India

10 Chapter Labor

-

-

1 Chapter Introduction

1.1 Draft budget for Economy, Tax System in 2014 and 2015

2 Chapter Basic Knowledge

3 Chapter Economic Environment

4 Chapter Incorporation

5 Chapter M&A

6 Chapter Accounting

7 Chapter Tax System

8 Chapter International Tax

9 Chapter Transfer Pricing Taxation

10 Chapter Labor

-

-

-

India- Japan Relations

The friendship between India and Japan has a long history rooted in spiritual affinity and strong cultural and civilizational ties. India’s earliest documented direct contact with Japan was with the Todaiji Temple in Nara, where the consecration or eye-opening of the towering statue of Lord Buddha was performed by an Indian monk, Bodhisena, in 752 AD. In contemporary times, among prominent Indians associated with Japan were Swami Vivekananda, Gurudev Rabindranath Tagore, JRD Tata, Netaji Subhash Chandra Bose and Judge Radha Binod Pal. The Japan-India Association was set up in 1903, and is today the oldest international friendship body in Japan.

Throughout the various phases of history since contacts between India and Japan began some 1400 years ago, the two countries have never been adversaries. Bilateral ties have been singularly free of any kind of dispute – ideological, cultural or territorial. Post the Second World War, India did not attend the San Francisco Conference, but decided to conclude a separate peace treaty with Japan in 1952 after its sovereignty was fully restored. The sole dissenting voice of Judge Radha Binod Pal at the War Crimes Tribunal struck a deep chord among the Japanese public that continues to reverberate to this day.

Exchange between Japan and India is said to have begun in the 6th century when Buddhism was introduced to Japan. Indian culture, filtered through Buddhism, has had a great impact on Japanese culture, and this is the source of the Japanese people's sense of closeness to India.

After World War II, in 1949, Indian Prime Minister Jawaharlal Nehru donated an Indian elephant to the Ueno Zoo in Tokyo. This brought a ray of light into the lives of the Japanese people who still had not recovered from defeat in the war. Japan and India signed a peace treaty and established diplomatic relations on 28th April, 1952. This treaty was one of the first peace treaties Japan signed after the World War II.

Ever since the establishment of diplomatic relations, the two countries have enjoyed cordial relations. In the post World War II period, India's iron ore helped a great deal Japan's recovery from the devastation. Following Japanese Prime Minister Nobusuke Kishi's visit to India in 1957, Japan started providing yen loans to India in 1958, as the first yen loan aid extended by Japanese government. Since 1986, Japan has become India's largest aid donor, and remains so.

The modern nation States have carried on the positive legacy of the old association which has been strengthened by shared values of belief in democracy, individual freedom and the rule of law. Over the years, the two countries have built upon these values and created a partnership based on both principle and pragmatism. Today, India is the largest democracy in Asia and Japan the most prosperous.

Recent Relations

Prime Minister Yoshiro Mori’s visit to India in August 2000 provided the momentum to strengthen the Japan-India relationship. Mr. Mori and Prime Minister Atal Bihari Vajpayee decided the establishment of "Global Partnership between Japan and India". Since Prime Minister Junichiro Koizumi’s visit to India in April 2005, Japan-India annual summit meetings have been held in respective capitals. When Prime Minister Manmohan Singh visited Japan in December 2006, Japan-India relationship was elevated the "Global and Strategic Partnership". In September 2014, Prime Minister Modi paid an official visit to Japan and had a summit meeting with Prime Minister Shinzo Abe. They agreed that Japan-India relationship was upgraded to “Special Strategic and Global Partnership.” In December 2015, Prime Minister Abe paid an official visit to India and had a summit meeting with Prime Minister Narendra Modi. The two Prime Ministers resolved to transform the Japan-India Special Strategic and Global Partnership into a deep, broad-based and action-oriented partnership, which reflects a broad convergence of their long-term political, economic and strategic goals. They announced “Japan and India Vision 2025 Special Strategic and Global Partnership Working Together for Peace and Prosperity of the Indo-Pacific Region and the World” a joint statement that would serve as a guide post for the “new era in Japan-India relations.”

High Level Visits

In addition to the annual summit meetings, annual Strategic Dialogue at Foreign Minister-level has been held in respective capitals since 2007. The launch of Ministerial Level Economic Dialogue was agreed during Prime Minister Singh’s visit to Japan in October 2010.

Cooperation in Security Fields

During Prime Minister Singh’s visit to Japan in October 2008, two leaders issued "the Joint Declaration on Security Cooperation between Japan and India". Furthermore, to advance security cooperation based on the Joint Declaration, Action Plan was issued during Prime Minister Hatoyama’s visit to India in December 2009. There are also various frameworks of security dialogue between Japan and India. The Comprehensive Security Dialogue at the level of Joint Secretary / Director General level was set up in 2001 and eight rounds of dialogue have been conducted since then. Annual Subcabinet / Senior Officials 2+2 dialogue, which was agreed to establish in 2009, was held in New Delhi in July 2010.

Maritime Self Defense Force (SDF) joined in the "Malabar 09" which was co-hosted by U.S. and India in April 2009. Defense Minister of India, Mr. Antony visited Japan in November 2011 to hold the Japan-India Defense Ministerial meeting with Mr. Ichikawa, Japanese Defense Minister. During the meeting, the two Ministers decided to carry out bilateral exercise between the Japan Maritime Self-Defense Force and the Indian Navy. At the annual summit in December 2011, Prime Minister Noda and Prime Minister Singh affirmed that they would expand cooperation in the area of maritime security, including safety and freedom of navigation.

Between the coast guards, combined exercises on anti-piracy, search & rescue etc. have been conducted since 2000. The both coast guards conducted joint exercise at Chennai in January 2012. Heads of coast guards of both countries visit each other almost every year. The two coast guards exchanged a Memorandum on Cooperation at the occasion of commandant Ishikawa's visit to India in November, 2006.

Economic Relations

The Japan-India Comprehensive Economic Partnership Agreement (CEPA) took effect in August 2011, which will eliminate about 94% of the tariffs between Japan and India within 10 years. Agreement between Japan and India on Social Security was signed in November 2012.

India has been the largest recipient of Japanese ODA Loan for the past several years. Delhi Metro is one of the most successful examples of Japanese cooperation through the utilization of ODA. The Dedicated Freight Corridor (DFC) and the Delhi-Mumbai Industrial Corridor (DMIC) are two symbolic projects of cooperation between Japan and India. Prime Minister Abe reaffirmed that Japan would continue its ODA at a substantial level to encourage India’s efforts towards social and economic development during his visit to India in January 2014.

Political Relations

In the first decade after diplomatic ties were established, several high level exchanges took place, including Japanese Prime Minister Nobusuke Kishi’s visit to India in 1957, Prime Minister Nehru’s return visit to Tokyo the same year (with a gift of two elephants) and President Rajendra Prasad’s visit in 1958. The visit of their Highnesses, the then Japanese Crown Prince Akihito and Crown Princess Michiko in 1960 took the relations to a new level.

The momentum of bilateral ties, however, was not quite sustained in the following decades. After Prime Minister Hayato Ikeda’s visit to India in 1961, the next Prime Ministerial visit from Japan was by Yasuhiro Nakasone in 1984. Prime Ministerial visits from India included Smt. Indira Gandhi (1969 & 1982), Shri Rajiv Gandhi (1985 & 1987) and Shri P. V. Narasimha Rao (1992).

A transformational development in the economic history of India was Suzuki Motor Corporation’s path breaking investment in India in the early 1980s that revolutionized the automobile sector, bringing in advanced technology and management ethics to India. A test of the reliability of Japan as a friend was witnessed in 1991, when Japan was among the few countries that unconditionally bailed India out of the balance of payment crisis.

The beginning of the 21st century witnessed a dramatic transformation in bilateral ties. During Prime Minister Mori’s path-breaking visit to India in 2000, the Japan-India Global Partnership in the 21st century was launched. The Joint Statement signed by Prime Ministers Manmohan Singh and Shinzo Abe in 2006 factored in the new challenges, and the relationship was upgraded to a Global and Strategic Partnership with the provision of annual Prime Ministerial Summits. A Comprehensive Economic Partnership Agreement (CEPA) between Japan and India was concluded in 2011.

Their Majesties Emperor Akihito and Empress Michiko visited India from 30 November-6 December 2013. President Shri Pranab Mukherjee hosted a banquet in their honour and Vice-President, Prime Minister and Leader of Opposition, Lok Sabha called on them. Their Majesties also visited Chennai.

PM Abe paid an official visit to India for the 8th Annual Summit with Prime Minister Dr. Manmohan Singh from 25-27 January 2014 and was the Chief Guest at the Republic Day parade in New Delhi.

Prime Minister Shri Narendra Modi visited Japan from 30 August – September 3, 2014 for the 9th Annual Summit Meeting with Prime Minster Shinzo Abe. PM Abe received PM Modi in Kyoto and hosted a private dinner. During the visit, the two sides upgraded the relationship to a ‘Special Strategic and Global Partnership’. During the visit, both sides agreed to establish the ‘India-Japan Investment Promotion Partnership’. PM Abe pledged to realize public and private investments worth JPY 3.5 trillion and doubling of the number of Japanese companies in India over the next five years.

Prime Minister Shinzo Abe visited India for the 10th Annual Summit with Prime Minister Shri Narendra Modi from 11-13 December 2015. Following their meeting, the two Prime Ministers issued a Joint Statement and a Fact Sheet agreeing to expand bilateral cooperation in a wide range of areas including in the fields of civil nuclear energy, high-speed rail (bullet train) network, defence equipment & technology, taxation, science & technology, investment, education, disaster relief and people-to-people exchanges. 16 Agreements/MoUs/ MoCs/ LoIs were signed/exchanged during the visit. In a special gesture, India also announced “visa on arrival” scheme for all Japanese travelers, including for business purposes, from March 1, 2016. (This has since been implemented). PM Abe, accompanied by PM Modi also visited the city of Varanasi, which signed a partnership agreement with the city of Kyoto in August 2014. A ‘Japan-India Make in India Special Finance Facility’ of JPY 1.3 trillion was also established during the visit of PM Abe to India in December 2015.

Prime Minister is expected to visit Japan for the 11th Annual Summit in November 2016.

The Foreign Minister level 8th Strategic Dialogue was held in New Delhi on 17 January 2015. Other Ministerial visits in 2015 included Home Minister Mr Rajnath Singh to participate in the UN-Third World Conference on Disaster Risk Reduction in Sendai (14-16 March); Raksha Mantri Mr Manohar Parrikar for the Annual Defence Ministers Meeting (29-31 March); Minister of Economy, Trade and Industry (METI) Mr Yoichi Miyazawa to India (27 April-1 May); Minister of State for Finance Mr Jayant Sinha (May); Minister for Railways Mr Suresh Prabhu (6-9 September); Minister for Science & Technology Mr Harsh Vardhan (2-4 November).

Ministerial visits in 2016 included Minister (IC) for Power, Coal, New and Renewable Energy Mr. Piyush Goyal, (12-15 January); Minister of State (Home) Mr Kiren Rijiju (19-21 January); Union Health and Family Welfare Minister Mr. Jagat Prakash Nadda to attend the Asian Health Ministers' Meeting on Anti-Microbial Resistance(15-17 April); then Minister of Education, Culture, Sports, Science and Technology Mr. Minister Hiroshi Hase (6 May); Union Finance Minister Mr. Arun Jaitley ( 29 May-4 June); then Defense Minister Gen Nakatani for the Annual Defense Minister consultations (14 July).

The two countries have several institutional dialogue mechanisms, which are held regularly, at senior official and functional levels to exchange views on bilateral issues as well as regional and international cooperation. There is Foreign Office Consultation at the level of Foreign Secretary / Vice Foreign Minister as well as a 2+2 Dialogue at the level of Foreign and Defense Secretaries. Similarly, there are dialogue mechanisms in diverse fields such as economy, commercial, financial services, health, road transport, shipping, education etc. to name a few sectors.

Economic and Commercial Cooperation

Economic relations between India and Japan have vast potential for growth, given the complementarities that exist between the two Asian economies. Japan's interest in India is increasing due to a variety of reasons including India's large and growing market and its resources, especially the human resources. The India-Japan Comprehensive Economic Partnership Agreement (CEPA) that came into force in August 2011 is the most comprehensive of all such agreements concluded by India and covers not only trade in goods but also Services, Movement of Natural Persons, Investments, Intellectual Property Rights, Custom Procedures and other trade related issues. The CEPA envisages abolition of tariffs over 94% of items traded between India and Japan over a period of 10 years.

Japan has been extending bilateral loan and grant assistance to India since 1958, and is the largest bilateral donor for India. Japanese ODA supports India’s efforts for accelerated economic development particularly in priority areas like power, transportation, environmental projects and projects related to basic human needs. The Ahmedabad-Mumbai High Speed Rail, the Western Dedicated Freight Corridor (DFC), the Delhi-Mumbai Industrial Corridor with twelve new industrial townships, the Chennai-Bengaluru Industrial Corridor (CBIC) are all mega projects on the anvil which will transform India in the next decade. Delhi Metro Project has also been realized with Japanese assistance.

In the Financial Year (FY) 2015-16, India-Japan trade reached US$ 14.51 billion, showing a decrease of 6.47% over FR 2014-15, when the total bilateral trade was

India’s primary exports to Japan have been petroleum products, chemicals, elements, compounds, non-metallic mineral ware, fish & fish preparations, metalliferous ores & scrap, clothing & accessories, iron & steel products, textile yarn, fabrics and machinery etc. India’s primary imports from Japan are machinery, transport equipment, iron and steel, electronic goods, organic chemicals, machine tools, etc.

Japan is also a major investor in India. The amount of Japan's cumulative investment in India since April 2000 to March 2016 has been US$ 20.966 billion, which is nearly 7 per cent of India's overall FDI during this period. Japanese FDI into India has mainly been in automobile, electrical equipment, telecommunications, chemical and pharmaceutical sectors.

Presence of Japanese companies in India has been increasing steadily. As of October 2015, there were 1,229 Japanese companies that are registered in India, an increase of 73 companies (6% growth) as compared to 1,156 (revised) in October 2014. These companies had 4,417 business establishments that are operating in India, which is an increase of 536 establishments (14% growth) compared to 3,881 (revised) in October 2014.

Science & Technology and Cultural Cooperation

The bilateral Science & Technology Cooperation Agreement signed in 1985 underpins the bilateral S&T cooperation. The India-Japan Science Council (IJSC) was established in the year 1993 and so far has organised 19 annual meetings, supported 250 joint projects, 1600 exchange visits of scientists, 65 joint seminars/workshops and 9 Asian Academic seminars and 10 Raman-Mizushima lectures. In 2006, Department of Science and Technology (DST) initiated a value based partnership working on the principles of 'reciprocity and co-funding with the Japan Society for the Promotion of Science (JSPS) and Japan Science and Technology Agency (JST) through MEXT (Ministry of Education, Culture, Sports, Science and Technology). Since then several Institutional Agreements/ MoUs in the areas of life sciences, material sciences, high energy physics, ICT, biotechnology, healthcare, methane hydrate, robotics, alternative sources of energy, earth sciences, outer space etc. have been signed between the science agencies of both countries.

Since May 2015, about 250 students have visited Japan under the annual “Japan-Asia Youth Exchange Program in Science” also known as the “SAKURA Exchange Program" implemented by DST and JST.

A cultural agreement was signed between India and Japan on 29 October 1956, which came into effect on 24 May 1957. In 1951, India established a scholarship system for young Japanese scholars to study in India. Prime Minister Rajiv Gandhi attended the April 1988 opening ceremony of the Festival of India. The Vivekananda Cultural Centre in Tokyo opened in September 2009. The Centre offers classes on Yoga, Tabla, Bharatanatyam, Odissi, Sambalpuri, Bollywood dances and Hindi and Bengali languages. The ICCR has set up two Chairs on India studies at Ryukoku University, Kyoto and in Reitaku University, Chiba. A year-long Festival of India in Japan 2014-15 was held from October 2014 to September 2015. The Embassy and the Consulate General in association with a number of partners organised various events marking the celebrations of 2nd International Day of Yoga on 19 June 2016. In pursuance of the MoU signed in 2015 between Yoga Organisation of Japan and the Quality Council of India for the promotion of Scheme for Voluntary Certification of Yoga, the first QCI examination outside India, was held in Japan at the Vivekananda Cultural Centre on 23 April, 2016.

Indian Community

The arrival of Indians in Japan for business and commercial interests began in the 1870s at the two major open ports of Yokohama and Kobe. More Indians entered Japan during World War I when Japanese products were sought to fill gaps in demand that war-torn Europe could not meet. Following the great Kanto Earthquake in 1923, most of the Indians in Yokohama relocated to the Kansai region (Osaka-Kobe) and the city hosted the largest migrant Indian population in Japan. Yokohama authorities offered special incentives to the Indian community after World War II to revive their old base in Kanto. The old Indian community in Japan focused on trading in textiles, commodities and electronics. With close linkages to India as well as connections in Hong Kong and Shanghai, they became major players in trading activities across Asia. A newer segment of the community is engaged in gems and jewelry.

In recent years, there has been a change in the composition of the Indian community with the arrival of a large number of professionals, including IT professionals and engineers working for Indian and Japanese firms as well as professionals in management, finance, education, and S&T research. The Nishi-

kasaiKasai area in Tokyo is emerging as a “mini-India”. Their growing numbers had prompted the opening of three Indian schools in Tokyo and Yokohama. The community is actively engaged in events organized by the Embassy. The Indian community lives harmoniously with the neighbours and has developed relations with local governments to become valuable members of the Japanese community. Presently 28,352 Indians live in Japan.India-Japan Economic Relations

Economic relations between India and Japan have vast potential for growth, given the obvious complementarities that exist between the two Asian economies. Japan's interest in India is increasing due to variety of reasons including India's huge and growing market and its resources, especially the human resources. The signing of the historic India-Japan Comprehensive Economic Partnership Agreement (CEPA) and its implementation from August 2011 has accelerated economic and commercial relations between the two countries. During the visit of Prime Minister Modi to Japan in September 2014, PM Shinzo Abe pledged $35 billion in investment in India's public and private sectors over the next five years. The two countries also set a target of doubling Japanese FDI and the number of Japanese firms in India by the year 2019.

2. Bilateral trade between the two countries more than doubled between 2006-07 and 2012-13. However, total trade has come down to $ 14.51 billion in 2015-16 from a peak of $ 18.5 billion in 2012-13. In 2015-16, India's exports to Japan were $ 4.66 billion while imports were $ 9.85 billion. The negative or slow growth in trade with Japan is a matter of concern for India in view of the fact that there is high potential for faster progress on goods and services trade. The share of India-Japan bilateral trade in Japan's total trade has been hovering around 1 per cent but it is in the range of 2.2 to 2.5 per cent of India's total trade. The export-import statistics for the last eight years as per India's Ministry of Commerce data bank are as follows:

(Dollar billion)

Year

2007-08

2008-09

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

(Apr-Mar)

India's export

to Japan

3.86

3.02

3.63

5.09

6.33

6.09

6.81

5.38

4.66

India’s Total Export

163.13

185.29

178.75

251.13

305.96

300.27

314.40

310.33

262.29

%Share

2.37

1.63

2.03

2.07

2.07

2.03

2.17

1.73

1.77

India's import from

fromJapan6.32

7.89

6.73

8.63

12.10

12.51

9.48

10.13

9.85

India’s Total Import

251.65

303.69

288.37

369.77

489.32

491.94

450.20

448.03

381.00

%Share

2.52

2.60

2.34

2.33

2.47

2.54

2.11

2.26

2.58

India-Japan

bilateral trade

10.18

10.91

10.36

13.72

18.43

18.61

16.39

15.51

14.51

Percentage Change

36.5

7.2

-5.04

32.4

34.3

1.00

-11.9

(-) 5.36

(-) 6.4

India’s primary exports to Japan have been petroleum products, chemical elements/compounds, fish and fish preparation, non-metallic mineral ware, Metalliferous ores & scrap, clothing and accessories, iron & steel products, textile yarn/fabrics, machinery, feeding-stuff for animals, etc. India’s primary imports from Japan are machinery, iron & steel products, electrical machinery, transport equipment, chemical elements/compound, plastic materials, manufactures of metals, precision instruments, rubber manufactured, coal/coak and briquettes, etc.

Japan's Investment

3. Regarding investment, India has been ranked as the most attractive investment destination in the latest survey of Japanese manufacturing companies, conducted by the Japan Bank for International Cooperation (JBIC). Japanese FDI in India has increased in recent years but it still remains small compare to Japan's total outward FDI. In terms of cumulative FDI inflows into India, Japan is India's fourth largest source of FDI. Japanese FDI in India grew exponentially from US$ 139 million in 2004 to all time high of $5551 million in 2008 due to mega deals particularly acquisition of Ranbaxy by Daichi Sankyo. In the last two years, Japanese FDI into India increased from $ 1.7 billion in 2013-14 to $2.61 billion in 2015-16. The amount of Japan's cumulative investment in India since April 2000 to March 2016 has been US$ 20.966 billion, which is nearly

Year

Japanese FDI in India (million US$)

% Change

2001

150

(-) 14.3

2002

146

(-) 2.7

2003

124

(-) 15.1

2004

139

12.1

2005

266

91.4

2006

512

92.5

2007

1506

194.1

2008

5551

268.6

2009

3664

(-) 34.0

2010-11

2864

(-) 21.8

2011-12

2326

(-) 18.8

2012-13

2786

19.8

2013-14

1718

(-) 38.36

2014-15

2084

21.3

2015-16

2614

25.4

However, the number of Japanese affiliated companies in India has grown significantly in recent years. As of March 2016, there were 1,209 Japanese companies that are registered in India, an increase of 137 companies (13%) compared to 2013. These companies had 3,961 business establishments that are operating in India, which is an increase of 1,419 establishments (56%) compared to 2013.

Japanese Official Development Assistance (ODA)

Japan has been extending bilateral loan and grant assistance to India since 1958. Japan is the largest bilateral donor to India. Japanese ODA supports India’s efforts for accelerated economic development particularly in priority areas like power, transportation, environmental projects and projects related to basic human needs. A noticeable positive trend in these years is that even as amount committed has stabilized or gone down somewhat, actual disbursement has increased. From 2007-08, Japanese side has introduced a Double Track Mechanism for providing ODA loans which allows us to pose project proposals to the Japanese side twice in a financial year. The interest rates applicable from April 2013 are

Year

Commitment

Disbursement

Yen Billion

Yen Billion

2002-03

120

81

2003-04

125

80

2004-05

134.466

68.85

2005-06

155.458

68.68

2006-07

184.893

55.47

2007-08

225.13

94.65

2008-09

236.047

122.56

2009-10

218.2

128.95

2010-11

203.566

123.84

2011-12

134.288

139.22

2012-13

353.106

113.964

2013-14

365.059

144.254

2014-15

71.39

74.36

2015-2016

400

390*

* highest ever ODA loan disbursement in a financial year in Yen terms.

Specific Projects and Industrial Corridors

- The DMIC - a flagship project of Indo-Japanese cooperation. Implementation of the project is in progress. Indian Government, through the Delhi Mumbai Industrial Corridor (DMIC) Project, is in the process of initiating a new era of industrial infrastructure development with the creation of new generation smart cities across six Indian States.

- In addition to new manufacturing hubs, DMIC will envisage development of infrastructure linkages like power plants, assured water supply, high capacity urban transportation and logistics facilities as well as important interventions like skill development programme for providing employment opportunities of youth.

- The master planning of the DMIC New industrial cities has been carried out by the world class international consultants. Engineering, Procurement and Construction (EPC) contracts for approximately Rs. 3200 crore have been awarded in Dholera in Gujarat, Shendra in Maharashtra, Vikram Udyogpuri in Madhya Pradesh and Integrated Industrial Township Project at Greater Noida.

- In Dholera, the roads and services work has been awarded to M/s Larsen & Tubro while the similar work for Shendra and Integrated Industrial Township Project at Greater Noida have been awarded to M/s Shapoorji & Pallonji. Construction has started at all the project sites namely at Vikram Udyogpuri in Madhya Pradesh, Shendra in Maharashtra, Dholera in Gujarat and Integrated Industrial Township at Greater Noida.

- Shareholders’ Agreement (SHA) has been executed with the State Government of Madhya Pradesh, Uttar Pradesh, Maharashtra and Gujarat. Accordingly, SPVs for the Integrated Industrial Township Project at Greater Noida, Uttar Pradesh; Vikram Udyogpuri near Ujjain in Madhya Pradesh, Phase-I of Shendra Bidkin Industrial Park in Maharashtra and Dholera Special Investment region in Gujarat have been incorporated. The equity of the State Government and DMIC Trust has been released/transferred to the SPVs.

- Earlier environmental clearance has been obtained and Digital master planning/ Information and Communication Technology Master Planning work is completed for almost all the projects. The cities are being benchmarked against the world class standards of sustainability and eco-friendly developments.

- DMICDC has also commissioned a 5MW Model Solar Power Project at Neemrana, Rajasthan with latest cutting edge Japanese technology and the power is being supplied to the grid.

- DMICDC is also implementing a smart solution for Logistic sector by creating a Logistics Databank for near to real time tracking of the movement of the containers so as to bring in efficiency in logistics value chain in partnership with NEC Corporation of Japan. The regulatory and statutory approvals have been obtained and the trial operations will start shortly.

- DMICDC has prepared the DPRs for MRTS projects for Ahmedabad- Dholera in Gujarat and Manesar- Bawal in Haryana, awaiting approval from State Govts. States to start Land acquisition process for taking the projects forward.

- In Principle Approval has been obtained for Greenfield International Airport at Dholera (Gujarat) and Site clearance has been obtained for the Greenfield Airport at Kotkasim (Rajasthan).

- The DMIC - a flagship project of Indo-Japanese cooperation. Implementation of the project is in progress. Indian Government, through the Delhi Mumbai Industrial Corridor (DMIC) Project, is in the process of initiating a new era of industrial infrastructure development with the creation of new generation smart cities across six Indian States.

-

Business Culture in India

Business Culture

Business Culture India is a relationships-driven society. Everyone is connected to everyone else with whom one does business. Dealing with strangers is avoided – reasons for this are not too far to seek. With a judicial system that is painfully slow, expensive and unpredictable, one wants to avoid going to courts. If one is dealing with someone on whom one can exert some pressure, whether it is emotional or from relatives and friends, one is assured of some recourse if matters turn sour. Relationships are built upon mutual trust and respect. In general, Indians prefer to have long-standing personal relationships prior to doing business. It may be a good idea to go through a third party introduction. This gives you immediate credibility. Doing business in India involves spending a lot of time building relationships with all sort of people whether in business or in government or in community or in politics. This is strange for foreigners who come to India from Western Europe or USA. However, this does not surprise anyone who has done business in most of Africa or South America or Asia. It is not unusual for business associates to try to establish relationships that extend to families and friends. This seems strange to western mindset where business and personal life are kept separate. The dividing line in India is either non-existent or very thin. So, if you receive a request from your Indian associate to go to a picnic together with families on the weekend, do not be surprised. Language of contracts in India is often flowery and extremely elaborate. Indian advocates and solicitors sometimes draw up such elaborate and complex contract documents that virtually no one bothers to read through the whole of it. It is not uncommon for parties to a contract to rely on the informal or email or verbal assurances that they have among themselves while the formal contract is seen as no more than a necessary evil that one would rather not touch. We, Anil Chawla Law Associates LLP, advise strongly against this approach. Indian entrepreneurs and senior managers often work for more than 10 hours a day and work on weekends too. Calling up business associates on a Sunday or at 8 pm is not considered something extraordinary. Everyone in India has one or more mobile phones. Calling people on mobile at odd hours (keeping in mind the time when the person receiving the call goes to sleep and wakes up) is considered normal. Not picking up a call from someone known is considered rude.

Answering machine facility is almost unknown in the country. Typically, if one misses a call from someone known, calling back as early as possible is considered almost mandatory. India is a hierarchical society. Even in some large cities where due to western influence calling each other by first name has become acceptable, the hierarchical mindset remains deep rooted. As a general rule, calling people by first name is avoidable unless the person is equivalent or lower to you in age and rank. Anyone who is older (or of higher rank) must be addressed respectfully. This is a hierarchical culture, so greet the eldest or most senior person first. The usual form of greeting does not involve shaking hands even though shaking hands is common. Men may shake hands with other men and women may shake hands with other women; however there are seldom handshakes between men and women. Indians consider it rude to say a clear 'no'. Indians will offer you the response that they think you want to hear. Since they do not like to give negative answers, Indians may give an affirmative answer but be deliberately vague about any specific details. This will require you to look for non-verbal cues, such as a reluctance to commit to an actual time for a meeting or an enthusiastic response. A problem that many foreigners face when dealing with Indian business houses over email etc. is the tendency of Indians to fall silent. Often, when an Indian does not wish to pursue the matter further, the tendency is to fall silent rather than close the matter with a clear ‘no’. Indians enjoy eating together. All food on the table must be shared. The western habit of individual potions being served and each one ordering one’s own food is a strict no-no. A group orders food together. So, before ordering there is quite some discussion to ensure that everyone’s tastes are taken care of and no food is wasted. Often people make compromises only to ensure consensus in the group. For example, if everyone else in the group wants ice cream for dessert, someone who wants coffee is likely to go with the group and have ice cream. If everyone on the table is inclined to have Indian vegetarian food, it will be rude for one individual to order chicken for oneself. Punctuality is the norm as far as business meetings are concerned. However, on social occasions, where large numbers of people are invited, it is customary to be late. It is advisable to ask others who may be invited to the same event whether it will be appropriate to be late. As a general rule, if someone is waiting for you in particular, you must not be late. On the other hand, if you are faceless part of a large crowd, it is fine to be late. Clothing in almost all business situations is conservative though it is not formal. Women, in particular, are advised to avoid dresses that expose legs or other such body parts.

-

Labor Environment

a. Labor Laws

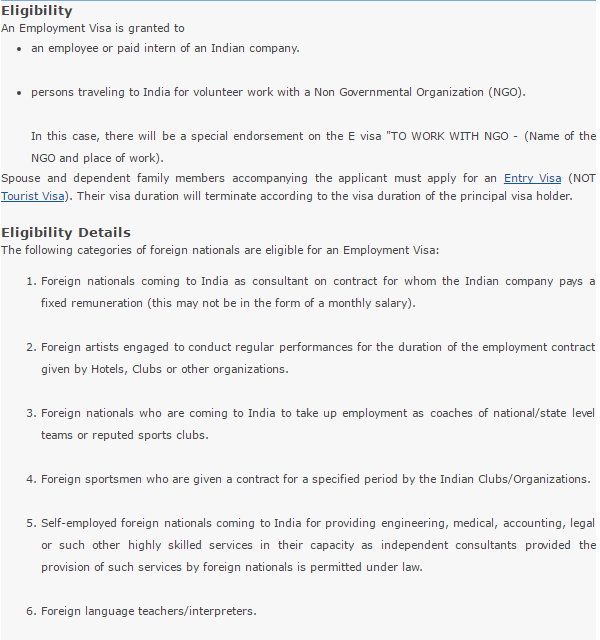

i. Laws applicable to foreign nationals

foreign national can work in India only if he or she has a valid Indian employment visa (“‘E’ visa”), unless the foreigner is already holding a valid Person of Indian Origin (PIO) card or a Overseas Citizen of India (OCI) card.

I hope this quick summary can be used as a road map for employers doing business in India. Please post your questions and comments.

Important Note: This posting is intended to provide a brief overview of employment law in India. It is not intended as a substitute for professional legal advice and counsel.

-

Deployment of Foreign Employees

1.1 The deputation for expatriates and foreign nationals attracts several issues under the Indian legal system. Foreign nationals are engaged in India to provide training and development to local employees, for technology transfer, compliance of joint ventures and license agreements etc.1.2 At the time of setting up a business in India, the foreign employer generally prefers to appoint its own employees for the management and control of the business. This is done in order to smoothen the transfer and execution of company policies to the Indian business arm. Further, it is convenient for the foreign employees working in India to co-ordinate with the parent company in terms of decision making, financial management and other business matters.

The major tax implications on a foreign and Indian national, working in India, and the liability of their employer under the Indian Income Tax Act, 1961 ('IT Act') are laid out below:

1.3 Residential Status of an Expat

An individual is taxed in India on the basis of their residential status under the IT Act. The residential status is determined on the basis of the physical presence of the individual in India during that particular financial year (1 April to 31 March).

The categorization of the individuals on the basis of their residential status in a given financial year is done as follows:

1. Resident in India –

o Resident and ordinarily resident (ROR)

o Resident but not ordinarily resident (RNOR)

2. Non-Resident in India (NR)

Foreign nationals may be exempt from tax in India if their stay does not exceed 90 days, as prescribed in the Act, or the number of days prescribed (generally 183 days) under various double taxation avoidance agreements (DTAA) into which India has entered with other countries, subject to the satisfaction of all the other conditions.

However, in practice, an expatriate coming to India for the first time may remain RNOR for first 3 tax years. But the facts and circumstances may vary from case to case in determining the residential status.

Remuneration for services rendered by a foreign national employed by a foreign enterprise during his/her stay in India will be exempt from tax in India if:

- the total period of the stay in India does not exceed 90 days in a financial year

- the foreign enterprise is not engaged in any trade or business in India

- the remuneration is not charged to an employer subject to Indian income tax.

It may be noted that to the extent the individual qualifies for relief in terms of the 'dependent personal services' article of the applicable DTAA, there will be no tax liability. However, this exemption will not apply if the Indian entity is the individual's economic employer. In addition, any salary or local benefits received in India are also not eligible for relief.

1.4 Tax liability of an Employee

1.5 In respect of Indian employees

- Under Section 192 (1) of the IT Act, employers are required to deduct income tax on the amount payable as salary to the employees at the rate as may be applicable in the relevant financial year.

- Employers also have an option to pay tax on behalf of an employee without making any deduction from her/his income, on the income in the nature of perquisites, which are not provided for by way of monetary payment.

- Section 200(1) of the Companies Act, 1956 prohibits a company from paying remuneration free of income tax. No company shall pay to any officer or employee thereof, whether in his capacity as such or otherwise, remuneration free of any tax.

- Employers can pay tax on non-monetary perquisites provided to their employees without making any deduction from his/her salary and the tax so paid by employer on behalf of the employee on non-monetary perquisites is exempt in the hands of employee under Section 10(10CC) of the IT Act.

1.4.1 In respect of foreign nationals-

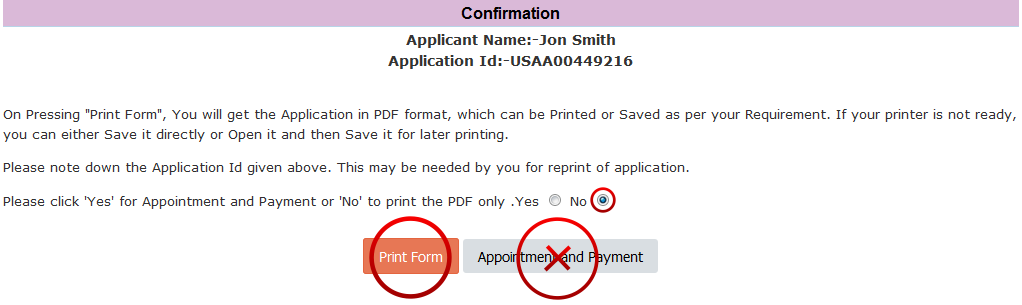

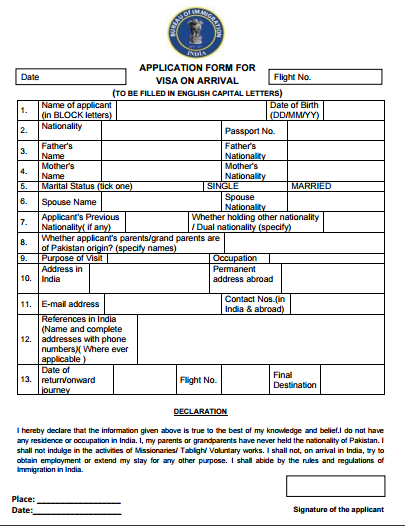

1.4.2 Visa Requirements

- Employment visas are issued to foreigners who are working in India, for an Indian entity. Employment visas are usually granted for one year, or the term of the contract. It can be extended in India.

- Foreign national who wants to visit India for employment in a company/ firm/organization registered in India or for employment in a foreign company/ firm/organization engaged for execution of some project in India, can obtain employment visa provided that they are being sponsored for an Employment Visa by their employer and they draw a salary in excess of USD 25,000 per annum. The condition of annual floor limit on income will not apply to:

- Ethnic cooks,

- Language teachers (other than English language teachers) / translators and

- Staff working for the concerned Embassy/High Commission in India.

- Ethnic cooks,

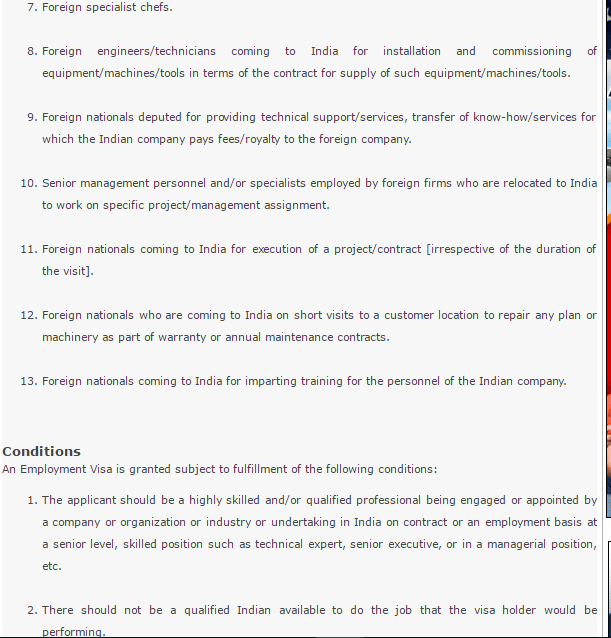

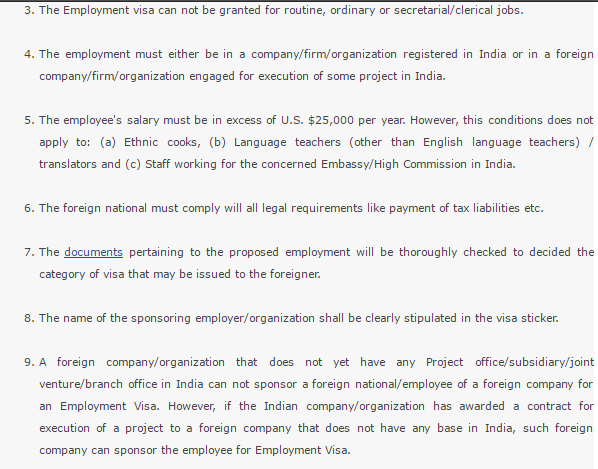

- Employment visa is also granted to foreigners coming to India as a consultant on contract for whom the Indian company pays a fixed remuneration (this may not be in the form of a monthly salary), foreign artists engaged to conduct regular performances for the duration of the employment contract given by Hotels, Clubs, other organizations, coaches of national /state level teams, or reputed sports clubs, sportsmen who are given contract for a specified period by the Indian Clubs/organizations, self-employed foreign nationals coming to India for providing engineering, medical, accounting, legal or such other highly skilled services in their capacity as independent consultants provided the provision of such services by foreign nationals is permitted under law, engineers/technicians coming to India for installation and commissioning of equipment/machines/tools in terms of the contract for supply of such equipment/machines/tools, providers of technical support/services, transfer of know-how/services for which the Indian company pays fees/royalty to the foreign company.

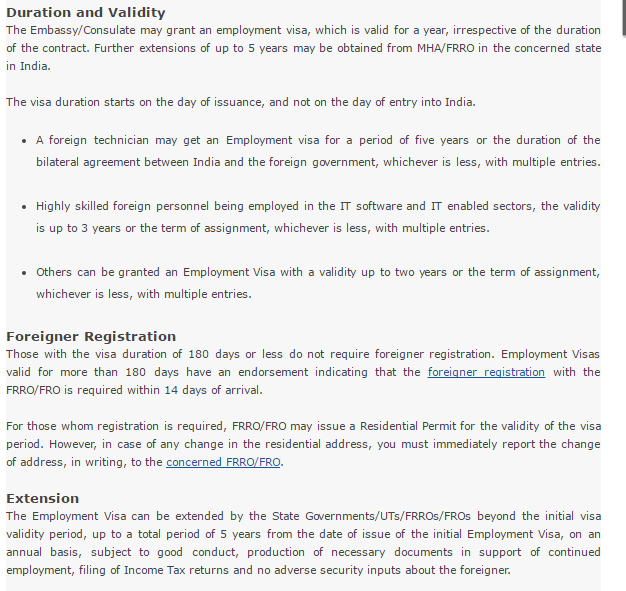

- Embassy/Consulate may grant employment visa, which is valid for an year irrespective of the contract. Further extension may be obtained from MHA/FRRO in the concerned state in India. The visa duration starts from the day of issuance and not from the day of entry in India. Foreign technician may get visa for period of five years or the bilateral agreement between Indian and foreign government whichever is less with multiple entries. For highly skilled IT person visa validity is up to 3 years with multiple entries. Others can be granted visa with validity of two years with multiple entries.

- Indian Missions/ Posts may grant multiple entry project Visa to skilled or highly skilled foreign nationals coming to India for execution of projects. Project Visa will cover only professionals related to Power and Steel sector.

- Business visa is given strictly to those who make business related trips to India such as making sales or establishing contact on behalf of the company outside India.

- This is not applicable for people who are coming to India for part time or full

1.4.3 Remuneration received by foreign expatriates working in India generally is assessable under the head "salaries" and is deemed to be earned in India. Income payable for a leave period that is preceded and succeeded by services rendered in India and that forms part of the service contract is also regarded as income earned in India. Thus, irrespective of the residence status of an expatriate employee, the salary paid for services rendered in India is liable to tax in India. There are no special exemptions or deductions available to foreign nationals working in India.

However, a foreign national who comes to India on short-term business visits can claim an exemption under the domestic tax law or a relevant tax treaty.

1.4.4 Where salary is payable in foreign currency, the salary income must be converted to Indian rupees. For this purpose, the rate of conversion to be applied is the telegraphic transfer-buying rate as adopted by the State Bank of India on the last day of the month immediately preceding the month in which the salary is due or paid. However, if tax is to be withheld on such an amount, the tax withheld is calculated after converting the salary payable into Indian currency at the rate applicable on the date tax was required to be withheld.

1.4.5 The remuneration received by a foreign national is assessable under the head 'salaries' and is deemed to be earned in India if it is payable to him for services rendered in India.

- There are certain exceptions to this rule, few of them being the following:

i. Remuneration of an employee of a foreign enterprise is exempt from tax if his stay in India is less than 90 days in aggregate during the financial year and is not liable to be deducted from the income of the employer. This is further subject to the provisions of Double Taxation Avoidance Agreement(s) ('DTAA(s)') entered by India with various countries.

ii. Remuneration received by a foreign expatriate as an official of an embassy or high commission or consulate or trade representative of a foreign state is exempt on reciprocal basis.

iii. Remuneration under co-operative technical assistance programme or technical assistance grants agreements.

iv. Where the income is derived by way of royalty or fees for technical services received pursuant to an agreement.

- In addition to the above, the Central Government has entered into DTAAs with various countries. As per Section 90(2) of the Act, in relation to an assessee to whom any DTAA applies, the provisions of the Act shall apply only to the extent they are more beneficial to the assessee. The provisions of the DTAAs prevail over the statutory provisions.

1.4.6 Registration with FRRO

Foreign nationals including their family members who intend to stay in India for more than 180 days have to get themselves registered with the Foreign Regional Registration Office (FRRO) within two weeks of arrival in India. For the purposes of registration, the individual is required to make an application in the prescribed form and be present in person at the time of registration. There is no registration fee charged for registration by FRRO.

1.4.7 What constitutes a Permanent Establishment?

- As per treaty laws, India cannot tax the business income of a foreign entity, unless that entity has a Permanent Establishment ('PE') in India.

- Article 7 of the various DTAAs stipulates that only the profits directly or indirectly attributable to the PE in India would be taxed in India. Therefore, only the PE generating income with a business connection in India will be taxable in India.

- The PE of the foreign enterprise in India may use its assets and resources to earn income both in India and outside India, but only the segment of Income that relates to the business connection in India is taxed. In the absence of business connection in India, the PE would just be a taxable entity and not a tax paying entity.

- A foreign company is generally considered to have a PE in India if the foreign company is regarded as having a fixed place in India through which the said foreign company carries on business in India.

- Under some DTAAs, a foreign company is regarded as having a PE in India, if the company renders services (Royalties or Fees for Technical Services) to an Indian company through employees or other personnel deputed to India and such services are rendered by its employees for more than a specified period of time. Such type of a PE is known as Service PE. Furnishing of services is the most important check for attraction of Service PE.

1.4.8 Secondment (employee loan/lease) by Parent Company to Indian subsidiary.

- The secondment of employees though may seem to be very simple, can lead to serious tax implications both for the Indian Subsidiary Company and the Parent Overseas Company.

- The tax obligations of the seconded employee working for Indian company depend upon various factors like the residential status he acquires while working in India, place where services are being rendered, receipt of salary in India or abroad etc. However the tax obligations of the Indian and Foreign employer may not end even if seconded employee has been subject to taxes in India for salary earned as seconded employee.

- A case of secondment of employees by a foreign company may constitute a Service PE if:

i. The foreign company retains the direct supervision and control over the seconded employees.

ii. The work being performed by the employees is on behalf of the foreign company.

iii. The foreign company is getting any amount over and above the mere re-imbursement of the salaries of the concerned employees.

- In the case of DIT (International Taxation), Mumbai Vs. Morgan Stanley and Co. Inc., the Service PE was held to be in place for the foreign company due to the reason that the services were being rendered by the seconded employees on behalf of the foreign company, the foreign company being responsible for the work performed by the seconded employees and that the seconded employees continued to have a lien over their employment with the foreign company.

- The Income Tax Appellate Tribunal (ITAT) has laid down certain factors to hold that an arrangement would not constitute a Service PE on account of following reasons:

i. The services rendered are independent of and not under the control of the foreign company.

ii. The concerned employees are for all practical purposes, employees of the Indian company.

iii. The foreign company is providing only the personnel and not furnishing any services through the personnel.

iv. The reimbursement being made by the Indian company to the foreign company is only towards the actual cost of the salaries paid to the concerned employees and without any mark up.

The Indian company has the right to terminate the concerned employees from the services to the Indian company.

i. Laws applicable to Indian nationals

In the Constitution of India from 1950, articles 14-16, 19(1)(c), 23-24, 38, and 41-43A directly concern labo

ur rights. Article 14 states everyone should be equal before the law, article 15 specifically says the state should not discriminate against citizens, and article 16 extends a right of "equality of opportunity" for employment or appointment under the state. Article 19(1)(c) gives everyone a specific right "to form associations or unions". Article 23 prohibits all trafficking and forced labour, while article 24 prohibits child labour under 14 years old in a factory, mine or "any other hazardous employment".Articles 38-39, and 41-43A, however, like all rights listed in Part IV of the Constitution are not enforceable by courts, rather than creating an aspirational "duty of the State to apply these principles in making laws".[1] The original justification for leaving such principles unenforceable by the courts was that democratically accountable institutions ought to be left with discretion, given the demands they could create on the state for funding from general taxation, although such views have since become controversial. Article 38(1) says that in general the state should "strive to promote the welfare of the people" with a "social order in which justice, social, economic and political, shall inform all the institutions of national life. In article 38(2) it goes on to say the state should "

minimiseminimize the inequalities in income" and based on all other statuses. Article 41 creates a "right to work", which the National Rural Employment Guarantee Act 2005 attempts to put into practice. Article 42 requires the state to "make provision for securing just and human conditions of work and for maternity relief". Article 43 says workers should have the right to a living wage and "conditions of work ensuring a decent standard of life". Article 43A, inserted by the Forty-second Amendment of the Constitution of India in 1976,[2] creates a constitutional right to codetermination by requiring the state to legislate to "secure the participation of workers in the management of undertakings".Indian labo

ur law makes a distinction between people who work in "organized" sectors and people working in "unorganized sectors".[citation needed] The laws list the different industrial sectors to which various labour rights apply. People who do not fall within these sectors, the ordinary law of contract applies.[citation needed]India's labo

ur laws underwent a major update in the Industrial Disputes Act of 1947. Since then, an additional 45 national laws expand or intersect with the 1948 act, and another 200 state laws control the relationships between the worker and the company. These laws mandate all aspects of employer-employee interaction, such as companies must keep 6 attendance logs, 10 different accounts for overtime wages, and file 5 types of annual returns. The scope of labour laws extend from regulating the height of urinals in workers' washrooms to how often a work space must be lime-washed.[3] Inspectors can examine wok in jirkspace anytime and declare fines for violation of any labour laws and regulations.mong the employment contracts that are regulated in India, the regulation involves significant government involvement which is rare in developed countries. The Industrial Employment (Standing Orders) Act 1946 requires that employers have terms including working hours, leave, productivity goals, dismissal procedures or worker classifications, approved by a government body.[4]

The Contract Labour (Regulation and Abolition) Act 1970 aims at regulating employment of contract labo

ur so as to place it at par with labour employed directly.[5] Women are now permitted to work night shifts too (10 pm to 6 am).[5]The Latin phrase 'dies non' is being widely used by disciplinary authorities in government and industries for denoting the

'unauthorised'unauthorized absence' to the delinquent employees. According to Shri R. P. Saxena, chief engineer, Indian Railways, dies-non is a period which neither counted in service nor considered as break in service.[6] A person can be marked dies-non, if· absent without proper permission

· when on duty left without proper permission

· while in office but refused to perform duties

In cases of such willful and unauthorized absence from work, the leave sanctioning authority may decide and order that the days on which the work is not performed be treated as dies non-on the principle of no work no pay. This will be without prejudice to any other action that the competent authority might take against the persons resorting to such practices.[7] The principle of "no work no pay" is widely being used in the banking industry in India.[8] All other manufacturing industries and large service establishments like railways, posts and telecommunications are also implementing it to minimize the incidences of unauthorized absence of workers. The term 'industry' infuses a contractual relationship between the employer and the employee for sale of products and services which are produced through their cooperative endeavor.

This contract together with the need to put in efforts in producing goods and services imposes duties (including ancillary duties) and obligations on the part of the employees to render services with the tools provided and in a place and time fixed by the employer. And in return, as a quid pro quo, the employer is enjoined to pay wages for work done and or for fulfilling the contract of employment. Duties generally, including ancillary duties, additional duties, normal duties, emergency duties, which have to be done by the employees and payment of wages therefor. Where the contract of employment is not fulfilled or work is not done as prescribed, the principle of 'no work no pay' is brought into play.

The Payment of Wages Act 1936 requires that employees receive wages, on time, and without any unauthorized deductions. Section 6 requires that people are paid in money rather than in kind. The law also provides the tax withholdings the employer must deduct and pay to the central or state government before distributing the wages.[9]

The Minimum Wages Act 1948 sets wages for the different economic sectors that it states it will cover. It leaves a large number of workers unregulated. Central and state governments have discretion to set wages according to kind of work and location, and they range between as much as ₹ 143 to 1120 per day for work in the so-called central sphere. State governments have their own minimum wage schedules.[10]

The Payment of Gratuity Act 1972 applies to establishments with 10 or more workers. Gratuity is payable to the employee if he or she resigns or retires. The Indian government mandates that this payment be at the rate of 15 days salary of the employee for each completed year of service subject to a maximum of ₹ 1000000.[11]

The Payment of Bonus Act 1965, which applies only to enterprises with over 20 people, requires bonuses are paid out of profits based on productivity. The minimum bonus is currently 8.33 per cent of salary.[12]

Weekly Holidays Act 1942 Beedi and Cigar Workers Act 1967

The Workmen's Compensation Act 1923 requires that compensation is paid if workers are injured in the course of employment for injuries, or benefits to dependants. The rates are low.[13][14]

· Factories Act 1948, consolidated existing factory safety laws

· The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 that seeks to protect and provides a mechanism for women to report incidents of sexual harassment at their place of work.

The Employees' Provident Fund and Miscellaneous Provisions Act 1952 created the Employees' Provident Fund Organisation of India. This functions as a pension fund for old age security for the organized workforce sector. For those workers, it creates Provident Fund to which employees and employers contribute equally, and the minimum contributions are 10-12 per cent of wages. On retirement, employees may draw their pension.[15]

· Indira Gandhi National Old Age Pension Scheme

· Public Provident Fund (India)

The Employees' State Insurance provides health and social security insurance. This was created by the Employees' State Insurance Act 1948.[16]

The Unorganized Workers' Social Security Act 2008 was passed to extend the coverage of life and disability benefits, health and maternity benefits, and old age protection for unorganized workers. "Unorganized" is defined as home-based workers, self-employed workers or daily-wage workers. The state government was meant to formulate the welfare system through rules produced by the National Social Security Board.

The Maternity Benefit Act 1961, creates rights to payments of maternity benefits for any woman employee who worked in any establishment for a period of at least 80 days during the 12 months immediately preceding the date of her expected delivery.[17]

The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952, provides for compulsory contributory fund for the future of an employee after his/her retirement or for his/her dependents in case of employee's early death. It extends to the whole of India except the State of Jammu and Kashmir and is applicable to:

· every factory engaged in any industry specified in Schedule 1 in which 20 or more persons are employed.

· every other establishment employing 20 or more persons or class of such establishments that the Central Govt. may notify.

· any other establishment so notified by the Central Government even if employing less than 20 persons.

was the view of many in the Indian Independence Movement, including Mahatma Gandhi, that workers had as much of a right to participate in management of firms as shareholders or other property owners.[20] Article 43A of the Constitution, inserted by the Forty-second Amendment of the Constitution of India in 1976,[2] created a right to codetermination by requiring the state to legislate to "secure the participation of workers in the management of undertakings". However, like other rights in Part IV, this article is not directly enforceable but instead creates a duty upon state organs to implement its principles through legislation (and potentially through court cases). In 1978 the Sachar Report recommended legislation for inclusion of workers on boards, however this had not yet been implemented.[21]

The Industrial Disputes Act 1947 section 3 created a right of participation in joint work councils to "provide measures for securing amity and good relations between the employer and workmen and, to that end to comment upon matters of their common interest or concern and endeavo

ur to compose any material difference of opinion in respect of such matters". However, trade unions had not taken up these options on a large scale. In National Textile Workers Union v Ramakrishnan[22] the Supreme Court, Bhagwati J giving the leading judgment, held that employees had a right to be heard in a winding up petition of a company because their interests were directly affected and their standing was not excluded by the wording of the Companies Act 1956 section 398.· Excel Wearv. Union of India A.I.R. 1979 S.C. 25, 36

Collective action[edit]

The Industrial Disputes Act 1947 regulates how employers may address industrial disputes such as lockouts, layoffs, retrenchment etc. It controls the lawful processes for reconciliation, adjudication of labour disputes.[23]

According to fundamental rules (FR 17A) of the civil service of India, a period of unauthorized absence

(i) in the case of employees working in industrial establishments, during a strike which has been declared illegal under the provisions of the Industrial Disputes Act, 1947, or any other law for the time being in force;

(ii) in the case of other employees as a result of action in combination or in concerted manner, such as during a strike, without any authority from, or valid reason to the satisfaction of the competent authority; shall be deemed to cause an interruption or break in the service of the employee, unless otherwise decided by the competent authority for the purpose of leave travel concession, quasi-permanency and eligibility for appearing in departmental examinations, for which a minimum period of continuous service is required.[24] hanalcasca, xnak

· Provisions of the Factories Act 1948

Main articles: Equality before the law and Discrimination law

Article 14 states everyone should be equal before the law, article 15 specifically says the state should not discriminate against citizens, and article 16 extends a right of "equality of opportunity" for employment or appointment under the state. Article 23 prohibits all trafficking and forced labo

ur, while article 24 prohibits child labour under 14 years old in a factory, mine or "any other hazardous employment".· Caste Disabilities Removal Act 1850

Sex discrimination[edit]

Article 39(d) of the Constitution provides that men and women should receive equal pay for equal work. In the Equal Remuneration Act 1976 implemented this principle in legislation.

Article 39(d) of the Constitution provides that men and women should receive equal pay for equal work. In the Equal Remuneration Act 1976 implemented this principle in legislation.

· Randhir Singh v Union of India Supreme Court of India held that the principle of equal pay for equal work is a constitutional goal and therefore capable of enforcement through constitutional remedies under Article 32 of Constitution

· State of AP v G Sreenivasa Rao, equal pay for equal work does not mean that all the members of the same cadre must receive the same pay packet irrespective of their seniority, source of recruitment, educational qualifications and various other incidents of service.

· State of MP v Pramod Baratiya, comparisons should focus on similarity of skill, effort and responsibility when performed under similar conditions

· Mackinnon Mackenzie & Co v Adurey D'Costa, a broad approach is to be taken to decide whether duties to be performed are similar

· Interstate Migrant Workmen Act 1979

Bonded Labour System (Abolition) Act 1976, abolishes bonded labo

ur, but estimates suggest that between 2 million and 5 million workers still remain in debt bondage in India.[25]Child labour in India is prohibited by the Constitution, article 24, in factories, mines and hazardous employment, and that under article 21 the state should provide free and compulsory education up to a child is aged 14.[26] However, in practice, the laws are absolutely not enforced.

· Juvenile Justice (Care and Protection) of Children Act 2000

· Child Labour (Prohibition and Abolition) Act 1986

Some of India's most controversial labo

ur laws concern the procedures for dismissal contained in the Industrial Disputes Act 1947. A workmen who has been employed for over a year can only be dismissed if permission is sought from and granted by the appropriate government office.[27] Additionally, before dismissal, valid reasons must be given, and there is a wait of at least two months for government permission, before a lawful termination can take effect. Redundancy pay must be given, set at 15 days' average pay for each complete year of continuous service. An employee who has worked for 4 years in addition to various notices and due process, must be paid a minimum of the employee's wage equivalent to 60 days before retrenchment, if the government grants the employer a permission to lay off.A permanent worker can be terminated only for proven misconduct or for habitual absence.[28] The Industrial Disputes Act (1947) requires companies employing more than 100 workers to seek government approval before they can fire employees or close down.[5] In practice, permissions for firing employees are seldom granted.[5] Indian laws require a company to get permission for dismissing workers with plant closing, even if it is necessary for economic reasons. The government may grant or deny permission for closing, even if the company is losing money on the operation.[29]

The dismissed worker has a right to appeal, even if the government has granted the dismissal application. Indian labo

ur regulations provide for a number of appeal and adjudicating authorities – conciliation officers, conciliation boards, courts of inquiry, labour courts, industrial tribunals and the national industrial tribunal – under the Industrial Disputes Act.[30] These involve complex procedures. Beyond these labour appeal and adjucating procedures, the case can proceed to respective State High Court or finally the Supreme Court of India.· Bharat Forge Co Ltd v Uttam Manohar Nakate [2005] INSC 45, a worker found sleeping for the fourth time in 1983. Bharat Forge initiated disciplinary proceedings under the Industrial Employment Act (1946). After five months of proceedings, the worker was found guilty and dismissed. The worker appealed to the labo

ur court, pleading that his dismissal was unfair under Indian Labour laws. The labour court sided with the worker, directed he be reinstated, with 50% back wages. The case went through several rounds of appeal and up through India's court system. After 22 years (ahem ahem), the Supreme Court of India upheld his dismissal in 2005· National Rural Employment Guarantee Act 2005

The Industries (Regulation and Development) Act 1951 declared that manufacturing industries under its First Schedule were under common central government regulations in addition to whatever laws state government enact. It reserved over 600 products that can only be manufactured in small-scale enterprises, thereby regulating who can enter in these businesses, and above all placing a limit on the number of employees per company for the listed products. The list included all key technology and industrial products in the early 1950s, including products ranging from certain iron and steel products, fuel derivatives, motors, certain machinery, machine tools, to ceramics and scientific equipment.

1. The Employees’ Provident Fund and Miscellaneous Provisions Act, 1952

2. The Employees’ State Insurance Act, 1948

4. The Contract Labour (Regulation & Abolition) Act

6. The Industrial Disputes Act, 1947

7. The Industrial Employment (Standing Orders) Act, 1946

8. The Maternity Benefit Act, 1961

10. The Payment of Bonus Act, 1965

11. The Payment of Gratuity Act, 1972

12. The Payment of Wages Act, 1936

13. The Workmen Compensation Act, 1923

In India there are different definition of

If we consider the IDA (Industrial Dispute Act, 1947) the employer will be either the authority that is the head of a Central Government or a State Government, mainly for public employment. Or in relation to a local industry, the chief executive officer of that authority.

An employee for the IDA, called a workman, will be any person (including an apprentice) employed in any industry to do any manual, unskilled, skilled, technical, operational, clerical or supervisory work for hire or reward, whether the terms of employment be express or implied.

But it is important to mention that under the IDA, a person who is employed mainly in a managerial or administrative capacity, or a supervisor who draws a monthly salary exceeding Indian rupee (INR) 1,600 will not be considered a workman.

Also, in 2009 a new bill was introduced to widen the definition of “employee” and bring in more people under the ambit of the Payment of Gratuity Act. (a new amendment was done to this bill in 2009). In both the bills, the definition of “employee” has been widened to include any person who is employed for wages, other than an apprentice.

There is no separate definition of an independent contractor under Indian labor laws. The relationship with an independent contractor will therefore be governed by the provisions of the Indian Contract Act, 1872 (ICA).

a. Labor Standards

i. Categories of worker

Skilled

Semi Skilled

Unskilled

Main workers:

Main workers were those who had worked for the major part of the year preceding the date of enumeration i.e., those who were engaged in any economically productive activity for 183 days (or six months) or more during the year.

Marginal workers:

Marginal workers were those who worked any time at all in the year preceding the enumeration but did not work for a major part of the year, i.e., those who worked for less than 183 days (or six months).

Non-workers:

Non-workers were those who had not worked any time at all in the year preceding the date of enumeration.

Main activity of a person who was engaged in more than one activity was reckoned in terms of time disposition. For example, if a person had worked as a daily wage labo

urer for four months, as an agricultural labourer for one month and as a cultivator for two months he was reckoned as daily wage labourer for question 15A since he had spent more time in this activity than as a cultivator or agricultural labourer.A person who normally worked but had been absent from work during the reference period on account of illness, holiday, temporary closure, strike etc., was treated as engaged in the work he would have otherwise have been doing, but for his temporary absence. Persons under training such as apprentices, with or without stipend or wages were treated as workers. A person who had merely been offered work but had not actually joined, was not treated as engaged in that work.

Activity Status The activity status of each of the members of the surveyed households was ascertained and recorded in the survey schedule. The codes used for recording the activity status of employed persons are the following in all the three rounds: Self employed own account worker 11 Self employed employer 12 Unpaid family worker 21 Worked as regular salaried/ wage employee 31 Worked as casual wage labo

ur in public work 41 Worked as casual wage labour in other types of work 51Location of Workplace Location of work place in rural and urban areas has been coded separately in both the 55th and 61st Round surveys, although there was an additional category – street without fixed location in 61st Round. Codes of 55th Round are given below: No fixed work Place 10 Work place in rural areas and located in Own dwelling 11 Own enterprise/ unit/office/ shop but outside own dwelling 12 Employer’

‟s dwelling 13 Employer’‟s enterprise/ unit/ office/shop but outside employer‟’s dwelling 14 Street with fixed location 15 Construction site 16 Others 19 Work place in urban areas and located in Own dwelling 21 Own enterprise/ unit/office/ shop but outside own dwelling 22 Employer‟’s dwelling 23 Employer‟’s enterprise/ unit/ office/shop but outside 24 employer‟’s dwelling Street with fixed location 25 Construction site 26 Others 29 In 61st Round, street without fixed location had code 16 in rural areas and 26 in urban areas. Thus the codes for construction site became 17 and 27 respectively. In 66th Round, these codes were more detailed as follows: No fixed work Place 10 Work place in rural areas and located in Own dwelling 11 Structure attached to own dwelling 12 Open area adjacent to own dwelling unit 13 Detached structure adjacent to own dwelling unit 14 Own enterprise/ unit/office/ shop but away from own dwelling 15 Employer’‟s dwelling unit 16 Employer‟’s enterprise/ unit/ office/shop but outside employer‟’s dwelling 17 Street with fixed location 18 Construction site 19 Others 20 Work place in urban areas and located in Own dwelling 21 Structure attached to own dwelling 22 Open area adjacent to own dwelling unit 23 Detached structure adjacent to own dwelling unit 24 Own enterprise/ unit/office/ shop but away from own dwelling 25 Employer‟’s dwelling unit 26 Employer‟’s enterprise/ unit/ office/shop but outside employer‟’s dwelling 27 Street with fixed location 28 Construction site 29 Others 30Domestic Worker

As per the definition provided by the ILO, “domestic work means any type of work performed in or for a private household and a domestic worker is any person engaged in domestic work within an employment relationship”.

No: NCO Code Description 1 233 Other teaching professionals 2 512 Housekeeping and restaurant service workers 3 513 Personal care and related workers 4 611 Market gardeners and crop growers 5 832 Motor vehicle drivers 6 913 Domestic and related helpers, cleaners and launderers 7 914 Building caretakers, window and related cleaners 8 915 Messengers, porters, door keepers and related workers 9 916 Garbage collectors and related labo

urers 10 931 Building and construction labourers Entitlement to statutory employment rightsStreet Vendors Street Vendors are usually identified by the NCO code 431 as per NCO-68 which relates to “street vendors, canvassers and news vendors” and NCO-2004 code 911 which relates to Street vendors and related workers.

The distribution of those with NCO code 431 by activity status revealed that they were mostly own account workers (code 11) and unpaid family workers (code 21). Tabulation by place of work revealed that street vendors either didn

‟’t have any fixed work place (code 10) or were working from own dwelling (codes 11 & 21) or street with fixed locationHome-Based Workers with location of work place as own dwelling (code 11 in rural areas and 21 in urban areas) were considered as Home Based Workers. In the 66th Round those with location of work place codes 11-14 and 21-24 were considered as home based workers.

“garbage collection, transportation and disposal”, 371 “recycling metal waste and scrap” and 372 “recycling of non-metal waste and scrap”. Thus all the informal sector informal workers in these industries are considered as waste pickers.

Cultivators

Agricultural labourers

Household industry workers

Other worke

Migrant labours[edit

]

Migrant skilled and unskilled labo

urers of India constitute about 40 to 85 percent of low wage working population in many parts of the Middle East. They are credited to having built many of the notable buildings in the Arab countries, including the Burj Khalifa in Dubai (above). Various claims of poor living conditions and labour abuse have been reported.[22]India has two broad groups of migrant labo

urers - one that migrates to temporarily work overseas, and another that migrates domestically on a seasonal and work available basis.About 4 million Indian-origin labo

urers are migrant workers in the middle east alone. They are credited to have been the majority of workers who built many of Dubai, Bahrain, Qatar and Persian Gulf modern architecture, including the Burj Khalifa, the tallest building in world's history which opened in January 2010. These migrant workers are attracted by better salaries (typically US$2 to 5 per hour), possibility of earning overtime pay, and opportunity to remit funds to support their families in India. The Middle East-based migrant workers from India remitted about US$20 billion in 2009. Once the projects are over, they are required to return at their own expenses, with no unemployment or social security benefits. In some cases, labour abuses such as unpaid salaries, unsafe work conditions and poor living conditions have been claimed.[22][23]Domestic migrant workers have been estimated to be about 4.2 million - (Domestic workers, not domestic migrant workers). These workers range from full-time to part-time workers, temporary or permanent workers. They are typically employed for remuneration in cash or kind, in any household through any agency or directly, to do the household work, but do not include any member of the family of an employer. Some of these work exclusively for a single employer, while others work for more than one employer. Some are live-in workers, while some are seasonal. The employment of these migrant workers is typically at the will of the employer and the worker, and compensation varies

India enacted Bonded Labour System Abolition Act (1976) to prohibit any and all forms of bonded labo