Mongolia

7 Chapter Tax

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.4 Investment regulation and incentives

3 Chapter Establishment

3.1 Characteristics of business base

3.2 Establishment of business base

3.3 Liquidation and withdrawal

4 Chapter M&A

4.2 Laws and regulations concerning M & A

5 Chapter Corporate Law

5.1 Organization of the company

6 Chapter Accounting

7 Chapter Tax

7.2 Individual Issues of Domestic Tax Law

7.5 Tax survey and tax penalty

8 Chapter Labor

8.4 Foreign Employees in Mongolia

9 Chapter Q&A

-

-

-

Tax relating to entry

In recent years, a corporate investment in Mongolia has progressed, the importance of taxation in Mongolia is increasing. It is also necessary to consider business risks for international tax matters between Japan and Mongolia. Unless you are systematically grasping the tax system in Mongolia and Japan, unexpected tax risks may arise. Since risks in taxation may have a major impact on business, risk management by prior tax planning is necessary.

In this chapter, we will explain the overall picture of taxation system in Mongolia systematically, not only in Mongolian domestic tax law, but also on the concept of tax treaty and international taxation. -

Tax on advancement

In entering Mongolia and conducting business, the main tax considerations to be considered in risk management are as follows.

· Presence or absence of tax treaty with the parties to the transaction and its contents

· Mongolian tax system (tax item, content) a

· Presence or absence of preferential treatment system for investment and its contents

· Taxation system for transactions (indirect tax etc. accompanying transactions etc.)

· Mongolian profit reflow scheme

In constructing advance tax schemes, it is necessary to comprehensively consider these points, and the relevant tax regulations differ from depending on the form of entry into Mongolia.

Tax risk is quite limited when conducting business activities without establishing a base in the local area, such as export sales from Japan through Mongolian agents. However, in the case of doing business by establishing a base in the local place through direct investment, such tax regulations will increase greatly, so it is important to manage advance tax planning and tax risk management. Below, we will examine different tax risks depending on the form of entry.

■ When doing a business without establishing a base

In the absence of permanent establishment (PE: Permanent Establishment) in Mongolia, in principle, it is said to be a "non-resident" and income generated in Mongolia is taxed according to Mongolian tax law. However, even if you make a transaction through a Mongolian distributor without setting up a base, tax will be imposed on the income that accompanies that transaction.

Non-resident refers to a foreign company that conducts business in Mongolia through a proxy office and earns income (Article 5, paragraph 4 of the Income Tax Law).

For nonresidents, a 20% corporate income tax (10-25% for residents) is taxed on income earned in Mongolia (Article 17.9). Income which is subject to taxation is as follows;

· Dividend received from Mongolian company

· Interest and guarantee fee

· Royalty, administrative expenses, rental fee, tangible and intangible fixed asset usage fee

· Income arising from sales activities, business activities and service offerings made in Mongolia

In addition, when a non-resident conducts business in Mongolia through a proxy office,

Costs incurred outside Mongolia "and" Management costs not related to income "cannot be deducted from income”.

■ When establishing bases and doing business

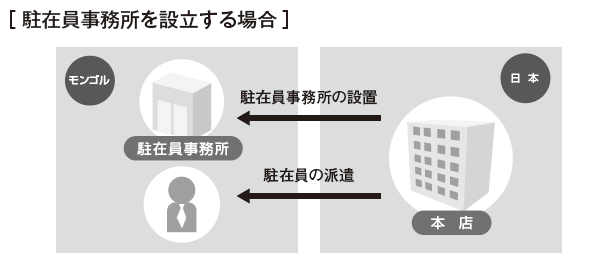

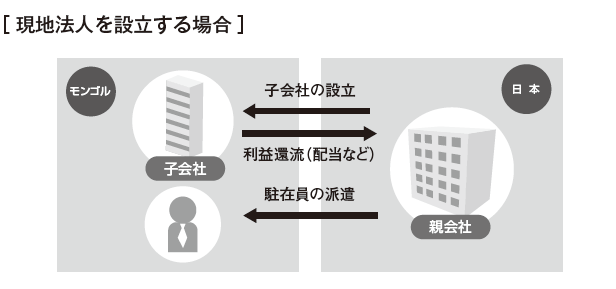

When local business activities become active, it is common to establish a base and conduct business by considering the exchange of people, goods and money with local people. When establishing a base, the form of a representative office is permitted in addition to the local corporation, and the type of related taxes varies depending on which form is selected. Branches cannot be registered by foreign companies.

Tax regulations for each form of advance are as follows;

Mongolian sideWhen setting up a representative office in Mongolia, profit-making activities are prohibited, and the purpose of the activity is restricted to information gathering, market research, etc.Therefore, no revenue will be recorded in Mongolia and the possibility of tax risks is low. However, if the representative office is certified as PE, Mongolian corporate income tax will be imposed on income deemed to have occurred in PE.

Japanese sideExpenses incurred at the Mongolian representative office will be included in the income calculation on the Japanese side.

Mongolian side

In establishing a subsidiary in Mongolia, the corporation is a domestic corporation in Mongolia, so Mongolian corporate income tax is imposed on all income (global income) that the corporation gained.

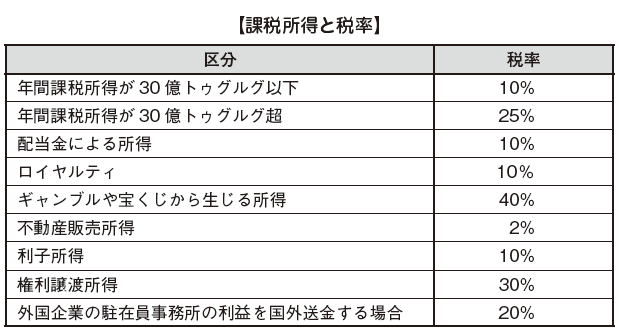

Regarding the tax rate, 10% of the annual taxable income is less than 3 billion Tugrug (about 200 million yen) and 25% of the annual taxable income is over 3 billion Tuglarg.

Japanese side

On the Japanese side, it is necessary to pay attention to the transfer pricing tax system related to the transaction with the Mongolian corporation, the presence or absence of tax withholding at the time of remittance of the transaction consideration, the tax risk on the salary burden on the seconded employee. -

Verification of investment return method

If you have advanced into Mongolia and profits occur through business activities, There is a problem of reinvesting by retaining the interests of the company and returning it to the parent company.

In the case of reinvesting in the local area, there is no particular tax problem, but in case of returning profits to the parent company in Japan, tax treatment will be different depending on the reflux method.

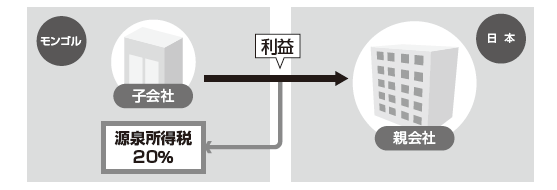

■ Method of returning profits from subsidiaries to parent company by dividends

The following method can be cited as a method of returning profits from a Mongolian subsidiary to a Japanese parent company.

· How to reflux with dividends

· Method of returning by commercial transaction (interest, royalty etc.)

[Method of returning to parent company by dividend]

For dividends paid by Mongolian subsidiaries, we will pay to the parent company after deducting 20% withholding tax from the payment.

On the parent company side in Japan, 95% of the dividend received from Mongolian subsidiary is non-profitable, according to the provision of "No tax deduction from foreign subsidiaries".

In other words, double taxation will be avoided by paying withholding income tax of 20% on dividend amount in Mongolia and making Japanese nontaxable income tax.

※ If a Japanese corporation holds stocks of affiliated companies in Mongolia continuously holding voting shares 25% or more from six months or more prior to the date on which payment obligation is decided.

[Method of reflowing to parent company by business transaction]

In addition to dividends which are appropriation of profits, there is also a way to reflow through ordinary commercial transactions. E.g. royalties are methods through payment of interest and so on.

Reflux by royalty

When returning profits from Mongolia to Japan by royalties, caution is required because the transfer price tax system will be applied at the Japanese side.

In addition, with paying royalties from Mongolia to Japan, a withholding tax of 20% of the payment will be imposed.

Reflux through payment of interest

In the case of returning profits from Mongolia to Japan by interest, if the interest rate (interest on investment) on interest is lower than the procurement rate in Japan, the Japanese side pointed out the lack of collection of interest due to the application of the transfer pricing taxation. Be careful as it may be done.

In addition, when paying interest from Mongolia to Japan, a withholding tax of 20% of the payment is imposed.

-

-

-

Latest News & Updates

■ 20% of VAT payment amount refunded to consumers

The value added tax is a consumption tax paid by the end consumer and it was decided to refund 20% of the tax payment amount, that is, 2% of the purchase amount to the consumer.

This will reduce the tax burden of consumers, tax evasion by the intermediary which has been occurring so far will decrease, and the tax revenue is expected to gradually increase.

Details will be updated soon.

■ Electronicization of tax returns, refund procedures

By requiring all business operators to use receipts of the same standard with a lottery number, it was decided to digitize the system for tax returns and refund procedures.

Consumer needs to register their personal information in www.ebarimt.mn site first. Once they registered, you can log in to the site by lottery number on receipt, and if you fill in and register within one week, you can automatically participate in monthly lottery. The winning prize money is up to 100 million Tugurugu. Rebates and tax refunds will be automatically transferred to the accounts registered on the above site.

Details will be updated soon. -

Mongolian tax system

■ Outline of the Mongolian Tax Law in Mongolia, a tax system in line with the market economy was established in 1992. There was a substantial revision of the tax law in 2008, and further revisions were made in December 2008, March 2009, July 2009, June 2010, and in November 2010, the economic environment and policies was also revised. A revision reflecting was made and reaches the present.

The Mongolian tax law is constituted by constitutional law and other accompanying law stipulated by resolution of Diet. For this law, corporate income tax law, personal income tax law, value added tax law are enacted for each tax item.

Since it is expected that tax reform will be carried out from time to time due to the economic situation and social situation in Mongolia in the future, it is necessary to constantly check the latest tax system trends and practical handling etc.

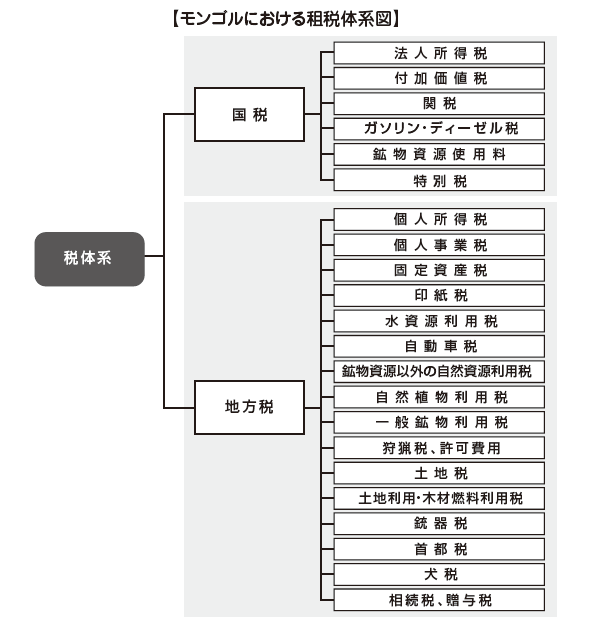

■ Types of tax items

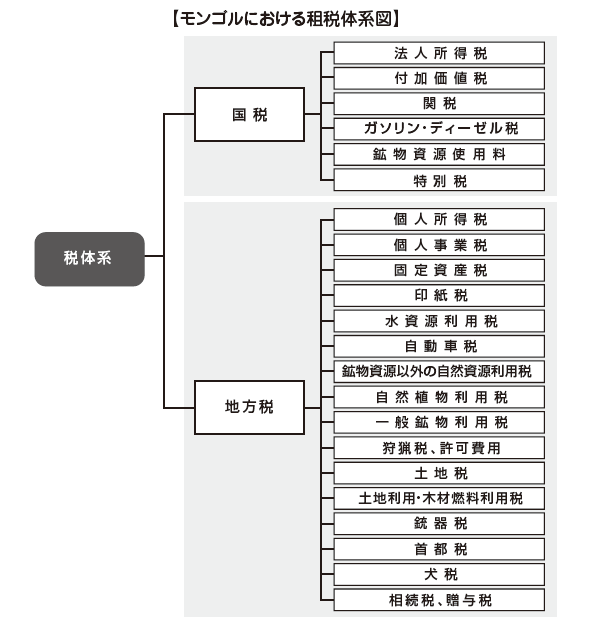

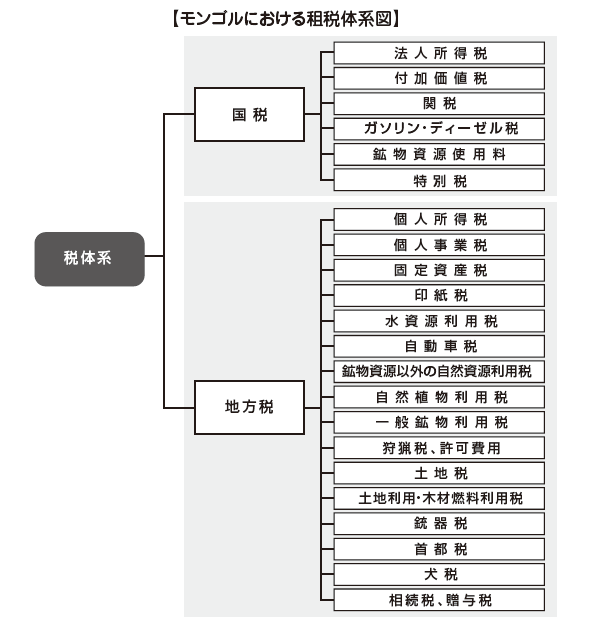

Looking at the types of taxes in Mongolia, it is classified into two types, national tax and local tax, and can be classified into two, direct tax and indirect tax.

[National Tax and Local Tax (Article 7 of Tax Code)]The national tax is the tax item directly managed and collected by the country, and the local tax is the tax that the local public entity decides the tax rate and obligates payment to local governments.

[Direct tax and indirect tax]Direct tax is the tax that is the same as "taxpayer" that pays taxes and "taxpayer" who actually pays taxes. In Mongolia, corporate income tax, personal income tax etc. fall under this.Indirect tax differs from direct taxes, and taxpayers and taxpayers refer to different taxes. It is called indirect tax because it pays taxes to the country indirectly through the tax payment obligor rather than directly paying the tax burden. VAT, customs duty, special tax, gasoline · diesel tax etc. fall under this category.

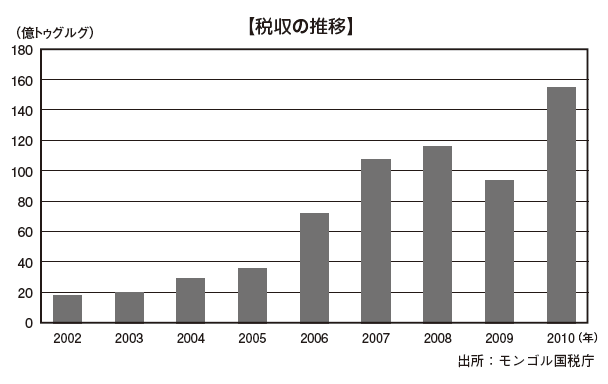

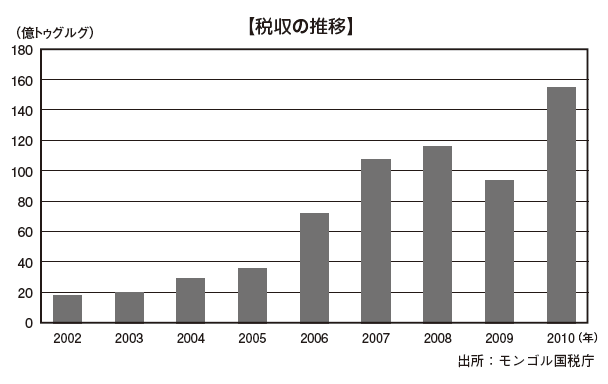

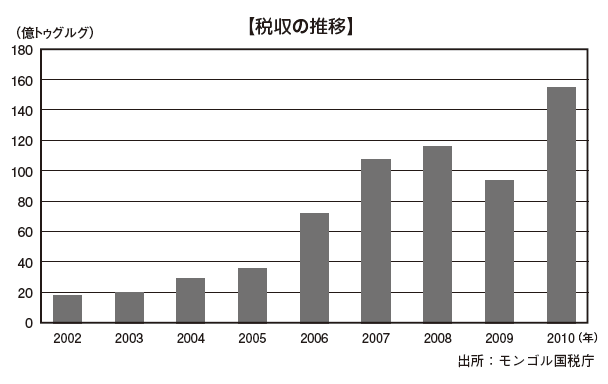

■ Mongolian tax revenue transitionMongolia shifted to market economy in 1999, but suffered from the fiscal deficit due to lack of revenues.After 2006, we achieved a surplus by increasing investment from abroad and increased revenue from economic growth, temporary decline due to the global economic crisis in 2009, but after that the revenue continued to rise sharply I will. As Mongolia's overseas investment in mineral resources in Mongolia has increased and the number of companies entering the country has increased rapidly, tax revenues are expected to increase in the future.

-

Personal Income Tax

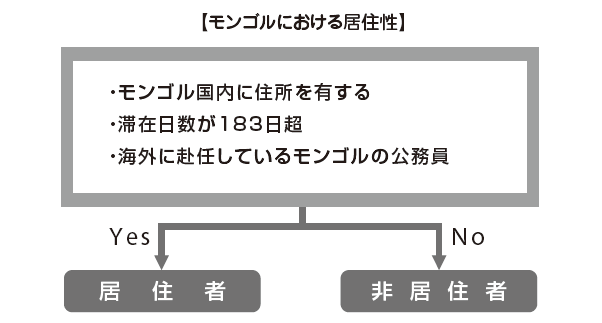

■ Outline of personal income taxWhen calculating the personal income tax amount for individuals living in Mongolia and foreigners working in Mongolia, it is necessary to first calculate the individual income tax amount for Mongolian residents, whether they are "resident" or "non- resident" in Mongolia, It is necessary to judge habitability. Due to this comfort, the range of income taxed is different.

■ Definition of residentsIf it meets any of the following requirements, it will be classified as a resident (Personal Income Tax Act Article 6 (1)).

· Person who has address in Mongolia· Those who are staying in Mongolia for more than 183 days in tax payment year (taxable year)· Public officials in Mongolia who are assigned to overseas

Those who do not meet these requirements or those working in Mongolia through foreign consulates / embassies and their families are treated as "nonresidents" (Article 6, paragraph 3).

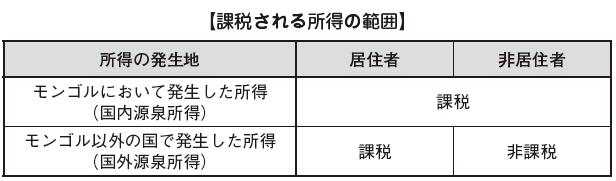

According to the above requirements, "resident / nonresident" is determined and taxed according to the classification. The range of income to be taxed is as follows.

If you become a resident in Mongolia even though you are earning income in other countries yet still, you will be taxed in Mongolia. (Personal Income Tax Act Article 9 (1) 1).

In addition, if you become a non-resident, you will be taxed in Mongolia only for domestic source income generated in Mongolia. Other foreign source income is taxed in each country.

For example, if you are an expatriate who has been transferred from Japan and an individual who has become a resident in Mongolia who owns real estate in Japan, it is combined with income of Mongolia and personal income tax. Therefore, you will still be taxed in Mongolia.

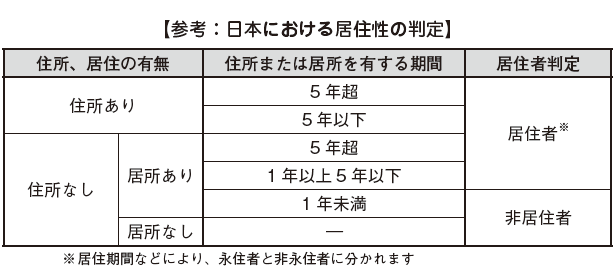

As stated above, the Mongolian tax law defines that residents of taxation stay in Mongolia for more than 183 days or have addresses in Mongolia.

On the other hand, in the Japanese Income Tax Law, because individuals with domicile addresses or individuals who have address for more than one year since then they are defined as residents, in certain cases, both in Japan and Mongolia Under the accreditation of residents, income tax will be doubly taxed in both countries.

Currently, since Japan and Mongolia have not concluded a tax treaty, foreign tax credit is not applied and double taxation may occur, so caution is necessary.

Taxable year

The taxable year in Mongolia is the calendar year (January 1 - December 31).

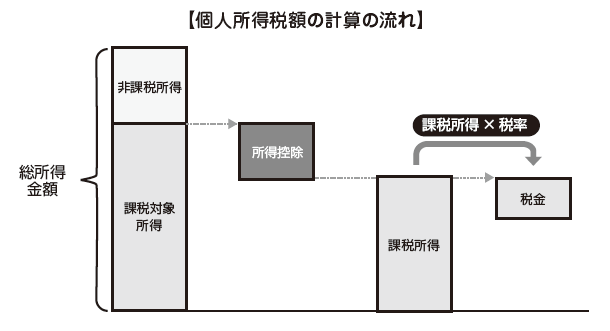

■ Personal income tax calculation

The personal income tax amount in Mongolia is calculated after separating all income for that year up to taxable income and tax free income.

According to the procedure in the following figure, taxable income minus income deduction from total taxable income multiplied by personal income tax rate will be the personal income tax amount to be paid.

[Taxable income]In calculating personal income tax amount, taxable income is categorized as follows (Personal Income Tax Law Article 8 (1)).

· Salary, bonus· Business income· Capital income (rental income, dividend income, interest income, etc.)· Income from transfer of assets· Income obtained from research, composition, writing, concert etc· Prize money or prize money of hukuyo or prize· Horse racing and bicycle race refunds

[Tax-Free Income]The main income prescribed as tax-exempt under the personal income tax law is as follows (Personal Income Tax Law Article 16 1).

· Pensions, benefits, etc.· Donor allowance· Insurance income· Corporate bonds paid by the country and Mongolian Development Bank, income from interest· Received income for disaster support purposes· Salaries, bonuses for those working in Mongolia through foreign consulates, embassies, etc.· Those working in Mongolia through foreign consulates, embassies, etc., their family's income in foreign countries· Income of those who lost more than 50% of the labor force due to disability

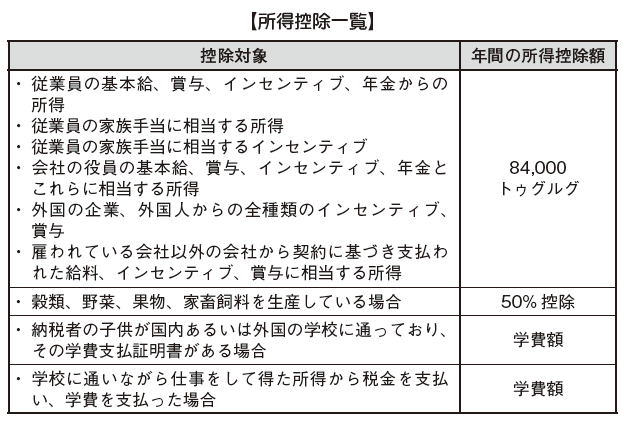

[Calculation of income deduction amount]From the taxable income classified by the above, the next income deduction will be deducted (Article 24 of the Personal Income Tax Act). Even in Mongolia, various income deductions are allowed as well as Japan, but the amount is small compared to the Japanese income tax.

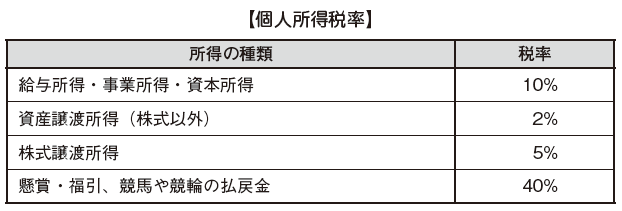

■ Tax calculationAccording to the amount of taxable income obtained by deducting various deductible amounts from gross income as described above, tax resident individuals on tax will calculate tax according to the following classification and tax rate (Personal Income Tax Act Article 23 1, 2 Section).

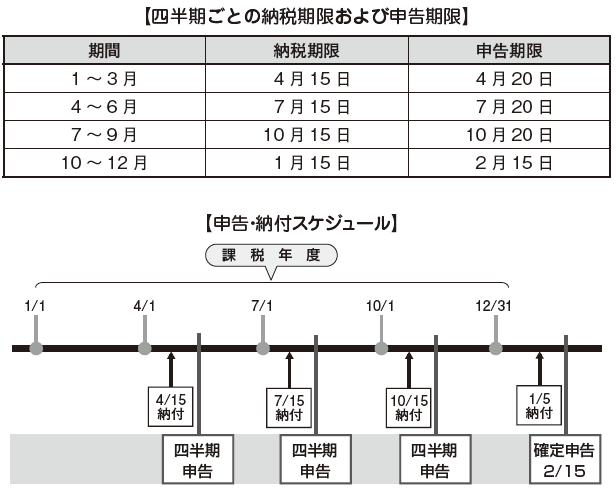

■ Declaration / Payment ProcedureAfter calculating the personal income tax amount, you will be required to file a personal income tax declaration and payment procedure.Regarding the method of declaration, there are quarterly declaration and final return. The quarterly declaration must be declared until the 20th day of the following month of the last month of each quarter, and the final return must be declared by February 15th the next year of the tax year (Article 28 of the Personal Income Tax Act).Tax payment must be made by quarterly by the 15th day of the following month of the last month of each quarter (Article 27).

[National Tax and Local Tax (Article 7 of Tax Code)]

The national tax is the tax item directly managed and collected by the country, and the local tax is the tax that the local public entity decides the tax rate and obligates payment to local governments.

[Direct tax and indirect tax]

Direct tax is the tax that is the same as "taxpayer" that pays taxes. While on the other hand "taxpayer" who is actually pays taxes. In Mongolia, corporate income tax, personal income tax etc. fall under this.

Indirect tax differs from direct taxes, and taxpayers refer to different taxes. It is called indirect tax because it pays taxes to the country indirectly through the tax payment obligor rather than directly paying the tax burden. VAT, customs duty, special tax, gasoline · diesel tax etc. fall under this category.

■ Mongolian tax revenue transition

Mongolia shifted to market economy in 1999, but suffered from the fiscal deficit due to lack of revenues.

After 2006, we achieved a surplus by increasing investment from abroad and increased revenue from economic growth, temporary decline due to the global economic crisis in 2009, but after that the revenue continued to rise sharply. As Mongolia's overseas investment in mineral resources in Mongolia has increased and the number of companies entering the country has also increased rapidly, tax revenues are expected to increase in the future.

[National Tax and Local Tax (Article 7 of Tax Code)]

The national tax is the tax item directly managed and collected by the country, and the local tax is the tax that the local public entity decides the tax rate and obligates payment to local governments.

[Direct tax and indirect tax]

Direct tax is the tax that is the same as "taxpayer" that pays taxes. While on the other hand "taxpayer" who is actually pays taxes. In Mongolia, corporate income tax, personal income tax etc. fall under this.

Indirect tax differs from direct taxes, and taxpayers refer to different taxes. It is called indirect tax because it pays taxes to the country indirectly through the tax payment obligor rather than directly paying the tax burden. VAT, customs duty, special tax, gasoline · diesel tax etc. fall under this category.

■ Mongolian tax revenue transition

Mongolia shifted to market economy in 1999, but suffered from the fiscal deficit due to lack of revenues.

After 2006, we achieved a surplus by increasing investment from abroad and increased revenue from economic growth, temporary decline due to the global economic crisis in 2009, but after that the revenue continued to rise sharply. As Mongolia's overseas investment in mineral resources in Mongolia has increased and the number of companies entering the country has also increased rapidly, tax revenues are expected to increase in the future.

-

Corporate income taxes

■ Taxpayer

The taxpayers for corporate income tax in Mongolia are as follows; (Article 3, Paragraph 1 of the Income Tax Law).

· Companies established under the laws of Mongolia, their representative offices

· Foreign companies whose head office is located in Mongolia

· Foreign companies that have posted sales in Mongolia, their representative offices

Taxpayers for corporate income tax are divided into residents and nonresidents (Article 5.2). Residents are companies established by Mongolian law and headquarters refers to foreign companies located in Mongolia (Article 5, paragraph 3). On the other hand, foreign companies that are profitable from Mongolia through the Representative Office are nonresidents (Article 5.4).

■ Calculation of taxable income

Taxable income is calculated by deducting the amount of all deductions from the accumulated amount of all gross surplus related to the business operated in one accounting period and the taxable year is 12 months from January 1 to December 31 Income tax law 16 Article 1).

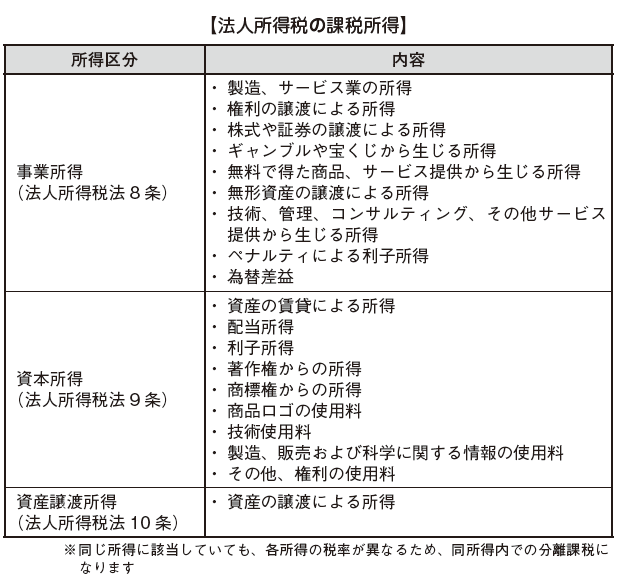

Taxable income includes business income, asset income and asset transfer income, details are as follows (Article 7, paragraph 3).

[Tax exempt income · profit]

According to the Mongolian Income Tax Law, revenues that are tax-exempt are stipulated in the calculation of taxable income (Article 18 of the Income Tax Law).

Revenues that are tax-exempt are as follows;

· Payment of corporate bonds from the country and Mongolian Development Bank, interest expense

· Mongolian non-resident, income arising from a production sharing contract in the oil industry operating in Mongolia (20% withholding tax is exempted for this income when remitting overseas)

· Companies with more than 25 employees, income from companies with disabled workers account for more than two-thirds

· Machinery and parts in Mongolia (List of machines and parts to the government

Income from manufacturing and sales of

[Deductible expenses]

In calculating the corporate income tax amount, the expenses included in the amount of deductible are as follows; (Article 12 of the corporate income tax law).

· Material cost

· Salary

· Social insurance, health insurance payment

· Bonuses, incentives

· Discount on housing allowance, rent etc

· Depreciation and amortization

·repair costs

· Interest on loans (Article 14)

- interest on borrowings for manufacturing, providing services, purchasing assets

- Interest expense from the start of business when constructing or assembling machinery by borrowing money, foreign exchange loss

· Payment amount for service provision

· Rent

· Newspaper book cost

· Insurance fee

· Bank and non-bank credit losses

· Advertising expense

· R & D expenses

· Travel expenses

· Assets with a useful life of 1 year or less

· Training fee

· Stock purchase cost

· Donation

However, even if it falls under the deductible expenses that described above, still, there are no deduction for the "expenses for obtaining tax exempted income" and "expenses for which use is unknown without receipt etc.".

[Expenses not included in deductible money]

As there are no special mention on expenses that is not included in deductible expenses, the applicable expenses for the following items are considered non-deductible.

· Expense other than expenses for deductible expenses

· In case of exceeding the limit specified individually for tax purposes, overtime expenses

[Calculation of Depreciation Expenses]

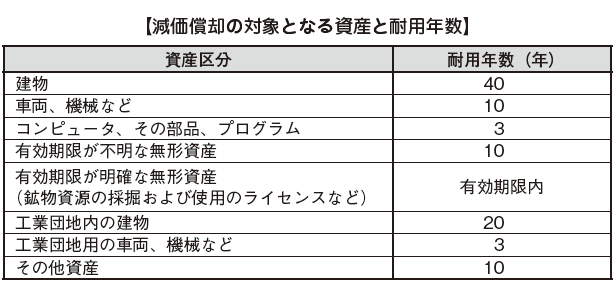

If the useful life of the assets held by the taxpayer is over 1 year, it is subject to depreciation calculation (Article 13 paragraph 1 of the Income Tax Law). In the case of Mongolia, for tax purposes, depreciation is calculated by the straight-line method with the following useful life (Article 13 (2)).

■ Tax rate

Regarding the corporate income tax rate, Mongolia aimed at the lowest tax rate in Asia, and in 2006 revised the corporate income tax law substantially.

As a result, we reduced the minimum tax rate from 15% to 10% and the maximum tax rate from 30% to 25%, respectively, raising the standard of the highest tax rate from 100 million Tugrique to 3 billion Tugulg. Therefore, 99% of corporate income taxpayers will be placed in a flat tax environment.

The tax rate for each item is as follows (Article 17 of the corporate income tax law).

■ Declaration / Payment Procedure

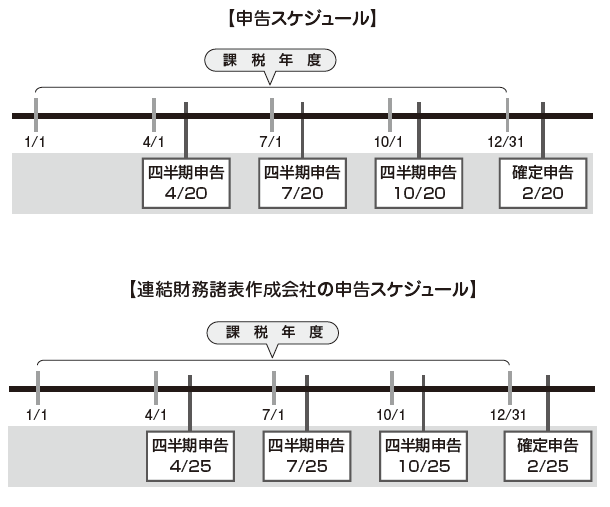

Regarding tax returns, there are quarterly declarations and final return declarations. The quarterly declaration is required until the 20th day of the next month after the end of each quarter, and the final return must be made by February 10th, the next year of the tax year (Article 21 paragraph 4 of the Income Tax Law).

Therefore, the quarterly declaration is due April 20, July 20, October 20 and the final return by February 20 are deadlines.

Companies who prepared consolidated financial statements have quarterly declarations by the 25th day after the end of each quarter and the final return form has been extended by February 25 of the following year.

For tax payment, the corporate income tax must be paid by 25th of the relevant month (Article 21 paragraph 4). -

Value-added tax

Outline of VAT

VAT (Value Added Tax) is a tax that is subjected to taxable economic value in Mongolia, and it is added to individuals, imports and exports of corporations, products and services sold and in Mongolia Value tax is imposed (Article 3, paragraph 1 of the VAT law).

■ Taxpayer

If the annual sales of the person who provides exported and imported in Mongolia, the goods and individuals and corporations who provided the service becomes 50 million Tuguru or more, it will become VAT tax payment obligor from the following month (VAT regulation Article 5 2). Subsidiaries and representative offices of foreign companies will also be taxpayers of VAT if they meet the above requirements (Article 5.2).

[Registration of Taxpayer Obligor]

Taxpayers meeting VAT 's tax liability requirement must apply for registration to the tax bureau within 3 business days (VAT law Article 6, paragraph 1). Specifically, you will be taxed from transactions that occur after you become a taxable operator. The tax office must complete registration and issue a certificate within two business days from the application for the procedure (Article 6.2).

Also, in the following cases, you can apply for taxpayer registration before meeting the taxpayer's requirements (Article 6.4).

· When you run a basic business taxed VAT

· If the sales of service offering is over 8 million Tugurugu

· When investing more than 2 million dollars in Mongolia

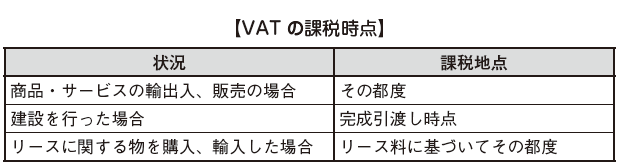

[Taxable Point]

The point at which VAT 's tax obligation occurs is called the taxable point. The timing of taxation in Mongolia is the following timing (Article 8 (1) of the VAT method).

■ Calculation of taxable income

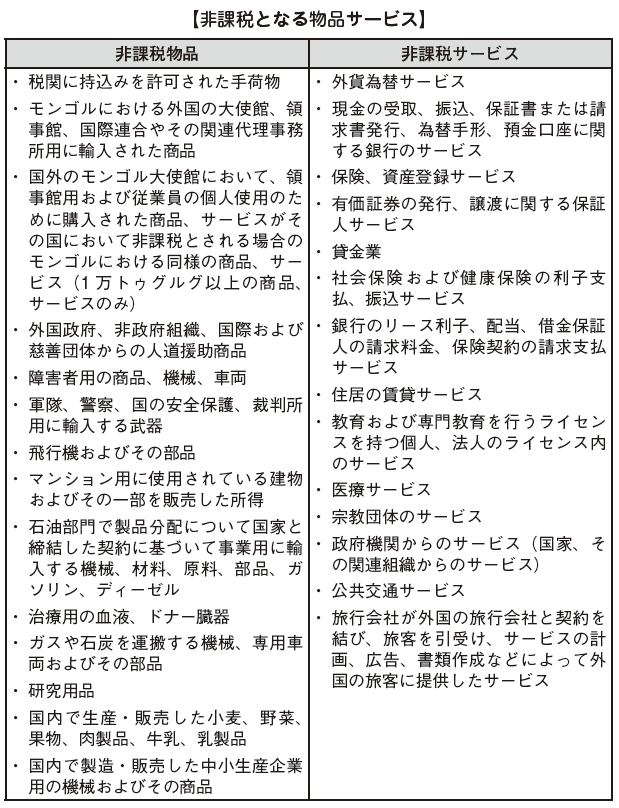

[VAT's tax exemption transaction]

In principle, all goods and services are subject to taxation, unless otherwise stipulated in law, The goods and services listed in the following table are exempt from tax (Article 13 of the Value Added Tax Law).

In addition, VAT is not taxed on salaries, incentives, pensions, bonuses paid to workers (Article 5, paragraph 3).[Exemption from VAT]For the next exported goods, VAT will be exempted (Article 12 of the VAT law).

· Products exported from Mongolia for sale purpose· Transportation services from Mongolia overseas, from overseas to Mongolia domestically and internationally via Mongolia· Services offered outside Mongolia· Services to foreigners and foreign corporations who did not stay in Mongolia at the time of service provision (Services excluding those directly related to assets in Mongolia are excluded, conducted under contract with foreigners, foreign companies Export services are included)· Services for domestic and overseas aircraft carrying overseas transportation services· Medals, money, coins produced in Mongolia by reservation by the government, Mongolian Bank· End products of exported minerals

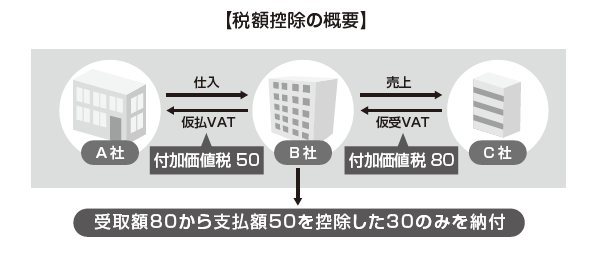

[Output VAT]

The amount of VAT that is going to be paid is calculated as the difference between output VAT and input VAT. The seller will charge VAT to the buyer when selling the taxable goods or taxation services. This VAT is output VAT (provisional reception VAT, sales VAT) from the standpoint of the seller.

[Input VAT]

Buyer must pay VAT to seller when purchasing taxable goods or taxation service. From the viewpoint of the buyer, this is input VAT (provisional payment VAT, purchase VAT).

If the purchased taxable product or taxation service is related to the buyer's business, this input VAT can be offset with the buyer's output VAT. Likewise, the seller can also offset the output VAT and the input VAT paid when purchasing a taxable product or taxation service.

[Deduction method (invoice method)]

The deduction method is a method of paying the difference obtained by deducting the VAT that can be deducted from the input VAT paid from the output VAT received every month. The calculation formula is as follows.

Payment tax amount = output VAT (provisional reception VAT) - input VAT (provisional payment VAT)

The outlines of the tax deduction in the case where the input VAT paid at the time of purchase is 50 and the output VAT received at the time of sales is 80.

[tax rate]

A tax rate of 10% is taxed for goods and services provided by importing, producing and selling (VAT rate Article 11 paragraph 1).

For gasoline and diesel that have been imported, produced and sold, the government limits the tax rate to 10% and tax is imposed (Article 11, paragraph 3).

■ Declaration / Payment Procedure

The taxpayer must transfer the VAT relating to the product and service provision to the government's unified account by the 10th day of the following month and declare it to the tax office (Article 16 paragraph 1 of the VAT law).

Regarding value-added tax on imported goods, we pay directly to the customs duty by the customs authorities, after the customs transfer the taxpayer's VAT to the general account of the government. Regarding declaration, it is divided into quarterly declaration and final return. The quarterly declaration must be declared until the 10th day of the next month at the end of each quarter and the final return must be declared to the Financial Regulatory Commission by January 15th of the following year (Article 16 (2) (3)).

[Penal Provisions]

In the case that the taxpayer did not register as a taxpayers, but produce or sells goods or provides services, or did not pay tax, in addition to the amount of tax originally generated, additionally the following penalty (Value added tax law Article 17 paragraph 1).

· Interest equivalent to 0.3% of total value added tax

· 50% of the total value-added tax amount

[VAT refund]

Regarding the refund of VAT, it will be refunded to the taxpayer if it falls under the following (Article 15 VAT).

· Taxpayers who received more tax returns than scheduled tax payments applied for refund at the tax office

· A foreign ambassador who is a resident of Mongolia, an embassy or his / her employee submits a refund application with the relevant documents to the tax office within 10 days of the following month.

In Mongolia, VAT is generally refunded to major companies and exporters. It takes about two months from application until refund is received.

-

-

-

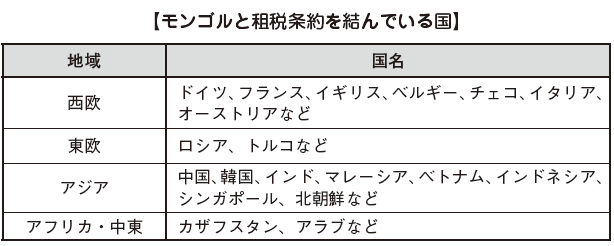

Tax treaty

A tax treaty is a process for avoiding double taxation and preventing tax evasion, etc.

It is an agreement (treaty) between countries, by the composition to be concluded between the houses. Since this treaty is an agreement between countries, the application will be applied in preference to the domestic law prescribed by each country. In other words, even if it is "taxed" under domestic law, it can be treated as "tax free" if it is said to be "tax free" in the tax treaty.

However, by applying the tax treaty, if it is become disadvantageous compared with the domestic law, it is possible to apply domestic law's priority, which is called "preservation closed".

In Mongolia, we have concluded a tax treaty with about 30 countries, but we have not yet concluded a treaty with Japan.

-

Foreign tax credit

■ Avoid double taxation

Taxes are imposed on the movement or consumption of human resources, goods, money and management resources. Similarly for international transactions, if you move or consume management resources, taxation associated with it will result in a tax-related relationship between internationally.

The problem here is that the tax imposed on the transfer or consumption of management resources between the international countries is taxed based on each country's own idea (tax law). In other words, due to differences in laws, there is a possibility that two countries will be taxed at the same time in one transaction.

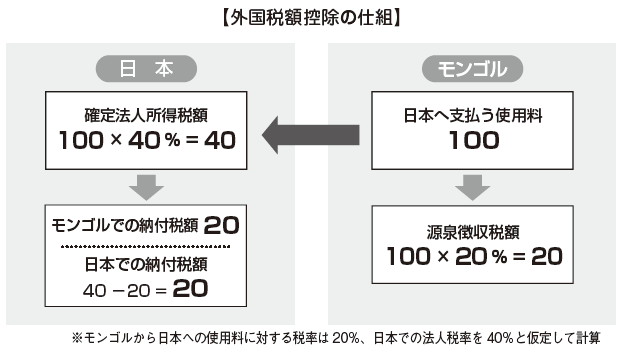

In order to eliminate such double taxation, the provision of "foreign tax credit" is stipulated in each country's tax law.

Foreign tax credit is a system established to prevent double taxation of international income by deducting taxes paid abroad to overseas income from the taxes of the country of residence. For example, this includes foreign income taxes paid by overseas branches, foreign source income tax withheld from payments such as royalties and interest received from overseas, dividends and so on. When such a tax amount occurs, double taxation occurs between the source country of income and the country of residence, so it can be adjusted according to the provision of foreign tax credit in the tax return of the country of residence.

If double taxation occurs for residents of Mongolia, the overlapping tax amount will be deducted from the corporate income tax amount to be paid in Mongolia according to the provision of foreign tax credit (Article 19, 9 of the Income Tax Act).

-

Transfer price taxation

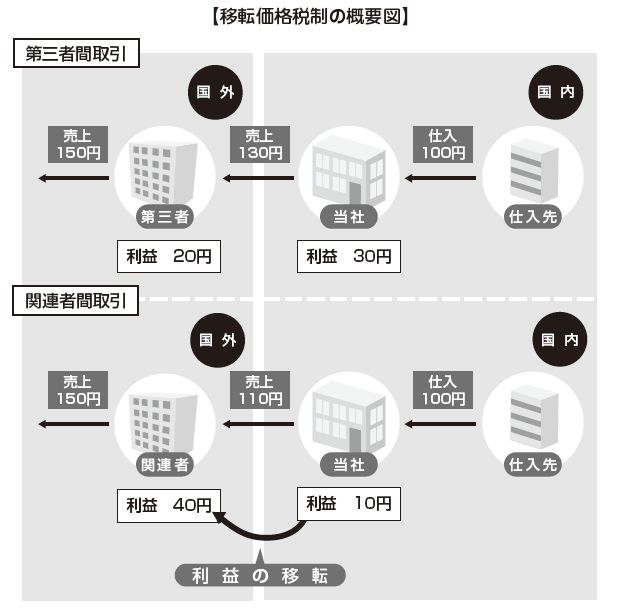

Overview of transfer pricing taxation

With regards to the transactions among affiliates within the same company group, from the relevance, it is possible to freely decide the price pertaining to the transaction between companies. However, if you decide the transaction price freely for transactions with overseas affiliates, it is easy to transfer profits to other countries with a low tax rate. Then, each country will can’t keep its own taxation right, so we established a provision of transfer pricing taxation to prevent the transfer of profits to overseas (tax outflows abroad).

In other words, transfer pricing taxation is aimed at achieving appropriate international taxation by recalculating the transaction price among affiliates into the transaction price (interdependent enterprise price) between third parties.

In practice, taxpayers are not asked whether they intend to avoid taxes, so it is very important to prepare in advance for indications of transfer pricing and to consider risk prevention measures in advance.

■ Overview of Mongolia transfer pricing

In Mongolia, there is no tax law on transfer pricing taxation, so it is necessary to pay attention to transfer pricing taxation mainly in Japan side. However, as international investment in Mongolia will expand in the future, it is fully conceivable that transfer pricing taxation will be developed in Mongolia. -

Transactions via tax · haven

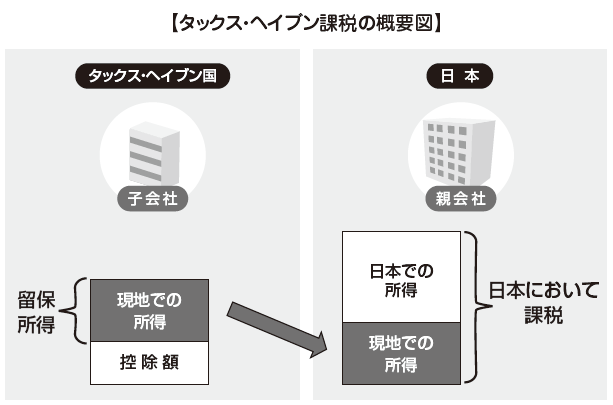

The Cayman Islands, Bermuda Islands, Luxembourg, Cyprus, Singapore and Hong Kong, etc. are called Tax Haven (Tax Haven) and enjoy great benefits in terms of taxation by bringing profits to these countries It is possible to do.

In Mongolia investment, it is possible to think that it is not a direct investment from Japan, but a case where it is managed as a subsidiary company through regional headquarters (RHQ: Regional Headquarters) and managed. By establishing a central office in Tax · Haven, it is possible to retain the profits aggregated from each subsidiary by taking advantage of the maximum tax benefits.

However, if this RHQ is approved by the tax authorities as a "paper company without actual" at the Japanese side, the profits retained at the RHQ are added to the income of the Japanese side and the Japanese corporate tax will be imposed. We called this "tax and haven tax system".

■ Tax · Haven tax system

The tax · haven tax system (total subsidiary taxation system) stipulated in the Japanese Corporate Tax Law means that a domestic corporation has a specified foreign subsidiary company (a foreign affiliated company located in a light tax country), the specified foreign subsidiary Etc., the amount corresponding to the ownership ratio of the subsidiary shares owned by the domestic corporation is regarded as the profit of the domestic corporation, etc., and it is a system that intends to add tax together in Japan.

In other words, in Japan, tax is taxed in Japan regarding the profits retained abroad by recognizing "money" in taxation despite accounting "revenue" is not recognized.

Applicable to this taxation system is a foreign resident or domestic corporation that directly or indirectly holds more than 50% of its shares (together with a decision to exclude voting rights, shares without the right to distribute dividends) It is a company that is a subsidiary company and located in a country / region where tax exemption for corporate income or tax burden ratio is 20% or less.

Among them, if you are a resident or a domestic corporation holding directly or indirectly 10% or more of the shares of a specified foreign subsidiary, etc., the tax incentive will be applied to the amount of retained income of such foreign subsidiary.

In other words, a company that is located in Tax Haven, owns more than 10% of its shares in the same family, and more than 50% of its capital is Japanese equity.

However, all companies that meet the above requirement are not subject to taxation. It is not applied when falling under the following criteria because it is avoided that the enterprise's normal overseas investment business activities are obstructed by conducting the combined taxation.

· Business Criteria * 1 ... The contents of the business is not holding of shares or bonds, provision of rights such as know-how, other than lending business of aircraft etc.

· Entity standard ... have fixed facilities such as office, store, factory

· Control and control standards ... that they themselves are controlling and managing in the country of residence

· Unrelated party standard or country of origin standard

- Unrelated party criteria ... that the main business is being conducted with non-related persons (wholesale business, banking business etc. * 2)

- Country standard of country of residence ... what the main business is done in the country where the head office is located

(Manufacturing industry, retail industry etc.)

* 1 As a result of the 2010 tax reform, the controlling company holding a certain percentage of the shares etc. of the controlled company was excluded

* 2 As a result of the revision of the tax system in 2010, the managed company related to the controlling company whose main business is wholesale business and banking business was excluded

In certain cases where a specified foreign subsidiary company has an entity as an independent entity and it is deemed that there is sufficient economic rationality for conducting business activities in the country where it is located, tax avoidance is not a purpose, it is not covered by the same taxation system.

In other words, in order to avoid applying the same taxation system, it is necessary to prepare activity entities of specified foreign subsidiaries etc. before being pointed out by tax authorities.

■ Other international taxes

Overall, Mongolia has few provisions in the field of international taxation, so in the case of investment from Japan, we will mainly verify the tax provision on the Japanese side.

It is fully anticipated that international taxation in Mongolia will be strengthened as the investment from foreign countries in Mongolia will become popular in the future, so it is necessary to always keep up-to-date information on this point.

-

-

-

Latest News & Updates

* About the consumption tax of the city of Urban

Consumption tax of 1% of the original tax rate was introduced in URBANTOUR, the capital city, on October 1, 2015. The taxable amount is levied on the purchase of alcoholic beverages, alcoholic beverages, purchases of hotels, hotels and other lodging facilities, Meals and drinks at bars and restaurants.

Details will be updated soon.

* Increase in the tariff rate of imported goods

In order to support domestic production and sales in Mongolia, we increased the tariff rate imports from 20% to 20% from 5% for imports that exceeded the total number of 100 items in 14 categories from May 2016. Among the 100 items, Foodstuffs, wood, etc. In regards to these 100 items, we have produced 100% domestic products that meet quality and standards, and are considered to meet domestic demand sufficiently. It will be applied from May 2016.

In addition, imports could be reduced by raising tariffs on five categories and ten items in 2015.

Details will be updated soon. -

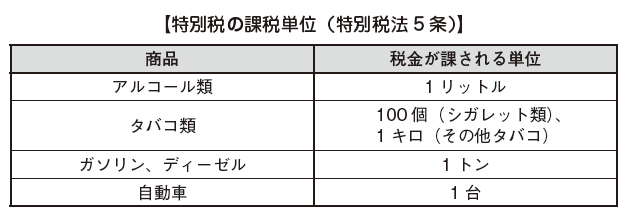

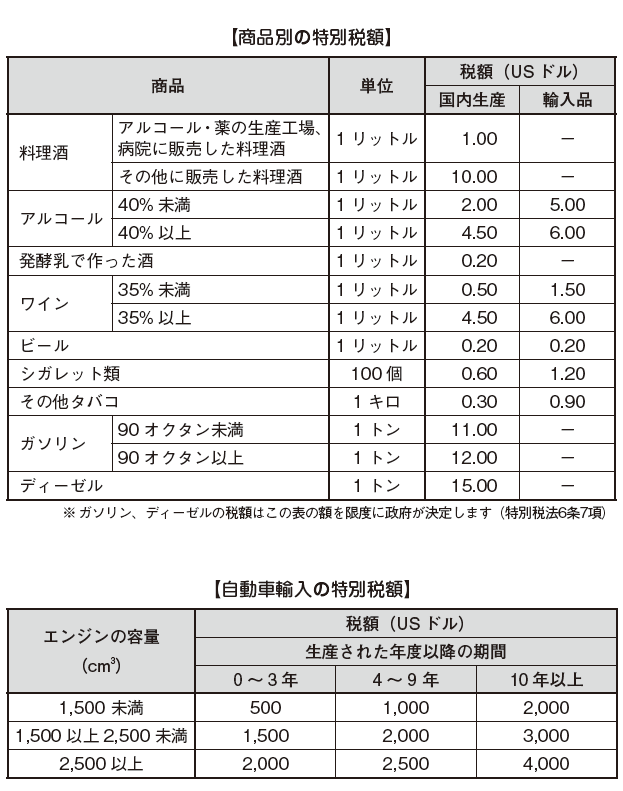

Special tax

Special tax means all kinds of alcohol, tobacco, gasoline, and dee.

It is tax imposed on individuals and corporations who imported, imported, automobiles etc., produced and sold in the country, and also produced and sold special purpose machine parts used for gambling business etc. (Special tax law 3 · Article 4).

■ Calculation of taxable income

Goods to which special tax is imposed are transferred free of charge to others, low price assignment,

In the case that the corporation uses itself, it is assumed that it sold them and tax is imposed (Article 5, paragraph 3 of special tax law).

■ Tax amount

Regarding the tax amount, it is classified in detail according to the type and quantity of the goods (Article 6 of the special tax law). Tax value for each item is as follows.

For individuals and corporate businesses that are in charge, taxes equivalent to US $ 25,000 per month are imposed. In addition, when this tax is collected, it is calculated at the exchange rate of the Mongolian Bank on that day (Special Tax Code Article 6, paragraph 5 · 6).

■ Exemption from special taxFor the following items, they are exempted from special tax (Special Tax Code 7 Article).

· All kinds of alcohol produced and exported in Mongolia, Tobacco, Gasoline, Diesel, Automobile· Milk products made at home, liquor· Snuff· The amount of alcohol consumed by passenger individuals in the range approved by customs, cigarette· Eco car

■ Declaration / Payment ProcedureTaxpayers with special taxes will pay taxes to the general account of the government by 25th of every month for products other than alcohol produced in Mongolia (Article 8, paragraph 2 of the Special Tax Code). We will schedule a special tax on the 25th day from 1st to 3rd of every month and submit a final return to the tax office by 5th of the following month (Article 8.3). If the planned tax payment amount is insufficient with respect to the declared amount, additional tax payment will be paid at the time of final return when declared, and if it is excessive it will be paid by subtracting the difference at the next payment.For special taxes that are taxed on alcohol products sold by alcohol refining factories, it is necessary to transfer them to the general account of the government within 2 days (Article 8 (4)). For individuals and corporations who conduct business related to dedicated machines and parts used in gambling related business, individuals who conduct business related to corporations and gambling related business through the Internet, we planned tax payment by the 25 th month and declare We will submit to the tax office by the 10th day of the following month (Article 8, 9).In this case, the tax amount will be decided by the final return filed on the 10th day of the following month, and if you pay excessively, you will be paying the difference after the next payment. -

Tariff

Customs duty is the tax imposed in accordance with the customs law when goods are exported or imported through the customs authorities of the country.

■ Taxpayer

The taxpayer of the customs duty is the person who applied for the export / import of the goods by using the Mongolian tax authority.

■ Tax rate

The amount of customs duties is divided into the normal tax rate and the special tax rate. The normal tax rate is one-half of the special tax rate (Article 4 of the Customs Tariff Law). Article 3, Article 4, Paragraph 5). Special tax rates are used for goods of the following countries (Article 4, Paragraph 4).

· Member countries of the Mongolian multilateral treaty (152 countries, including Australia, the United States of America, Malaysia, Japan, and Japan)

· Countries that have agreed on international conventions other than multilateral treaties (Belarus, Republic of Kazakhstan, Lao People's Democratic Republic, Russian Federation)

· Other agreed countries

Basically, the tariff rate is 5 to 25%, and the tax rate varies depending on the type of goods.

■ Declaration and payment procedure

The taxpayer shall calculate the amount of customs duties by the customs law, and then report the amount to the tax authorities (Article 7, Paragraph 1 of the Customs Duties Law) Section).

Customs duties on imported goods are paid directly to the tax authorities, after which the tax authorities transfer the tax duties of the taxpayers to the government. -

Stamp tax

The stamp tax is set forth in the Monogram Tax Act of the Monogram and is a tax paid by individuals and corporations for the services provided by the Act (Article 3 of the Seating Tax Act) .The stamp tax differs depending on the type of service, One characteristic of the tax is that the stamp tax levied on foreign corporations is very high. For example, the stamp tax for registration of corporations in domestic investment is 4,000 to 10,000 tons, The stamp tax for registration is set at between 300,000 and 750,000.The types of services for which the stamp tax is collected include the following (Article 5).

· Services in court, notarized services· National registration services (passports, visas, etc.), consular services· Registration of vehicle transportation equipment and issuance of a driving license· Registration of newspapers, magazines, radio and television stations· Corporate registration service· Registration of a local corporation and a representative office of a foreign company· Issuance of corporate licenses

43 types of services are covered by the stamp tax, including the other, the stamp tax amount varies depending on the type of service mentioned above, the taxpayer does not pay the taxpayers directly, (Article 43) The method of collecting the stamp tax can be cash or bank transfer, but the method of payment at each institution is different. After the payment is made, the receipt of the receipt will be issued, so that the receipt of the receipt will be possible.

-

-

-

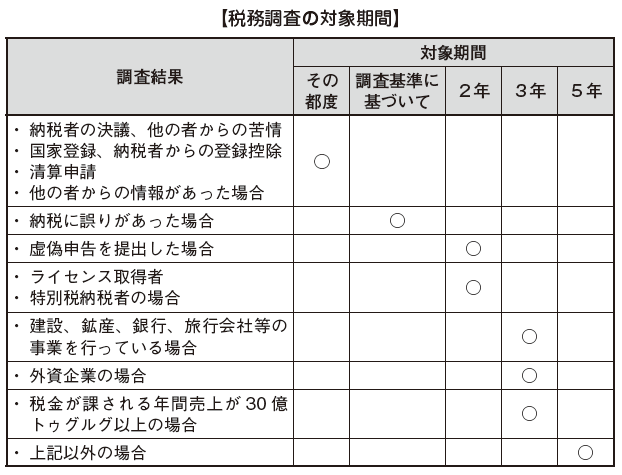

Overview of the tax audit

Even in Mongolia, there is a system of tax surveys, and the Taxation Bureau is the main body, and as a general rule, surveys are conducted every two years, but due to the difference in sales of companies, the period of the tax investigation is determined as follows It is.

· When the sales amount is less than 50 million tug ➡ 30% of all taxpayers are surveyed every year

· When the sales amount is less than 50 million to 100 million tug / month · Every 3 years

· When the sales amount is more than 100 million tugu ➡ Every 2 years

The taxpayers to be surveyed are selected according to the standards of the Tax Bureau, but they are subject to survey in the following cases.

· If the survey period is determined from the previous survey that passed for an enterprise with sales of 540,000T or more

· If you have not paid your tax or have escaped the Tax Office's point of view

· If you are making a zero declaration

· When liquidation application is made

· When the contents and documents of the declaration are inadequate

· If the profit is very low compared to the profit level in the market

· When there are other special causes

If a tax audit is actually conducted, a notice will be sent to the taxpayer in advance to conduct a tax audit in advance, usually 30 days before the start of the tax audit. Contains the date of the survey, required documents, and information about the person in charge.

In the case of an urgent tax audit, a tax audit may be conducted without notice from the Tax Office.

-

Penalties for Taxes

If taxpayers do not comply with the provisions of the tax laws or if they violate them, penal regulations are established in each case.

For example, if you do not pay the tax within the deadline, you will receive an interest rate of 0.1% per day in the day-to-day calculation for the period from the payment deadline to the actual payment of the tax (Article 74 (2) of the Tax Law).

In the following cases, a penalty amounting to 30% of the accrued payment amount incurred in each case will be levied (Article 74 (1) of the Tax Law).

· When you hid taxable sales

· Transfer of taxable sales to another person for no particular reason

· If taxable sales are not reflected in accounting and financial documents

· If the cost is too high to reduce profits

· When the accounting and financial documents are hidden or disposed of

· In case of forgery of documents, etc.

· If there is no accounting process or the account book cannot be filed because the accounting book has not been created

· When a contract is forged

· If the liabilities were falsely recorded

· When transferring and using the business name, address, seal, logo, account, corporate registration certificate, license, asset, and document of a corporation to another person without concluding a special contract

-

-

-

References

・General Taxation Law of Mongolia 2008(モンゴル税法)・Personal Income Tax Law of Mongolia 2006(モンゴル個人所得税法)・Company Law of Mongolia 2011(モンゴル会社法)・Foreign Investment Law of Mongolia 2008(モンゴル外国投資法)・Value Added Tax Law of Mongolia 2006(モンゴル付加価値税法)・モンゴル特別税法2006年・Customs Law of Mongolia 2008(モンゴル関税法)・State Stamp Duties Law of Mongolia 2010(モンゴル印紙税法)

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya