Indonesia

2 Chapter Investment Environment

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.2 Investment regulation and incentives

3 Chapter Economic Environment

3.2 Economy Aiming for Innovation

3.3 Issues of Indonesian Economy

4 Chapter Establishment

4.1 Characteristics and tendency how to set up the legal entity in Indonensia

5 Chapter M&A

5.1 Trends in M & A in Indonesia

5.2 Laws and Regulations Concerning M & A

6 Chapter Coporate Law

7 Chapter Accounting

8 Chapter Tax

9 Chapter Labor Law

9.1 labor law and related rule article

10 Chapter Q&A

-

-

-

Investment Environment in Indonesia Seen in Business Questionnaire

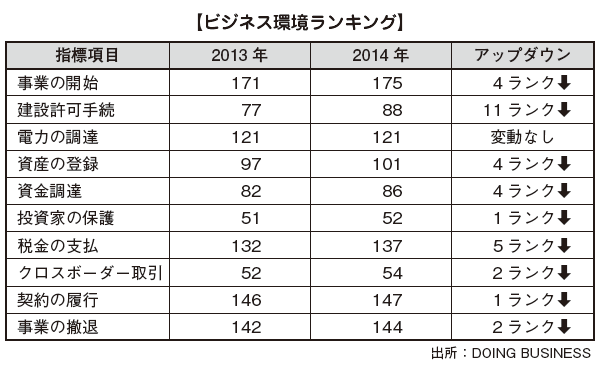

According to "the current state of business environment 2014" jointly announced by the World Bank and the International Finance Corporation (IFC) in October 2013, Indonesia ranked 120 in overall ranking of 189 countries. While, it ranked 128th in 2013. There is a big gap compared with other ASEAN countries like Singapore (1st place), Malaysia (6th place) and Thailand (18th place) and even belong to low ranked countries worldwide.

Meanwhile, according to the "World Investment Report 2013" announced by the United Nations Conference on Trade and Development (UNCTAD) (UNCTAD: United Nations Conference on Trade and Development), in the ranking of countries that multinational companies sees as investment destinations Indonesia got the 4th place. Indeed, it is a place to invest. Despite challenges in the business environment, it attracts attention as a target country for investment from all over the world.

In the ranking of 2013, Indonesia has a ranking higher than the overall ranking, five items are construction permission proceedings, asset registration, fund procurement, investor protection and cross-border transactions.

.png)

-

Financial (stock) Market

The Indonesian Stock Exchange (IDX) is in its capital, Jakarta. The Jakarta Stock Exchange (JSX) and the Surabaya Stock Exchange (SSX), predecessor of the Batavia Stock Exchange in the Dutch East Indies era, merged in 2007 to become the Indonesian Stock Exchange.It was a merger where the mutual benefits of the Jakarta Stock Exchange where the stock trading was main and the Surabaya Stock Exchange which was focused on bonds and futures trading were considered. Market capitalization as of December 2013 was US $ 346.6 billion, which expanded to the 27th largest market size in the world. But considering the Indonesian economy, the market size is still relatively small and future development is expected.

Factors for expanding the market scale in recent years are mainly due to the rise in market capitalization with the strong Indonesian economy as a background, and there are not many new listed companies. Companies in Indonesia are often owned by families.In large companies, there is little tendency not to be listed in the stock market since transparency is required. The share of circulating stocks is small even after listing the company, investor’s money were tend to be invested in Singapore. It is said that there are many problems exist, like the case above.

The stock market is divided into main board on which large companies are listed and a development board by small- and medium-sized enterprises There is a characteristic that a majority of transactions are concentrated on a specific number of main boards. In general, the index is the Jakarta Composite Index (JCI) which is the market capitalization weighted average index for all issues.

.png)

-

Exchange Rate

Indonesia has experienced the crisis situation of its own currency at the time of the Asian currency crisis and has steadily increased foreign reserves since the beginning of the 21st century. The country is becoming ready for foreign exchange stability. Because we are developing infrastructure at the national level that requires funds in the long term, long-term external debt is relatively large, but the reserved foreign exchange reserve ratio has been decreasing year by year.The Bank of Indonesia has gradually reduced the policy interest rate to 6% level since 2009. Along with the expansion of deficit in the balance of payments, the rupiah has been moving since the beginning of 2012, but the interest rate hikes have been suspended even in as early as 2013. However, the Indonesian Central Bank has declared that it will decisively intervene in the foreign exchange market for excessive rupiah.

The exchange rate as of May 31, 2014 is 1 yen = 121.11 Rupiah (www.oanda.com).

.png)

-

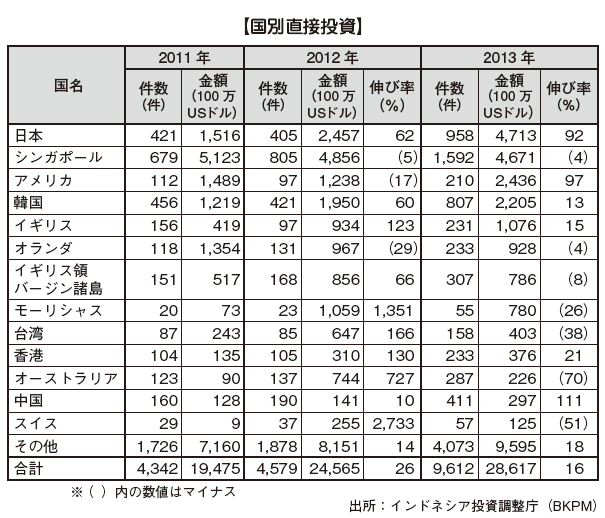

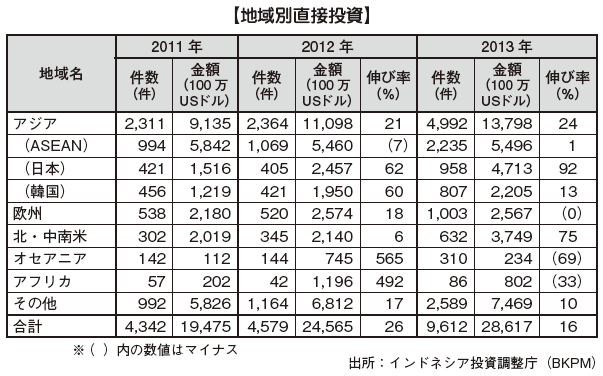

Foreign Direct Investment Amount

The Foreign Direct Investment (FDI), which had been stagnating due to the Asian currency crisis, is on an increasing trend since around 2005 when Indonesian politics became stable and economic growth began in earnest. Due to the impact of the global financial crisis, it fell drastically in 2009, but after that, the investment steadily expanded, with US $ 19.4 billion in 2011, US $ 24.5 billion in 2012 and US $ 28.6 billion in 2013.We are updating our record high every year.

Countries as of 2013, incurred the re-funding of funds from Indonesia, Japan is the highest amount, which is US $ 4.7 billion, accounting for 16% of the total. Second place is S $ 4.6 billion by Singapore, followed by US $ 2.4 billion and South Korea by 2.2 billion dollars. The amount of direct investment from Japan in 2013 increased by 92% from the previous year, and investment from Japan to Indonesia has been rapidly increasing.

Asia accounts for 48% of the total by regional direct investment, of which half is from ASEAN region such as Singapore and other than ASEAN, the other half is composed of Japan and Korea.. In the UK, Germany and other European countries composed9% of the total, North, Central and South America is the 13%, Oceania 1%, Africa 3%. There are also a small number of circumvention investments using tax and havens such as the British Virgin Islands. Overall, the investment from Oceania and Africa has decreased relatively, and the investment from Asia and North / Central / South America has greatly increased.

By industry sector, secondary industries such as manufacturing account for nearly half of the total, followed by tertiary industries such as service industry at 27.9%, primary industry such as agriculture and mining at 24.2%.

As a characteristic, investments related to natural resources such as mining, forestry and textiles and their processing fields are steady and continue to be major investment target areas. Among manufacturing industries, investment in the transportation equipment sector such as the automobile industry is growing. In the tertiary industry, construction, real estate, etc. are growing strongly against the backdrop of a strong economy and active infrastructure development.

Investment from Japan is mostly in the manufacturing industry. In the automobile industry large investment for expanding Toyota and Daihatsu production lines and new part manufacturers are continuing to expand. Investment in the precision equipment field has been active, such as Samsung announcing plans for mobile phone production in Indonesia, domestically from South Korea. As a whole, the motivation for direct investment in Indonesia is against the background of robust domestic demand, so it can be said that the range of investment fields is expanding more than ever before.

.png)

-

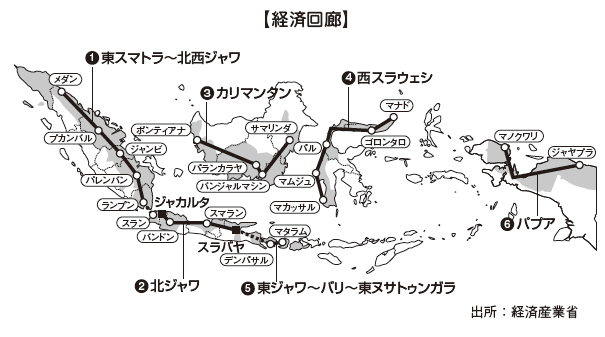

Infrastructure

According to the World Economic Forum's "The Global Competitiveness Report 2013-2014", the comprehensive evaluation of the infrastructure in Indonesia ranked 82nd out of 148 countries and gained ten place from the previous year. However, compared with the six major ASEAN countries, Singapore ranked fifth, Malaysia 25th and Thailand 61st, Indonesia, the Philippines (98th), Vietnam (110th). Evaluation of each infrastructure shows the breakdown of 78th in the road, 44th in the railroad, 69th in the port, 68th in the airport, 89th in the power.In May 2011, President Yudhoyono announced the "Economic Corridor Concept" that divided the whole country into six regions in the Economic Growth and Acceleration Master Plan (MP3EI),that focuses in the road, railroad, harbor, airport, power, hydropower etc. We are expressing our commitment to developing a wide range of infrastructure. To that end, we will promote public-private partnership (PPP), establish national priorities such as establishment of infrastructure finance corporation (SMI: Sarana Multi Infrastruktur) and Indonesia government guarantee fund (IIGF: Indonesia Infrastructure Guarantee Fund). As a result, we are clarifying our commitment to infrastructure development. In the second term of the Yudhoyono administration (October 2009 - 2014), the infrastructure in Indonesia made a big step forward.

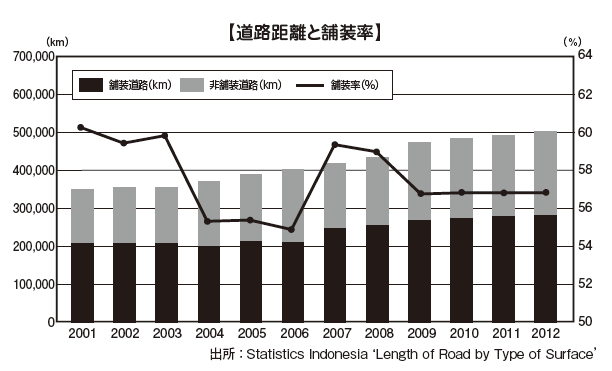

■ Road

The total distance of the Indonesian road is extended to over 500,000 km, of which the paved roads remain only about 56.8% (2012). In Indonesia, the increase in population and the rise in economic activity s made logistics and movement of people significant. The number of car owners including motorcycles is rapidly increasing. However, it can be said that road maintenance is not simultaneously improving with economic growth. The economic corridor concept is a concept aiming for mutual benefits between regions, as well as infrastructure development that can be used and beneficial in each region. This advancement initiative is to be carried out particularly from the eastern part of Sumatra Island to the northwest Java region and the northern Java region. Transport infrastructure including road maintenance will be comprehensively promoted by connecting the regions. A huge project "Sunda Kaikyo Ohashi" connecting Sumatra Island and Java Island by Japan's ODA loan is also included. Dynamic economic growth is anticipated through regional traffic improvement. Delay in road maintenance in urban transport is a big problem. In particular, traffic jams in Jakarta during commuting are more serious, and it is said that the total occupied area of the car is close to the state of grid lock which exceeds the total area of the road. We have taken various actions, such as introducing a system called "bus way" on a bus lane, encouraging commuters to use public transportation and widening general roads and transforming them into expressways. However, fundamentally it is necessary to develop a large-scale public transportation network based on mid- to long-term urban planning. The Government of Indonesia has announced the "Metropolitan Priority Area (MPA) Initiative Concept", for the benefits of people in the center of the city,the connecting of Tanjung Priok port, Soekarno Hatta Airport and suburban industrial park with a loop line. We are introducing distributed urban planning that logistics is not concentrated. The plan is underway as of 2014 with the aim of completion in 2020.

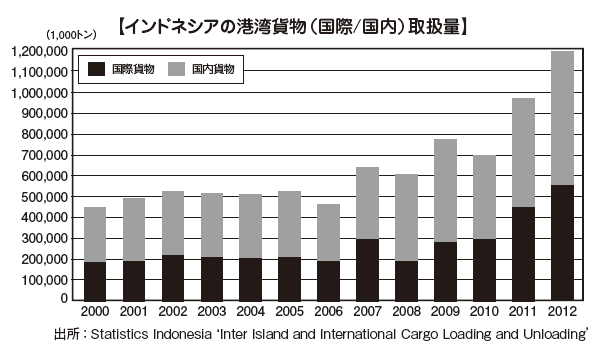

■ Port

Indonesia is the world's largest island archipelago with over 10,000 islands.Its land is located in the vast waters that corresponds to the nodal points of the Indian Ocean, the Pacific Ocean, the South China Sea, and so on. For that reason, shipping is so important as to be the lifeline both internationally and domestically. The importance of port infrastructure in Indonesia is very high. The port of Indonesia plays an important role not only for importing and exporting but also as a domestic means of transportation. As can be seen from the graph below, more than half of the annual cargo handling volume is domestic cargo. It is pointed out that the proportion of domestic cargo is relatively high compared with Singapore and Malaysia's Tanjung Perapas Port, etc. because Indonesian ports have relatively low function as international hub., This is a case that indicates future possible issues. The main ports of Indonesia have been exclusively managed by four state-owned port companies (PELINDO: PT.Pelabuhan Indonesia). Inefficient operation has been occurring and investment necessary for the modernization of facilities and expanding tolerance has not been done sufficiently. As a result, the Transport Law was revised in 2008, private enterprises were allowed to enter, foreign investment opportunities were born, and service competition between ports also occurred.

The Indonesian government has announced plans to transform 25 ports strategically from over 100 domestic commercial ports as international ports. Among them are Tanjung Priok port in Jakarta, Tanjung Emasu port in Surabaya in eastern Java Island, Bellawan port in Medan in northern Sumatra, Makassar port in southern Sulawesi. These ports are regarded as international hub center.. At present, the volume of containers being handled at Tanjung Priok port is about 50% of Indonesia as a whole However, chronic logistics stagnation due to insufficient capacity and poor efficiency of operation is a problem. With the expansion of Tanjung Priok Port, improvement of Tiramaya International Port which is a new port is proceeding on the outskirts of Jakarta. The main port aims for partial operation in 2020. It is expected that the volume of port cargo handled in Indonesia will continue to increase in the future and immediate maintenance is required.

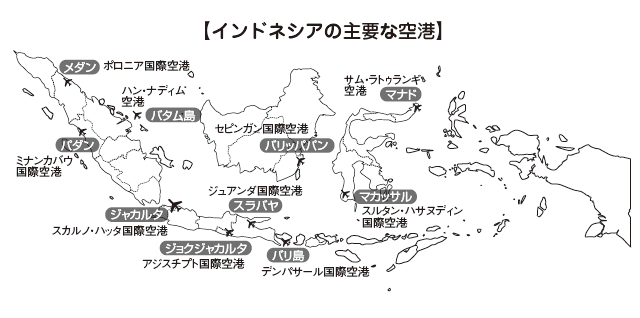

■ Airport

There are 36 public airports in Indonesia, 13 of which are international airports. As the number of passengers and air cargoes continue to increase year by year at major airports, expansion of runways, expansion of passenger terminals and construction of new airports are underway at a rapid pace. Soekarno-Hatta International Airport, about 20 km from the city of Jakarta, has an annual passenger count of 58.37 million in 2012, far exceeding twice the annual capacity, and in the first half of 2013 (January to June) has already become 32.32 million. The number of passengers go in and out of Indonesia’s airports is ranked 12th in the world, and i is the largest in Southeast Asia beyond Bangkok and Singapore.

Also at the Denpasar International Airport in Bali, New International Terminal was opened last September 2013 for the preparation of APEC Leaders' Meeting in October 2013 to be held in Indonesia. It is expected that the tolerance will be greatly increased by Kuala Nam International Airport, which opens a new port to Medan in Sumatra. However, due to the problems of budget and land expropriation, situation is not necessarily progressing as planned, and we need to pay close attention to future progress.

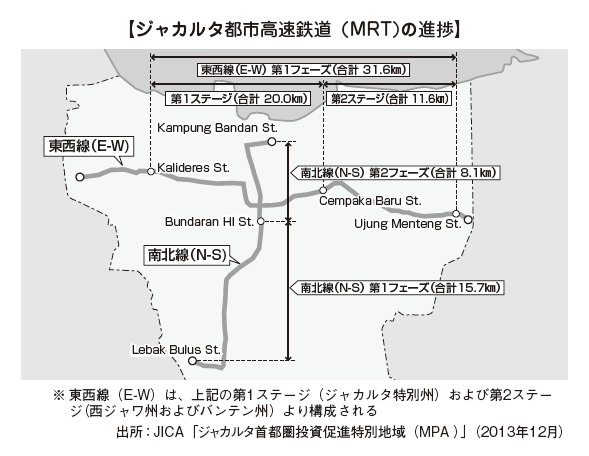

■ Railway

A railway with a total extended distance of over 5,000 km laid in Indonesia, all of which are on Java Island and Sumatra Island. Most are for cargo shipping, many of which are non-electrified and single wire. Only the urban area of Jakarta and a part of Surabaya are electrified. The route network is being developed as a commuting route. In Jakarta, the construction of the Indonesian's first subway called Mass Rapid Transit (MRT) and Sukarno - Hatta International Airport access railway is in progress. The MRT is a full-scale urban transportation plan covering about 110 kilometers of the Namboku and Tozai lines. The North-South route is being promoted by Japan's ODA loan under the support of JICA. Currently, the first phase section, which connects about 15 kilometers (13 stations) and allows the transfer of passengers from Rebak Bulus to the business center of the hotel and Indonesia intersection in about 30 minutes, is in preparation for design and construction order. I aim for it. Moreover the main street of Jakarta such as Sudirman Street was planned to have an underground tunnel structure and the other Southern Industrial Park will be elevated structure. When all the north and south lines are opened, it is considered to contribute greatly in the reduction of traffic congestion in Jakarta. With this, cooperation with bus ways, other route buses and existing commuter railroads, and improvement of access roads and pedestrian spaces around the station are tasks that have to be considered in the future.

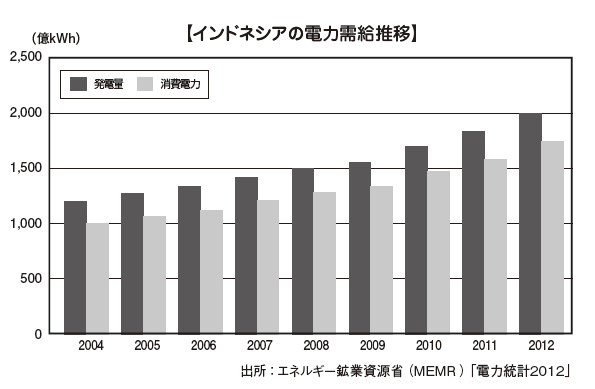

■ Power

The State Electricity Authority (PLN: Perusahaan Listrik Negara Persoro) has monopolized the power transmission business for many years. But in 1992 it was approved to enter the private-sector enterprises in the power generation field, it was transformed to encourage private investment in the power infrastructure. Currently the capacity of PLN's power generation facilities is about 80%. In Indonesia, thermal power generation by domestically produced fossil fuels such as oil, gas, and coal is mainstream, but the main fuel is shifting to coal due to a decrease in oil production. In addition, Indonesia is a powerful energy source with its tropical rain forest climate, hydropower by abundant water resources and geothermal power generation as it is also the world's leading volcanic country. Demand for electricity is 1 to 2% higher than GDP growth rate, and it is steadily increasing year by year. As a whole, consumption is manageable, but in the dry season the amount of hydroelectric power generation will be reduced and the amount of electricity generated will drop at inspection of the power plant, so the supply and demand balance may become tight. As the future forecast for electricity demand is greatly increased, the Government of Indonesia positions expansion of electricity supply as a priority issue. As part of the Economic Growth and Acceleration Master Plan (MP3EI), the establishment of the Indoramayu Coal Thermal Power Plant and the Banten Coal Thermal Power Station, and the Power Transmission Project Improvement Plan such as the Java-Sumatra Connection Transmission Line Plan are being promoted. Also, as a characteristic of Indonesia there is a disparity in the electrification rate by the region. Many of Java Island and Sumatra Island have electrification rate of about 80%, Jakarta is 99%. On the other hand, in Papua and Sulawesi Islands, there are also about 40 to 60% of areas. In order to promote electrification to resolve regional disparities, securing the amount of electricity generated by each region and enriching the electricity transmission network are also issues.

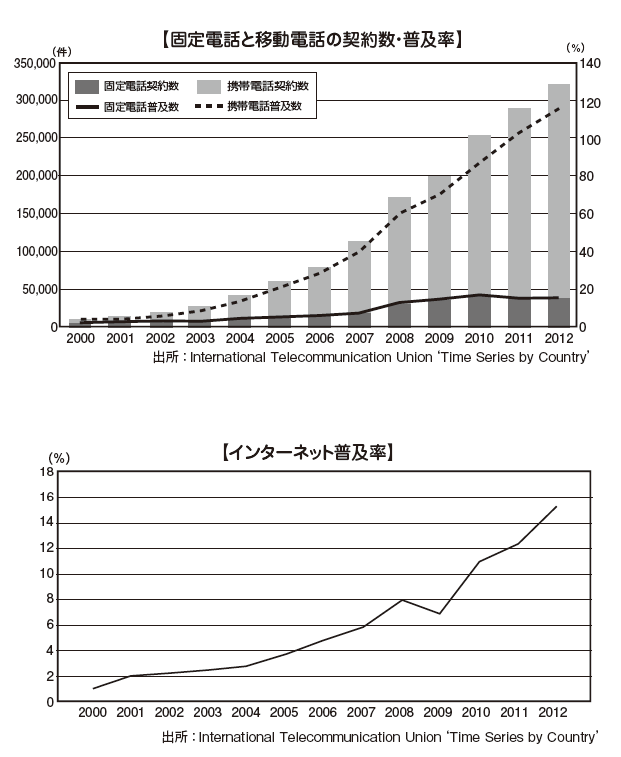

■ CommunicationIn Indonesia, the telephone business was monopolized by state-owned enterprises once, but deregulation enabled private enterprises to enter. The spread of fixed phones has not progressed so much, and the number of cellular phone subscribers is rapidly increasing. Approximately 281.96 million cases in 2012, about 307 million cases in 2013 (provisional value, according to market research company) number of contracts, many of which accounted for by Telekomunikasi Selular (Telkomsel), Indosat, XLAxiata It is done. In addition, with the spread of mobile terminals, the number of users of the Internet at mobile terminals is rapidly increasing. Although the Internet penetration rate is still less than 10% nationwide, the regional difference is large, and it can be said that the future growth is very large.

-

Latest News & Updates

[Indonesia's E-Commerce - its Market Potential and Regulation -]

1. Market Overview

The e-commerce market in Indonesia is said to be one of the most attractive areas now. Especially in 2017, the market size was estimated to reach US $ 56.8 billion. In this article, after reviewing the remarkable growth of the e-commerce market, we will explain the related laws and regulations.

Why is the e-commerce market expanding sharply in Indonesia? The main factors that can be cited are the population size. Currently Indonesia is said to be about 250 million inhabitants, but when viewed on an annual basis the population growth rate will exceed 1.5%. In addition, about half of the total population is the young generation (under 30) and contributes to the growth of the Internet population. Next is the rapid penetration of smartphones. Out of 250 million people, about 100 million people are said to be smartphone users. In addition, it can be said that the increase in incomes of middle income earners also contributes to the expansion of e-commerce market.

2. Foreign capital regulation

Although it is a remarkably growing Indonesian e-commerce market, the reality is that barriers to entry are still high.

First of all, the foreign capital ratio will change depending on capital.

① 100 billion rupiah or more (or employing 1000 or more people): 100% foreign capital allowed

② Between 10 billion rupiah and less than 100 billion rupiah: Up to 49% foreign capital allowed

③ Less than 10 billion rupiah: no foreign investment

Normally, it is thought that it will acquire foreign capital up to 49%, but even in this case, capital of more than 100 million rupiah (actually it is possible to raise 25 million rupiah by actually authorized capital) is prepared It can be said that it is necessary to have a barriers to entering IT entrepreneurs and Japanese small and medium-sized enterprises.

3. In the case of Fintech

From now on it is said that it is the era of Fintech. Fintech is "Financial Technology", that is, it uses financial technology to provide financial services. Even in Indonesia, Fintech entrepreneurs are getting attention.

Well, although it is such Fintech, the following regulations are separately imposed by the Indonesian Financial Supervisory Authority to acquire the license of the Fintech business.

· Have a minimum capital of 1 billion rupiah

· Additional 2.5 billion rupiah is required to acquire licenses

· The foreign capital ratio is limited to 85%

· There are no restrictions on interest rates.

4. Conclusion

Although the Indonesian e-commerce market attracts attention from its market potential in many cases, strict foreign capital regulation still exists and can not enter easily. It can be said that we need to keep an eye on future amendments to the law.

-

-

-

Investment regulation on entry to Indonesia

In investing in Indonesia, it is necessary to investigate whether investment is possible and investment amount.

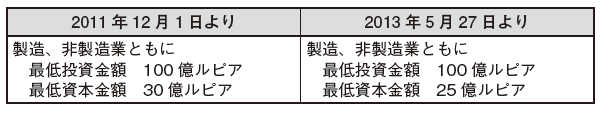

With regard to the contribution amount, capital regulation and investment amount regulation, which had been conventionally a window regulation, have been clarified by the above-mentioned Circulars due to Decree No. 5 of the Investment Adjustment Agency Directive 2013 (effective May 27, 2013). Under the same ordinance, the minimum investment amount is stipulated, it is necessary to set investment amount and capital amount of foreign currency (US dollar) corresponding to each amount.

Especially in the case of service business including trading companies, the investment amount of 10 billion rupiah is not realistic. Regarding the investment amount, it is necessary to report to the Investment Adjustment Agency (BKPM: Badan Koordinasi Penanaman Modal) about the procurement progress once every six months, but the investment amount can not be procured, resulting in the investment not being realized There are no penalties due to the fact that capital amount is paid in full as a general rule and its certificate is necessary for company registration process). In the case of considering entering Indonesia in a specific business type other than manufacturing industry or trading company, there is a prohibited field for foreign investment and a regulation field (regulation in the negative list form), so it is necessary to confirm the actual regulation field and the contents of the regulation there is.

Especially in the case of service business including trading companies, the investment amount of 10 billion rupiah is not realistic. Regarding the investment amount, it is necessary to report to the Investment Adjustment Agency (BKPM: Badan Koordinasi Penanaman Modal) about the procurement progress once every six months, but the investment amount can not be procured, resulting in the investment not being realized There are no penalties due to the fact that capital amount is paid in full as a general rule and its certificate is necessary for company registration process). In the case of considering entering Indonesia in a specific business type other than manufacturing industry or trading company, there is a prohibited field for foreign investment and a regulation field (regulation in the negative list form), so it is necessary to confirm the actual regulation field and the contents of the regulation there is. -

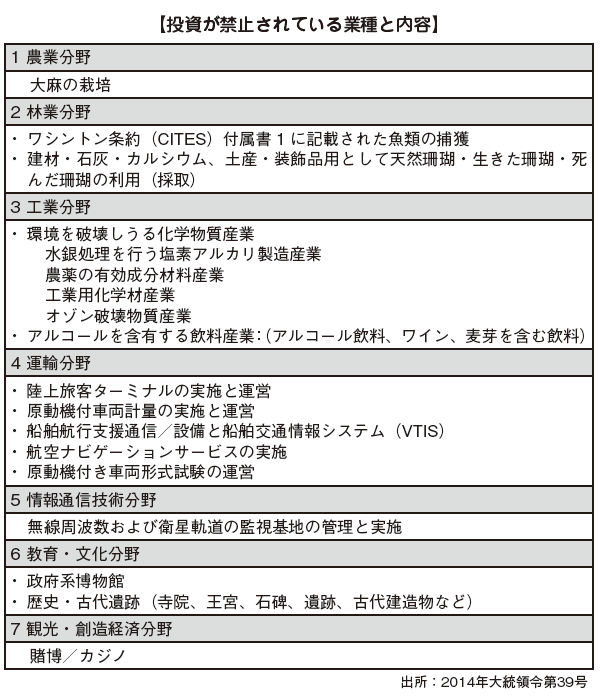

Negative list revision

Presidential Decree No. 39 (Negative List) 2014 prescribing the foreign investment regulation that was discussed from the previous year on April 24, 2014 was enforced. This regulation will be concentrated in the direction of protection of domestic industry (reinforcement of investment restrictions) and development of special industries such as electric power field (relaxation of investment deregulation) on the premise of forming the ASEAN economic community. These are divided into areas where foreign investment is prohibited and areas which are partially open.

As one of easing investment deregulation, up to 51% investment in advertising companies has been approved (only through subsidiaries in ASEAN).

Also the wholesale industry was noticed as the biggest issue. In the former negative list, wholesale trade had no particular arrangement, and in principle it was possible to enter 100% foreign capital contribution. However, in revising the negative list this time, Mr. Frankie, secretary general of the Indonesian Management Association (APINDO), told local newspaper that "Because wholesale business fields do not require special know-how and many capital, the entry barriers of foreign capital "We have been working to set up the" Since then, as Director of Mahendra Investment Adjustment Agency said that it would cut the foreign capital ratio in the distribution (including wholesale trade) field from 100% to 33% so far, concern that foreign capital control of wholesale business will be strengthened (As reported on 24th December 2013).

However, the Investment Adjustment Agency responded that import and export and sales through agents are basically no problem even after regulatory revision. As a result, trading companies whose import / export is essentially the main business style are unchanged from the previous one, and it is possible to make a 100% investment advancement.

However, the Investment Adjustment Agency responded that import and export and sales through agents are basically no problem even after regulatory revision. As a result, trading companies whose import / export is essentially the main business style are unchanged from the previous one, and it is possible to make a 100% investment advancement. -

Regulated Industry

Businesses that are conditionally permitted to invest are subject to detailed regulatory requirements, such as when the capital contribution ratio of foreign capital is restricted or where special permission is required. Representative ones are listed below, but it is important to check the original contents in detail and decide what kind of restrictions you can invest.

.png)

■ Regulations concerning capital

In Article 32 of Indonesia Company Law (Law No. 40 of 2007), the minimum authorized capital is set at Rp. 50 million. However, attention should be paid because the Investment Adjustment Agency may require additional capital in practice in order to determine the investment amount and capital from the contents of the investment project.

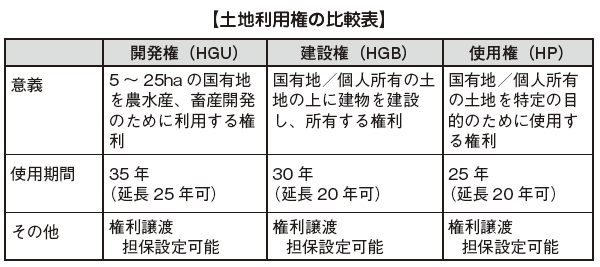

■ Regulations on the Land Use of Foreign Companies

In Indonesia, foreigners and foreign companies are forbidden to possess land. Foreign companies are only permitted to use the land according to law. The use right of this land can only be exercised on the surface of the land, not including the use of natural resources in the air and underground.

Land use rights obtainable by foreign investment enterprises (PMA: Penanaman Modal Asing) are classified into development rights, construction rights, and usage rights due to differences in their uses.

There is a real estate registry system in Indonesia as well as in Japan. Right will be issued from the time of registering the above three rights at Indonesian National Land Bureau. If you acquire land use rights, 5% of the acquisition amount is imposed as real estate acquisition tax.

In order to build a factory in Indonesia, in addition to HGB, after acquiring location permission (IL) from the Land Department, it is necessary to obtain the Building Construction Permit (IMB) from Public Works Bureau.

-

Investment incentives

Even in Indonesia with few investment incentives, there are cases where some special business conditions, regions, or tax benefits at the time of establishment are accepted.

■ Tax holiday system

In order to nurture domestic industries in Indonesia, there are measures to allow corporate tax exemption in the following five areas that should be focused on development (Regulation No. 130 of the Finance Minister on August 15, 2011).

· Basic metal

· Petroleum gas mining or organic fundamental chemistry derived from petroleum gas

·machine

· Renewable energy

· Communication equipment

In these fields, companies that invest more than 1 trillion rupiah can enjoy the tax exemption of corporation tax of 5 years up to 10 years, but as a condition, 10% of the investment amount will be allocated to Indonesian It is obliged to deposit with domestic banks. As a procedure to receive tax exemption, apply to the Ministry of Industry and obtain permission from the Minister of Finance. Application can be made by the Investment Adjustment Agency through a one-roof service.

■ Preferential treatment within bonded area

When importing goods from a foreign country, payment VAT (PPN), customs duty (BM), prepaid corporate income tax (PPh 22) will be added, but payment of these taxes is unnecessary as merit of bonded business when operating in bonded area is. For export oriented enterprises, there is also a cash flow advantage. The bonded status is given to the bonded factory (PDKB) and bonded warehouse (PPKB), but the tax benefits are the same in both cases. It is basically a company that exports as a business that can build a factory in a bonded area, but companies that can sell domestically if it is a certain degree can also be constructed

.

Although there was amendment of the law many times in this part, Finance Minister Ordinance No. 44 concerning the bonded area was issued on March 16, 2012. According to it, until December 31, 2014, the finished goods shipped from the bonded area are up to 50% of the sales in the relevant fiscal year, and the domestic sales ratio of parts is up to 60% of the previous year's sales. However, there is a possibility that the sales ratio will be revised, so we need to keep an eye on it.

In order to acquire the status of bonded goods, in addition to clearing the following physical conditions, it is necessary to receive a customs inspection once a year or several years.

· Establish a fence of 2.5 meters or more around the factory

· Only one spot is allowed from the public road

· Establish a packing place for personnel dispatched from customs

In principle, we confirm the carry-in / carry-in from the bonded factory or warehouse and check whether we have got the goods received in bonded condition illegally for general domestic market. Although there are auditing correspondence and administrative procedures, the bonded system is attractive in Indonesia with less tax incentives.

■ Capital goods and raw material master list system

There is a master list system of capital goods and raw materials as tax incentive incentive scheme.

On December 16, 2009, under the Regulation No. 176 of the Minister of Finance (partly changed in Regulation No. 76 of the Minister of Finance enforced on May 21, 2012), when importing machinery at the time of the start of business or when importing raw materials It is stipulated that the customs duties on the goods will be exempted.

In addition to the manufacturing industry, the master list of capital goods and raw materials also includes development and expansion of the industry, such as tourism / culture, transportation / communication (public transportation service), public medical service, nonmanufacturing industry such as mining, construction, harbor and the like If you find it necessary, you can receive an exemption from tariffs.

In the case of applying for the capital goods master list, we apply to the Investment Adjustment Agency for master list of import machine and receive preferential approval. Also, even if it is not a new investment company, when additional investment is necessary, similarly, apply for additional investment approval to the Investment Adjustment Agency and apply for it.

As a rule, it is possible to apply for the master list of import machines and their approval only once for one project. A project that has already been approved can not obtain approval again when importing the same machine, but it is possible to modify investment authorization.

Raw Material Master List The application exemption period is two years from the exemption decision. However, only in the manufacturing industry, if more than 30% of the total value of the machines to be used is Indonesian domestic products, it can receive an import tax exemption from imported raw materials necessary for production for 4 years.

Upon application, we prepare the documents in the table and apply to the Investment Adjustment Agency.

.png)

After applying at the Investment Adjustment Agency, we apply for tax exemption permission to the local tax office. In the case of second-hand capital goods, we will obtain permission from the Commerce Minister afterwards and obtain permission before shipping.

■ Preferred system of other (Small Business Protection / Economic Special Zone)

Normally, Indonesia's corporate income tax is stipulated as 25%, but in the case of small scale projects with annual sales of less than 5 billion rupiah there is a measure that exempts corporate income tax by 50%.

Regions that have been designated as Special Economic Zones (KAPET) have tax incentives recognized in bonded areas, as well as preferential treatment such as accelerated depreciation.

-

Latest News & Updates

【Easing restrictions on foreign capital investment in Indonesia】At the Presidential Decree No. 2016 of May 12, 2016, the Government of Indonesia announced the details of the "Released Business Areas with Conditions" list, and came into force on May 18th.

Through easing of foreign capital deregulation, the Government of Indonesia aims to accelerate economic growth by attracting foreign investment. Industries with high interest in Japanese affiliated companies are included, such as 100% opening up to the foreign capital of the food service industry, raising the cap on foreign capital contribution ratio in trading companies and wholesale business. We will introduce the major foreign investment restraint relaxation industries announced this time.

① Industry relaxing industry

業種

旧外資出資比率上限

新外資出資比率上限

備考

映画

—

100%

電子商業

—

100%

・ 上限100%:現地中小企業との協力を条件

・ 投資額1000億ルピアであれば上限比率49%(電子システムを介した取引)

高速道路

95%

100%

スポーツセンター

49%

100%

病院経営コンサルティング

67%

100%

病院、クリニック67%

倉庫

33%

67%

市場調査

-

70%

通信網事業

65%

67%

ホテル

51%

67%

無害ゴミの処理

95%

100%

医薬品原料産業

85%

100%

既成薬製造業85%

デパート業(400m2-2000m2)

-

67%

私立博物館

51%

67%

陸上旅客輸送

-

49%

レストラン、カフェ

51%

100%

カラオケ、ボーリング場

49%

67%

仕出し業

51%

67%

販売代理店(特定地域)

33%

67%

建設コンサルティング

55%

67%

再生ゴム

-

100%

工業長官の特別許可が必要

冷凍倉庫業

33%

100%

高圧電力設備の設置

49%

② Industry with strong regulation

In the construction industry, the investment ratio of foreign capital remains unchanged at 67%, but the minimum construction cost has been raised from 1 billion Rupiah to 50 billion Rp.

【About real estate investment in Indonesia】

In Indonesia, the constitution prohibits foreigners from possessing land in Indonesia.

However, there are some permissible means and loopholes. In this article I will briefly explain them.

■ Indonesia Property Law

Various kinds of rights are prescribed in Indonesia's property rights law, including ownership rights.

Below, I will list representative ones.

· Ownership (Hak Milik)

· Construction rights (Hak Guna Bangunan)

· Leasehold (Hak Pakai)

· Building lease (Hak Sewa Bangnan)

And so on.

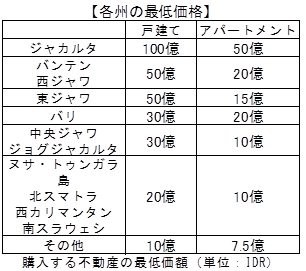

Among these, for detached houses and apartments built on the land on which the leasehold (Hak Pakai) is set, the law was amended on December 22, 2015, and a foreign corporation with offices in foreign countries and domestic Ownership will be approved. This is a groundbreaking legal revision for those who are planning to invest real estate in Indonesia.

■ Points to be noted about leasehold land (Hak Pakai)

However, the possession of detached houses and apartments is not unconditionally accepted. It is necessary to clear some requirements.

① To be owned for up to 80 years

② When transferring residence to another country, transfer to a third party within one year from relocation

➂ The minimum price of each state is exceeded

■ Workaround using nominee

There is also a well-accepted way of holding real estate indirectly using nominee. However, despite being explicitly prohibited, adoption of this method is naturally accompanied by risk.

What can be mentioned as a risk is that there is a possibility that nominee will betray it. As the owner of real estate ownership is nominee, that right also belongs to nominee.

In addition, if you are a low-income nominee, there are cases in which you suspect where you purchased the real estate purchase price at the time of final return.

However, according to the National Land Agency which has jurisdiction over real estate, finding nominee is practically almost impossible.

-

-

-

References

[1] International Bank for Reconstruction and Development / The World Bank 'Doing Business 2014'

[2] UNCTAD 'World Investment Report 2013'

[3] Indonesia Stock Exchange 'History'

[4] Hidenaki Nishitani, Jun Kamei "The Current Asian Stock Market - The Third Indonesian Stock Market" Monthly Capital Market No. 290 (October 2009 issue)

[5] International Investment Management Investment Adviser "Indonesia: Exchange Rate Increasing Deferred Policy Rate and Fluctuation" Asian Investment Environment Report January 15, 2013

[6] Japan Bank for International Cooperation (JBIC) "Investment environment in Indonesia" April 2012

[7] Japan Bank for International Cooperation Infrastructure & Finance Division "Infrastructure overseas expansion ③ Indonesia growing expectation - its current situation and issues" December 2011

[8] Takada Shi "Does investment in Indonesia where hope is great?" Research TODAY February 27, 2013

[9] Indonesia Investment Coordinating Agency (BKPM)

[10] World Economic Forum 'The Global Competitiveness Report 2012-2013'

[11] Mr. Kazuhisa Matsui "Long-Term Development Goals, Potentiality and Challenges in Indonesia" Indonesia Research Institute free report June 13, 2011

[12] Trade Policy Bureau, Ministry of Economy, Trade and Industry "Chapter 2 Section 4 Infrastructure Needs Strengthening with Economic Growth" Commercial White Paper 2010

[13] Statistics Indonesia 'Inter Island and International Cargo Loading and Unloading Indonesia 1998-2012 (thousandtons)'

[14] Jakarta Capital Region Investment Promotion Special Area (MPA) The 4th Steering Committee

[15] Ministry of Foreign Affairs "Joint Press Release" December 11, 2013

[16] JACA, December 2013

[17] Takashi Nakayama "Indonesian Economic Corridor Showing Outline" JETRO Survey Report, November 2010

[18] Advanced Information Science and Technology Research Organization 'National situation and energy situation in Indonesia' January 2013

[19] Ministry of Energy and Mineral Resources "Power Statistics 2012"

[20] International Telecommunication Union 'Time Series by Country'

[21] JETRO "Basic Indonesian System on Indonesian Expansion - Regulation on Foreign Capital"

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya