Bangladesh

3 Chapter Establishment

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.2 Investment Regulation and Incentives

3 Chapter Establishment

3.1 Characteristics of business base

4 Chapter Corporate Laws

4.2 Regulatory Body and Affiliated Institutions

4.4 Foreign Investment Incentives

5 Chapter Accounting

5.1 Bangladeshs accounting system

5.2 Disclosure system of Bangladesh

6 Chapter Tax

6.1 Tax overview in Bangladesh

6.2 Individual Issues in the Bangladesh Domestic Tax Law

7 Chapter Q&A

-

-

-

Characteristics of business base

■Characteristics of business base

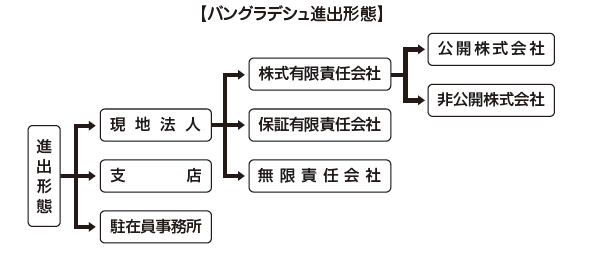

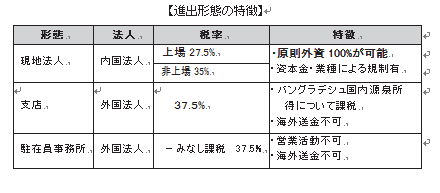

There are local companies, branches, representative offices in the country of Bangladesh. The method of establishing and registering a company was regulated by the Companies Act of 1994 and is under the jurisdiction of the commercial registration office.

■ Local company

Registration of a local corporation give authorization of the three types of stock limited liability company (private company and public corporation), guarantee limited liability Company, and unlimited liability company.[Company Limited by Shares]

Refers to a company form in which the shareholder is responsible to limit the underwriting price of the shares held by the shareholder and is divided into a private company (Private Limited Company) and a public corporation (Public Limited Company).The private company has restrictions on transferring of shares due to the limit of shareholders are not exceeding of 50 or less than 2 (Article 2(1)) and two or more directors must be placed. It cannot issue shares on the stock market (Article 90 (2)).

The Public corporation requires 7 or more shareholders, where there is no ceiling limit (Article 5). And at least 3 directors are required and shares can be issued in the stock market (Article 90 (1)).

.png)

[Company Limited by Guarantee]

It refers to a corporate form that has infinite joint and responsibility with the company with respect to company creditors (Article 8).■Form of expansion other than local subsidiaries

[Branch]

The branch will be treated as a foreign corporation and the installation procedure is the same procedure as the representative office.

It will be set up to do activities which is similar to the head office in Bangladesh. It is not allowed to manufacture the branches of India but it is possible to do so in Bangladesh where it has no restrictions by the industry.

[Representative Office]

The representative office will be established for the purpose of market survey and intermediary with local business partners.

There are many representative offices of textile companies in Bangladesh, and it negotiate the tie-ups with local garment factories which followed by product development, quality control, and guidance of engineers.

The representative office is treated as a foreign corporation, and there is no restriction by industry, but sales activities are prohibited. Moreover, overseas remittance is not allowed at all.

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya