Egypt

2 Chapter Investment Environment

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

3 Chapter Corporate Law

4 Chapter Tax Law

5 Chapter Accounting

-

-

-

Economic Trend

Egypt has achieved economic growth of 5% on average in the period of 1993 to 2010 and has been hailed as an emerging country representing MENA (Middle East / North Africa Region), but political turmoil and security continuing from 2011 The economic downturn happened due to the deterioration of the economy. However, in the 2020s it is a population large country that surpasses 100 million people, the potential as a major power of the region playing a central role in Arab / Africa, which is expected to grow in the future, is high, and the success or failure of political stability is the key.

■ Changes in GDP and Economic Growth Rate

Since the beginning of the 21st century the economy grew due to the economic reform progress and the booming economy of the Arab oil-producing countries due to the high oil prices, and the economy grew at the high growth rate of 7% in 2007 and 2008, and per capita GDP Also increased greatly.

On the other hand, citizens' dissatisfaction is high due to the high inflation rate, the unemployment rate, the widening gap between rich and poor, and it will be a situation that has social unrest. Starting from the "Arab Spring", the Mubarak administration will end with the "January 25 Revolution" in 2011, after which the political turmoil and the uncertain social situation will continue. Stagnation of the tourism industry, which is a major industry, a sharp decline in foreign investment, and so on, the economy fell sharply. Under the Muslim regime with the Muslim Brotherhood as its support base, 2012 remained at a growth rate of 1.8%, which is lower than the population growth rate, and in 2013 and 2014 it also fell to the 2% level.

However, there are signs of economic recovery since the latter half of 2014 due to the transition to the El-Sisi regime in June 2014 after the interim administration by the coup and large-scale economic support from the Gulf countries. In spite of repeated political change, domestic consumption trends are strong, and it is thought that growth is expected again if security recovers. The GDP growth rate in the first half of 2015 is in good condition with 4.3% (Egyptian planning ministry), and the IMF predicts GDP growth rate in 2015 to 4.2%..png) Source: IMF "World Economic Outlook Database, October 2015"

Source: IMF "World Economic Outlook Database, October 2015".png) Source: IMF "World Economic Outlook Database, October 2015"

Source: IMF "World Economic Outlook Database, October 2015"■ National finance

Egypt has a chronic fiscal deficit constitution since the Nasser Era, where Arab socialism has been raised, and has been trying to rebuild it repeatedly by IMF loans etc. In the latter half of the 2000s, the economy began to record high growth and the ratio of budget deficit to GDP was down to the 7% level despite its high level. However, the fiscal burden such as subsidies for fuel and food items that are as much as a quarter of expenditures, civil servant salary, interest payment, etc. are large, and the fundamental deficit constitution has been inherited without fundamental solution being made.

Since the political change in 2011, the Mursi regime has drafted a policy of reducing the fiscal deficit by austerity finance and requesting the IMF to finance based on that condition. However, as the political situation is unstable, it is difficult to conclude such as reducing energy subsidies, negotiations with the IMF have not been concluded, and in 2013 the government was lost.

The provisional administration after the coup in 2013 and the El-Sisi regime have laid out a completely different policy from the Mursi regime. Firstly, we have supported US $ 12 billion from Saudi Arabia, UAE and the three Gulf coasts of Kuwait. By doing so, we adopted an expanded fiscal policy that promotes growth by targeting economic stimulus measures and aims to increase tax revenue while avoiding fiscal deterioration and macroeconomic instability. In August 2013 right after the inauguration of the provisional administration, fiscal announcement of 3.2 billion dollars has been announced for the infrastructure improvement of roads, houses, electricity transmission networks, etc.

At present, the budget deficit continues to increase, and the ratio of GDP is at worst, 14.1% in 2013 and 13.6% in 2014. However, since the second half of 2014 the economy is getting better, in August 2015 it was possible to hope for an increase in the toll fee due to the advancement of the second Suez Canal ahead of time, although it is provisional, there is also a favorable material such as the beginning of institutional reform, and the Egyptian government expects the fiscal deficit to be 8.9% of GDP in 2015/2016 budget. The progress of reforms such as the full-scale subsidy system and tax system in the future is attracting attention..png) Source: IMF "World Economic Outlook Database, October 2015"

Source: IMF "World Economic Outlook Database, October 2015"■Inflation rate

Egypt's inflation rate was moderate at the 2 - 3% range in the first half of the 2000s, and it has been tolerated as inflation in the high growth period although it was in the 10% range since 2007 when high economic growth was recorded. However, the Egyptian economy has a high degree of external dependence in trade and investment, and has been greatly affected by the rise in international grain prices since 2009. In particular, we imported half of the staple foods, and in 2009 the inflation rate rose to 16.2% due to the effect of soaring wheat prices and other factors.

Also, as Egyptian pounds continue to decline over the long term reflecting the weakness of the macroeconomic economy, there is a continuing situation where import prices are rising and it is not possible to escape from high inflation and the situation of social unrest It is a big factor.

.png) * Consumer price index is an index with 2000 as 100Source: IMF "World Economic Outlook Database, October 2015"

* Consumer price index is an index with 2000 as 100Source: IMF "World Economic Outlook Database, October 2015" -

Trade

The amount of trade in Egypt has increased with economic growth, but the import value always exceeds the export value, so the trade deficit is becoming current. Also, although exports have doubled in the past 10 years, imports have further expanded sharply and tripled, so the trade deficit value continues to increase. In 2014, the deficit was further expanded to US $ 44.5 billion as exports and imports increased from the previous year.Background of the chronic trade deficit is economic quality that relies heavily on imports for foodstuffs such as wheat, which is the main cereal, and for industrial raw materials and equipment. In addition, Egypt is the largest non-OPEC producer of oil, but it is partly due to the fact that it turned into a net importer in 2008 due to the rapid increase in domestic demand. For this reason, various initiatives such as attracting and cultivating export industries such as the automobile industry, exploration and development of petroleum and natural gas, efficiency improvement of small-scale, low-productivity agriculture have been carried out.Since the political change since 2011, the series of reforms has been in a trampling situation, however, there are signs of recovery in the economic activities under the administration of Elsie, so the movement toward expanding exports in the future is drawing attention. In 2015, a huge gas field was discovered in the Mediterranean seaside area, and expectations are also being received for an increase in natural gas exports..png) Source: UNCTAD: United Nations Conference on Trade and Development■ Free Trade AgreementEgypt is active in free trade and in 1998 the Arab Free Trade Area: GAFTA / PAFTA (18 Arab countries including Saudi Arabia, UAE, Syria), Egypt · EU Union Association in 2004, Agadir Agreement in 2006 (Tunisia , Morocco, Jordan), EFTA (Switzerland, Norway, etc.) in 2007, FTTA with Turkey entered into the same year in the same year, building a free trade network widely around Europe and the Arab and Muslim sphere.■ Export (by country, by item)Looking at export destinations by country, the top is Italy (9.4%), then Saudi Arabia (6.8%), India (6.3%), Turkey (4.8%), Germany, the United States, the UK, France, UAE and Libya Continue. You can see the strong linkage with Egypt's geopolitical strengths, the Islamic cultural sphere and the European economic sphere. Especially in recent years, exports (41.3%) to Saudi Arabia, India etc. Asia · Middle East region increased, exceeding Europe (34.4%).By type of products, oil and natural gas are the most frequent, including more than 20% of exports, including related products, so it can be said that it is relatively sensitive to the international price of energy resources. However, there are diverse export items, mainly light industrial products such as clothing and plastic products, which is different from the typical oil-producing country economy.

Source: UNCTAD: United Nations Conference on Trade and Development■ Free Trade AgreementEgypt is active in free trade and in 1998 the Arab Free Trade Area: GAFTA / PAFTA (18 Arab countries including Saudi Arabia, UAE, Syria), Egypt · EU Union Association in 2004, Agadir Agreement in 2006 (Tunisia , Morocco, Jordan), EFTA (Switzerland, Norway, etc.) in 2007, FTTA with Turkey entered into the same year in the same year, building a free trade network widely around Europe and the Arab and Muslim sphere.■ Export (by country, by item)Looking at export destinations by country, the top is Italy (9.4%), then Saudi Arabia (6.8%), India (6.3%), Turkey (4.8%), Germany, the United States, the UK, France, UAE and Libya Continue. You can see the strong linkage with Egypt's geopolitical strengths, the Islamic cultural sphere and the European economic sphere. Especially in recent years, exports (41.3%) to Saudi Arabia, India etc. Asia · Middle East region increased, exceeding Europe (34.4%).By type of products, oil and natural gas are the most frequent, including more than 20% of exports, including related products, so it can be said that it is relatively sensitive to the international price of energy resources. However, there are diverse export items, mainly light industrial products such as clothing and plastic products, which is different from the typical oil-producing country economy..png)

.png) ■ Import (by country, item by item)Looking at imports, China (12.2%) ranked first, followed by the US (7.7%), Germany (6.1%), Italy (4.6%), Turkey (4.1%), And continue. It is characterized by imports of industrial raw materials such as petroleum products, steel and chemical products, intermediate goods, and grains such as wheat and corn. Egypt is the world's largest wheat importing country, and its reliance on the wheat in the Black Sea grain areas such as Russia, Ukraine, Romania is high, it is said that securing diversification and stable supply of imports is a challenge.

■ Import (by country, item by item)Looking at imports, China (12.2%) ranked first, followed by the US (7.7%), Germany (6.1%), Italy (4.6%), Turkey (4.1%), And continue. It is characterized by imports of industrial raw materials such as petroleum products, steel and chemical products, intermediate goods, and grains such as wheat and corn. Egypt is the world's largest wheat importing country, and its reliance on the wheat in the Black Sea grain areas such as Russia, Ukraine, Romania is high, it is said that securing diversification and stable supply of imports is a challenge..png)

.png)

-

Industry Trends

Looking at the industrial composition of Egypt by GDP ratio, the primary industry is 14.5%, the secondary industry 39.9%, the tertiary industry 45.6% (CIA forecast 2014). It is characteristic that agriculture is active and occupies most of the primary industry, in the secondary industry, manufacturing industry accounts for 15%, oil and gas account for 17% (2013/2014 Egypt Finance Ministry statistics), in the tertiary industry, sightseeing and wholesale and retail trade account for a large weight.

It is a great strength to have a well-balanced industrial structure that is rare in Africa, developed by agriculture, manufacturing industry and service industry. However, since the political change in 2011, the tourism sector and the manufacturing industry have declined greatly due to the sharp decline of foreign tourists and foreign investment. Also, production of petroleum is also declining.

There are signs of recovery in the second half of 2014, and recovery of security has become a situation where the demands of major industries can be expected.

■CarEgypt has been trying to promote export industries by attracting foreign factory automobile factories such as Sipole (GM) and Nissan since the 1980s. Since the accumulation of parts makers is weaker than in Turkey and eastern European countries, we increased the number of productions with the main knockdown production method as the main, exceeding 100,000 in 2007. However, triggered by the political change in 2011, foreign-affiliated companies such as GM raised capital and stopped and stopped the production line one after another. It declined to peak at 116,683 units in 2011, and declined to 30,000 in 2013. Together with stability of political situation, Toyota and others are resuming production, and in 2014 it has recovered slightly to 42,515 units.Countries with certain industrial base are limited in Africa and the Middle East, which is regarded as a future growth market, and Egypt as a production base for automobiles is expected as a gateway in these areas. Also, in Egypt where high unemployment rate is one factor of instability of security, the revival of supporting automobile production of supporting industries is an important issue in terms of expanding employment opportunities.Meanwhile, despite repeated political changes, domestic sales can be said to be steady. In Africa's third largest population, GDP per capita already exceeds US $ 3,000, which is a promising market where the spread of automobiles is rapidly progressing. While Chevrolet (GM), which is entering the market earlier, is the top share in 22%, Korean manufacturers are rapidly proceeding and Hyundai · Kia accounted for 21.6% in 2014. For Japanese manufacturers, Nissan is 10.4% and Toyota is 9% (2014)..png)

Source: OICA (National Federation of Automobile Industries Association)■ Tourism

Egypt tourism and related industries accounted for 12.8% of GDP (2014), and along with exports of oil and gas, toll tax of the Suez Canal, remittance from overseas, together with 1 of the main industries said to be the four pillars of foreign currency acquisition It is one.

Accompanied Egyptian ruins scattered in Luxor from Cairo / Giza along the Nile River In addition to sightseeing and desert tours, the resort development of Hurghada on the Red Sea coast and Sharm el-Sheikh on the Sinai Peninsula progresses, visitors the number continued to increase. Also, in addition to visitors from Europe and Arab countries, diversification was made by increasing number of resort guests from Russia.

In 2010, the number of visitors per year exceeded 14 million, tourism related revenue also recorded 12.5 billion US dollars. However, due to the political change since 2011, the tourism industry has declined greatly, and the number of visitors has been around 10 million. Signs of recovery were seen in 2015, but in November of the same year there was a case of a Russian plane crash from Sharm el-Sheikh, concerned that the most visits from Russia will be affected by the number of country visitors It has been..png)

Source: World Bank※ World Travel and Tourism Council 2014■ Agriculture

Agriculture in Egypt is about 15% (2013/2014 Egypt Ministry of Finance) in GDP, but occupies a quarter in the working population and agricultural products such as cotton and oranges are exported even in exports, and now But I can say one of the major industries. Cereal production such as rice and wheat, livestock production is also popular, and the production (amount) of date palm is known in the world, tomato (5th place), strawberry (5th place), orange (7th place), olive (8th place) etc It is.

95% of the land is Egypt in the desert, agriculture can be done in a belt-shaped area a few kilometers wide on both sides of the Nile called "Green Belt", delta area north of Cairo, only some oasis, it is said to be only 3.6%.

Most of the water resources necessary for agriculture depend on irrigation from the Nile because rain does not fall in the desert area. Since the completion of Aswan · High Dam (1970), irrigated farmland expanded dramatically and agricultural production also increased, but food demand due to population increase sharply increased, food self-sufficiency rate is low, many of major cereals It depends on imports. 40% of staple food wheat was imported, import volume of 1014 million tons was the world first in 2014.

In Egyptian agriculture, small farmers account for the majority, and improvement of productivity has become a long-term task. For that reason, various agricultural reforms such as privatization of agriculture related corporations, elimination of regulations on agricultural products, scale expansion by revision of land law have been carried out. In addition, development of agricultural land at the national level such as the large-scale farmland development project on the Sinai Peninsula and the large-scale farm development "Toshka Project" through the construction of a large canal to the oasis in the southern desert zone is proceeding.

■ Oil, natural gas

Egyptian oil and natural gas accounts for 17% of GDP and 20% of exports and is one of the most important industries as one of the four major foreign income sources together with sightseeing, remittance from overseas workers and Suez Canal Traffic Tax is.

[oil]

As a non-OPEC country, petroleum has been the largest producer for a long time, but due to the aging of oil field facilities and the stagnation of new oil field development, the production volume has reached a peak of about 700,000 barrels per day. Currently it is a net importing country due to domestic demand growth.

Regarding petroleum products, Suez, Alexandria, Ashut, Cairo etc. have a refinery by a subsidiary of state-run Egyptian Oil Company (EGPC: Egyptian General Petroleum Corporation), boasting one of the largest oil refining capacities in Africa. However, the occupancy rate is seen as about 60% (as of 2013) due to the aging of facilities and so on, and we are importing many petroleum products. As a result, the construction of a new refinery is under way, and there is also a refinery plan by the Egyptian Refining Company (ERC) scheduled to operate in 2016, a refinery and a joint project with Chinese companies, but concern about the uncertainty of progress There are also voices.

[Natural gas]

In the 21st century natural gas started to develop in the Mediterranean offshore sapphire and gas fields, simian and gas fields, and production increased significantly, in Africa it became the second largest gas producer after Algeria in Africa. Along with this, policies that prioritized domestic consumption will be transformed into export promotion. In the mid-2000s, the LNG plant began operating near the Alexandria and Mediterranean coasts such as Damietta, to Spain and other European countries, and to Egypt and Israel by pipeline.

Production volume of natural gas was also ceasing since political change, but in recent years the discovery of gas fields in Nile · Delta off the coast is one after another. BP (UK) found a deep sea gas field of 10 trillion cubic feet, Eni company (I) discovered a giant gas field of 30 trillion cubic feet in 2015 and said that it has an influence on international energy balance.

.png) Source: BP Statistical Review of World Energy, June 2015

Source: BP Statistical Review of World Energy, June 2015.png) Source: BP Statistical Review of World Energy, June 2015

Source: BP Statistical Review of World Energy, June 2015

-

-

-

Investment Environment in Egypt

■Current status of business environment From 2015The World Bank and the International Finance Corporation (IFC) have jointly announced the "Current Business Condition 2016" in June 2015. I will look at Egypt's evaluation of the world from this questionnaire.Egypt is 131th among the countries and regions where the overall ranking is 189 (126th in 2015). There is a big gap compared with Turkey (55th place), Tunisia (74th place), Morocco (75th place) of MENA (Middle East / North Africa region), and it is in low rank even worldwide..png) In the ranking of 2016, Egypt ranked higher than the overall ranking, "Start of business" "Construction permission procedure" "Asset registration" "Fund procurement" "Protection of investors" "Business withdrawal" It is 6 items.

In the ranking of 2016, Egypt ranked higher than the overall ranking, "Start of business" "Construction permission procedure" "Asset registration" "Fund procurement" "Protection of investors" "Business withdrawal" It is 6 items. -

Financial (stock) market

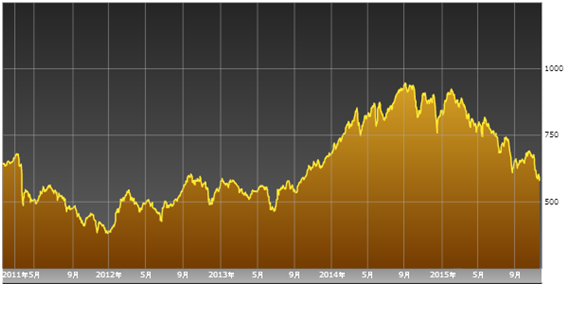

■ Stock marketThe Egyptian Stock Exchange, predominantly the Alexandria Stock Exchange and the Cairo Stock Exchange, is one of the world's historic stock exchanges. The market capitalization is $ 53 billion (as of November 2015), and the number of listed companies is 195 companies.In line with Egypt's economic growth, stock prices rose sharply from 2004 to 2008, but the global financial crisis and a sharp drop in crude oil prices caused the stock price to decline sharply. Due to the political turmoil in 2011, some financial institutions were closed and the exchange's management was temporarily suspended. Although the trend remained sluggish even after the resumption, when the military-led interim government was launched by the coup d'etat in July 2013, the market improved and the stock price rose. From the beginning of 2015 it is on a downward trend again due to the slowdown in economic recovery and the introduction of capital gains tax.【Trend of Egyptian Stock Exchange Stock Price (Hermes Index: HFI)】 Source: Bloomberg* Hermes Index (HFI): Egyptian Stock Exchange's most actively traded listed stock market capitalization weighted average index

Source: Bloomberg* Hermes Index (HFI): Egyptian Stock Exchange's most actively traded listed stock market capitalization weighted average index -

Exchange Rate

■Exchange rate

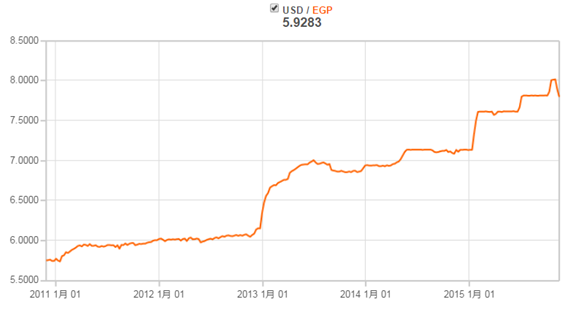

Tourism income and foreign direct investment, pillars of Egypt's foreign currency acquisition, declined dramatically after 2011 and foreign reserves, which amounted to about US $ 35 billion, are less than three months of imports at the beginning of 2012 150 It fell to US $ 100 million. At the end of 2012 the Egyptian pound plunged and the currency crisis was concerned.

Saudi Arabia, UAE, Kuwait, who had been in Distance to the Mursi regime, provided economic support totaling 140 billion US dollars against the interim administration after the coup. As a result of this large amount of foreign currency inflows, the fall of the Egyptian pound had a certain pause. However, the fundamental problems of current account deficit and fiscal deficit have not yet been solved, and the US monetary easing is on the verge of declining, so the Egyptian pound is still on a downward trend.

[Exchange rate transition] (US dollar / Egyptian pound)

Source: OANDA "Forex Trading and Exchange Rates Services"

-

Foreign Direct Investment

■ FDI (FDI)

Foreign direct investment in Egypt was less than US $ 1 billion in the first half of the 2000s, but aggressive economic reform progressed under the Nazi cabinet during the Mubarak administration (2004 - January 2011) It was successful to attract foreign capital. Also, with the surge in international crude oil prices in the latter half of the 2000s, the oil money in the Gulf countries turned to invest in Egypt, the investment in natural gas related fields in Egypt became thriving, etc., Direct investment remained at a high level.

However, as a result of the political change in 2011, the rise in investment and other factors continued to greatly backward. Although it is on a recovery trend after 2012, it is said that concerns about political situation and security are at the heart of investment.

The El-Sisi regime, which was established in 2014, says that recovery of security should be the most important issue, and we will strongly rebuild the economy. In March 2015, the "Egypt Economic Development Conference (EEDC)" was held to announce the economic development strategy to the heads and economic people of more than 100 countries. We have made great results by appealing Egypt as a promising investment destination and deciding investment of US $ 20 billion in the oil and gas sector. However, issues such as administrative reform and fiscal consolidation are significant, and with the restoration of security, the progress of these efforts is drawing attention.

.png)

Source: UNCTAD "Wordld Investment Report 2015"

* Based on international balance of payments, flow, calendar year

■ Foreign investment acceptance by country

In foreign direct investment by country, the UK which has historically been connected maintains the top for many years, accounting for 47% in 2013/2014. Next, the US accounts for 20.5%, Belgium is 5.7%, and investment from Europe and the US including France, Germany, the Netherlands etc accounts for 80% of the total. This background is said to be one of the few countries that has established a normal relationship with Israel in Arab countries.

Investment from the Middle East / Gulf countries has increased since the latter half of the 2000s, and it has come to occupy a certain number. However, Qatar and Turkey, who have supported the Mursi regime, are expected to see an increase in investment from the United Arab Emirates, Saudi Arabia and Kuwait who are closely related to the El-Sisi regime, with a remarkable decrease in investment after the coup in 2013.

.png)

■ Foreign investment acceptance by type of industry

Looking at foreign direct investment by type of industry, oil and gas-related matters are overwhelmingly large, accounting for 70% of the total. There are also various investments such as manufacturing, real estate, construction, finance, etc. There are also observations that full-scale investment will be after economic reform and security restoration have been done.

In oil and gas related divisions where overwhelming investment is concentrated, BP (UK) of oil major announces investment of US $ 12 billion in gas field development in the Nile Delta region in March 2015, Italy hydrocarbon We also announced that we will make large-scale investments such as ENI (Italy), Siemens (Germany) and Alftime (UAE). Among others, ENI has discovered the giant gas field "Zolph gas field" off the Mediterranean, and it is expected that large investment will continue in the future Egyptian energy sector.

.png)

-

infrastructure

■ Infrastructure

According to the World Economic Forum's "The Global Competitiveness Report 2015-2016", the overall rating of Egyptian infrastructure is 111th in 150 countries. It is in a lower ranking compared with Turkey (33rd), Morocco (55th) and Tunisia (90th) in MENA (Middle East / North Africa region).

Evaluation of each infrastructure is 110th in the road, 70th in the railroad, 55th in the port, 53th in the airport, 101th in the power.

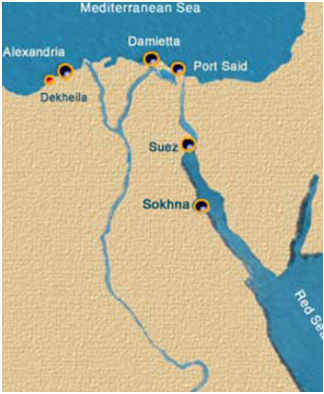

■ Port

Egypt has 15 major commercial ports on the Mediterranean side and the Red Sea side, and import and export and transit cargo etc. are handled. There are also ports dedicated to oil and minerals, various fishing ports of large and small sizes, ferry port and so on.

The commercial port with the largest handling cargo is the port side port, facing the Mediterranean Sea and located at the northern end of the Suez Canal. Container handling volume is Egypt's largest trade port, container handling volume is 4,100 TEU (2013), 34th in the world, third in the Middle East / North Africa region, after Dubai (UAE) and Jeddah (Saudi Arabia). Next, Alexandria Harbor is a port city that flourished as a center of trade since anciently facing the Mediterranean Sea with 1,508 TEU (2013). Others include the Damietta Port, which is located in the mouth of the Nile Delta and where oil related facilities accumulate, and the Suez port (Red Sea Port) located at the exit of the Red Sea side of the Suez Canal.

Also, in 2002 Ein · Sokhna port facing the Red Sea opened as the first port of private investment in Egypt. In 2004, East Port Saeed Port will open on the Sinai Peninsula side of the Suez Canal, and an increase in transit cargo is expected due to the synergistic effect of opening the new Suez Canal in 2015. Both New Port are adopted BOT system (construction by private operation and operation, transfer method of ownership to public agencies after a certain period) is taken.

Egypt's port cargo handling volume is expected to increase over the medium to long term due to population growth in Egypt and economic development in the MENA region. In addition, taking advantage of the geopolitical advantage of Egypt as a nodal point between the Mediterranean Sea, the Red Sea and the Indian Ocean, a strategy to make it a shipping hub has been laid out, further port development progresses along with the development of the new Suez Canal and its surroundings It is considered to be.

【Major Port of Egypt】

Source: RAFIMAR

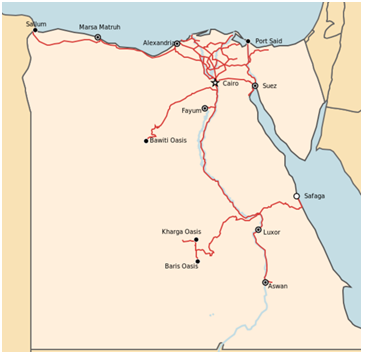

■Road

The Egyptian road network consists of a radiant road that spreads fan-shaped like Nile Delta and Suez, centered on Cairo, a north-south road along the Nile River, the Mediterranean Sea and the Red Sea Coast Road, a habitable area that is a small part of the vast land area It spreads like connecting.

Maintenance such as Cairo-Alexandria, Cairo-Suez and other highways are built on the highway, bypass is built on the north-south line of Cairo-Aswan, and it will be 137,430 km across the country (2010 CIA). Also in Egypt, the Nile River and the Suez Canal crossing bridge and tunnel are also important infrastructures, the "Suez Canal Bridge" opened in 2001 was constructed by Japanese ODA, also called "Egyptian Japan Friendship Bridge" It is.

Cairo with concentrated population is said to have serious chronic congestion, and problems such as frequent occurrence of air pollution and traffic accidents are said to be growing serious. Construction of outline ring roads and bypass construction has been proceeded in order to resolve traffic congestion, but in fact it has not kept pace with rapid motorization and population increase, and in fact the social infrastructure including the improvement of public transportation including the construction of a new subway line Maintenance is awaited.

【Main road of Egypt】

.png)

Source: EURO MED Transport Project

■ Railway

The history of the Egyptian railway is old and in the 19th century already between Cairo and Alexandria has opened. After that, the railway network continued to expand, total extension 5,195 km (2012 World Bank) has become one of major transportation agencies that carry about 500 million passengers both in and out of the year. The main routes are "Cairo-Luxor-Aswan Line" which runs north and south along the Nile River, "Cairo-Alexandria Line" connecting Egypt's 1st and 2nd Cities, "Alexandria" connecting Alexandria along the Mediterranean Sea, Port side line "," Alexandria- Mersa Matruh line "and so on.

Although freight shipping is fewer than passengers, it transports 6 million tons of wheat and mineral resources, containers, etc. annually, and it is also used as a "land bridge" connecting the Red Sea and the Mediterranean Sea with land transportation.

The state-run "Egyptian National Railways" (ENR: Egyptian National Railways) carries out passenger and freight business together. Although there are challenges such as countermeasures against deterioration of facilities and modernization of control systems, it is said that fundamental institutional reform is necessary because it compensates for the chronic deficit from the country.

In the Cairo metropolitan area, the "Cairo Metro Organization" under the umbrella of ENR operates the subway, and lines 1, 2 and 3 (part) are opened, 61 stations are set at 77.9 km I have. Development began as a trump card to overcome chronic congestion in Cairo since the 1990s and it is an important public transportation system used by millions of people a day. In the future, it is planned to complete completion of the international airport on Route 3 and to establish a loop line and so on.

【Egypt Railway Map】

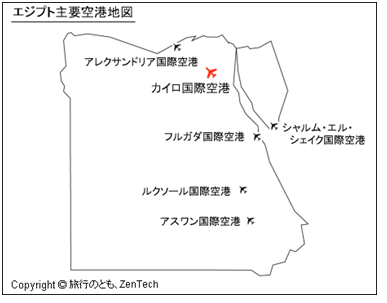

■Airport

There are more than 20 large and small airports in Egypt, a tourism powerhouse, and many international flights operate from all over the world, mainly in Europe. In the latter half of the 2000s, the number of passengers using airports in Egypt sharply increased due to an increase in tourists from abroad, exceeding 40 million in 2010. However, in 2011, it was a drastic decrease of about 10 million people due to political change, after that it has picked up somewhat but it is still far from the level before the political change. In the medium to long term, with the stabilization of political situation, airport users are expected to turn again to increase once the number of tourists visits is restored.

The largest airport in Egypt is Cairo International Airport, located approximately 16 km northeast from Cairo city. The annual number of passengers is 14.68 million (2014), in Africa it is second to Johannesburg International Airport in South Africa. As the number of customers increases, the expansion and refurbishment of passenger terminals are proceeding. In 2009, Terminal 3 opens, Terminal 2, which was undergoing renovation by investing US $ 4 million in 2016, renewed open intend to do something.

Next to Cairo is the international airport of Hurghada, the resort of Sharm el-Sheikh, the largest resort of Egypt on the Sinai Peninsula, the coast of the Red Sea. The number of passengers, mainly from recruiters from Europe and Russia, has increased, Sharm el-Sheikh recorded 8.99 million people in 2010 and Hurghada 8.06 million in 2010. However, in addition to the decline due to political change, in October 2015 the concern about the impact of Russian plane crash from Sharm el-Sheikh is concerned. The crash is believed to be caused by terrorism, and the blow to tourism is inevitable.

In the second city of Egypt, Alexandria opened a new terminal by Japanese ODA at Borg el Arab Airport, located about 40 km southwest of the city, in 2010, and the new Alexandria Airport (El Nouzha Airport) We are moving from one to the next.

.png)

Source: Egyptian Holding Company for Airports and Air Navigation

Source: Travel, Zen Tech

■Power

89.1% of Egypt's power generation facilities are thermal power plants, and other water resources such as Aswan · High · Dam etc 8.7% and alternative energy accounts for 2.1%. Natural gas generation of thermal power generation accounts for 88.1% (Egypt Power Corporation of 2013/2014). Egypt is one of the cheapest countries in terms of electricity charges worldwide, as policies that give domestically produced fossil fuels preferentially use electricity generation and give large grants. For this reason, electricity is supplied to almost all the residential areas, and not only urban areas but also rural areas are electrified.

Due to the rapid economic growth in the latter half of the 2000s, the demand for electricity has increased sharply, and the supply was not catching up due to the hot summer of 2010, leading to frequent blackouts. Even in the period of economic downturn after the political change in 2011, the demand for electricity continues to increase with a focus on private consumption. The Egyptian Electricity Corporation (EEHC: Egyptian Electricity Holding Company), which accounts for 90% of the amount of electricity generated, is expanding its facilities, and in the sixth five-year total plan (2007 to 2012), we have achieved a capacity increase of 5700 MW, In the seventh five-year plan (2012 - 2016), we are planning to further increase 12,400 MW.

The Egyptian government has set out a policy to lower the ratio of thermal power generation by natural gas and oil to preserve fossil fuel as a source of foreign exchange income, and by 2020 the power generation by renewable energy taking advantage of the advantage of natural conditions etc. We set the target to be 20% (wind power 12%, hydraulic power etc. 8%) by the year. In recent years, the introduction of coal-fired power and the study of nuclear power generation have also begun.

.png)

Source: Egyptian Electricity Holding Company

.png)

■Communication

As in many developing and emerging countries, the spread of fixed telephones has not progressed and the trend has declined, and the spread of mobile phones is rapidly progressing.

The penetration rate of mobile phones rapidly increased during the economic high growth period in the latter half of the 2000s, and in 2011 the number of contracts exceeded the population. The penetration rate will rise even after the political change, and it is 114.3% in 2014. Mobile phone services are offered by three companies, France's capital Mobinil, Vodafone Egypt, Etisalat Egypt. In 2008, Mobinil introduced 3G, but in the future it is expected that the need for high-speed communication will be high, and further investment in facilities will be expected. In addition, the Internet has become a penetration rate of over 30% growth unchanged after political change.

It is said that the "Arab Spring" has spread rapidly through twitter and facebook called social network, and there is rapid spread of the Internet and mobile phones in Arab countries such as Egypt.

.png)

Source: ITU (International Telecommunication Union)

.png)

Source: ITU (International Telecommunication Union)

-

-

-

Regulation

■ RegulationThe import sales agency business is regulated by the commercial agency business law (law No. 120 of 1982) and the importer registration law (1982 law 121). In the case of individuals it is limited to companies that are Egyptian, in the case of corporate entities they are 100% Egyptian capital.In addition, regarding military supplies and related industries, tobacco and tobacco product manufacturing industry, and investment in the Sinai Peninsula, it is necessary to obtain approval from the Investment Free Zone Authority (GAFI) and relevant ministries beforehand. -

Incentive

■ IncentivesThe Egyptian investment incentive system is based on the "Investment protection and preferential treatment" (1997 Law No. 7) revised in 1997. In addition to that, there is a legal system that regulates "Investment Zones", "Special Economic Zones (SEZ)", "Free Zones" and so on. Therefore, the preferential treatment that can be accepted depends on which legal system establishment / application was made.[Inward Investment]Investor protection and rights, investment incentive measures and their fields are stipulated by investment protection / preferential treatment law (1997 law 7) in 1997 and enforcement regulation 2004 (Prime Minister Ordinance No. 8) in 1997..png)

.png) [Investment Zones]

[Investment Zones]The investment zone was newly established based on the Investment District Law (Law No. 19 of 2007) and the Prime Minister Order (2007 1675) for the purpose of building industrial clusters. Private enterprises such as Saudi Arabia, Spain, Turkey, Jordan, etc. are the subject of development as well as Egypt domestic enterprises, mainly characterized by private enterprises from establishment to operation.

In the industrial field, there are also textile and sewing, building materials, automobile parts, etc., and zones targeted for small business zones and educational institutions. There are investment zones in 13 wards (as of October 2010) in the metropolitan area such as Cairo, Giza, Nile / Delta area such as Faiyum district and Sharqia prefecture.

The biggest advantage in the investment zone is that administrative procedures can be simplified. You only need to apply to the Board of Investment Zone for permission required for founding, etc. and you can do customs clearance of production goods within investment zone. Also, export items are tax exempt, but export duties are not imposed..png) [Special Economic Zones (SEZ)]

[Special Economic Zones (SEZ)]In order to promote exports, it is a system stipulated by the "Special Economic Zone Act (Law No. 83 of 2002)" established in 2002. As of 2015, the first phase 20.4 ㎢ has been established in the area adjacent to Ain · Sokhna Harbor in northern part of Suez Bay.

We are attracting a wide range of fields such as automobile parts, chemical and petrochemical chemistry, building and building materials, textiles and ready-made garments, agriculture · food processing, home appliances · electronics, distribution · warehouse, pharmaceuticals. We are aiming to be an export base to Europe, the Middle East, Africa and Asia, taking advantage of the geographic conditions of the entrance of the Suez Canal.

Import duties on raw materials and equipment for exported goods, income tax, taxation on wages, sales tax, indirect taxes will be reduced, part of labor regulations will be relaxed.[Free Zones]The Free Zone has been established pursuant to the Investment Protection and Preferential Law (Act No. 7 of 1997) aimed at promoting foreign direct investment and increasing exports. Since it is positioned as a production base for export, it is supposed to export 50% or more of the product as a tenant condition. Since the free zone is a tax-exempt area treated offshore, preferential treatment is far greater than investment zone and special economic zone because almost all taxes are exempted. In addition, the rent is kept low both for factories and warehouses.There are public and private in the free zone, and public office is set up by investment · free zone agency (GAFI). It is an advantageous location for export and import adjacent to ports and airports, and it is located in nine locations as of 2015..png)

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya