Brazil

5 Chapter Accounting

-

-

1 Chapter Basic knowledge

1.2 Political System and History

2 Chapter Investment Environment

3 Chapter Incorporation

3.1 Feature of Business Location

3.2 Establishment of Business Location

3.3 Liquidation and Evacuation (Dissolution) of Company

4 Chapter M&A

4.2 Laws and Regulations Concerning M & A

5 Chapter Accounting

6 Chapter Labor

6.4 Points that Should Pay Attention to When Japanese Assigned to a Foreign Office

7 Chapter Q&A

-

-

-

1.1 Overview of accounting system

[Brazilian accounting standards are inspired by the American model, and are regulated by the Federal Accounting Council CFC and Law 6,404 of December 15th, 1976. Tax year begins on January 1 and ends on December 31 of the same year. According to the American model, the financial statements must contain at least one book different variations equity reserve account and the remainder to new account, a book of cash flows and notes thereto.[1]]Accountancy associations and groups.

· Comitê de Pronunciamentos Contábeis (CPC)

-

1.2 Publicly-owned company and Privately-owned company

1.1.1 Publicly-owned company and Privately-owned company[In Brazil, the most common business entities are corporations (Sociedade anonima “SA”) and Limited Liability Companies (Sociedade Limitada “Ltda”). Publicly held companies (“Limitadas”) are usually Limited companies and represent the most common type of business entity. Publicly traded companies must be corporations. Only shares of a corporation may be traded on a Stock Exchange.

Privately held corporations must publish their financial statements annually. Publicly traded corporations must issue quarterly reports and publish their audited financial statements annually. The Brazilian Stock Exchange has four corporate governance segments: Levels 1 and 2, Bovespa Mais, and Novo Mercado. Each segment has different requirements. Banks and insurance companies must publish their audited financial statements twice a year. Financial statements must be prepared in Portuguese and expressed in Brazilian currency (BRL, Reais).][1]

1.2.2 SPED

[SPED – Sistema Público de Escrituração Digital -, was created to standardize and computerize the relationship between the tax authorities and the tax payers. SPED consists of the modernization of the current procedures used to duties compliance transferred from the tax payers to the regulatory agencies. The signature of the document is made through a digital certification that restricts the juridical validation of the document to its digital form.

The system started to be developed in the year 2000 and was part of an initiative to modernize tax and customs administration. It began to be used by some companies in 2008 and in 2009 it was adopted by most companies taxed by Lucro Real.][2]

1.2.3 Obligation of reserving book

[Commercial companies must publish a balance sheet, income statement and all the information necessary to make reference to the financial health of the company annually. The documents are examined within 60 days prior to the annual general meeting of shareholders.][3]

1.2.4 Accounting period

January 1 and ends on December 31 of the same year.

-

1.3 Accounting system in Brazil

1.3.1 Introduction of international accounting system[Brazilian accounting standards were adapted to IFRS progressively, from 2008 to 2010.

The amendments contained in Law No. 11.638 represent a major step and the initial starting point of the convergence process of Brazilian accounting practices towards International Financial Reporting Standards (IFRS). The law states that accounting standards issued by the Securities and Exchange Commission of Brazil (CVM, “Comissão de Valores Mobiliários”) must be in compliance with IFRS.][1]

1.3.2 Companies that can apply to Brazilian accounting system

[Companies that operate in specialized business sectors must comply with specific accounting practices established by the regulatory agencies for these sectors, such as: SUSEP (Insurance) ANEEL (Energy), or ANS (Health). Most of these agencies have initiated their convergence process towards IFRS.][2]

-

-

-

2.1 Overview of disclosure system

[On December 7, 2009, the Brazilian Securities and Exchange Commission (Comissiio de Valores Mobilidrios-CVM) released CVM Regulation n. 480 (the "Regulation"), providing for a consolidated set of new rules for registration, delisting, and disclosure-related rules applicable to publicly traded corporations (companhias abertas), which includes securitization companies and other issuers of securities main objectives of the Regulation, namely: (i) the creation of two categories of securities issuers (A and B), with different regulatory regimes applicable thereto; (ii) the adaptation of Brazilian disclosure standards for the shelf-registration system, which replaces the Annual Information Form (Formulario de Informa(:oes Anuai-IAN) with the Reference Form (Formuldrio de Referenda); (iii) new rules to define a foreign issuer permitted to have Brazilian Depositary Receipts ("BDRs") offered and traded in Brazil; and (iv) a new status of issuer-the issuer with high market exposure, or "EGEM" (emissor com grande exposi(:iio ao mercado)-designed to provide a fast-track structure for public offerings, similar to the concept applied in the U.S. to the WKSls (well-known seasoned issuers). ][1]

[1] New Disclosure Rules for Brazilian Issuers of Securities, NYSBA New York International Chapter News, Summer 2010, Vol.15. No. 1

-

2.2 Flow of disclosure system

[According to this registration system, all information concerning the issuer is brought together in a single document that the IOSCO calls a "shelf document" and the CVM designates as the Reference Form-to be filed with the competent governmental authority, and regularly updated, usually once a year. When performing a public distribution of securities, the issuer is then required to prepare only one additional document, relatively short, in comparison to the former "prospectus," which IOSCO calls an "offering note." The CVM designates the supplement, which describes the specificities of the securities and the offering, and incorporates by reference information contained in the issuer's shelf document.][1]

[1] New Disclosure Rules for Brazilian Issuers of Securities, NYSBA New York International Chapter News, Summer 2010, Vol.15. No. 1

-

-

-

3.1 Internal audit system

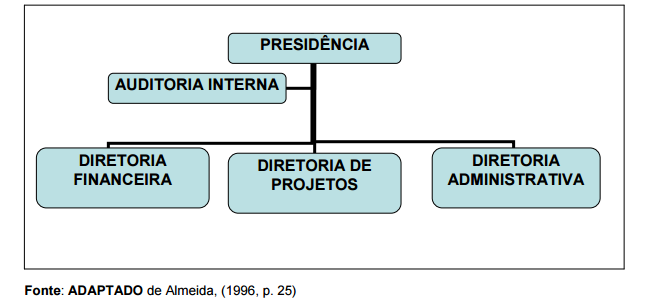

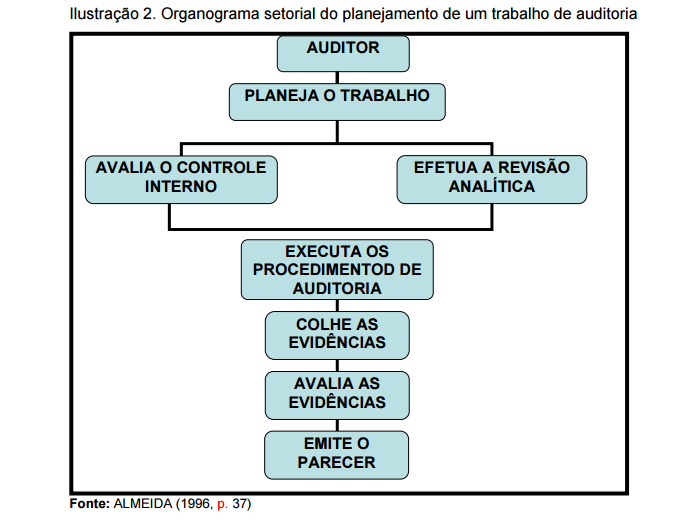

[With the expansion of business enterprises have had the need to a person as well as review the internal controls and procedures operating also help in the administration and execution of activities. Then, came the internal auditor to conduct a more regular audit, more degree of depth and also aiming at other areas not related to accounting, to check if the internal rules are being followed. At the same time the internal auditor performs accounting audit. The internal auditor is an employee of the company, has to perform audit accounting and operational processes and should have some independence within the entity. If the auditor is a subordinate to the accounting or administrative department, may come under pressure when performing their jobs. To have the highest possible independence, must be subordinated to the presidency of the company. In big companies, there is a real Internal Audit department. The work of the internal auditor helps the company planning strategic moves to achieve higher performance in the plans, goals, objectives and policies drawn by the company.][1] -

3.2 External audit system

3.2.1 Duty of audit[The external auditors came up with the need that investors had to have information on the veracity of financial statements that the company features. With this, investors began to demand that the statements of company were examined by an independent professional who had no employment contract or relationship with the company, ensuring any kind of no personal interference in its opinion. This professional is the external auditor with the greatest degree of independence and performs the accounting audit.] [1]

[Upon detecting errors or fraud in the course of their work, the auditors have the obligation to communicate them to the management of the entity and suggest corrective measures, reporting on the possible effects in its opinion, if the corrections were decided to be not adopted.][2]

[1] Auditoria Interna e Externa, Gisele Cristiane Galo, Roseli Aparecida de Oliveira Barbosa.

[2] http://thebrazilbusiness.com/article/accounting-audit-in-brazil

3.2.2 Context of audit

[Listed companies, government-owned companies, financial institutions, insurance companies and legal entities applying for public funds must engage independent auditors registered with the CVM. Independent auditors are appointed or dismissed by the Board of a corporation (conselho de administracão). Independent auditors must attend the annual shareholders’ meeting.

Privately held companies, such as corporations (SAs) or limited companies (Ltdas) are not subject to any audit requirements in Brazil, unless they are large companies (as defined previously) or participate to public bids requiring the communication of audited financial statements. In practice, most of Brazilian subsidiaries of international foreign groups are audited for consolidation purposes.

Due Diligence process

The performance of Due Diligence procedures previously to any transaction is of critical importance in Brazil, taking into account that privately held companies are not subject to any audit requirement.][1]

-

3.2.3 People who have qualification of audit

[Accountants must be registered with one Regional State before initiating public practice. Only certified public accountant in Brazil (Contador registrado) may sign audit reports. Accountants must also be registered in the Cadastro Nacional dos Auditores Independentes (CNAI) and at the CVM in order to hold an executive position in public companies and financial institutions audits.][1]

-

-

-

References:

Auditoria Interna e Externa, Gisele Cristiane Galo, Roseli Aparecida de Oliveira Barbosa.New Disclosure Rules for Brazilian Issuers of Securities, NYSBA New York International Chapter News, Summer 2010, Vol.15. No. 1

http://www.cesarramos.com/ENG/accounting-and-auditing-in-brazil/

http://thebrazilbusiness.com/article/accounting-audit-in-brazil

https://es.santandertrade.com/establecerse-extranjero/brasil/fiscalidad

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya