Turkey

3 Chapter Investment Environment

-

-

1 Chapter Coming Soon

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.4 Advances of Japanese Companies

4 Chapter Incorporation

4.1 Feature of business location

4.2 Establishment of Business location

4.3 Liquidation and evacuation (dissolution) of company.

5 Chapter M&A

5.1 Trends of mergers and acquisitions in Turkey

5.2 Laws and Regulation related mergers and acquisitions

5.3 Tax law related mergers and acquisitions

5.4 Base of scheme of mergers and acquisitions

5.5 Problem after corporate acquisition

5.6 Process of mergers and acquisitions

6 Chapter Corporate Law

7 Chapter Accounting

8 Chapter Tax Laws

8.1 Important points about tax law to advance into Turkey

8.2 Regulation of international tax and accounting in Turkey

8.3 Regulation of domestic tax law

9 Chapter Labor

-

-

-

Economy

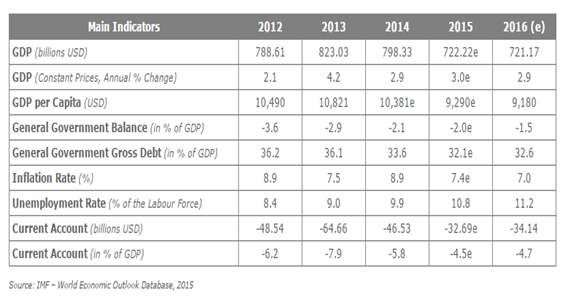

■Economic TrendGDP and Change in the Economic Growth RateTurkey is the 27th largest export economy in the world and the 40th most complex economy according to the Economic Complexity Index (ECI). The Turkish economy has a current account deficit around 5.8% of GDP. Change in the Public FinanceIn June of 2014 the World Bank released a report that talked about the fiscal policy over the last decade in supporting initial macroeconomic adjustment and creating the space for rapid economic progress and improved social outcomes. over the past decade, Turkey’s prudent fiscal policy was supported by structural changes in the economy. In the aftermath of the 2001 banking crisis, expenditure restraint helped contain fiscal deficits. Revenue growth was supported by a compositional change in revenues from direct to indirect – or consumption-based – taxation.With declining informal employment as agricultural labor shedding gathered pace, increases in social contributions also boosted revenues. The consolidation of public finances also helped the country attract greater international capital flows, reinforcing the decline in interest rates and fueling private sector growth. However, the report says that the access to cheap global liquidity also precipitated a trend decline in domestic savings and a corresponding increase in external imbalances.Control of InflationThe bank’s Monetary Policy Committee mentioned that there will be an end to the factors that led to the decline of the Lira, Turkey will be able to control the inflation and increase its economic stability. Improved currency stability has been one factor leading to steady interest rates in Turkey, another factor reducing the need for a wide interest rate corridor is the effective use of policy instruments. The tourism sector and exports have benefited from the sharp depreciation of the Turkish lira in 2014. Tight monetary policy and credit control is helping to stabilize inflation, although food prices continue to rise.

Change in the Public FinanceIn June of 2014 the World Bank released a report that talked about the fiscal policy over the last decade in supporting initial macroeconomic adjustment and creating the space for rapid economic progress and improved social outcomes. over the past decade, Turkey’s prudent fiscal policy was supported by structural changes in the economy. In the aftermath of the 2001 banking crisis, expenditure restraint helped contain fiscal deficits. Revenue growth was supported by a compositional change in revenues from direct to indirect – or consumption-based – taxation.With declining informal employment as agricultural labor shedding gathered pace, increases in social contributions also boosted revenues. The consolidation of public finances also helped the country attract greater international capital flows, reinforcing the decline in interest rates and fueling private sector growth. However, the report says that the access to cheap global liquidity also precipitated a trend decline in domestic savings and a corresponding increase in external imbalances.Control of InflationThe bank’s Monetary Policy Committee mentioned that there will be an end to the factors that led to the decline of the Lira, Turkey will be able to control the inflation and increase its economic stability. Improved currency stability has been one factor leading to steady interest rates in Turkey, another factor reducing the need for a wide interest rate corridor is the effective use of policy instruments. The tourism sector and exports have benefited from the sharp depreciation of the Turkish lira in 2014. Tight monetary policy and credit control is helping to stabilize inflation, although food prices continue to rise. -

International Trade

■International Trade•Exports by countries and productsThe top export destinations of Turkey are:-Germany ($15.5B)-Iraq ($11.9B)-The United Kingdom ($8.92B)-France ($7.7B)-Italy ($7.26B)The top exports of Turkey are:-Cars ($7.32B)-Refined Petroleum ($5.01B)-Raw Iron Bars ($4.81B)-Vehicle Parts ($4.59B)-Delivery Trucks ($4.27B).•Imports by Countries and productsThe top import origins are:-Germany ($25.8B)-China ($24.3B)-Russia ($14.5B)-Italy ($13.2B)-The United States ($12.1B).

Its top imports are:Gold ($16B)Refined Petroleum ($15.9B)Cars ($9.3B)Scrap Iron ($7.19B)Petroleum Gas ($5.3B). -

Trends by Industries

•Industrial Structures in TurkeyThe tertiary sector contributes at least two-thirds to the GDP. Tourism represents 4% of the GDP with about 31 million tourists a year and nearly USD 22 billion in profits, thus making it one of the key sources of foreign currency for the country. Turkey is among the ten most visited countries in the world. •Manufacturing IndustryThe manufacturing industry, the main industrial activity of the country, makes up 27% of the GNP and commands almost 26% of the workforce, with the textile and automobile sectors as the main activities. The Turkish government gives special priority to large infrastructure projects, particularly in the transport sector, which mostly function under the BOT model (build, operate, transfer).•Livestock and Agriculture.The Turkish agriculture sector, which contributes 8.5% of the GNP and employs nearly a quarter of the population, still suffers from low productivity because of its management system (small farms). 11% of the country's territory is cultivated. Wheat is the main crop. The country is the world's third largest exporter of tobacco and a leading producer of hazelnuts (70% of world production). Mineral resources are abundant but under-exploited.•Mining IndustryTurkey has the largest prospective land area in Europe. The complex geologic structure of Turkey makes it more difficult for mine exploration and mining facilities. Despite this, Turkey is one of the few countries which can provide most of their raw materials. Turkey is in the 10th place throughout the world according to mineral variety and 28th for its production of underground resources of 132 countries. Turkey has 2.5% of the industrial raw material, 1% of the coal and 0.8% of the geothermal and 0.4% of the metallic mineral reserves of the world. It also has a significant potential for natural stone. Turkey's exportation of natural stone is in 3rd rank in the world, but 1st of the world in marble and travertine exportation.

•Manufacturing IndustryThe manufacturing industry, the main industrial activity of the country, makes up 27% of the GNP and commands almost 26% of the workforce, with the textile and automobile sectors as the main activities. The Turkish government gives special priority to large infrastructure projects, particularly in the transport sector, which mostly function under the BOT model (build, operate, transfer).•Livestock and Agriculture.The Turkish agriculture sector, which contributes 8.5% of the GNP and employs nearly a quarter of the population, still suffers from low productivity because of its management system (small farms). 11% of the country's territory is cultivated. Wheat is the main crop. The country is the world's third largest exporter of tobacco and a leading producer of hazelnuts (70% of world production). Mineral resources are abundant but under-exploited.•Mining IndustryTurkey has the largest prospective land area in Europe. The complex geologic structure of Turkey makes it more difficult for mine exploration and mining facilities. Despite this, Turkey is one of the few countries which can provide most of their raw materials. Turkey is in the 10th place throughout the world according to mineral variety and 28th for its production of underground resources of 132 countries. Turkey has 2.5% of the industrial raw material, 1% of the coal and 0.8% of the geothermal and 0.4% of the metallic mineral reserves of the world. It also has a significant potential for natural stone. Turkey's exportation of natural stone is in 3rd rank in the world, but 1st of the world in marble and travertine exportation.

-

-

-

Investment Environment in Turkey by Questionnaire

■Investment Environment in Turkey by QuestionnaireAccording to the World Bank, Turkey

■Foreign Business Trends of Japanese Manufacturing CompaniesJapanese companies are being attracted to Turkey for the ample low costs labor and tax incentives given by the government. Some Japanese manufacturers have already teamed up with turkish partners like Sumitomo Rubber Industries and Turkish ire producer Abdulkadir Ozcan Otomotiv Lastik, that have set up a joint venture in Cankiri and are building on a the first Japanese-backed plant in central Turkey. By the end of 2019, the goal is to have a workforce of 2,000 and daily production of 30,000 tires.

■Foreign Business Trends of Japanese Manufacturing CompaniesJapanese companies are being attracted to Turkey for the ample low costs labor and tax incentives given by the government. Some Japanese manufacturers have already teamed up with turkish partners like Sumitomo Rubber Industries and Turkish ire producer Abdulkadir Ozcan Otomotiv Lastik, that have set up a joint venture in Cankiri and are building on a the first Japanese-backed plant in central Turkey. By the end of 2019, the goal is to have a workforce of 2,000 and daily production of 30,000 tires. -

Equity Capital Markets

Borsa Istanbul is the sole exchange entity in Turkey, combining the former Istanbul Stock Exchange, Istanbul Gold Exchange and the Derivatives Exchange of Turkey. The equity market of Borsa Istanbul consists of the National Market, Collective Products Market, the Second National Market, the Watchlist Companies Market, the Primary Market, Wholesale Market and the Rights Coupon Market. -

Foreign Exchange

Name: Turkish LiraSymbol: kuruş: KrMinor Unit: 1/100 = kuruşCentral Bank Rate: 0.00Coins: Freq. Used: 1, 5Kr, 10Kr, 25Kr, 50KrRarely Used: 1KrThe most popular Turkey Lira exchange rate is the TRY to EUR rate.The pass-through effect of exchange rates and interest rates on FDI is much lower. There is certainly the overall effect of interest rate and exchange rate levels on physical investments and these factors affect the amount of FDI. However, more obvious factors in the decision-making process of FDI investors are the political and economic stability of the country, confidence in the legal system, geostrategic position, advantages provided to investors and much more. -

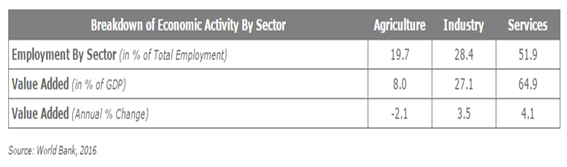

Foreign Direct Investment (FDI)

· Incomes of FDI by Sectors

-

Infrastructures

In the infrastructure sector the government allocated 26 billion dollars, 30% of this budget is for the transportation sector, followed by education, energy, healthcare, and agriculture.

-

-

-

Investment Regulations

■Regulations of Foreign Investment Law•Forbidden FieldsMost sectors in Turkey have been opened to foreign investment, only state-owned entities mine and process borax, uranium and thorium. Law prohibits investments that could create or become part of a monopoly.•Regulated FieldsThe investment that still requires a permit is the opening of a liaison office. Size restrictions in real state of twenty five thousand sqm or less. Most farmland is not typically available for purchase.•Regulations of CapitalRegulations allow for the free transfer of profits, fees and royalties, as well as the repatriation of capital.•Regulations of Foreign ExchangeRegulations allow for the free transfer of profits, fees and royalties, as well as the repatriation of capital.•Another RegulationRegulations allow for the free transfer of profits, fees and royalties, as well as the repatriation of capital. -

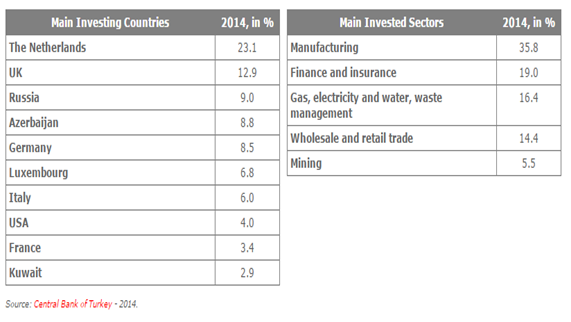

Summaries of Regions

Free Zones are defined as special sites within the country but deemed to be outside of the customs territory and they are the regions where the valid regulations related to foreign trade and other financial and economic areas are not applicable, are partly applicable or new regulations are tested in.

Free Zones are defined as special sites within the country but deemed to be outside of the customs territory and they are the regions where the valid regulations related to foreign trade and other financial and economic areas are not applicable, are partly applicable or new regulations are tested in. -

Investment Supports to Specific Areas

The new investment incentives system has been comprised of four different schemes. Local and foreign investors have equal access to:1- General Investment Incentives Scheme2- Regional Investment Incentives Scheme3- Large-Scale Investment Incentives Scheme4- Strategic Investment Incentives Scheme ■ Investment Supports to Specific Industries[Support for Technology Development Zones]The advantages in Technology Development Zones are:•Profits derived from software development and R&D activities are exempt from income and corporate taxes until 31.12.2023.•Sales of application software produced exclusively in TDZs are exempt from VAT until 31.12.2023. Examples include software for systems management, data management, business applications, and different business sectors, the Internet, mobile phones and military command control.•Wages of R&D and support personnel employed in the zone are exempt from all taxes until 31.12.2023. The number of the support personnel covered by the exemption shall not exceed 10 percent of the number of the R&D personnel.•Investments for the production of the technological product obtained as a result of the R&D projects conducted in the zone may be made in the TDZ, if deemed suitable by the operator company and allowed by the Ministry.•50 percent of the employer’s share of the social security premium will be paid by the government for 5 years until 31.12.2024.[Industrial Thesis (SANTEZ) program]Direct financial support for new technology adaptation, process development, quality improvement and environmental modification projects to be achieved via university partnerships:•Up to 85 percent of the project budget could be supported by direct grants•Project term is 2 years, with a possible extension of 6 months•Expenditure on staff, travel, consumable materials, machinery equipment, consultancy and relevant service procurements, transportation, insurance and customs are supported•The application file could be approved within 4 months, and the project supervision committee is independent[Loans for technology development projects]The Technology Development Foundation of Turkey (TTGV) offers long term interest-free loans for technology development, renewable energy production, energy efficiency improvement and environmental impact-reduction projects.Exemplary support for environmental projects:•The maximum contribution rate is 50 percent per project•Maximum budget of USD 1 million per project•The pay-back term is 4 years in total after project execution, including a one-year grace period[Training support]ISKUR, the National Recruitment Agency, may support vocational training projects for a maximum period of 6 months.• Direct salary support for interns, and unemployed candidates that are registered at ISKUR, (partial wage=TRY 25/day) during the pre-employment training session• Social security premium expenses (Occupational accidents and occupational diseases) are covered by ISKUR.• Program expenses such as the trainer's fee, energy and water bills are partially paid to the employer by ISKUR. The total amount is calculated by the cost per trainee and the employer must bill ISKUR for the services given.• ISKUR considers the employer (company) the legal party in this training program.• A certain number (percentage) of trainees must be employed after the program.]■Another Incentives•Freedom of Information LawTurkish Law on the Right to Information, Law No: 4982: Article 1 - The object of this law is to regulate the procedure and the basis of the right to information according to the principles of equality, impartiality and openness that are the necessities of a democratic and transparent government.a) Institutions: All the authorities that can be included under article 2 of this law.b) Applicant: All natural and legal persons who apply to the institutions by way of exercising the right to information andc) Information: Every kind of data that is within the scope of this law and are included in the records of the institutions.d) Document: Any written, printed or copied file, document, book, journal, brochure, etude, letter, software, instruction, sketch, plan, film, photograph, tape and video cassette, map of the institutions and the information, news and other data that are recorded and saved in electronic format that are within the scope of this law.e) Access to information and document: Depending on the nature of the information and the document, providing a copy of the information or the document to the applicant; in cases where it is not possible to give a copy, permitting the applicant to examine the original information or the document and to take notes or to see the contents, or to listen to.f) Board: The Board of Review of Access to Information

■ Investment Supports to Specific Industries[Support for Technology Development Zones]The advantages in Technology Development Zones are:•Profits derived from software development and R&D activities are exempt from income and corporate taxes until 31.12.2023.•Sales of application software produced exclusively in TDZs are exempt from VAT until 31.12.2023. Examples include software for systems management, data management, business applications, and different business sectors, the Internet, mobile phones and military command control.•Wages of R&D and support personnel employed in the zone are exempt from all taxes until 31.12.2023. The number of the support personnel covered by the exemption shall not exceed 10 percent of the number of the R&D personnel.•Investments for the production of the technological product obtained as a result of the R&D projects conducted in the zone may be made in the TDZ, if deemed suitable by the operator company and allowed by the Ministry.•50 percent of the employer’s share of the social security premium will be paid by the government for 5 years until 31.12.2024.[Industrial Thesis (SANTEZ) program]Direct financial support for new technology adaptation, process development, quality improvement and environmental modification projects to be achieved via university partnerships:•Up to 85 percent of the project budget could be supported by direct grants•Project term is 2 years, with a possible extension of 6 months•Expenditure on staff, travel, consumable materials, machinery equipment, consultancy and relevant service procurements, transportation, insurance and customs are supported•The application file could be approved within 4 months, and the project supervision committee is independent[Loans for technology development projects]The Technology Development Foundation of Turkey (TTGV) offers long term interest-free loans for technology development, renewable energy production, energy efficiency improvement and environmental impact-reduction projects.Exemplary support for environmental projects:•The maximum contribution rate is 50 percent per project•Maximum budget of USD 1 million per project•The pay-back term is 4 years in total after project execution, including a one-year grace period[Training support]ISKUR, the National Recruitment Agency, may support vocational training projects for a maximum period of 6 months.• Direct salary support for interns, and unemployed candidates that are registered at ISKUR, (partial wage=TRY 25/day) during the pre-employment training session• Social security premium expenses (Occupational accidents and occupational diseases) are covered by ISKUR.• Program expenses such as the trainer's fee, energy and water bills are partially paid to the employer by ISKUR. The total amount is calculated by the cost per trainee and the employer must bill ISKUR for the services given.• ISKUR considers the employer (company) the legal party in this training program.• A certain number (percentage) of trainees must be employed after the program.]■Another Incentives•Freedom of Information LawTurkish Law on the Right to Information, Law No: 4982: Article 1 - The object of this law is to regulate the procedure and the basis of the right to information according to the principles of equality, impartiality and openness that are the necessities of a democratic and transparent government.a) Institutions: All the authorities that can be included under article 2 of this law.b) Applicant: All natural and legal persons who apply to the institutions by way of exercising the right to information andc) Information: Every kind of data that is within the scope of this law and are included in the records of the institutions.d) Document: Any written, printed or copied file, document, book, journal, brochure, etude, letter, software, instruction, sketch, plan, film, photograph, tape and video cassette, map of the institutions and the information, news and other data that are recorded and saved in electronic format that are within the scope of this law.e) Access to information and document: Depending on the nature of the information and the document, providing a copy of the information or the document to the applicant; in cases where it is not possible to give a copy, permitting the applicant to examine the original information or the document and to take notes or to see the contents, or to listen to.f) Board: The Board of Review of Access to Information -

Another Merits and Demerits of Investment

•Human ResourcesThe Turkish scene is concerned, HRM is a "developing field'' in a "developing country". Some organizations follow the newest trends in HRM practices (e.g. job enrichment and empowering supervision), but they experience difficulties due to some of the ``emic'' characteristics of both the societal and organizational cultures. There are two trends that are important for HRM practices in Turkey. The first is the changing values and expectations of a young and well-educated workforce; the second is the increasing participation of women in the workforce. Another reflection of collectivism is the heavy reliance on one-on-one interview as the most frequently used method of selection (almost 90 percent). Only a few organizations use "objective and standard tests''. Interviews are unstructured and heavily influenced by the interviewer's subjective evaluation and intuition. A few popular "objective'' tests are just translated from English to Turkish without a proper adaptation and standardization procedure.•Vast Consumers MarketsTurkey has a vast consumer market and a skilled young population Consumer lifestyles continue, in large part, to mirror those in other European countries. The influence of the internet, particularly social networking sites, has been significant in recent year in shaping consumer habits and attitudes. Among newer trends generating excitement amongst consumers is the greater demand for private pensions, schemes that allow consumers to better plan their finances, and the rising acceptance of using credit cards for purchases. Turkish consumers have been keen on new products coming from abroad, especially Asian products which are less expensive, and western products which have a luxurious, modern connotation. 81% of consumers plan their purchases ahead of time but 87.7% of consumers buy products they had not planned to acquire.Japanese Turkish Japonya Türkleri are Turks living in Japan. The term has historically included Turkic (particularly VolgaTatar) émigrés and immigrants from former Russian Empire most of whom later acquired Turkish citizenship.

-

-

-

Advances of Japanese Companies

•FDI of Japanese CompaniesIn 2013, Turkey attracted $483 million of FDI from Japan. Japanese investors are mostly interested in the automotive, automotive supply, chemicals, petro-chemicals, food and beverage and tobacco products sectors.•Numbers of Japanese Companies.Aprox. 200 companies.

-

-

-

References:

Human resource management in Turkey. Current Issues and future challenges, Zaynep Aycan, Koc University, Istanbul, Turkey, International Journal of Manpower.Taxation and Investment in Turkey 2014, Reach, relevance and reliability, A publication of Deloitte Touche Tohmatsu Limited.Investment in Turkey, KMPG, 2014.Doing Business in Turkey, PWC, 2011.

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya