Mongolia

3 Chapter Establishment

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.4 Investment regulation and incentives

3 Chapter Establishment

3.1 Characteristics of business base

3.2 Establishment of business base

3.3 Liquidation and withdrawal

4 Chapter M&A

4.2 Laws and regulations concerning M & A

5 Chapter Corporate Law

5.1 Organization of the company

6 Chapter Accounting

7 Chapter Tax

7.2 Individual Issues of Domestic Tax Law

7.5 Tax survey and tax penalty

8 Chapter Labor

8.4 Foreign Employees in Mongolia

9 Chapter Q&A

-

-

-

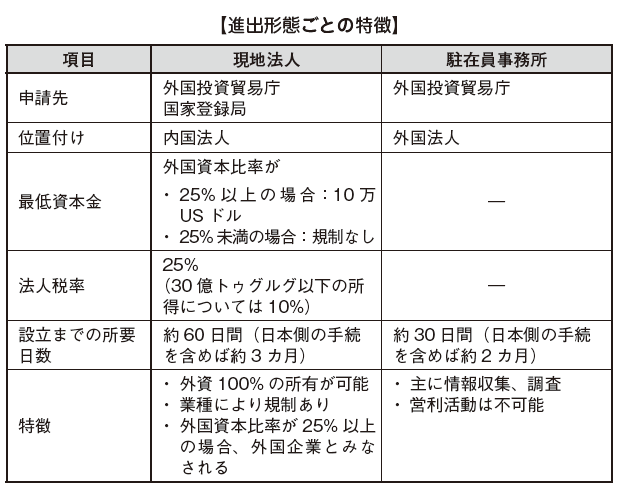

Form of advancement

In establishing a base in Mongolia, it is necessary to proceed under the provisions of Civil Code of Mongolia, Company Law of Mongolia 2011 and Foreign Investment Law of Mongolia 2008.Since November 2013 the Foreign Investment Act was abolished and the Investment Law was enacted, there was no discrimination between foreign-funded enterprises and domestic companies.When a foreign company enters Mongolia, there are legal forms of local corporations, branch offices and representative offices. However, although the establishment of a branch office is legally permitted, it is not practically permitted to register "a branch of a foreign company". If a foreign company establishes a base in Mongolia, it will choose either a local affiliate or a representative office. It is, of course, possible for Japanese companies to set up local subsidiaries in Mongolia and then to set up a branch office in Mongolia in Mongolia.

-

Local corporation

Under the Corporate Law of Mongolia, the company type is divided into "LLC (Limited Liability Company)" and "JSC (Joint Stock Company)" (Article 3, 4 of the Companies Act).In any company form, any business other than those prohibited by law can be done. In addition, the purpose of the company is restricted by the articles of incorporation (Article 8, paragraph 2), and in the case of a business requiring licensing, there is also a common point that it is necessary to acquire a license in advance and to conduct the business.■ limited liability companyA limited liability company (LLC) is a company form in which the transfer of shares is restricted by law and articles of incorporation (Article 3, paragraph 5 of the Companies Act). The number of founders of limited liability company shall be one or more and not more than 50 (Article 5 paragraph 1).For foreign companies entering Mongolia, it is possible to establish a 100% subsidiary, so Japanese companies will choose the form of limited liability company when entering Mongolia. If the foreign capital ratio is less than 25%, there is no requirement for minimum capital but in the case of 25% or more, each investor will not pay minimum capital of 100,000 US dollars or more at the request of the investment law There is no doubt.■ Co., Ltd.Corporation (JSC) is divided into a closed company (CJSC: Closed JointStock Company) and a public corporation (OJSC: OpenJointStock Company) (Article 3, paragraph 6 of the Company Law).Public corporation is a company that shares are registered on stock exchanges and can be freely traded on the market (Article 3, paragraph 7). On the other hand, a private company is a company form in which stocks are registered in theSecuritiesClearingHouseandCentralDepositoryofMongolia (SCH & CD) and sold relative to each other without going through the market (Article 3, paragraph 8).

[Common points and differences between limited liability company and corporation]In any company form, the shareholders' responsibility is a limited liability limited to the amount of contribution, and one or more shareholders can be established.In addition, if the foreign capital ratio is 25% or more, the minimum common capital is commonly 100,000 US dollars for both limited liability company and corporation. On the other hand, as a difference, in the case of a limited liability company, the establishment of directors is optional, but in the case of a corporation, it is obliged to establish nine or more directors. -

Branch and Representative Office

■ BranchIt is not currently allowed to establish branches of foreign companies. It is possible to establish a local subsidiary in Mongolia and establish it as a branch of the corporation. A branch of a local subsidiary of Mongolia is established at locations other than the head office and can fulfill all or part of the company's main functions (Article 7, paragraph 1 of the Companies Act).When a local corporation established in Mongolia establishes a branch of a local subsidiary of Mongolia, it can be decided by a resolution of the Board of Directors (or general shareholders meeting) unless otherwise stated in the articles of incorporation (see Article 7 4).

■ Representative OfficeThe Representative Office is established as a local office of the head office, but the content of the activity is limited to non-profit activities such as surveys and information gathering, and performs revenue activities such as concluding contracts with customers I can not do it.The overseas affiliate has independent corporate status from the parent company, but in the case of the representative office it is not a legally independent organization from the head office, so the responsibility owed by the representative office belongs directly to the head office You will be doing. The head office will conduct business by appointing the representative of the representative office and delegating authority to that person.The representative office of a foreign company in Mongolia does not need to register with the State Registration Agency (SRA), and the registration with the Foreign Investment and Trade Agency (FIFTA) and the Taxation Bureau It is necessary.Also, even if you are a representative office you must also file a tax return. As for corporate tax returns, we will file a quarterly declaration until 20th of the following month and a final return by February 15 as well as corporate tax office.

-

-

-

Latest News & Updates

* Amendment of corporate registration lawLaw amendments enforced on March 1, 2015 are roughly divided into six contents.1: In addition to traditional window application, electronic application (registration application on the Internet) became possible.That although corporate registration amendment before is to hire an agent takes a very long time in order to establish a corporation was common, is now to be registered in the Internet environment (http://103.17.108.238/ubeg/citizen) It became possible. However, since the original document is necessary for the following documents, it is necessary to submit it with the national certificate to the window of the National Register Bureau within 5 business days after electronic registration (Article 13.3 of Corporation Registry).· Certificate of acquiring a corporate name of a corporation (new law 17.1.1)· Application form (new law 17.1.2)· Documents necessary for company establishment (documents prescribed in the Company Law) (New Law 17.1.3)However, if the applicant certifies the above documents according to the Electronic Signature Act at the time of electronic registration, there is no need to submit the original (new law 13.4).Also, before, we submitted the documents prescribed in the Company Law to the National Registry Bureau, but this time additional documents in the new law will be required, so please be careful. After receiving the original documents of applications and documents, the State Registration Bureau will notify you within 10 business days for business registration of foreign-funded enterprises and within 2 business days for other corporations (new law 13.1).2: Introduction of history number to manage change history of corporate registrationsIf the establishment of a corporation is permitted, a corporate profile will be opened and a profile number will be issued. The profile, corporate trade name, type, address, change history, founders and shareholders of information, establishment documents, capital, information of executive officers, contains information of the corporation of branches and representative offices. When there is a change in these information, it is necessary to notify the corporate registry office within 15 business days (new Article 11).3: Correspondence to electronic signatureThe Electronic Signature Act is a law introduced in 2011, and electronically transmits information and documents other than the secret information of the state, and manages relationships relating to relocation (Electronic Signature Act 3.1). The contents can roughly be divided into electronic signature and numeric signature. Electronic signature refers to electronic data including words, numbers, trademarks and images attached to electronic documents for the purpose of indicating those who signed electronic documents (Electronic Signature Act 4.1.1). On the other hand, a numeric signature refers to a document in which information is encrypted using a numeric signature private key for the purpose of preventing fake creation and change of electronic documents.Currently electronic signatures are widely used in banks, but numeric signatures are widely used by all companies for electronic filing. Electronic declarations include quarterly and declarations of definite financial statements, tax returns to tax offices and declarations of social insurance. However, for declaration of social insurance, it is necessary to have the original certified after electronic filing.The above three items will be the main contents of this amendment.In caseDetails will be updated soon. -

Establishment procedure of limited liability company

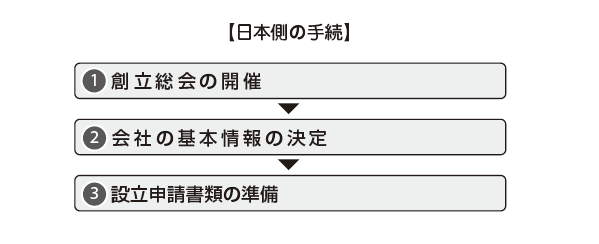

I will explain the establishment procedure of a limited liability company which is a form generally established by Japanese companies.

■ Preliminary Preparation ProceduresThe procedures of the Japanese side are as follows.

[Holding of foundation general meeting] ... ❶The organizer must hold a founding general meeting before establishing the company and decide on the following matters (Article 14, paragraph 3 of the Companies Act).

· Deciding to establish a company in Mongolia· Determination of the company's articles of incorporation· Contents of common stock and preferred stock and their issue price· When establishing a director, appoint a director· Approval of amount of transformation foundation (establishment cost)· Determining the period of investing funds for the company

Unless otherwise specified in the contract between the founder (the founders' contract), attendance of all founders becomes a quorum, and a resolution will be held by a majority vote of attendees (Article 14 (4)) unless otherwise specified. In the case of investing in kind other than money investment, it is necessary to evaluate it at the evaluation organization as necessary, and it is necessary to approve it at the foundation meeting (Article 14 (6)).After holding the foundation general meeting, we will prepare minutes shortly. You must apply to the State Registration Bureau within 30 days from the date of the resolution.

[Determination of company basic information] ... ❷After deciding to establish a local subsidiary at the foundation meeting, we will prepare necessary documents based on the resolution content.

Determination of trade nameFirst of all, we need to decide the company's company name. The Mongolian Company Law provides certain rules for trade name (company name), with XXK (Mongolian, English name is LLC) for limited liability company, XK (Mongolian for English name, JSC for English) It must be attached after the trade name (Article 10, paragraph 1 of the Companies Act). Also, the same trade name or similar trade name as the already registered trade name can not be used (Article 10 (2)). In some cases you may not be able to select the trade name you want, so it is a good idea to prepare 3 to 5 business name candidates in advance.

Determination of capital and investorUnder the Corporate Law, there is no restriction on minimum capital of limited liability company. However, as for investment from foreign companies, there is a separate provision in the Foreign Investment Law. In other words, if a foreign company contributes more than 25% of the total capital, the company will be treated as a foreign company and will require a minimum capital of 100,000 US dollars or more (Foreign Investment Act Article 11 (1)). Also, the minimum capital varies depending on the type of industry.In the case of a limited liability company, it is possible for one or more persons and shareholders to set up. Most cases are cases where the founders become investors (shareholders) as they are, and 100% ownership is possible.

Decision of company organizationThe establishment of other executive officers, directors (association), accounting auditors is optional, but in the case of a foreign company (foreign capital ratio of 25% or more), accounting auditor is required even for a limited liability company Be aware that there are points. In this case it is necessary to appoint a Mongolian CPA as the auditor.

Determination of Registered AddressIt is necessary to register the address before applying for the registration of the company, but at that time you will be required to submit the lease contract of the office. It is necessary to decide an office in advance, or to use an address lending service such as an accounting office entrusting the establishment agency (see P.359 [Address registration] ... ❹).

[Preparation of establishment application documents] ... ❸We need to prepare necessary documents for company establishment. In applying for trade name or establishment, because application documents are written in Mongolian language and the procedures for applying to the authorities are complicated, in general, the substitution of foundation in law firm or accounting office in Mongolia I often ask you.Those who can apply for company establishment are as follows.

• Founder• Executive officers, right holders• Persons who have been delegated

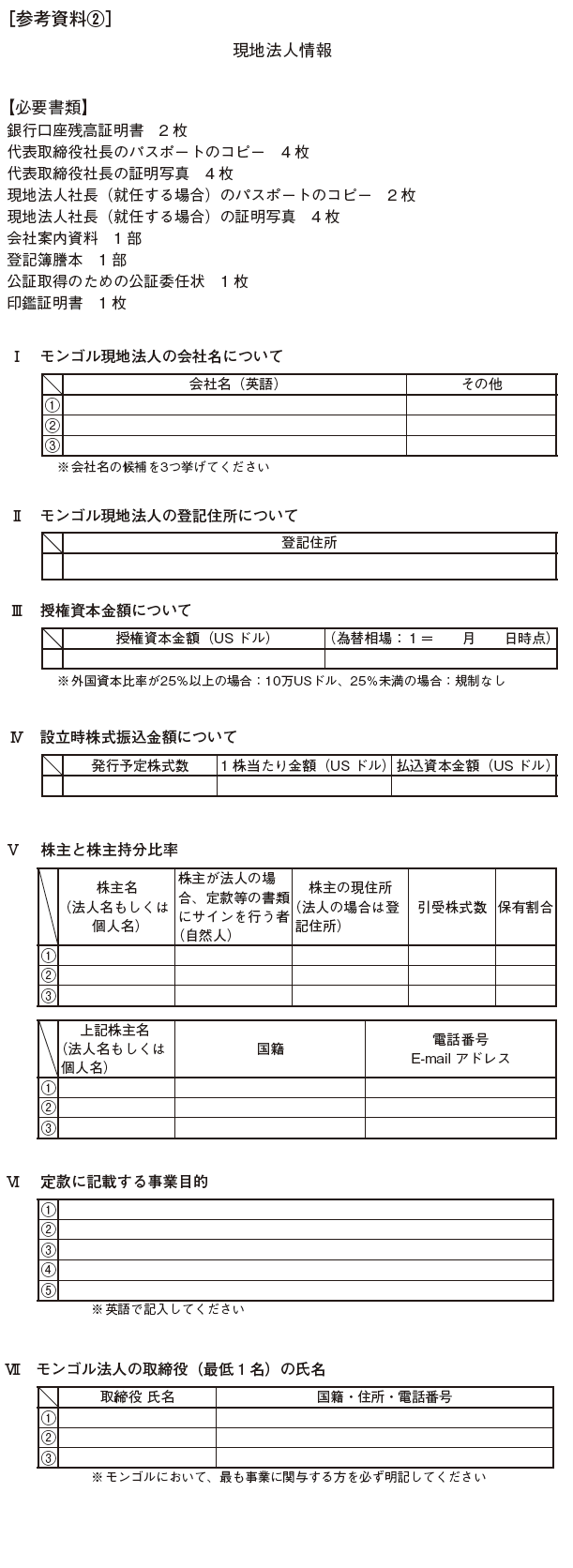

Documents necessary for requesting an external consulting company etc. to establish a company are as follows.Documents prepared by shareholders (parent company) (if the company is a corporation)· Certificate of stamp of the parent company (within 3 months from issue)· Certified copy of registry of parent company (within 3 months from issue)· Copy of the passport of the representative director of the parent company and one other optional director, transcript of family register, certificate photo· Pamphlet of parent company (English)· Copy of the articles of incorporation of the parent company (in English)· Parent company's bank account balance certificate (English)· Notary power of attorney (in case of outsourcing the certification procedure at the notary office in Japan)Documents prepared by the agent for format· Minutes of the foundation meeting that resolved to establish a new company (in English)· Articles of incorporation of the new company· Attorney for establishment to a local agent· Lease agreement of the new company* The above is a general one, and required documents may be different depending on law firm office, accounting officeAs a preparation document of the new company, there are two points: the articles of incorporation of the new company and the letter of attorney for establishment in the local agent.

Articles of incorporation of the new companyIn general, it is not a problem if you use what prepared by a law firm office or accounting office, but it is recommended that you always check the contents. Since the following items are absolute description items (Article 16, paragraph 2 of the Companies Act) that have to be stated in the articles of incorporation, it is necessary to confirm whether these articles are included in the articles of incorporation prepared by accounting firms .

· Corporate name· Number of shares, type, par value and capital amount· When issuing preferred stock, the number of preferred shares and its contents· When establishing a director, the number of directors· The purpose of the company

Attorney for establishment to local agentFor the proxy for establishment to a local agent, the following matters must be listed.

· Name (or trade name) of entrustor (parent company) and trustee (accounting office etc)· Contents and period to delegate· Signature of representative of company to delegate· Company seal[Notary of Document, Authentication]Of the above prepared documents, you must receive the following documents certified by the notary public office in Japan.For copying of the passport of the representative director of the parent company, it is necessary to further certify at the Mongolian embassy in Japan.· Copy of passport of representative director of parent company· Attorney for establishment to a local agentIn order to obtain certification at the Mongolian embassy in Japan, the power of attorney from the parent company to the agent who actually conducts the procedure, the identification certificate of the application agent, the articles of incorporation of the new company, and the original passport of the representative director of the parent company It is necessary. As for procedures for certification at the Mongolian embassy, the procedure required by the officer may be different, so it is desirable to contact the embassy in advance.※ When you receive certification of the document at the foreign embassy / consulate, the document must first proceed with procedures such as the Japanese Legal Affairs Bureau, the notary office, and the Ministry of Foreign Affairs. You can visit each institution to do procedures, but in the Tokyo and Kanagawa prefectures public notarization office, these procedures can be received at the notary office with one stop service. Please check the detailed procedure at the nearest notary office■ Procedures on the local side of MongoliaAfter the completion of the procedure by the Japanese side, we send necessary documents to Mongolian accounting office etc. and move on to Mongolian side procedure. The procedure of Mongolian side is as follows..png) [Translation and notarization of required documents] ... ❶Translate the documents sent from Japan from English to Mongolian and get notarized by the Mongolian notary for this document.We translate documents prepared in languages other than Mongolian as preparations, translate them into Mongolian, confirm that the content is correct, "Mongolian Certified Translator" confirms and marks approval seal. Documents requiring approval mark are as follows.

[Translation and notarization of required documents] ... ❶Translate the documents sent from Japan from English to Mongolian and get notarized by the Mongolian notary for this document.We translate documents prepared in languages other than Mongolian as preparations, translate them into Mongolian, confirm that the content is correct, "Mongolian Certified Translator" confirms and marks approval seal. Documents requiring approval mark are as follows.

· Articles of incorporation of the new company· Agreement of the new company (only when there are two or more shareholders of the new company)· Minutes of company establishment· Attorney for establishment to a local agent· Application Form for Foreign Investment Trade Agency· Lease agreement of the new company· Parent company's bank statement

After accepting the above translation authorization, we must obtain notary notary by Mongolian notary about the articles of incorporation of the new company, the contract of the new company (if any) and the power of attorney for the local agent.Also, it is necessary to be notarized for foreign company certificate, corporate registration certificate, signature certificate of bank account (see)) documents issued by each ministry in subsequent procedures.[Application / acquisition of trade name] ... ❷After completing the translation approval and notarization of "proxy letter of establishment to local agent" and "minutes of company establishment", it is possible to apply for and acquire the trade name. The application for the trade name is carried out by the promoter or agent ("local agent" stated in the "proxy for establishment to the local agent"). The founders or proxies will apply for a company name at the national registration authority. As necessary documents, it is necessary to have a copy of the passport of the new company's shareholders and representatives of the new company, the minutes of the establishment of the company and a letter of attorney for establishment to the local representative. 500 Tugurugu is necessary as a commission. Payment is not cash but will be paid as acquisition of trade name to GOLOMT BANK's 1401001101 account. Procedures are on track if payment is before application.When applying for the trade name is completed, "certificate of acquisition of trade name" and "permit of opening bank account" will be issued. Based on this, we will temporarily open a bank account.The expiration date of the certificate of trade name acquisition and the permission to open a bank account is 30 days from the issue date and automatically becomes ineffective if the company registration to the national registration authority is not made within 30 days after acquisition of the business name Because it is, attention is necessary.

[Temporary opening of bank account and payment of capital] ... ❸After acquiring the trade name of the company, temporarily open the bank account and pay the capital. Since it is provisional opening at this stage to the last, we ask you to issue the balance certificate from the bank after paying capital to the bank account. And after completing all the establishment procedures and obtaining the corporate registration certificate from the National Registry Bureau, you will be able to open an official account.A bank account is opened at a commercial bank in Mongolia, and the currency can be selected as circle, dollar, tuggle. In the case of paying capital from Japan, we will be caught on Mongolian bank account in 1 day after remittance procedure in Japan.The provisional opening of a bank account requires the following documents.· Permit to open a bank account (It will be issued when acquiring trade name)· Trade name acquisition certificate (Issued upon acquiring trade name)

[Address registration] ... ❹At the time of company establishment, the address filled in the application form will be the registered address of the new company. Since you need a rental agreement for address registration, you must prepare a lease contract by deciding an address in advance.In addition, because accounting offices and others are lending addresses etc., there are also places where you can use such services is also one of the options. However, since the tax office to which the tax office belongs is determined by the registered address, it is recommended that the address with the office in the future is not far from the registered address.

[Application for corporate registration certificate to State Registry Bureau] ... ❻A corporate registration certificate will be issued within 14 days after application to the State Registration Authority. When a certificate is issued it must be notarized at the notary office of Mongolia. The following supplementary documents are required for application to the national registration authority.

· Fill in UB No. 12 application from the national registration authority· Trade name acquisition certificate (original)· Certificate of establishing bank account· Minutes resolved to establish a new company (Certified translation)· When foreign state-owned enterprises own 33% or more of all the shares of Mongolian domestic capital enterprises and conduct mining, finance, media and telecommunications businesses, approval from related institutions of investment (original)· Articles of Association of the New Company (2 copies, 1 Certified Translation)· Joint venture agreement of the new company (only when there are two or more shareholders of the new company) (2 copies, 1 certified translation)· License acquisition license (only for industries requiring licenses)· Receipt paid stamp duty (GOLOMT BANK 1401002649 account, 750,000 Tugurugu)· Certificate of transfer of investment amount (Investment amount must be transferred directly from Japan to bank account of new company)· Copy of visa, ID card, passport copy if the promoter is an individual, copy of the registry certificate if the incorporator is a juridical person

After submitting the above documents to the State Registration Authority, you will be notified of the reply within 6 business days.

[Creation of company seal] ... ❼There are 2 kinds of seal of company, it becomes company sign and financial seal. Only the manufacturer specified by the country (TodTamgaLLC) can create a seal of the company. Choose from three types of circle, square, and triangle, you can also create a seal with a logo. In general, there are many companies that have chosen a square seal. In addition, in order to prepare a seal, a corporate registration certificate from the State Registration Bureau is necessary, and normally it can be created in about 2 to 3 days after requesting.

[Taxpayer corporation registration at the local tax office] ... ❽After acquiring the certificate from the State Registration Authority, the new company must apply to the tax office within 14 days and obtain the tax ID number. One company has one person in charge of tax office for each company, who will manage tax return etc etc.

[Sign registration / replacement of bank account] ... ❾After completing all the procedures, you need to replace the temporarily opened bank account with an official bank account. At this time, you need to register the signature of the bank account. The necessary documents are as follows.

· Signature certificate (documents requested to be submitted from bank)· Company seal of new company· Copy of corporate registration certificate

As for the signature certificate, after completion of the procedure at the bank, it is necessary to notarize the document obtained from the bank at the local notary office and submit it again to the person in charge of the bank.If there are no problems in the above procedures, the establishment of a subsidiary will be completed in about three months, including procedures by the Japanese side. -

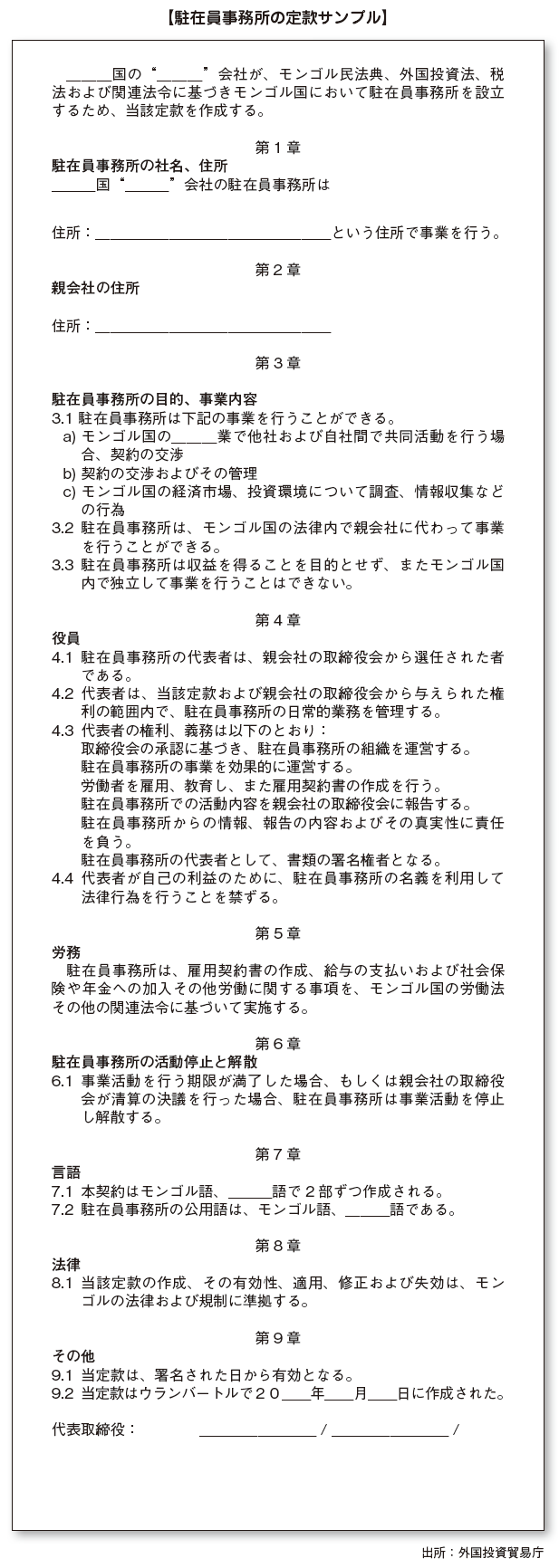

Establishment of Representative Office

Another form of entering Mongolia is the Representative Office. When establishing a representative office in Mongolia, you need to apply and register with the Foreign Investment Trade Agency and the Taxation Bureau. First of all, the following documents are required for applying to the Foreign Investment Trade Agency.· Fill in UB No. 13 application from the National Registry Office· Parent company's Board of Directors Meeting Proceedings relating to Establishment of Representative Office of Parent Company (Original and Certified Translation)· Parent company's brochure· A copy of the registry of the parent company ·, (copy and certified translation of the articles of incorporation)· Parent company's English bank account balance certificate· Copy of the ID card of the manager of the representative office· Constitution of Representative Office (Certified translation 1 part)· Receipt paid stamp duty (GOLOMT BANK 1401002649, 1,100,000 Tugurugu)· If the company establishes a representative office in a foreign country under Japanese law, if the approval from Japan is required, the certificateAfter submitting the above documents to the State Registration Authority, you will be notified of the reply within 6 business days.The person who can apply for establishing a representative office is as follows.• Founder• Executive officers, right holders who can represent without power of attorney• Persons who have been delegatedEven in the case of the establishment of a representative office, we asked for approval and notarization of translation in Mongolia concerning "Board of Directors Meetings Concerning Establishment of Representative Office of Parent Company", "Certificate of Bank of Japan Statement of English Bank Statement" and "Constitution of Representative Office" will become necessary. After submitting the above documents, the registration certificate of the representative office and the establishment permit will be issued within 10 business days.Next, it is necessary to apply and register to the tax bureau. Required documents are as follows.· Application form for taxpayers· Certificate of Registration from Foreign Investment Trade Agency· Foreign investment trade agency establishment permit· Parent company's board of directors meeting on establishing a representative office of the parent company· Constitution of Representative Office· Application form for Representative of Representative Office· Copy of passport of representative office representative office· Proof of address of the representative office (rental agreement)· Clear file to put documentsThe period until the completion of establishment registration is shorter than in the case of a limited liability company, and it will be completed in about a month and a half if there is no problem.Even in the case of the establishment of a representative office, we asked for approval and notarization of translation in Mongolia concerning "Board of Directors Meetings Concerning Establishment of Representative Office of Parent Company", "Certificate of Bank of Japan Statement of English Bank Statement" and "Constitution of Representative Office" will become necessary. After submitting the above documents, the registration certificate of the representative office and the establishment permit will be issued within 10 business days.Next, it is necessary to apply and register to the tax bureau. Required documents are as follows.· Application form for taxpayers· Certificate of Registration from Foreign Investment Trade Agency· Foreign investment trade agency establishment permit· Parent company's board of directors meeting on establishing a representative office of the parent company· Constitution of Representative Office· Application form for Representative of Representative Office· Copy of passport of representative office representative office· Proof of address of the representative office (rental agreement)· Clear file to put documentsThe period until the completion of establishment registration is shorter than in the case of a limited liability company, and it will be completed in about a month and a half if there is no problem.

.png)

-

-

-

Liquidation of overseas affiliates

The company will be liquidated by a general meeting of shareholders or by a court decision (Article 26, paragraph 1 of the Companies Act).The court can make a liquidation decision for the following reasons (Article 26 (2)).· Company goes bankrupt· When there is no single shareholderOther causes prescribed by lawIn the case of liquidation by a resolution of the shareholders meeting, the General Meeting of Shareholders shall make a special resolution and appoint a liquidator etc. (Article 26 (3)).After a liquidator has been appointed at a court or general meeting of shareholders, the rights of the executive officer of the company will expire and the business execution authority concerning liquidation will shift to the liquidator (Article 26 (4)).The liquidator must prepare a document including the balance of the company's assets, the amount of the obligee's credits, etc., to the creditors, and obtain approval at the Board of Directors (or shareholders meeting if not established) (Article 27 6 Section).If the company has residual assets, distribute the residual assets to the shareholders, report to the State Registry Bureau and the Foreign Investment Trade Agency, and submit the liquidation financial statements etc. on liquidation. After that, the State Registration Authority and Foreign Investment Trade Agency will cancel the company registration and the company's liquidation procedure will be completed. The fact that the company's liquidation has been completed will be made public through the website of the National Registry Bureau (Article 29 (2)).

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya