Turkey

9 Chapter Labor

-

-

1 Chapter Coming Soon

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.4 Advances of Japanese Companies

4 Chapter Incorporation

4.1 Feature of business location

4.2 Establishment of Business location

4.3 Liquidation and evacuation (dissolution) of company.

5 Chapter M&A

5.1 Trends of mergers and acquisitions in Turkey

5.2 Laws and Regulation related mergers and acquisitions

5.3 Tax law related mergers and acquisitions

5.4 Base of scheme of mergers and acquisitions

5.5 Problem after corporate acquisition

5.6 Process of mergers and acquisitions

6 Chapter Corporate Law

7 Chapter Accounting

8 Chapter Tax Laws

8.1 Important points about tax law to advance into Turkey

8.2 Regulation of international tax and accounting in Turkey

8.3 Regulation of domestic tax law

9 Chapter Labor

-

-

-

Working environment

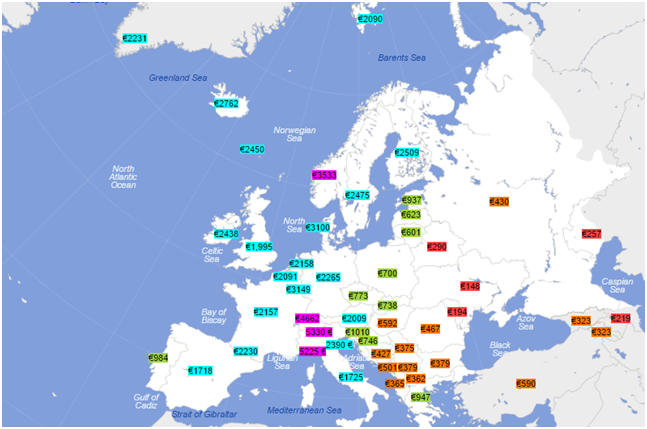

■Labor forceLabor Force Participation Rate in Turkey averaged 47.13 percent from 2005 until 2016, reaching an all-time high of 52.10 percent in May of 2016 and a record low of 43.90 percent in February of 2006. Turkey's labor force is around 29.7 million people, which makes Turkey the 3rd largest labor force market in Europe.Turkey’s young population is an important contributor to labor force growth and has boosted the country’s rank over its competitors. Turkey has posted the largest labor force growth in relation to EU countries.Some characteristics of the Turkish Labor force is that their working population is very young compared to other countries in the EU where the population is getting old. Labor costs are low in comparison as well and the productivity is good, therefore Turkey is a very competitive country in regards of workforce, employees have good skills and with a low cost for employers. And Turkey encourages it, its universities offer 600,000 graduates every year, which means foreign investors can look for employees with a high education and good qualifications. ■Unemployment rateThe unemployment rate in Turkey increased to 10.2 percent in June of 2016 from 9.6 percent a year earlier. The rate averaged 9.91 percent from 2005 until 2016, reaching an all-time high of 14.80 percent in February of 2009 and a record low of 7.30 percent in June of 2012. The Unemployment rate is reported by the Turkish Statistical Institute.■Wage by industryJobNational SalarySoftware Developer$35,692Software Engineer$42,167Mechanical Engineer$31,800Civil Engineer$28,200Senior Software Engineer$59,998Country Manager$86,752Electrical Engineer$36,303■Comparison of average wages in neighboring countriesThe countries in purple have salaries in excess of €3500 a month, in blue from €1700 to €3499, in olive from €600 to €1699, in yellow from €300 to €599, in red below €300.

■Unemployment rateThe unemployment rate in Turkey increased to 10.2 percent in June of 2016 from 9.6 percent a year earlier. The rate averaged 9.91 percent from 2005 until 2016, reaching an all-time high of 14.80 percent in February of 2009 and a record low of 7.30 percent in June of 2012. The Unemployment rate is reported by the Turkish Statistical Institute.■Wage by industryJobNational SalarySoftware Developer$35,692Software Engineer$42,167Mechanical Engineer$31,800Civil Engineer$28,200Senior Software Engineer$59,998Country Manager$86,752Electrical Engineer$36,303■Comparison of average wages in neighboring countriesThe countries in purple have salaries in excess of €3500 a month, in blue from €1700 to €3499, in olive from €600 to €1699, in yellow from €300 to €599, in red below €300.

-

Labor Union and labor dispute

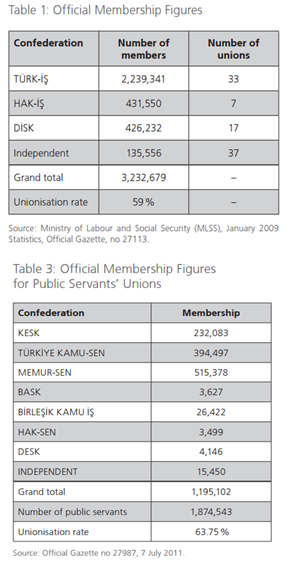

■History of Turkish Labor UnionThe Turkish Confederation of Workers’ Unions (TÜRK-İŞ), which mainly organizes public sector workers, was formed in 1952 on the basis of the first trade union law of 1947. After the military coup of 1960, the Trade Union Act no 274 and the Collective Bargaining, Strikes and Lockouts Act no 275 were enacted in 1963. With these the right to strike was reorganized this facilitated a dramatic increase in union membership, which exceeded one million by 1971. After that the TÜRK-İŞ split after a strike on glass, then Confederation of Progressive Trade Unions (DİSK) was founded in 1967. Organizing mainly private sector workers, DİSK adopted an overtly radical position.In 1970 the Confederation of Nationalist Workers’ Unions (MİSK) was founded. It received some support during the period of the National Front government in 1975 but did not record any major successes. The military intervention of 1980 banned the activities of DİSK, HAK-İŞ and MİSK. DİSK leaders were brought to trial and most of its members had to move to TÜRK-İŞ affiliated unions. HAK-İŞ was allowed to operate again in 1981, MİSK in 1984 and DİSK in 1991.The legal framework of union organizing was restructured in 1983, with the enactment of the Trade Unions Act no 2821 and the Collective Bargaining Agreement, Strike and Lockout Act no 2822, this new restructures severely restricted the freedom to organize.But in 1995, by pressure from workers the right to organization by public workers was recognized. The unions that represented public workers were, Turkiye KAMU-SEN, KESK and MEMUR-SEN. It was until 20012 that public employees had a separate law that defined the legal status of their unions, this Law was No. 4688, the legal framework was outlined but still did not granted a right to strike or engage collective bargaining.■How to join Labor UnionA new trade union member in the private sector must visit a public notary to certify five copies of the application form which is then forwarded to the trade union. It is then required to send a copy of the application form to the Ministry of Labor and Social Security. A visit to a public notary is not necessary for public employees in the public sector. But the unionization in the public sector is hindered by the fact that membership is illegal for many categories of public workers. ■Status of labor disputeThere are strict procedures to declare a strike in the private and public sector. Strikes are illegal in numerous industries from the production of coal, water, electricity, gas and coal power plants; in banking and public notaries. As well strikes are illegal in all health, educational and training institutions. Even if the procedures have been followed according to law there may still be a postponement of strike action by the Council of Ministers on the grounds of a threat to general health or public security. If a strike is postponed by the Turkish authorities, then it is considered to be illegal in practice, and it is not possible to recommence industrial action.■How to solve labor disputeThe labor Dispute can be solved bay an agreement but cases where the strike or lockout is prohibited or postponed, the dispute shall be settled by the Supreme Arbitration Board at the end of the period of postponement. The disputing parties may apply to the Supreme Arbitration Board by mutual agreement at any stage of the dispute. The decisions of the Supreme Arbitration Board shall be final and have the force of a collective bargaining agreement.İŞKUR is the Turkish Employment Agency a public authority in charge of designing and implementing Active and Passive Labor Market Policies in Turkey. Associated with the Ministry of Labor and Social Security. This Agency can be consulted in case of a Labor Dispute.■An example of labor disputeA labor dispute over wages and working conditions, started on May 14 of 2015 in the Oyak Renault factory and Tofaş, owned by Italy’s Fiat and Turkey’s Koç Holding in Bursa, before spreading to other carmakers, including Ford’s Turkish unit, Ford Otosan, and several auto part makers.Which halted operations at its factory in the northwestern province of Bursa, ended following an agreement with the protesters.The company paid workers a lump sum of 1,000 Turkish Liras ($370) in one week and complete a study into improving pay conditions within one month after the end of the strike. The top management agreed to grant workers a performance-based annual cash bonus.No protesting workers faced legal or disciplinary action because of the strike.In most of the factories, production was resumed following a similar deal between the employers and the workers, except at Ford Otosan’s İnönü factory in the Central Anatolian province of Eskişehir.

■Status of labor disputeThere are strict procedures to declare a strike in the private and public sector. Strikes are illegal in numerous industries from the production of coal, water, electricity, gas and coal power plants; in banking and public notaries. As well strikes are illegal in all health, educational and training institutions. Even if the procedures have been followed according to law there may still be a postponement of strike action by the Council of Ministers on the grounds of a threat to general health or public security. If a strike is postponed by the Turkish authorities, then it is considered to be illegal in practice, and it is not possible to recommence industrial action.■How to solve labor disputeThe labor Dispute can be solved bay an agreement but cases where the strike or lockout is prohibited or postponed, the dispute shall be settled by the Supreme Arbitration Board at the end of the period of postponement. The disputing parties may apply to the Supreme Arbitration Board by mutual agreement at any stage of the dispute. The decisions of the Supreme Arbitration Board shall be final and have the force of a collective bargaining agreement.İŞKUR is the Turkish Employment Agency a public authority in charge of designing and implementing Active and Passive Labor Market Policies in Turkey. Associated with the Ministry of Labor and Social Security. This Agency can be consulted in case of a Labor Dispute.■An example of labor disputeA labor dispute over wages and working conditions, started on May 14 of 2015 in the Oyak Renault factory and Tofaş, owned by Italy’s Fiat and Turkey’s Koç Holding in Bursa, before spreading to other carmakers, including Ford’s Turkish unit, Ford Otosan, and several auto part makers.Which halted operations at its factory in the northwestern province of Bursa, ended following an agreement with the protesters.The company paid workers a lump sum of 1,000 Turkish Liras ($370) in one week and complete a study into improving pay conditions within one month after the end of the strike. The top management agreed to grant workers a performance-based annual cash bonus.No protesting workers faced legal or disciplinary action because of the strike.In most of the factories, production was resumed following a similar deal between the employers and the workers, except at Ford Otosan’s İnönü factory in the Central Anatolian province of Eskişehir.

-

-

-

Overview of Labor Standards Act

■ System for flexible employment[Rules of an employee´s transfer]If an employee wants to transfer offices to another entity owned by a different person, the employee will not retain their rights based on continuous employment, and employment benefits linked to the length of employment will be reset.But, if the employee is transferred to a new entity owned by a different person as a result of a business transfer made by the employer, then the employee will retain all rights linked to the length of employment and will continue to work in the same place, and in such case the working conditions of the employee cannot be changed.In such a transfer, all of the employment agreements will also be directly transferred to the new owner.[Extension of trial employment period]If the employer and employee have agreed to include a trial clause in the employment contract, the duration of the trial term shall not exceed two months. The trial period may be extended up to four months if it’s by a collective agreement. Within the trial term the parties are free to terminate the employment contract without having to observe the notice term and without having to pay compensation. The employee’s entitlement to wages and other rights for the days worked is reserved.[Institutionalization of contracts of fixed-term employment]Employment contracts shall be made for a fixed term or indefinite known as open-ended contract period. In terms of the manner of working, these contracts may be concluded on a full-time or part-time basis, or with a probation period or in other forms possible. An employment contract for a definite period is known as a fixed term contract, has a specified term or which is based on the emergence of objective conditions like the completion of a certain work or the materialization of a certain event. An employment contract for a definite period must not be concluded more than once, except when there is an specific reason.[Institutionalization of labor contracts of part-time]This employment contract shall be considered as a part-time contract where the normal weekly working time of the employee has been fixed considerably shorter in relation to a comparable employee working full-time.There must be no difference between the part-time worker in comparison to a full-time employee solely because his contract is part-time. The divisible benefits to be accorded to a part-time employee in relation to wages and other monetary benefits must be paid in accordance to the length of his working time proportionate to a comparable employee working full-time.[Institutionalization of On-call labor]According to Turkish Law the employment relationship which foresees the performance of work by the employee upon the emergence of the need for his services, as agreed to in the written employment contract, qualifies as a part-time employment contract based on work on call. This means that when the employee is needed he will be called.In the event the length of the employee’s working time has not been determined by both, the employer and employee, the weekly working time is considered to have been fixed as twenty hours. The employee is entitled to wages irrespective of whether or not he is engaged in work during the time announced for work on call. Unless the contrary, the employer who has the right to request the employee to perform his obligation to work upon call must make the said call at least four days in advance.The employee is obliged to perform work upon the call communicated to him within the said time limit. If the daily working time has not been decided in the contract, the employer must engage the employee in work for a minimum of four consecutive hours at each call.■Rules of labor protection[Labor protection attend on changing office’s owner]Under Article 6 of the Turkish Labor Code, in the event that the workplace or a part of the workplace is transferred through a legal transaction, all of the existing employment agreements will also be transferred to the new owner together with all rights and obligations that have accrued under those agreements.The new employer will be held liable for debts accrued before the transfer date along with the old employer. The liability will expire following the end of two years following the transfer date.[Institutionalization of shorter working hours]The tendency to shorten weekly hours is quite high in industrialized countries of the European Union. With the reduction in working hours the decrease in the supply of labor force related to the decrease in population causes the economic labor force to fall. A decrease to 45 hours per week would result in employment for 1.867 workers. If the working hours were reduced by one hour per week, 231,000 additional jobs could be created.[Expansion of guaranteed employment plan]The employer, who terminates the contract of an employee engaged for an indefinite period, who is employed in an establishment with thirty or more workers and who meets a minimum seniority of six months, must depend on a valid reason for such termination connected with the capacity or conduct of the employee or based on the operational requirements of the establishment or service.The six-month minimum seniority of the employee shall be calculated on the basis of the sum of his employment periods in one or different establishments of the same employer. In the event the employer has more than one establishment in the same branch of activity, the number of employees shall be determined on the basis of the total number of employees in these establishments.■ Labor standards in Turkish Labor LawEmployees are entitled to paid annual vacation for the periods as long as the they have worked for at least one year including the probation period.Years of workMinimum paid vacation period1-5 years (inclusive)14 working days5-15 years20 working days15 years (inclusive) or longer26 working daysThese benefits are the minimum levels set by law and may be increased depending on the collective or personal employment contract.Days of OperationHours of operationBreakOfficesMondays to Fridays09:00 - 17.00with an hour's break at noon.BanksMondays to Fridays09:00 - 17.00with an hour's break at noon.StoresMondays to Sundays09:00 - 19.00During the summer months, the working day begins at 7am or 8am and end at 2pm, in some cities.■Wage Relation LawThe Minimum Wage Regulation (last modified in 2014). The purpose of the regulation is to lay out the principles to be applied when determining the minimum wage, and the workings and the meetings of the Minimum Wage Determination Commission. Provisions of this regulation covers all sectors employing all kind of workers with a job contract.Main articles in the Turkish Labor Law act related to wage are the following:ARTICLE 5. – Mentions that the application of special protective provisions due to the employee’s sex, race, sex, political opinion, philosophical belief, religion and or similar reasons shall not justify paying the employee a lower wage. If the employer violates the above provisions in the execution or termination of the employment relationship, the employee may demand compensation up to four months’ wages plus other claims of which the employee has been deprived.ARTICLE 12 – Mentions that divisible amounts for a given time period relating to wages and other monetary benefits to be given to an employee working under a fixed-term contract shall be paid in proportion to the length of time during which the employee has worked in the company.

ARTICLE 13 - Mentions that an employee working under a part-time employment contract must not be subjected to differential treatment in comparison to a comparable full-time employee, the divisible benefits to be accorded to a part-time employee in relation to wages and other monetary benefits must be paid in accordance to the length of his working time proportionate to a comparable employee working full-time.

ARTICLE 14. – Mentions that employment in a work on call contract, the employee is entitled to wages whether or not he is engaged in work during the time announced for working on call.

ARTICLE 21. – Mentions that when there is a termination of contract the employee shall be paid up to four months’ total of his wages and other entitlements for the time he is not re-engaged in work until the finalization of the court’s verdict.ARTICLE 27. – Mentions that during the term of notice the employer must grant the employee the permission to seek a new place of employment within working hours without any deduction from his wage. The time devoted to this purpose should not be less than two hours daily and if the employee so requests such hours may be added together and taken at one time. But if the employee wishes to take these hours at one time, he must do so on the days immediately preceding the day on which his employment ceases and must inform the employer in advance.ARTICLE 38. -Mentions that by Law no employer may impose a fine on an employee’s wage for reasons other than those indicated in the collective agreement or the employment contract. The employee must be notified at once with the reason.

Deductions must not exceed three days’ wages in any one month.

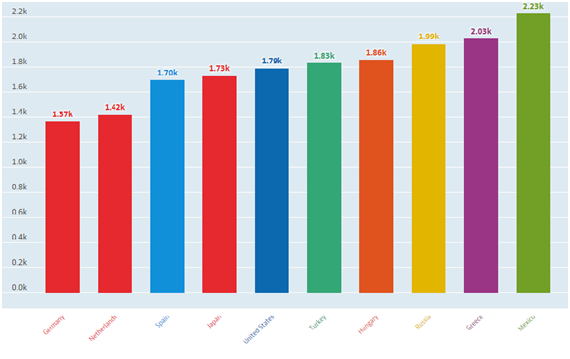

These deductions shall be credited within one month to the account of the Ministry of Labor and Social Security in a bank established in Turkey and must be designated by the Ministry for use in the training of and social services for employees. Every employer must maintain a separate account in his establishment showing such deductions. A committee presided over by the Minister of Labor and Social Security and including employees’ representatives shall decide where and in what amounts the fines thus collected are to be used. Rules for the establishment and working methods of this committee shall be indicated in a regulation to be issued.■ Status of wageThe average monthly swage that workers take home is 1671 TRY, or 709 USD. Turkey generally has quite a low cost of living.According with Turkish no deductions of any kind can be made to the employee’s wages this can be made only by Law determined every two years at the latest by the Ministry of Labor and Social Security through the Minimum Wage Fixing Board not by the employer or any other Agency.■Minimum wageMinimum Wages in Turkey increased to 1647 from 1273.50 in December of 2015. The amount is the decided by the Minimum Wage Fixing Board and their decisions are final and become effective upon their publication in the Official Gazette. The board is presided over by one of its members to be designated by the Ministry of Labor and Social Security, it shall be composed with the General Director of Labor or his deputy, the General Director of Occupational Health and Safety or his deputy, the chairman of the Economic Statistics Institute of the State Institute for Statistics or his deputy, representative of the Under- Secretariat of Treasury, the head of the relevant department of the State Planning Organization or his representative, five employees’ representatives from different branches of activity selected by the highest – ranking labor organization representing the majority of employees and five employers’ representatives selected by the employer organization representing the majority of employers.■Status of labor hoursUnder Article 63 of the Turkish Labor Code, working hours in a week cannot exceed 45 hours. Further, working hours per day cannot exceed 11 hours. The 45 hours of work time can be distributed unevenly between the days of the week by mutual agreement of the parties (through employment contracts or collective agreements) to the extent that the maximum daily limit of working hours is not exceeded.These limits cannot be exceeded even by way of agreement between the employer and employee. The working hours exceeding these limits are considered as overtime work and must be compensated by an overtime work payment by the employer.In 2014 in comparison with other countries affiliated to the OECD the Average annual hours actually worked in Turkey was 1 832.0, which locates Turkey in place 24th of the list of all countries in the OECD. ■BonusThere are no legal regulations in regards of bonus entitlements the regulation is by mutual agreement between employee and employer. Employers can decide to reward employees with bonuses based on performance. Bonuses are included in the employment contract this means that bonuses cannot be changed or revoked unilaterally by employers, according to law, changes may be made only after a written notice is delivered.■ Rules of retirement[Cases of severance pay]The severance pay amount is based on the last thirty days’ gross wage per year of employment starting on the date of employment. For periods of more than one year, this will be proportioned and included in the calculation. Along with wages paid to the employee, severance pay calculations consider the gross amounts of all money and benefits that are provided regularly such as travel expenses, food allowance, bonuses, etc. The amount of severance pay paid is limited by a severance pay upper limit in effect on the date of termination.■ Employment obligation of disabled personsIn the private sector workplaces employing fifty or more employees, the employer must employ disabled persons, numbers of which cannot be less than the %3 of total employees.■ Protection of female employeePregnant employees can take fully paid leave for:· Eight weeks before childbirth.· Eight weeks after childbirth.Pregnant employees or employees whose wives are pregnant will be entitled to nursing benefits if certain premium conditions are fulfilled.For women to be able to cash maternity benefits, they must have at least 120 days of contributions.Women receive a lump sum for pregnancy and childbirth benefits and they are entitled to a nursing grant as well. The lump sums are paid according to a schedule in law. The lump sum is increased for multiple births.The minimum and maximum daily covered earnings used to calculate maternity benefits are adjusted according to changes in the minimum wage.Additionally, Turkish citizens are entitled to a payment of TRY300 for the first child, TRY400 for the second child and TRY600 for the third and any following children. This birth aid is granted to parents who are Turkish citizens, and where both of them are Turkish citizens, the birth aid is granted to the mother of the children.All this benefits come from contributions to the Social Security, for workers is a deduction of 5% of their monthly earnings, this deductions will cover as well sickness.■Protection of childrenEmployment of children who have not completed the age of fifteen is prohibited. However, children who have completed the full age of fourteen and their primary education on light works that will not hinder their physical, mental and moral development, and for those who continue their education, in jobs that will not prevent their school attendance. However, children who have not completed the full age of fourteen may be employed in the artistic, cultural and advertising activities that will not hinder their physical, mental and moral development and that will not prevent their school attendance, on condition that a written contract is entered and permission is obtained for each activity separately.

■BonusThere are no legal regulations in regards of bonus entitlements the regulation is by mutual agreement between employee and employer. Employers can decide to reward employees with bonuses based on performance. Bonuses are included in the employment contract this means that bonuses cannot be changed or revoked unilaterally by employers, according to law, changes may be made only after a written notice is delivered.■ Rules of retirement[Cases of severance pay]The severance pay amount is based on the last thirty days’ gross wage per year of employment starting on the date of employment. For periods of more than one year, this will be proportioned and included in the calculation. Along with wages paid to the employee, severance pay calculations consider the gross amounts of all money and benefits that are provided regularly such as travel expenses, food allowance, bonuses, etc. The amount of severance pay paid is limited by a severance pay upper limit in effect on the date of termination.■ Employment obligation of disabled personsIn the private sector workplaces employing fifty or more employees, the employer must employ disabled persons, numbers of which cannot be less than the %3 of total employees.■ Protection of female employeePregnant employees can take fully paid leave for:· Eight weeks before childbirth.· Eight weeks after childbirth.Pregnant employees or employees whose wives are pregnant will be entitled to nursing benefits if certain premium conditions are fulfilled.For women to be able to cash maternity benefits, they must have at least 120 days of contributions.Women receive a lump sum for pregnancy and childbirth benefits and they are entitled to a nursing grant as well. The lump sums are paid according to a schedule in law. The lump sum is increased for multiple births.The minimum and maximum daily covered earnings used to calculate maternity benefits are adjusted according to changes in the minimum wage.Additionally, Turkish citizens are entitled to a payment of TRY300 for the first child, TRY400 for the second child and TRY600 for the third and any following children. This birth aid is granted to parents who are Turkish citizens, and where both of them are Turkish citizens, the birth aid is granted to the mother of the children.All this benefits come from contributions to the Social Security, for workers is a deduction of 5% of their monthly earnings, this deductions will cover as well sickness.■Protection of childrenEmployment of children who have not completed the age of fifteen is prohibited. However, children who have completed the full age of fourteen and their primary education on light works that will not hinder their physical, mental and moral development, and for those who continue their education, in jobs that will not prevent their school attendance. However, children who have not completed the full age of fourteen may be employed in the artistic, cultural and advertising activities that will not hinder their physical, mental and moral development and that will not prevent their school attendance, on condition that a written contract is entered and permission is obtained for each activity separately. -

Employment contract, Labor contracts and working rules

■Employment contract[Expiry of employment contract]The contract shall terminate:a) in the case of an employee whose employment has lasted less than six months, at the end of the second week following the serving of notice to the other party;b) in the case of an employee whose employment has lasted for six months or more but for less than one-and-a-half years, at the end of the fourth week following the serving of notice to the other party;c) in the case of an employee whose employment has lasted for one-and-a-half years or more but for less than three years, at the end of the sixth week following the serving of notice to the other party;d) in the case of an employee whose employment has lasted for more than three years, at the end of the eighth week following the serving of notice to the other party.These are minimum periods and may be increased by contracts between the parties. The party who does not abide by the rule to serve notice shall pay compensation covering the wages which correspond to the term of notice. The employer may terminate the employment contract by paying in advance the wages corresponding to the term of notice.・Case of requiring advance notice for expiry of employment.The notice of termination shall be given by the employer in written form involving the reason for termination which must be specified in clear and precise terms.・Based on justifiable reasons, case of no requiring advance notice for expiry of employmentThe employer has the right to break the employment contract for serious misconduct or malicious or immoral behavior of the employee.・Collective dismissalWhen the employer contemplates collective terminations for reasons of an economic, technological, structural or similar nature necessitated by the requirements of the enterprise, the establishment or activity, he shall provide the union shop-stewards, the relevant regional directorate of labor and the Public Employment Office with written information at least 30 days prior to the intended lay-off.A collective dismissal occurs when,a) in establishments employing between 20 and 100 employees, a minimum of 10 employees.b) in establishments employing between 101 and 300 employees, a minimum of 10 percent of employees.c) in establishments employing 301 and more workers, a minimum of 30 employees, are to be terminated in accordance with Article 17 on the same date or at different dates within one month.The employer must send a notification with its intentions to collectively dismiss its employees, in writing, to the workplace labor union representatives, the relevant regional directorate of the Ministry of Labor and Social Security and the Turkish Employment Organization known as ISKUR. This notice must be sent 30 days prior to such dismissal and must include the reason for the contemplated lay-off, the number of persons and groups to be affected by the lay-off, as well as its timing.

■Working rulesThe rules of work are annexed to the contract, there is indicated additional information related to the place of work. Rules at the place of work are not regulated or required by law, it is common under big companies, the rules can include qualifications of management, procedures within the company, different types of safety rules, different authority given to different supervisors or employees etc., all needs to be set out in some form of document that must be given to the employees.

-

-

-

Social Security Law

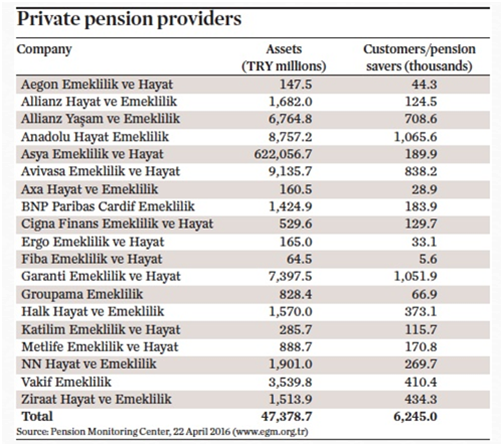

■Social Security SystemAs in many countries all over the world the social security system in Turkey was transformed in 2007 into a more efficient and faster system, based on centralizing the control of different social security funds in a single institution. The three insurance funds, namely SSK, Emekli Sandigi and Bag-Kur, were merged under a sole body called the Social Security Institution (SSI) in 2007. The three insurance funds together cover around 81% of the population as of 2008.■Pension system Pensions in Turkey can be public or private.

■Payment of social insurance premiums

Type of Risk

Employer´s share (%)

Employee´s share (%)

Total (%)

Short- term risks

2●

-

2●

Long-term risks

11

9

20

General Health Insurance

7.5

5

12.5

Contribution to unemployment insurance

2

1

3

Total

22.5●

15

37.5●

■Payment of unemployment insurance premiumsEmployees, employers and the state are required to make a contribution to the Unemployment Insurance Plan at the rates of 1%, 2% and 1%, respectively, of the gross salary of the employee. Like the social security premium payments, unemployment insurance premiums are also to be paid on a monthly basis. Employers are able to deduct such contributions from their taxable income. -

Other social welfares

■Status of health servicesThe Green Card system known as the Yeşil Kart was established in 1992 and introduced with Law 3816 is a non-contributory insurance program and is directly funded by the Government. Poor people earning less than a minimum level of income which is defined by the law, are provided a special card giving free access to outpatient and inpatient care at the state and some university hospitals, and covering their inpatient medical drug expenses but excluding the cost of outpatient drugs. Only the Ministry of Health is authorized to issue Green Cards.■ Public assistance systemThe Red Crescent (Kizilay), equivalent of the Red Cross, is a humanitarian aid organization, health and care activities include first aid and emergency response as well as epidemic control, programs in health promotion and prevention, providing psychosocial care and helping communities.

-

-

-

Visa and Foreign working permit

■Visa and Foreign working permitMost foreigners may enter Turkey without a visa or obtain it in the airport and can stay in the country up to 90 days.Types of resident permits:·Short-Term Residence Permit·Family Residence Permit·Student Residence Permit·Long- Term Residence Permit·Humanitarian Residence Permit·Residence Permits for the victims of Human Trafficking■ Application procedure of working permitForeigners must obtain a work permit in order to be employed in Turkey. The application for a work permit can be filed either within Turkey or from abroad.·If the foreign is outside of Turkey, the foreign will need to apply to Turkey's foreign offices with a passport, a work visa, a copy of the employment agreement and a single passport picture.[In case of domestic in Turkey]·Inside Turkey. Foreigners who have obtained at least a six-month residence permit will be able to directly apply to the Ministry of Labor and Social Security to obtain a work permit.■Application requirements of working permitShort-term residence permits are granted in accordance with the visiting purpose of the foreigners. Short-term residence permits will be issued for no more than one year. In the case of staying outside Turkey more than 120 days within one year after having the residence permit issued the permit might be cancelled.To Apply if traveling for business its required for the foreign traveler to bring his passport, in original and photocopies of the page bearing the foreigner´s photo, the page stamped at the last entry, the page indicating the validity and expiry dates of the passport. Four Photographs passport-size.It’s important to fill an application form which has to include the Tax ID, this can be done at the police department in the city in which they will work in order to obtain a residence permit within 30 days following their arrival. Other requirements are proper type of visa obtained from Turkish Consulates (Business Visitor Visa) and the following need to be original and notarized:

• The Turkish Trade Registry Gazette of the Company indicating the most recent capital and shareholding structure of the organization.

• Commercial Activity Certificate of Company.

• Signature Circular of Company.

• Valid Tax Certificate of Company.

• Proof of Income.

• Valid Health InsuranceIf the foreign has an expired residence permit he must submitted it for renewal. -

Social insurance of correspondent resident officer

■Continued requirements of social insurance insured statusIf Foreigners are making social security contributions in their countries, they do not have to pay the Turkish social security premiums if there is an agreement between the home country and Turkey.■Freely ongoing subscription of health insurance[Insurance fee of freely continued requirement health insurance insured status]A foreign individual who remains covered under the compulsory social security system from their country that has a social security agreement in effect with Turkey is not liable for insurance payments to the Turkish social security. The proof of foreign coverage has to be filed in the local social security office.[Insurance fee of national health insurance]If the employee is not subject to a foreign social security, full contributions will generally be imposed. Unemployment insurance premiums are declared and paid to the Social Security Institution together with social security premium contributions.■ Turkish general health insuranceThe Social Security Law mentions that optional insurance holders shall be obliged to pay universal health insurance premiums unless the residence in Turkey of foreigners is not over one year, universal health insurance premium shall not be charged and such individuals shall not be deemed to be universal health insurance holders.■ Overseas traveler’s personal accidents insuranceAn insurance is not required to travel to turkey, this is up to the company to send their employees abroad to Turley with insurance.

-

-

-

Bibliography

-Trade Unions in Turkey, Friedrich Ebert Stiftung, Study, DEMET ŞAHENDE DINLER Dezember 2012.-Turkish trade unions and industrial relations, European Trade Union Confederation.-Comparing Constitutional Adjudication, A Summer School on Comparative -Interpretation of European Constitutional Jurisprudence 4th Edition – 2009- Turkey and the European Community, Zentrum für Türkeistudien, 1993, page 16th.-http://us.practicallaw.com-http://www.invest.gov-http://www.worldwide-tax.com-http://www.allaboutturkey.comhttps://data.oecd.org/http://bianet.org/english/labor/129742-turkish-workers-many-hours-little-leave

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya