Brazil

6 Chapter Labor

-

-

1 Chapter Basic knowledge

1.2 Political System and History

2 Chapter Investment Environment

3 Chapter Incorporation

3.1 Feature of Business Location

3.2 Establishment of Business Location

3.3 Liquidation and Evacuation (Dissolution) of Company

4 Chapter M&A

4.2 Laws and Regulations Concerning M & A

5 Chapter Accounting

6 Chapter Labor

6.4 Points that Should Pay Attention to When Japanese Assigned to a Foreign Office

7 Chapter Q&A

-

-

-

1.1 Overview of working environment

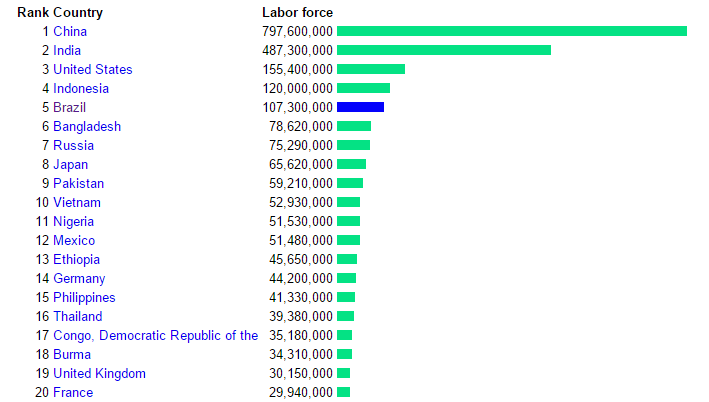

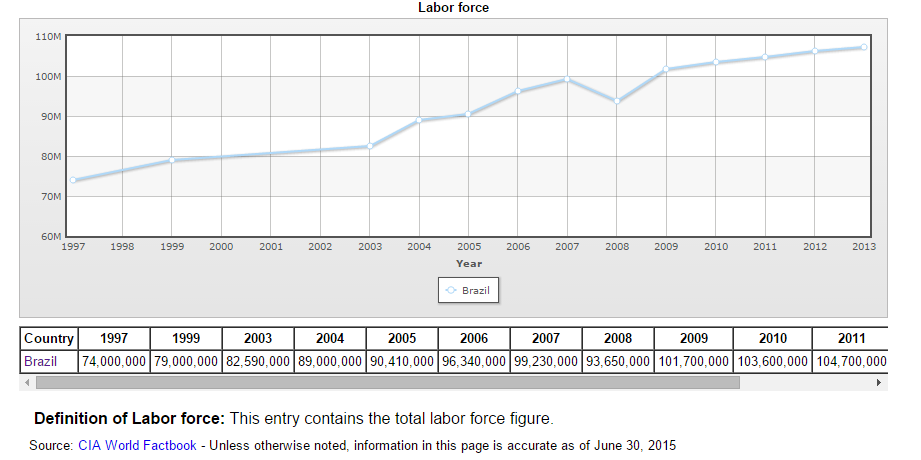

1.1.1 Working population

1.1.2 Working population in different industries

Agriculture 20%, industry 14%, services 66%

1.1.3 Unemployment rate

The unemployment rate is 7.50%

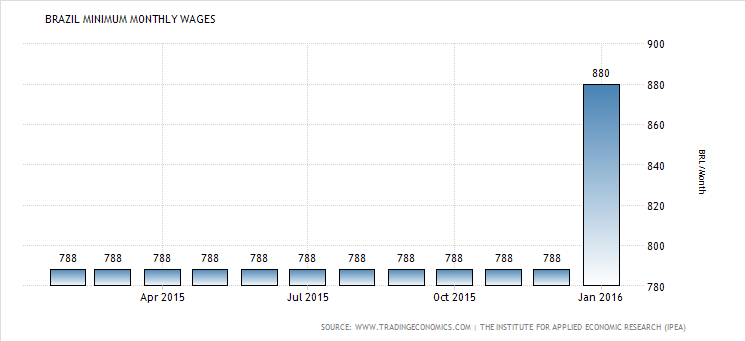

1.1.4 Comparison of wage

Minimum Wage comparison in Latin America

Country

Wage in Dollars

Wage in Local Currency

Basic Food Basket

Coverage

Colombia

$215

$ 689.450,00 + $ 77.000 (Transport payment)

$ 1.300.000

58.96%

Panamá

$744

$ 744,00

$ 322,00

231,05%

Costa Rica

$512

$288,386.69

$50,028

576,45%

Argentina

$448

$6,060

$4,000

151,50%

Cuba

$23

26,5

25

106,00%

Chile

$350

$250.00

$137.46

181,87%

México

$120

$ 2.220.41

$2.86

77,62%

Uruguay

$422

$11.15

$3.37

330,86%

Ecuador

$366

$366

$481

76,09%

Venezuela

$ 714 (48 dollars changing to SIMADI)

$ 9.648,18

No updated data

-

Brazil

$212

$880

$400

220,00%

Dominican Republic

$ 288 (maximum value on the scale)

$12.87

$27.81

46,29%

Peru

$218

$750

$1.52

49,50%

El Salvador

$251

$251

$200

125,50%

Bolivia

$238

$1.66

$1.07

154,62%

Nicaragua

$115

$7.13

$12.28

58,10%

Honduras

$341

$7.76

$7.76

100%

Paraguay

$320

$ 1.824.055

$ 3.656.266

49,89%

Guatemala

$369

$ 2.747,06

$3.41

80,67%

-

1.2 Labor Union and labor dispute

1.2.1 Labor Unions[In Brazil, labor unions are the direct result of a change in the economic scenario. By the end of the 19th century coffee was no longer the main economic activity and in the 20th century Brazil was entering the industrial world.

Labor unions are also involved in agreements regarding holidays, labor gymnastics, working hours and wage raise. One of the major causes of the labor unions nowadays is the reduction of working week from 44 to 40 hours.

Major labor unions in Brazil are:

· Sindicato dos bancários (banker’s association);

· Sindicato dos metalúrgicos (metal worker’s association);

· Sindicato dos comerciários (commerce worker’s association);

· Sindicato dos professores (teacher’s union).

Benefits to the affiliates

In order to attract affiliates, labor unions offer several benefits to their members. The most common are:

College tuitions discounts;

Leisure activities such as resorts, water parks and discounts for gym memberships;

· Health insurance discounts;

· Partnership with several educational institutions;

· Dental plans discounts;

· Legal services;

· Drug stores discounts;][1]

1.2.2 Situation of labor dispute

1.2.3 Procedure of solution of labor dispute

[The Labor Judiciary is a specialized and largely independent branch of the general judiciary. It acts as moderator in questions arising between employers and employees. The system is structured with three levels:

· First Instance — Municipal-level conciliation and judgement courts.

· Second Instance — Regional courts in major cities.

· Final Instance — Superior Labor Court (TST) in Brasília.

The principal attributions of the Labor Judiciary, as defined by Article 114 of the 1988 Federal Constitution, are:

· To hear and rule on formal complaints, mainly initiated by employees.

· To act as mediator in collective agreements between employee and employer unions, when required.

· To hear public civil actions initiated by the Public Prosecutor (Ministério Público).][2]

-

1.3 Employment practice and labor management

1.3.1 Welfare[Bolsa Família (Family Allowance) is a social welfare program of the Brazilian government, part of the Fome Zero network of federal assistance programs. Bolsa Família provides financial aid to poor Brazilian families; if they have children, families must ensure that the children attend school and are vaccinated. The program attempts to both reduce short-term poverty by direct cash transfers and fight long-term poverty by increasing human capital among the poor through conditional cash transfers. It also works to give free education to children who cannot afford to go to school to show the importance of education.][1]

-

-

-

2.1 Labor Standards Act

2.1.1 Basic principles of Labor Standards Ac2.1.1.1 Principle of priority to worker protection

[Consolidation of Labor Laws (Consolidação das Leis do Trabalho (CLT)) is legislative standard Brazilian relating to labor law and procedural labor law.

The Consolidation of Labor Laws, and Decree-Law No. 5,452, of May 1 of 1943 is composed of eight chapters covering and specify rights of most Brazilian labor groups. In its 922 articles are found information as: professional identification, duration (day) of work, minimum wage , vacation yearly, safety and occupational health , labor protection of women and the child, social security and regulations of trade unions of the working classes.][1]

2.1.1.4 Principle of continuation of employment relationship

[The Labor Law establishes the continuity of the employment agreement and this factor enables the worker’s integration into the company’s structure, acquiring economic and social safety, thus attaining improvement in the labor conditions, which is the teleological goal of Labor Law.

The employment agreement may be amended, provided that observing the provisions of article 468 of the Labor Code, to assure to the employee evolution within the company and to keep it effective.

The labor agreement may also be maintained despite the existence of a breach of obligations by one of the parties or nullities. The breach must be of a grave nature to lead to the termination of the agreement and such grave events are, by rule, described in articles 482 and 483 of the Labor Code, which address the events that constitute grave fault by the employee and by the employer, respectively, and authorize termination for just cause.][2]

2.1.2 Regulations on labor standard

2.1.2.1 Union labor law

[Article 8 of the Constitution provides for freedom of association or professional association. The union is regulated in Title V - "From the Union Organization" Consolidation of Labor Laws, as amended. Law 11,648 / 2008, dated March 31 regulates the unions. In Brazil trade union organizations of employers and workers. The structure is vertical (unions, federations and confederations) in both cases.][3]

2.1.3 Legislative system on wage

2.1.3.1 Minimum wage

Minimum Wage in Brazil is $212 dollars, $880 Reales.

-

2.2 Contract of employment and work regulations

2.2.1 Conclusion of contract of employment[A contract for an indefinite term can only be broken upon prior notice to the other party. Failure by the employer to do so, without the presence of any of the legally recognized grounds for dismissal (which we shall call "justified causes") entitles the employee to certain rights for breach of contract (see item '3' below). No indemnity is payable to an employee on termination of his/her employment after expiration of a fixed-term contract. But if the employee is unfairly dismissed during the course of the contract, he/she is entitled to an indemnity of half of the salary due to him/her for the unexpired portion of the contract. On the other hand, if it is the employee who rescinds the contract, he/she is liable to indemnify the employer for any loss resulting from this breach of contract.][1]

2.2.2 Contract of employment

[The employment may be contracted orally or in writing. In Brazil, however, employment contracts in writing are usually adopted as a legal guarantee. Trial employment contracts in writing are mandatory.

An employment contract may establish whether the period of employment is definite or indefinite. A contract for an indefinite period is one in which the parties do not stipulate any termination date. The great majority of the employment contracts in Brazil are of this type.][2]

2.2.3 Cancellation of contract of employment

[According to Brazilian law, employment contracts may be terminated if the employer has justified cause. Below are the cases which may give rise to termination of employment by a justified cause:

- any dishonest act;

- lack of self-restraint or misconduct;

- the employee's doing regular business on his/her own account or on behalf of third parties without the employer's consent, or whenever there is a conflict of interest between any such activities and those of the employer to the detriment of the latter;

- the employee's criminal prosecution in final judgment, provided that the penalty has not been pardoned;

- sloth in the employee's performance of his/her duties;

- regular intoxication, or intoxication during working hours;

- violation of trade secrets;

- any act of indiscipline or insubordination;

- abandonment of employment;

- any act detrimental to the honor or reputation of any person, practiced during working hours, as well as physical violence practiced under the same conditions, except in case of self- or third-party defense;

- any acts detrimental to the honor or reputation of the employer or ranking superiors, or physical violence against them, except in the case of self- or third-party defense; and

- constant gambling.][3]

- any dishonest act;

-

-

-

3.1 Social security law

3.1.1 Scope of application[According to the article 201 of the Federal Constitution the Brazilian government is obliged to provide its insured workers financial conditions to live, once they lose their labor capability. In Brazil, the Social Security system is managed by three institutions:

- Social Security Ministry

- Instituto de Seguridade Social (INSS)

- Superintendência Nacional de Previdência Complementar (PREVIC)

Every month, workers have part of their salaries discounted from their payroll by way of INSS. If the person is employed accordingly to the CLT laws, the INSS contribution is discounted automatically. If he is an independent contractor, he will have dedicate himself part of his salary to INSS, as an individual contributor. It provides several types of benefits and aids to the insured workers. Each of the benefits will require a different process of application. This is the most important:

-Retirement due to age (Aposentadoria por idade)

-Disability Retirement (Aposentadoria por invalidez)

-Retirement due to contribution time (Aposentadoria por tempo de serviço)

-Special retirement (Aposentadoria especial)

-Sickness Aid (Auxílio-doença)

-Accident Aid (Auxílio-acidente)

-Reclusion Aid (Auxílio reclusão)

-Pension due to death (Pensão por morte)

-Maternity leave (Auxílio maternidade)

-Social Assistance to the Elderly and Disabled][1]

3.1.2 Insurance premiums

3.1.2.1 Pension eligibility

[Age pension (social insurance): The monthly benefit is 70% of the insured's average earnings plus 1% of average earnings for each year of contributions, up to 100%.For persons first insured before November 29, 1999, average earnings used to calculate benefits are based on the best 80% of monthly earnings since July 1994. For persons first insured after November 28, 1999, average earnings used to calculate benefits are based on the best 80% of total monthly earnings. Insured persons may opt for the pension to be calculated using the Factor Previdenciario method. The Factor Previdenciario is an actuarial coefficient based on the insured's contribution rate, contribution period, age, and life expectancy. The minimum monthly earnings used to calculate benefits are the legal monthly minimum wage (545 reais). The maximum monthly earnings used to calculate benefits are 3,691.74 reais. The minimum monthly age pension is the legal monthly minimum wage (545 reais). The maximum monthly age pension is 3,691.74 reais. Schedule of payments: Thirteen payments a year. Benefit adjustment: Benefits are adjusted annually according to changes in the consumer price index. Contributory pension (social insurance): 100% of the insured's average earnings are paid. For persons first insured on or before November 28, 1999, average earnings used to calculate benefits are based on the best 80% of monthly earnings since July 1994, multiplied by the Factor Previdenciario. For persons first insured after November 28, 1999, average earnings used to calculate benefits are based on the best 80% of total monthly earnings, multiplied by the Factor Previdenciario. The Factor Previdenciario is not applied to arduous work with 15, 20, or 25 years of contributions. The Factor Previdenciario is an actuarial coefficient based on the insured's contribution rate, contribution period, age, and life expectancy. The minimum monthly earnings used to calculate benefits are the legal monthly minimum wage (545 reais). The maximum monthly earnings used to calculate benefits are 3,691.74 reais. The minimum contributory pension is the legal monthly minimum wage (545 reais). Schedule of payments: Thirteen payments a year. Benefit adjustment: Benefits are adjusted annually according to changes in the consumer price index. Old-age assistance (social assistance): The monthly benefit is the legal monthly minimum wage (545 reais). Benefit adjustment: Benefits are adjusted annually according to changes in the minimum wage.][2]

3.1.3 FGTS

[The Fundo de Garantia do Tempo e Serviço, also known as FGTS, which is the Severance Indemnity Fund for employees. It was created in 1967 by the Federal Government to protect the worker fired without just cause with the objective of forming a capital resource to the help the following workers:

- Workers ruled by the Consolidação das Leis de Trabalho, known as CLT, which is a legislative decree that establishes work rules in Brazil

- Rural workers.

- Temporary workers.

- Freelance workers.

- Diretor não empregado: in Brazil the employee designated to become the company director has his work agreement suspended, because he cannot occupy the position of an employee and an employer at the same time. The worker is deemed as diretor não empregado. In order to guarantee workers’ rights, he will be still subject legally to the company.

- Professional athletes.

- Domestic maids: are not mandatory included in the FGTS, the fund should be paid if the employer desires to.

The account balance of FGTS is formed by monthly deposits made by the employer equivalent to 8% of the employee’s salary. The deposits are mandatory and must enter into each worker’s account by the 7th day of the month. The fund must be deposited in any branch of the bank Caixa Econômica Federal, or in financial institutions accredited by the government, such as Lotéricas and internet banking services.][3]

3.2 Industrial Accident Insurance Act

[SAT is the Accident Insurance granted to workers, providing financial aid in case of an accident or any other harmful situation that might occur in a working situation. In this article you are going to understand how this insurance is applied.

The contribution to SAT focuses on compensation paid by companies to their employees and temporary workers. It is calculated based on two rates called Occupational Accident Risk or RAT and the Accident Prevention Index or FAP.

These rates vary according to the degree of risk in your job. The percentages are determined according to the risks involved in a jobs activity:

· 1% applied for low risk work activity

· 2% applied for medium risk activity

· 3% applied for severe risk activity][4]

- Social Security Ministry

-

-

-

4.1 Work permit for foreigners

In order to have a remunerated job in Brazil you will need both a residence permit (either temporary or permanent) and a work visa (Autorizaçao de Trabalho).4.1.1 Obligation to acquire a work visa

4.1.1.1 Acquirement of a work visa

[In order to apply for the work permit your future employer will have to submit your CV, certificates, documents stating your education and work experience and a certified copy of your passport at the Coordenação de Imigração do Ministério de Trabalho.

The submission of further documents will depend on the type of work visa you will be applying for.

All the documents to be approved by the Brazilian authorities have to be translated into Portuguese and certificated before being submitted. The approval will then be sent to the Ministry of Foreign Affairs who will authorize the responsible Brazilian embassy or consulate in your home country to start the work visa procedure.

To apply for a work visa in your home country you have to submit your passport with a remaining validity of minimum 6 months, two application forms which are available in the consulate, two passport-sized photos and a police report stating you hold no criminal record (not older than 3 months).][1]

4.1.1.2 Business visa

[Business Visa and other specific situations (VITEM II)

I. Visits to firms and companies in Brazil with the purpose of:

· signing contracts;

· conducting administrative and financial auditing;

· purchasing products and services, and

· Investigating the existence of business opportunities in Brazil.

II. Other possible situations:

· journalists (short term stays, with or without filming);

· production of media reports (with or without filming);

· adoption of Brazilian children, and

· crew members of a sea vessel without the international seamen's identification card][2]

4.1.1.3 Short-stay visa

[Tourist Visa (VITUR)

• touristic trip;• Visit to relatives and/or friends for a short period of time;

• Scientists, professors or researchers attending cultural, technological or scientific conferences and seminars, and

• Participation at artistic or amateur sport competitions, whenever no monetary prize or paid admission is involved.][3]

4.1.1.4 Permanent residence visa

[Permanent Visa (VIPER)

• Family reunion;• Transfer of residence to Brazil following retirement, and

• Personal investment in Brazil.][4]

4.1.2 Requirements for acquiring a visa

4.1.2.1 Necessary documents to apply for a work visa in Brazil

· [Work Permit Application Form

· Applicant and Candidate Form

· Officially delegated power of attorney, or with a notarized authenticated signature in the case of a private application, if the applicant is represent by an attorney

· GRU - State Revenue Collection Guide including proof of payment of the individual immigration tax of BRL 16,93 for the foreign citizen and each of his/her dependents

· Legible non-notarized copy of the foreign passport's identification pages, containing the number, name, date of birth, nationality and the photograph

Also, many occupations require that the foreigner presents a signed document taking full responsibility for all medical and hospital expenses incurred by him or his dependents during the stay in Brazil.][5]

4.1.2.2 Necessary documents to apply for a work visa in Japan

· [Original passport

· Passport-type photograph

· ID and a proof of address

· For some countries, such as the US, a photocopy of round trip tickets or a letter signed by a travel agent with confirmed round trip tickets will be required

· Yellow Fever Vaccination for those who had been to one of the Yellow Fever Countries within 90 days

· If you are attending a conference or a seminar, you must present a letter of invitation from the organization in Brazil that is hosting the event and a day-by-day itinerary of the event

· A copy of the most recent monthly bank statement, showing the applicant's name as the account holder, the balances of the accounts and the date of the statement.][6]

-

4.2 Social insurance for employees assigned to an abroad office

4.2.1 Social insurance4.2.1.1 Continuation and loss of the rights to be insured

[Brazil has an extensive social security system to which everyone working in Brazil is obligated to contribute, including expats. Social security contributions are paid by both employee and employer. Between 8 and 11% of the employee’s pre-tax salary is deducted for social security by the Ministry of Social Affairs (Ministério da Previdência Social).

With a small number of countries, such as Chile, Greece, Italy, Luxembourg, Spain, and Portugal, Brazil has entered into specific social security agreements. The government has also signed such agreements with Belgium, Germany, and Japan, but these have not been ratified yet. Although nationals from these countries usually have to contribute to the Brazilian social security system, their contributions may be taken into account when calculating benefits in their home country after their return.][1]

4.2.1.2 Agreement of social insurance

[Any legal citizens, including foreign residents, are entitled to free healthcare at a public clinic or hospital by producing an RG (Brazilian identification card) and an SUS card (Cartão SUS).][2]

4.2.1.3 Use health insurance from your country abroad

[With a small number of countries, such as Chile, Greece, Italy, Luxembourg, Spain, and Portugal, Brazil has entered into specific social security agreements. The government has also signed such agreements with Belgium, Germany, and Japan, but these have not been ratified yet. Although nationals from these countries usually have to contribute to the Brazilian social security system, their contributions may be taken into account when calculating benefits in their home country after their return.][3]

4.2.1.4 Continuation of health insurance system

[Another option in Brazil is to use coverage from back home. Depending on where you live, you may find that your current health insurance provider has participating doctors and hospitals in Brazil].[4]

4.2.1.5 Special participation of Industrial Accident Insurance Act

[The contribution to SAT (Accident Insurance) focuses on compensation paid by companies to their employees and temporary workers. It is calculated based on two rates called Occupational Accident Risk or RAT and the Accident Prevention Index or FAP].[5]

4.2.2 Overseas travel insurance

4.2.2.1 Things to do when employees go to a foreign office

[Brazilian citizens are required to present an ID card (RG) and in 49% of the Brazilian municipalities, a proof of residence. If the RNE or the passport will be accepted as an ID card, it depends on the municipality. To get a private health insurance, a CPF (CPF is a document that identifies a taxpayer at the Federal Internal Revenue Department. The CPF carries registration information supplied by the individual and by the Federal Internal Revenue Department database.) Number is required. Foreigners who do not have a CPF number may present the RNE (Foreigners registration). If you are getting a health insurance for your kids, you will need to issue their CPF as well. A problem present in both public and private health care providers in Brazil is the lack of staff who speaks English. With the exception of a few sophisticated medical centers, foreigners will hardly find someone who speaks English and in most cases will have to take a Portuguese speaker with him when going to see a doctor.][6]

[1]https://www.internations.org/brazil-expats/guide/working-in-brazil-15371/social-security-and-etiquette-in-brazil-2

[2] http://brazil.angloinfo.com/healthcare/health-system/

[3]https://www.internations.org/brazil-expats/guide/working-in-brazil-15371/social-security-and-etiquette-in-brazil-2

[4] https://internationalliving.com/countries/brazil/healthcare/

[5] http://thebrazilbusiness.com/article/mandatory-insurance-for-work-accidents

[6] http://thebrazilbusiness.com/article/healthcare-in-brazil

-

4.3 The way to decide wage and the examples to calculate wage

4.3.1 Differences of wage between Japan and Brazil4.3.1.1 Comparison of tax rate of Japan and Brazil

-In Brazil: $880 Reals per month $224 USD

-In Japan: 308.673 yen per month $2,616.62 USD

-

-

-

References:

http://www.tradingeconomics.com/

https://www.linkedin.com/pulse/brazilian-labor-relation-carlos-humaire

http://www.empleo.gob.es/es/mundo/consejerias/brasil/trabajar/contenidos/admonlab.htm

http://www.mondaq.com/brazil/x/2339/Employment+Rules+And+Regulations+In+Brazil+An+Overview

https://www.ssa.gov/policy/docs/progdesc/ssptw/2010-2011/americas/brazil.html

https://www.justlanded.com/english/Brazil/Brazil-Guide/Visas-Permits/Work-visas

http://www.cgbrasil.org/Templates/InsideTemplate.aspx?PostingId=267

http://brazil.angloinfo.com/healthcare/health-system/

https://internationalliving.com/countries/brazil/healthcare/

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya