Turkey

5 Chapter M&A

-

-

1 Chapter Coming Soon

2 Chapter Basic knowledge

3 Chapter Investment Environment

3.4 Advances of Japanese Companies

4 Chapter Incorporation

4.1 Feature of business location

4.2 Establishment of Business location

4.3 Liquidation and evacuation (dissolution) of company.

5 Chapter M&A

5.1 Trends of mergers and acquisitions in Turkey

5.2 Laws and Regulation related mergers and acquisitions

5.3 Tax law related mergers and acquisitions

5.4 Base of scheme of mergers and acquisitions

5.5 Problem after corporate acquisition

5.6 Process of mergers and acquisitions

6 Chapter Corporate Law

7 Chapter Accounting

8 Chapter Tax Laws

8.1 Important points about tax law to advance into Turkey

8.2 Regulation of international tax and accounting in Turkey

8.3 Regulation of domestic tax law

9 Chapter Labor

-

-

-

Trends of mergers and acquisitions in Turkey

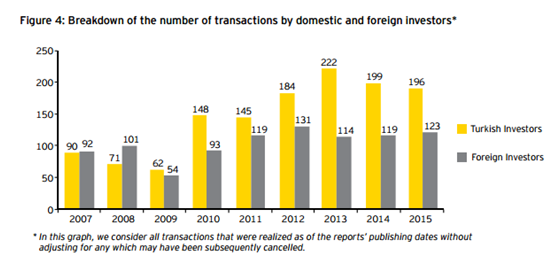

In 2013, the total disclosed value of deals realized in Turkey was US$13.7 billion from a total of 135 deals with disclosed values.The number of disclosed deals realized in Turkey in 2014 was 130, 76 of them were transactions from foreign investors. The most common M&A transactions for foreign investors were financial services, leasing, and energy sectors. In 2014, the countries with more M&A transactions in Turkey were USA, Germany, Holland and Luxembourg. The total transaction value was approximately US$17.7 billion in 2014. In 2015, there were 140 deals with disclosed values with a total value amount of US$10.7 billion with the undisclosed values the total transaction volume was around US$15 billion. Foreign investors significantly increased their transaction volume compared to 2014 and realized 62% of total transaction volume, more than domestic investors.

-

-

-

State of development of laws related mergers and acquisitions

Mergers & Acquisitions in Turkey are regulated by the Turkish Commercial Code, the Code of Obligations, the Capital Markets Law, the Law on the Protection of the Competition, the Labor Law and relevant Tax Laws. -

Regulation of foreign capital

■Industry type of regulation and prohibitionThere are approval requirements and restrictions on foreign ownership that vary for each regulated sector, the regulated sectors are:・Energy.・Aviation.・Private education.・Marine.・Telecommunication.・Banking.・Insurance.・Financial intermediary institutions.・Mass media.Besides this sectors there are no other Sectors restricted for foreign in Turkey.■In case of foreign company own landUnder Law No. 2644 for Land Registry, foreign companies cannot own real property or limited rights in Turkey unless there is a special law such as the Petroleum Law, Law on Tourism, or Industry Zones Law allowing them to do so.■System of CE markingThe CE Mark was established by the European Union to ensure the free circulation of products in Europe, this means that when companies sell to the Turkish market they must submit the CE Mark that is evidence of conformity. Companies can provide a notarized conformity certificate from a notified body or a manufacturer’s issued certificate of conformity.This is mandatory for manufacturers, the initial step to obtain the CE marking is to identify all applicable EU directives and determine the essential requirements indicated in the directives, followed by the selection of the appropriate conformity assessment module, which determines the relevant procedures to demonstrate conformity.For low risk profile products, this process is easier than for the high- risk group, because in this group manufacturers can self-certify without a third party involved. The High-risk group products are certified via an accredited testing laboratory, which is referred to as a “Notified Body”, that may be involved in the design, the production phase or both. After the CE marking the identification number must be assigned. Is possible to have multiple notified bodies involved in the conformity assessment process for those products, which fall under more than one directive. -

Capital market law in Turkey

■Regulation of takeoverThere are no specific laws that regulate takeovers in Turkey, some regulations and laws apply for takeovers mainly by the Turkish Commercial Code No. 6761, the Capital Markets Law No 2499, the Turkish Code of Obligations No. 818 and the Law on the Protection of Competition No. 4054.■Regulation of insider tradingThe Capital Markets Board regulates measures against insider trading, this practice by the Turkish Capital Market law is considered as the use of information that may affect the value of investment instruments and is not services to the public yet with the purpose to make profit or prevent a loss, by using these ways the equality of opportunity for investors is damaged. -

Protection of competition law

The Competition Authority regulates competition in Turkey facilitating and protecting competition with restrictions, preventions on abuse and creation of new monopolies. The Competition Authority was established to ensure the formation and development of markets for goods and services in a free and sound competitive environment, to observe the implementation of the Act No. 4054. -

Accounting standard in Turkey

In Turkey, all public interest entities are required to apply the Turkish Accounting Standards (TAS) when preparing their separate and consolidated financial statements. TAS is in full compliance with IFRS developed and issued by the International Accounting Standards Board. -

New foreign direct investment law

The New Foreign Direct Investment Law regulates principles to encourage foreign direct investments in Turkey, includes rights to protect investors in accordance with international standards.With the New Foreign Direct Investment Law the pre-approval procedures were abolished, set ups and share transfers and foreign investors will no longer be required to obtain pre-approval from the General Directorate of Foreign Investment for these transactions.

-

-

-

Tax law related mergers and acquisitions

■In case of assets obtainment[Goodwill]Turkish tax law does not require recognition of internally developed goodwill and rights in the tax basis balance sheet, usually there is no tax basis cost for the goodwill in the seller’s books, it is represented as pure taxable income. In asset deal, an excess of the purchase price over the fair value of the assets that were transferred represents goodwill that can be capitalized by the buyer and depreciated for tax purposes over a period of 5 years.[Depreciation]In an asset deal the depreciation period of an asset is refreshed. The selling entity may deduct all remaining net book value of assets as the tax basis cost against the transfer value; and the buyer must book the assets at their transfer value and start depreciating a new term of useful life for each asset.[VAT]Tax-free mergers of small and medium-sized companies and tax-free divisions that meet the conditions listed in the Corporate Tax Law are exempt from VAT. Taxable mergers and asset transactions are subject to VAT at 18%.Some examples on VAT exemptions:-Capital gains are not subject to taxation under the article 81 of income tax law.-Takeover and division of the companies under the Corporate Tax Law.-Under Article 8 of the Corporate Tax Law, capital gains derived from the sale of shares and immovable properties are exempt from corporate tax on the condition that the shares and immovable properties are held for over two years and gains are added to the paid-up capital in two years beginning from the first day of the following year of the sale.-Renting of immovable properties which are not included in the assets of the companies.Sales of shares in an AS company are exempt from VAT. A sale of shares in a Ltd. company by another company is exempt from VAT, provided the participation is held for at least 2 years. A sale of shares by an individual is not subject to VATForeign companies can acquire Turkish companies by acquiring the company’s assets or shares. An asset acquisition can be done by a branch of the foreign entity (non-resident) or through a Turkish subsidiary of the foreign company.[Allowance and assurance in tax]In a share deal transaction, the historical tax liabilities remain in the company and are acquired by the new shareholders. The buyer usually asks for tax indemnities and warranties in a share acquisition. In a Takeover merger, as well, the transferee company takes all the tax liabilities even if they are known or unknown, from the transferor company. The Asset Peace Act is a tool used for tax liabilities of a target company in an M&A transaction. With this act companies, must declare their assets, such as cash, foreign currency, gold, securities, real estate, and other capital market instruments.[Deficit which is carried-over in tax]Tax losses may be carried forward for five years, as long as they have been shown in corporate tax returns separately for each year. There is an exception when the company is liquidated.[Stamp duty]By law, written agreements are subject to stamp duty tax of 0.948%. For different obligations, guarantees determined in an agreement, there may be a stamp duty tax. For the transfer of the participation shares of a limited liability company notaries apply stamp tax as 0.948% on the sale price.Loan contracts (and security documents, such as mortgages) for loans from local and foreign banks are exempt from the stamp duty. A stamp duty exemption is available for documents related to tax-free mergers or tax-free divisions (that meet the conditions in the Corporate Tax Law) and documents related to the sale of real estate property or shares/participation rights held by a company at least 2 years.

-

-

-

Method which is trade of mergers and acquisitions

■TakeoverMerger transactions which meet certain conditions in Corporate Tax Law are defined as ‘takeover’ transactions and are considered tax-free for corporate tax.Takeovers are when, both the transferor and transferee companies are tax residents and the transferee company incorporates all assets and liabilities of transferor company into its balance sheet, then the transferee company undertakes all known and unknown tax liabilities of the transferor company with the merger. According to Law, bidders must publicly announce a takeover bid immediately after the decision is made.The bidder’s disclosure requirement must include:·number and amount of the listed and unlisted shares at the end of each trading day during the offer period.·total number and number of shares acquired.·the total number of shareholders responding to the offer at the end of the offer period.·the target company’s detailed shareholding and management structure.·renouncement of obtaining shares through a voluntary bid.■ Relative tradeA foreign company can acquire a Turkish company by acquiring either its assets or its shares. An asset acquisition can be effected either through a branch of the foreign entity, which is taxable in Turkey as a non-resident, or through a Turkish subsidiary of the foreign company. In share purchases the liabilities are generally transferred to the buyer, while in an asset purchase liabilities generally remain with the seller.The purchase of shares is regulated by the Istanbul Stock Exchange (ISE), to proceed with it a certification by the Capital Markets Board (CMB) is required.■Share-DealIn a share deal, the target company´s business such as assets, agreements, permits, licenses, employees and liabilities are subject to be transferred, the buyer will acquire shares from the target company. This means that when there are assets or other elements from the target company that are not going to be covered by the transfer, these should be taken out from the company through separate legal transactions before the share transfer transaction is made under the sale and purchase agreement.■Asset-DealAn asset deal is where there is a transfer of business. The parties have the right to choose which assets and other elements are going to be included in the sale or purchase transaction. This can be considered an advantage being able to choose from certain assets and risks within a business during the transfer.In regards of tax expenses, share deals are more likely to be preferred for its exceptional provisions.■Mergers[Merger in form of an Absorption]This is when two or more companies merge into another existing company. If one or more companies are absorbed by one of the merging companies, all the assets and liabilities will be taken over by the absorbing company. The shareholders of the absorbing company must approve the capital increase from the acquisition, shareholders will continue to be shareholders and must be given shares in the absorbing company proportionately to their previous shareholding.Companies merged under a new established company or the companies absorbed by one of the merging companies will be dissolved without exercising the liquidation process as set forth under the Turkish Commercial Code.Assets must be managed separately until the company´s liabilities are settled, the board of members of the absorbing company are in charge of managing the assets separately for each merged company.The process goes as follows:1.A merger balance sheet must be prepared.2.After the balance sheet is done an application should be made to the court for determination of the net assets of the companies to be absorbed by the absorbing company.3.Determine the amount of capital to be increased by the absorbing company; and the exchange ratio of the shares of the companies to be merged.4.The merger agreement should be authenticated through a public notary.5.The general assembly of each company must approve the merger6.An application must be made for the registration and publication of the merger.7. The merger will be finalized after three months from the registration and publication of the merger, if there is no objection from the creditors.[Flow of mergers which is newly establishment Merge in form of a Consolidation]When two companies merge under a new established company. Assets of the merging companies constitute a part of the entire capital. After the merger, all rights, obligations, and the credits of the acquired company would be automatically transferred to the newestablished company completely. The new company will take over all the assets and the liabilities of the merging companies. The company merged under a new established company will be dissolved without liquidation, as indicated by the Turkish Commercial Code. The new company has the right to book the assets at their market values as their tax basis for depreciation purposes. Tax loses from the transferor companies cannot be transferred to the new company. But, transferor companies can offset their existing tax losses against the capital gains arising from the transfer of assets through the merger.The process goes as follows:1.A merger balance sheet must be prepared2.After being prepared an application should be made to the court for determination of the net assets of the companies to be merged, and the capital of the new company.3.The merger agreement and the articles of association of the new company should be authenticated through a public notary.4.The general assembly of each company must approve the merger.5.An application should be made for the registration and publication of the merger and establishment of the new company;6.The merger will be finalized after three months of the registration and publication of the merger, if there is no objection by the creditors.

-

-

-

Exit strategy

·Trade sales: popular between trade buyers who are involved in the same industry and who have common business interests are driven to pay higher prices.· IPO: enables a company's shares to be listed on the stock market for the first time.

-

-

-

Process and points of each phases

· Mergers can be met by:-Establishment of a new company after merger of two or more companies.-Takeover of one or more companies by another company.· Acquisitions can be met by:-Share transfers: On a Limited Liability Company, the transferor and the transferee must file a share transfer agreement sign by a Notary Public. Shareholders must approve the share transfer; the resolution must be registered and posted at the Trade Registry. In Joint stock companies the process is different, the shares are bearer or registered.-Capital increases: This is a method to increase the company’s capital is by issuing new shares and to use the resources from the capital increase in new investments. Companies must regulate by law, the nominal value of the contingent capital increase, type of shares, the rights to be granted to certain shareholder groups, limits regarding the transfer of the newly registered shares, etc.-Asset transfers: This transfer is to avoid taking certain liabilities of the transferor, by taking over some assets. Depending on the type of the asset to be transferred, provisions of different laws are applicable.-Business transfers: The whole or a part of a business can be transferred to a third party. In case that the whole business is intended to transfer, rights and obligations related to the business are transferred automatically to the transferee. In this case the transferor and transferee will be jointly liable for the company´s obligations against creditors for a period of two years. The transferor as well is liable starting on the date the transfer of business was announced to the creditors or in the newspapers.Other Transactions:-Demergers:·Pure demerger – All assets of a company are split into units and transferred to an existing or new company.·Partial demerger – Part of a company’s assets are transferred to an existing or new company.-Joint ventures: This agreement requires an approval from the Competition Authority and to pay stamp tax for the agreement, this transaction usually include establishment of a Special Purpose Vehicle (SPV) under Turkish law (TCC). This requires notarization and registration at the Trade Registry Office and Tax office.■Phase of primary discussion[Contact and percussion to company which is subject to merger or joint venture partners] …4The first phase in a merger is to have a written merger agreement executed between parties, and a merger report including the information required by the Turkish Commercial Code (TCC) must be prepared as well. Parties can prepare this report separately or together, the parties involved adopt resolutions for the preparations of the merger agreement and the merger reports. These resolutions are not required to be registered with the Trade Registry. In the case of Joint ventures, there is an agreement as well, which may include contractual business operation principles, or provisions requiring incorporation of a special purpose vehicle company for business operations.Non-disclosure determines the extension and rules for the negotiations, for example the information shared with the other party during the negotiations is strictly confidential, and must not be disclosed to anyone or any authority without obtaining the other party's written consent.Non-disclosure agreements are not regulated under Turkish law, but are usually included in the letter of intent.[Consensus of purpose and conclusion of letter of Intent] …6The letters of intent are not regulated by the Turkish law, but is commonly classified as a preliminary contract, is commonly used in strategic investment transactions and can be considered as a declaration if it clearly includes the intention of the parties to enter an agreement and the main provisions of the agreement. It usually outlines the other party's intentions to have an agreement with the opposing party.In acquisitions, it includes the percentage of the share capital to be transferred and the consideration agreed for the transfer.■ Final phase of discussion[Due Diligence] …7The legal due diligence may be extensive study or include just the most important and risky points before a merger or acquisition is decided.Areas for a legal due diligence:-Corporate information like ownership and company´s shares.-Company´s banking and insurance information.-Environmental issues.-Agreements.-loan agreements information-Company´s assets-Employment.

-

-

-

Bibliography

http://www.mondaq.com/turkey/x/354358/Contract+Law/FixedTerm+Employment+Contracthttps://www.kpmg.com/Global/en/IssuesAndInsights/ArticlesPublications/Lists/Expired/TAX-MA-2010/MA_Cross-Border_2010_Turkey.pdf

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya