Malaysia

7 Chapter Tax

-

-

1 Chapter Basic knowledge

1.3 Political regime and history of Malaysia

1.4 Education and education system in Malaysia

2 Chapter Investment Environment

3 Chapter Establishment

3.1 Characteristics of business base

3.2 Establishment of business base

3.3 Liquidation and withdrawal

4 Chapter M&A

4.2 Points to keep in mind when doing M & A

4.3 Laws and regulations concerning M & A

4.5 Other considerations in M & A

5 Chapter Corporate Law

5.2 Shareholders (shareholders meeting)

5.3 Director (Board of Directors)

6 Chapter Accounting

6.1 The accounting system of Malaysia

6.2 Malaysian Accounting Standards

6.4 Disclosure system in Malaysia

7 Chapter Tax

7.2 Domestic tax law in Malaysia

8 Chapter Labor

8.3 Social security system in Malaysia

8.4 Points to keep in mind while residing in Japan

9 Chapter Q&A

-

-

-

Latest News & Updates

【About the Malaysia Budget (2017)】

1. Summary of budget proposal

As crude oil revenues decline year after year, the Malaysian government is thinking of way to somehow to increase tax revenue. At this time, the government is starting to show attitudes toward strengthening taxation by establishing an information management system. In terms of corporate taxes, the main point of reform is the expansion of the scope of withholding tax and redefinition of royalty. Regarding personal income tax, I think main focus is the strict implementation of the requirements for deduction of spouse, etc.

2. Establishment of information management system (CIA)

The Malaysian government decided to set up an information management system (Collection Intelligence Arrangement, CIA) directly under the Ministry of Finance. This system efficiently determines whether the Malaysian Taxation Bureau (IRB), the Customs Department (RMCD), and the company registration authority (SSM) share information and are not making inappropriate tax declarations or appropriate tax returns. It will be an information management system to check the agencies in a straightforward way. By doing so, I can say that the Malaysian government is showing a stand toward further strengthening of tax collection.

3. Tax reform

[3-1. Corporate Income Taxes]

① Reduction of corporate tax for SME enterprises

From the year 2027, the corporate tax for SME companies will be reduced from 19% to 18%. However, other companies except for SMEs will remain unchanged at 24%.Taxable incomePermitted year2016Years 2017 and 2018Up to 500,000 RM19%18%500, 001 or more24%24%* 1 A company to be considered as SME must not only have paid-in capital of 2.5 million RM or less, its affiliates must also have paid-in capital of 2.5 million RM or less.

Tax Regulations Enforced from the year 2017

① Reduction of corporate tax for taxable years 2017 and 2018

For taxable years 2017 and 2018, the government established a system that will partially reduce corporate tax for the portion that increased from the previous year. This will result in a slight reduction in the effective tax rate.Increase in taxable income (compared with the previous year)Reduction deduction ratio Reduced tax rateLess than 5%None24%5% to less than 10%1%23%10% to less than 15%2%22%15% to less than 20%3%21%20% or more4%20%Example) The taxable income for the year 2016 will be 1 million RM and the taxable income for the year 2017 will be 1.2 million RM..png) Applicable only for the year 2017 and 2018

Applicable only for the year 2017 and 2018[3-2. Withholding tax]

① Expansion of the scope of withholding tax on income

The scope of withholding tax on income for non-resident Malaysian as stipulated in Article 4A (i) and (ii) of the Income Tax Act will be expanded. As of now, non-resident Malaysian citizen is only being taxed on the income derived from Malaysia. But as per the new tax reform, non-resident Malaysian citizen will be taxed on the income derived inside and out of the country.

(I) Consideration for services provided in connection with installation rights and specifications of machinery and equipment

(Ii) Consideration for services provided in connection with technical management and management in commercial business

Regarding the above items, withholding tax will be imposed on the services rendered not only inside Malaysia but also those rendered outside.

Finance Act 2016 according to enforcement

② Expanding the definition of royalties

At present, software, which is not included in the items of royalty where tax can be imposed is added in the new regulation.

a) Payment for the following, i) and ii)

i) Right to use patents, trademarks, designs, images, music etc in Malaysia

ii) payment for experience and skills such as know-how

a) Payment of royalty for right of use of software

b) Right to provide images and sounds transmitted by satellite broadcasting, cable or optical fiber

c) Right to use royalty-defined property / rights or other items

Finance Act 2016 according to regulation[3-3. GST]

① ① Change of GST taxation point in import service

The regulation clarifies the change in point of time of taxation for GST.

i) The date and time when payment was made for the invoice

ii) Date and time the invoice was issued by a corporation outside Malaysia

GST will be imposed on whichever is earlier on the above items.

i) The date and time when payment was made for the invoice

ii) Date and time when invoice was received from a company outside Malaysia

Whichever is earlier is applied as the taxing point.

Starting from 1st of January 2017

② ② Change of GST registration requirements

It was decided to exempt two new items from the taxable property or inventory amount required for the GST registration requirement.

i) Removal of fixed assets for business

ii) Inventories from import services

iii) Inventories under warehousing scheme

iv) Possession of belonging or recipient outside Malaysia in the Approval Toru Manufacturer Scheme

V) Supply within design areas (Labuan, Langkawi, Tierman) under Article 155. However, excluding those prescribed in Article 160 (1).

The following two items are newly added

i The above item i) was modified to eliminate with the suspension of business.

ii) Supply within the free zone as provided in Article 162, except for the supply specified in paragraph 1 of Article 163

Enforcement effective January 1, 2017

③ Penalty for GST Payment Delay

Penalties for delay will be strengthened and penalties up to 40% will be given.

Delayed days currentRevision proposalFrom 1 to 30 days5%10%From 31st to 60thAddition: 10%(Total: 15%)Addition: 15%(Total: 25%)From 61st to 90thAddition: 10%(Total: 25%)Addition: 15%(Total: 40%)Enforcement effective January 1, 2017

[3-4. Personal Income Tax]

① Limitation on spouse deduction

Requirements for spouse deduction have been added to limit the taxpayers who can receive deductions.

Currently, if your spouse does not have any income, you will receive a deduction of 4,000 RM.

Also, if your spouse has any disabilities, you will allow a further 3,500 RM deduction.

If your spouse has income overseas and the amount is over 4,000 RM, you cannot receive spouse deduction. However, this does not apply if the spouse has any disabilities.

Enforced from the year 2017

② Add lifestyle deduction

Until now, although the deductible amount was specified for each category, the government decided to unify it and establish a new category "lifestyle".

a) For the purchase of books, magazines and similar references, deduction up to 1,000 RM per year is permitted

b) For purchase of personal computer, deduction up to 3,000 RM is permitted for every 3 years

c) For purchase of exercise equipment, allowable deduction is up to 300 RM every year

In addition to the above three items as enumerated at the present regulation, the authorities enacted "lifestyle deduction" in which includes newly listed items below and allow deduction up to 2,500 RM each year

a) Purchase of daily newspaper

b) Purchase of smartphone and tablet

c) Internet communication expenses

d) Gym Membership FeeDeduction itemCurrentAfter amendmentDeduction item1 year3 years 1 year3 yearsDeduction on reading1,000RM3,000RM2,500RM7,500RMDeduction for personal computer purchase3,000RM(every 3 years)3,000RMDeduction for exercise equipment300RM900RMtotal6,900RM7,500RMThe amount that can be deducted increases by 200 RM per year (600 RM in 3 years).

Enforced from the year 2017

① Deduction on nurseries and kindergarten expenses

From the fiscal year 2010, deductions on the above items will be implemented.

Deduction of 1,000 RM is permitted for individuals who have children under the age of 6 and who have children who attend nursery schools (prescribed at the Child Care Center Act 1984) and kindergartens (prescribed by the Education Act 1996).

Enforced from January 1, 2017

② Deduction for breastfeeding equipment purchase

From the fiscal year 2010, deduction on this item will be implemented.

Regarding the purchase of nursing equipment, deduction of 1,000 RM is allowed. However, it applies only to women who have children under 2 years old and the application will be allowed only once every two years.

Enforced from the year 2017

[3-5. Stamp tax related to real estate]

The stamp tax duty in real estate in Malaysia will change from the year if the payment year is 2018.number market pricecurrentRevision proposal ①First 100,000 RM1%1%②100, 001 RM to 500,000 RM 2%2%③500,001 RM or more3%3%④1,000,000 RM or more3%4%Example)Purchase amount 2 million RMStamp tax duty calculationAmount of moneyPercent stamp dutyTarget priceStamp tax amountFirst 100,000 RM1%100,000RM1,000RM100, 001 RM to 500,000 RM2%400,000RM8,000RM500, 001 RM to 1,000,000 RM3%500,000RM20,000RM1,000,001 RM4%1,000,000RM40,000RMTotal amount 2,000,000RMTotal amount 69,000 RM (conventionally, 54,000 RM)Enforcement effective January 1, 2018

[3-6. Preferential tax system]

① Extension of duration of double deduction for internship program

The duration of the deduction for the internship program has been extended. It is a major objection to promote employment for Malaysian graduates.

Talent Corporation, Malaysia Berhad will participate in companies that are offering internship program, internship in this company will give you double deductions. Depending on the degree, the duration that can be deducted will change.

i) Degree - Yearly 2012 through 2016

ii) Specialist - from the year 2015 to the year 2016

We extend each of these wage years by 3 years so it will be applicable until 2019.

Only for the year 2017 to 2019

(2) Relaxing incentives for halal foods handled in HALAL PARK

We have relaxed incentives for new functional foods and probiotic foods.

The following incentives are given to HALAL business affiliates operating in HALALPARK promoted by HDC (Halal Development Corporation).

i) Taxes on qualified capital expenditure are exempted for 10 years while export sales will be exempted for 5 years.

ii) Customs duties for the importation of raw materials necessary for developing and producing halal products will be exempted.

iii) GMO code (meal meets the standards of food prescribed by WHO and FAO -

Tax system

There are no local or citizen taxes other than national taxes that the country has jurisdiction in Malaysia, all are national taxes. The main type of taxes are as follows.

.png)

In Malaysia, the Internal Revenue Service in the Treasury Department of the Ministry of Finance collects personal and corporate income tax, oil income tax, real estate transfer tax and stamp tax duties. While the Customs Department within the jurisdiction of the ministry of Transportation Bureau collects import and export duties, GST and excise tax.

Corporate income tax and personal income tax are stipulated in the income tax law. In addition, there is no detailed provision such as enforcement orders, enforcement regulations, basic instructions, individual notifications, and tax special measures law supplementing each tax system in Japan. In Malaysia, tax administration is often executed based on judicial precedents and customs.

■ Direct tax and indirect tax

"Direct tax" refers to the tax that "taxpayers" who are supposed to pay taxes are the same as those who actually remit the payment. In Malaysia, personal income tax, corporate income tax, etc. fall under this category.

Indirect tax is a tax whose taxpayer is different from the person who actually borne the burden of payment. GST, excise tax etc. fall under this type. -

Tax law of Malaysia

Regarding the tax law of Malaysia, not like in Japan, the system of enforcement orders, enforcement regulations, and notifications is not in place, and the 5 tax items of national tax are stated in the "income tax law" Ruling, ministerial ordinance, revenue country rules, etc.. The contents of each are as follows:

Personal income tax, corporate income tax, real estate transfer profit tax, stamp tax duty are stipulated for 4 tax items, and it is the main law in Malaysia tax law.

Royal Decree

Issued by the Cabinet for the purpose of determining exemption and deduction in taxation stipulated by the Income Tax Law.

It is issued to determine details of laws and regulations and urgent tax exemption.

It corresponds to a more practical individual case over the interpretation of laws and ordinances.

When the taxpayer is troubled with interpretation of the tax law or handling in practice, it is possible to make inquiries directly to the Revenue Department in writing, and the fact that it is returned to the questioner as an answer is called a ruling I will.Some inquiries are open to the public and are used as practical guidelines. However, since it is a matter as an individual case to the last, not all the same interpretation can be applied with this.Although there are legislation themselves in this way, each has left ambiguous parts in the competent ministries and agencies and scope of application, and tax system revision is carried out from time to time depending on the economic situation, social situation etc. from time to time.

-

-

-

Personal Income Tax

■ Outline of personal income tax

When calculating personal income tax, the range of income to be taxed depends on whether the taxpayer is a "resident" or "a non-resident". Therefore, when calculating income tax, first, it is necessary to judge the period of physical presence of the target individual.

■ Definition of Habitability / Non-Habitation

Judgment of habitability is based on the "address" in Malaysia, it does not refer to "nationality" "domicile" or "birth place" as a standard. Therefore, period of physical presence will be judged based on the "address" in Malaysia. Also, in Malaysia, "calendar year (January 1 to December 31 of that year)" is the taxable year, and "resident" is defined as shown below.

If you stayed in Malaysia for 182 days or more during one calendar year.png)

Staying in Malaysia for less than 182 days during the year, "staying continuously" and "continuing" for more than 182 days in a year immediately before, or immediately after, the year will be considered resident.

Example) Staying Period (October 1, 2014 - April 20, 2015).png) If the number of days stayed during the fiscal year is 90 days or more and you are a resident or staying for 90 days or more in the last three fiscal yearsExample)

If the number of days stayed during the fiscal year is 90 days or more and you are a resident or staying for 90 days or more in the last three fiscal yearsExample).png)

Based on condition no. 2, in 2013 you will be considered as resident if within the four years following immediately before the judging year ※, you stayed for more than 90 days in fiscal 2011 and fiscal 2014. Based on this, it means that "the number of days stayed during the fiscal year is 90 days or more, and you will be considered as resident for staying for 90 days or more in the last three fiscal years". Moreover in 2015, you will also be treated as resident. Even if you do not stay at all in Malaysia or you have no any record of stay, you will be deemed resident during this fiscal year if you are accredited as a resident in the last three years and in the immediately following year. For example, if you are accredited as a resident in 2011, 2012, 2013 and 2015, you will be certified as a resident in 2014 as well.

Example).png)

Since 2011 to 2013 and fiscal 2015 you are judged as residents, we will be treated as residents in fiscal 2014 as well.

The range of income taxed according to the classification of habitability is as follows..png)

【Scope of Taxable Income】

■ Definition of Domestically Sourced Income

Domestically sourced income in Malaysia is defined as follows:

· Income from job positioned in Malaysia· Income arising from businesses or businesses in Malaysia

· Income arising from assets located in Malaysia

In this way, the place of receipt of income or the classification as a resident / nonresident are not considered.

In other words, if you become a "resident" in Malaysia, income from Malaysia, income remitted in Malaysia as well as income generated in other countries will be taxed. In addition, if a person is regarded as non-resident, only taxable income generated in Malaysia will be taxed. However, Malaysia's tax law defines a resident in four forms, whereas in Japan's income tax law, on the other hand, individuals with domestic addresses or individuals who have inherited residence for over one year is treated as resident. Therefore, in certain cases, individual from both in Japan and Malaysia will be certified as resident, income tax will be doubly taxed in both countries..png)

Cases which fall under double taxation happened if one is dispatched to a subsidiary in Malaysia, for example to support the launch of a manufacturing subsidiary soon after its establishment, or he needs to travel frequently for business, and as a result the cumulative number of stayed days reaches 182 days or more. In the case of staying in Malaysia for a short period (182 days or less) for business trips from Japan, if certain requirements are met, payment within that period will not be taxed by the Japan Battle Treaty. (Details will be described later)

■ Calculation of income tax amount

The income tax calculation in Malaysia is calculated by the following procedure..png)

① ① Gross income amount

First of all, it is necessary to distinguish taxable income from non-taxable income in one calendar year.

The taxable income is enumerated as follows in Article 4 of the Income Tax Code.

· Trade, gain and profit earned from business

· Profits and benefits arising from employment

· Dividends, interest and discounts

· Pension and other regular income

· Gains and benefits other than those mentioned above nature of income

② ② Income deduction

Subtract various deductions from the amount of income and calculate amount of taxable income. Income deduction is only available to Malaysian residents. As for income deduction, there are the following types.【Income Tax Credit List】.png)

If the total employment period in Malaysia is within 60 days in one calendar year or the employment period spans two years, non-residents employed in Malaysia will be considered as short-term employee and will be subject to tax exemption.

Those who are not Malaysian citizens working in Malaysian Management Headquarters (OHQ), Regional Office (RO), International Materials Procurement Center (IPC), etc are being taxed on the portion of income for employment i equivalent to the number of days stayed in Malaysia. However, if you stayed in Malaysia for 60 days or more in a calendar year, the part of income that will be exempted from tax is equivalent to the income earned within 60 days in proportion with the total amount of income earned in Malaysia. Calculation of tax deduction when staying more than 60 days in calendar year is as follows..png)

③ In-kind benefitsAll in-kind benefits to be given by employers in Malaysia are subject to taxation. The assessed amount to be taxed is the amount calculated using the following formula established by the Internal Revenue Service

.png) The useful lives of the main assets are as follows.

The useful lives of the main assets are as follows.

.png)

④ Tax Refund

If the annual income of an individual does not exceed 35,000 RM, 400 RM of the tax already paid will be refunded. For example, if the annual income of a couple do not exceed 35,000 RM, they will be eligible for a total refund of 800 RM.

· In accordance with Islamic teachings such as Zakato and Phytola, if you donated money as part of your obligation, you will refund the amount of donation paid.

⑤ Calculation of income tax amount

⑥ The amount of income tax payable is calculated by multiplying the taxable income derived above by the following progressive tax rate.

.png)

.png)

For example, if income is 200 thousand ringgit,200,000 × 24% -24,000 = 24,000 RM will be the tax amount to be paid..png)

-

Declaration and Payment Procedures

.png)

■Penalty for delayed payment

In Malaysia, payment of tax amount every month is being carried out, the trend of adjustment of excess and deficient payment is done by annual final return. Therefore, the employer pays to the Revenue of Inland Revenue the tax on compensation withheld by the 15th of every month. The penalty when payment is delayed is between 200RM and 2,000RM.

■ Declaration / Payment

There are two types of personal income tax declaration in Malaysia: one that needs to fill in prescribed forms directly and one that uses e-Filing system on the Internet (electronic filing).

Since the Internal Revenue Service encourages electronic filing, somewhat electronic filing is allowed to extend the declaration deadline.

First of all, by the end of March, the company must submit Form E to the Internal Revenue Department either by applying online, by post, or by contacting the counter. However, from FY 2016, it is announced that this application will be integrated on-line. Then, based on that document, the final declaration form, Form BE must be filled up and final return be submitted. Personal income tax payment procedure is until April 30th. The taxable period of personal income tax is January to December.

■ Penalties due to tax returns and payment delays

If declaration / payment is delayed, a penalty of 10% will be imposed if payment within 30 days is paid, and a penalty of 5% will be added if payment will be made after 30 days, a total penalty of 15% will be imposed. -

Corporate Income Taxes

■ Taxpayer

Regarding the residency status of a corporation in Malaysia, the place of residence is determined by administrative dominance. Normally, companies established under the Company Law in Malaysia are treated as resident corporations even foreign capital invested companies such as those that came from Japan. However, regardless of whether it was established under the Corporate Law of Malaysia, if a general meeting of shareholders or a board of directors is held in a foreign country other than Malaysia and the operation and management of business execution is conducted, based on the Malaysian Income Tax Law Above the company will be considered a non-resident corporation.

Due to Malaysia's tax system’s double taxation avoidance treaty, resident corporations are given preferential treatment, non-resident corporations are not subject to tax exemption, tax exemption for foreign source income, withholding tax exemption etc. Residents' judgment is made every fiscal year.

■ PE (Permanent Establishment) taxation in Malaysia

Normally, when establishing a permanent establishment (PE) in Malaysia and conducting business activities, tax liability will be incurred in Malaysia. In other words, if there is no PE in Malaysia, tax liability will not occur in Malaysia. However, even if you do not have a PE legally, if you are deemed to have PE in Malaysia as a matter of fact, tax on the income considered will be imposed. This is called "PE certified taxation".

Regarding the scope of this PE, it is roughly exemplified in Article 5 of the Malaysian domestic law and the Japan Cyclical Tax Convention. It can be roughly classified into the following three types:

· When a Japanese company conducts transaction through an office etc. in Malaysia

· When conducting transactions through service provision

· When making a transaction through the agent PE

This is a representative example of PE, Japanese companies have offices such as branch and sale office in Malaysia. In this case, since the office is registered in Malaysia and has obtained its tax number, it falls under PE.

In the case of a representative office, since income does not occur and profitable activities are prohibited, income tax is not imposed on corporate income. However, as a matter of fact, in cases where it is being certified for engaging in sales activities, it will be subject to taxation as PE (Japanese corporate branch), so be careful.

In the case of service offering transaction, the judgement on whether it corresponds to PE depends on the period of service provision. The following cases correspond to PE:

· Activities related to construction work etc., when activities over a period longer than 3 months (Construction PE)

· In cases where Japanese companies provide service through employee or other staff in Malaysia and such activities are conducted for a single construction or multiple related work for a period of more than a total of 6 months in 12 months

If the definition of proxy PE falls under the following items, PE is assumed to be in Malaysia.

· If you have the authority to enter into a contract on behalf of a Japanese company in Malaysia and exercise this authority iteratively

· In cases where there is no authority to conclude a contract but in Malaysia it repeatedly holds goods or stockS belonging to a Japanese company and these stocks are ordered or handed over on behalf of Japanese companies

· You do not have the authority to conclude a contract, but you are repeatedly ordering for a Japanese company or affiliate in Malaysia

Since there is no need for an individual, corporation or capital relationship to an agent, PE will be deemed exists if it conducts transaction iteratively with the company name in Japan. However, not only for a specific company, but if an agent contract to a large number of companies, the agent will be considered an independent agent, not a PE..png)

The risk in taxation for a PE accredited company or individual, even though there is circumstance that the company does not generate income in the first place, as PE accredited by tax authorities they still need to pay tax without fail and this will lead to double taxation. Although there is a general guideline on the scope of this PE, since it is concrete and not clearly stipulated and it is based on the judgment of the tax authorities, in the worst case Japanese company or individual in Malaysia can be recognized as PE and be taxed as consequence. In spite of this, care should be taken since Japan is not certified as PE, it is possible that adjustment of double taxation can be made.

■ PE certified taxation method in Malaysia

If PE authorization is carried out by the tax authorities in Malaysia and the collection of tax right exists on Malaysia side under the tax treaty, the company side will incur income tax payment obligation according to Malaysian tax law.

However, when the company side does not approve PE the PE accreditation given by authorities and receives an indication from the tax bureau, since the company usually does not declare taxes, the tax authorities themselves have the authority to assess their incomes and calculate the tax amount by themselves.

To prevent PE risks in Malaysia, companies themselves must approve the PE certification given and register as taxpayers in Malaysia. It will not be a problem if you pay corporate income tax after finalizing accounting records etc. especially when conducting business including parent companies, it is important to grasp the PE rules and consider the correspondence beforehand.

This provision is called PE certified taxation, and the definition of PE is stipulated in the tax treaty signed by each country and Malaysia.

Normally, as taxation is done on the company side without recognition, if taxpayers cannot submit declarations and calculate taxable income, the provision of deemed taxation shall apply mutatis mutandis and charges must be imposed. -

Tax Year

The tax year for corporate income tax in Malaysia is basically the fiscal year basis as a rule. This fiscal year can be set for each company.

-

Calculation of Taxable Income

Taxable income under the Income Tax Act is calculated by deducting all deductibles from all gross profits related to businesses generally operated for one accounting period (usually a business year). In principle, the business year is 12 months.

Since gains and losses are recognized based on accrual principles, regardless of actual receipts of money or the payment is made or not, all gains arising in the relevant business year will be included in the calculation of income amount. -

Types and classification of taxable income

■ Taxable Income

The criterion for the income to be taxed is whether it was earned in Malaysia or not. Malaysia's corporate income tax payment obligor are the corporations and cooperatives established in Malaysia and corporations and cooperatives established by a foreign law and operate business in Malaysia. This principle is said to be called a territorialism. In case of income derived in Malaysia and overseas income, all income received in Malaysia are subject to taxation.

The taxable income in Malaysia are as follows:

· Income incurred in Malaysia

· Income earned in Malaysia

· Income received in Malaysia out of foreign source income

■ Foreign source income

As mentioned, income received in Malaysia is regarded as source income earned in Malaysia which is subject to taxation. However, those income which were received in Malaysia but were earned and remitted from overseas will not be subject to tax payment in Malaysia anymore if they were already taxed in the country of origin. (Except to those related to banking business, insurance industry and air and sea transportation companies in Malaysia which is need to be taxed.)

Also, if the foreign corporation was established originally for other purpose not engaging in business in Malaysia, if eventually the foreign corporation conducts business at a permanent establishment (PE) and if it will be subject to the provisions of withholding tax, then it will need to pay such taxes. -

Summary of Benefits

In the calculation of taxable income in Malaysia, taxable income is calculated by adding or subtracting adjusting items to accounting profit like in Japan.

Malaysia's corporate income tax is calculated by territorial basis as well as personal income tax. In other words, income of a local Malaysian individual or corporation, whether the source is from inside Malaysia or overseas, will be subject to taxation. Specifically, if it belongs to the following listed items in Article 4 of the Income Tax Law:

· Gains and benefits earned from business activities

· Profits and benefits arising from employment

· Dividends, interest and discounts

· Pension and other regular income

· Gains and benefits other than those mentioned above with the nature of income -

Outline of Deduction

In calculating taxable income in Malaysia, the related deductible provisions are as follows;

■ Company Secretary Cost

Payments for secretarial services can be deducted from 2015. In doing so, the company providing secretarial services must comply with the laws of Malaysia Company Law and the secretary's laws to protect. The amount can be included as deduction is up to 5,000 RM. Also, since the payment cannot be deferred, it will be processed in the fiscal year that occurred.

■ Cost associated with tax return

It is possible to deduct up to 10,000 RM for each of the following three expenses, which is charged by the income tax law and the Tax agent approved under the GST Law.

a) Document preparation expenses related to refunds prescribed in Article 77, 77 A, 77 B, 83 and 86 according to the income tax law, and costs incurred at the time of submission

b) Document preparation costs and expenses required at the time of submission

c) Document preparation expenses incurred in relation to GST tax payment and expenses required at the time of submission

■ Automobile related expenses

In Malaysia domestically, when used as a company car, it is possible to include in the deductible amount up to a total acquisition cost of 50,000 RM. In case of getting 100,000 RM deductible, it will be possible if in terms of car lease, no one is using before and in terms or purchase, if the total acquisition cost does not exceed 150,000 RM. Other than that, any excess is not permitted to be included as deductible.

■ Entertainment expenses

In Malaysia, expenses related to sales (promotion of new products, issuance of discount tickets, etc.) can be considered deductibles if in cases where only the employees are targeted, or customer service such as outdoor food and hotel industry is the object of the project or sales. Otherwise, in principle any other items will not be included in the amount of deductible.

■ Employee benefits welfare expenses

Among the benefits to be given to employees, those that fall under the following are eligible for deductibility.

a) Monthly flat-rate magazines, fixed phones and mobile phone charges are also can be considered as deductibles. Depending on the company, I think that for the telephone fee, monthly payment to the employees is fixed. This cost can be deducted. However, telephone fees cannot be used as deductions if the amount of monthly payment to employees is not fixed. b) Cost of purchasing digital equipment such as personal computers and mobile phones to be used at work

* Deduction of commuting allowance and gasoline fee etc was also possible, but this part has been deleted in 2010.

■ Donation

Deductions are allowed only for donations made by a government and charity committee to specific organizations that are engaged only in charitable activities.

■ Opening Fee

In Japan, the establishment expenses and opening fee are deemed to be deferred as assets and it is possible to use it as post deductible losses. But in Malaysia the expenses required to commence operations are not recognized as deductible at all. However, at the time of establishment, it is necessary for the company to have authorized capital of 2,500,000 RM or less, and if this condition is satisfied, it is possible to include the expenses as deductible. However, if the authorized capital exceeds 2,500,000 RM within the fiscal year from the establishment date, this condition will not apply. For companies that satisfy the conditions, the following expenses are considered deductible.

1) Expenses related to the preparation of the articles of incorporation (M & A)

2) Expenses related to registration (stamp duties, things related to preparation of court documents etc)

3) Expenses such as the printing of share certificates and the preparation of documents concerning the transfer of share certificates

4) Expenses related to creation of company seal

5) Stock subscription fee -

Corporate Tax Rate

From the fiscal year 2015, the tax rate can be changed with the introduction of GST. The details are as follows..png)

■Depreciation

In Malaysia, depreciation expenses are calculated based on accounting principle to synchronize with capital gains tax exemption. However using depreciation is not allowed as deduction for tax purposes. This is because it is not allowed to include deduction of expenditure related to capital items in principle. As a general rule, accounting depreciation expenses are added to taxable income in full and the new tax depreciation expenses are calculated and subtracted from taxable income.

■Acquisition price

Accounting treatment is applied mutatis mutandis to acquisition cost in principle. Acquisition price is the sum of purchase price, cargo handling fee, transportation insurance fee, tariff, installation cost and other expenses required for acquisition.

■ Amortization rate

From fiscal 2005 onwards for industrial buildings such as factories and wharfs, depreciation is computed based on the purchase price. For the acquisition year the annual depreciation rate of 10% will be applied and for the next fiscal year the depreciation rate to be used is 3%. In addition, companies that acquire the MSC status are granted a period of 10 years' industrial building amortization period.

Here, the depreciation rate differs for each of the three categories. The three categories are heavy machinery, machinery equipment and plants, others (office machinery, etc.). Regarding heavy machinery, we are allowed to amortize 20% on the acquisition year and 20% for the next fiscal year. With respect to machinery and equipment and plants, amortization is permitted for 20% on the acquisition year and 14% for the next fiscal year. Amortization of other (office equipment, etc.) is permitted to 20% on acquisition year and 10% for the next fiscal year. For vehicles only, if the acquisition price is less than 150 thousand ringgit and has been acquired after October 28, 2000, qualifying expenditure will be up to 100 thousand ringgit, otherwise it will be up to 50 thousand ringgit.

The depreciation for facilities and buildings is divided into 4 categories, each depreciation rate is as follows:

The first is for land maintenance, planting of agricultural crops and expansion of roads, the depreciation rate is 50%. The second is for facilities related to agricultural business, here the depreciation rate is 10%. The third is for building constructed for agricultural workers, here the depreciation rate is 20%. The fourth is buildings constructed for other purposes, and the depreciation rate is 10%..png)

As the method of depreciation is not stipulated under the Internal Revenue Code, basically it follows the tax depreciation method.

If you do not amortize the first year at the time of acquisition, you cannot amortize from the following fiscal year. Also, it is not permitted to include deductible depreciation expenses accumulated from the past periods when starting to consider depreciation.

Accelerating depreciation

Regarding accelerating method of depreciation, rate to be used depends on the following categories; mainly industrial buildings (buildings in which manufacturing and tourism are licensed to be used for businesses, buildings to provide to its employees), plants and machinery facilities (to sell natural gas machinery and equipment in the manufacturing industry used for recycling equipment, waste, etc.).

■ Preferred tax system for regional headquarters

A preferential tax system will be applied to companies that meet certain conditions and are active as a regional headquarters in Malaysia. If you are recognized as a Regional Headquarter, you will be exempt from corporate tax for 10 years' prescribed income by 100%. -

Declaration and Payment Procedures

After the settlement day, tax returns will be submitted to the Internal Revenue Service of Malaysia and tax payment will be made. Document necessary for application is called CP207. This is available from HP of the Internal Revenue Service.

[Declaration · tax payment of corporate income tax]

You must pay to the Internal Revenue Service within 7 months from the end of the fiscal year using Form CP 2017. Payment can be made in the Internal Revenue Service window, post office, bank and through Internet.

■Estimated payment

Unique calculation method is taken in Malaysia. Taxpayer calculates the estimated amount of corporate tax beforehand, notifies it to the Internal Revenue Service and pays on the 15th of every month. The tax to be paid is not calculated adequately, it is calculated based on the business plan of the following year. The opportunity to correct the estimated is given twice a year. But if there is a big difference between the actual amount to be paid and the estimated payment amount, a fine will be imposed on the difference..png)

.png)

.png)

■ Target company

The time to start tax payment will change depends on the size of the company. A company that meets the definition as a small business in Malaysia will make an estimate payment from the third term of the business year. Payment for the first term and second term is not necessary. Small and medium enterprises is defined as those with capital amount less than 2.5 million at the beginning of the project.

■Payment start time

We will submit the document CP204 to the Internal Revenue Service one month before the end of the fiscal year in which the estimate payment starts.

In the case of a business model that requires payment from the beginning of the fiscal year, declaration is unnecessary if the fiscal year is within 6 months, but if it continues for more than six months, the company must submit the document within 3 months of starting the business. Payment must start within 6 months. Payment deadline is 15th of every month.

Example:

The business starts on March 1, 2015 and the end of this fiscal year is December 31, 2015. As of March 1, 2015, the capital is 5 million RM, which is out of the definition of SMEs and estimate payment starts from the first year. At that time, we must proceed payment as follows..png)

Since the estimate payment period occurs according to the project period, assuming that this case was paid for the first time on August 15, 2015, the business year is 10 months, so the estimated payment will continue until May 15, 2016. Tax payment after the end of the first fiscal year cannot be cancelled out in the second term, and the payment will advance in parallel.

■ Restriction on revised estimate payment amount

As mentioned above, this is not just a simple calculation.

When correcting the payment amount, it cannot be corrected below 85% of the estimated amount.

Penalty for estimate payment amount

In the event that you ultimately pay the amount of 30% or more of the estimated total payment amount, a penalty of 10% will be imposed on the excess.

【Calculation method of fine against excess payment】

{(Actual Payment - Estimated Payment Amount or Estimated Amount) - (30% × Actual Payment Amount)} × 10%

■ Delay

If your monthly payment is delayed, a 10% penalty will be imposed on that delay.

In the case of delayed payment, penalty of 10% will be imposed within 30 days. For the following months, 5% each month will be added. -

About GST overview

Value-added tax (GST: Goods Service Tax) is an indirect tax imposed on goods and services traded in Malaysia. Indirect tax is a tax whose taxpayer is different from the person who actually borne the burden of payment., unlike the direct tax that real tax burdens and taxpayers are the same . Since GST is similar in tax collection method on consumption tax in Japan, it is interpreted as being equivalent to Japanese consumption tax. The GST rate imposed is 6% from 1 April 2015.

■ Normal transaction form.png)

GST is a type of indirect tax, and GST (6%) is applied to all transactions.

■ Zero transaction object.png)

For vegetables, livestock (cattle and goats), poultry (such as birds and ducks), salted seasoned eggs or eggs, fish and international services subject to tax, those transactions are GST exempt. It means that you can deduct the GST (6%) that is spent on purchases.

■ Exempt from tax.png)

Tax exemptions in Malaysia are mainly for the purchase and sale of property for living, lending and financial services, land for agriculture purposes, private medical care and education services by national and local governments. It is necessary to note here that GST (6%) on purchases other than mentioned above cannot be deducted.

■ Taxpayer

In the past year or this year, the business operator who is required pay GST are those who registered taxable sales of 500,000 RM or more to the Revenue Agency.

Even if annual taxable sales are less than 500 thousand RM, it is also possible to voluntarily register as GST taxpayer. However, in that case, you must do business as a registrant for at least two years. Also, companies that have taxable sales of less than 500 thousand ringgit and are expected to exceed 500 thousand RM in the future or exceeded it, they have to register within 28 days from the last day of the month they found out about the expected future sales. From the first day of the next month upon registration completion, you will be doing business as a GST registrant.

① When sales from the past exceeded 500,000 RM.png)

② If future sales are likely to exceed 500,000 RM.png)

Both of these cases are being considered at the present time, so if you have a chance of increasing sales, you should register early. In addition, registration will occur in the middle of the fiscal year, so you need to look carefully about the total figures of sales.

■Penalty due to registration delay.png)

Register GST online at HP (http://gst.customs.gov.my/en/Pages/default.aspx).

Here, download the registration form from the above website, send it to the relevant department after filling in, registration will be completed. In order to register, the necessary information is as follows. (If you are receiving preferential treatment etc., we also have necessary information separately.)

① Company registration number

② Passport number of the representative of the company (in case of Malaysian, identification card number)

③ Visa, number of labor permission (only for foreigners)

④ Social insurance registration number

① Corporate bank account number

■ Calculation of tax amount to be paid

The provision of goods or services is "the business operator provided goods or services in other form due to business conduct."

In recognition of the provision of goods or services, the following requirements must be taken into consideration.

· In case of providing goods or services including imports in Malaysia

· A resident of Malaysia provides goods or services inside the country

Non-covered transactions

· A person residing outside Malaysia provides goods or services to a person living in Malaysia

The provision of goods or services will be recognized at the earliest of the following:

· When the goods or service provider issues a GTS invoice (tax invoice)

· When the goods or service provider receives the consideration

In principle, when transactions are made in cash, the basis will be the transaction price, but in other cases except for cash payment transactions, fair market price may apply..png)

■■ Notice of invoice creation

The GST Registration Company regulates information that must be placed on the invoice. The information is as follows. I will also attach an image of the sample. Please refer.

· Required information

① The term Tax invoice

② Invoice number

③ Invoice issue date

④ Company name (or individual name) issuing invoice, address, GST registration number, telephone number

⑤ Company name (or personal name) of the billing address, address

⑥ Product name (or service content), quantity, amount

⑦ Total amount

⑧ Taxable Total GST

⑨ Total amount (including GST amount)

The sample below is a sample invoice in foreign currency converted to Malaysian ringgit. If it is only a Malaysian Ringgit transaction, I think that you can delete the part of foreign currency part (Total (USD) column)..png)

■ Tax invoice method (Tax Invoice method)

The invoice system is adopted for GST in Malaysia. If a taxpayer trader conducts a transaction where GST is being imposed, he needs to issue an invoice called tax invoice. With this as evidence, the total GST amount paid can be included in the purchase tax deduction. In other words, GST must always be recognized, invoiced and paid backing up the tax invoice.

For Tax Invoice, you must list Tax Invoice as the title, GST Registry Number, Company Registration Number, GST Amount etc. Also, if it is a request made in a foreign currency, you must calculate GST using the rate at the time of purchase occurrence upon converting it to Malaysian Ringgit.

■Tax point

It is important to consider the time taxpayer must declare and pay GST. In principle, the taxing point is at the time of shipping if it is a good and at the time of providing the service if it is a service transaction. However, if issuance of invoice or receipt of consideration is made before the principal tax point, the date of invoice issuance or the date of consideration will be the taxable point. According to the Guidelines issued by the Government Bureau Insurance Agency, the key point is whether the invoice is issued within 21 days from the time of delivery of goods or service provision..png)

【When the invoice is issued 21 days after shipment】.png)

Appropriate care is needed to be taken as the period for declaration will change as the invoice is issued in this way.■Tax point check flow.png)

Deduction method

The tax amount payable is obtained by subtracting the deductible input GST (GST related to purchase) from the received output GST (GST related to sales).

【a formula】

Payment Tax Amount = Output GST - Input GST

If the input GST is cannot be deducted from output GST related to sales, you can request for a refund. In the case of electronic filing, refund can be made within 14 business days after filing. If it is a manual procedure, refund will be made within 28 business days after filing. However, since the Director General of Customs has the authority to reserve the payment of the refund request, there is a possibility that a tax examination related to that will be conducted simultaneously when requesting refund.

■ Tax duration, payment procedure, refund

The taxable period subject to declaration and tax payment is determined by annual sales..png)

■ PenaltyIf the specified payment deadline of GST has passed, a 5% overdue tax on the payment amount will be imposed. In addition, if payment is not made even after 60 days from the due date, a 3% delinquent tax will be added monthly. However, the total tax rate for penalties is limited to 25%..png)

For an export-oriented company, since it sells goods or services to foreign countries, GST is not imposed on the product or service sold, but as GST for purchase increases, temporary cash flow is expected to increase. However, although GST related to this purchase is likely to be able to request for refund, in order to reduce the burden, the authorities plan to establish a device (ATS) which exempt purchase of imported goods from GST payment.

-

Other Tax Items

■ Oil Income Tax

Petroleum income tax is a tax system based on the oil income tax law and tax imposed on the income of oil companies. This refers to taxation on individuals engaged in petroleum business by concluding a petroleum agreement with Petronas or Malaysia and Thailand Supervisory Authority.

The income of oil companies also includes those oil and natural gas produced, transported, and sold, and those reflecting the amount paid to the government as a consideration for the royalties and assignments of the mining districts to the price of gas, The tax rate for most oil companies is 38% of net profit.

■ Stamp duty

Stamp duties refer to taxes imposed on certificates and documents such as legal affairs and finance. The tax rate depends on the type of certificate. It is possible to receive tax exemption for some certificates and documents.

For documents created in Malaysia payment must be made within 30 days. While for documents created outside Malaysia, stamp duties must be paid within 30 days after receiving the documents. If payment cannot be made within the deadline, penalties will be imposed.

The main stamp duties are as follows:.png)

■ Real Estate Sales Tax

A real estate sales profit tax (RealPropertyGainTax) is imposed on the capital gain due to the sale of real estate. The real estate sales tax was abolished in 2007, but it was introduced again in 2010 to suppress speculation.

The tax rates are as follows. The tax rate varies depending on the holding period of real estate.

.png)

■ Excise Tax

Excise duties are imposed on certain items such as beer, stout beer and other alcoholic beverages, tobacco cigarettes including tobacco leaves, playing cards and cars. The tax rate of the excise tax varies depending on the target product, and the automobile has a range of 60% to 105% depending on the engine displacement.

There is an obligation to acquire licenses in manufacturing and storing products subject to excise tax.

■ Import and Export Tax

When importing taxable items into Malaysia, import tax is imposed. Except for some items, the import tax value is determined by the cost method.

In order to increase the export of finished goods from Malaysia, raw materials and parts, machinery for factories, etc. are subject to low tax rate or tax exemption.

Export taxes are imposed on major Malaysian products such as perming oil and crude oil.

-

Tax survey in Malaysia

The tax investigation procedures in Malaysia is as follows.

① ① Hearing from national tax officials

After submitting the declaration to the tax office, a tax investigator views the declaration documents and make a telephone or document inquires to the taxpayer side. In case of continuing argument against an indication from an investigator, tax authority will send out a summons and a full tax investigation will begin.

② ② Full investigation by summons

If a subpoena is issued, a tax examination will be conducted for all taxes related to that subject. After the investigation is finished, the tax authorities issue a notice of correction and order the taxpayer to pay taxes including penalty. If you are not satisfied with this disposition, you will be resolved through procedures such as opposition and tax litigation.

③ ③ Survey by refund declaration

If the tax taxpayer submits a tax refund requests, the refund procedure will be taken after receiving the authorities’ review.

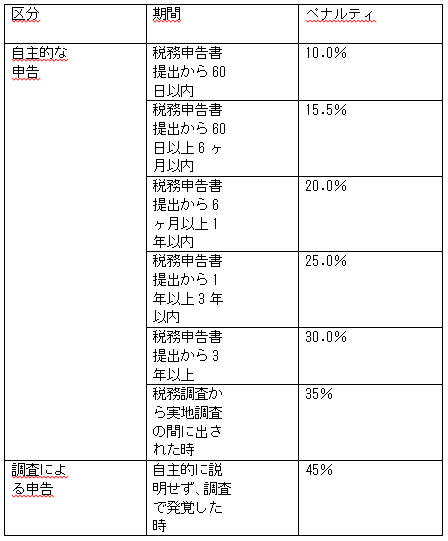

Penalties relating to tax investigation

In the case of under-declaration, a fine as indicated below will be added to the undeclared amount. However, if the taxpayer voluntarily makes a correction declaration, a penalty of 35% will be imposed.png)

-

-

-

Outline of Withholding Collection System

Malaysian withholding tax is tax on income paid to foreign corporations or individuals. Although it is not wide as the scope of taxation, it is necessary to pay attention because the tax rate is divided finely.

■ Personal

【Withholding income tax rate】

.png)

Also, the scope of withholding tax for income derived in Malaysia for nonresidents was changed.

Details are as follows.

① ① Expansion of the scope of withholding tax on income

The range of withholding taxes on income in non-residents in Malaysia as stipulated in Article 4A (i) and (ii) of the Income Tax Act was expanded. As of now, expanded tax is being imposed only on the income generated for services rendered inside Malaysia, but based on the new tax reform, withholding tax will be imposed even for services outside Malaysia.

(I) Consideration for services provided in connection with installation rights and specifications of machinery and equipment

(Ii) Consideration of services provided in connection with technical management and management in commercial business

Services provided domestically and even overseas will be subject to withholding tax in Malaysia.

※ Enforcement year ............ Finance Act 2016 according to enforcement

② ② Expanding the definition of royalties

At present, royalties for right to use of software is not defined in the tax law. However, it was being added in the new tax regulation.

a) Payment for the following, i) and ii)

i) Right to use patents, trademarks, designs, images, music etc. in Malaysia

ii) Payment for experience and skills such as know-how

a) Payment of tax on royalty for the right to use b) Right to provide images and sounds transmitted by satellite broadcasting, cable or optical fiber

c) Right to use royalty-defined property / rights or other items

Enforcement year ............ Finance Act 2016 According to enforcement

Corporation

【Withholding income tax rate】.png)

■Procedure of withholding tax payment

Submission of tax return and payment of withholding tax shall be made within one month from the earliest day of payment date or unpaid record date. The prescribed form can be obtained from HP of the Internal Revenue Service..png)

■ Penal Provisions on Withholding Collection

With regard to payment of withholding tax, the following penalties will be charged in case of delay or accrued payment.

Fine of the amount between 200RM and 2,000RM or for six months imprisonment. Or both are given as penalties.

The penalties for delayed paymentare shown in the table below..png)

-

-

-

Foreign tax credit

Foreign tax credit (FTC) is a method to adjust the taxes paid twice on international income by deducting the amount of tax paid abroad for foreign source income from the tax amount of the country of residence.

■ Foreign tax credit based on tax treaty (DTR: Double Taxation Agreement)

A Malaysian resident corporation can apply for a deduction of foreign taxes paid to other country which is the tax on foreign source income generated in the Contracting State under the tax treaty.

■ Unilateral tax credit (UTC: Unilateral Tax Credit)

A Malaysian resident corporation who is taxed on foreign source income generated in other country that has not concluded a tax treaty can apply for tax credit of foreign tax amount paid.

However, in order to apply for a foreign tax credit, it is necessary to satisfy all the following three requirements.

· Be a resident of Malaysia in the current year

· Foreign tax amount has already been paid or planned to be paid abroad

· The income is subject to taxation in Malaysia

In case.png)

In Malaysia, foreign tax credits are not stipulated in the Income Tax Law instead in the Royal Decree in the Convention between Malaysia and the countries that have a tax treaty.

, it is stipulated that "in accordance with the treaty on foreign tax credit between foreign country and Malaysia foreign tax credits will be granted in accordance with the provisions of the "double taxation elimination" . In other words, the contents of the foreign tax credit will be greatly influenced by the contents stipulated in the tax treaty. (Note, according to Royal Decree R. D. No. 300 B. E.2539, even if it is a foreign tax paid in a country where no tax treaty has been concluded, either a foreign tax credit or a deduction of the foreign tax amount paid is permitted to be applied.)

In Japan - Tax Convention and foreign tax credits are stipulated in Article 21, paragraphs 2 and 4. With regard to tax deductions, the amount of foreign tax paid by a corporation established in Malaysia outside the country is limited to the corporate income tax amount to be imposed in Malaysia, and other taxes paid are treated as deductible for calculation of taxable income. It is done under the assumption that there is no thing or tax deduction certificate required for deduction. In addition, it is necessary to pay attention to the application of deemed foreign tax credit * as a point to be noted in transactions with Japan.

* A system that allows foreign tax credits to be applied, assuming that the tax reduced or exempted by the tax treaty was paid. -

Transfer price taxation

■Overview of transfer pricing taxation in Malaysia

Transfer pricing is a process in which transactions are carried out between the corporation and its foreign affiliated persons and transactions are carried out at a price different from the existing market enterprise price (ALP: Arm's Length Price). Transfer pricing tax a tax system that is imposed to prevent relocation of income from overseas through transfer price transactions among affiliates.

[Overview of transfer pricing taxation system].png)

In Malaysia, the Internal Revenue Service announced transfer pricing guidelines in July 2003. This was not a "law" but a proper "management guideline". Although there is no legal enforcement, taxpayers have to deal with this in practice because it is the guidelines indicated by the Revenue Department that conduct taxation.

The transfer pricing guidelines are in close agreement with the transfer pricing guidelines by OECD, and since January 1, 2009, the transfer pricing guidelines have been enforced on the basis of Article 140 A of the income tax law.

■ How to calculate intercompany price

It is stipulated by ALP that the international transaction price, which is the basis of income calculation after applying transfer pricing taxation, is based on ALP. For the ALP calculation method, companies will select the most appropriate method, considering the content and form of the transaction, from among the following prescribed methods.

The CUP (Comparative Uncontrolled Price Method) is a method of comparing the amount of consideration for a transaction (third party transaction) conducted between non-related parties under conditions similar to those of foreign affiliated transactions.

The resale price method (RP method: Resale Price Method) is a method of setting the amount obtained by deducting the amount of profit ordinarily obtained from the sales to a third party. The amount obtained will be the ALP for foreign related transactions..png)

The cost basis method (CP method: Cost Plus Method) is a method to determine the ALP for foreign related transactions using the sum of the cost generated from the transaction between the foreign affiliated company and a third party plus the amount of profit which would normally obtained from the transaction.

In calculating ALP, if you cannot use the above method, "Profit division method"

and "trading unit operating profit method" can be used.

Profit splitting method (PS method: Profit Split Method\

It is a method to calculate ALP in which the the total amount of operating income is allocated proportionately based on the contributing centers in realization of the operating profit

The transaction unit operating profit method (TNMM method: Transaction Net Margin Method) is a method of calculating ALP based on the operating margin realized in similar transactions between similar independent companies and third parties.

■ Documentation obligation

In Malaysian tax law, there is no specific obligation to prepare (document) the document which analyzed the details of the transaction at the transfer price transaction. However, in the case of receiving an indication from the tax authorities, there is a risk that the tax investigation etc. will result unfavorably if the taxpayer side does not have solid basis data. So even though, there is no duty for documentation to be established, I think that it is preferable to create and keep a transfer pricing document. Also, the language used at this time can be either English or Malay.

■ Transfer price survey in Malaysia

The transfer pricing survey in Malaysia is conducted in the usual tax investigation. In other words, authorities do not conduct a special investigation called transfer pricing survey. It will start with a hearing from a national tax official, which is an ordinary tax investigation. After submitting the declaration form to the tax office, the tax examination officer reviews the declaration documents and inquires by telephone regarding the document. If you cannot answer properly at the time of this inquiry, you will be asked for rehabilitation and you may be forced to incur estimated tax on a semi-compulsory basis. Moreover, there are cases where you will be asked for additional document, and if further document submission etc. becomes necessary for the verification, beforehand notice will be given, the subject company will be visited by the investigator and the investigation will pursue. In addition, there are factors such as intense fluctuations in gross profit margin and continuing deficit as conditions of corporations that may be subject to survey.

When verifying the transfer pricing in the tax investigation, the Revenue Bureau Circular will mainly verify the following documents.

· Organization chart of group affiliated companies, business contents of each company

· Budget, business plan, future financial forecast

· Contents of transactions, sales and profit / loss with group affiliates

· Functions and risks of each affiliated company

· Reason for transfer pricing method, reason for not adopting other method

· Other documents related to price determination

Penalties due to rehabilitation and surrender

When tax authorities receive an indication about transfer pricing and a correction / additional tax amount occurs, a penalty is given to the incremental tax amount as follows.

■ Prior confirmation system

The advance confirmation system (APA: Advance Pricing Agreement)) is a preliminary confirmation of the validity of pricing to the Revenue Department whether the relevant transaction price is appropriate in overseas related transactions when the corporation decides for the transaction price. In that case, companies can apply for that system. It is introduced and being utilized by companies having transactions between Japan and Malaysia. When making an application, you must conduct actual transactions according to the conditions indicated in the prior confirmation. Since the company agreed on the transaction in advance from the tax authorities, it can prevent the risk of being asked to declare amendment after filing. -

Other International Taxes

In Japan, in addition to the above, tax haven tax system, under capital tax regime etc. are stipulated. Howeverthere are no such special laws and regulations in Malaysia. Overall, Malaysia still has few provisions in the field of international taxation, so we need to pay attention to taxation mainly in Japan side.

However, it will be fully anticipated that international taxation in Malaysia will be strengthened by the thriving investment from foreign countries in Malaysia, so it is necessary to pay attention to it.

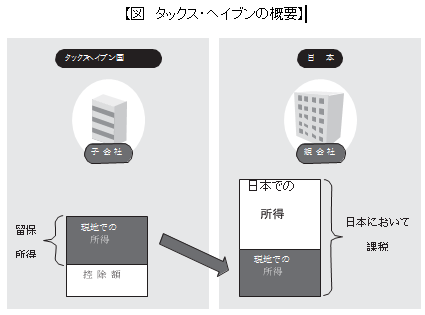

■ Tax Haven tax system

The Cayman Islands, Bermuda Islands, Luxembourg, Cyprus, Belize, Singapore and Hong Kong etc. are called tax havens (light tax country), and by generating profits in these countries, it is possible for companies to enjoy a great benefit in terms of taxation. In terms of investing in Malaysia, there are also cases where management is made as a subsidiary company through regional management headquarters (OHQ) instead of direct investment from Japan. By establishing a central office in Tax Haven, it is possible to reserve profits gathered from each subsidiary by utilizing the maximum benefits of taxation system.

However, if this OHQ is being found out by the tax authorities as a "dummy company" the income derived and retained in the OHQ will be taxed in Japan as the site of the head office. The tax haven system (total subsidiary taxation system) stipulated in the Japanese Corporate Tax Law means that a domestic corporation, etc. has a specified foreign subsidiary company (a foreign affiliated company located in a light tax country). The specified foreign subsidiary Etc., the amount corresponding to the ownership ratio of the subsidiary shares owned by the domestic corporation is regarded as the profit of the domestic corporation. It is a system that intends to accumulate taxes together in Japan.

In other words, in Japan, it is a taxation system that taxes overseas retained income in Japan by recognizing "money" in taxation although "accounting revenue "is not recognized.

Companies to which this taxation system applies are owned directly or indirectly by Japanese resident or domestic corporation directly or indirectly that exceed 50% of the shares (together with judgment to exclude voting rights and shares without right to distribute dividends). A company that is a foreign subsidiary, etc. that does not have tax on corporate income, or that the foreign capital investment is 20% or less, is eligible.

Among them, if the company is a domestic corporation or a resident who directly or indirectly owns the shares of the specific foreign company, etc., it shall be subject to the same taxation system for the retained income amount of such foreign subsidiary company.

In other words, a company that is located in Tax Haven, has a shareholding of 10% or more in the same family, and a company whose capital is more than 50% foreign capital.

Moreover, companies that meet the above requirement are not subject to all tax under the tax system, but in order to avoid hindrance to corporate normal foreign investment business activities by conducting a combined taxation, the following application requirements may not be satisfied.

· Business Criteria · · · · · · Business where this system is applicable are businesses except lending business of aircraft etc, provision of rights such as holding shares or bonds, know-how etc.

· Entity standard · · Have fixed facilities such as office, store, factory

- Management control criteria - The fact that they control and operate themselves in the country of residence.

· Unrelated party criteria · The main business is being conducted with non-related persons.

· Country criteria of location · Main business is done in the country where the head office is located.

In certain cases where a specific foreign subsidiary or the like is an entity as independent company and it is deemed that there is sufficient economic rationality to conduct business activities in the country where it is located, it is said that tax avoidance is not the purpose. Therefore, application of the tax haven system is not necessary.

In other words, in order to avoid applying the same taxation system, it is necessary to prepare for the actual situation of local activities in OHQ before being pointed out by tax authorities.

Also, if Malaysia's corporate income tax falls below 20% in the future, Malaysia must grasp that it may be subject to the taxation system.

-

-

-

Outline of Tax Treaty

Tax treaty is a mutual agreement (treaty) between nations by a statement to concluded between countries for the purpose of eliminating double taxation and prevention of tax evasion. Since the treaty is a convention between countries, the application will be applied in preference to the domestic law prescribed by each country. In other words, even if an item is being "taxed" in the domestic law, it can be treated as "tax free" if it is said to be "tax free" in the tax treaty.

Also, various treaties other than one may also decide on specific tax treatments in Japan, such as residents of partner countries.

The countries where Malaysia has a tax treaty are as follows.

-

Japan-Malaysia Tax Treaty (Japan-Tax Convention)

■ Definition of PE (Japan - Tax Convention Treaty Article 5)

In the Japan-Star and Tax Treaty, the definition of permanent establishment (PE: Permanent Establishment) has been made, and the following are stipulated as PE:

· Office managing business

· Branch

· Factory, workshop

· Mines, petroleum or natural gas wells, quarry and other places to collect natural resources (excluding places used only for purchasing and storing assets)

· Supervisory activity related to construction work etc, if it exists for more than 6 months (construction PE)

· The agent has the authority to conclude a contract on behalf of a Japanese company in Malaysia and exercises this authority repeatedly (agent PE)

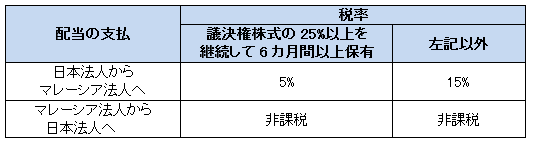

■ Taxation on Dividends (Japan-Star Tax Treaty Article 10)

Tax on dividends will be imposed on dividends to be paid to a resident corporation by other Contracting Party from a legal entity residing in one Contracting Party.

If there is payment from a Japanese corporation to a Malaysian corporation, the tax rate will be determined in the following cases.

· If the company holds 25% or more of the voting shares of the dividend paying corporation continuously for six months prior to the dividend payment date: 5%

· Other than above: 15%

Also, dividend payment from a Malaysian corporation to a Japanese corporation will be tax exempt.

■ Taxation on interest (Article 11 of the Japan Bali Tax Treaty)

Tax on interest is imposed on the interest to be paid to residents of one Contracting Party in the other Contracting Party up to 10% of the interest amount. However, if the partner to be paid is a government or a local public entity of the other Contracting Party, the interest will be tax exempt.

■ Tax on royalties (Article 12 of the Japan Bali Tax Treaty)

For royalties, charges incurred by one Contracting Party but not exceeding the tax amount of 10% are levied on royalties paid to residents of the other Contracting Party. In addition, the usage fee is defined as follows:

The usage fee

Right to use licensed works such as films and tapes , art works, scientific works, royalties, trademark rights, royalties, designs and models, drawings, secret systems, secret processes etc. · Right to use or use of industrial, commercial or academic facilities

· Information on industrial or academic experience

Royalty refers to all kinds of payment received as consideration for the above items.

-

-

-

Websites

[1] INLAND REVENUE BOARD MALAYSIA

[2] SCHEDULE ON GENERAL ISSUE AND SUBMISSION OF INCOME TAX RETURN FORMS

[3] マレーシアの法律

[5] JBS HP

[7] Getting Ready for GST – Registering for GST

[8] Handbook for goods and services Tax for bisinesis

[9] KPMG INSIGHT

[10] MINISTRY of finance malaycia

[11] 国際協力銀行「マレーシアの投資環境」

[12] 日馬租税条約

-

Other

[1] マレーシアの内国歳入委員会

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya