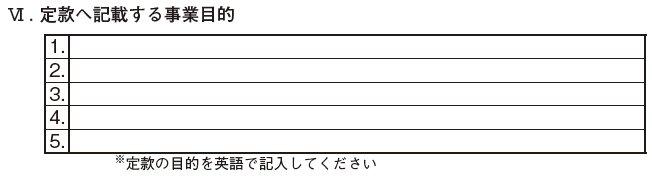

[Purpose of establishment · About purpose of company]

The point to pay particular attention to when registering the basic constitution is the description of company purpose. The purpose of the company needs to describe all the actions that the company can comprehensively.

In principle, the acts that are not included in the company purpose are invalid and the legal effect is not attributable to the company. This point is the same as Thai concept of Japan in Thailand.

Therefore, it is necessary to carefully consider whether the description of company purpose covers all the project purpose of the new company. However, as for the company purpose, there are templates and the majority of business activities are covered. However, this template is created with Thai company in mind, and it is common that it does not cover the special business activities of Japanese companies, and it is necessary to carefully consider carefully when creating corporate objectives .

[Registration Cost of Company Articles of Incorporation]

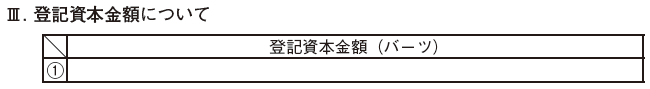

Although the registration fee of the basic constitution is 50 Baht per 100 thousand baht registered capital, the lower limit and the upper limit are determined, the lowest is 500 baht, and the maximum is 25 thousand baht.

[Change in Articles of Association]

Once registration of the basic constitution is completed, the trade name you reserved can not be used by any other third party. In addition, changes to the Articles of Association and the Articles of Association must be made within 14 days after the resolution of the General Assembly.

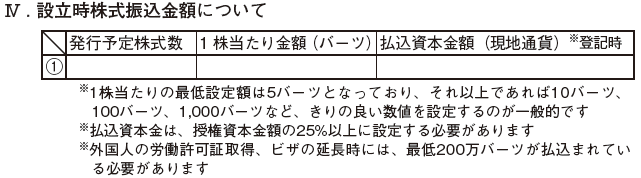

[Setting of capital]

Registered capital

In Thailand, the incorporator determines the total capital of the company at the time of incorporation, and it establishes in the basic constitution as "registered capital" at the time of registration at the time of incorporation.

Minimum capital

In the case of a Thai company whose private capital does not fall under the "Foreigner" of the Foreign Business Act, the minimum capital amount is not stipulated in particular. But it goes without saying that it must be a sufficient amount to achieve company goals.

In addition to the Foreign Business Act, in principle, in order to obtain a work permit for one foreigner, the minimum amount of the capital to be paid by the company is required at least 2 million baht. If the foreigner lives with a Thai spouse, the amount paid for the above capital will be reduced by 50%. In Thailand's Immigration Bureau, the company asset amount must be 1 million baht or more in the annual account report to be submitted upon extension of work visa (B visa).

For foreign companies, the minimum capital amount is stipulated in the Foreign Business Act. A foreign company conforming to the Foreign Business Act is a company whose foreign capital occupies a majority in principle, and when this foreign company conducts the regulated industry under the Foreign Business Act, it is equivalent to at least 3 million baht, which does not fall under regulated industries For industries, foreign capital equivalent to 2 million baht must be invested as capital.

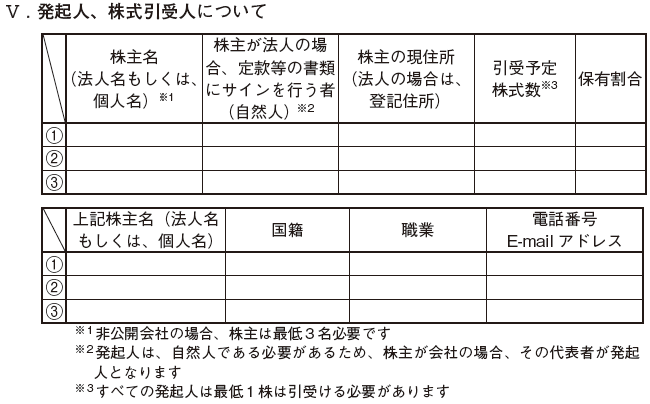

Stock underwriting ... ❹

All stocks must be underwritten or allocated before the Organizational Meeting. Each founder must be obliged to accept at least one share (Article 1100 of the Commercial Code), it must be made clear that the underwriting is by money or money other than monies (in-kind contribution).

If you do not make money, you do not need to mention it in the articles of incorporation, but you need to obtain approval at the founding general meeting to be described later. At this time, there is no provision of investigation by inspectors like Japan.

Also, after the company is registered, the shareholders can not request the court to cancel the underwriting due to mistake, intimidation or fraud (Article 1114 of the Commercial Code) is almost the same as the Japanese company law .

■ Holding of foundation general meeting ... ❺

After all shares that must be paid in cash have been accepted, the organizer shall hold the founding general meeting without delay, review the necessary items, and obtain approval.

At least 7 days prior to the general meeting date, it is necessary to send a report describing the resolutions at the founding general meeting to the shareowner and to notify the company registrar of a part of the copy. In addition, it is necessary to submit the list of shareowners (name of the underwriter, address, number of underwritten shares) at the founding general meeting (Commercial Code of 1107).

[Matters to be resolved at the Organizational Meeting]

At the founding general meeting, the content to be resolved is stipulated as follows (Ministry of Commerce Code 1108).

· Adoption of Articles of Association (Decision of corporate agencies such as general shareholders meeting and board of directors)

· Approval of contracts entered into by the incorporators and spending expenses during the company establishment period

· When payment is made to the founders Determination of the amount (remuneration for founders)

· Confirmation of the list of the underwriters

· When issuing preferred shares, the number, nature, range

· Determination of the number of ordinary shares to be issued and the preferred number of preferred shares for consideration of sponsorship in kind

· Election of first director / auditor and determination of each authority

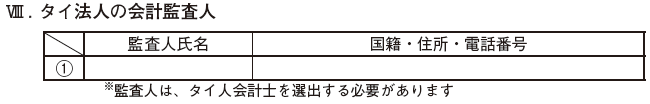

"Auditor" here must be a certified public accountant in Thailand, not a corporate auditor in a so-called Japanese company, it is equivalent to an accounting auditor.

In Thailand it is necessary to pay attention to auditing obligation imposed on all companies regardless of the company size by the auditor, and report the name and license number of the Thai CPA who is in charge of the audit to the Department of Commerce Have to. Although it is practical in the case that it is impossible to decide up to the auditor at the time of establishment, in such a case, it is provisionally registered, after formally deciding, we will change the auditor by a resolution of the extraordinary general shareholders meeting. There are lawyers that it is customary unnecessary to hold the meeting of shareholders in general, but it can be interpreted as being required under the Corporate Law.

After the holding of this foundation meeting, the promoter will inherit the business to the director

(Ministry of Commerce Code 1110 1 paragraph).

■ Payment of shares (remittance of capital) ... ❻

Stocks can not be issued at a price lower than par value (M & A Code 1105). On the other hand, if permitted by the articles of incorporation, shares can be issued at a higher price than face value, but in that case the excess must be paid with the initial payment.

Prior to registration of the establishment of the company, the director must ask for the promoter and the shareowner to pay 25% or more of the underwritten shares (Article 1110 of the Commercial Code).

In establishing the company, if all the shares equivalent to registered capital (Registered Capital) are issued and more than 25% of the face value of each stock is paid, the company will be established by the director applying for registration of the company 1111). The remainder of the payment will be paid by the shareholders according to the request of the director, which is a split payment system (in the case of BOI promoting companies, full payment is required before the start of operation).

In practice, after registering the basic articles of incorporation, ask the bank to open a temporary account and request payment to shareholders, attach a confirmation of the director at the time of registration of the company establishment, register the company, We open an account and make payment. Since the amendment of the company law in 2008, it is more likely that the latter case will be more now, as it is more likely that the basic articles of incorporation and company registration will be done on the same day.

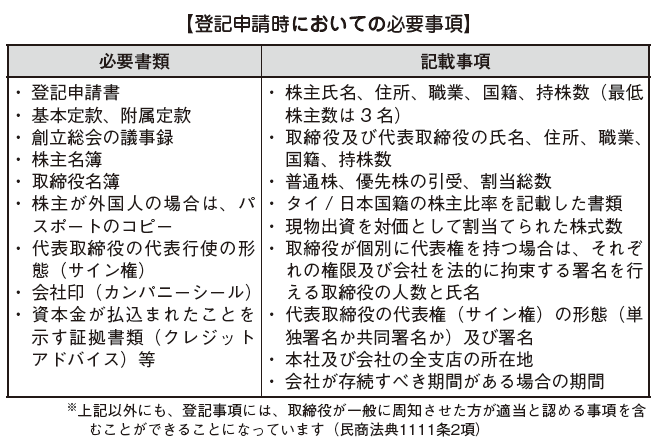

■ Company registration ...❼

We have to apply for registration of the company to the Business Development Department within 3 months after the founding general meeting. Registration application will be completed by filling out the necessary information on the application for registration in accordance with the decision of the foundation meeting and submitting it.

[Registration fee]Registration fee will be paid even when registration is established as well as registration of basic constitution. Established registration fee is 500 baht per 100,000 baht registered, minimum 5,000 baht, maximum 250 thousand baht.

[Responsibility for establishment registration]If the registration was not made within three months after the founding general meeting, the company shall not be established, and the director shall jointly and refund all monies received from the underwriter without discounting Commercial Code 1112). If money is not refunded within three months after the founding general meeting, you will be responsible for paying interest with interest from the date of 3 months expiration (Article 1 paragraph).However, if any of the directors proves that the shortage or delay in money is not the responsibility of the director, the director shall not be responsible for the principal and interest (Article 2 of the same article).Also, the company promoter shall be jointly and severally liable to all obligations and expenses not approved at the founding general meeting, and even if it is approved, unless it is likewise responsible until the registration of the company It is said that it does not become (Article 1113 of the Commercial Code).

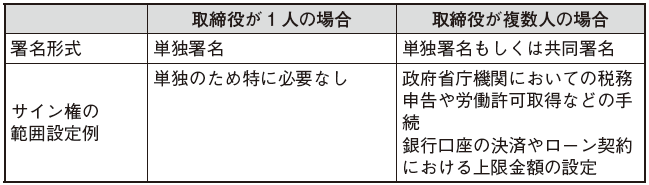

[Signature form and range setting of signature right]The signature rights can be divided into independent signature or joint signature. In the case of one director, we grant the right to sign the same to the same director, and it becomes a form of independent signature.On the other hand, if there are multiple directors, you can choose to grant the signature to one person or multiple people. In addition, when giving to multiple people, you have to pay attention to deciding the number of people to be targeted and setting the scope of the signature right.

[Example of setting range of signature authority]For example, if you only grant a signature right to a director in Japan and do not grant a signature right to a director in Thailand, you will need to send a document for obtaining a tax return or work permit to Japan The procedure may be complicated, such as signing with.Therefore, it is considered desirable to assign the authority to a director in Thailand for procedures, etc. for banks etc. for business efficiency.

Completed company establishment / business start ... ❽After completion of the above procedure, "Company Registration Card" will be issued and business start will be possible.

■ VAT registration ... ❾As a general rule, the deadline of VAT registration must be done by the day before the sale of goods and provision of services (Revolution Law Article 85).However, in the case that the sales by the transaction subject to taxation is less than 1.8 million baht per year, the obligation to register VAT is exempted (paragraph 1 of the same Article).In general, the establishment procedure of the above private company will be completed in about one to two months throughout. When the procedure is carried out smoothly The breakdown of the establishment period takes about 2 business days for reservation of trade name (company name), 12 business days for founder's application, 12 business days to apply for establishment.Also, if there is a separate license acquisition etc., it will take additional days in addition to the above.For application, it is common to use consultants, law firms and accounting firm foundation proxy services because the language of the application documents is Thai language and the procedure is complicated, so it is common to use the articles of incorporation The support, translation, and submission of application documents to the local authorities etc. are included. Documents necessary for asking for agency establishment agency are as follows.

· Copy of the representative prospect's passport photo page· If there is an entry history in Thailand, a copy of the last immigration stamp page· Copy of passport photograph page of each founder or copy of ID card· Address of company registration place, contact address of property owner· Company name (company name)· Certificate of all history items of Japanese parent company (in case of becoming shareholder of 20% or more) -

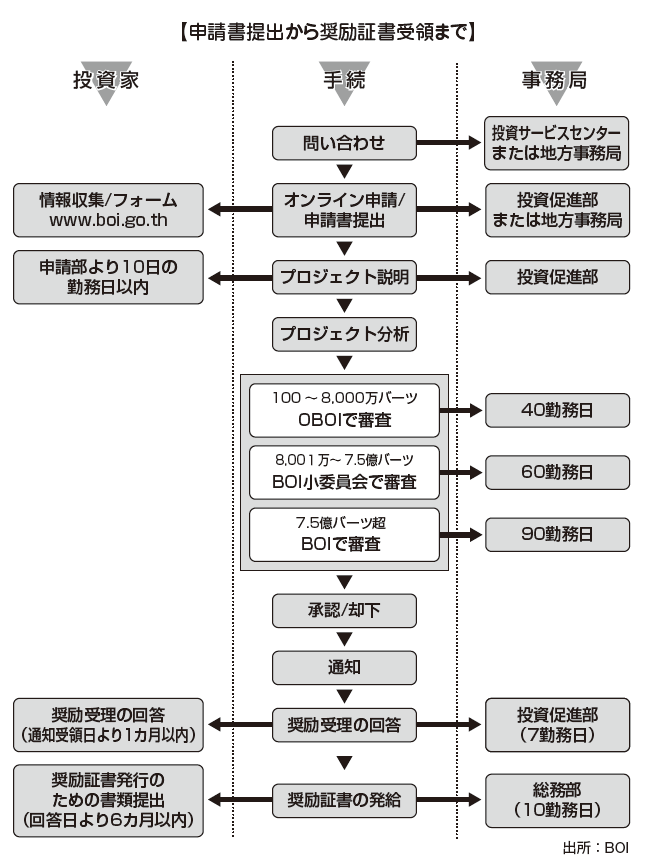

Application procedure for BOI encouragement

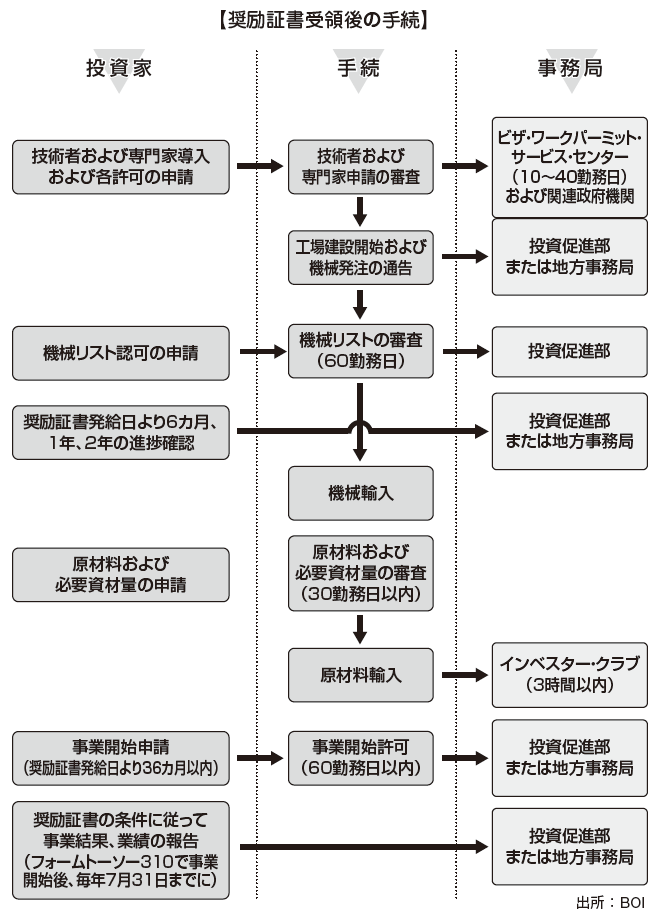

We will explain procedures after approval from investment encouragement applications to BOI which we have already seen in investment regulations and incentives. The authorization acquisition procedure published by BOI is as follows.

■ Submit application formThe application form is in reverse of English and Thai. If the preliminary survey is completed and the business plan is completed, it can be transferred to the application form. In the application form, in addition to the catalog of products to be manufactured, company profile, it is necessary to attach a process chart of the project. Since this process chart is obliged to be protected after being encouraged, you must fill in all the material arrival and inspection, and shipment and inspection of the product.In the case of Japan, the application will be submitted to the office of BOI in Tokyo, the general affairs department of the headquarters in Thailand, and the regional office.

■ Interview with review officialsImmediately after the application has been accepted, a notice of the interview will be handed over to the submitter of the application or will be sent to the Thai domestic contact listed on the application form. The applicant contacts the division specified in the notice, takes an appointment with the review officer, and in principle receives an interview within 2 weeks from receipt of the application form.The purpose of the interview is to raise the case to the committee by obtaining inadequate information in the application form so that the technical details such as product details, manufacturing processes and the current business contents of the applicant (corporation) We will hear about two hours. Therefore, if the applicant can not answer adequately, it would be desirable to accompany a technician.

■ Project examination by committeeOnce the review report is prepared by the review officer, it will be proposed to the committee and deliberated. The committee that conducts the examination varies depending on the investment amount.

Investment amount 80 million baht or less (excluding land fee and working capital)➡ Internal Committee of BOI SecretariatInvestment amount exceeds 80 million baht, up to 750 million baht (same as above)➡ BOI Secretariat Sub-CommitteeInvestment amount over 750 million baht (ibid)Exports over 80%➡ BOI Secretariat's Subcommittee exports 80% or less➡ This committee (chaired by the prime minister)

Applications requiring this committee approval are within 90 business days from the receipt of the application form to approval of the application, and in principle once a month. On the other hand, approval by the committee (including the subcommittee) within the BOI secretariat is held every week, and the period from receipt of the application to approval of the examination is also shorter than 60 business days.

■ Authorization notification and response to itWhen approved by the committee, it will be notified through the agent by the document. Contents of the document are listed in Thai language and conditions of BOI policy. It is necessary to reply to agree or not agree with the content of the notice within one month after receiving this notification (expiration date is allowed).As soon as we receive the notification, we will check the contents. At that time, if the benefits and conditions are different from what you already understand, you can withhold the answer and inquire in writing. However, in practice, there are not many inconsistencies as the benefits and conditions are determined by the zone and industry.