Cambodia

2 Chapter Investment Environment

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.3 Investment Regulation and Incentives

2.4 Industrial Park Information

3 Chapter Incorporation

3.1 Characteristics of Business Base

3.2 Incorporation of Business Base

3.3 Liquidation and Dissolution of Corporation

4 Chapter Corporate Law

4.2 Stockholder [general meeting of stockholders]

5 Chapter Accounting

5.2 Responsibility Obligation Accountability Duties

6 Chapter Tax

7 Chapter Labor

-

-

-

Economy

■ Economic Trends

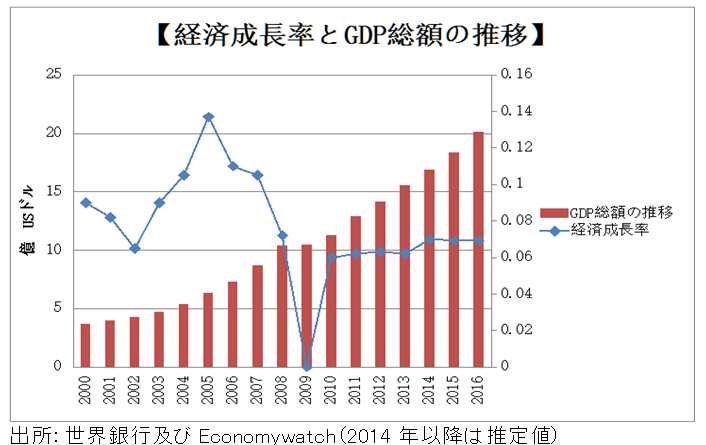

Since entering into the 2000s, the Cambodian economy began to stabilize, and has been recovering from the long-term civil war. GDP growth rate is one of the top class in the ASEAN region as a symbol of it, and we have achieved double-digit growth from 2004 to 2007.

Tourism revenue centered on the Angkor monuments, sewing industry · good condition of agriculture, construction rush such as houses and factories, and lending by foreign investment and commercial banks increased.

In 2009, due to the impact of the global financial crisis resulting from the subprime loan problem in the United States, the economy fell sharply due to exports of sewn products and a decrease in tourists from Korea and other countries.

It is the economic growth of the following year that shows the resilience from this decline, again realizing an economic growth rate of around 6%, and the expansion of the middle class and the consumer market will continue to stably maintain high levels It is expected to change.

[Basic economic indicator]

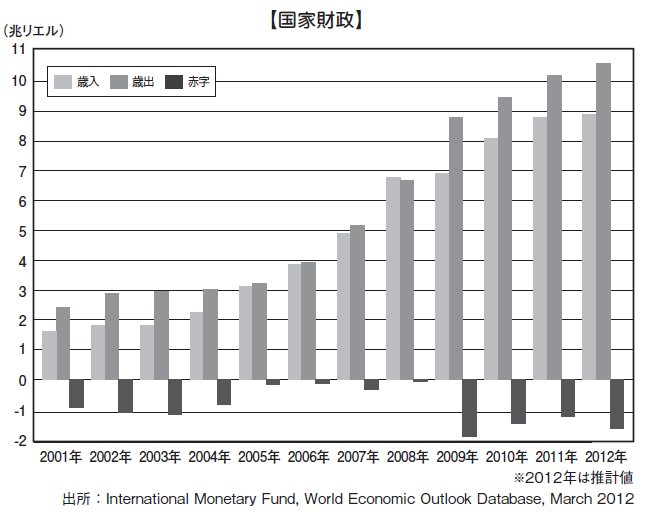

In Cambodia, there is no government revenue to cover expenditure because the tax collection is not properly done and tax exemption measures by the Investment Law (details will be described later) are extensive, and the fiscal deficit continues constantly. Although it temporarily turned into a surplus in 2008, it became red again the following year due to the influence of the global economic crisis and it was the largest loss ever, reaching 1,830.7 billion Riel. The amount of deficit in 2011 is decreasing to 1,1 161.5 billion Riel.

In addition, the proportion of loans to total foreign aid is also increasing, and it seems that the budget deficit will continue for a while. Going forward, fiscal consolidation by the government will be a task for the time being.

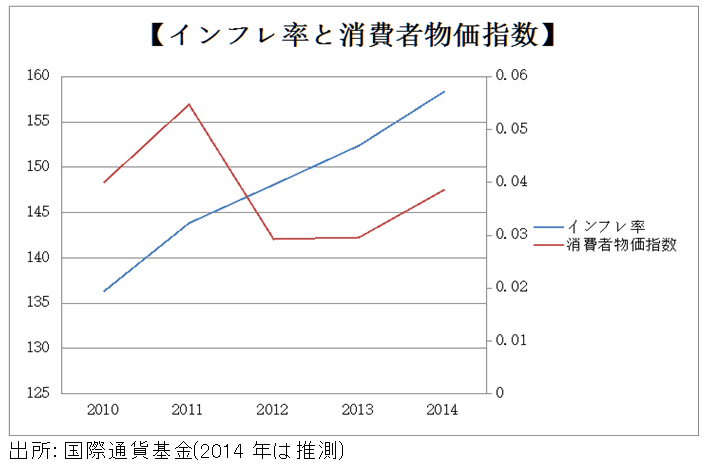

Regarding the rise in prices, the inflation rate in the first half of 2001 was moderate, but in 2008 it recorded a 25% inflation rate due to the rise in oil prices. From this, we can see that the rise in oil prices has a big impact on the economy.

The Consumer Price Index, which was set at 100 in 2006, continues to rise, which is about 1.5 times over the past six years.

In addition, the inflation rate in 2013 is 2.9%, and the inflation rate is comparatively low compared with Asian countries such as China and Vietnam.

■ Trade

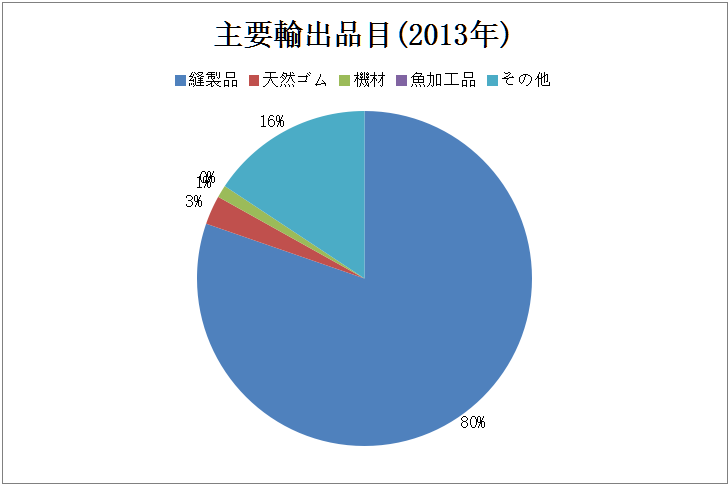

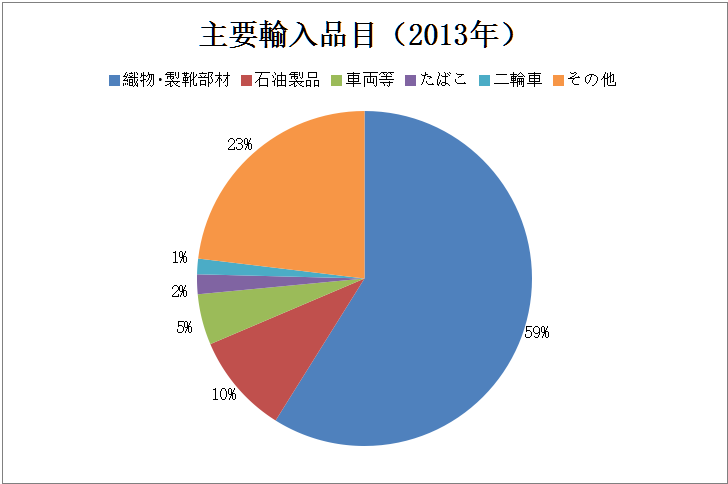

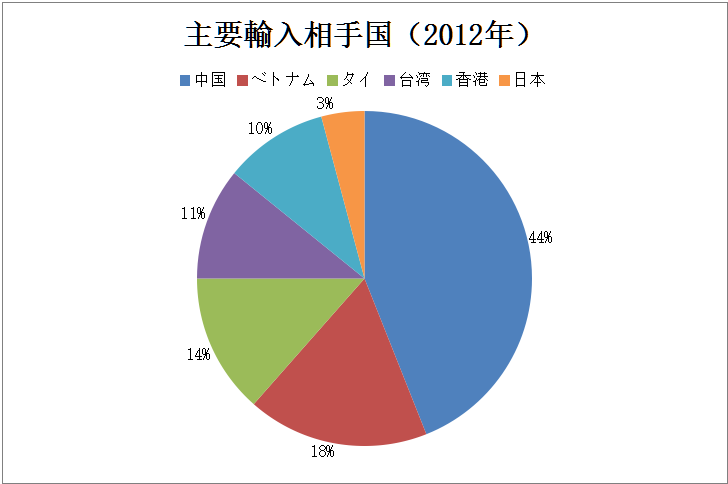

Given the rise in production costs in India and China, shifting of the apparel industry to countries where low wages such as Cambodia is expected is a global trend. In Cambodia, clothing accounts for 80.3% of exports, most of which are for the US and Europe. 58.9% of imports are garments raw materials and are procured from neighboring countries Vietnam and China for clothing production.

Although there was concern about the decline in exports of clothing items due to the financial crisis originating in the US, the impact was not so big and we were able to stably produce low-priced clothing. Thanks to that, exports to Japan, China, South Korea etc. are rapidly increasing after the recovery of the financial crisis.

Source: JETRO and Ministry of Foreign Affairs

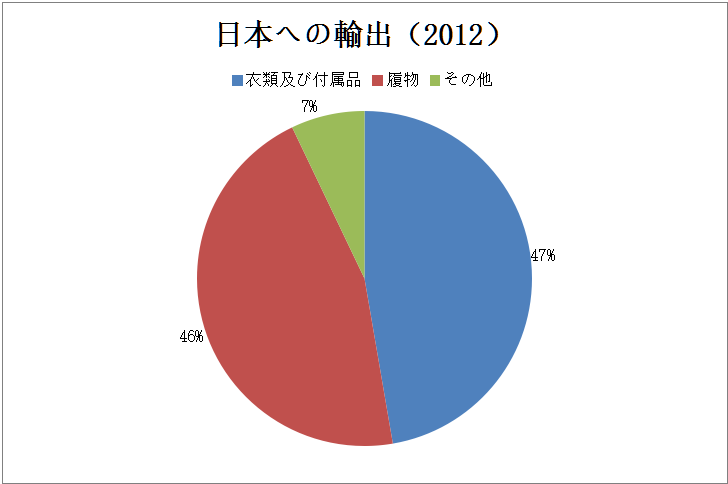

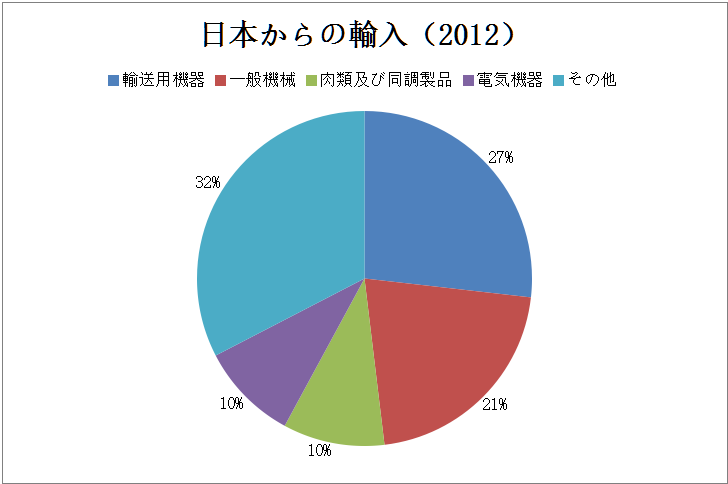

Looking at Japan's trade, imports are mainly industrial products such as small ships and vehicles, while exports are shoes, clothing, etc. Until 2009, the balance of trade with Japan had been in deficit, but it has become a trade surplus since 2010.

Source: Ministry of Foreign Affairs and Japan Bank for International Cooperation

■ Industry Trends

The Cambodian industry is mainly tourism and agriculture, accounting for over 70% of the whole.

[Tourism · Service]

There are many World Heritage sites in Cambodia including Angkor Wat, and it is one of precious resources. Today, more than 90% of people visiting Cambodia are for sightseeing purposes and the tourism industry contributes greatly to Cambodia's economic growth. According to a survey by a private company, Angkor Wat is listed as the 3rd place of "World Heritage Rankings for Japanese to Go Once in a Lifetime."

[Agriculture]

Agricultural crop export policy

As it has been said since ancient times that "If you live in the Mekong river basin there is no word to starve and death", you can harvest many types of rice and food. As stated by Prime Minister Hun Sen's "To make Cambodia a world rice basket (rice bunk)", the Cambodian government will set the surplus of rice more than 4 million tons by 2015, export at least 1 million tons or more to polish We set the goal to do.

For the agricultural sector engaged in about 70% of the workforce, this comprehensive policy is very important in improving income in rural areas in the future, which can lead to Cambodian economic development and poverty reduction It is expected. Agriculture is a major industry in Cambodia as it accounts for over 30% of GDP.

[Sewing industry]

MFN treatment from the US

The development of the sewing industry is said to contribute most to the development of the Cambodian economy. With the grant of MFN from the United States in 1997, export of textile garment products for the US was tax exempted, so it became priming for foreign investment. As a result, the construction of sewing factories by foreign investment increased in search of cheap labor, especially Phnom Penh.

Cambodia plant improvement program

"Cambodia Factory Improvement Program (Better Factories Cambodia)" is managed by the International Labor Organization (ILO), and it is managed by the Government, the Cambodian Garment Industry Association (Garment Manufacturers' Association in Cambodia) and the labor union. Based on the ILO checklist, nearly 500 items are inspected against the garment factory and investigated in various ways including wages, working hours, noise, labor contracts and child labor. This leads to improvement of productivity and improvement of working conditions.

Since the sewing industry is an industry (labor intensive industry) that can secure many employers, it is expected to contribute to national development and poverty reduction as well as agriculture.

-

-

-

Investment Environment

■ Financial (stock) market

On 11th July 2011, the Cambodian Stock Exchange, the first in Cambodia, opened with the Cambodian government and the Korea Stock Exchange jointly with 55% and 45% respectively.

According to the "Law No. 70 concerning the preferential tax system for the securities sector", listed companies are expected to reduce the corporate income tax by 10% (Article 4), withholding tax on interest / dividend reduced by 50% (Article 5) Measures can be taken.

On April 18, 2012, Phnom Penh Water Supply Company listed on the Cambodia Stock Exchange. In addition, two state-owned companies such as Telecom Cambodia and Sihanoukville Corporation are preparing for listing. Among private enterprises, it is said that large companies such as ACLEDA, Mobitel, CATS, etc. are scheduled to be listed.

Exchange rate

Cambodia is an economy with nearly US dollar, usually US dollars are used for shopping in the downtown area, Riel will pay less than 1 US dollar or be used in rural areas.

Looking at the movement of Riel which is the currency of Cambodia for the past year, you can see that there is a tendency of Riel high. In April 2011, we recorded a temporary record of 3,900 Riel / US dollar. There are two possible causes for this Riel high: basic and seasonal.

As a fundamental thing, we have US dollar depreciation due to quantitative monetary easing measures in the United States. In particular, the mitigation measures (QE 2: Quantitative Easing Mark 2) that took place from November 2010 to June 2011, as the Federal Reserve Board purchased US $ 600 billion of US Treasuries, and it is said that the US dollar that was supplied in large quantities had a major impact on the markets of each country.

As a seasonal thing, Riel is necessary because of the deadline of tax payment at the end of March and the purchase of rice during harvest season.

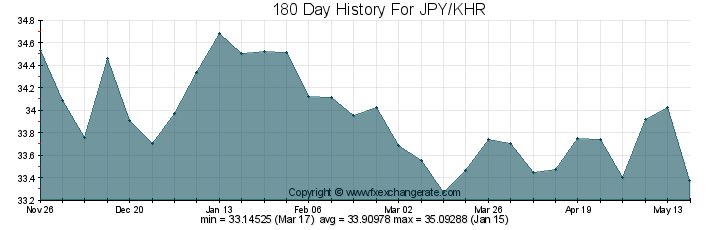

As of May 23, 2015, the exchange rate is 1 yen = 33.56 Riel (exchane-rate.org).

http://jpy.jp.fxexchangerate.com/khr-exchange-rates-history.html

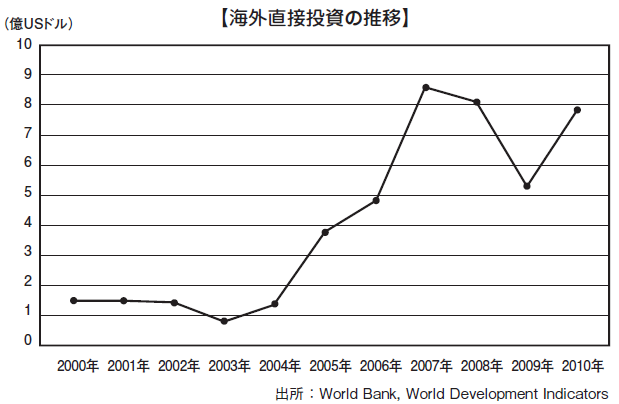

■ Foreign Direct Investment (FDI)

As the graph on the next page shows, the amount of foreign direct investment in Cambodia since 2004 has sharply increased, exceeding US $ 800 million in 2007.

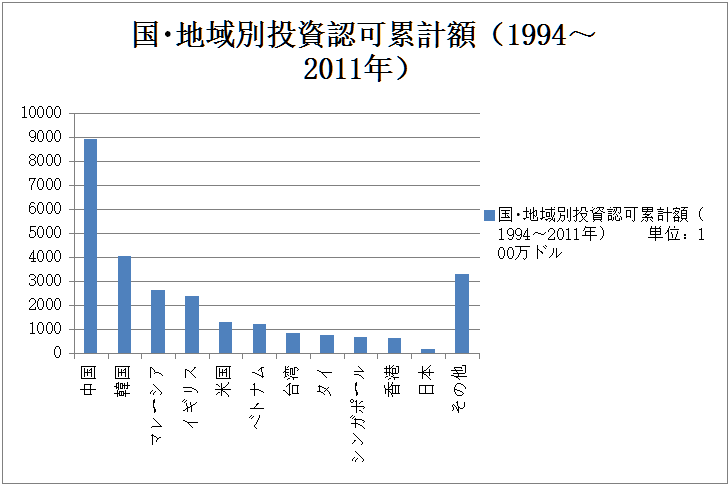

Especially striking is investment by China and Korea, Japan is completely lagging behind.

Source: Japan Bank for International Cooperation

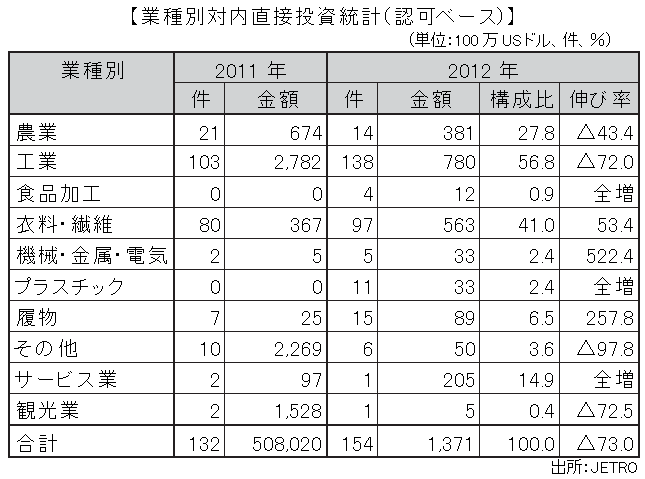

In 2011, production shifts of labor-intensive industries to Cambodia, which can secure inexpensive and abundant human resources from high wages in Thailand and Vietnam, became active.

For overseas direct investment, it is expected to reach 5.4% of GDP in 2010 and 6.0% of GDP in 2011. Cambodia, after Thailand and Vietnam, has attracted attention as a new investment destination for the next generation, and there are also expansion investment of motorcycle manufacturers. Some move to increase the added value of the final product, such as the introduction of painting and welding processes other than assembly.

In the future, it is expected that the relocation of factories from the southern part of Vietnam to Cambodia will become active and stable growth will continue.

■ Infrastructure

[Road, railway, water transport]

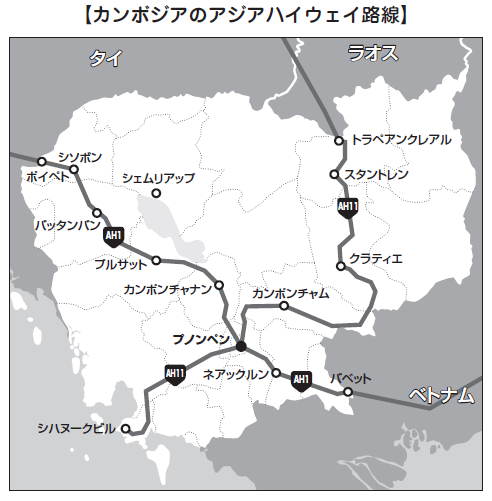

Cambodia's most noteworthy road construction is planned for Asian Highway No. 1, which connects Bangkok, Thailand, Ho Chi Minh City in the east and Vietnam through the Phnom Penh in Japan. This route is called "second eastern west economic corridor" and "southern economic corridor" in the sense that it means a trunk road crossing the three countries along the Southeast Asia. In Cambodia, there are 2 routes of national highway No. 5 west of Phnom Penh and national highway No. 6 which go through Siem Reap in the north and also have unpaved sections. In the eastern part of Phnom Penh, nekircluon did not have a bridge over the Mekong River, so the Neakkulun bridge opened in April 2015 with Japanese aid.

If you connect between Thailand and Vietnam by land, you can shorten the time shorter than the sea route, but there were bottlenecks such as requiring tariffs when passing through Cambodia over the land. Recently, however, the second east-west economic corridor has begun to function as a real economic corridor, for example, the Japanese shipping company began offering services between Thailand and Vietnam in cooperation with a local shipping company with a bonded transport license.

Improvement in infrastructure, such as complete paving of roads connecting railroads from Thailand in the northwest part of Cambodia to Shissoon located east of it, and restoration of railroads has also been enriched.

In the future it is planned to construct a railway between Phnom Penh and the Vietnamese border called "Missing Link" scheduled to extend from Singapore to the provincial capital "Kunming" in Yunnan Province, China.

Representatives from Japan, Lao PDR, Myanmar, Vietnam, Thailand and Cambodia held discussions on infrastructure development in the Mekong region including response to Missing Link at the Fourth Mekong Foreign Ministers' Meeting held in July 2011 Did.

This plan is based on the capital of China, and after the completion, the distance between Cambodia and China shrinks at once, enabling large movements of goods and humans.

The development of infrastructure such as transportation network and the development of visible bridges such as installation of bridges to the Mekong River are currently proceeding. If it leads to a major economic zone connecting west Thailand and Vietnam in the east, there will be moves to advance into Cambodia as a "second base" of Japanese companies in Thailand that already exceeds 1,000 companies.

It is necessary to select the location carefully when entering the country, but when you base your base in Cambodia, it is time to go back and forth in the city that the Mekong River reaches the sea and is located in the center of ASEAN You can feel in miscellaneous words, marine products aligned with the market, building rush and enthusiasm of economic development, and the young Cambodian smile.

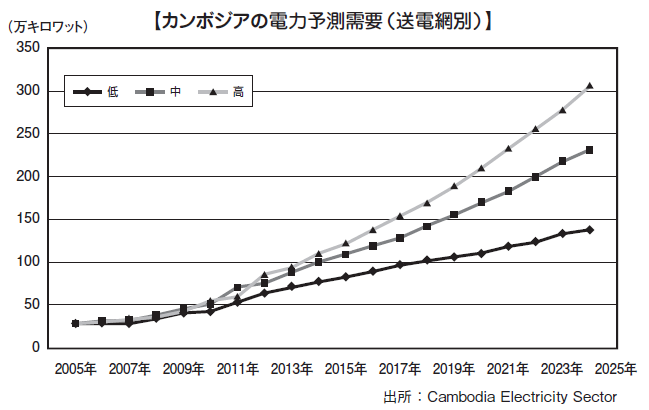

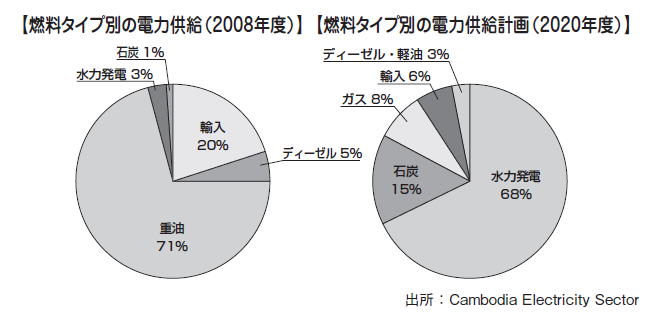

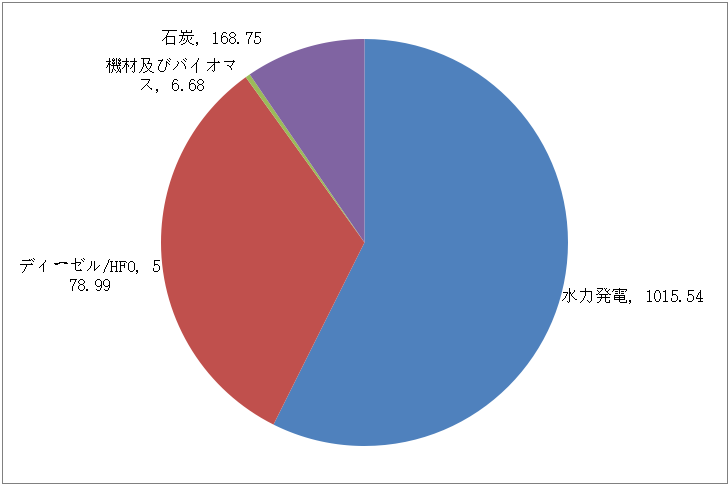

[Power]

Power supply by fuel type (2012)

Source: ELECTRICITY AUTHORITYOFCAMBODIA

In order to do business in Cambodia, we had to use a private generator using diesel and heavy oil as fuel, and electric power shortage was one problem, but in December 2011, we will use Cambodia's largest hydroelectric power plant One Kam Chai Dam started operation. This dam constructed with the capital of China costing US $ 2 800 million, total output is 195 MW.

Furthermore, the government is planning to complete nine dams that can supply a total of 2,045 MW of electricity by 2019, and in the future the power shortage will gradually be resolved.

As a result of the Great East Japan Earthquake that occurred in March 2011, concerns about nuclear power generation spread all over the world. As a large-scale introduction of hydroelectric power generation capable of achieving both "safety" and "environment", Cambodia's dam construction plan attracts great attention not only from Japan but also from overseas.

[communication]

Communication means are gradually spreading all over the people. The fixed phone usage rate was 4% in 2012, compared with 0.4% in 2009. In addition, the number of cellular phones has also increased significantly to 132% in 2012, compared to 44.8% in 2009.

According to the Ministry of Posts and Telecommunications (MPTC), the number of Internet and telephone subscribers in 2014 increased to 5.22 million and 360,000, respectively.

In addition, the domestic major Internet communication charges at the January 2012 stage are speeds of Mbps and unlimited items are about US $ 80 per month, separately deposits and equipment rental fees are charged. Because the Internet environment is underdeveloped compared with Japan, the local communication means will be mobile phones as well.

How to use mobile phones is different from Japan, only prepaid method. In a system that purchases a certain talk time with advance payment, the available time of call varies depending on the amount charged. In addition, the call charge is about US $ 0.05 per minute for long distance calls.

■ Human resource

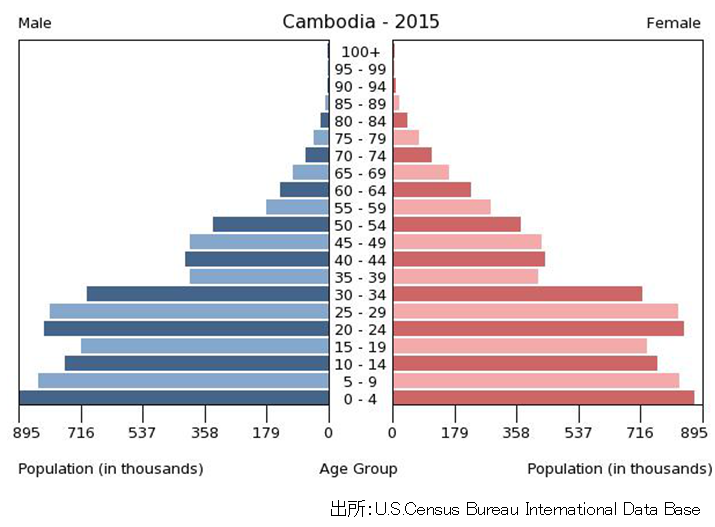

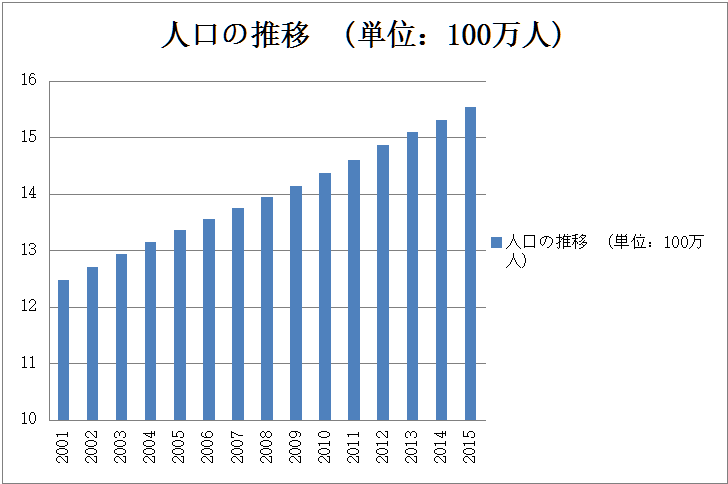

The population pyramid of Cambodia is slightly irregular shaped against the backdrop of mass genocide in the Polpot era, and generations over thirties are decreasing extremely. However, now we are showing a recovery from its dark history, and the population is increasing steadily. According to the World Bank 's announcement, it reached 14.7 million in 2013.

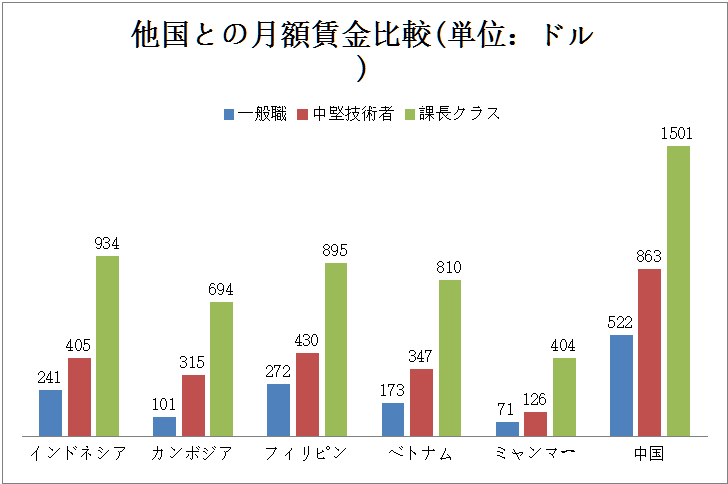

More than half of the total population can supply young labor force of 25 years old or younger, and it is inexpensive to see monthly wages compared to other Asian countries.

(US dollar)

Source: JETRO

Due to the past civil war, the loss of competent human resources, the literature including laws, the traces of destruction in various areas such as infrastructure, the buried landmines that hinder the free traffic of the country, and the low government governance ability established under the initiative of the United Nations There are certainly adverse effects in various aspects, such as.

Nonetheless, as the population pyramid shows, the population under the age of 20 is now developing vigorously as a "young country" that compensates for the loss.

(Ten thousand people)

Source: International Monetary Fund (estimated after 2013)

Other Investment Advantages / Disadvantages

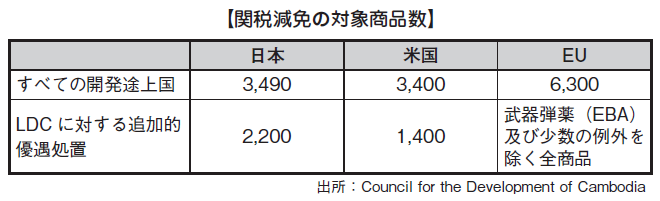

[General preferential tariff system]

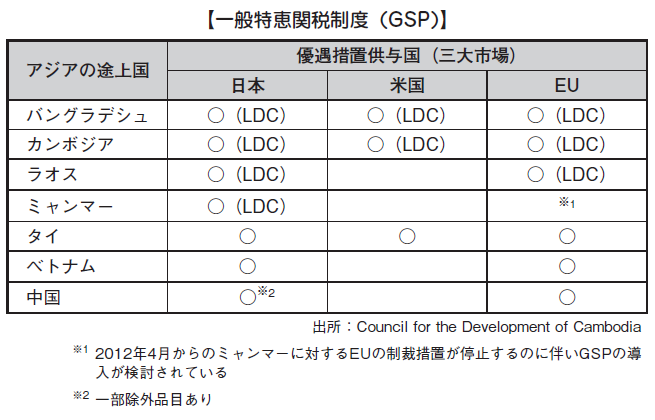

Cambodia is one of the beneficiary countries of the Generalized System of Preferences (GSP) provided by developed countries.

GSP is a system whereby import tariffs are exempted or reduced for goods exported from beneficiary countries as long as they satisfy conditions such as country of origin rules.

In addition, Cambodia falls under Least Developed Country (LDC), so you can receive additional incentives from other developing countries.

As a result, when exporting to developed countries such as Japan, depending on the item, it may be advantageous in terms of tariffs rather than based in Thailand, Vietnam or China.

As for exports to Japan, preferential tariffs are applied to 5,690 items, including representative exports of Cambodia such as clothing and footwear.

-

Latest News & Updates

[Emergence of company aiming to list the fifth company of the Cambodia Stock Exchange]

Century 21 Mekong, who runs the real estate business, announced the intention to list on the Cambodian Stock Exchange (CSX) Cambodia Stock Exchange.

Chief Executive Officer Chrek Soknim said that last month he submitted texts indicating the intention of listing to the Securities and Exchange Commission of Cambodia (SECC) Cambodia Securities and Exchange Commission.

Listing aims for the second half of 2017.

Currently the number of branches of Century 21 Mekong is one in Phnom Penh, the number of staff is 15 people, it will fall into the category of small business.

When the company is listed, it will become CSX's first real estate service enterprise and will become the first growing market for small and medium enterprises Growth Board. Growth Market Growth Board needs at least $ 500,000 in operating funds and announces financial performance only for one year.

CSX has been suffering from the number of listed companies since its establishment in 2012, and only four companies have been listed so far. All four companies are listed on regular markets.

In Cambodia, it is expected that an increase in listed companies will greatly contribute to economic development, so further improvement of the surrounding legislation etc. is expected.

-

-

-

Investment Regulation

■ Prohibited industries

An ineligibility list is prescribed by government ordinance issued by the government, and investment by foreign companies is prohibited for the following business (Article 1 of Appendix 111ANK / BK concerning the enforcement of the Investment Law Amendment Act).

· Production and processing of psychotropic drugs and narcotics

· Manufacturers of hazardous chemical substances prohibited by international regulations or the World Health Organization, agricultural chemicals / agricultural insecticides, and other products using chemical substances that affect public health and the environment

· Processing and production of electricity using waste imported from abroad

· Forest development project prohibited by forest law

■ Regulation of ownership ratio

In Cambodia, there are no ceilings on the investment ratio like other Asian countries. Therefore, in principle, establishing a local subsidiary with 100% foreign capital is permitted except for the above-mentioned banned industries. This is probably due to the absence of subjects to be protected because there are few industries of local capital in Cambodia. In any case, it can be said that it is one of the most open countries for foreign capital.

However, up to 49% of the capital contribution of foreign capital to companies in the form of a public company (described later) is permitted.

■ Regulations concerning capital

The minimum capital of new registration is 4 million Riel (about 1,000 USD as of July 31, 2015). However, when applying for investment incentive measures, the minimum investment amount is separately determined (see page 287).

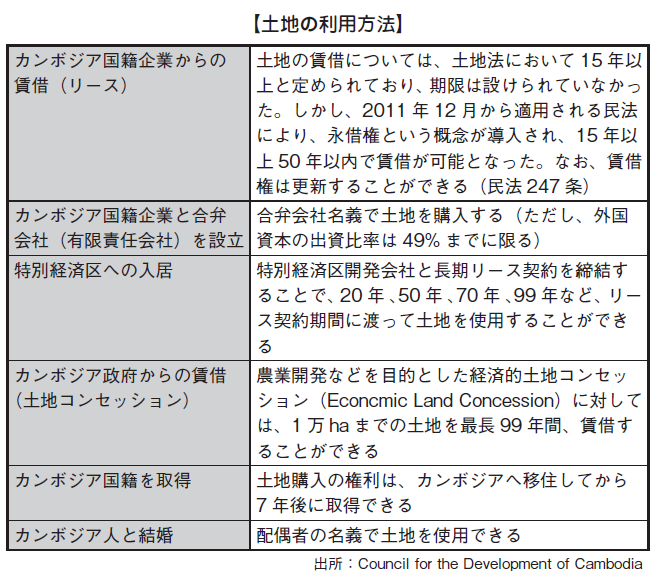

■ Regulations on Land Ownership by Foreign Companies

Under Article 44 of the Constitution, it is clearly stated that foreign companies and foreigners can not possess land. For this reason, foreign companies will use the land in one of the following ways.

Regarding real estate other than land, ownership of foreign companies (individuals) is approved for the upper floor part from the 2nd floor for apartment houses such as apartments and condominiums.

■ Employment cap for foreigners

In order to protect the employment of Cambodian citizens, foreign companies must, in principle, prioritize the employment of Cambodian citizens.

However, if it is not possible to acquire human resources in Cambodia, you can employ foreign managers, engineers or specialists (Article 11 of the Special Economic Zone). According to Article 18 of the Revised Investment Act, the upper limit is set at 10% of total employees.

■ Foreign exchange regulation

In the "Law on the Foreign Exchange" enacted in September 1997, it stipulates that "If it is through an authorized bank, we will not restrict foreign exchange transactions."

[Foreign remittance]

In the case of remittance of more than 10,000 US dollars, we have to notify the National Bank of Cambodia of remittance and obtain approval (Article 17 of the Foreign Exchange Act).

[Carrying out foreign currency]

In case of paying more than 10,000 US dollars equivalent or equivalent local currency, we have to file a declaration to customs (Foreign Exchange Act 12, 13).

[Borrowing funds]

Regarding borrowing of funds, both domestic and foreign can be done between residents and non-residents. However, lending and repayment must be carried out through an official bank (Article 18 of the Foreign Exchange Act).

[Others]

In order to export and import precious metals such as gold and uncut jewelry, it is necessary to notify the National Bank of Cambodia in advance.

Also, when importing and exporting domestic currency of 10,000 US dollars or more, or equivalent of 10,000 US dollars, you must declare it to customs (Foreign Exchange Laws 12 and 13).

-

Investment Incentives

Regulations on investment in the Kingdom of Cambodia are based on the Investment Act of Kingdom of Cambodia in 1994, the Improvement Act of Kingdom of Cambodia in 2003 (hereinafter referred to as "Investment Act Amendment Law") and the Enforcement Ordinance on the Revision Act of the Royal Cambodian Kingdom Investment Act in 2005 (Cabinet Order No. 111 ANK / BK).

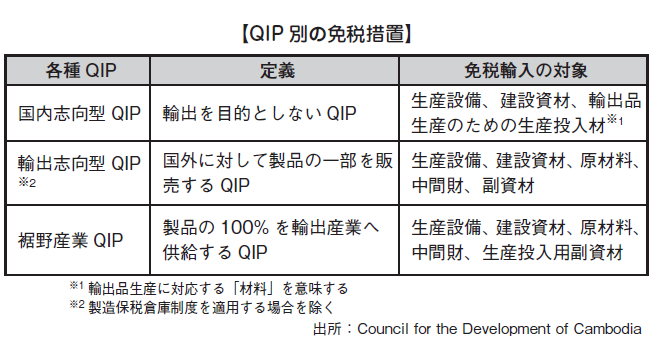

Various systems are provided as a way to receive incentives such as preferential treatment by qualified investment project (QIP: Qualified Investment Project), special economic zone system and preferential treatment for specific field.

■ Investment incentive measures for QIP

The qualified investment project system is a system aimed at job creation and industry development and is one of the policies for attracting foreign capital.

In order to implement a qualified investment project, you must apply to the Cambodia Development Council (CDC: Council for the Development of Cambodia) and obtain authorization.

As long as we can acquire approval, we can receive various incentives such as tax exemption for corporate tax as described below, so most enterprises will consider using for entering.

[Content of incentive measures]

One stop service

The Cambodia Special Economic Zone Committee is established within the Cambodia Development Council (CDC) to improve ongoing investment promotion service. Under the control of the Cambodia Special Economic Zone Committee, we will provide one stop service from the registration of investment projects to daily import and export permission.

Income tax exemption or special depreciation incentives

Companies are generally required to pay 20% corporate income tax, but if you receive QIP tax exemption, you can receive corporate tax exemption for up to 9 years. It consists of ① starting period, ② 3 years, ③ priority period. The starting period is the shorter one of "the year from when the final registration certificate is issued until the profit is posted" or "3 years after the first sales are posted". The priority period (maximum 3 years) is the extension period allowed by the investment industry and investment amount, and the authority will decide for each individual case. As a disadvantage, in order to receive corporate tax exemption, it is necessary to obtain a "performance obligation performance certificate" every year, and it is necessary to disclose the financial situation etc, so the indirect cost is increased.

Still, as stated above, since it is duty-free for up to 9 years, it can be said to be one of the preferential measures you want to exploit by all means when investing.

Also, if you are not subject to corporate tax exemption, 40% of the fixed assets are subject to a special amortization and 40% of the new or used tangible fixed asset value used in the manufacturing / processing process can be specially amortized I can do it.

Preferential treatment of import duty-free tax

Another importance of QIP's preferential treatment system is tax exemption for import tariffs. Common to all QIPs is import duty on production equipment and construction materials.

Domestically oriented QIPs (Domestically oriented QIPs) are exempted from import tariffs on production input materials, production materials and production input materials for the production of export goods. Domestically oriented QIP can receive refund of import tariff on production basis for declared production input materials. In other words, tax is imposed at the time of import, but if it is supplied directly to export or export industry, it will be exempted from customs duty after reviewing the quarterly report according to the quantity of the production material used to produce the exported goods, It will be a mechanism.

For Export Oriented QIPs (Export Oriented QIPs), import duties on raw materials, intermediate goods and sub-materials are exempted in addition to production facilities and construction materials. Specific criteria are not stipulated, such as export-oriented type QIP must be exported by more than%.

Supporting Industry QIPs (supporting industry industries QIPs) will be exempt from import tariffs on production equipment, construction materials, raw materials, intermediate goods and sub-materials for production input. If you do not offer the product to a 100% exporting company or you can not export it, import duties and other taxes will be imposed on that part.

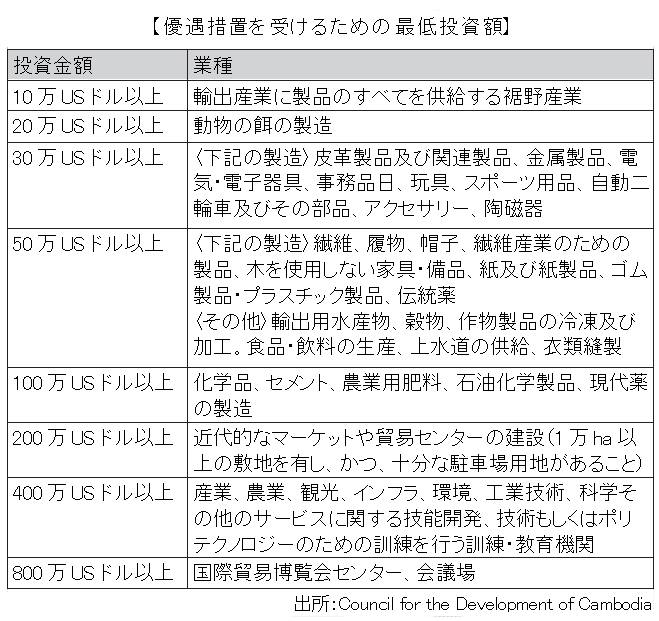

[Minimum investment amount for receiving preferential treatment]

As a result of the revision of the Investment Law, the scope of investment incentives has been expanded, and the minimum required investment has been reduced. As a result, even SMEs can benefit from preferential treatment by QIP.

The minimum investment amount by industry is as shown in the table below.

■ Incentive Project Inappropriate Project

For the following projects, we can not receive preferential treatment.

· Various commercial activities (import, export, wholesale, retail, duty free shop)

· Restaurant, Karaoke, Bar, Nightclub, Massage Shop, Fitness Center

· Casino, gaming, sightseeing, professional services

· Currency and financial services of banks, financial institutions, insurance companies, financial intermediaries

· Below 3 stars

· Real estate development, warehouse facilities, parking lot

· Newspaper and media related activities (radio, TV, news, magazines, movies, video production etc.)

· Transportation services by waterways, roads and airways (excluding investments in the railway field)

· Production of tobacco

· Manufacture and processing of wood products using natural forest wood

· Comprehensive entertainment facilities less than 50ha (including hotels, theme parks, sports facilities, zoos etc.)

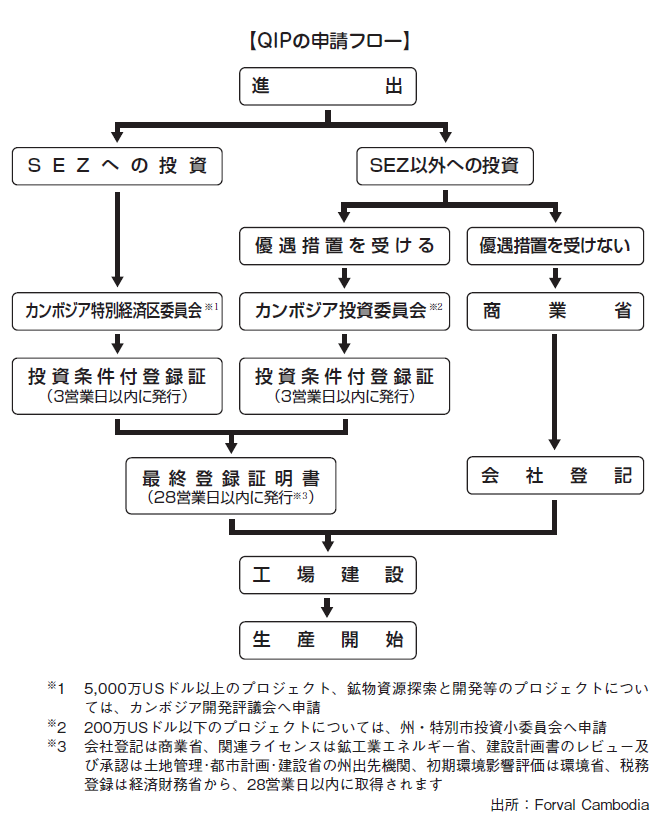

■ Application Procedure for QIP

If you invest in the Special Economic Zone (SEZ), you can apply to the Cambodia Special Economic Zone Committee established within the Cambodia Development Council (CDC) to obtain the Investment Conditional Registration Certificate within 3 business days Will be issued. As a result, final approval certificate will be issued within 28 business days after approval of QIP application is decided. Meanwhile, the Cambodia Special Economic Zone Committee will take over the necessary licenses from relevant ministries and agencies.

When investing in areas other than the Special Economic Zone, when you receive preferential treatment, you must apply to the Cambodian Investment Committee. The flow until issue of final registration certificate is the same as investment in SEZ.

■ Services for Japanese companies

The Japan Desk is established at the Cambodia Development Council and the Japanese staff is stationed so that you can receive the following services.

· Construction of business model (Investment consultation window)

· QIP application support

· Established company support (personnel, accounting, law, logistics, local procurement, construction, real estate)

· After-sales service such as capital increase, shareholder change, customs clearance, QIP renewal

· Investment seminar implementation support

· Cambodia tour support support (various logistics, tour arrangement)

· Japan Cambodia Public-Private Joint Meeting Implementation Support

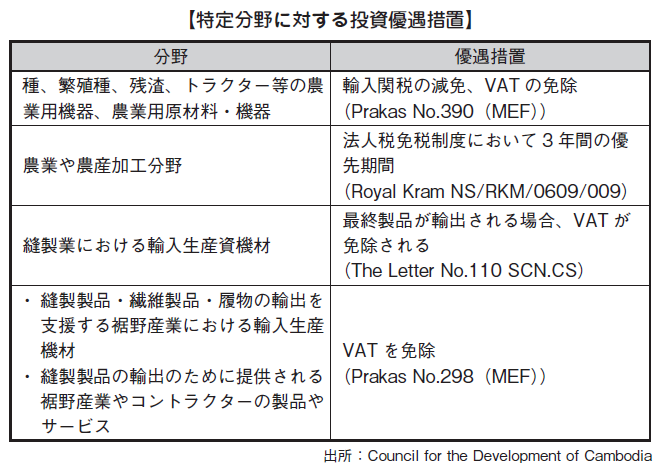

Additional incentives for specific fields

In addition to investment incentives for QIP, additional investment incentives for the following specific industries are stipulated by ministerial ordinance and others.

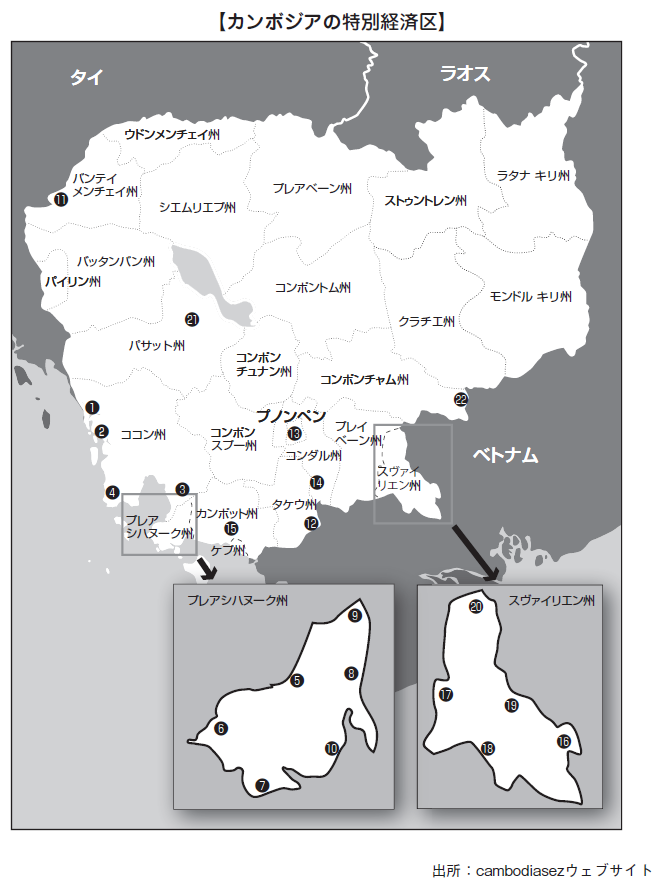

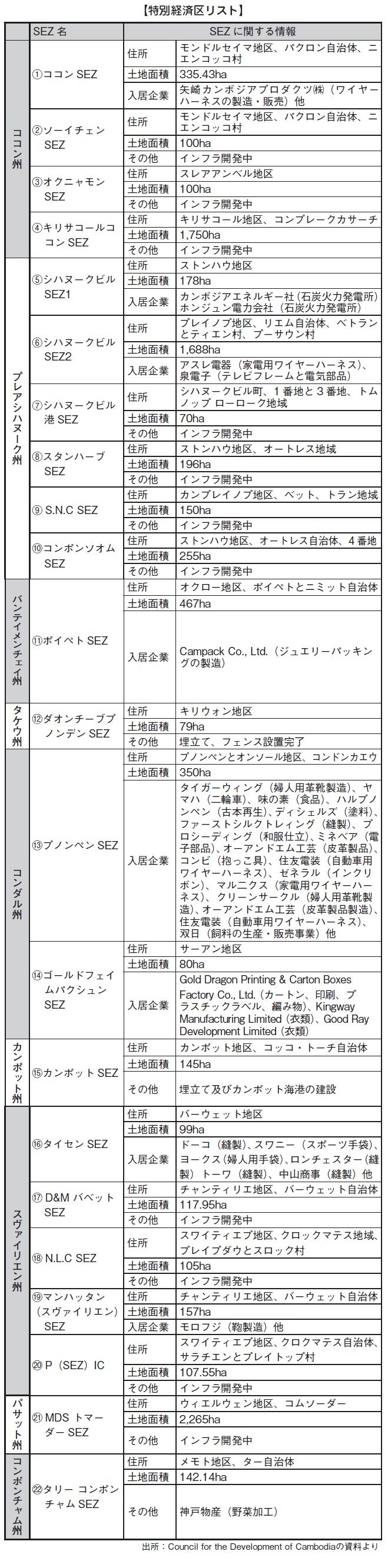

■ Preferential treatment in special economic zone

Currently, there are 32 special economic zones in Cambodia, infrastructure for the manufacturing industry is being developed. Companies entering the Special Economic Zone can receive exemption from VAT (Value Added Tax) in addition to the same preferential treatment as QIP.

However, many companies are not able to refund a large amount of VAT paid at the time of plant construction. In Cambodia, it is difficult to receive tax refund once paid, but there are still many cases that the system and actual operation are different.

In addition, we can conduct investment application, substitution for visa acquisition procedure, and consultation on troubles such as labor problems.

[Special customs clearance procedure (Ministry of Economy Ordinance No. 734)]

For special economic zones located within 20 km from the border, procedures are being simplified in importing and exporting.

As for imports, we only present copies of cargo content at the time of checking the border. Submission of import declaration and seal of container by customs is unnecessary, cargo is transported through "seamless route" and can be sent directly to the factory after submitting customs declaration form at the entrance of special economic zone.

For export, you can do customs procedures within the special economic zone, so you can transport cargo to the border along with the export documents and transport the customs export documents to the customs official at the border checkpoint so that you can transport it outside of the country.

-

-

-

Industrial Park Information

■ Special economic zone

[Overview]

There are many special economic zones (SEZ) in Cambodia, and there is an industrial park within that area. In addition to the industrial area, there are also infrastructure in public areas such as roads, drainage canals, central wastewater treatment facility, flood prevention system, public facilities such as electricity, water supply, telephone, etc. prepared inside the apartment housed to distribute industrial factories in a well-balanced manner.

The history of the industrial park in Cambodia is still shallow, the Poipet Special Economic Zone was approved as No. 1 in June 2006, and the Phnom Penh Special Economic Zone operated in August 2008.

[Special economic zone]

Cambodia is at the center of Southeast Asia, and the convenience of access to Thailand and Vietnam is expected to utilize Southeast Economic Corridor. As of 2015, 8 plants are in operation, and 32 special economic zones including those under construction are approved.

Here, we will look at the main ones among 22 special economic zones in Cambodia.

[Phnom Penh SEZ]

Please update the above table based on the URL below. The total number of special economic zones is 32 (in operation 8).

https://www.jetro.go.jp/world/asia/kh/pdf/sezmap201404.pdf

Phnom Penh SEZ (PhnomPenhSEZ) located 20 km from the city center of Phnom Penh and 8 km from the airport and having a size of about 77 Tokyo Dome, companies in China, Taiwan, South Korea and India living in addition to Japanese companies doing.

It is the only Japanese industrial park in Cambodia and the cost of real estate rental fee etc is higher than that of other industrial parks but it is fairly substantial in terms of infrastructure facilities and services. As Japanese staff are always resident, we are committed to supporting everything from application for company establishment to production start of factory.

A power transmission company established with a joint venture with Singaporean capital has realized stable power supply. Water purification facilities and sewerage facilities are all equipped within the estate, and there are other facilities such as banks, restaurants, dry-ports and convenience stores. The convenience store has a selection of Japanese food and Japanese sake for Japanese people.

In the future, it is expected that the expansion of Japanese manufacturers into Phnom Penh SEZ will increase, but there are many manufacturers of cameras, printers, household appliances etc, parts industry centered on the automobile industry, food processing industry, sewing with higher added value, the shoes industry is expected to enter the manufacturing industry from developed countries in Europe and the United States.

[Sihanoukville Port SEZ]

Sihanoukville Port SEZ (Sihanoukville Port SEZ) is located about 240 km southwest of Phnom Penh, was established with the aim of attracting export oriented companies, and was developed as Japan's ODA.

It is located about 3 hours by car from Phnom Penh and about 3 hours to Thailand and Vietnamese border and it is not only domestic but also directly connected to Singapore Port and Hong Kong's two major hub ports, it plays a role as a southern economic corridor among the Greater Mekong Subregion (GMS). A large-scale ship can enter the port and it is the base for sea transportation in Cambodia.

It is facing the ocean, the sea bathing at the coast and the national park are known as sightseeing spots, and there are luxury hotels and restaurants such as five-star Socca Beach Resort in the city. Amusement such as diving, cruising, cycling, golf, casinos, night clubs and so on is also substantial, and the environment that can satisfy clothing, food and living is in place. In August 2009, a yen loan agreement with a limit of 7,176 million yen was signed in order to improve the terminal, and high-level infrastructure by Japanese construction companies can be used.

It is no doubt that it will be a logistics base in Cambodia on the site, so many enterprises are expected to enter such as export oriented manufacturing industry. In February 2012, Oji Paper announces that it will establish corrugated factory in the same SEZ.

[Manhattan (Svay Rieng) Special Economic Zone]

This Manhattan (Svay Rieng) special economic zone (Manhattan (Svay Rieng) SEZ) located in the Vietnam border area, leading to the national highway No. 1 in Vietnam meets the standards of industrial parks with necessary facilities for Japanese companies It has been drawing attention as one, and development is still under way.

Construction of a gas station, a police station, a fire department, an administrative management center, a hospital are planned, and the administrative management center has a "one stop service" office, an administrative office, an employee training, a bank, postal service , Insurance, customs clearance procedures, etc. will be established. Other living environments, such as five-star casino hotel, three-star business hotel, supermarket, restaurant, shopping facility etc., construction of employee lodgings borne by both investment enterprises and residents are planned.

Currently it is linked to the electricity network in the Babet area, but in the future it is planned to construct a power distribution substation and a private power plant.

Sewage treatment plants, water supply plants, warehouses and container terminals, and garbage disposal facilities infrastructure are being developed.

-

Latest News & Updates

【Construction of the 3rd plant in Minebea Cambodia】

Minebea, a Japanese electric parts supplier, is planning to complete the construction of the third factory in Cambodia by the end of FY 2016.

The company currently manufactures microactuators and small motors at two factories in the Phnom Penh Special Economic Zone (Phnom Penh SEZ) in Phnom Penh Special Economic Zone. Since 2011 we have invested 100 million in Cambodia and we are planning to set up a new production line at the 3rd plant this time.

The current number of employees in Cambodia is 5,300, which is 1/3 of the total number of Phnom Penh SEZ total workers, but after the third plant is in operation, the company has 20,000 employees, a larger factory.

Although Cambodia is suffering from technical shortage of workers, Minebea is striving to develop human resources on a long-term perspective and it is evaluated that it is fruitful. The government also makes human resource development an important point of education curriculum, and it is hoped that training of technologically powerful workers will be further developed through internal education more and more in the future.

It is also expected to develop in the future how Minebea, a symbolic presence for Cambodia's success in Japanese companies, will showcase further contributions to Cambodian society.

-

-

-

Websites

[1] JETRO

[2] Japan Bank for International Cooperation

[3] ASEAN Center

[5] Economy Watch

[6] Ministry of Economy and Finance

[7] Ministry of Foreign Affairs

[8] International labor Organization

[9] Aichi Industry Reconstruction Organization

[11] Asian Development Bank "Financial Sector Blueprint for 2001-2010"

[12] Securities and Exchange Commission of Cambodia

[13] NNA.ASIA

[14] PhilSTAR.com

[15] JICA

[16] Ministry of Land, Infrastructure and Transport

[17] Ministry of Foreign Affairs of Japan

[18] MORNINGSTAR.

[19] Cambodia Electricity Sector

[20] United Nations Development Program Cambodia Energy and Environment Program "

[21] US Census

[22] Council for the Development of Cambodia

[24] Manhattan (Svay Rieng) SEZ

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya