Vietnam

4 Chapter Incorporation

-

-

1 Chapter Basic knowledge

2 Chapter Investment Environment

2.1 Investment environment in Vietnam

3 Chapter Economic Policy

3.1 To stability of macro economic from high growth

3.2 Change of import and export and image for the future

4 Chapter Incorporation

4.2 Establishment of local subsidiary

4.3 Establishment of Representative Office

4.4 Establishment of branch office of overseas affiliate

4.5 Points to note when setting up a base

5 Chapter M&A

5.1 Trend of Mergers and Acquisitions

5.2 Important points which is case of mergers and acquisitions

5.3 Process of mergers and acquisitions

5.4 Laws and Regulation related mergers and acquisitions

5.5 Base of scheme of mergers and acquisitions

6 Chapter Corporate Laws

6.3 Shareholding company (Article 110)

7 Chapter Accounting

8 Chapter Tax Laws

8.1 Overview of tax in Vietnam

8.3 Regulation of international tax

8.8 Tax for foreigner contractors

9 Chapter International Human Resources Management

9.1 Introduction to International Human Resource Management

9.3 Wage system and evaluation system

-

-

-

Investment form

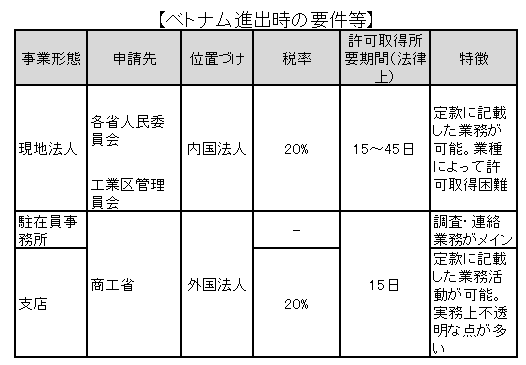

In order to do business in the country of Vietnam, it is necessary to establish first a base for the business itself.

There are four main forms on this. In the Investment Law of 22 or less (hereinafter referred to as the "Investment Act of 2004"), the following investment forms are mainly prescribed, and apart from that it should have one representative office and branch office.

The most common form of investment and advancement among these is a local corporation where one person is limited company and a representative office.

The advancement per branches is limited to some industries such as financial institutions with capital restrictions.

-

Expanding in a local subsidiary

When it comes to establishing a corporation in Vietnam, there are four types of corporations based on the Corporate Law enforced in July 2015 (hereinafter referred to as "Corporate Law"):

· Limited companies

· Corporations

· Partnership companies

· Private Enterprises

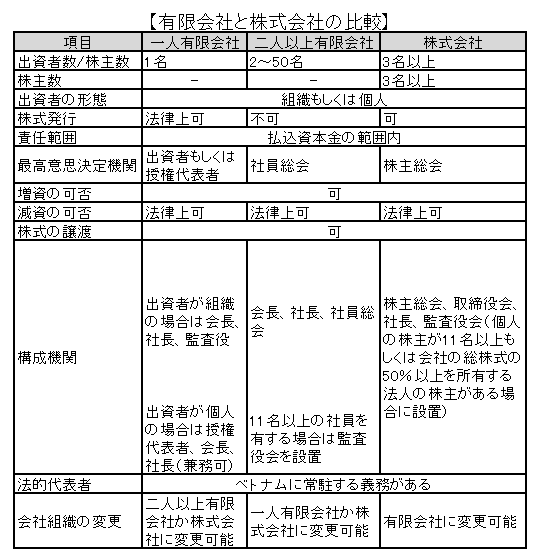

Foreign companies, including Japanese companies, are mostly under the limited companies. The corporation hoit ver requires at least three (3) partners. Due to this, private enterprises with unlimited liability or foreign companies most likely enter into a group company.

The limited company is two or more person that when it comes to Limited Companies with one employee and each has different institution design. For the contributors for the limited companies, it is alloit d with both corporations and individuals but the limit of the employees must be 50 people.

The employees are responsible for corporate obligations and other financial obligations within the range of company investment.

■ Limited company

When it comes to limited company, it has one affiliate on the industry. The simplest design in an industry where it has one authorized representative. In this case, one authorized representative will concurrently serve as the chairman and will make company decisions and can also appoint multiple authorized representatives.

The authorized representative will decide the company's decision on behalf of the investor and along with the president, will appoint the president who performs ordinary business execution.

At least one of the legal representatives of the company (signatory owner, which can be set up more than one in corporate law) is obliged to stay in Vietnam, so if one of them are unavailable in Vietnam for more than thirty (30) days, the delegate authority to others can appoint a person to appoint to the site. (Article 13, paragraph 3, Article 5 of the Corporate Law).

In the case of one limited company, it is necessary to appoint a corporate auditor. The investor will appoint one to three auditors, and corporate auditors oversee the company's compliance status.

■ 2 or more limited company

More than two people limited company has two or more shareholders. The investor of the company exceeds up to 50 people and the investors will make a decision for the when it comes to general meeting where it consist of people who represent the investors, and the President.

Normally, the legal representative of the company concurrently serves as the president but at least one of the legal representative is required to live in the country of Vietnam.

If ever there’s a case that there are more than 11 investors, it is required to establish a board of corporate auditors, or corporate auditor.

■ Co., Ltd.

There is no upper limit regarding with the number of shareholders in the company but the minimum number consist of three.

The shareholders of the organization are responsible only within the underwriting amount of the shares that has to be invested so the delegated management is responsible for the management itself.

The most common form in Japan is a Corporation hoit ver, in Vietnam, the corporations is a complicated institution design compared with the limited company due to it has three of more shareholders and the established of a board of corporate auditors is one of the requirements to fulfill that is why corporation is not very common when it comes to the country of Vietnam.

.png)

■ Expanding in a Representative Office

Unlike the corporations and branches, the representative office has limited activities specifically, when it comes to engaging with the head office, promoting business transaction, conducting market research and overseeing the performances of contracts that signed with the Vietnamese partners.

The representative offices are not alloit d to conduct the business activities that generate profits such as sales activities and trading activities but it is limited when it comes to headquarters agent.

As a condition for establishing a representative office, the business activity record for more than one year after being registered as a company in the home country is required.

The establishment procedure is very simple compared with the local corporation. In addition, the period of the expatriate office's activity is stipulated for 5 years maximum, but have to renew it in case of extension.

For details of the renewal procedure, please refer to page 146.

■ Advancement of branch offices (Branches of Foreign Corporations)

The activity of the branch office is described by having the establishment permit and it is considered as the activity specified by the special law when it falls under the conditional investment field.

For those permitted at the time of investment application, the one who got assigned can conduct profit-making activities and as a condition for establishing a branch office, it is necessary to record the business activity for more than 5 years after being registered as a company in the home country.

The period of the branch office is stipulated for 5 years maximum, and if extend it will need to renew the proceedings. The establishment of the branch office is still limited to the financial industry and some industries such as banks with capital restrictions, many of which are still unclear in practice. The branch here is a branch office of a foreign corporation, and it is different from the branch of a local subsidiary in Vietnam.

.png)

-

-

-

Introduction

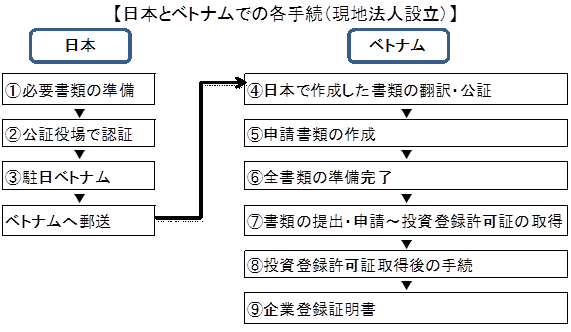

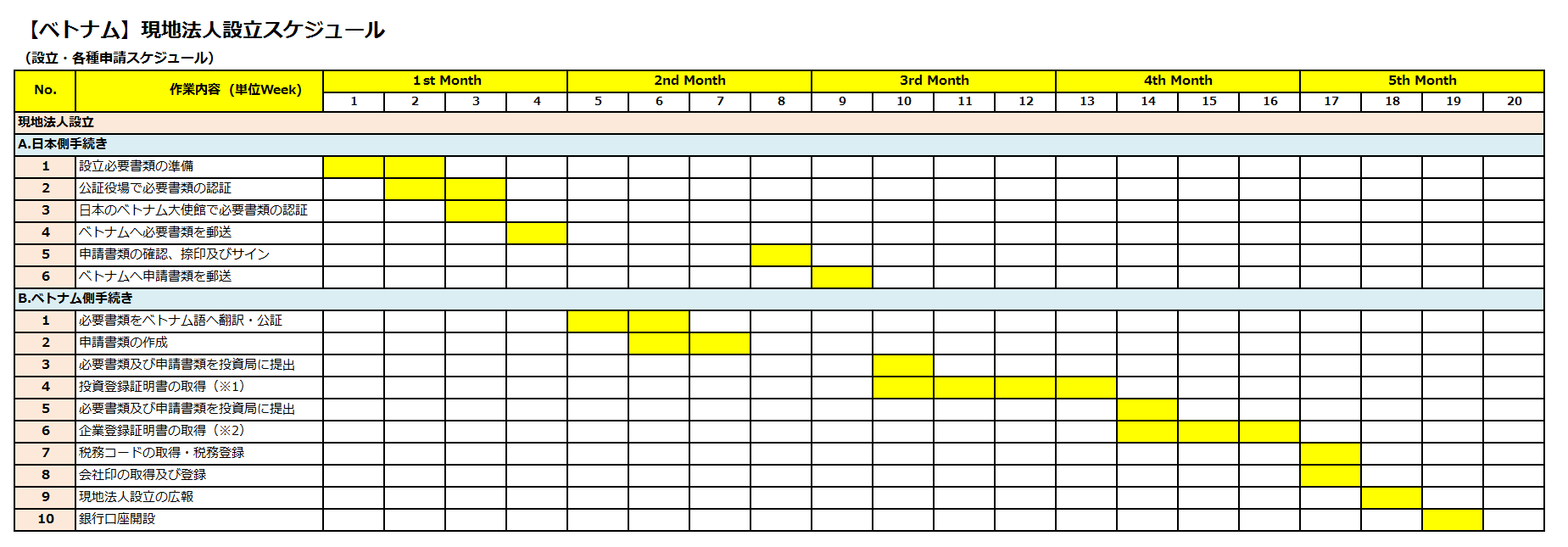

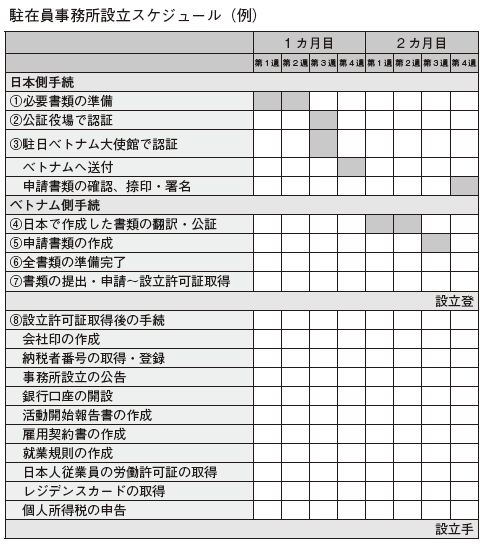

After deciding the form of advancement, it will enter the establishment procedure.will enter the establishment procedure. Here, it will look at the establishment procedure of the local corporation and the representative office which is the most advanced form. -

Incorporation Procedure of Local Affiliate

The procedures for establishing a subsidiary in Vietnam are completed by acquiring an investment permit and a company registration certificate.

The company registration certificate is the one corresponds to the registration procedure of the company. Therefore, at the time the company registration certificate is issued, the company registration can be completed and can do the business depending on the business contents, it is necessary to separately obtain the operating license.

In establishing a subsidiary in Vietnam, it must have the overall flow and necessary documents to know the outline. When it comes to principle, it is necessary to do procedures in Japan and Vietnam and according for both countries, the necessary documents are prepared by Japan and Vietnam.

Application documents in Vietnam’s administrative procedures may differ depending on the area, person in charge, time, so it is necessary to check with the experts or authorities beforehand.

-

Procedures in Japan

Listed below is the explanation of the case where the parent company is a Japanese company.If the parent company is a company other than Japan, it must proceed to that country.

❶ The Preparation of Necessary Documents

The documents to be prepared in Japan are as follows:

[Investment registration certificate (parent company: Japan)]

① Transcript of registry of parent company (※ within 3 months after entering into force)

② The articles of incorporation of the parent company

③ The latest audited financial statements (※ Hanoi for 1 term, Ho Chi Minh for 2 terms) or tax certificate

④ Parent company's bank balance certificate (※ one that is pushed by bank stamp and also has balance stated above capital amount)

⑤ Copy of passport of the representative of the parent company

⑥ Copy of passport of representative of overseas affiliate

⑦ Investor's company brochure (available in Japanese) (In many cases it is not necessary)

⑧ Poit r of Attorney (when requesting authentication from an agent)

❷ Authentication at the notary office

After preparing the above documents, in order for these documents to have legal effect in Vietnam, first it must be notarized by the Japanese Legal Affairs Bureau, the notary, and the Ministry of Foreign Affairs.

Although it is possible to conduct procedures at the responsible agencies, but in the case of Tokyo and Kanagawa prefectures, it is possible to perform all procedures by a one-stop procedure at the notary office. Hoit ver, the notarization procedure of the Vietnam Embassy in Japan must be done separately.

In addition to this, when applying for proxy application for certification at the notary office.

The following documents are required:

·Seal of Attorney

A registered seal stamped in the stamp certificate and a notary poit r of attorney signed by the person registered in the stamp certificate

· Certificate of seal impression

It was imprinted on the poit r of attorney and within three months from issuance by the Legal Affairs Bureau

· Registered transcript

Necessary in cases where the delegate agent is a corporate entity. Three months or less after being issued by the Legal Affairs Bureau

· Identity card and seal of agent

Necessary to prove the identity of the agent

❸ Japan Vietnam Embassy in Japan certified

Documents that have been certified at the notary office must be certified at the Vietnam Embassy or Consulate in Japan. Regulations require English submission, but in practice it is not a problem to submit in Japanese. The embassies or consulates in Japan that can be notarized Japan have the following two bases.

· Embassy Tokyo Vietnam Postal code: 151-0062

Address: 50-11 Motooyogi-machi, Shibuya-ku, Tokyo

Phone: 03-3466-3311, 3313, 3314

E-mail: vnembasy@blue.ocn.ne.jp

· Osaka Vietnamese Consulate General Postal Code: 590-0952

Address: 4-2-15 Ichinose-machi, Sakai-ku, Sakai-shi, Osaka

Phone: 072-221-6666

E-mail: tlsqvn.osaka@mofa.gov.vn

Also, notarization can be done in Vietnam. There are cases where it is notarized in Hanoi and notarized with Ho Chi Minh.

In the case of Hanoi, it will notarize the certificate at the Japanese embassy in Vietnam and then perform the notarization for certification at the Consular Office of the Ministry of Foreign Affairs of Vietnam.

In the case of Ho Chi Minh, after notarizing at the Japanese consulate in Vietnam, it will notarize the certificate for certification at Ho Chi Minh City Foreign Office Bureau of Consular Affairs.

After the notarization work is finished, it will send the documents of ① to ⑧ to Vietnam and it will enter the procedure in Vietnam. -

Procedures in Vietnam

❹ Translation and notarization of investment registration certificate and company registration certificate created in JapanIn order to submit the documents of ① to ⑧ prepared in Japan to the Vietnamese authorities, it is necessary to translate the documents to Vietnamese and to notarize the documents again.

Translation to Vietnamese must be done by a translation agency designated by the government.

Take note that in the case the translation of organization are not approved by the government, the documents will be useless and will not accept.

The number of days required when asking a government authorized translation agency is usually about 1 to 2 it eks and it is possible to carry out the notarization of the documents at the translation agency.

❺ Creating Application Documents

Next, the preparation of the documents. Apart from the documents (① - ⑧) prepared in Japan, it is necessary to prepare documents to apply to the Vietnamese authorities.

This process is most important and takes more effort to do so. If the documents have erasures and mistakes in the contents of application form, articles of incorporation, and etc., it will greatly affect the project and cash flow after acquisition of investment registration certificate, so it is necessary to pay sufficient attention on the contents of the documents.

【Investment Registration Certificate Application Documents (Vietnam)】

① Application form for investment plan implementation

② Investment plan proposal

③ Financial support pledge, Treasury security pledge

④ Lease agreement (or agreement form)

⑤ Poit r of attorney

【Company registration certificate application document (Vietnam)】

① Company registration application form

② Constitution of local subsidiary

③ List of representative members

④ Appointment letter of representative

⑤ Business license

⑥ Investor's passport

⑦ Bank balance statement

⑧ Audited financial statements

⑨ The articles of incorporation of the parent company

The documents listed above is a general document prepared in Vietnam. It is also possible to submit application documents by preparing them in foreign languages such as English, but in doing so it also need to submit Vietnamese translations at the same time.

If there is a discrepancy betit en the contents of the documents of Vietnamese and foreign languages, the Vietnamese translation takes precedence. Depending on the type of industry, it may asked to submit qualification certificates showing the expertise of that type of business, contracts or invoices showing achievements in Japan, etc. as the basis documents.

The points to be noted when preparing the documents are as follows:

[Constitution draft of newly established company]

The contents of the articles of incorporation can be stated to the extent not contrary to the laws of Vietnam. Hoit ver, there are items absolutely described in the articles of incorporation that it must be entered, or at least the following contents must be stated in the articles of association of the limited company (Article 25 of the Corporate Law).

[Articles of incorporation absolute description common to all corporate forms]

· In the case of a partner company, the full name, address, nationality and basic characteristics of all partners who contributed. In the case of a limited company, the name, address, nationality and basic characteristics of the owner or the sponsor investor. In the case of a corporation, the name, address, nationality and basic characteristics of the initiating shareholder

· In the case of a limited company and a group company, the contribution ratio and investment amount of each investor. In the case of a company, the number of shares purchased by the initiating shareholder, the type of shares, the par value of shares, the number of shares classified by type to be listed

· The rights and obligations of employees (investors) in the case of limited companies and partnership companies. In the case of a stock company the rights and obligations of shareholders

· Legal representative in the case of limited company and corporation

· In the case of a partner company, the names and signatures of all the partners who contributed. In the case of a limited company, the name and signature of the legal representative of the company, the owner of the company, all the investors or commissioned representatives. In the case of a corporation, the legal representative of the company, the name and signature of the entrusted representative of all the issued shareholders or the initiating shareholder

[Articles of incorporation absolutely written matter]

· Name and address of head office, branch office, representative office (if any)

· Business contents

· Method of increasing capital and capital reduction of statutory capital, statutory capital

· Management organization

· Procedures for approval of decisions, principles of dispute resolution occurring within the company

· Rationale for calculating salaries, remuneration and bonuses of members of administrators and Board of Corporate Auditors or corporate auditors · Methods · Methods In case of a corporation, the salary of the directors, president and corporate auditors, the basis and method of calculating remuneration and bonuses

· Arrangement in the case where the investor or shareholder requests the company to repurchase own investment ratio (limited company), shares (corporation)

· Principles on distribution of tax profit and sharing of losses

· Business dissolution, dissolution procedures and liquidation procedures of assets

· Amendments to the articles of incorporation · additional procedures

Regarding with the precaution when preparing the articles of incorporation, the preparation of capital through in-kind investment, also the need to state that fact in the articles of incorporation.

Unless otherwise stated, all of the capital will become a cash contribution. Also, the settlement of the month is automatically set to December. If it do not make any revision, even if it was set in the closing month to anything other than the month of December, please stated the note if that’s the case.

Hoit ver, the settlement month other than December will be either March, June or September, and any other month will not be accepted. Changing the closing month after the creation of the articles of incorporation requires registration procedures to the Treasury Department etc. It is safe to decide the settlement month beforehand.

[Real estate rental agreement]

The submission of a real estate rental agreement upon application. Therefore, it is necessary to fix an office or factory site before acquiring investment registration certificate.

As long as the period from concluding a lease agreement to acquiring an investment registration certificate becomes longer, it need to be careful that vacant rent will occur during that period.

If the rental agreement is over 6 months and the owner of the property is not a real estate rental agency, certification of the rental contract is required. Also, if the property owner is an individual, it need to register as a private business owner with the Public Security Bureau and related organizations such as the tax office.

In the case of an owner who does not register, the registration cannot be done. Also, the content described in the land use right, business permit etc. of the real estate owner must coincide with the business contents of the local corporation to be established. As a rule, it cannot register an office that runs consulting business in the factory site.

In order to describe the address in Vietnam of the representative of the Vietnamese corporation also in the application documents, it is necessary to confirm the residence of the scheduled representative in advance, but in reality, even if it is an address in Japan it is often not pointed out. There is no obligation for the representative to submit the rental agreement for the residence, but it will be stated in the investment registration certificate.

[Stakeholder's passport]

Representative Director of the parent company, the representative director of the local subsidiary of Vietnam and the passport of the director and each person must be certified.

❻ Preparation of all documents

❼ Documents submission / application - acquisition of investment registration certificate

After all the documents are prepared, the documents will submit to the authorities. The submission destination is in the Investment Planning Bureau of the jurisdiction or the Industrial Park Management Committee.

According to the Vietnamese regulations, the number of days of ownership is 15 to 45 days from submission of a document to acquisition of an investment registration certificate.

If it is a manufacturing industry in an industrial estate, it is possible to acquire an investment registration certificate in a normal number of days, but it is rare that industries other than the manufacturing industry can acquire as planned, depending on the contents of investment registration certificate it may take more than half a year to acquire.

Procedure of company registration certificate

After acquiring the investment registration certificate, it will proceed to acquire the company registration document. Although it is regarded as acquisition completion on legislation in 3 days from the application, in practice it takes more time than that.

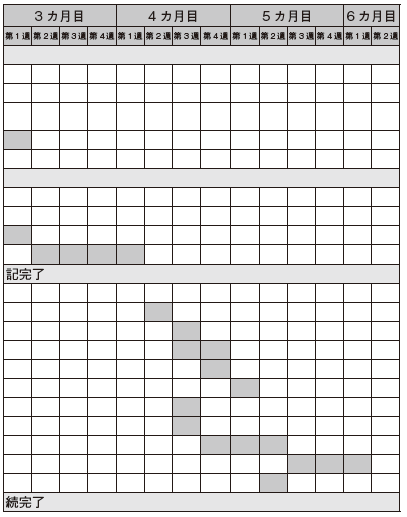

❽ Procedure after acquisition of investment registration certificate and company registration certificate

Even after acquiring a company registration certificate there are many procedures. Any of the following are mandated by foreign corporations, and penalties may be imposed if there is a deficiency.

[Creation of company seal]

Previously, at the Public Security Bureau, it acquired company seal and seal registration certificate immediately after obtaining investment license, but jurisdiction changed from Public Security Bureau to Investment Bureau by New Company Law. The company can freely decide the style of the company seal (it is necessary as a company seal), and after registering the company seal, it will register with the investment authority.

[Acquisition / registration of taxpayer number]

With issuing company registration certificate, within ten days, obtain the tax ID number at the tax office of the jurisdiction, register and obtain the tax registration certificate.

[Public Notice of Establishment of Company]

After obtaining investment registration certificate, it will notify the company establishment at portal site jurisdiction of planned investment authority. The contents to announce are information of company name, address, business content, capital amount, investor, representative of Vietnam corporation, etc.

[Opening bank account]

In order to transfer the capital stated in the articles of incorporation, it is necessary to open a bank account immediately after the establishment of the company.

In addition, it will open an account for trading separately from the account for depositing capital. The account of capital and the account for trading are usually separated, but since the correspondence differs depending on the bank, it is necessary to check in advance with the bank scheduling the transaction.

Examples of documents required for opening a bank account are as follows.

· Bank account opening application form

· Copy of investment registration certificate, company registration certificate (required authentication)

· Copy of tax ID number certificate

· Copy of seal impression certificate

· Copy of representative's passport

· Chief Accountant (Chief Accountant) appointment letter

[Capital transfer]

The limited company must transfer the capital within 90 days after the establishment of the company (during the period stated in the investment registration certificate).

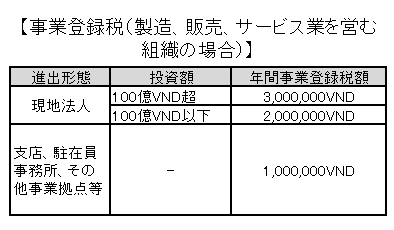

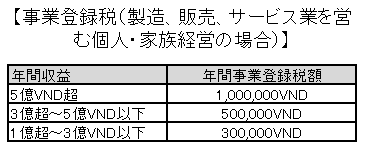

[Payment of business registration tax]

The corporation operating in Vietnam is obliged to pay the business registration tax within 30 days after obtaining the investment registration certificate according to the statutory capital amount registered in the investment registration certificate.

In addition, January 30 every year is the final deadline of tax payment for that year.

[Purchase of VAT (Value Added Tax) Invoice]

There is a receipt and invoice called VAT invoice (Red Invoice) in Vietnam where it is a receipt and invoice designated by the government, and there is a strict rule that the tax deduction cannot be recorded without this.

This paper is usually purchased from a designated printing company, but it can download if it needs as one of the requirements.

In case of in-house creation, it must apply for permission for use to the tax office.

[Notice of fiscal year, registration of accounting system, etc.]

After establishing the company, it need to notify the tax office about the following and register it.

· Accounting period

· Method for amortizing fixed assets

· How to record inventory assets

· Accounting policy

· Selection of journal style

· Accounting software to be used

[Creation of Employment Contract]

Employment contracts must be prepared when hiring employees.

[Creation of employment rules]

Companies with 10 or more employees are obliged to prepare work rules and register with the People's Committee Labor Bureau.

[Acquisition of Work Permit of Japanese Employees]

A Japanese worker needs a work permit to work in Vietnam due to the revision of the law in 2013, the validity period of the work permit has been changed from 3 years to 2 years.

[Acquisition of Residence Card]

For foreigners to live in Vietnam it need to obtain a residence card because the validity period of the residence card is stipulated as being within the validity period of the work permit, it is a maximum of 2 years.

In order to acquire this card, it is necessary to obtain a work permit in advance.

[Registration of personal income tax]

The individual taxpayer number is necessary to pay personal income tax. If it have a previous position in Vietnam it can continue to use past tax number, but it must acquire newly when it work in Vietnam.

[Social insurance registration of staff]

When employing Vietnamese staff, it is necessary to subscribe to social insurance and health insurance.

Until now, there it re obligations to join unemployment insurance when there it re more than ten Vietnamese staff, but from January 1, 2015 based on No. 38/2013 / QH 13 which was constructed in 2013, unemployment Insurance must be subscribed when signing an employment contract of 3 months or longer including seasonal workers. From the month following payroll generation, it have to file monthly declaration, it will pay social insurance fee to social insurance office every month.

In Vietnam, there are various procedures even after the establishment of the company, many of which are related to taxes and accounting. Because there are times when penalties are imposed if there are inadequacies, it is necessary to complete the procedure surely after consulting experts.

In addition to the above, as a periodical task, it can file a monthly (or quarterly) VAT declaration, a monthly (or quarterly) personal income tax return and tax return, a quarterly / annual next income tax return, It need to be audited. For various taxes, please refer to the "taxation" chapter.

【World Heritage Hoi An】

There is a city called Hoi An, in Vietnam. It is an old port town of about 120,000 inhabitants located 30 km south of Da Nang, where it is the central city of central Vietnam, and was registered as a World Heritage Site in 1999.

As a result, the number of tourists has increased fourfold, and in the first half of 2013, 1.6 million tourists visited Hoi An.

Hoi An is very deeply involved in Japan, and at the beginning of the 17th century, the Shenzhen boat trade with the Edo Shogunate was flourishing at that time, in Hoi An, a large Japanese street was formed, and it is said that about 1,000 Japanese people lived in the peak period.

The symbolic thing is that the bridge still said to have been built by the Japanese people at the time and it is still there, and it is the site of Hoi An sightseeing as a World Heritage site.

The bridge is a bridge with a roof, called the Terminal Bridge (Nihonbashi), which is also drawn in the banknotes of Vietnam.

Regarding with the history of the bridge the Japanese people believed to have built over 400 years ago tells us about the high technology of making Japanese products from long ago.

※ 1 Acquisition of investment registration certificate is 15 business days according to law. Practically, it tends to be delayed.

※ 2 Acquisition of company registration certificate is 3 business days by law. Practically, it tends to be delayed.

* 3 There is amendment to the Investment Act in July 2015, and it has been changed as described above.

【How to handle expenses paid by parent company to set up local subsidiary before establishment】

Various expenses will be incurred when establishing a subsidiary in Vietnam for example, there are real estate rents, interior construction fees, equipment such as photocopiers, consulting fees paid to consulting companies, etc and these expenses will be paid by the parent company before subsidiary establishment.

In Vietnam, there is a strict receipt and invoice red invoice system, and if there is no red invoice in the name of the subsidiary, expenses will not be tax deductible because there is no company in Vietnam before the establishment of the company, it cannot acquire Red Invoice under this subsidiary's name.

Back to the question, how can it make the subsidiary bear the expenses that the parent company has changed for the subsidiary before establishing a subsidiary (subsidiary)?

In such a case, it will follow the procedure below.

1. Red Invoice and agreement for expenses incurred prior to establishment shall be prepared under the name of the parent company. After the establishment of the subsidiary, the expenses are regarded as accounts payable to the related company and are recorded in the debt item of books of subsidiaries

2. In order to repay it to the parent company, remittance from the affiliated company is sent abroad (*) at the bank

3. After completing overseas remittance, balance of accounts of affiliates accounted for as debt items of books of subsidiaries is offset by Deposit Course (journalizing example: Accounts payable to related companies / Deposits)

· Since Vietnam is a trade deficit country on a permanent basis, regulations on overseas remittance are strict and it is necessary to prepare various documents. Also, due to revision of the Banking Law, it may be necessary to open a non-resident account of the parent company on site.

As an example of repaying the interior construction fee paid by the parent company for the subsidiary, the following documents are required from the bank at the time of overseas remittance.

· Red Invoice (interior construction contractor → parent company) of interior construction cost in the name of the parent company

· Contract of interior construction fee under parent company's name (parent company ⇔ interior construction company)

· Bank's remittance document proof that the parent company has changed its position (parent company → interior construction company)

· An agreement (parent company ⇔ subsidiary company) to prove that the parent company has replaced it

· Debit note (parent company → subsidiary) where the parent company requests payment from subsidiary company

Of the above documents, the agreement and debit note must be original documents, but other documents can be copied without any problems. Since correspondence varies depending on the bank, it is necessary to prepare the documents while checking with the business partner bank.

-

-

-

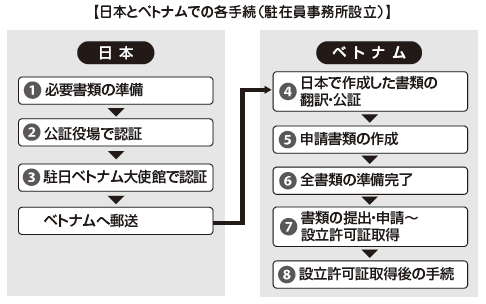

Introduction

To establish a representative office in Vietnam, it is necessary to obtain a registration permission from the Ministry of Commerce and Industry of Vietnam.

By doing this, it can start activities as a representative office in Vietnam. Procedures are required in Japan and Vietnam when the representative office is established.

The overall flow of establishing a representative office is the same as when establishing a local corporation.

-

Procedures in Japan

❶ Preparation of necessary documents

The following items are prepared by the parent company in Japan.

· Registered certificate (within 3 months after issue)

· Constitution (sometimes not necessary)

· Financial Statement (usually one term)

· Tax certificate (sometimes not required)

· Bank balance certificate (sometimes unnecessary)

· Copy of representative prospective passport

The administrative procedures in Vietnam vary according to the area, the person in charge of the application, and the time of application. It is necessary to check with an expert, authorities window beforehand.

❷ Authentication at the notary office

Procedures at the time of document certification are the same as those at the establishment of a local corporation

❸ Certification at Embassy of Vietnam in Japan

Procedures for obtaining certification at the Vietnamese Embassy in Tokyo are the same as at the time of establishing a local subsidiary.

-

Procedures in Vietnam

❹ Translation and notarization of documents created in Japan

As in the case of the establishment of a local subsidiary, it is necessary to translate and legalize with a translation agency designated by the government.

❺ Creating Application Documents

Documents to be applied to the Vietnamese authorities are as follows.

· Application form for establishing a representative office

· Board of Directors' Meeting (Resolution on Establishment of Representative Office of Parent Company)

· Appointment letter (appointment letter of Representative Office representative)

· Office lease contract (contract with real estate company in Vietnam)

As with the establishment of a local corporation, it is necessary to prepare all the documents in Vietnamese, and in each case the representative sign of the parent company and the signature are required.

The types of documents are feit r than at the time of the establishment of an overseas affiliate.

It is also possible to submit English-translated (or other foreign-language translated) documents, but even in that case it is absolutely necessary to submit the same documents translated in Vietnamese. If there is a discrepancy built on documents in both languages, the Vietnamese translation takes precedence.

❻ Preparation of all documents

❼ Documents submission / application - acquisition of a registration permit

A complete set of application forms will be submitted to the Ministry of Commerce and Industry under the jurisdiction.

According to the rule, it is supposed to be able to acquire a permit of establishment in about 15 business days from receipt of the document, but as with the establishment of the local corporation, there is a possibility that it may be later than the planned acquisition date, so it can afford a margin It is safe to see.

■ Procedures necessary after acquiring the establishment permit

There are also a number of procedures even after obtaining the establishment permit. Both procedures are mandated by the representative office of a foreign corporation, and penalties may be imposed if there are incompleteness.

[Creation of company seal]

At the Public Security Bureau, it will obtain a company seal and seal stamp certificate immediately after obtaining the establishment permit.

[Acquisition / registration of taxpayer number]

After obtaining the establishment permit, within 10 days, obtain the tax ID number at the tax office of the jurisdiction, register, and obtain the tax registration certificate.

[Public Notice of Establishment of Office]

After obtaining the establishment permission, it announce the company establishment at the portal site which is under the jurisdiction of the planned investment authority. The content to announce is information of company name, address, business content, investor, head of the Vietnamese representative office.

[Opening bank account]

The basic procedure at the time of opening a bank account is the same as when setting up a local corporation, but since the correspondence of necessary documents varies depending on the bank, it is necessary to check in advance.

[Preparation of activity start report]

Within 45 days after the establishment of the representative office, it is necessary to notify the Ministry of Commerce and Industry to the effect that the business opened. In addition, it need to submit a similar activity report in writing every year.

[Creation of Employment Contract]

When hiring an employee, it need to create an employment contract.

[Creation of employment rules]

For offices with 10 or more employees, it is mandatory to create work rules and register with the People's Committee Labor Bureau.

[Acquisition of Work Permit of Japanese Employees]

A Japanese worker needs a work permit to work in Vietnam. Due to the revision of the law in 2013, the validity period of the work permit has been changed from 3 years to 2 years.

[Acquisition of Residence Card]

For foreigners to live in Vietnam it need to obtain a residence card. Because the validity period of the residence card is stipulated as being within the validity period of the work permit, it is a maximum of 2 years. In order to acquire this card, it is necessary to obtain a work permit in advance.

[Declaration of personal income tax]

It need to file quarterly declaration and final return at the end of the fiscal year.

[Extension Procedure of Representative Office]

There are many advances in the form of a representative office in Vietnam, mainly in industries such as trading companies.

There is a deadline for establishment in the installation permit of the representative office. Since the installation permission deadline is a maximum of 5 years, if there’s a case of extension, it is necessary to proceed before 5 years elapse.

Documents necessary for extension application are as follows:

① License for establishment of representative office (original)

② Audited settlement statement of the parent company or certificate of tax payment (required notary)

③ Application for extension of Representative Office

④ Activity report of the representative office (for the past 5 years)

Application for extension must be made at least 30 days before the expiration date of the representative office establishment permit. If the extension application is delayed, it may imposed several hundred US Dollars.

The representative office is obliged to report the activities of the previous year to the Ministry of Commerce and Industry once a year, and will be the activity report submitted in the past. If it forget to submit the report it need to be cautious as it may be fined.

It recommend that it prepare with a margin on the schedule after calculating notarized documents prepared in Japan, their translation, the time required for mailing documents from Japan to Vietnam, and so on.

【Procedure for Closing a Representative Office】

While there are cases where a representative office is established as a foothold to entering Vietnam, cases of establishment for investigation purposes can be seen, but in principle neither sales activities nor contractualization can be done.

Therefore, when establishing a subsidiary at the time when it seems possible to some extent in business in Vietnam, which makes it unnecessary for a representative office or if there is no possibility of business in Vietnam, the representative office it will close down.

In doing so, closing procedures are necessary.

The director of the representative office and the representative of the overseas affiliate cannot be concurrently held in the closing procedure. There is a department that manages tax payment at the representative office of the Ministry of Commerce and Industry, but during the closing procedure it is necessary to undergo a tax audit.

The closing procedure of the representative office is as follows:

① Submit a notice of closing the representative office to the Ministry of Commerce and Industry

② Tax treatment of personal income tax etc. * 1

③ Notice of close of representative office by newspaper (national newspaper)

④ Submit application form for closing the representative office to the Ministry of Commerce and Industry

※ 1 This is not a tax office, it can complete the procedure within the Ministry of Commerce and Industry

※ 2 Notice of closure on 3 consecutive issue dates

The biggest point is the tax audit especially the survey will be conducted in detail on the processing of personal income tax of foreign expatriates.

Regarding the expenses of the representative office because it is impossible to deduct the purchase VAT, it is pointed out that the VAT was not paid for payment of expenses recorded in the operation of the representative office Cases also occur.

What is common in completely withdrawing from Vietnam is that the case where it is left as it is without closing the representative office. If there are cases like this in the past, there is a possibility that it will become difficult to advance as it will pointed out by the authorities when advancing to Vietnam next time. Therefore, when the representative office becomes unnecessary, it is necessary to surely carry out the closing procedure.

-

-

-

Establishment of branch office of overseas subsidiary

The establishment procedure of branch offices of local subsidiary is simple, and it can get permission relatively easily. Applicants for the establishment of a branch will be the investment planning authority or industrial estate of the jurisdiction, export processing zone, high-tech district etc.

Required documents are as follows.

In case

· Application form for branch establishment

· Decision of investor who established branch office

Minutes of the investor meeting for establishing a branch

· Copy of the company's articles of incorporation (required notary)

· Copy of investment registration certificate of overseas affiliate (required notary)

· The most recently audited settlement report of overseas affiliates

· Activity implementation report of overseas affiliates

· Instruction of branch manager

· Copy of the branch manager's passport (required notary)

· Lease agreement of the office

Usually, if there is no incompleteness in the document, it can obtain a permit of establishment in about a month after submitting it to the authorities. After the branch will establish, it is necessary to acquire branch signs, pay corporate tax, obtain taxpayer number, and announce the establishment of branch as it as overseas corporation and representative office.

-

-

-

Points to note when setting up a base

■ Vietnamese translation of documents to be submitted

Translation of the documents prepared in Japan needs to be translated by government designated translation agency, and if it bring it to the notary office in Vietnam usually it can do translation and certification in sets. The cost of translation is usually about 6 USD per page.

■ Confirmation points before submitting application documents

At the time of establishment of the corporation, the application form created, and the contents of the constitution draft, etc. will greatly affect the operation and cash flow after the establishment of the company.

A Japanese representative filed an application without confirming the contents of documents created in Vietnamese often, which may cause problems later. For example, an example timing of the financial results, the contents of the capital, "the settlement month in December, capital is fully paid in cash" for but confirmation of such is not a sufficient amount of registered capital that had been treated with There is also.

If it set the registered capital separately from the paid-up capital, the procedure for capital increase becomes easy.

Since it is a Vietnamese document that actually has effect, it is necessary to carefully check whether the contents of Vietnamese description are correct or not.

■ Correspondence to under table

Vietnam is a country that often requires bribing except for industries in which it is relatively easy to acquire the investment registration certificates, such as software development and manufacturing, under-tables are sometimes required. Of course, it should not pay under-tables that receipts are not issued.

There are malicious cases where procedures are postponed until the under table is paid and intentionally delaying the procedure of the investment registration certificate.

Also, using this fact that Vietnamese is not proficient, it may point out imaginary document inadequacies to the desire of under table. It is prudent to leave responses to under-tables to experts familiar with local circumstances without forcing them to process them at their own company.

■ Resident obligation of the local corporate representative

The legal representative of the local corporation must reside in Vietnam. If it is a Japanese representative, it must be a resident of Vietnam. If the representatives leave Vietnam more than 30 days, appoint an agent in writing. Also, at the time of application, it is necessary to describe the legal representative's address in Vietnam, but there is no obligation to submit lease agreement for the residence.

The representative does not necessarily need to be Japanese, it can be Vietnamese. Since there is no rule that it must always adopt local staff, operation by only representative is also possible.

■ Apply before and after Teto New Year (Lunar New Year)

Vietnam usually has a Teto New Year in the middle of February, and all administrative agencies enter a long vacation. Because the officials are absent from the government office for the preparation of the New Year at that time, the procedure tends to be delayed. Also, preparation of the New Year costs expensive, so it may be asked for a large under table.

Outsourcing to consulting company etc.

When asking a substitute agency or a consulting company at the time of establishing a local corporation or a representative office, it is necessary to clearly decide how far outsourced is possible. If it make this ambiguous, it can be troubled later.

-

-

-

References

[1] Vietnamese Ministry of Commerce and Industry

[2] Vietnam Investment Planning Bureau

[3] International Organization Japan ASEAN Center

[4] JETRO "Basic Vietnamese System on Advancement in Vietnam - Procedures for Establishing a Company of Foreign Companies · Required Documents" December 17, 2013

-

Japan

Japan UnitedStates

UnitedStates China

China Hong Kong

Hong Kong Mongolia

Mongolia Russia

Russia Thailand

Thailand Vietnam

Vietnam Laos

Laos Cambodia

Cambodia Myanmar

Myanmar Indonesia

Indonesia Philippines

Philippines Singapore

Singapore Malaysia

Malaysia India

India Bangladesh

Bangladesh Pakistan

Pakistan Sri Lanka

Sri Lanka Mexico

Mexico Brazil

Brazil Peru

Peru Colombia

Colombia Chile

Chile Argentina

Argentina DubaiAbuDhabi

DubaiAbuDhabi Turkey

Turkey South Africa

South Africa Nigeria

Nigeria Egypt

Egypt Morocco

Morocco Kenya

Kenya