Indonesia

3 Chapter Economic Environment

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.2 Investment regulation and incentives

3 Chapter Economic Environment

3.2 Economy Aiming for Innovation

3.3 Issues of Indonesian Economy

4 Chapter Establishment

4.1 Characteristics and tendency how to set up the legal entity in Indonensia

5 Chapter M&A

5.1 Trends in M & A in Indonesia

5.2 Laws and Regulations Concerning M & A

6 Chapter Coporate Law

7 Chapter Accounting

8 Chapter Tax

9 Chapter Labor Law

9.1 labor law and related rule article

10 Chapter Q&A

-

-

-

Potential Indonesia’s Economic

Developments in Indonesia during the Asian economic crisis of 1997–98 impacted heavily on the exports imports in particular. Steady growth in economic freedom over the past 5 years has tapered off more recently. However, since 2011, economic freedom in Indonesia has advanced by over 2.0 points, reflecting a more sustained commitment to opening up the financial sectors and improving the investment regime. Other changes have led to score advances in 6 of the 10 economic freedoms, reflecting relatively broad-based policy improvements.Nonetheless, economic freedom remains weakly entrenched in Indonesia. The judiciary has demonstrated some independence, but corruption is present. Overregulation of the business and labor markets leads to inefficiencies in labor supply and business formation. Despite its presence in a dynamic East Asian trading network, Indonesia remains relatively closed off from the global marketplace.■Potential Indonesia’s EconomicIndonesia is a large country with the largest economic in South East Asia, that grow fast. Indonesia has an abundant potential natural resources and human resources, that can be used as an opportunity to advance Indonesia’s economic. Recently, a new set of emerging economies has gained public attention. Members of this set are countries that contain promising markets with diverse economies, reasonably sophisticated financial systems and fast growing populations.Indonesia’s strong points that explain increasing foreign investments and the recent macro economic growth :· Abundant and diverse natural resources· Young, large and burgeoning population· Political stability (relatively)· Prudent fiscal management since the late 1990s· Strategic location in relation to the giant economies of China and India· Low labour costsIndonesia is a market economy in which the state owned enterprises and play a significant role, thus shows a number of highly positive features at the beginning of what can become a period of substantial economic development.● Growth of Indonesia’s economicThe fall of economic conditions in Indonesia is not a problem to the growth of Indonesia’s economic. The goverment strive to encourage the economic development that can give a positive impact to the growth of Indonesia’s economic, with a minim infrasturcture in Indonesia, that makes the world’s investors interested to invest here in Indonesia. Indonesia’s economic has an enormous promise because Indonesia has a young population and grow fast, that powering economic growth.There are several ways to realize the potential of the growth of Indonesia’s Economic :· A modern development infrastructure and efficient. The lack of sufficient infrastructure makes another sector does not efficient.· Improve the investment climate that conducive to the absorbtion of new technologi, and the capacity to compete on producing a large amount of goods and services.· All of that have to done with the international trade policy that support the process of Indonesia’s economy integration with the world.· Become a manufacturing exporter, in terms of export Indonesia is still dependent on (raw) commodity exports. To overcome this vulnerable position Indonesia needs to diversify its export products, particularly boosting downstream industries for the manufacturing of value-added products. Improving the domestic supply side is also important as the Indonesian population (which is characterized by a rapidly expanding middle class which numbers about 75 million now) is demanding more and more products.· Lower the benchmark interest rate. Indonesia’s economic slowdown (which started in 2011) is partly self-inflicted as Bank Indonesia raised its key interest rate (BI rate) in a move to combat high inflation (that emerged as a consequence of Indonesian subsidized fuel price hikes, curb the country’s wide current account deficit, support the rupiah exchange rate, and to avert future capital outflows ahead of an expected US interest rate hike later this year.· Foster political stability. Investors prefer to invest in Indonesia when the political situasion is stable.Indonesia have to take the advantage of economy resources, not just from human resources and natural resources, and utilize every oportunity from every aspects.●GDP and Rate of Indonesia’s economic GrowGross Domestic Product (GDP) is the monetary value of all the finished goods and sevices produced within a country’s borders in specific time period. Though GDP is usually calculated on an annual basis, it can be calculated on a quarterly basis as well.GDP is one of the primary indicators used to gauge the health of a country’s economy. It represents the total dollar value of all goods and services produced over a specific time period; you can think of it as the size of the economy. As one can imagine, economic production and growth, what GDP represent, has large impact on nearly everyone within that economy.According to www.tradingeconomics.com The Gross Domestic Product (GDP) in Indonesia was worth 888.54 billion US dollars in 2014. The GDP value of Indonesia represents 1.43 percent of the world economy. GDP in Indonesia averaged 214.72 USD Billion from 1967 until 2014, reaching an all time high of 917.87 USD Billion in 2012 and a record low of 5.98 USD Billion in 1967. GDP in Indonesia is reported by the World Bank GroupIndonesia's economy is struggling against a backdrop of weaker external demand for commodities, delayed infrastructure spending and tight monetary policy. The government has introduced several stimulus packages, but real GDP expansion is still expected to remain sedate in 2016, at 5.2%, compared with forecast growth of 4.9% this year.● Potential of huge marketIndonesia is a developing country that have a big potential of huge market, because its society growth rapidly, and “Asia’s next big opportunity,” according to a new report from Boston Consulting Group, which cites its fast-growing economy (up 6.2% last year, forecast to grow 6.8% in 2013) and favorable demographics. . Indonesia is a populous country that makes business people interested to emerge in this potential market. We can see this potential market through the growth of middle class and affluent consumers.The Indonesian archipelago has a very young working population (average age 28), more than 30% of whom belong to one of the world’s fastest growing middle classes. Overall purchasing power is increasing and major international brands in all sectors are falling over themselves to Indonesian consumers. The capital Jakarta boasts around 100 shopping centres where all the big chains have stores.Domestic consumption is high. In the last three years, economic growth in the archipelago has been among the highest in the world in 2013, largely because of the Indonesian government’s policies to encourage foreign investment.・Stable economic situationDespite slowing down in recent years, Indonesia’s growth trajectory remains impressive. The country’s gross national income per capita (Atlas method) has steadily risen. Today, Indonesia is the world’s fourth most populous nation, the world’s 10th largest economy in terms of purchasing power parity. It has made enormous gains in poverty reduction, more than halving the poverty rate since 1999 until 2014. The World Bank Group remains the largest provider of development finance and advice for Indonesia, and continues to positively impact development in many sectors.・InflationInflation has long been another problem in Indonesia. Because of political turmoil, the country had once suffered hyperinflation, with 1,000% annual inflation between 1964 and 1967, and this had been enough to create severe poverty and hunger. Even though the economy recovered very quickly during the first decade of New Order administration (1970–1981), never once was the inflation less than 10% annually. The inflation slowed during the mid 1980s, however, the economy was also languid due to the decrease of oil price that reduced its export revenue dramatically. The economy was again experiencing rapid growth between 1989-1997 due to the improving export oriented manufacturing sector, still the inflation rate was higher than economic growth, and this caused widening gap among several Indonesians. The inflation peaked in 1998 during the Asian financial crisis, with over 58%, causing the raise in poverty level as bad as the 1960s crisis. During the economic recovery and growth in recent years, the government has been trying to decline the inflation rate. However, it seems that Indonesian inflation has been affected by the global fluctuation and domestic market competition. As of 2010, the inflation rate was approximately 7%, when its economic growth was 6%. Inflation is affecting Indonesian lower middle class, especially those who can't afford food after price hikes.Historically, the level and volatility of Indonesia's inflation rate have been higher than in peer emerging nations. Whereas these other emerging markets shared inflationary rates of between 3 and 5 percent during the period 2005 to 2014, Indonesia contained an average annual inflation rate of around 8.5 percent over the same period. There are 2 annual peaks of inflation in Indonesia. First, the December – January period always bring higher prices due to Christmas and New Year celebration, besides the traditional floods in January (a peak of the rainy season) cause a disrupted distribution channels in several cities, that cause a higher logistics costs. Second, the June – July period, where Inflationary pressures in these two months emerge as a result of the holiday period, and the start of the new school year. A marked increase is detectable in spending on food and other consumables (such as clothes, bags and shoes), accompanied by retailers adjusting prices upwards.・ Indonesia’s financeThe Indonesian financial market have recovery from the Asian Crisis in the late 1990s. Prudent fiscal management and strong economic fundamental have succedeed in realising robust growth in recent years. Indonesia’s financial situation in 2015 is different with the financial situation in 1997 – 1998. The financial situation in 2015 is much better fundamentally.IMF assess Indonesia and other developing countries currently financial situation, affected by global crisis fluctuation. Indonesia believed can survive the turbulence, because of the experience encounter the crisis on 1997 - 1998. -

Aiming at change of Indonesia’s economic

The Indonesian economy grew less dependent on oil and agriculture during the Soeharto New Order. The severe contraction of Indonesia's economy at the time of the 1997 Asian financial crisis, however, highlighted the shortcomings of the New Order economic model (increasingly wasteful use of foreign investment, declining international competitiveness). Economic growth has gradually increased in 2001 (led by the export sector) until 2007; the figure for 2008 is estimated to be about 6.1%. Services, manufacturing (28%), agriculture (15%) and mining (9%) account for most of the origins of Indonesia's GDP.The Indonesian Government initiated a wide-ranging economic reform programme in 1998, with strong IMF advisory and financial support, to address the impact on Indonesia of the 1997 Asian financial crisis and to lay the foundations for long-term sustainable growth. On 1 January 2004 Indonesia graduated from the IMF's lending programme, and in early 2007 took the decision to disband the Consultative Group on Indonesia. The World Bank welcomed this step as a further sign of Indonesia's renewed economic confidence.■from import of resource to High added value tradeIn 2013 Indonesia is the largest imported in the world. During the last 5 years, the imports of Indonesia have increased at an annualized rate.The fear about Indonesia’s import escalation and export decline is quite obvious. Some trade policies have been implemented to tighten imports, such as introducing non-automatic licenses for imported products. These restrictive import policies add to many other regulations and policies that have been introduced to control Indonesia’s export of raw materials and intermediate inputs. These policies are in line with common perception that Indonesian industries should produce goods with higher added value. Such obsession with increasing domestic added value is not limited to raw material production, but also involves manufacturing products. The fact that almost 70 percent of industrial goods imported are parts and components has raised concern about the country’s dependence on imports. Import-phobia and the value-added obsession are not new to Indonesia. In fact, import substitution strategies such as local content requirements were implemented in the past without much success.■Trade of IndonesiaIndonesia posted a USD $ 709.4 million trade surplus in January 2015, according to the latest data from Statistics Indonesia (BPS) released on Monday 16th February. The economy of Indonesia expanded 5.02 percent in 2014, the slowest growth pace in five years. This economic slowdown is mainly caused by weak exports and slowing investment growth. Amid a sluggish global economy, demand for commodities has weakened hence resulting in low commodity prices. Indonesia, an important (mainly raw) commodity exporter, immediately feels the impact of lower commodity prices. Meanwhile, exports of unprocessed minerals have been banned by the Indonesian government since January 2014. Moreover, growth of investment realization in Indonesia has slowed in 2014 due to the political year (Indonesia organized legislative and presidential elections in 2014).■Situation of Export and Import each countriesIndoneisa’s export and import performance in 2015 is expected to improve as it is believed that the economic situation will not face any obstacles next year.■ Situation of Export and Import each itemsAugust 2014, Indonesia export 126,935 Completelety Build Up (CBU) vehicle units and 71,000 Completely Knock Down (CKD) vehicle units, while the total production is 878,000 vehicle units, so the export is 22.5 percent of total production. Automotive export is more than double of its import. Prediction, by 2020 the automotive export will be the third after CPO export and shoes export.While year to date August 2015, Indonesia export 123,790 motorcycles. The dominant manufactures, export 83,641 motorcycles and announced to make Indonesia as a base of exporting country of its products -

Change of industry’s structure

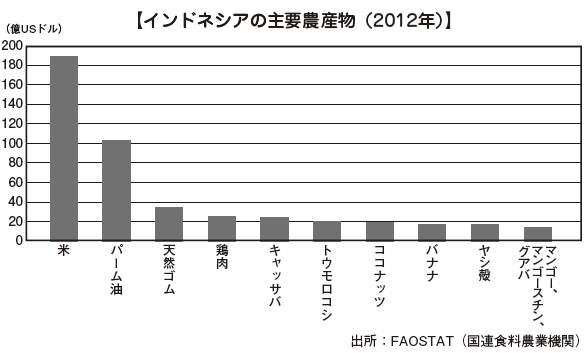

■ AgricultureThe agricultural sector of Indonesia comprises large plantations (both state-owned and private) and smallholder production modes. The large plantations tend to focus on commodities which are important export products (palm oil and rubber), while the smallhold farmers focus on rice, soybeans, corn, fruits and vegetables.The most important agricultural products of Indonesia are:• Palm Oil• Rubber• Cocoa• Coffee• Tea• Cassava• Rice• Tropical spicesAbout 45% of Indonesian workers are engaged in agriculture. Because the population is rapidly increasing, the government seeks to achieve food self-sufficiency through expansion of arable acreage, improved farm techniques (especially the use of fertilizers and improved seeds), extension of irrigation facilities, and expanded training for farmers. Production of rice, the staple food, has been gradually increasing, and production comes close to meeting domestic requirements. This increase has resulted less from extension of cultivated area through the government's resettlement policy than from expanded use of irrigation, fertilizers, and pesticides and cultivation of high-yielding hybrid rice, especially insect-resistant hybrids. It also reflects the success of the government's "mass guidance" program, which provides technical assistance, easy credit terms, and marketing support through a system of village cooperatives. Additional support was provided by the National Logistics Board, which is responsible for price regulation and the national rice-rationing programs. Due to the rapid growth of the industrial sector, the agricultural contribution to GDP is expected to decline to 11.8% by 2003.■ FoodFood and baverages industry in Indonesia has a significant increase in these past few years, both local and foreign brands. Nowadays local brands has increase production with a very good quality that help the growth Indonesia’s economic.Indonesia's economy is largely driven by rising household consumption, and one industry that thrives on this like no other is that of food and beverages. Sales growth is fuelled by rising personal incomes and increased spending on food and drink, especially from the growing number of middle class consumers. Consequently, this is also an industry where local companies have been particularly ambitious – and several of them have evolved into successful global exporters. At the same time, the internationalisation of local cuisine represents a prime opportunity for foreign companies to sell their products to Indonesian consumers, who are more and more open to new foods and flavours.■ VehicleVehicles sales are an important indicator to measure an economic conditions of a country.The general picture in Indonesia is one of an automotive sector that has experienced positive growth, a trend that was clearly demonstrated in the period between 2005 and 2012. Over the same time span, domestic vehicle sales increased by a compound annual growth rate (CAGR) and this was mainly driven by the sales of commercial vehicles and passenger cars. Vehicle production also increased by a CAGR between 2005 and 2012. Indonesia has a relatively low vehicle ownership rate, but its high population means the overall market volume is significant. Low interest rates have helped to boost consumption and economic growth over the past few years. As a result, vehicle sales increase in sales.■Oil and Natural GasThe landscape of the oil and gas industry in Indonesia, has experienced dramatic changes in recent years. The industry that have a very interested potency and profitability. The prospect of oil and gas Industry in Indonesia is very high related to the market of oil and gas in Indonesia and the big resource of oil and potency. This is because of oil and gas is the existing fuel and not yet owned by the substitution product which significant. Oil and gas Industry is the biggest contributor in devisa income and predominated by the government regulation with the monopolistic system.Indonesia’s oil production declined over the last decade due to the natural maturation of producing oil fields combined with a slower reserve replacement rate and decerased investment. Most oil and gas production is carried out by foreign contractors under production sharing contracts arrangements.The potency of oil and gas industry in Indonesia is big enough to be developed, especially in east side of Indonesia that have not been explored. The source of oil and gas with a low level difficulty exploration currently consumed up because of the exploitation and leaves a high level of difficulty.

-

-

-

From export of resources to highly value-added trade

Indonesia is a country blessed with natural resources. In addition to fossil energy resources such as petroleum, natural gas and coal, many mineral resources such as copper, nickel and tin are also reserved. Moreover, the country has produced a number of primary products from abundant marine resources such as fishes and shellfishes brought about by vast waters, palm oil taken from palm growing in hot and humid tropical rainforest climate and natural rubber harvested from rubber tree. Many of them were also influential export goods.

However, the Indonesian government has launched a policy to change the quality of these exports. Particularly, in the 1970s, we set the goal of reducing dependence on oil which will result in decrease of about 50% of exports to 20%. That goal was achieved in the 21st century. Furthermore, we aim to enhance international competitiveness by promoting processing trade, facilitation of logistics through infrastructure development, and development of industries with highly added value.

For Indonesia, which has a lower trade dependence than other ASEAN countries, the possibility of trade expansion is great. We are actively promoting bilateral and multilateral trade agreements, and from now on, dynamic trade expansion with a view to not only Asia but the world is expected.

-

Indonesian Trade

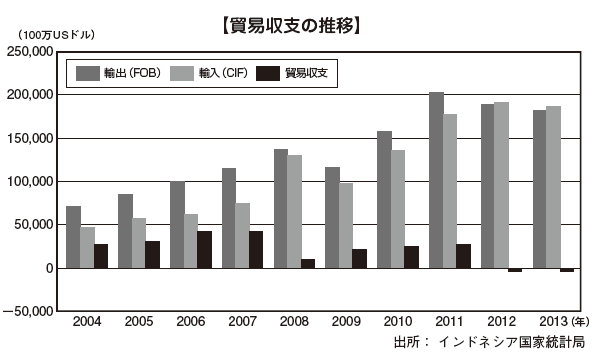

Looking at trends in exports and imports in Indonesia, exports and imports have continued to increase since the beginning of the 21st century, except for the decline in 2009 due to the impact of the global financial crisis. Increase occurred several times mainly at the beginning of the 21st century. Also, until 2011, exports always exceeded imports, so the trade surplus continued to be in surplus.However, due to stagnation of the world economy and weak resource prices in 2012, exports became sluggish and trade deficit occurred. Trade deficit is the result since domestic consumption is steady and imports have not decreased.

In 2012, economic growth of 6% was achieved in a form led by robust domestic demand.Indonesia has supplemented the deficit in the balance of payments by the trade surplus.The deficit in the trade balance means expanding the deficit in the balance of payments. Since the circumstances of Indonesia differ from those of the Asian currency crisis such as the foreign exchange reserves have been sufficiently accumulated, we need to pay close attention to the concern that in the short term period the rupiah will decline.

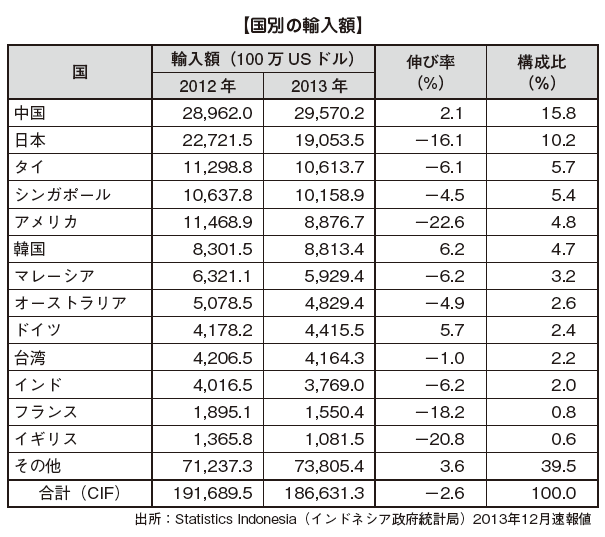

■ State of import and export by country

By country, Indonesia's export destinations are mostly in Japan with US $ 33.7 billion in 2011, accounting for 16.3% of the total, then China is second with 22.9 billion US dollars (9.9%), followed by US, third with 16.4 billion US dollars (9.1%), followed by Singapore 8.7%, Korea 8.0% and India 6.6%.

Although Japan is the top export destination in 1990 which has an overwhelming record of 42.5% , after several years the ratio of exports has been decreasing, it was 23.2% in 2000 and 16.3% in 2010. On the other hand, among Asian countries other than Japan, China, Korea, India, Malaysia and Thailand, are showing their presence. In particular, China's share has increased from 3.2% to 9.9%.

Exports to the ASEAN region are also greatly increasing. Looking at imports by country and region, China is the largest number with US $ 26.2 billion, accounting for 14.8%. Next, Singapore is second with 25.9 billion US dollars (14.6%), Japan ranks third with 19.4 billion US dollars (11.0%), followed by Korea 7.3%, Malaysia and Thailand with both 5.9%. Japan has also reduced the ratio for imports from 24.8% in 1990 to 11% in 2010, and the same trend in the U.S. Again, Asian countries such as China, Singapore, Malaysia, Thailand and India are on the rise. Among them, the ratio increase within the ASEAN region became more prominent, accounting for nearly 30% of the total.

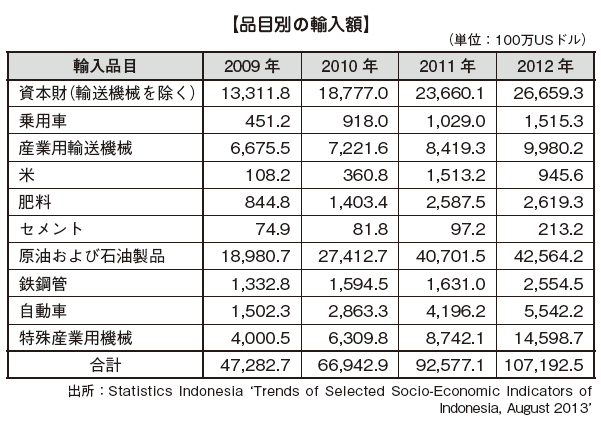

■ Status of import and export by item

Looking at Indonesian exports by item, mineral fuel such as coal, which is has major export destinations in China and India, amounted to US $ 27.4 billion, an increase of 46.6% over the previous year, accounting for 13.5% of the total exports. In addition, the exports in animal and vegetable oils grew due to soaring prices of palm oil. In terms of natural rubber and rubber products, exports increased due to reduced production in Thailand, one of the major producing countries. We export US $ 41.5 billion, which is 20% of the total exports of oil and natural gas. Also natural gas, which continues to accompany international crude oil prices, also surpassed that of the previous year significantly.

Regarding imports, while Indonesia exports natural gas and petroleum, it imports many petroleum products. In addition, while exporting iron ore, we also import iron making products. It is clear that the characteristics of developing country models that rely on reserve resources to export resources and import products are still remarkable. However, imports of electric products and other goods are also favorable due to the improvement of income, and it can be said that the transition from the economy driven by resource export-oriented type to domestic demand led type is entering.

Under the Yudhoyono administration, the Government of Indonesia has improved trading balance dependent on traditional petroleum and natural gas. It will clearly devises depolarization-dependent policy based on industrial development such as automobile parts, electric and electronics industry, textile, agricultural and fishery processing. In 2008, Indonesia has withdrawn from OPEC (Petroleum Exporting Country Organization), concluded EPA (Economic Partnership Agreement) with Japan, and liberalization is progressing in AFTA (ASEAN Free Trade Area). In addition, as China and ASEAN FTA (Free Trade Agreement) were concluded, the country was aiming for new production base in ASEAN and Asia.

-

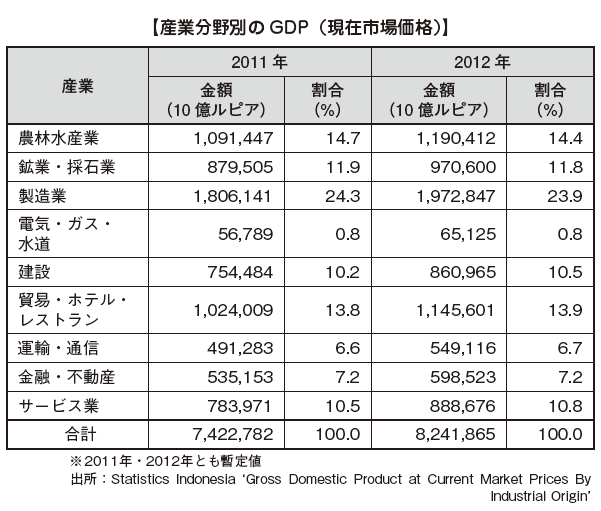

Changes in Industrial Structure

Indonesia is an agriculture, forestry and fishery country originally with abundant natural resources. It is also a resource country with abundant underground resources. However, the latter half of the 1960s during the President Suharto aimed for industrialization centered on the manufacturing industry, the ratio of secondary industries increased. It was back then when the agriculture, forestry and fishery industry was accounted for as 50% of GDP, but in the 1990s the ratio has reached the 10% level, and in the meantime the secondary industry has reached the 40% level from the 10%.In the latter half of the 1990s, the manufacturing industry declined greatly following the impact of the Asian currency crisis. Although the manufacturing industry gradually picked up afterwards, it is the tertiary industry that achieved higher growth and increased the ratio. As of 2012, the tertiary industry's share of GDP is 47.5%, exceeding the secondary industry. In particular, the growth in the transportation and communication fields has been remarkable, accounting for 10% of GDP, and the construction industry has also increased significantly.

Among the manufacturing industries, many traditional foods, rubber, wood pulp, etc., the area with remarkable growth is transportation equipment and machinery such as automobiles. These fields requiring expansion of the base by many suppliers are weaker than those of neighboring countries such as Thailand and Malaysia. The Indonesian Government is promoting these industry development and aiming to transform into an industrial structure with more added value.

■ Agriculture

The share of agriculture, forestry and fisheries in GDP has declined to 12.5% in 2012, but since the working population accounts for about 40%, it can still be said to be the main industry in Indonesia.

Indonesia is one of the world’s top producing country of many agricultural products growing in hot and humid tropical rainforest climate. Palm oil gave the world's largest production value, and when it is combined with the second place Malaysia it will be more than 90% of world production. Natural rubber is second only to Thailand, Cassava is second after Nigeria, Rice is third after China and India.

One characteristic of Indonesian agriculture is that major agricultural products differ depending on the region. Many domestic crops such as rice and cassava are made of small farmers mainly in Java and others, but most of the major export items such as palm oil and natural rubber are made in Sumatra Island. It means that the characteristics by region are large.

Forestry and fishery are also popular. Lauan timber plywood of tropical rain forests produced around Kalimantan Island and Sumatra Island is worldwide and there are abundant marine products landing from the vast waters.

The Government of Indonesia has set targets for each item with the aim of improving the food self-sufficiency rate. It is also important to take note that the country is a base of rich agriculture, forestry and fishery industries. In addition, differences between Java and other agricultural infrastructure are pointed out, infrastructure development appropriate for each region's natural environment and cultivated crops is an issue.

Food

In the food industry in Indonesia, domestic demand has increased due to the huge population and economic growth. Processed foods and the restaurant industry are booming. In the Islamic area, it is necessary to clear the halal system indispensable for food sales (criteria decided by food standards excluding pork and alcohol which are contraindications in Islam).Also, food industry in Indonesia has to draw attention, since large amount of Islamic food from all over the globe is entering the market. Already, Malaysia is doing the said efforts. Indonesia has over 200 million Muslims and has an overwhelming major domestic market. The synergistic effect and the possibility of exporting to the domestic market and the foreign Islamic area are drawing attention.

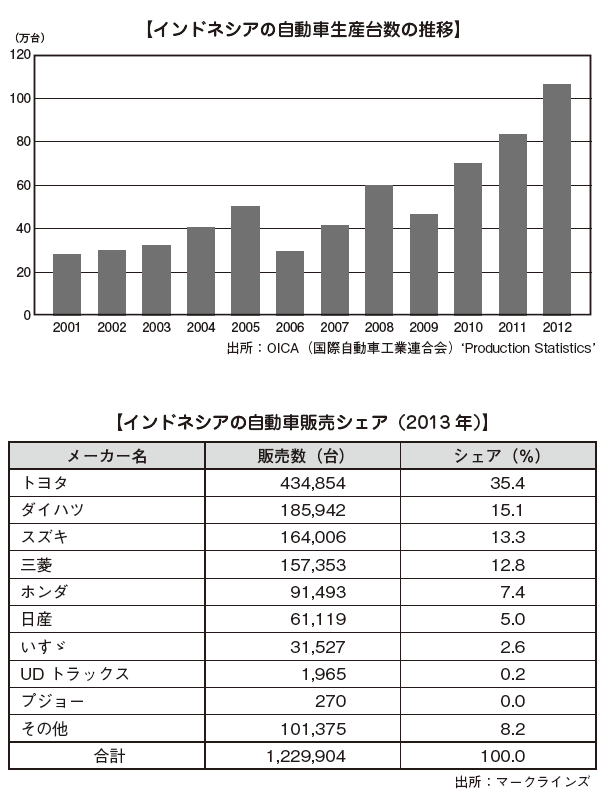

■ Automobile industry

In the 21st century, when Indonesia recovered from the blow caused by the Asian currency crisis, Indonesia's automobile production has been on an upward trend. In particular, it increased to 400 thousand in 2007 and 600 thousand in 2008, and although it decreased due to the impact of the global financial crisis in 2009, the recovery happened after three consecutive years. In 2012 the Indonesia’s automobile production finally got on the market with 1 million units, and in 2013 it is growing even further to 1.2 million units.

In Indonesia, since import and export of finished cars are each several tens of thousands each year, basically, many domestically produced cars are sold in Japan. A Japanese company with a track record of entering the local production from the Suharto era occupies over 90% of domestic sales. Seven out of the top 9 are Japanese-affiliated, and the total share of the Japanese-affiliated company in 2013 was 91.6%, Toyota (35.4%), which accounts for one third of the total, followed by Daihatsu (15.1%), Suzuki (13.3%), Mitsubishi (12.8%), followed by Honda, Nissan and Isuzu, followed by Sweden UD Trucks, 9th place is the French Peugeot.

With the steady economic growth in recent years, the purchasing power of citizens is increasing, which is the tailwind of the automobile industry. In general, it is said that with the popularization of durable consumer goods such as automobiles and home appliances Indonesia is expected to be entering that phase where there is an accelerate as the per capita GDP exceeds 3,000 US dollars. As the economic growth strategy, the Indonesian government has been promoting the development of high value added industries, and it is hoped that the automobile industry, which is the most prominent wing, will grow not only for domestic consumption but also as a production export base.

From 2011 to 2012, large-scale investment by Japanese automakers and other automobile manufacturers worldwide was announced one after another. In 2011, Toyota built a second factory in the neighborhood of the Karawang factory outside Jakarta, and decided to invest approximately 30 billion yen in consideration of exports to Asia. In addition, Honda announced that it will operate a new plant for four-wheel vehicles in 2014 to be the production base next to Thailand. Nissan is also aiming for production of 500,000 a year by improving the production capacity of existing plants.

Europe and the US automobile manufacturers Ford and General Motors turned to a strategy focused on compact cars and at the same time their sales have been increasing, BMW has also increased the production line. Chrysler also announces investment to expand its distribution network. Until now, the Indonesian automobile industry, was nearly monopolized by Japanese automobile manufacturers, but intensifying international competition is inevitable in the future.

The Indonesian government predicts that sales in 2013 will continue to increase drastically, but GAIKINDO (Indonesia Automobile Industry Association) expects the same level as the previous year with 1.1 million units (7.5% increase). There is a view to forecast a significant increase in sales as there is a plan to introduce a "low cost and green car (LOGC)", preferential treatment system for purchasing compact cars with low fuel cost and high fuel consumption. On the other hand, there are also forecasts that optimism will not be taken, as we are considering reviewing "fuel subsidies" which has become a pressure to be financed as a result of the popularization. You will need to look more carefully about future trends.

■ Oil and natural gas

The oil and natural gas industry has been supporting the Indonesian economy for long time. During President Suharto, the oil and gas corporation Pertamina monopolized exploration, development, production and sales which accounted for more than 50% of exports from the latter half of the 1970s and at the same time the early 1980s.

However, foreign investment slowed down in times of confusion after the Asian currency crisis and democratization. While the monopoly of Pertamina was abandoned and placed in international competition in 2002, petroleum production began to decline as the facility became obsolete. Domestic consumption continued to rise, exceeding imports. In 2009 OPEC (Petroleum Exporting Country Organization) temporarily withdrew.

Crude oil production is regarded in the three major production areas, on the south and the east coast of Sumatra Island \ and Kalimantan Island, where Japan has long been working on development since ancient times. Natural gas is also produced in Sumatra Island, Kalimantan Island, West Papua and so on and is being exported from LNG (Liquefied Natural Gas) terminal in West Papua, northern coast of Sumatra Island, east Kalimantan Island, Japan and etc.

Domestic demand for natural gas continued to increase, but pipeline is drawn from the gas field in the southern part of Sumatra to Java Island, which is a large consuming area of energy. Apart from that, because it is located in a remote island, it is difficult to lay pipelines, and despite tight domestic supply and demand, they are liquefied and sent for exports. Due to such geographical features and delays in infrastructure development, Indonesia becamean energy exporter, while also an importing country.

For this reason, the Indonesian government continue to promote investment in oil and natural gas facilities to clarify the policy to increase production again in order to respond to the increasing demand for domestic energy in the future.They are planning to give priority to supply to the site and construction of the LNG terminal.

■ Nonferrous metals

Indonesia produces a large amount of nonferrous metals, as to tin and nicke, theyl are second in the world, and as to copper, bauxite and gold, are the world's leading producers.

The trend of resource nationalism which is also a global trend is remarkable also in Indonesia, and in Indonesia's New Mining Act and its related law which came into effect in 2009. It was obliged to add high value of mineral resources domestically. So the production was made made domestically. The smelting was expanded and new restrictions were added to the export of ore.

In addition, restrictions on foreign capital to companies holding interests of mineral resources have been strengthene.d. Domestic capital is to be increased to 51% or more within 10 years from the start of mining. There is a tailwind of the soaring price of mineral resources due to the tight global supply and demand balance in recent years. The new industrial law is not directly reducing the foreign investment situation, so it is necessary to watch continuously since the future trend may continue.

-

-

-

Key Manufacturing Industry to Utilize

As Indonesia's strength in continuing economic growth, it is common to mention about 247 million people. Rather than having a large total population, it is the greatest advantage that there are many production workers who are said to be "population bonus". But whether to make good use of it depends on how much the change in industrial structure is going forward.

As mentioned earlier, Indonesia has abundant underground resources and agricultural forestry and fishery resources, so we were able to lead the economy by exporting resources. In addition, due to the large population and improved incomes, we are maintaining an economy with strong domestic consumption. However, in order for the Indonesian economy to achieve sustainable development over the medium to long term, the abundant production workforce needs to create added value in Japan. How much production workers will be able to engage in high-value-added labor will be key to sustainable economic growth.

In 2011, the Government announced the Basic Economic Growth Promotion and Expansion Plan (MP3EI), which upon entering will increase a numerical target GDP per capita to US $ 15,000 by 2025, with the nominal GDP of US $ 4,500 billion as the top 10 in the world. If the productivity is improved by technological innovation and the population bonus is to be dynamically utilized, the goal of MP3EI and the goal for sustaining medium and long term development is achieved. It will be far from impossibilities to break through the trap of the country.

-

-

-

References

[1] Japan Bank for International Cooperation (JBIC) "Investment environment in Indonesia" April 2012

[2] Indonesia Investment Coordinating Agency Japan Office "Information on Investment in Indonesia"

[3] IMF 'World Economic Outlook Database'

October, 21, 2013

January, 21, 2014

[4] JETRO "Indonesia - Economic Trends"

[5] Japan External Trade Organization (JETRO) Overseas Research Department "Trends of Automobile Production and Sales in Major World Countries in 2012" April 2013

[6] Statistics Indonesia 'Trendsof Selected Socio-Economic Indicatorsof Indonesia, August, 2013'

[7] Sakaguchi Announced "Political Economic Analysis of Oil Industry in Developing Countries" Iwanami Shoten, 2010

[8] FAOSTAT (United Nations Food and Agriculture Organization) 'Topproduction Indonesia 2011'

[9] Foundation Industry Center "Indonesia Food Industry Entry Possibility Investigation Report" March 2013

[10] Hori Chihi "Expanding food manufacturers entering Indonesia" Mizuho Research No. 123 (June 2012)

[11] OICA (International Automobile Manufacturers Association) 'Production Statistics'

[12] Takeshi Tsuchiya "Indonesia · Energy situation" e-NEXI, April 2011 issue

[13] Japan Trade Insurance (e-NEXI) "Feature Article Indonesia · Energy Situation"

[14] Mitsubishi Techno-Research Co., Ltd. (Survey commissioned by the Ministry of Economy, Trade and Industry, 2010) "Industry Advancement Promotion Project for Promoting Economic Partnership 2010 - Report on Mission Dispatch on Petrochemical Industry in Indonesia" March 2011

[15] National Institute of Oil, Natural Gas and Metals National Mineral Resources Organization "World Mining Trend 2012 - Republic of Indonesia"

[16] Ministry of Foreign Affairs "Official Development Assistance (ODA) Country Data Book 2012 - Indonesia"

[17] Nishi Tadashi "Indonesia, Challenges are still high in politics ~ Keys to make use of high attention by key recruitment and utilization of foreign capital" Dai-ichi Life Economic Research Institute Economic Research Division Macroeconomic Analysis Report, December 2012 14 Day

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya